Preview text:

BANKS OF QUESTIONS

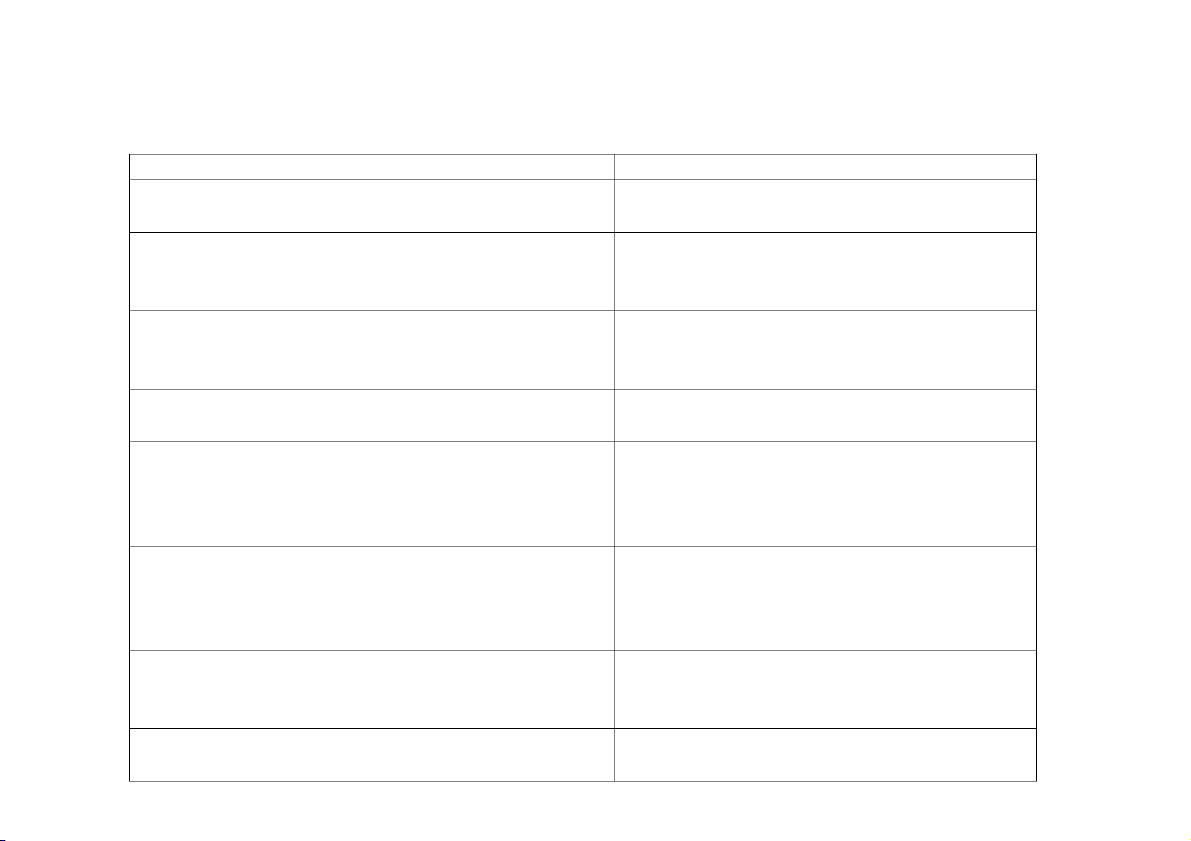

UNIT 6 MONEY AND BANKING Questions Answers 1. What is a deposit?

A deposit is a sum of money which is in a bank account

or savings account, especially a sum which will be left there for some time. 2. What is a demand deposit?

A demand deposit is a bank deposit from which

withdrawals may be made without notice. 3. What is a time deposit?

A time deposit is a bank deposit from which withdrawals

may be made only after advance notice or at a specified

future date/ to earn interest for a fixed period of time: 4. What is a NOW account?

A NOW account, known as negotiable order of

withdrawal account, is an interest-earning bank account

whereby the owner may write drafts against the money held on deposit.

5. What is a share draft account?

A share-draft account is a version of a checking account,

except it is offered by a credit union instead of a bank.

6. What does the central bank do specifically when it

As banker to the government, the central bank collects

functions as the government’s banker?

and disburses government income, manages the issues

and redemption of government debts, advises the

government on all matters pertaining to financial

activities, and makes loans to the government.

7. What does the central bank do specifically when it

As the banker of the banking system, the central bank

functions the banker of the banking system?

holds and transfers bank’s deposits, supervises their

operations, acts as a lender of last resort and provides 1

technical and advisory services.

8. What are functions of commercial banks?

Functions of commercial banks are to create money in

circulation in saving banks and share-drafts in credit

unions; to maintain and create demand deposits by loans and investments.

9. What are functions of insurance companies?

The main functions of insurance companies are to allow

people to pool their resources in order to minimize the

risk associated with accident, sickness, death, and other unpredictable circumstances

10. What does a nation’s money supply include?

A nation’s money supply includes the entire stock of

currency and other liquid instruments circulating in a

country’s economy at a particular time

11. How can commercial banks make/ earn profits?

Commercial banks make/ earn profits from the difference

between the interest rates on deposits and those they

charge for loans; and from the fees and commissions they charge for their services.

12. How can an insurance company act as a financial

As a financial intermediary, an insurance company intermediary?

collects the premiums, most of which is placed in long

terms investments such as bonds, mortgages, stocks, real estates…

MONEY & ITS FUNCTIONS

13. What is a medium of exchange?

A medium of exchange is anything that is widely

accepted in payment for goods and services and in p p y g 2 settlement of debts.

14. How is money used as a means of payment?

Money is used as a means of payment through which

people exchange goods and services.

15. What is a measure of value?/ a unit of account?

A unit of account (such as USD, VND, RMB…) or a

measure of value is the unit in which prices are quoted and accounts are kept.

16. For what purposes is money used as a measure of value?

Money is used as a measure of value to measure the value

of things offered in markets and help simplify the exchange of goods 17. What is a store of value?

Money is a store of value because can be used to make purchase in the future

18. Does money function as a perfect store of value? Why?

No. Money is not a perfect store of value especially when

there is inflation in the economy. /The value or

purchasing power of money may decrease in period of inflation.

19. What is a standard of deferred payments?

A standard of deferred payments is a function of money.

When you buy something and do not pay for it

immediately, your payment is expressed in terms of

money to be paid in the future.

20. For what purposes is money used as a standard of deferred Money is used as a standard of deferred payments for payments?

specifying future payments for current purchases (Buy

now, pay later or Installment buying). 21. What is a barter economy?

Barter economy is a cashless economic system in which

services and goods are traded directly at negotiable rates. 3 22. What is token money?

Token money is a means of payment whose value or

purchasing power as money greatly exceeds its cost of

production or value in uses other than as money. 23. What is commodity money?

Commodity money is a useful good whose value or

purchasing power is about equal to the value of the material contained in it. Topic questions:

1. What are functions of the Central bank?

- to serve as a government’s banker

- to act as the banker of the banking system

- to regulate the monetary system for both domestic and international policy goals

- to issue a nation’s currency

2. How can the central bank implement the monetary policy?

The central bank uses 3 monetary policy tools to increase or decrease the money supply in the economy : - reserve equipments - open market operation - interest rates

To increase the money supply, it lowers the reserve requirements, discount rates or buys government bonds. To

decrease the money supply, it increases the reserve requirements, discount rates or sells government bonds.

3. What are main functions of commercial banks?

Functions of commercial banks are to create money in circulation in saving banks and share-drafts in credit unions;

to maintain and create demand deposits by loans and investments.

4. What are four functions of money?

- As a medium of exchange (anything widely accepted in payment for goods and services and in settlement of debt) g ( y g y p p y g ) 4

- As a measure of value (Money measures the value in the unit of account such as USD, VND, RMB…)

- As a store of value (Money can store the value because it can be used to make purchases in the future)

- As a Standard of Deferred payment (When you buy something and do not pay for it immediately, your payment is

expressed in terms of money to be paid in the future)

5. What is the most important function of money? Why?

- The most important function of money is a medium of exchange, which is anything widely accepted in payments

for goods and services and in settlement of debts.

- As a medium of exchange, money helps facilitate and promote trade. Money is the most common medium of exchange.

6. What are differences between commodity money and token money?

- Token money is a means of payment whose value or purchasing power as money greatly exceeds its cost of

production or value in uses other than as money.

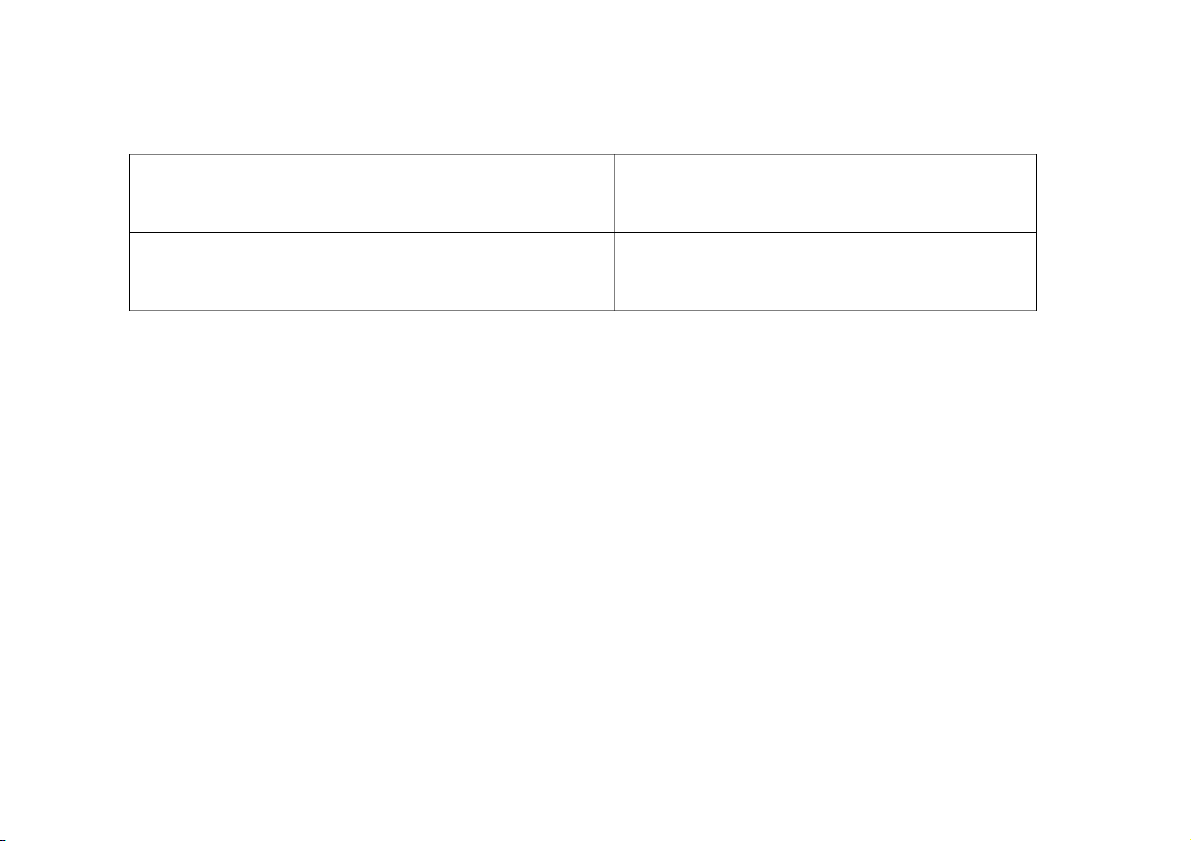

- Commodity money is a useful good whose value or purchasing power is about equal to the value of the material contained in it. UNIT 7 TAXATION Questions Answers TYPES OF TAXES

1. What is the definition of taxation?

Taxation is the act of imposing tax on individuals or organizations by the

government to finance government programs.

2. What is corporate income tax?

Corporate income tax is the tax imposed on a compay’s profits. 3. What is personal income tax

Personal income tax is the tax imposed on individual’s income. 4. What is customs duty?

Customs duty is the tax imposed on imports and exports. 5. What is excise tax?

Excise tax is the tax imposed on specific goods such as wine, cigarettes, cars

6. What is capital transfer tax?

Capital transfer tax is the tax on the gifts or inheritances over a certain value. p p g 5 7. What is capital gain tax?

Capital gain tax is the tax imposed on the profit from selling assets. 8. What is VAT tax?

VAT is the tax imposed on each stage of production excluding the already-

taxed cost from the previous stages. 9. What are progressive taxes?

Progressive tax is tax levied at higher tax rate on higher income.

10. What are regressive taxes?

Pregressive tax is the tax that takes lower percentage in higher income and

higher percentage in lower income. 11. What are direct taxes?

Direct tax is the tax paid directly to the government by the tax payer. 12. What are indirect taxes?

Indirect tax is the tax paid indirectly to the government by the tax payer

13. What is the primary function of taxation?

The primary function of taxation is to raise government revenue.

14. What is the function of corporate income Function of corporate income tax is to encourage capital investment. tax?

15. What is the function of income tax in Income tax is used to redistribute society income or wealth. general?

16. What is the function of excise tax?

Excise tax is used to restrict the consumption of some certain goods that are

not good for health or environment.

17. What is one of the functions of customs Customs duty is used to protect domestic industry. duty?

18. What is one of the functions of payroll Payroll tax is used to ensure social security and medicare. taxes?

TAX AVOIDANCE & TAX EVASION 19. What is tax avoidance?

Tax avoidance is using legal ways to avoid paying tax/ reducing the amount of tax to legal minimum. 20. What are perks?

Perks are non financial benefits or advantages of a job 6

21. What are loopholes in the tax laws?

Loopholes in the tax laws mean a means or opportunity of avading a law. 22. What are tax shelters?

Tax shelter means postponing the payment of tax such as by investing in life

insurance policies or pension plans. 23. What are tax deductibles?

Tax deductible means subtracting the taxable income from the income such as donating to charities.

24. How can a company avoid taxes on A company can avoid taxes on profits by making a tax loss or tax haven for a profits? multinational company. 25. What are tax havens?

Tax havens are countries which have low tax rate.

26. How can a multinational corporation It can set up head office in tax havens. avoid paying taxes? 27. What is money laundering?

Laundering money means passing money through series of companies in very

complicated transactions to disguise the origin from tax inspectors.

28. How does a criminal organization disguise It passes money through series of companies in a very complicated

the origin of their money from tax inspectors? transactions. 29. What is tax evasion?

Tax evasion means using illegal ways to avoid the payment of tax. TOPIC QUESTIONS

1. What are different functions of taxation?

1. Raise gov revenue to finance gov expenditure: defense, building infrastructure…

2. As a tool of fiscal policy, regulate the economy

3. Each type of tax has its own function:

+ customs duty: protect domestic goods….

+ excise tax: deterrent on some specific goods: cigarette, wine, cars 7

+ individual income tax: redistribute income

+ corporate income tax: encourage capital investment

+ payroll tax: ensure social security

2. What is tax avoidance? How do individuals avoid paying taxes?

Tax avoidance is using legal ways to avoid paying tax.

Individuals can avoid tax in some ways:

- Employers pay highly- paid employees perks instead of taxable money:

+ perk: non- financial benefits or advantages of a job: lunches, travelling. Health insurance.

- Tax shelter: postpone the payment of tax by investing in life insurance policies, pension plans…

- Tax deductible: subtracting taxable income by doing charity, listing dependants… never pay tax on subtracted money.

3. What is tax avoidance? How do firms avoid paying taxes?

Tax avoidance is using legal ways to avoid paying tax.

Businesses can avoid tax in some ways:

- Making a tax loss: bring forward capital expenditure so that at the end of the year all the profits are used up.

- Tax havens: multinational companies set up head offices in tax havens. Tax havens are countries which have low tax rates.

4. What are differences between progressive taxes and regressive taxes?

Progressive tax is a tax levied at higher rate on higher income while regressive tax is the tax that takes larger

percentage in lower income and lower percentage in higher income.

Progressive tax rate depends on income, so it can redistribute society income but regressive tax rate is often the same

for everyone so it can be unfair for the low income people.

5. What are differences between direct taxes and indirect taxes?

A direct tax is a tax that you directly pay to the authority imposing the tax, these taxes can’t be shifted to other

entities. Indirect tax is a tax that you indirectly pay to the authority imposing tax through an intermediary. 8

Direct tax is often on income such as individual income or corporate income or property but indirect tax is on goods and services such as VAT.

Direct tax can redistribute wealth in society but indirect tax can’t because indirect tax is often the same rate for everyone.

UNIT 8 ACCOUNTING & FINANCIAL STATEMENTS Questions Answers ACCOUNTING BOOKS

1. What is the definition of accounting?

Accounting is the process of identifying, measuring, recording, classifying,

summarizing, analyzing, interpreting and communicating the financial transactions of a company.

2. What is a journal or a book of original?

It is the book recording financial transactions for the first time.

3. For what purposes are the journals kept?

They are kept for memorandum purpose. 4. What are ledgers?

They include periodical records from a journal. 5. What is an account?

An account includes similar transactions.

6. What are common financial statements?

Balance sheet, Income statement and Cash flow statement ACCOUNTING PROCESS

7. What do accountants have to do daily?

They record financial transactions in a journal

8. What do accountants have to do regularly They transfer/ post information from a journal to a ledger (monthly or quarterly)?

9. What do accountants have to do at the end They make financial statements. of the fiscal year? FINANCIAL STATEMENTS 9

10. What is the basic accounting equation?

Assets= Liabilities + Owner’s equity

11. What information does a balance sheet A balance sheet provides information on financial condition of a business on provide?

a particular date, often the last day of financial year.

12. What do assets of a company include?

Assets of a company include debtors or accounts receivable that are assumed

to be paid such as land, building, inventory, accounts receivables, …

13. What do liabilities of a company include?

Liabilities include creditors or accounts payable that they will have to be paid

such as salary, rent, interest…

14. What information does an income Income statement provides information on a company’s revenue and expenses statement provide? in a period of time.

15. What information does a cash flow Cash flow statement shows the flow of cash in and out of a business in a statement provide? period of time. ACCOUNTING INFORMATION

16. What are main types of accounting They are financial accounting information, management accounting information?

information and tax accounting information.

17. What is the definition of financial Financial accounting information shows information on financial resources, accounting information?

obligations and economic activities of a business.

18. For what purposes do potential investors Potential investors need financial accounting information to decide whether to

need financial accounting information of the place their scarce resources or not. company?

19. For what purposes do creditors need Potential investors need financial accounting information to decide whether to

financial accounting information of the place their resources or not or to lend out or not. company?

20. Why is financial accounting considered as Because it is used by different groups of users for different purposes. 10