Preview text:

lOMoARcPSD| 38777299 NATIONAL ECONOMICS UNIVERSITY

SCHOOL OF ACCOUNTING AND AUDITING ==== ====

ACCOUNTING INTERNSHIP REPORT

COMPANY: BA VI TRADING AND CONSTRUCTION JOINT STOCK COMPANY Table of Content

CHAPTER 1: GENERAL OVERVIEW OF VAN LOC LIQUEFIED GAS

IMPORT-EXPORT AND TRADING JOINT STOCK

COMPANY...................3

1.1. History of the establishment and development of Van Loc Liquefied Gas Import-

Export and Trading Joint Stock Company......................................................................3

1.2. Organizational situation of production and labor management of enterprises........11

1.3. The data about The company's financial position in the last 3 years......................14 lOMoARcPSD| 38777299

CHAPTER 2: CHARACTERISTICS OF ACCOUNTING ORGANIZATION

AND ACCOUNTING SYSTEM IN VAN LOC LIQUEFIED GAS IMPORT-

EXPORT AND TRADING JOINT STOCK

COMPANY..................................16

2.1. Organizational characteristics of the accounting apparatus at the Company..........16

2.1.1. Organization chart of the accounting apparatus...............................................16

2.1.2. Accounting duties and functions......................................................................16

2.1.3. Relationship between accounting department and other departments..............18

2.2. Characteristics of the accounting system at the Company......................................19

2.2.1. The applicable accounting policies are............................................................19

2.2.1.1. Principles of recognition of cash and cash equivalents...............................19

2.2.1.2. Principles of recognition of trade and other receivables.............................20

2.2.1.3. Principles of inventory recognition.............................................................20

2.2.1.4. Principles of recognition and capitalization of other expenses...................21

2.2.1.5. Principles of recognition and depreciation of fixed assets..........................21

2.2.1.6. Principles of recognition of trade and other payables.................................22

2.2.1.7. Principles of recognition of equity..............................................................22

2.2.1.8. Principles and methods of revenue recognition..........................................22

2.2.1.9. Principles and methods of recording selling and administrative expenses..23

2.2.1.10. Principles and methods of recording current corporate income tax

expenses and deferred corporate income tax expenses............................................23

2.2.1.11. Other accounting principles and methods.................................................24

2.2.2. Applicable accounting standards and regimes..................................................24

2.2.3. Organization and application of accounting bookkeeping system...................25

2.2.4. Organization and application of the accounting voucher system.....................26

2.2.5. Organization and application of the accounting system...................................27

2.2.6. Organization of the accounting reporting system.............................................27

2.2.7. Organization of application of information technology in accounting work....27

2.3 Characteristics of some accounting cycles at the Company....................................28

2.3.1. Cash accounting...............................................................................................28 lOMoARcPSD| 38777299

2.3.2. Payroll accounting and payroll deductions......................................................34

CHAPTER 3: ASSESSMENT OF ACCOUNTING ORGANIZATION AND

ACCOUNTING SYSTEM AT VAN LOC LIQUEFIED GAS IMPORT-

EXPORT AND TRADING JOINT STOCK

COMPANY..................................38

3.1. Assessment of accounting organization.................................................................38

3.1.1. Advantages......................................................................................................38

3.1.2. Disadvantages..................................................................................................40

3.2. Recommendations to the organization of accounting at Van Loc Liquefied Gas

Import-Export and Trading Joint Stock Company........................................................40

CONCLUSION......................................................................................................42

List of figure and table

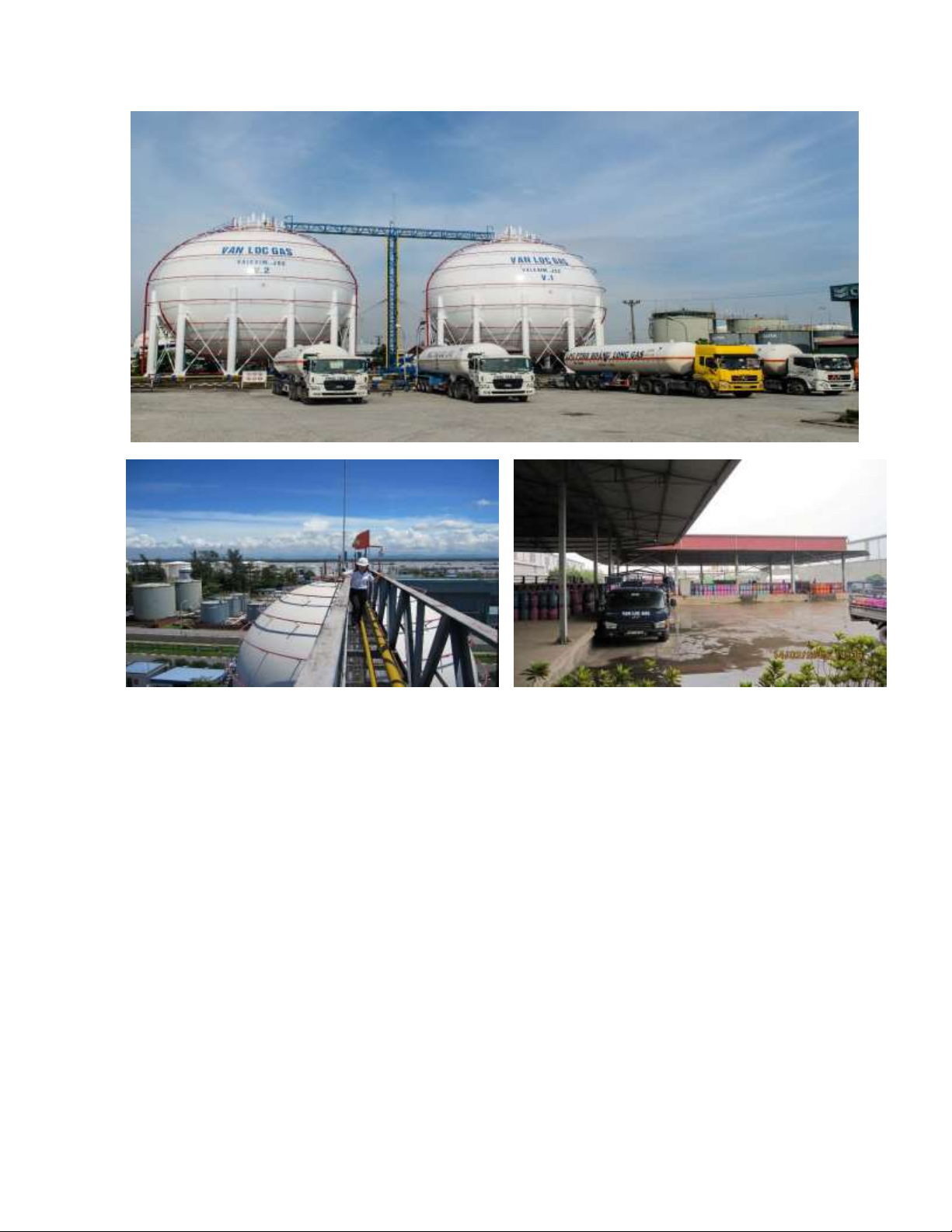

Figure 1.1. Some pictures of Van Loc Liquefied Gas Import-Export and Trading Joint

Stock Company..................................................................................................................5

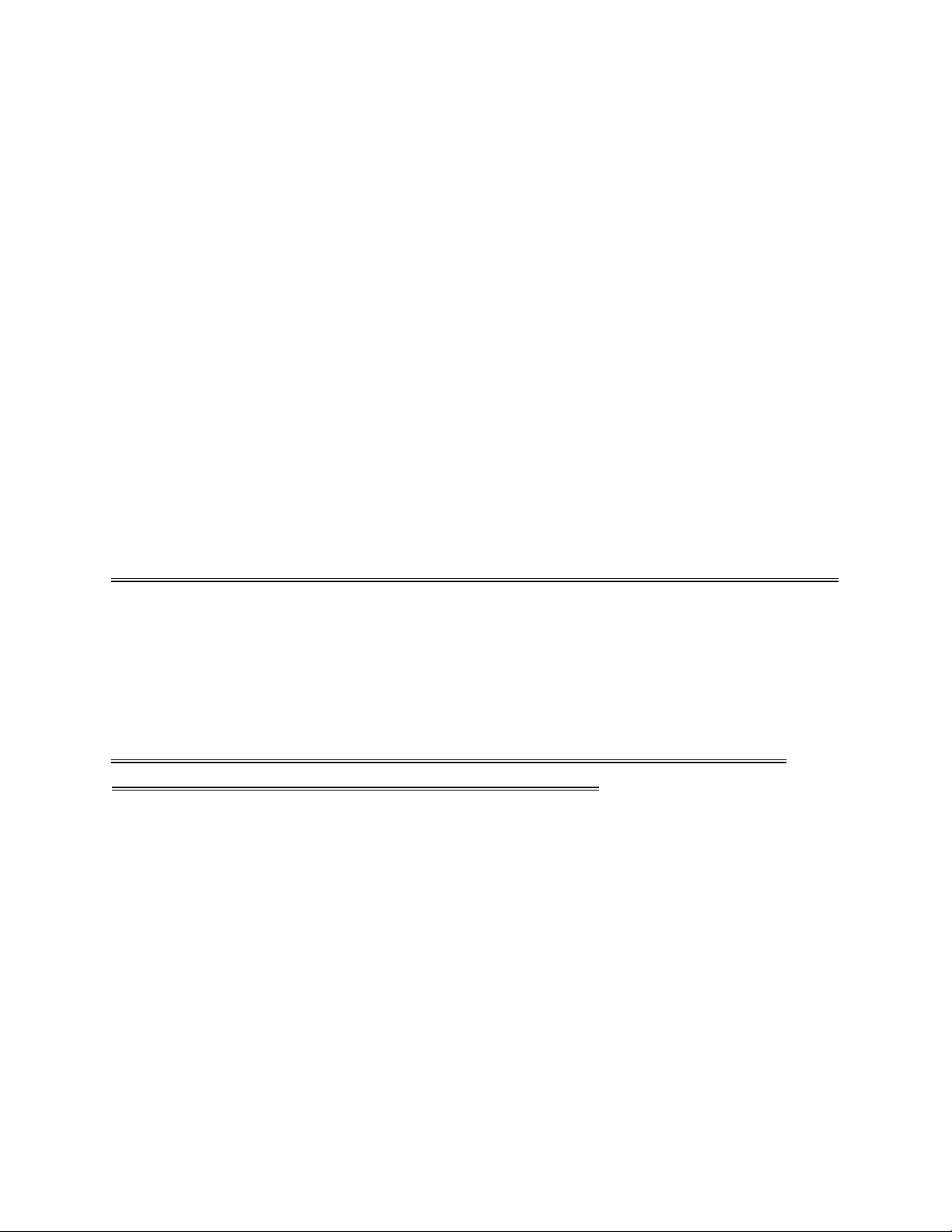

Figure 1.2. Business process of Van Loc Company...........................................................7

Figure 1.3. The diagram of the technology chain of Van Loc Liquefied Gas Import-

Export and Trading Joint Stock Company..........................................................................8

Figure 1.4. Technological process of LPG extraction from tank to tank of the Company..9

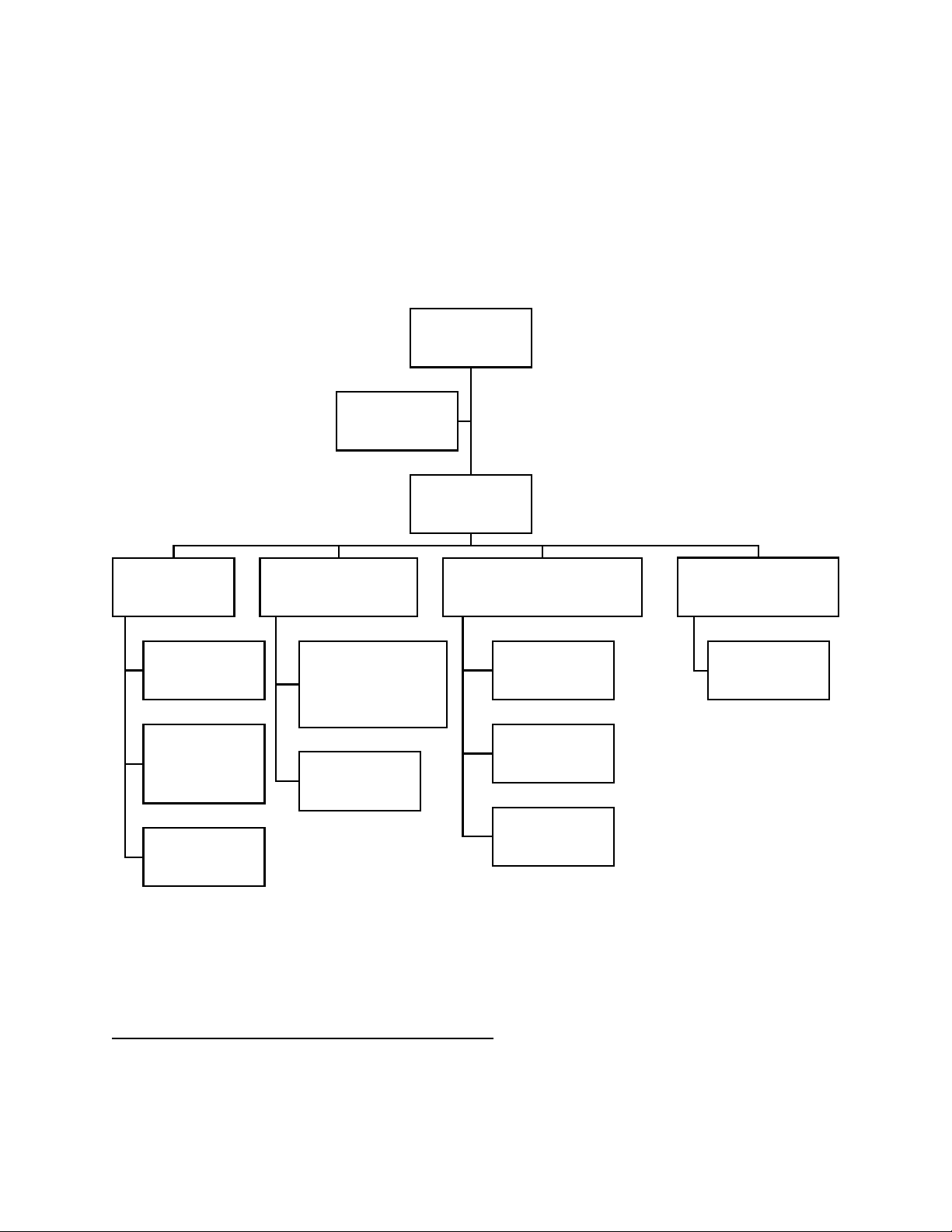

Figure 1.5. Organizational structure of Van Loc Liquefied Gas Import-Export and

Trading Joint Stock Company..........................................................................................11

Figure 2.1. Organizational structure of accounting apparatus at Van Loc Liquefied Gas

Import-Export and Trading Joint Stock Company............................................................16

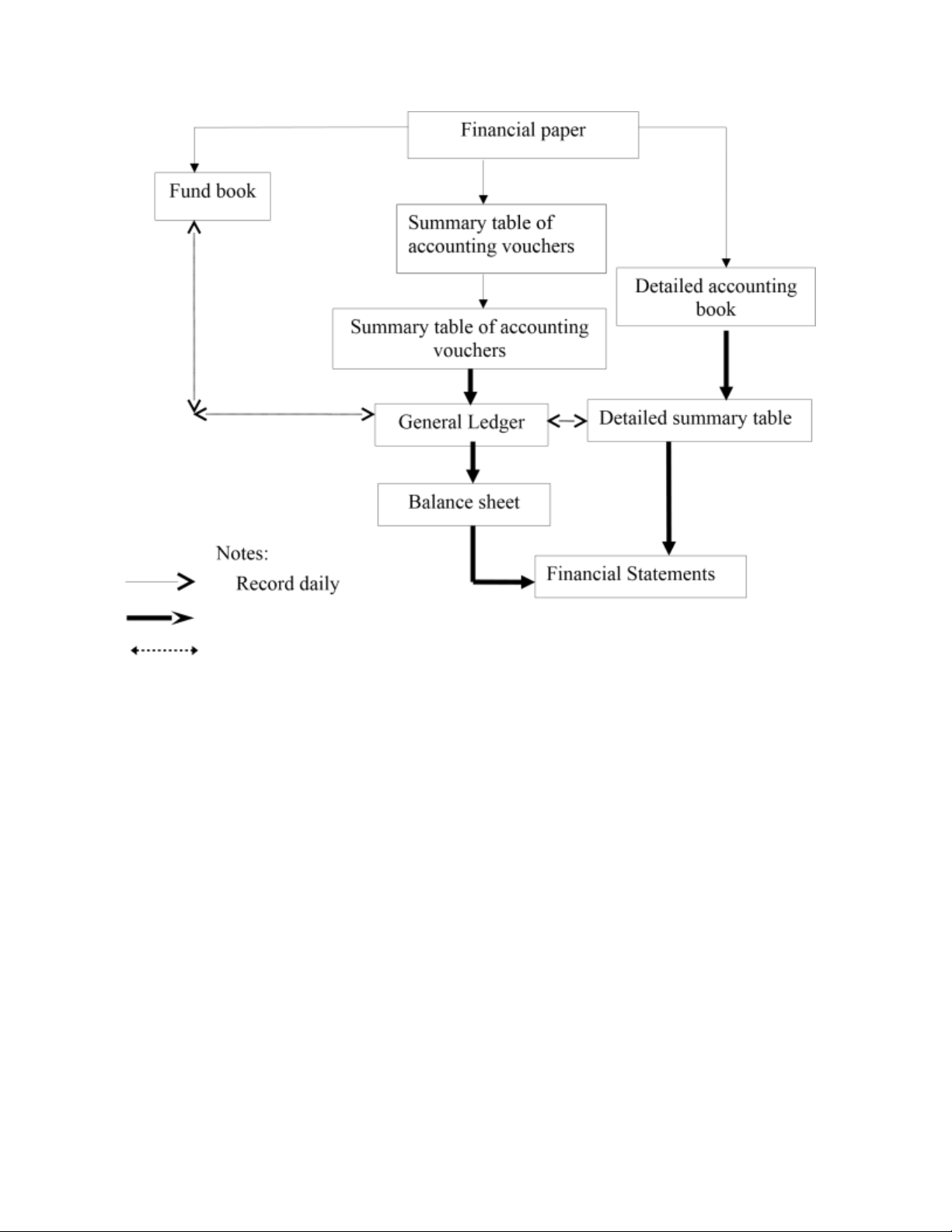

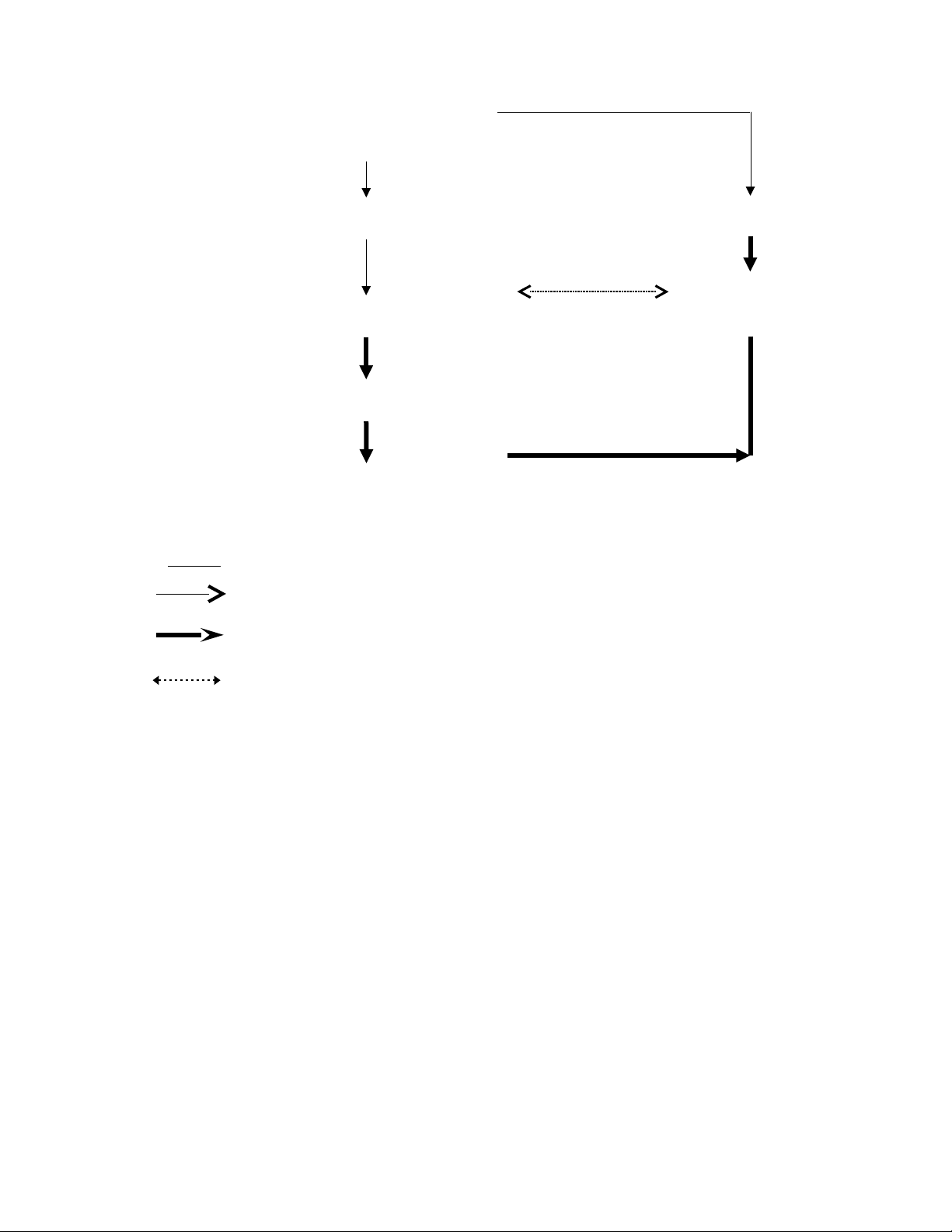

Figure 2.2. Order of bookkeeping at the company...........................................................26

Figure 2.3. General accounting chart of capital in cash...................................................29

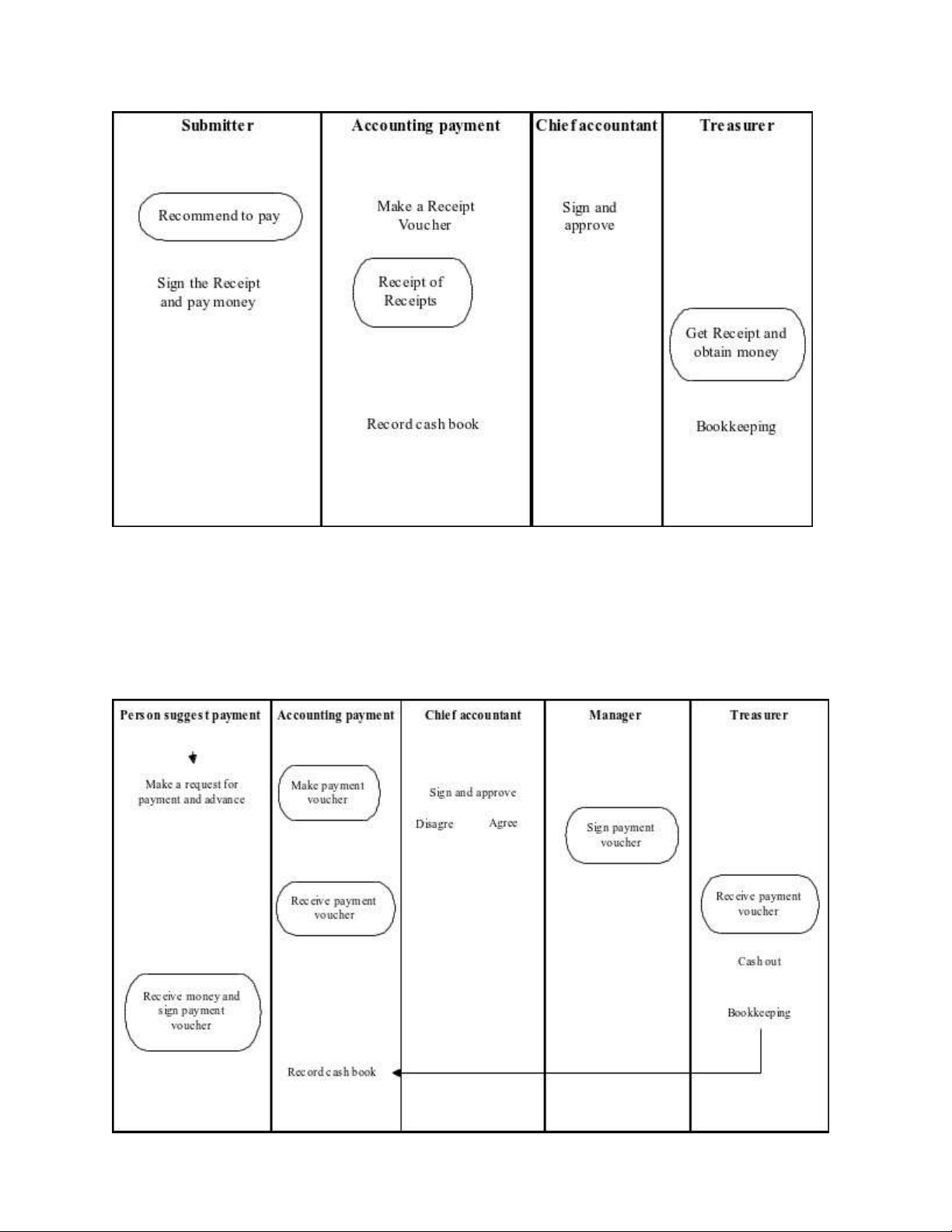

Figure 2.4. Flow chart of cash receipt accounting vouchers............................................30

Figure 2.5. Flow chart of cash payment vouchers...........................................................31

Figure 2.6. Flow chart of accounting vouchers for collection of bank deposits...............31

Figure 2.7. The flow chart of accounting vouchers for bank deposits.............................32

Figure 2.8. Sequence diagram of accounting book of cash capital..................................33

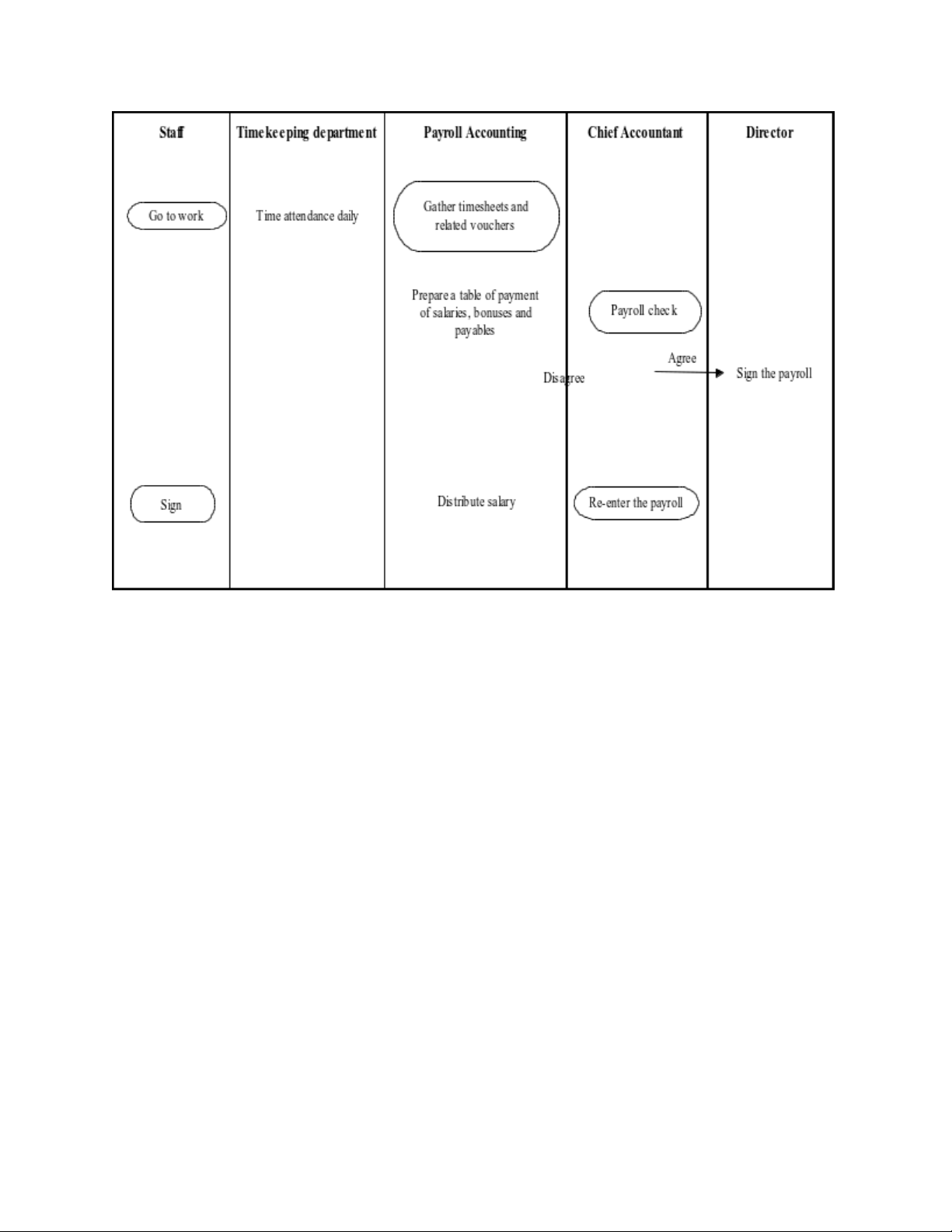

Figure 2.9. Sequence chart of salary accounting and salary deductions..........................35

Figure 2.10. Sequence diagram for recording salary accounting books and salary

deductions........................................................................................................................36

Figure 2.11. Flowchart of the circulation of salary accounting documents and salary

deductions........................................................................................................................37 lOMoARcPSD| 38777299

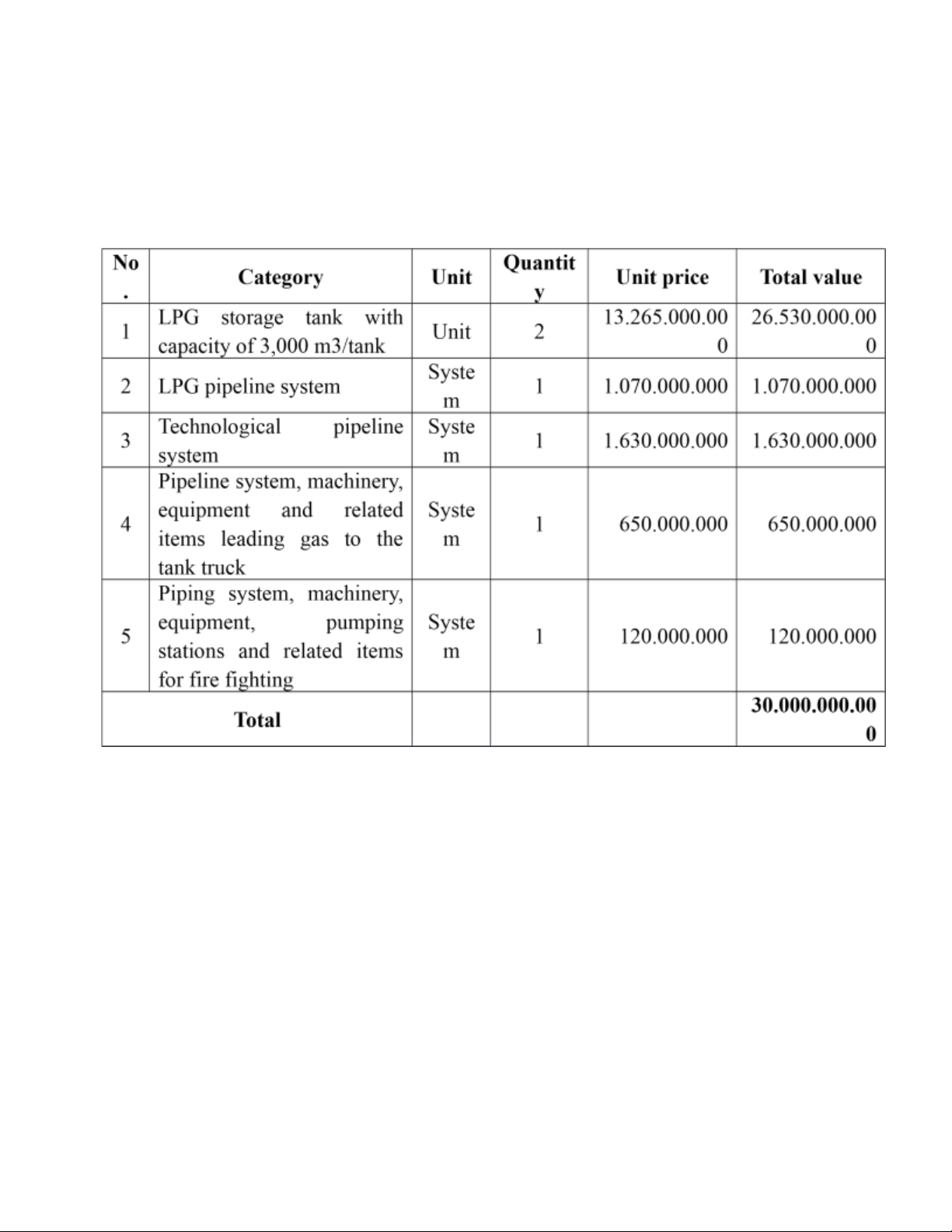

Table 1-1. List of equipment systems of Van Loc Company............................................10 lOMoARcPSD| 38777299 INTRODUCTION

Vietnam has progressively become one of the world's fastest growing economies

after a 30-year transition from a centrally planned, bureaucratic, and subsidized

economy to a market one. In Asia, things are moving quickly. Moreover, as a result

of rapid economic development, societal needs are expanding and constantly

changing. As a result, in order to meet society's needs and keep up with the

economy's growth trend, firms must constantly increase their ability to produce and

provide high-quality products. Domestic firms will have to compete on a fair playing

field with many opportunities, but will also confront problems, particularly now that

our country has entered the World Trade Organization (WTO). Threats have

increased the level of competition. Vietnam has steadily changed through

institutionalizing legal system institutions and establishing circumstances for all

companies to integrate and compete in a competitive environment. Vietnam's

accounting law system has been developing and perfecting for nearly two decades.

The highlight is that Vietnam has enacted the Law on Accounting, which establishes

a system of accounting and auditing standards that are compliant with international

norms and widely recognized, encompassing the majority of business operations.

enterprises, providing circumstances for data openness; at the same time, create a

favorable investment climate, and gradually implement accounting integration

commitments in accordance with international treaties to which Vietnam has

committed or acceded. Vietnam has signed a Framework Agreement on mutual

recognition of accounting and auditing services among ASEAN countries. ASEAN

countries can mutually recognize accounting and auditing practice certificates

granted by other ASEAN countries, according to the Framework Agreement.

Because the level of countries in the region is still highly varied, the roadmap for

implementing this Framework Agreement is implemented in stages, beginning with

each group of countries agreeing to recognize each other and then progressively

expanding to the entire region. As a result, every business must adhere to the

established standards and maintain appropriate honesty in all material aspects in

order to achieve maximum efficiency in its sector while also gaining a competitive

edge and position in today's market economy.

Through an internship in accounting at Van Loc Liquefied Gas Import-Export &

Trading Joint Stock Company, a company operating with nearly twenty years in the

field of liquefied petroleum gas business, now the company The company has

become one of the four largest suppliers of LPG products in the North of Vietnam,

with a system of extraction stations, distribution systems, and thousands of agents lOMoARcPSD| 38777299

spread throughout the North - Central - South, with extensive experience. and

reputation for many years, I myself have had the opportunity to research and

understand some of the real situations in the presentation of a financial statement,

accounting systems or processes and components. practice accounting at the

company and learn more about the working style of the predecessors.

First and foremost, I would like to thank Dr. Ha Thi Phuong Dung for guiding us

through the accounting internship program and this report. I'd also like to express

my gratitude to Van Loc Liquefied Gas Import-Export and Trading Joint Stock

Company's Board of Directors, Administration Department, and personnel for

supplying paperwork and setting favorable conditions. Please assist me in completing my assignment.

Accounting Internship report

Chapter 1: General overview of Van Loc Liquefied Gas Import-Export and Trading Joint Stock Company

Chapter 2: Characteristics of accounting organization and accounting system at Van

Loc Liquefied Gas Import-Export and Trading Joint Stock Company

Chapter 3: Assessment of accounting organization and accounting system at Van

Loc Liquefied Gas Import-Export and Trading Joint Stock Company

My internship report will invariably contain inaccuracies due to my limited

capacity and lack of expertise. As a result, I eagerly anticipate receiving teacher

instruction and assistance in correcting, learning from experience, and improving my

performance on the upcoming Internship Report. Sincerely, Van Pham Thanh Van CHAPTER 1:

GENERAL OVERVIEW OF VAN LOC LIQUEFIED GAS

IMPORT-EXPORT AND TRADING JOINT STOCK COMPANY

1.1. History of the establishment and development of Van Loc Liquefied Gas

Import-Export and Trading Joint Stock Company: lOMoARcPSD| 38777299

The Hanoi Department of Planning and Investment has awarded a certificate to

Van Loc Liquefied Gas Import-Export and Trading Joint Stock Company

(hereinafter referred to as Van Loc Company) (trade name: VALEXIM., JSC). Mr.

Phan Van Hung, Chairman of the Board of Directors and General Director,

registered the company for the eighth time on March 18, 2019 using the number

0102103491, which was first issued on December 7, 2006.

The company's major business activities, according to the business registration

license, are trade - importing and exporting liquefied petroleum gas, petroleum

products (LPG), and trading in tanks, as well as leasing and sending services.

Storage, transportation, and trading in petroleum and petrochemical products are all services provided by LPG.

Charter capital as at 18/03/2019 according to business registration is: 125.000.000.000 VND.

The company's head office is located at: Lot CN4 - Nguyen Khe Industrial Park -

Nguyen Khe Commune - Dong Anh District - Hanoi City with the number of employees is 146.

Total capital of the company as of December 31, 2020: 851.170.069.108 VND.

Van Loc Company was founded to address the rising demand for natural gas

among Vietnam's industries in recent years, as well as to expand the construction of

the low-pressure gas network to meet the demand for gas among industry and residential households.

With nearly twenty years of operation in the field, it is now considered as Van Loc

Gas Group and has risen to become one of the four largest LPG product suppliers in

the North of Vietnam, with a system of extraction stations, distribution system, and

thousands of agents spread throughout the North - Central - South. In addition to the

main business of liquefied petroleum gas, Van Loc Liquefied Petroleum Export &

Trading Joint Stock Company is also an authorized importer of the following

products: Liquefied Petroleum Gas; device; materials for oil and gas industry; metal

... has experience and reputation for many years. To carry out the policy: provide a

stable, high-quality source of goods. Van Loc Company established cooperation

relationships with the world's leading LPG supply groups, which are: E1

CORPORATION, ITOCHU, SINOPEC; SOJITZ CORPORATION; … with the

current import volume of 12,500 MT+/- 10% LPG/month. lOMoARcPSD| 38777299

With the orientation of strongly developing the consumption system in rural and

mountainous areas, penetrating the southern market. In the past two years, the

Company established more companies (new filling stations in the provinces: Hoa

Binh; Vung Tau; Hung Yen; Thanh Hoa; Lao Cai; Thai Nguyen; Ha Nam, bringing

the total number of filling stations to 17 stations), with many strong brands becoming

familiar to consumers such as: VAN LOC GAS; HOANG LONG GAS; PHUC

THAI GAS; THIEN AN GAS; ĐAI LOC GAS; VAN LOC-SG; VAN LONG GAS;

VAN LOC SAI GON; ĐAT VIET NINH BINH; TRUNG ĐUC GAS; AN PHU

HUNG GAS; PK. GAS; ASIA GAS,… are already on the market.

In addition to the retail distribution system, the corporation serves as a focal point

for selling items to companies that extract and extract outside of the system, as well

as supplying industrial gas to factories and industrial parks with a strong reputation

and capability. In terms of quality, pricing, and service, excellence is a given.

Financial capacity: With its existing reputation, diversified and high-value

collateral system, along with the convincing feasibility of operating at its business

system, at present Van Loc Company is a large, reputable and reliable customer of

the leading banks in Vietnam: VIETCOMBANK; BIDV; VIETINBANK;

AGRIBANK; MB BANK, VPBANK The fact that Van Loc Company is guaranteed

by the leading banks in Vietnam is the reason why in especially difficult times of

liquidity in Vietnam's financial market, Van Loc Company still can open a letter of

guarantee to import goods, enough to supply the system of 17 affiliated companies and customers who buy slag... lOMoARcPSD| 38777299

Transport capacity: The company has a fleet of specialized, qualified trucks with

a total capacity of 600MT/time, which is enough to meet the demand for LPG

transportation for the entire system and backup plans.

Van Loc Company produces enough gas cylinders to supply cylinders for the

entire system, constantly renewing and restoring old shells to ensure absolute safety

for consumers. With 03 factories producing LPG tank covers of all kinds with

modern technology, Van Loc Company produces enough gas cylinders to supply

cylinders for the entire system.

Source: Van Loc Company's Facebook page

Figure 1.1: Some pictures of Van Loc Liquefied Gas Import-Export and Trading

Joint Stock Company *

Geographical, economic and human conditions of the study area: lOMoARcPSD| 38777299

The company's head office is located at Lot CN4 - Nguyen Khe Industrial Park

Nguyen Khe Commune - Dong Anh District, Hanoi City, located at the northern

gateway of Hanoi capital, located in the industrial development planning area, urban

centers, services have been approved by the Government and the City, is an

important traffic hub connecting Hanoi Capital with the Northern Provinces. With

an area of more than 7.92 square kilometers, the population density is 1,345

people/km2 along with the climate conditions characterized by the Northern climate,

tropical monsoon climate, hot summer, heavy rain and cold winter, little rain.

And up to now, the number of people in Nguyen Khe commune has reached

10,654 people. This will not only be an abundant resource to create an open

consumer market for the company, but also an important resource to meet the

company's ever-increasing labor demand. Besides, with the activities, the emulation

movement "Be good at domestic work, take care of housework" launched in recent

years has shown the human resources here: "Good workers, good workers,

innovative initiatives" creation”, and in 2019 alone, 80% of female employees have

won the title, and more than 563 workers have won the title of good worker, along

with 973 households of employees. Abundant and high-quality human resources,

associated with the continuous development of the economy here will create

favorable conditions and promote the development of the company. *

Business process and system of filling stations serving the Company's business activities:

Company business process:

Van Loc Company is a legally created production and business unit whose core

activity is trading, LPG circulation organization, LPG purchase at the point of

production, and LPG selling at the point of need in order to profit. Despite the fact

that the Company operates on a huge scale, its business process is fairly

straightforward, as shown in Figure 1.2 below.

In order to determine the volume of LPG to be imported, the Company first needs

to conduct market research both at home and abroad. After determining the amount

of LPG to be imported, the company will import LPG from abroad and purchase

domestic LPG, but importation is a very complicated form of purchase and sale,

which is different from the domestic trade. Because of this difficulty and complexity,

when importing LPG, the company has followed the following process: First, the

Company Open a letter of credit (LC) at the bank about the payment to the Exporter

for the amount temporarily calculated according to the quantity of goods ordered, lOMoARcPSD| 38777299

then the Company's bank will send the information to the Exporter's bank. export of

letter of credit (LC) information. The Exporter's bank will notify the Exporter, and

the Exporter will load the goods onto the ship and transport to the port for the

Company, then the Company will import the goods from the port to the Company's

Dinh Vu Gas Warehouse in Hai Phong.

LPG will be pumped into tank trucks and transferred to the Company's filling

stations after being imported into a tank warehouse at Dinh Vu port in Hai Phong.

After that, LPG will be exported to 17 member companies, and the average

volume of imported LPG per month was agreed at the meeting at the beginning of

the year between the parent company and the member companies. And on the 27th

of every month, the parent company will hold a meeting to announce the selling price

and the member company to order the amount of LPG to be taken next month. Before

the date of arrival to receive LPG, the member company will notify the parent

company of the quantity of 50 - 150 tons and the control plate of the tank truck, along

with the information of the driver who concurrently receives the goods and the

member company will announce it on their own. arrange vehicles and means to pick

up goods. Next, the member company will bring the product to the market for

consumption. Besides exporting to 17 member companies, Van Loc Company also

sells directly to industrial parks and retail customers of the company. Market research

Import LPG to Dinh Vu warehouse in Hai Phong

Transport to the filling station

Export LPG to 17 member companies and other customers of the company Bring to the consumer market

Source: Sales Department of Van Loc Company

Figure 1.2: Business process of Van Loc Company lOMoARcPSD| 38777299

Through learning about the company's business process, it can be seen that this is

a simple but specific, effective and flexible business process. And although Van Loc

Company is a trading company, but because the characteristics of LPG are different

from other commodities, to be able to do business, the Company needs to have filling

stations and the company's filling stations all have generally a fairly simple

technological process, and can be summarized as the diagram below. Fillng i st o at i n LPG Bottle storage and Co presso Alarm Firefightin closing transportat io syte syste syste syste m r g n syste s m m m m m

Source: Technical Department of Van Loc Company

Figure 1.3: The diagram of the technology chain of Van Loc Liquefied Gas

Import-Export and Trading Joint Stock Company Inside:

- LPG storage and transportation system including tanks, pipeline system, pump, valve system, ...

- Bottle closing system including loading rods

- The air compressor system provides compressed air for the extraction process

to ensure safety during operation.

- Alarm system, responsible for alarming when there is an incident, including gas leak detectors.

- The fire fighting system is responsible for fighting fire when there is a fire

incident, including equipment such as: fire extinguisher, water pump, water pipe, ...

The technology line at the company's filling stations operates in two main steps:

Importing LPG from tank trucks into tanks: LPG is imported into tanks from tank

trucks using a pump mounted on the tank truck. The tank truck's liquid line is lOMoARcPSD| 38777299

connected to the tank's liquid inlet line, the tank truck's steam line is connected to

the tank's steam return line, after checking parameters such as pressure, temperature,

and grounding, open the valve. We engage the clutch to pump LPG into the tank.

Exporting LPG from the tank to the filling system: the process is done by pumping

LPG from the tank through a series of valves to the pneumatically controlled filling

rods. To ensure the safety of the system and ensure a stable gas flow, a return line is

installed. During the extraction operation, when the loading rods operate unevenly,

the internal pressure will increase rapidly, causing unsafe phenomena for the system,

then the return pipe will bring a part of the liquid to the tank to stabilize. flow and

pressure drop, ensuring the safety of the whole system. Put the jar on the Factory workers floor, wash the team bottle Weigh enough gas Put the tank in the in the tank intake manifold Check gas tank and gas cylinder valve Finished goods integrity

Source: Technical Department of Van Loc Company

Figure 1.4: Technological process of LPG extraction from tank to tank of the Company

And also due to the special nature of LPG, the system of equipment for LPG filling

process must comply with predetermined standards. When calculating for a certain

plant, equipment must ensure capacity, meet technical requirements, safety, ease of

operation as well as maintenance and repair. lOMoARcPSD| 38777299

At Van Loc Liquefied Gas Import-Export and Trading Joint Stock Company, the

main equipment system is as follows:

Table 1-1: List of equipment systems of Van Loc Company Unit: VND

Source: Technical Department of Van Loc Company

In recent years, in order to meet the increasing demand for quality and LPG output

year by year, the Company's technological equipment system has been increasingly

expanded and gradually replaced the lost equipment. to modern devices. Although

some newly invested equipment has advanced and modern technology, higher

productivity, less material consumption, good performance. But when damage

occurs, these devices often have to wait because spare parts do not respond in time,

causing difficulties for repair work, affecting equipment productivity, and

smoothness. of the technology chain. However, these modern machinery and

equipment still play an important role in the company's technological chain. lOMoARcPSD| 38777299

1.2. Organizational situation of production and labor management of enterprises:

In order to manage the business, production and services that are constantly

expanding, Van Loc Import-Export and Business Joint Stock Company has also

formed and gradually expanded the company's management apparatus according to

the direct model functional line and is represented by the following diagram: Board of Directors Contro l Board Di r ector ge n eral Business Administrative P roduction Direct or – Chief Accountant Director Director Technical Busine ss Organizati on Technical Accounting Departm ent and Department Department Administrat ion Departme nt Import - Production Export Security workshop Departm en t room Supplies Vehicle fl eet Department

Source: Administrative Department of Van Loc Company

Figure 1.5: Organizational structure of Van Loc Liquefied Gas Import-Export

and Trading Joint Stock Company

Functions and duties of the departments:

Board of Directors: The Board of Directors is responsible for supervising the

General Director and other management departments. The Chairman of the Board of

Directors cum General Director is Mr. Phan Van Hung. lOMoARcPSD| 38777299

General Director: is the person who manages all activities of the Company and is

responsible to the Board of Directors for the implementation of the assigned rights and duties.

Board of Directors (directors of divisions and departments): is the person who

helps the General Director run the Company as assigned and authorized by the

Director, is responsible to the General Director for the assigned tasks. and authorize.

Accounting Department: The Financial Accounting Department has the function

of advising and assisting the General Director in directing, managing and operating

economic and financial affairs and accounting; Promote and manage financial

investment, salary, bonus and other incomes or payments according to regimes and policies for employees.

Technical Department: Performs the task of repairing, maintaining, ensuring the

technical condition of the equipment, taking full responsibility for communication

and security at the workplace. Research and apply technology to the company's

production, improve product quality, diversify new products and products to meet the needs of the market.

Administration Department: Human resources, organization, recruitment,

training, and dispatch of personnel to serve production and business throughout the

company as assigned by the director. Administrative work, archives, care for the life

and health of employees throughout the company. Carry out emulation,

commendation and discipline work; deal with work related to the rights and

obligations of employees in the company in accordance with the State's policies and

regulations and the company's regulations. Formulate labor norms and wage unit

prices on the basis of labor norms of each type of product, manage the salary fund,

develop and organize the implementation of regulations on salary and bonus payment.

Sales Department: Carrying out the task of importing and trading LPG on the

national market. Develop and implement LPG business plans in each month, quarter

and year. Synthesize prices, statistics and analysis of LPG trading results at each

time of month, quarter and year. Develop production and business plans according

to each period of the company, and regulate production according to the established

and approved production and business plans.

Import-Export Department: Advise the company's sales director on import and

export, manage and organize the implementation of professional tasks according to lOMoARcPSD| 38777299

the development direction of the company's leaders and legal policies of the

company. Government. Carrying out procedures for signing export and import

contracts according to the needs of the company. Carry out customs procedures,

documents of origin, organize delivery, hire ships and means of transport of import

and export goods under the contract.

Security room: Protecting security and order, political security, assets in the

company. Performing fire prevention and fighting work and military work.

Production workshop: Ensure the correct implementation of the assigned

production plan. The production organization ensures absolute safety for people and equipment.

The division of labor by function has created a labor structure that is relatively

suitable with the production and trade characteristics of the company. Some

departments are fully assigned according to the requirements and in the departments

there is a specific assignment of tasks for each person, thus creating a high

responsibility for the workforce. Employees are assigned clear tasks, most of them

adapt to the job. Therefore, labor cooperation between functional departments,

between leaders and employees is carried out easily and effectively.

With the characteristics of both manufacturing and trading enterprises, the labor

structure of the company has a large difference between the number of direct

employees and indirect employees. However, whether it is direct labor or indirect

labor, the company's labor source is always appreciated for its quality, with more

than 81% of employees having college, university, vocational intermediate degrees,

etc. and nearly 18% of the remaining are unskilled workers. And like other

businesses, Van Loc Liquefied Gas Import-Export and Trading Joint Stock

Company also has a labor regime in compliance with the Labor Code, regulated by

the State, with the number of working hours. no more than 8 hours/day and 48

hours/week, the company does not apply overtime, and fully participates in social

insurance, health insurance, unemployment insurance and personal income taxes. In

addition, the company also provides employees with a stable income, with an

average income of VND 4,493,697 per person per month, along with that, the

company also develops a salary policy. As a result, work efficiency has the effect of

stimulating and encouraging employees to emulate and work enthusiastically to

increase productivity, quality and efficiency. There is a separate salary policy for

good employees, special positions with higher remuneration than ordinary

employees to encourage talent, retain good employees and at the same time attract lOMoARcPSD| 38777299

talent from outside. Develop regulations on reward according to work results for each employee.

1.3. The data about The company's financial position in the last 3 years:

In 3 years 2018, 2019, 2020 the company's financial situation has changed.

Although the epidemic situation has partly affected the production and business of

the company, it is still active to create products and bring profits to the company. In

2018, the company's profit after tax was VND 10.8 billion, but in 2019 there was a

slight decline due to the start of the Covid epidemic in some places, so the company's

profit was VND 10.6 billion, and by 2020, the economy of most businesses in

Vietnam will decline, not only Van Loc company, it will decrease to 6.6 billion VND

(decreased by about 4 billion compared to 2019).

* Future direction of business development:

Development strategy from 2020 and orientation to 2025: Building VAN LOC

GAS brand into Vietnam's strong brand in the field of liquefied petroleum gas

business, the leading LPG trading company in the region North in terms of scale,

market, capital, cooperation ability, integration and competition in the country and

region; achieved an average growth rate of 12% per year in the period 2010 - 2015;

and 17% annually in the period 2016 – 2020; to step up investment in construction

of technical infrastructure in the period of 2020 - 2025.

Through the analysis of the situation and operating conditions of Van Loc

Liquefied Gas Import-Export and Trading Joint Stock Company, the difficulties and

advantages of the Company are drawn as follows:

Advantages: The company's head office is located at Lot CN4 - Nguyen Khe

Industrial Park - Nguyen Khe Commune - Dong Anh District, Hanoi City, located

in the planning area for industrial, urban and service development approved by the

Government. and approved by the City, is an important traffic hub connecting Hanoi

Capital with the Northern Provinces. Having a convenient transportation system

facilitates product consumption and reduces selling costs. The company has a team

of experienced, skilled, creative and enthusiastic employees. The company's

business processes are streamlined and efficient, along with the company's

technological lines that are advanced and in line with market trends. The

management aspects of the Company are strict, but still ensure flexibility, in

accordance with the laws of the State. Having created the prestige and position of

the Company increasingly strong in the LPG trading market in the North. lOMoARcPSD| 38777299

Difficulties: Vietnam's LPG market in the recent period has had a strong

development. Therefore, associated with the rapid development of Van Loc

Company, in the past time the Company has faced stiffer competition from

competitors in the market, even in recent times, the Company has been facing fierce

competition from competitors. The company has suffered from unfair competition

from competitors. Besides, because it is a trading and importing company, its

business activities are always directly affected by fluctuations in the economy,

fluctuations in LPG prices globally in general and in Vietnam in particular in recent times.

In general, in recent years, despite facing many difficulties and facing stiff

competition, Van Loc Company still fulfilled the assigned plan targets, profitable

production and business and constantly improved improve the lives of employees.

And this will be analyzed more clearly in the content of the next chapter.

CHAPTER 2: CHARACTERISTICS OF ACCOUNTING

ORGANIZATION AND ACCOUNTING SYSTEM IN VAN LOC LIQUEFIED GAS

IMPORT-EXPORT AND TRADING JOINT STOCK COMPANY

2.1. Organizational characteristics of the accounting apparatus at the Company:

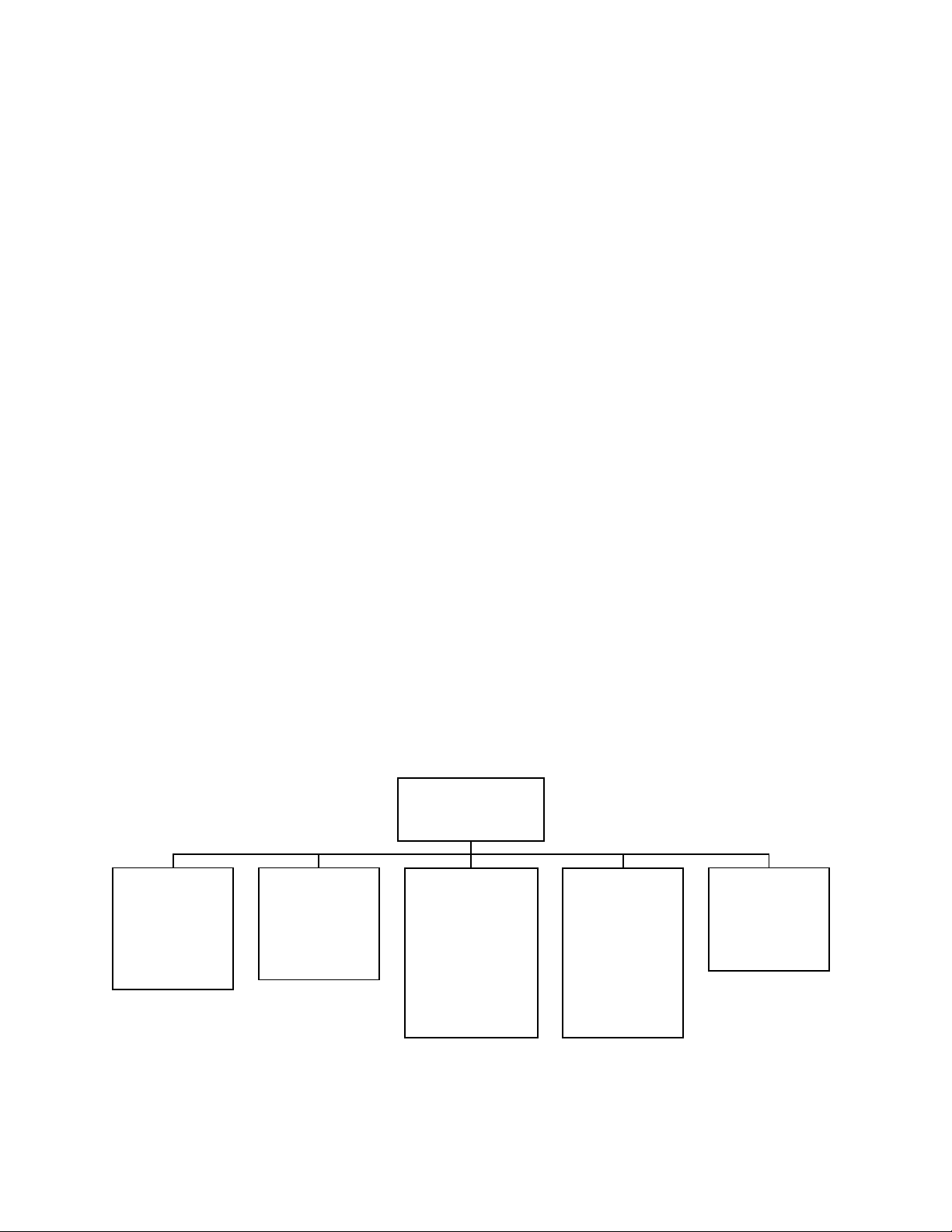

2.1.1. Organization chart of the accounting apparatus:

The organizational structure of the accounting apparatus is shown in the model below: Chief accountant Payroll Sales Material Bank Accounting; Accounting Accounting; Accounting; Accountant Capital payment; To Statistical construction Treasurer pay debt; investment; Receivable Price; synthetic

Source: Accounting Department of Van Loc Company

Figure 2.1: Organizational structure of accounting apparatus at Van Loc

Liquefied Gas Import-Export and Trading Joint Stock Company lOMoARcPSD| 38777299

2.1.2. Accounting duties and functions:

Chief accountant:

- To be accountable for the company's financial accounting in front of the

Board of Directors, the Board of Directors, and the law.

- All financial and accounting work in the company is directed, guided, and

inspected in accordance with current regulations.

- Make financial and accounting decisions in the unit, prepare the company's

financial statements at the end of the fiscal year, and explain the figures on

the vouchers and financial statements together when they

are available. Tax authorities, audits, superior management agencies, and

other legal authorities' requirements.

Accounting payment:

- Daily revenue and expenditure updates are required for cash accounting

(with comparison with cashier). Prepare documents and payment lists in

collaboration with Company employees.

- Other payment accounting: Payables and advances are detailed.

- Follow up on customer debt, analyzing each customer's debt period on a monthly basis.

- Accounting for finished product warehouses: Keep track of the Company's

import - export - finished product inventory. Products imported into the

warehouse must go through the KCS department to ensure quality. The

warehouse receipt is signed by the head of the Quality Assurance

Department, the storekeeper, the accountant, and the director. The

warehouse is exported in three ways: consignment export, direct export, and retail export.

Bank accountant:

- Accounting for bank deposits, as well as short- and long-term bank loans

(monitoring increase, decrease and daily balance on bank accounts).

- Contract guarantees must be made and followed up on. Pay the L/C for

exports and open the L/C for imports.

Material Accounting: lOMoARcPSD| 38777299

- Material and tool inventory is meticulously recorded. Monitor and enter the

input - output - inventory of materials and tools every day. Before importing

materials, conduct a supervision inspection (all signatures of the Security,

Quality Assurance Department, and Storekeeper must be on the import and

export documents). Export materials based on the needs of each

department, as certified by the department head. Compare the storekeeper's

warehouse card at the end of the month. Allocation of tooling costs is performed.

General accounting of costs, prices, salaries, Construction:

- Synthesize accounting data based on accounting book data provided by

other departments, create general ledgers, monthly, quarterly, and annual

settlement reports, determine whether or not the targets are balanced, and

report to the chief accountant for the chief accountant to sign for approval and submit to the director.

- Gather production costs and perform cost calculation for products.

- Monthly, make a summary of the company's salary based on the labor

results of each production team (with details for each person, each day).

Allocate salary and make salary-related deductions.

- Follow-up capital investment in construction Sales accounting – statistics:

- Check and make a list of book-keeping vouchers based on the sales invoices

of the offices and sales at the company on a monthly basis.

- Declare VAT, synthesize declarations, and calculate the monthly VAT payable.

- In the comparison and inspection offices, keep an eye on the situation of import and export warehouses.

- Creating statistics and reports on the company's production and financial performance.

- Create detailed statistics on all costs of materials and raw materials used

during the period, as well as inventory raw materials and unfinished

products at the end of the month.

- Calculating and allocating depreciation of fixed assets for the entire

Company on a quarterly basis. During the period, the update in the fixed

assets book increased (decreased). lOMoARcPSD| 38777299

2.1.3. Relationship between accounting department and other departments:

With the Director: Calculate the product cost using the cost calculation, then report

to the Board of Directors on the profit and loss situation to adjust the production and business plan.

The accounting department creates a report with the Deputy Director in charge of

construction and the Deputy Director in charge of business to report the cost of using

materials, equipment, and expenses to use the construction machine. the plan's

implementation, production and business expenses, and the situation of a surplus of

semi-finished products in production.

In collaboration with the planning department: The planning department is in

charge of providing monthly, quarterly, and annual production plans for each item,

as well as construction material estimates for production costs and cost plans.

Provide an estimate basis for each cost item so that the cost accountant can

compare and analyze the actual data to develop a plan for purchasing and reserving supplies.

Compare and coordinate with the planning department to evaluate the results of

meeting the planned targets, such as actual material used versus the planned norm.

Simultaneously, we organize advanced methods of planning and accounting to

determine product costs in collaboration with the research planning department.

For the administrative department: The administrative department provides the

accountant with the necessary cost collection and product costing documents for the

salary fund, salary, and detailed bases that comprise the total fund. salary, bonus, as

well as the norm of labor time, unit price, and salary for the accountant to have a

basis for comparison and comparison with reality to allocate production and

management costs, as well as semi-finished products and products at the end of the

period, unfinished products, ...

2.2. Characteristics of the accounting system at the Company:

2.2.1. The applicable accounting policies are:

2.2.1.1. Principles of recognition of cash and cash equivalents:

Cash includes cash, demand bank deposits.

Cash equivalents are short-term investments not exceeding 3 months that are

readily convertible to cash and subject to an insignificant risk of change in value

from the date of acquisition at the reporting date. lOMoARcPSD| 38777299

Economic transactions arising in foreign currencies are converted into Vietnam

Dong at the actual exchange rate of the transaction bank at the time of transaction.

All exchange rate differences arising in the period of production and business

activities, including capital construction investment activities, are immediately

accounted into financial expenses or financial income in the period.

2.2.1.2. Principles of recognition of trade and other receivables:

1. Principles of recognition:

Trade receivables, prepayments to vendors, internal receivables, and other

receivables at the reporting time, if:

- Having a recovery or payment period of less than 1 year is classified as Current Assets.

- Having a recovery or payment period of more than 1 year, it is classified as a long-term asset.

2. Provision for doubtful receivables:

Provision for bad debts represents the expected loss of receivables that may not

be paid by customers for receivables at the time of preparation of the financial statements.

Provision for bad debts is made for each bad debt based on the overdue age of the

debts or the expected level of loss, specifically as follows:

For overdue receivables, follow the instructions in Circular No. 48/2019/TTBTC

dated August 8, 2019 of the Ministry of Finance, specifically as follows:

- 30% of the value for overdue receivables from over 6 months to less than 1 year.

- 50% of value for receivables that are overdue from 1 year to less than 2 years.

- 70% of the value for receivables that are overdue from 2 years to less than 3 years.

- 100% of the value for receivables from 3 years or more.

2.2.1.3. Principles of inventory recognition:

1. Principles of inventory valuation:

Inventories are calculated at cost. In case the net realizable value is lower than the

original cost, it must be calculated according to the net realizable value. Cost of lOMoARcPSD| 38777299

inventory includes the cost of purchasing, processing and other directly attributable

costs incurred to bring the inventory in its current location and condition.

The cost of inventory purchased outside includes the purchase price,

nonrefundable taxes, shipping, handling and storage costs during the purchase and

other costs directly attributable to the purchase. inventory.

2. Inventory valuation method: The ending inventory value is determined

according to the actual method of identification.

3. Inventory accounting method: The company applies the regular declaration

method for inventory accounting.

4. Making provision for devaluation of inventories: Provision for devaluation of

inventories is made at year-end which is the difference between the original

cost of inventories and their net realizable value. The method of making

provision for devaluation of inventories is to make according to the difference

between the provision that must be made this year and the provision made in

the previous year that has not been used up yet, leading to an additional or reversal this year.

2.2.1.4. Principles of recognition and capitalization of other expenses:

Short-term prepaid expenses: These are prepaid expenses that, if only related to

the current financial year, are recognized in production and business expenses in the fiscal year.

Long-term prepaid expenses: Are expenses actually incurred but related to the

results of production and business activities of many accounting years.

The company calculates and allocates long-term prepaid expenses to production

and business expenses based on the nature and extent of each type of expense to

choose a method and allocation criteria from 2 to 3 years.

2.2.1.5. Principles of recognition and depreciation of fixed assets:

1. Principles of recognition of tangible and intangible fixed assets:

Fixed assets are stated at cost. During their use, fixed assets are recognized at cost,

accumulated depreciation and carrying amount.

2. Depreciation method of tangible fixed assets:

Depreciation is provided on a straight-line basis. The depreciation period is

consistent with Circular No. 45/2013/TT-BTC dated April 25, 2013 of the Ministry

of Finance and is estimated as follows: lOMoARcPSD| 38777299 Houses, structures 05 – 50 years Machines and equipment 03 – 20 years Means of transportation 06 – 10 years Other fixed assets 03 years

2.2.1.6. Principles of recognition of trade and other payables:

Trade payables, internal payables, other payables, loans at the reporting time, if:

- Having a payment term of less than 1 year is classified as a short-term debt.

- Having a payment term of more than 1 year is classified as long-term debt.

- Short-term assets are classified as Current Liabilities. - Deferred income

tax is classified as Long-term Debt.

2.2.1.7. Principles of recognition of equity:

Owner's investment capital is recognized according to the amount of capital

actually contributed by the owner.

Undistributed profit after tax is the profit from the enterprise's operations after

deducting adjustments due to retrospective application of changes in accounting

policies and retrospective adjustment of material errors of previous years.

2.2.1.8. Principles and methods of revenue recognition:

1. Sales revenue is recognized when the following conditions are simultaneously satisfied:

- The significant risks and rewards of ownership of the product or goods have

been transferred to the buyer;

- The company no longer holds the right to manage the goods as the owner of

the goods or control the goods;

- The revenue can be measured reliably;

- The Company has obtained or will receive economic benefits from the sale transaction;

- Determine the costs associated with the sale transaction.

2. Service revenue is recognized when the outcome of the transaction can be

measured reliably. Where the provision of services involves several periods,

revenue is recognized in the period according to the result of the work

completed at the balance sheet date of that period. The outcome of a service

provision transaction is determined when the following conditions are satisfied:

- The revenue can be measured reliably; lOMoARcPSD| 38777299

- It is likely to obtain economic benefits from the transaction of providing such services;

- The work completed at the balance sheet date can be determined;

- Determine the costs incurred for the transaction and the cost to complete the

transaction providing that service.

The portion of service delivery completed is determined by the work completion method.

3. Revenue from financial activities: Revenue arising from interest, royalties,

dividends, distributed profits and other financial incomes is recognized when two

(2) are satisfied at the same time. following conditions: - It is probable that

economic benefits will flow from the transaction; - The revenue can be measured reliably.

Dividends and distributed profits are recognized when the Company is entitled to

receive dividends or receive profits from capital contribution.

2.2.1.9. Principles and methods of recording selling and administrative expenses:

Business administration expenses: are indirect expenses for the distribution of

products and goods, provision of services to the market, and production and business

operations of the Company. All selling and administrative expenses incurred in a

period are immediately recognized in the income statement of that period when such

expenses do not bring economic benefits in the following periods.

2.2.1.10. Principles and methods of recording current corporate income tax

expenses and deferred corporate income tax expenses:

Current corporate income tax expense: The current corporate income tax

expense represents the sum of the tax payable in the current year and the deferred

tax. Current corporate income tax expense is determined on the basis of taxable

income and CIT rate in the current year. Taxable profit differs from net profit as

reported in the statement of income because it excludes items of income or expense

that are taxable or deductible in other years (including losses carried forward, if any).

The determination of CIT expenses is based on current tax regulations. However,

these regulations change from time to time and the final determination of CIT

depends on the inspection results of the competent tax authorities.

The corporate income tax rate in 2020 is 20%. lOMoARcPSD| 38777299

Deferred income tax: Calculated on the basis of temporary differences between

the carrying amounts of assets or liabilities on the balance sheet and the income tax

base. Deferred tax is determined at the tax rate expected to apply for the year in

which the asset is recovered or the liability is settled. Deferred tax assets are

recognized only to the extent that it is probable that future taxable profit will be

available against which the deductible temporary differences can be utilised.

Do not offset current corporate income tax expense with deferred income tax expense.

2.2.1.11. Other accounting principles and methods:

Basis for preparation of financial statements: The financial statements are

prepared and presented on the basis of basic accounting principles and methods:

accrual basis, going concern, historical cost, appropriateness, consistency, and

prudential basis. significant, material, offsetting and comparable. The financial

statements prepared by the Company are not intended to present the financial

position, results of operations and cash flows in accordance with accounting

standards, accounting regime or other accounting principles and practices. generally

accepted in countries other than Vietnam.

Related Parties: A party is considered to be related to the Company if it has the

ability to control the Company or to exercise material influence over the financial

and operating decisions of the Company.

2.2.2. Applicable accounting standards and regimes:

Applicable accounting standards and regimes:

The Company applies the corporate accounting system promulgated in accordance

with Circular No. 133/2016/TT-BTC dated August 26, 2016 of the Ministry of

Finance, circulars guiding, amending and supplementing the accounting regime.

corporate accounting and decisions on promulgating Vietnamese accounting

standards, guiding circulars, amending and supplementing Vietnamese accounting

standards issued by the Ministry of Finance, effective until the end of the fiscal year.

prepare annual financial statements.

Statement of compliance with accounting standards and accounting regimes:

The Company ensures that it has complied with the requirements of accounting

standards, the Vietnamese corporate accounting regime issued in accordance with

Circular 133/2016/TT-BTC dated August 26, 2016 as well as guiding circulars. lOMoARcPSD| 38777299

comply with the accounting standards of the Ministry of Finance in the preparation of financial statements.

Applicable accounting book form:

The company applies the form of accounting books: On computers.

2.2.3. Organization and application of accounting bookkeeping system:

* About the form of bookkeeping:

At Van Loc Liquefied Gas Import-Export and Trading Joint Stock Company, the

company's accounting books are in the form of vouchers, which are used in

conjunction with computer software. Every day, accountants enter data into a

computer according to pre-designed tables on the computer, based on accounting

vouchers or a summary of accounting vouchers of the same type that have been

checked and used as a basis for book-entry. Software for Accounting. The

information is automatically entered into the relevant bookkeeping vouchers,

ledgers, and financial statements with the assistance of the software. The following

diagram depicts the bookkeeping procedure at Van Loc Liquefied Gas ImportExport

and Trading Joint Stock Company: Financial - Bo okkeeping paper vouchers, ledgers, detailed accounts books ACCOUNTING - Types of books, SOFTWARE financial statements, Summary management table of reports. accounting vouchers of the same type Notes: Enter daily data

Periodically at the end of the month, at the end of the year Reconcile, check lOMoARcPSD| 38777299

Figure 2.2: Order of bookkeeping at the company

2.2.4. Organization and application of the accounting voucher system:

Accounting vouchers are used to prove the legitimacy of economic and financial

transactions, and they serve as the foundation for recording accounting books. Van

Loc Liquefied Gas Import-Export and Trading Joint Stock Company's accounting

voucher system is structured in accordance with the provisions of the current accounting regime.

To fully reflect arising economic transactions, the company is a production and

business unit, and the accounting unit has used the majority of the accounts in the

enterprise accounting system. There are, however, some unused unit accounts with

the following numbers: 113, 121, 128, 136, 151, 213, 221, 222, 228, 229, 244, 336,

344, 413, 611, 623. Because the Company is an independent accounting unit that

does not participate in joint ventures, does not invest in securities, does not have a

dependent internal accounting unit, and does not accept deposits, foreign currency

accounting is done at the current exchange rate ...

2.2.5. Organization and application of the accounting system:

The accounting system applied at Van Loc Liquefied Gas Import-Export and

Trading Joint Stock Company is built on the basis of the system of accounting

accounts specified in the accounting regime issued under Circular 133/2016/TTBTC

dated August 26, 2016 of the Minister of Finance.

2.2.6. Organization of the accounting reporting system:

The Company has properly implemented the financial reporting regime. The

financial statements of the Company have given the most comprehensive view of the

company's assets, equity and liabilities as well as its financial performance and

business results for the period. enough information for those interested (Chairman

of the board, members of the board of directors, Banks, Finance, Tax authorities...).

According to the prescribed regime, the financial statements are:

- Statement of financial position - Statement of profit or loss - Statement of cash flow

- Notes to financial statements

At Van Loc Liquefied Gas Import-Export and Trading Joint Stock Company,

Management accountants and financial accountants must both work part-time and

provide reports and information to managers. that the administrator. lOMoARcPSD| 38777299

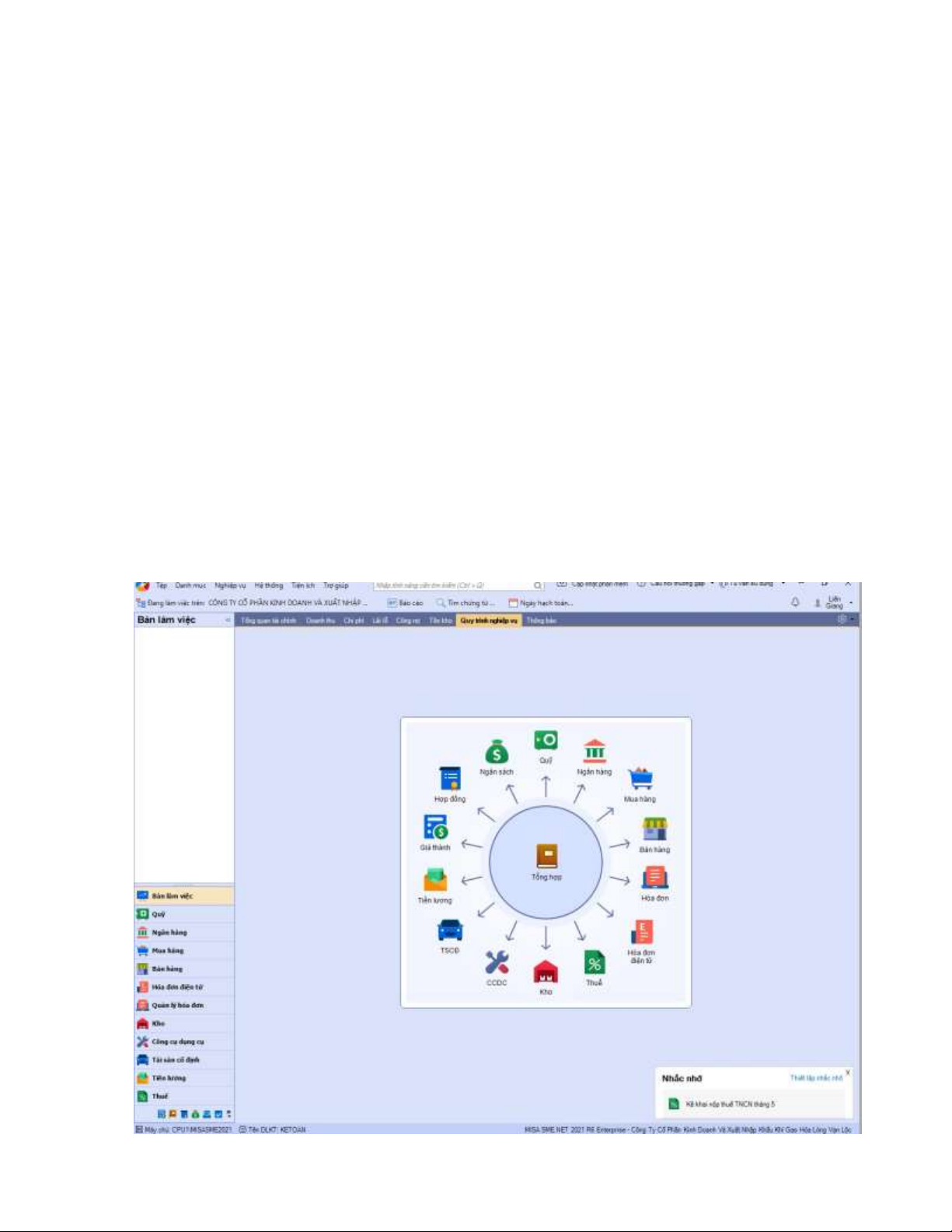

2.2.7. Organization of application of information technology in accounting work:

Currently, Van Loc Liquefied Gas Import-Export and Trading Joint Stock

Company is using Misa accounting software. This is accounting software that is

relatively easy to use, effective and has many powerful utilities and features.

MISA software is capable of managing most of the fund, banking, purchasing,

sales, invoices, taxes - warehouses, fixed assets - revolving assets, wages - costs,

contracts. – budget – synthesis, tools. Specifically, accounting software Misa will

help businesses easily track: sales, revenue and expenditure, debt. Enterprises can

calculate salary, profit, bonus for employees and departments automatically.

With the help of Misa accounting software, the company's accounting books are stored in two formats: - Stored on computer -

Print and close accounting books Screenshot of Misa software interface: lOMoARcPSD| 38777299

2.3. Characteristics of some accounting cycles at the Company:

2.3.1. Cash accounting:

Cash capital at Van Loc Liquefied Gas Import-Export and Trading Joint Stock

Company includes: Cash at the fund and bank deposits.

Cash: The Company's fund manages cash, which includes only Vietnamese

currency and no foreign currencies. The Company conducts a fund inventory on a

regular basis. The inventorying of the fund is carried out in accordance with current

regulations, from the issuance of an inventory order to the preparation of an inventory record.

Bank deposits: The majority of the company's payment operations are conducted

through banks. The bank deposits of the company include both Vietnamese and

foreign currencies. The accountant compares the ledger and the detailed book of

Account 112 at the end of the month, based on the subsidiary book created by the

bank, to check for fluctuations in the increase or decrease of the deposit. Proof of use:

- Request for payment, Request for advance, Economic contract;

- Debit and Credit notes of the bank;

- Receipt slip, payment slip, collection order, payment order, check.

User accounts: Account 111, 112 and other related accounts.

Accounting books used: Ledgers, detailed books of accounts 111, 112, recording vouchers.

The accounting sequence of some major transactions: ash capital at Van Loc

Liquefied Gas Import-Export and Trading Joint Stock Company is recorded according to the chart below:

TK 111, 112 TK 111, 112 TK151, 152, 153 lOMoARcPSD| 38777299 Withdraw the bank deposit to the cash fund Purchase materials, tools Deposit money in the bank TK511 Sales revenue TK 133 TK3331 VAT VAT deducted TK 515, 711 TK 331 Revenues from financial activities, other income Prepayment to suppliers

Source: Accounting Department of Van Loc Company

Figure 2.3: General accounting chart of capital in cash

Order of circulation of vourchers:

- Accounting vouchers for cash receipt: lOMoARcPSD| 38777299

Source: Accounting Department of Van Loc Company

Figure 2.4: Flow chart of cash receipt accounting vouchers

- Accounting vouchers for cash payment: lOMoARcPSD| 38777299

Source: Accounting Department of Van Loc Company

Figure 2.5: Flow chart of cash payment vouchers

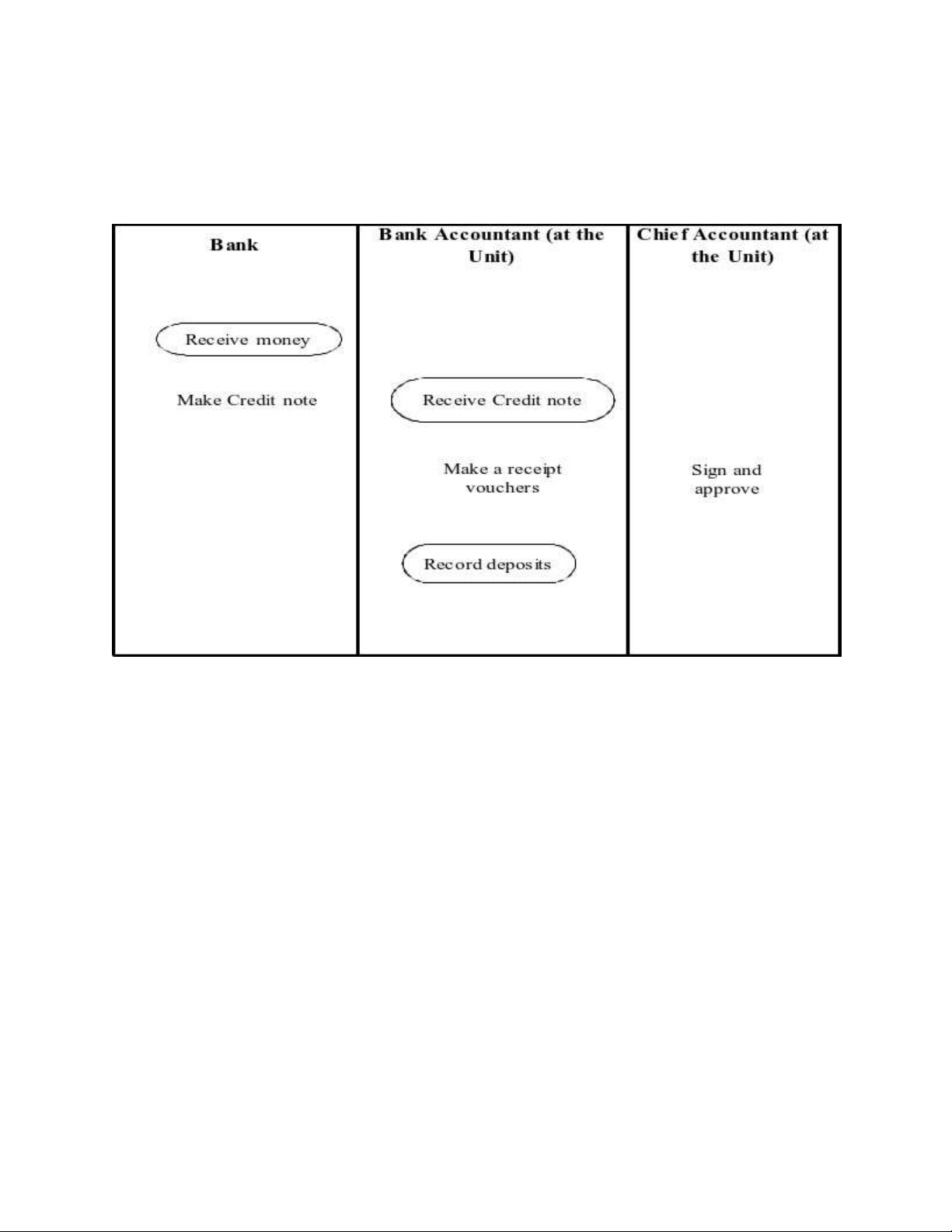

- Accounting vouchers receipt cash at bank:

Source: Accounting Department of Van Loc Company

Figure 2.6: Flow chart of accounting vouchers for collection of bank deposits

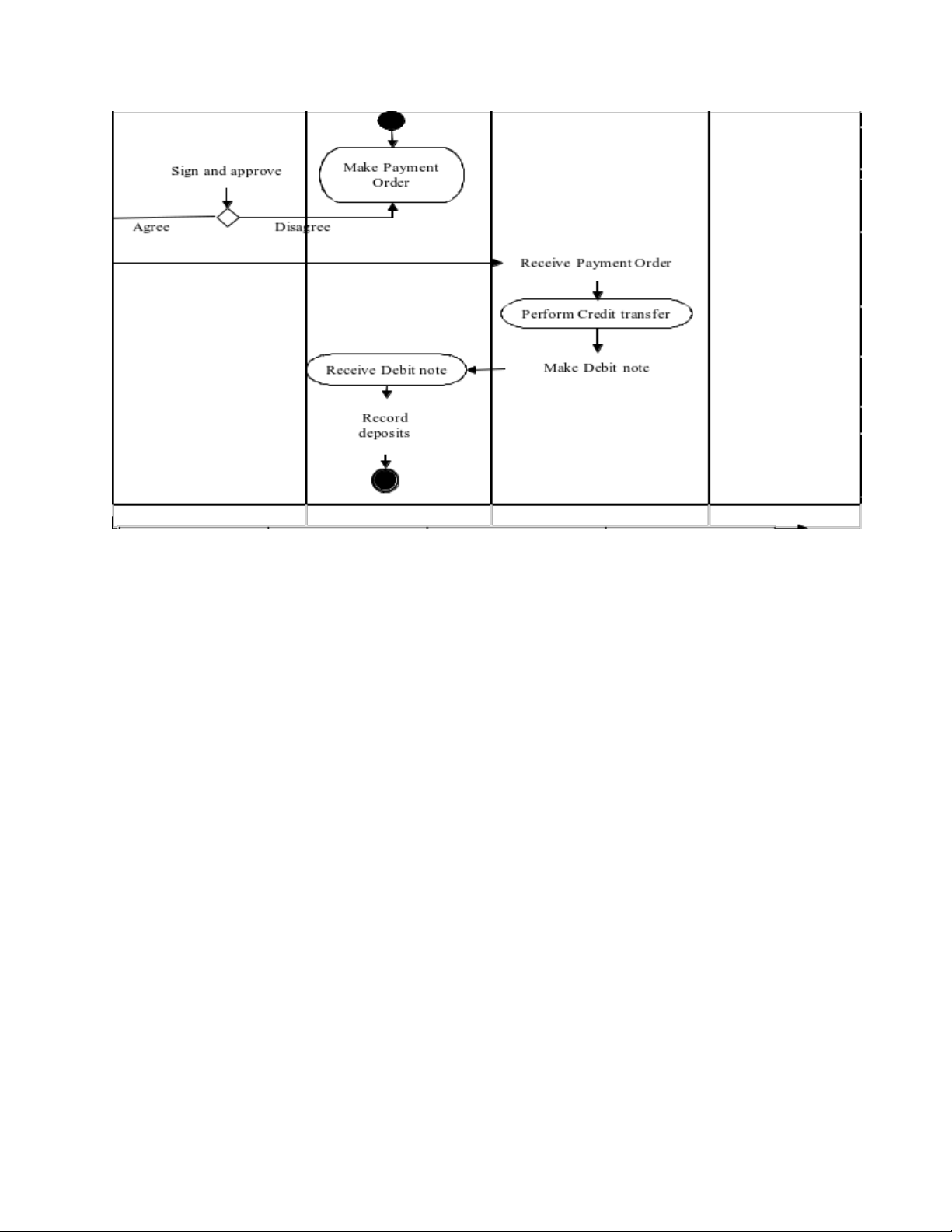

- Accounting vouchers for payment of bank deposits: lOMoARcPSD| 38777299

Source: Accounting Department of Van Loc Company

Figure 2.7: The flow chart of accounting vouchers for bank deposits

Order of bookkeeping: lOMoARcPSD| 38777299

Record at the end of the month or periodically Reconcile

Source: Accounting Department of Van Loc Company

Figure 2.8: Sequence diagram of accounting book of cash capital

Presenting information in the financial statements:

Financial statements: The entry "Cash and cash equivalents" in the Balance Sheet

contains information about the company's cash capital. The company also fully

presents the principles of cash and cash equivalents recognition, as well as the

method of converting other currencies into the currency used in accounting, in the

notes to the financial statements (accounting at the buying exchange rate). Actual

average interbank sales as reported by the State Bank of Vietnam at the time of accounting). lOMoARcPSD| 38777299

Management report: To serve the management, the company prepares a cash

balance report, a bank deposit balance report, a detailed report on cash receipts and

disbursements, and a detailed cash advance report.

2.3.2. Payroll accounting and payroll deductions: Pay forms:

The company applies a product-based payment method for direct production

workers, fixed-time wages for the service department, and salary-based wages for indirect employees.

(Coefficients salary + allowance) x minimum Actual wage number Time = x of wages working

Number of working days by mode days

Package salary = volume of work completed x unit price TL/SP. Proof of use:

- Based on the unit price to determine the salary level of each department.

- Based on the timesheet (for service department), summary table of

production results with details of each person (for direct production

workers), Labor classification table A, B (for indirect staff).

- Table of salary payment calculated for each production team, each department.

- Salary distribution table.

- List of deductions paid according to salary.

Monthly salary accounting is based on the labor results of each employee, the

summary table of each department's labor results, then compares and checks with

the salary unit price to make a payment table.

Accounts used: Accounts 334, 335, 338 and other related accounts lOMoARcPSD| 38777299

Accounting books used: Detailed books, ledger accounts 334, 335, 338, accounting vouchers.

The order of accounting for salary and deductions according to salary:

TK 111, 112 TK 334 TK 622

Salary payment Wages payable to direct production workers TK 138, 141 TK 335 Salary deductions

Actual salary Deducting leave for leave salary in advance TK 338 TK 627, 642

Calculating social insurance, Salary for project

health insurance, unemployment management staff insurance, unemployment insurance deducted from employee's salary

Source: Accounting Department of Van Loc Company

Figure 2.9: Sequence chart of salary accounting and salary deductions

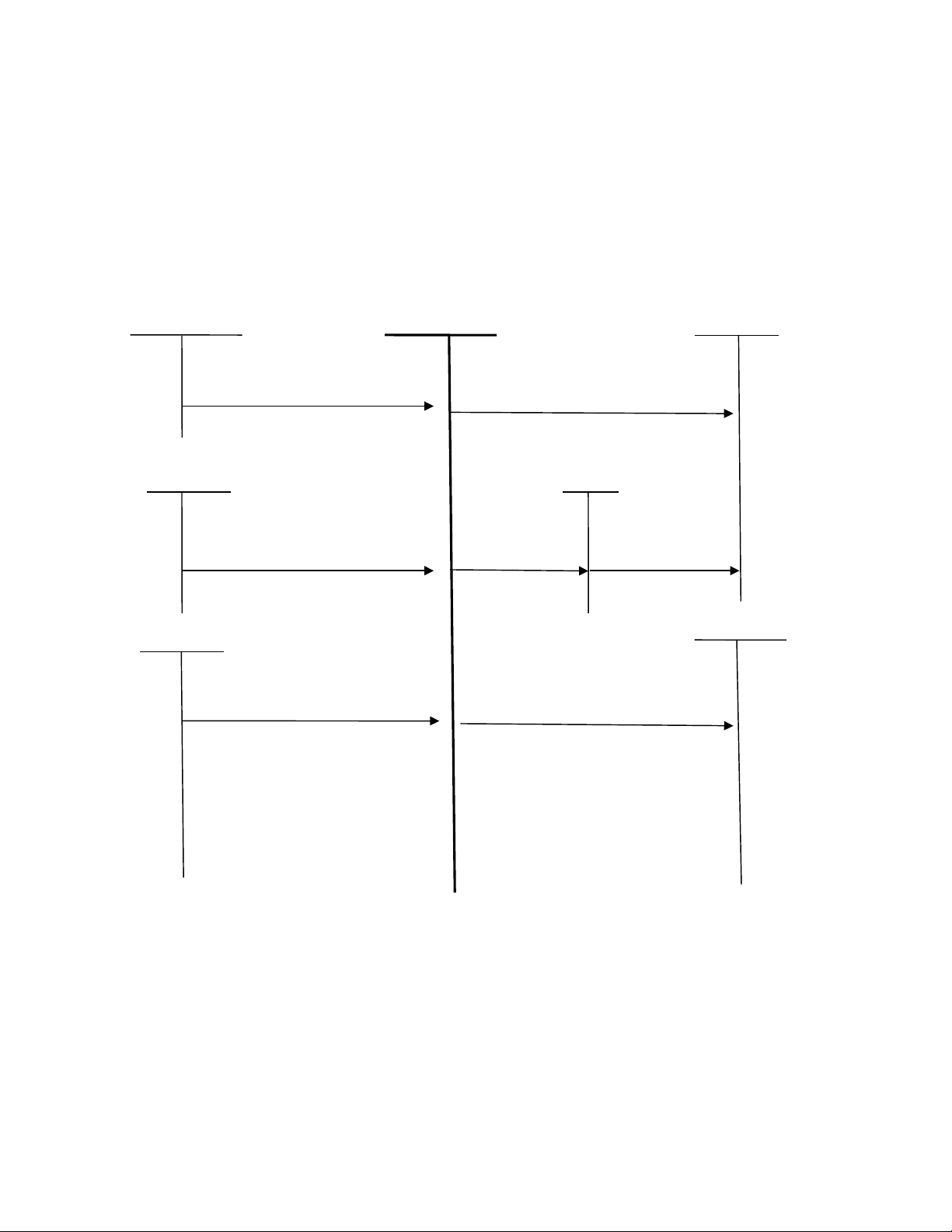

The order of recording salary accounting books and deductions according to salary:

Time sheet, salary payment table and salary deductions lOMoARcPSD| 38777299 Recording vouchers Account details book 338 Ledger account 334, 338 Detailed summary table Balance sheet amounts arising Financial Statement Notes: Record daily

Record at the end of the month or periodically Reconcile

Source: Accounting Department of Van Loc Company

Figure 2.10: Sequence diagram for recording salary accounting books and

salary deductions

The process of circulating salary accounting documents and deductions

according to salary: lOMoARcPSD| 38777299

Source: Accounting Department of Van Loc Company

Figure 2.11: Flowchart of the circulation of salary accounting documents and

salary deductions

Presenting information in the financial statements:

Financial statements: Information on salary and salary deductions is presented on

the item “Payable to employees” (code 315) and item “Other short-term payables

and payables” (code 319) ). The data on these two indicators will be explained and

explained in detail in the notes to the financial statements of the company.

Management reports: Regarding salary and salary deductions, Van Loc Liquefied

Gas Import-Export and Trading Joint Stock Company prepares management reports:

Salary balance report, distribution report allocate deductions according to salary,

report on quarterly salary distribution of each department and production team. lOMoARcPSD| 38777299

CHAPTER 3: ASSESSMENT OF ACCOUNTING

ORGANIZATION AND ACCOUNTING SYSTEM AT VAN LOC

LIQUEFIED GAS IMPORT-EXPORT AND TRADING JOINT STOCK COMPANY

3.1. Assessment of accounting organization:

3.1.1. Advantages:

During the process of construction and development of Van Loc Liquefied Gas

Import-Export and Trading Joint Stock Company, Van Loc has constantly improved

the management apparatus as well as the business method firmly to suit the market.

Through the process of internship at the Company, step by step getting acquainted

with the organization and management in general and the accounting work in

particular, I would like to make some comments as follows:

- The organization’s apparatus is very well organized, and the method of

organizing production and business activities is based on practical and

scientific principles. The management apparatus of the company is very

well organized. a method of organizing production and business activities

that is based on practical and scientific principles.

- The Company has strictly complied with the accounting regimes on salary,

bonus, allowances, and allowances according to the State's regulations,

correctly calculated and fully calculated the salary for employees, and

properly complied with the deductions. Pay salaries to employees quickly

and in a timely manner, taking into account factors such as social insurance,

health insurance, and labor unions.

- About the application of the accounting system: The Company applies the

corporate accounting system promulgated according to Circular No.

133/2016/TT-BTC dated August 26, 2016 of the Ministry of Finance,

circulars guiding, amending and supplementing the accounting regime.

corporate accounting and decisions on promulgation of Vietnamese

accounting standards, circulars guiding, amending and supplementing

Vietnamese accounting standards issued by the Ministry of Finance,

effective until the end of the fiscal year. accounting for annual financial statements.

- About accounting books: The Company applies the form of accounting

books: Computerized in combination with detailed and general books,

according to the prescribed form. The use of computerized accounting lOMoARcPSD| 38777299

software by the company has assisted the finance and accounting

department in reducing workload, maintaining high accuracy, and

facilitating the use of daily and monthly financial statements. Quarterly and

annual reports assist managers in understanding the company's financial situation.

- About usage voucher: The original accounting vouchers are meticulously

accounted for and arranged in chronological order. Accounting vouchers in

the company ensure both the legitimacy and the state-issued accounting

voucher regime. The rotation and preservation of accounting and payment

work documents is put in order. The departments arrange, classify,

evaluate, check, and monitor the original documents for the month-end

general report. related departments and accounting Documents are kept safe

and secure in the warehouse. The document system is organized by quarter

and year, making it easy to check and compare when necessary.

Furthermore, the company's chief accountant inspects and supervises to

determine the truthfulness of the arising economic transactions in order to

ensure that the transactions have been duly approved by the competent

person, thereby clearly identifying and strengthening the accountability of those involved.

- Accounting apparatus: in general, the accounting team has solid

professional qualifications, a reasonable human resource arrangement with

the right people for the right jobs, and a neatly organized, efficient

implementation of current accounting standards. The accounting apparatus

of the Company has become an effective tool in the Company, effectively

promoting the production and business processes.

- Accounting and payment records accurately reflect the company's financial

situation. Make monthly, quarterly, and annual reports based on the target,

quantity, and value, always providing complete, accurate, and timely

information to the manager. The accounting apparatus always knows how

to absorb and listen to the direction of the Company's Board of Directors as

well as the management levels, deserving to be the Company's advisory

body and economic management tool.

3.1.2. Disadvantages:

Although the company's accounting organization and accounting system have

made significant achievements, there are still some limitations that need to be addressed. lOMoARcPSD| 38777299

In actuality, updating accounting documents is still slow due to the accounting

department's reliance on the following departments before transferring to the

accounting department, resulting in the accounting staff not entering the accounting

software in a timely manner to update the data.

Although the company is currently using machine accounting in its operations,

this software has revealed some drawbacks. The software can become infected with

viruses, causing problems with the accounting data entry process. As a result, the

Company's payment accountant must keep anti-virus software up to date in order to ensure accurate accounting.

The majority of bank payment vouchers are subject to remittance and security

checks. The process of checking bank-to-bank transactions is often timeconsuming,

and the company's sales proceeds must be tracked over time. The accountant's

revenue recognition has been hampered by the slow bank deposit into the Company's account.

Because it is a company that does both business and production, sometimes there

will be confusion between accounting for the purchase of assets to use for production

and the purchase of assets for the economic purposes of the company.

3.2. Recommendations to the organization of accounting at Van Loc Liquefied

Gas Import-Export and Trading Joint Stock Company:

In order to maintain, stabilize, and develop the Company in the future, I would

like to make the following suggestions:

- More accounting training sessions and general accounting discussion

sessions with highly qualified people are needed by the company. People

can share professional experiences and gain more knowledge in accordance

with the state's newly issued regulations through these exchanges. The

company organizes a program on a regular basis to test the professional

skills and evaluate the qualifications of the accounting department's staff.

The company may have a reward and encouragement policy for outstanding

employees. Employees who do not meet the requirements can make

excuses and the company can take measures to apply to such employees,

such as requesting leave, allowing me to attend extra school to improve my

professional skills, and so on.

- To improve labor productivity and product quality, the company must have

timely incentive and reward policies in place, such as rewarding, ranking lOMoARcPSD| 38777299

workers, and rewarding immediately for innovative initiatives. enhance

labor productivity and product quality.

- Improving production machines to create higher quality products with

prices that are consistent with the common ground of all customers today.

- Upgrading the company's computer software to prevent the computer from

being infected with a virus and affecting the data in the company's accounting software.

- Pay more attention to employees' lives, such as shift diets, fostering regimes

when working overtime, overtime; toxic fostering on a monthly basis, gifts and bonuses on holidays...

- Strengthen advertising and joint ventures to expand domestic and foreign

markets and promote product consumption in order to increase revenue and

profit while gaining a strong position in the current market. CONCLUSION

Internship in accounting is an important process and brings many practical

meanings to each student. During this process, students have direct access to

production and business establishments, giving students the opportunity to access

their chosen career and apply the knowledge they have learned at school in practice.

work, helping students to recognize their own strengths and weaknesses so that they

can have training plans and equip them with the necessary knowledge and skills to

meet the requirements of the job. Thereby, helping students be more confident after

graduation and applying for jobs, and also help students not be too delusional leading

to disappointment in reality when actually participating in the labor market.

During my internship at Van Loc Liquefied Gas Import-Export and Trading Joint

Stock Company, I not only had the opportunity to learn in general about the

organizational situation of the company's accounting system. a business in reality.

But I also had the opportunity to observe and participate in a number of jobs that I

oriented to follow after graduation, which helped me to recognize my strengths and

weaknesses, as well as knowledge, skills necessary to meet the requirements of the

job that you orient. From there, it helps me to have a more effective training plan and strategy.

Despite my best efforts, my graduation internship report cannot be error-free due

to my lack of experience. To make this report more complete, we would like to hear

from teachers and Company employees.

Finally, I would like to express my deep gratitude for the guidance and help of lOMoARcPSD| 38777299

Dr. Ha Thi Phuong Dung, and the leadership of Van Loc Liquefied Gas

ImportExport and Trading Joint Stock Company, especially the Accounting

Department, which helped me in the process of training as well as writing reports.