Preview text:

1.

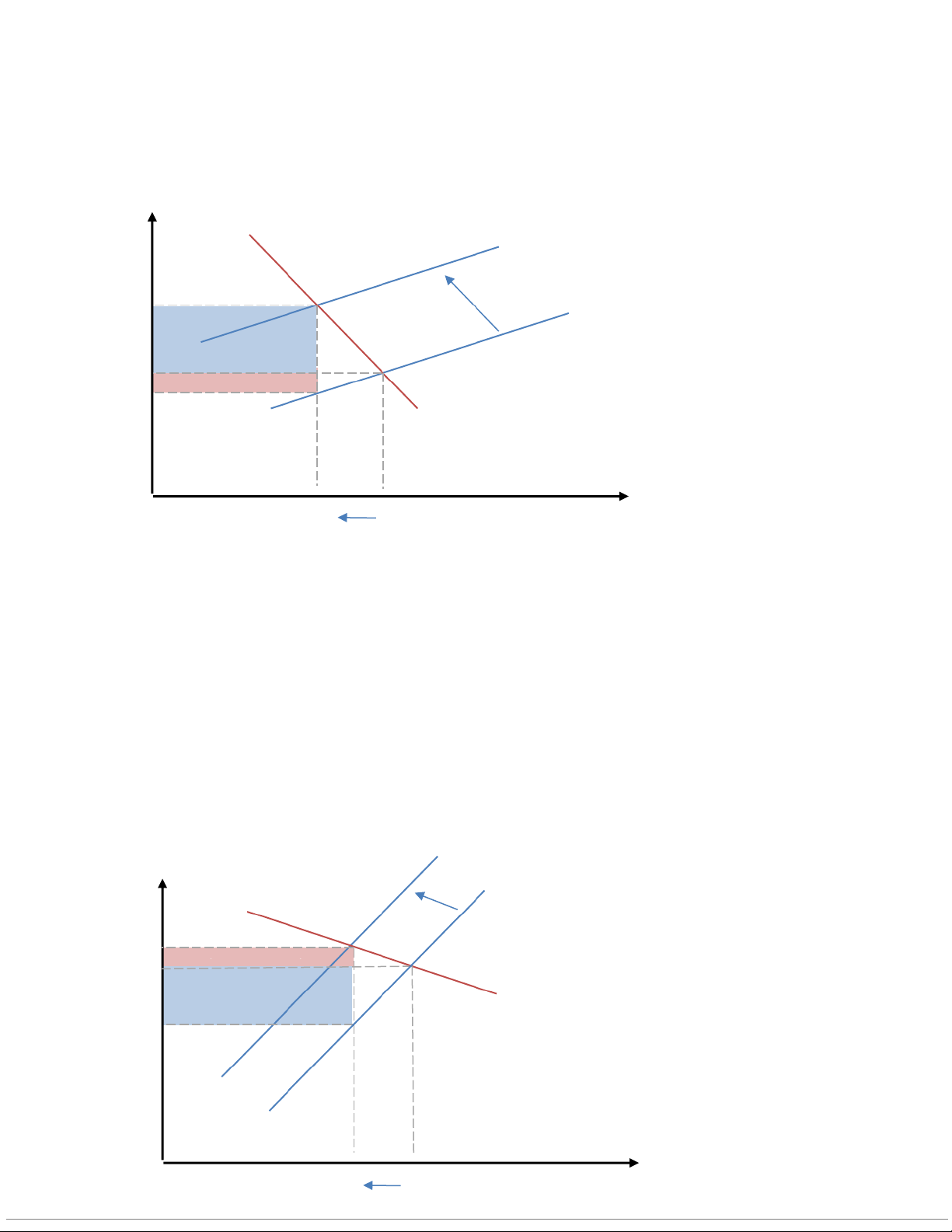

Case 1: It was assumed that demand for these high-end items was inelastic. Price D S A P1 S’ Producer’s tax evidence Pe P2 B Consumer’s tax evidence Quantity Q1 Q2

The gap between point A and point B in the demand curve is the 10% tax.

The supply curve shifted up with a much smaller rise in the equilibrium price. As

the demand is assumed to be inelastic, the demand curve is steep, leading to a large

increase in equilibrium price and a small decrease in equilibrium quantity The rich

do not respond dramatically when there is a change in price and would not pay

most of the tax. (Customer burden is greater than producer burden).

Case 2: When these luxury goods were reasonably elastic: Price S’ D S A P1 ’ B Consumer’s tax evidence Pe P2 Quantity Q1 Q2

The gap between point A and point B in the demand curve is the 10% tax.

The rich do not have a response when there is a change in price and would pay

most of the tax (Producer burden is greater than consumer burden). According to

the theory of supply, demand and elasticity, the buyer responds very instantly

when there is a change in price of these luxury goods as they buy substitutions to

avoid taxes. The burden of tax ended up falling on the workers and retailers who

produce or sell these luxury goods -> the purpose of the tax has failed.

2. To some extent, it shows that the government’s tax policy is inappropriate.

The Congress distributed a 10% “luxury tax” which is an inappropriate tax.

This leads to the government losing money and the fall of the supply quantity

resulting in the entire economy being damaged by the policy.

The Congress should have put a lower tax or put 10% tax in some states as a

trial and then analysis to see if they should keep it at that rate for the rest of the states.

Additional measures to avoid taxes affecting the economy negatively

- Raising import duties to deter consumers from substituting lower-cost or tax-free substitutes for the original

- Setting import quota on certain luxury goods to benefit local producers and workers.