Preview text:

HO CHI MINH CITY UNIVERSITY

OF FOREIGN LANGUAGES - INFORMATION TECHNOLOGY

FACULTY OF BUSINESS ADMINISTRATION ---------***-------- SECURITIES MARKET

Major: International Business

VIETNAM DAIRY PRODUCTS JOINT –

STOCK COMPANY (VINAMILK)

Nguyễn Thị Thanh Hồng_20DH121505

Phạm Hồng Lâm Như_20DH120620

Đặng Võ Đào Nhung_20DH121566

Lê Thị Cẩm Nguyên_20DH121059

Huỳnh Như Ý_20DH120592 HCMC, November/2023 Contents

CHAPTER 1: MACRO ANALYSIS..............................................................................1

1.1. Economy..............................................................................................................1 1.1.1.

GDP...........................................................................................................1 1.1.2.

Inflation.....................................................................................................2

1.2. Technology..........................................................................................................3

1.3. Political................................................................................................................3

1.4. Social culture.......................................................................................................4

CHAPTER 2: ANALYSIS OF VINAMILK’S INDUSTRY PROSPECTS.................5

2.1. Vinamilk’s development prospects....................................................................5

2.2. Competition in the dairy industry.....................................................................6

2.3. Vinamilk’s market share....................................................................................6

CHAPTER 3: ANALYSIS OF VINAMILK’S BUSINESS PROSPECTS..................8

3.1. Business model of Vinamilk...............................................................................8

3.2. Analyze results of activities business.................................................................8

3.3. Competitive advantage.....................................................................................11

3.4. Growth prospects of the business....................................................................11

CHAPTER 4: ANALYZE VINAMILK’S FINANCIAL INDICATORS.................12

4.1. Liquidity index..................................................................................................12 4.1.1.

Current ratio...........................................................................................12 4.1.2.

Quick ratio..............................................................................................13

4.2. Active index.......................................................................................................14 4.2.1.

Total assets turnover..............................................................................14 4.2.2.

Total equity turnover..............................................................................16

4.3. Leverage ratio...................................................................................................17 4.3.1.

D/A ratio..................................................................................................17 4.3.2.

D/E ratio..................................................................................................18

4.4. Profitability ratio..............................................................................................19 4.4.1.

Return on asset (ROA)...........................................................................19 4.4.2.

Return on equity (ROE).........................................................................20

CHAPTER 5: VALUATION AND RECOMMENDATION......................................22

REFERENCES............................................................................................................... 24

Table 1.1. The GDP growth rate in 3 quarters compared to the same period last year

...........................................................................................................................................1

Table 3.1 The results of Vinamilk’s business activities from 2018 to 2022..................9

Table 4.1 Current ratio..................................................................................................12

Table 4.2 Quick ratio.....................................................................................................13

Table 4.3 Total asset turnover.......................................................................................15

Table 4.4 Total equity turnover....................................................................................16

Table 4.5 Debt to asset ratio..........................................................................................17

Table 4.6 Debt to equity ratio........................................................................................18

Table 4.7 Return on assets.............................................................................................19

Table 4.8 Return on equity............................................................................................20

Table 5.1 The average P/B and P/E of businesses with the same business field........22

Table 5.2 Profit after tax of the last 4 quarters of VNM.............................................23

Table 5.3 Valuation results............................................................................................23

Figure 1.1 The GDP growth rate in 3 quarters in 2022 compared to the same period

last year.............................................................................................................................1

Figure 1.2 The GDP growth rate in 3 quarters in 2023 compared to the same period

last year.............................................................................................................................2

Figure 1.3 CPI in 9 months in 2023 compared to the same period last year................3

Figure 2.1 Industry life cycle of Vinamilk......................................................................5

Figure 2.2 Consolidated profit after tax.........................................................................6

Figure 3.1 The results of Vinamilk’s business activities from 2018 to 2022...............10

Figure 4.1 Current ratio................................................................................................12

Figure 4.2 Quick ratio....................................................................................................14

Figure 4.3 Total asset turnover.....................................................................................15

Figure 4.4 Total equity turnover...................................................................................16

Figure 4.5 Debt to asset ratio.........................................................................................17

Figure 4.6 Debt to equity ratio......................................................................................19

Figure 4.7 Return on assets...........................................................................................20

Figure 4.8 Return on equity...........................................................................................21

CHAPTER 1: MACRO ANALYSIS 1.1. Economy 1.1.1. GDP

Following the Covid-19 pandemic, the economy steadily recovered and consumer

health concerns grew, which made it advantageous for Vinamilk (VNM) to invest in

growing its production operations and market share.

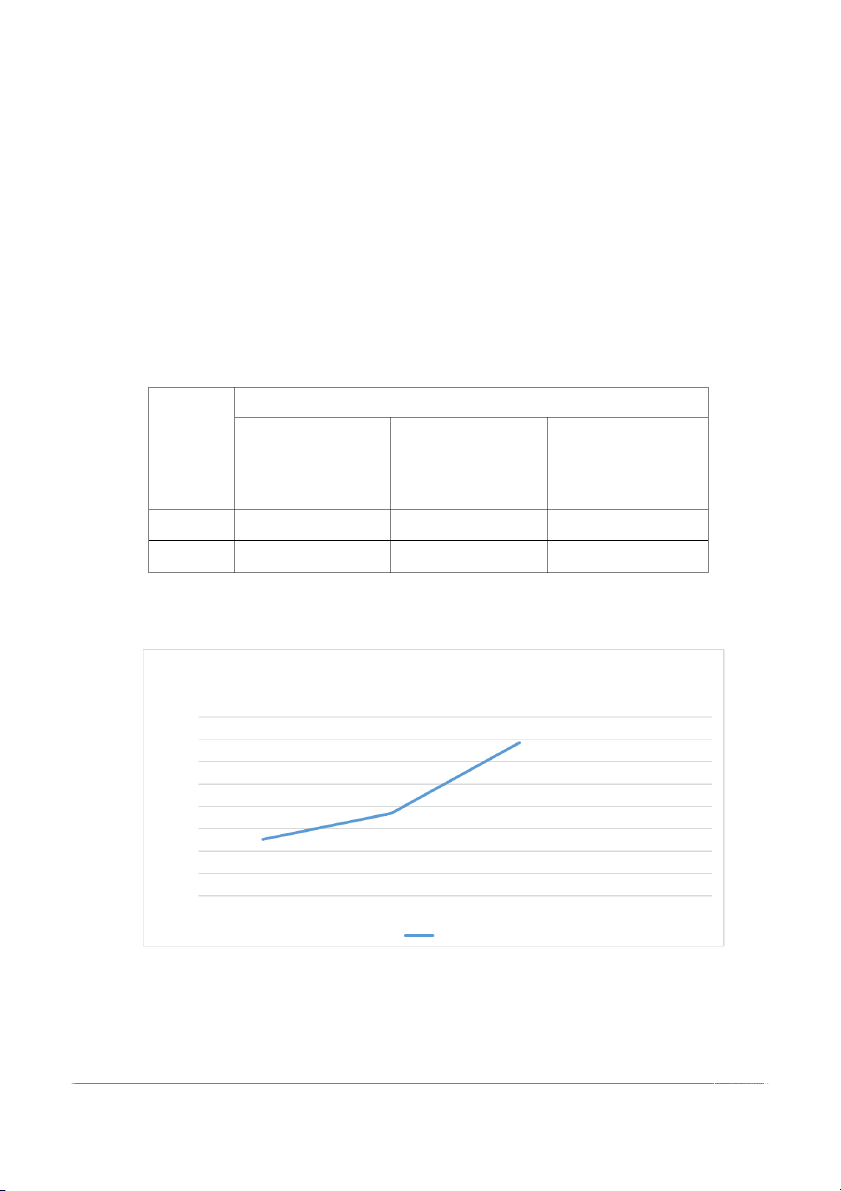

Table 1.1 The GDP growth rate in 3 quarters compared to the same period last . year (Unit %) GDP

Quarter 1 compared Quarter 2 compared Quarter 3 compared to the same period to the same period to the same period last year last year last year 2022 5.05% 7.38% 13.71% 2023 3.32% 4.14% 5.33%

Figure 1.1 The GDP growth rate in 3 quarters in 2022 compared to the same period last year

Growth rate of GDP in 3 quarters of 2022 compared to the same period last year 16.00% 14.00% 13.71% 12.00% 10.00% 8.00% 7.38% 6.00% 5.05% 4.00% 2.00% 0.00% Q1 Q2 Q3 GDP (Source by the author) 1

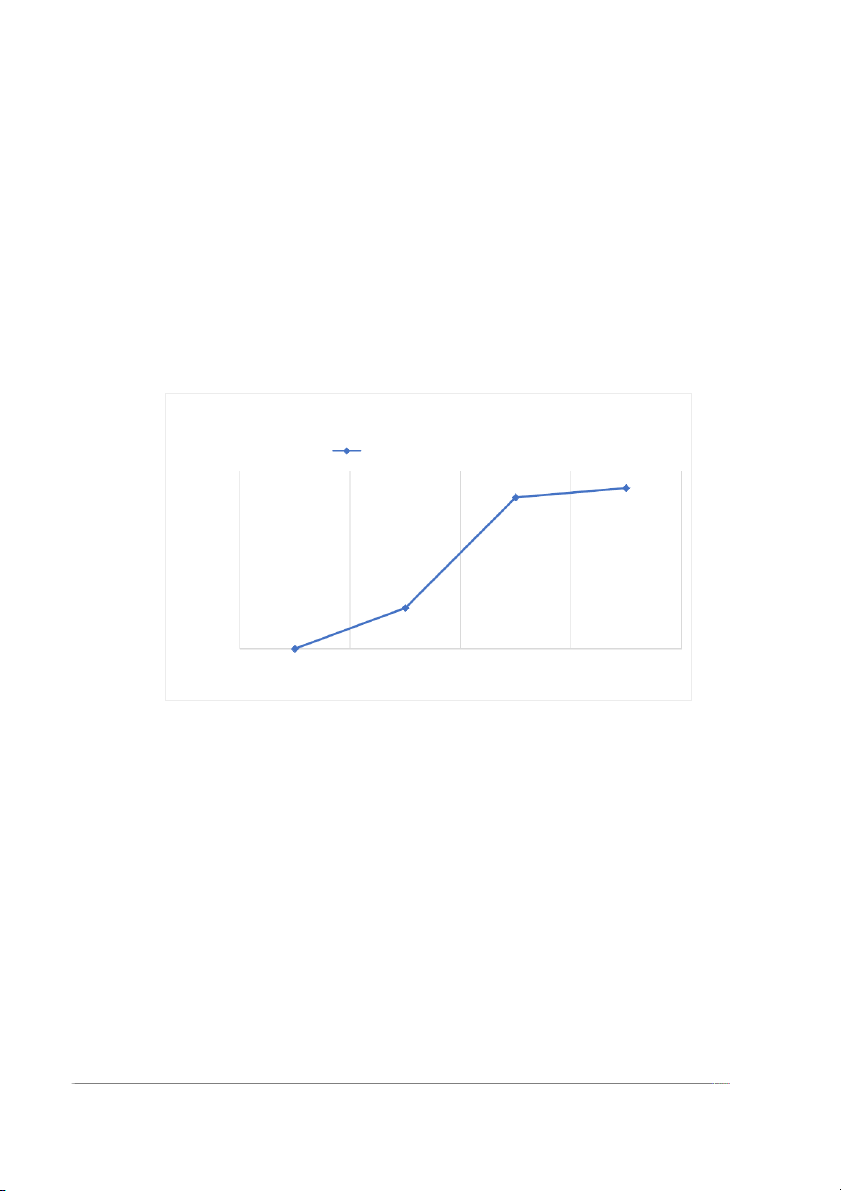

Figure 1.2 The GDP growth rate in 3 quarters in 2023 compared to the same period last year

Growth rate of GDP in 3 quarters of 2023 compared to the same period last year 6.00% 5.33% 5.00% 4.00% 4.14% 3.32% 3.00% 2.00% 1.00% 0.00% Q1 Q2 Q3 GDP (Source by the Author)

According to Figure 1.1, in the third quarter of 2022, the GDP growth rate reached

13.71% over the same period last year due to the economic situation recovering after the

covid - 19 epidemic. Based on Figure 1.2, the GDP growth rate in 3 quarters of 2023

increased gradually over the quarters compared to the same period last year. Specifically,

the first quarter increased by 3.32% over the same period in 2022, the second quarter

increased by 4.14% and the third quarter increased by 5.33% compared to the same

period last year. The increase in GDP growth rate makes consumer trends and needs

different, they are willing to spend more to meet the demand for quality and variety of

products... Thereby, creating a difference to differentiate income in society as well as

create many distinct segments in the market. For that reason, Vinamilk must be aware of

this diversity in order to be able to adjust and satisfy the needs of each segment. 1.1.2. Inflation

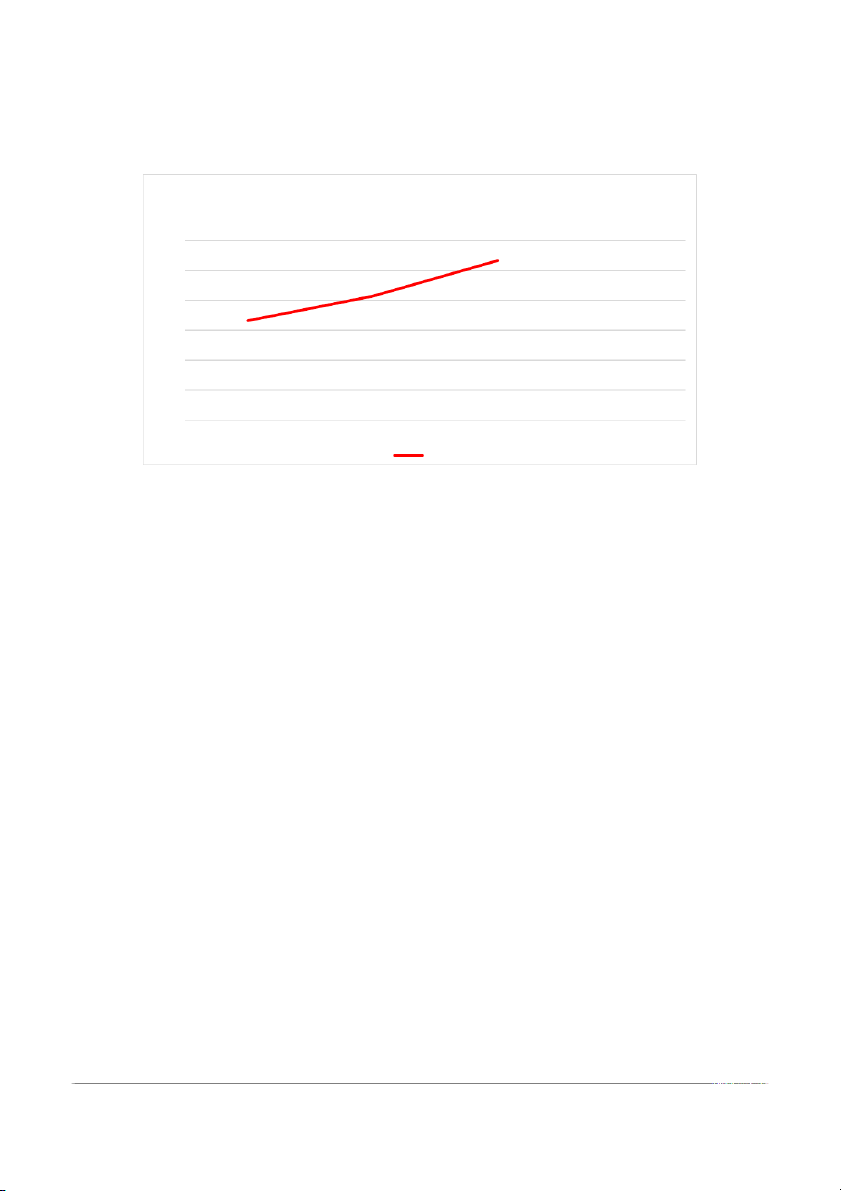

Based on the Figure 1.3, in 2023, the CPI fell from January to July before

progressively rising once more. Furthermore, during the first nine months of 2023, there

was a 4.49% increase in inflation. This led to a rise in raw material costs, which is why

Vinamilk decided to raise prices by 3-5%. To face this challenge, Vinamilk will make an

effort to enhance revenue and decrease expenses in order to improve profit margins despite market challenges. 2

Figure 1.3 CPI in 9 months in 2023 compared to the same period last year

CPI in 9 months in 2023 compared to the same period last year 6.00% 5.00% 4.89% 4.31% 4.00% 3.35% 3.66% 2.96% 3.00% 2.81% 2.43% 2.00% 2.06% 2.00% 1.00% 0.00% arch ay April M June July January August February M September CPI (Source by the Author) 1.2. Technology

As science and technology advance, Vinamilk prioritizes production efficiency via

the use of cutting-edge machinery and sophisticated technology. At the 15th global dairy

conference in France, Vinamilk spoke about promoting the Green Farm project, an

environmentally friendly farm system, and environmentally friendly goods (Vinamilk

chia sẻ về mô hình "Green Farm" - bước tiến về phát triển bền vững của ngành sữa tại

Hội nghị toàn cầu tại Pháp, 2022). Recently, VNM was confirmed to be the first dairy

company in Vietnam to have a farm that meets carbon-neutral standards. All animal

waste from these operations will be collected using advanced systems and processed to

produce organic fertilizer for crops and support more agricultural efforts (Lan, 2023). 1.3. Political

Vinamilk imports about 10% of raw materials from Europe. The 5% import duty

that currently applies to products like skimmed and unskimmed milk powder will be

lowered to 2.2% on 1/8/2020, and then to 0% till after 2022. This helps Vinamilk's dairy

products be more price competitive. Vinamilk products can benefit from this

advantageous condition to become more cost-competitive and Vinamilk's gross profit

margin will improve from this (THUY, 2020). 3 1.4. Social culture

Vietnamese people have the habit of using milk every day, especially families with

small children. According to statistics, the average milk consumption per capita in

Vietnam is 27 liters/person/year and will continue to increase by 7-8% every year (Hang,

2022). Besides, according to a survey by UNICEF, Vietnam has 1.8 million children

under 5 years old who are malnourished (Bình, 2023). This shows that this is a potential

market and creates opportunities for Vinamilk to expand production to meet consumer

demand as well as take advantage of opportunities to build a reputable and quality image for its products. 4

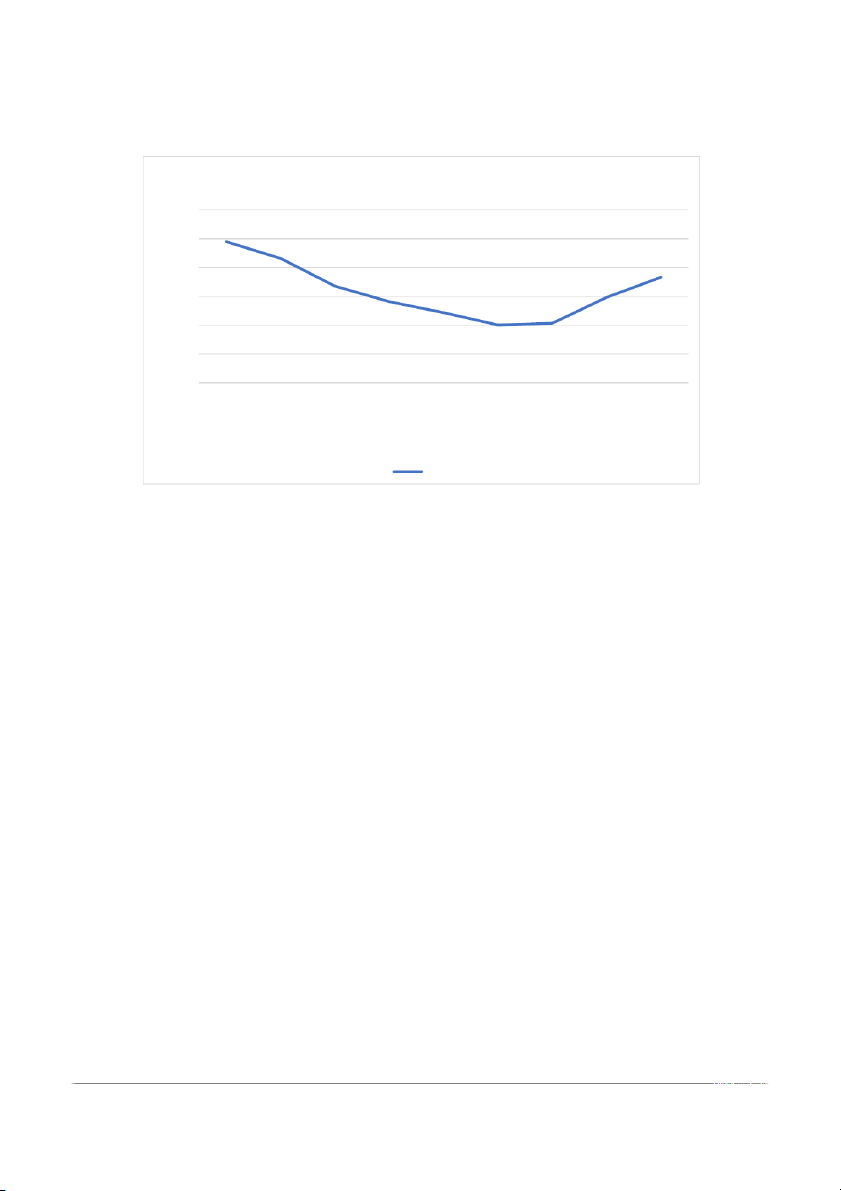

CHAPTER 2: ANALYSIS OF VINAMILK’S INDUSTRY PROSPECTS 2.1.

Vinamilk’s development prospects

In the second quarter of 2023, the dairy market has gradually recovered from the

events caused by the impact of the Covid-19 epidemic and the impact of an increase in

raw material prices from 60%-70%. At the beginning of 2023,according to industry life

cycle of Vinamilk, Vinamilk set a target of achieving total revenue of VND 63,380

billion. However, profits did not reach expectations and tended to decrease over the same

period due to pressure from costs.

Figure 2.1 Industry life cycle of Vinamilk

INDUSTRY LIFE CYCLE OF VINAMILK

INDUSTRY LIFE CYCLE OF VINAMILK 70000 63,380 59,732 60000 50000 e 40000 enu ev 30000 R 20000 16,081 10000 0 0 1 9 7 6 2 0 1 0 2 0 2 0 2 0 2 3 time

(Source by the Vinamilk's financial statements)

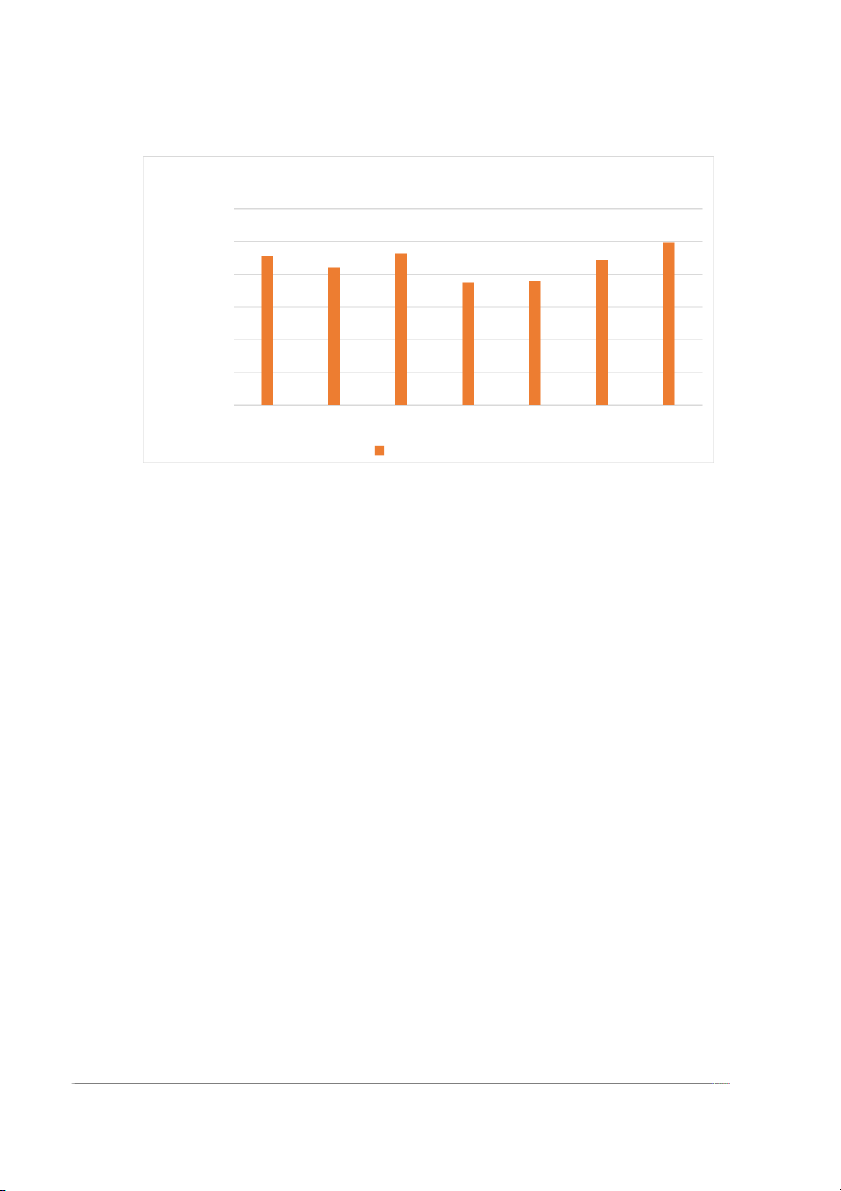

However, entering the second quarter of 2023, Vinamilk recorded more positive

signs when revenue reached 15,200 billion VND, profit after tax reached 2,220 billion

VND, an increase of 16.5% compared to the first quarter. In the third quarter of 2023,

Vinamilk's profit after tax is VND 2,492 billion, an increase of 8.5% compared to the

third quarter of 2022 based on Figure 2.2. 5

Figure 2.2 Consolidated profit after tax Profit after tax of Vinamilk 3000 2,492 2500 2,283 2,323 2,102 2,220 2000 1,869 1,906 D 1500 on VN li il 1000 B 500

0 Q1/2022 Q2/2022 Q3/2022 Q4/2022 Q1/2023 Q2/2023 Q3/2023 Profit after tax (Source by the Author)

Currently, the dairy industry in the Vietnamese market is still saturated with a stable

trend, but high prices of input materials are still putting pressure on dairy businesses in

Vietnam. As a giant in the dairy industry, Vinamilk still has to struggle to balance

product prices suitable for consumers and input material costs.

To avoid being affected by rising raw material supply prices, Vinamilk needs to

build on the trend of modernization, green sustainability and create a raw material supply from the production site. 2.2.

Competition in the dairy industry

In 2023, it is predicted that milk raw material prices will return to the price range of

2021, this is an opportunity to help Vinamilk grow strongly again. In addition, Vinamilk

also needs to adjust milk purchasing prices and packaging costs so that gross profit grows but slowly. (VIRAC, 2023)

Vinamilk's product research and development team always updates their knowledge and

learns deeply about domestic and foreign markets. This also helps businesses promptly

grasp opportunities and come up with optimal ideas for product development. (Yen, 2022) 2.3.

Vinamilk’s market share 6