Preview text:

CHAP 4: ACCRUAL ACCOUNTING CONCEPTS (KT dồn tích)

1. Explain the accrual basis of accounting and the reasons for adjusting entries

- Divides the economic life into artificial time periods: Periodicity asumption (Giả định thời gian)

- Gennerally a month, a quarter, a year.

- Fiscal year: accounting time period that one year long (Năm TC) vs Calendar year

The revenue recognition principle (ghi nhận doanh thu):

Recognize revenue in which the performance obligation is satisfied (maybe not received cash)

Ex: service provide in June but be paid in July

The expense recognition principle (ghi nhận chi phí):

Match Expense – Revenue _ Matching Principle

Accrual versus cash basis of accounting:

- Accrual-Basis Accounting: record when events occur

- Cash-Basis Accounting: record at time receive cash (not accordance with GAAP)

The need for adjusting entries:

- Ensure 2 principles are followed (Revenue & Expense) - Require when prepare FS

- All adjusting entries include: 1 income statement account & 1 balance sheet account - Some reasons:

+ Some events are not recorded daily. Ex: the use of supplies and the earning of wages

+ Some costs are not recorded because it expires with the passage of time. Ex: the use of

buildings and equipment, rent and insurance.

+ Some items may be unrecorded. Ex: utility service bill.

Types of adjusting entries:

- Deferrals (trì hoãn):

+ Prepaid Expense (CP trả trước): expense paid in cash before they are used.

+ Unearned Revenues (DT chưa thực hiện): cash received before services are performed.

- Accruals (dồn tích):

+ Accrued Revenues (DT dồn tích): revenue for services performed but not yet received in cash.

+ Accrued Expenses (Nợ tồn đọng): expenses incurred but not yet paid.

2. Prepare adjusting entries for deferrals:

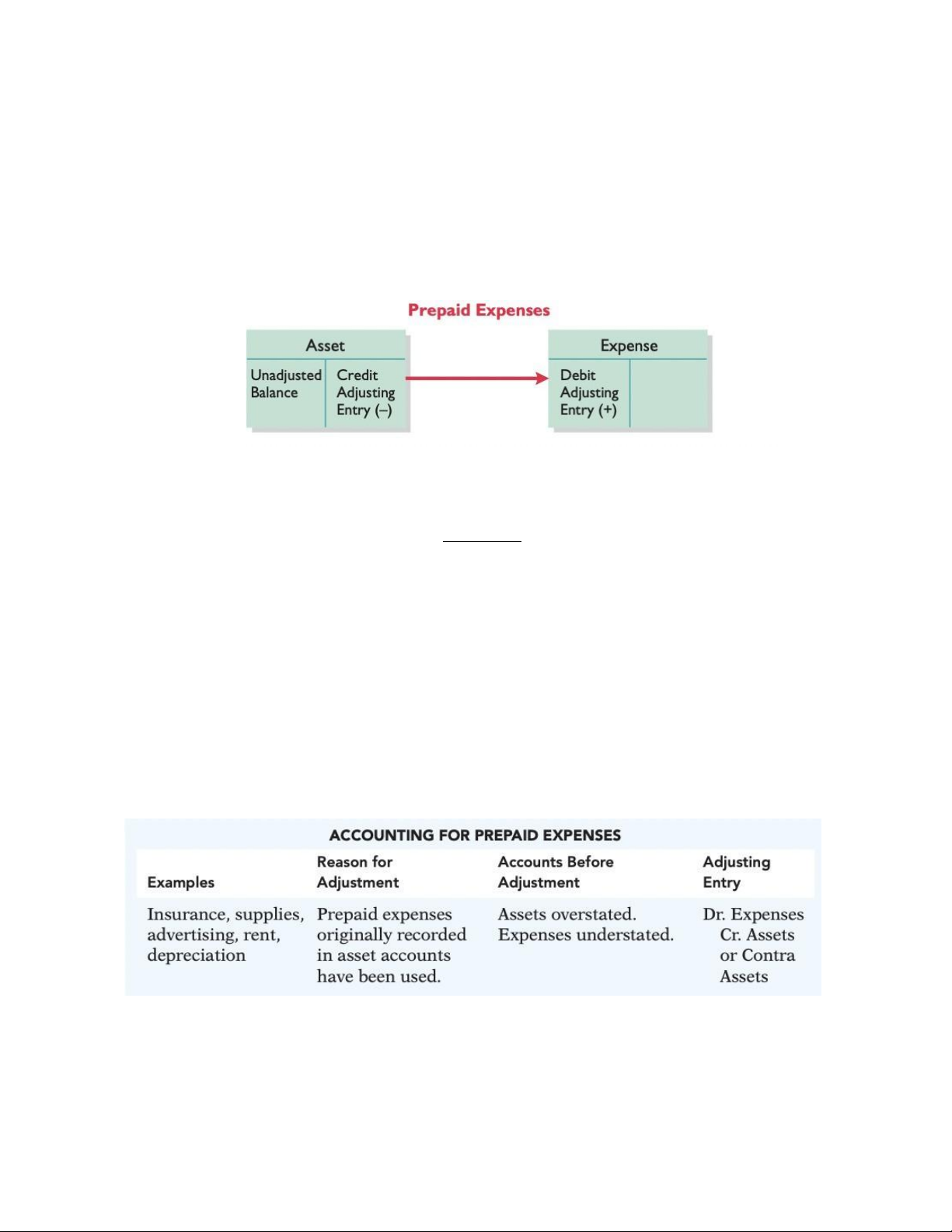

a. Prepaid expense/ Prepayment (CP trả trước): expense paid in cash before they are used.

- expense prepaid so asset increased (debit)

- They are the cost that expire either:

+ Passage of time: rent, insurance + Through use: supplies

(Not require daily entries)

An adjusting entry for prepaid expenses results in: an increase (a debit) to an expense account

and a decrease (a credit) to an asset account (Debit T expense & Credit asset)

Supplies: recognize at the end of the accounting period.

Debit T expense: debit Supplies Expense => overstated Credit asset: credit Supplies

Insurance: at the end, Insurance Expense increase (debit) & Prepaid Insurance decrease (credit)

Debit T expense: debit Insurance Expense

Credit asset: credit Prepaid Insurance

Depreciation: “useful life” - allocate cost to period in which it is used not the actual change in asst’s value.

Debit T expense: debit Depreciation Expense

Credit asset: credit Accumulated Depreciation

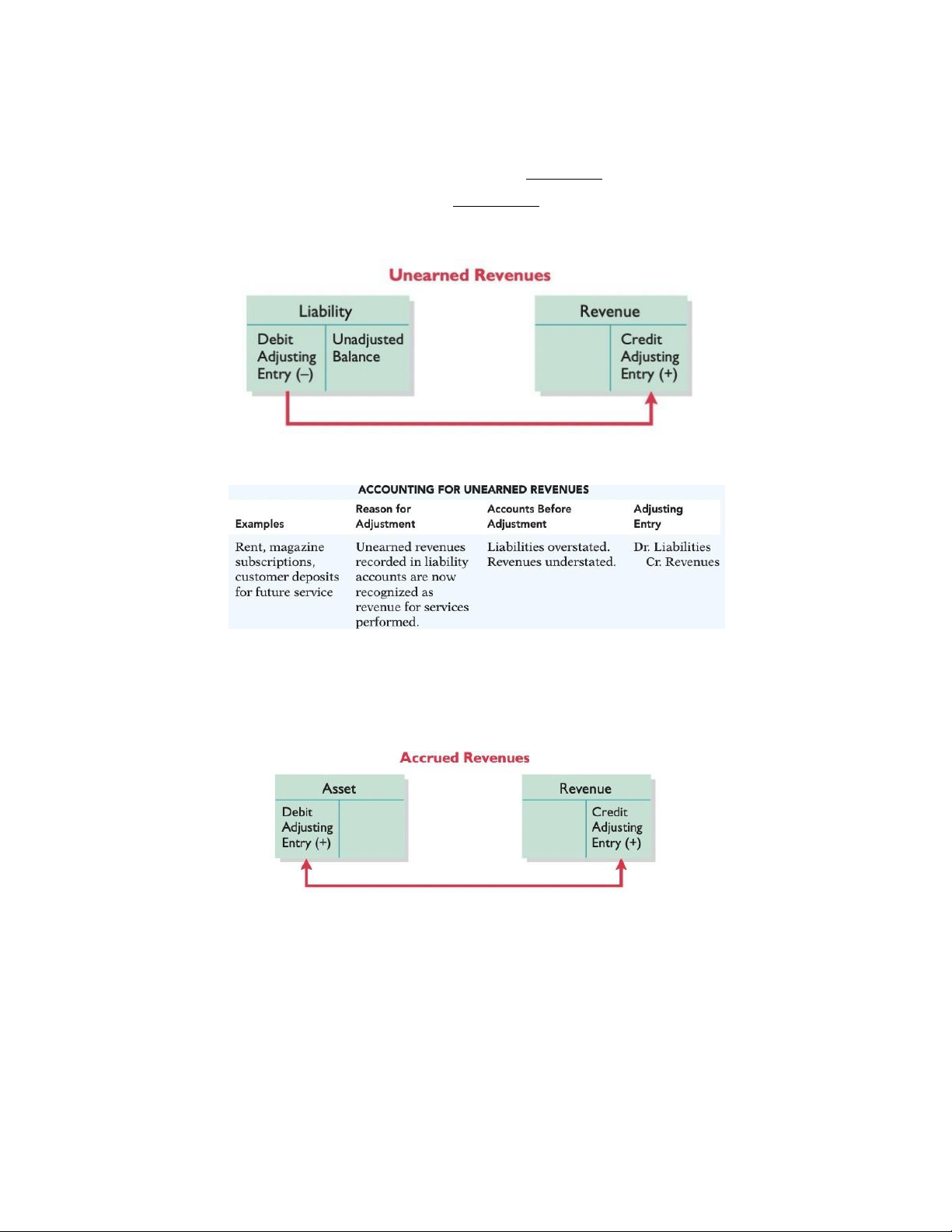

b. Unearned Revenues: (DT chưa thực hiện): cash received before services are performed.

increase (crediting) a liability account called “unearned revenue”

Debit liabilities: debit Unearned Service Revenue => overstated

Credit T revenues: credit Service Revenue => understated

3. Prepare adjusting entries for accruals:

a. Accrued Revenue (DT dồn tích): revenue for services performed but not yet received in cash.

Debit T Assets: debit Account Receivable

Credit T revenues: credit Service Revenue

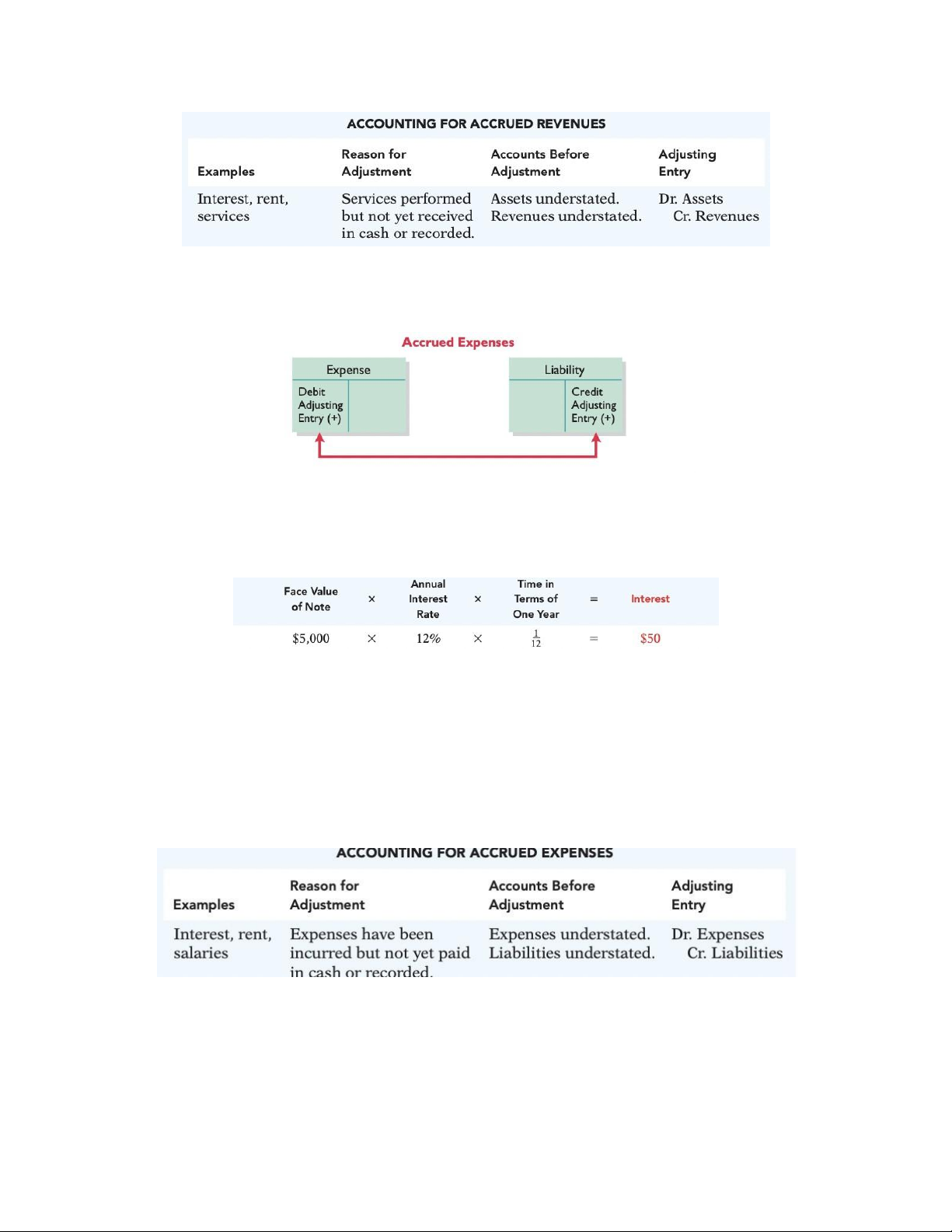

b. Accrued expenses (Nợ tồn đọng): expenses incurred but not yet paid.

interest, taxes, utilities and salaries Debit T Expense: debit Expense

Credit T Liabilities: credit Payable Accrued Interest:

Debit T Expense: debit Interest Expense

Credit T Liabilities: credit Interest Payable Accrued salaries:

Debit T Expense: debit Salaries & Wages Expense

Credit T Liabilities: credit Salaries & Wages Payable

Note: Understated – indicates a reported amount < true amount

Overstated – indicates a reported amount > true amount

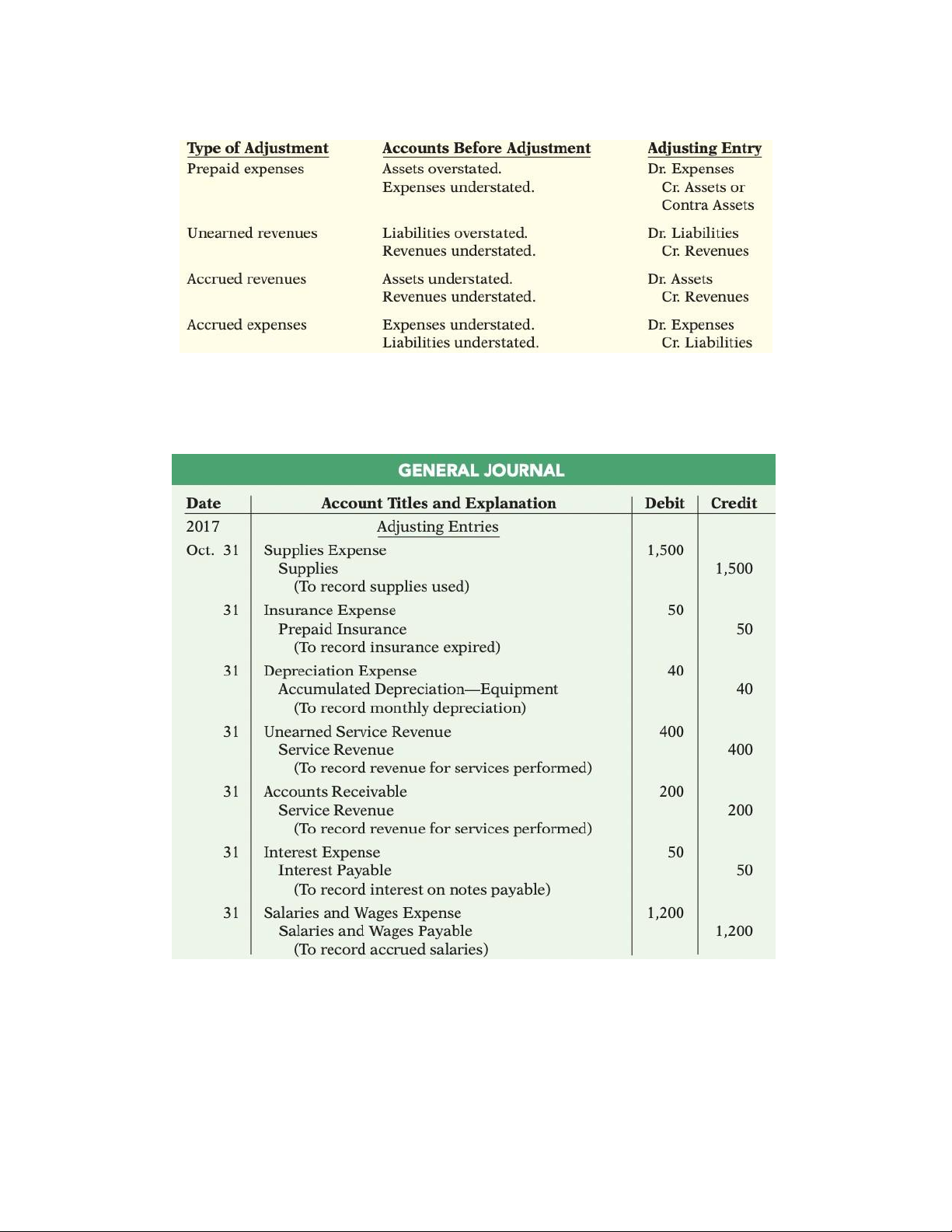

Summary of basic relationships:

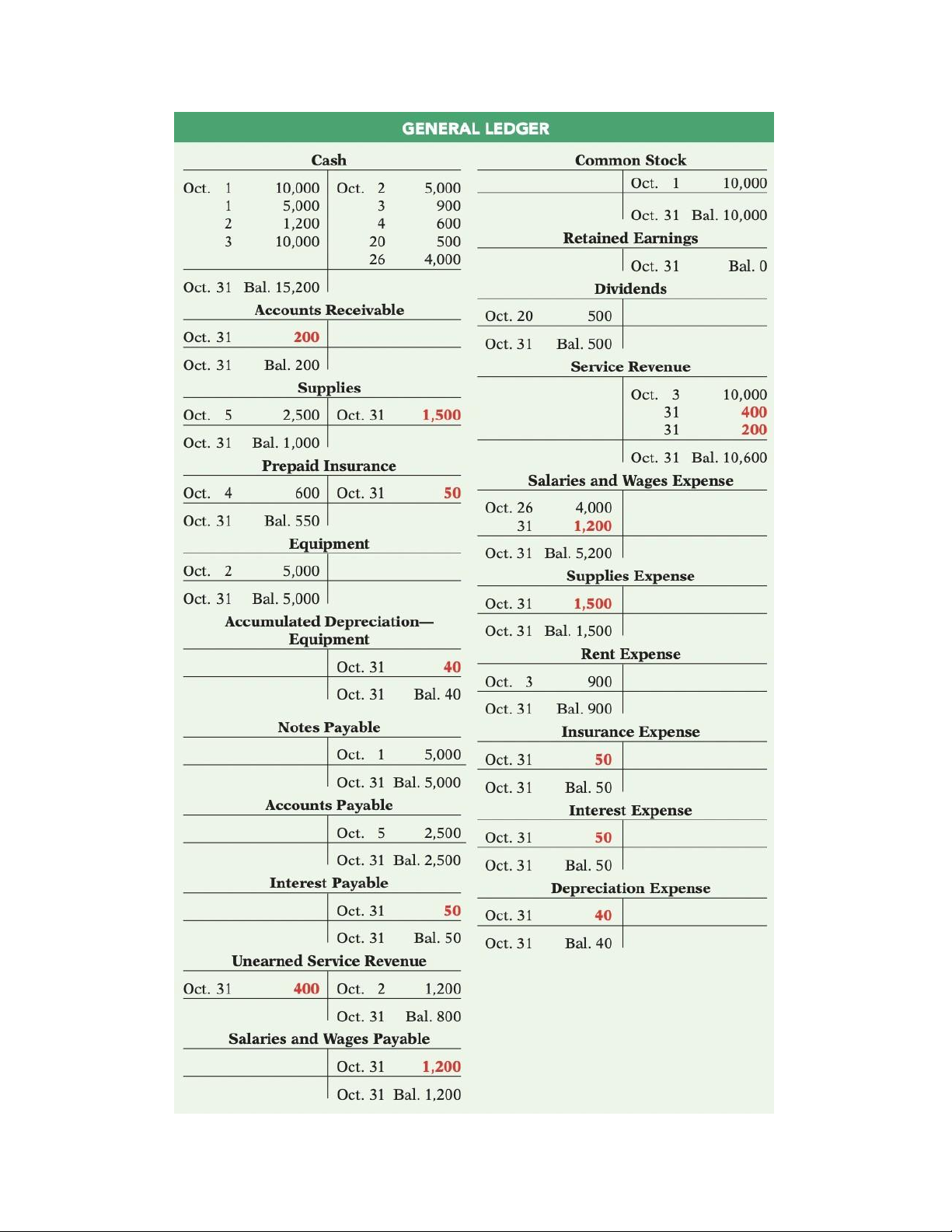

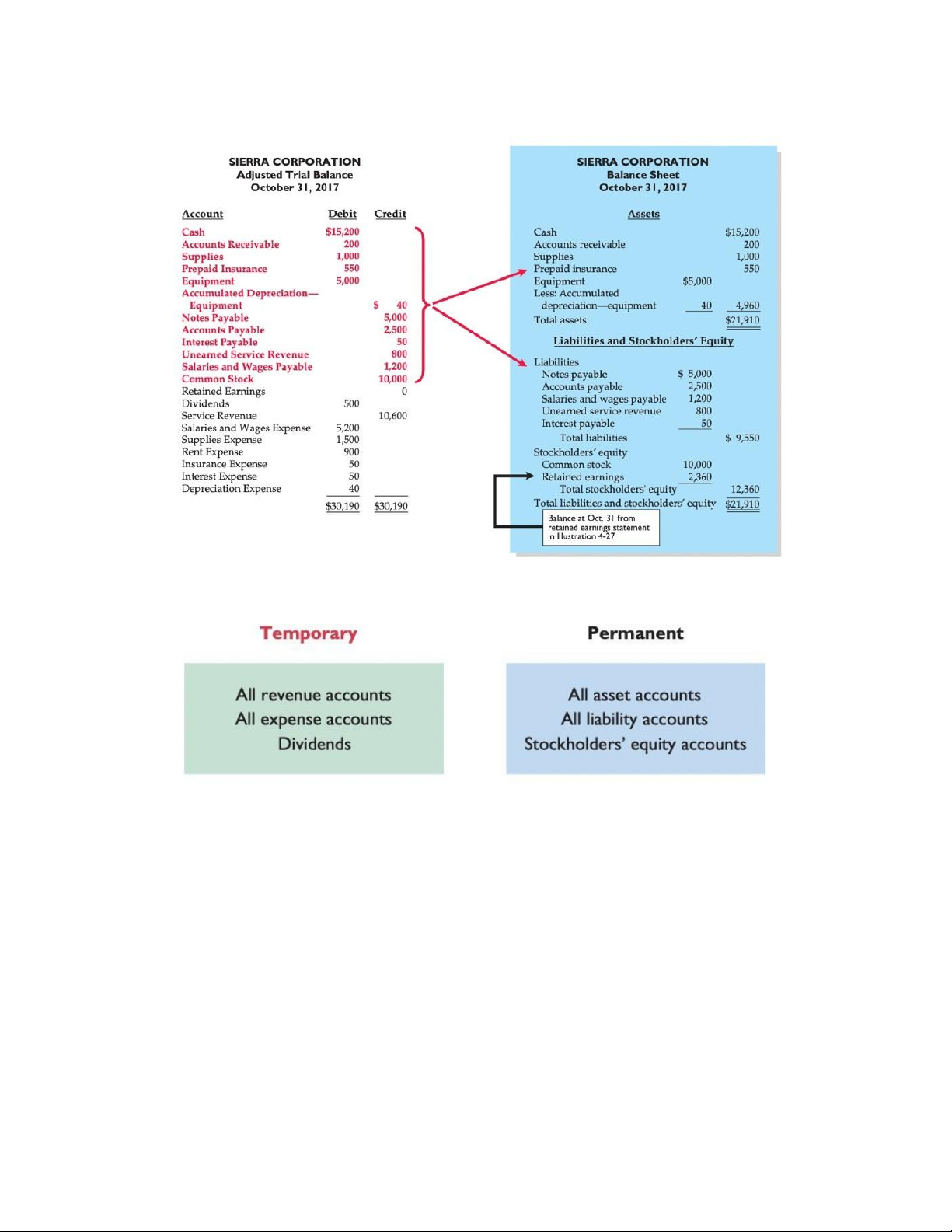

4. Prepare an adjusted trial balance and closing entries:

Preparing the adjusted trial balance: adjusted entries in different colors

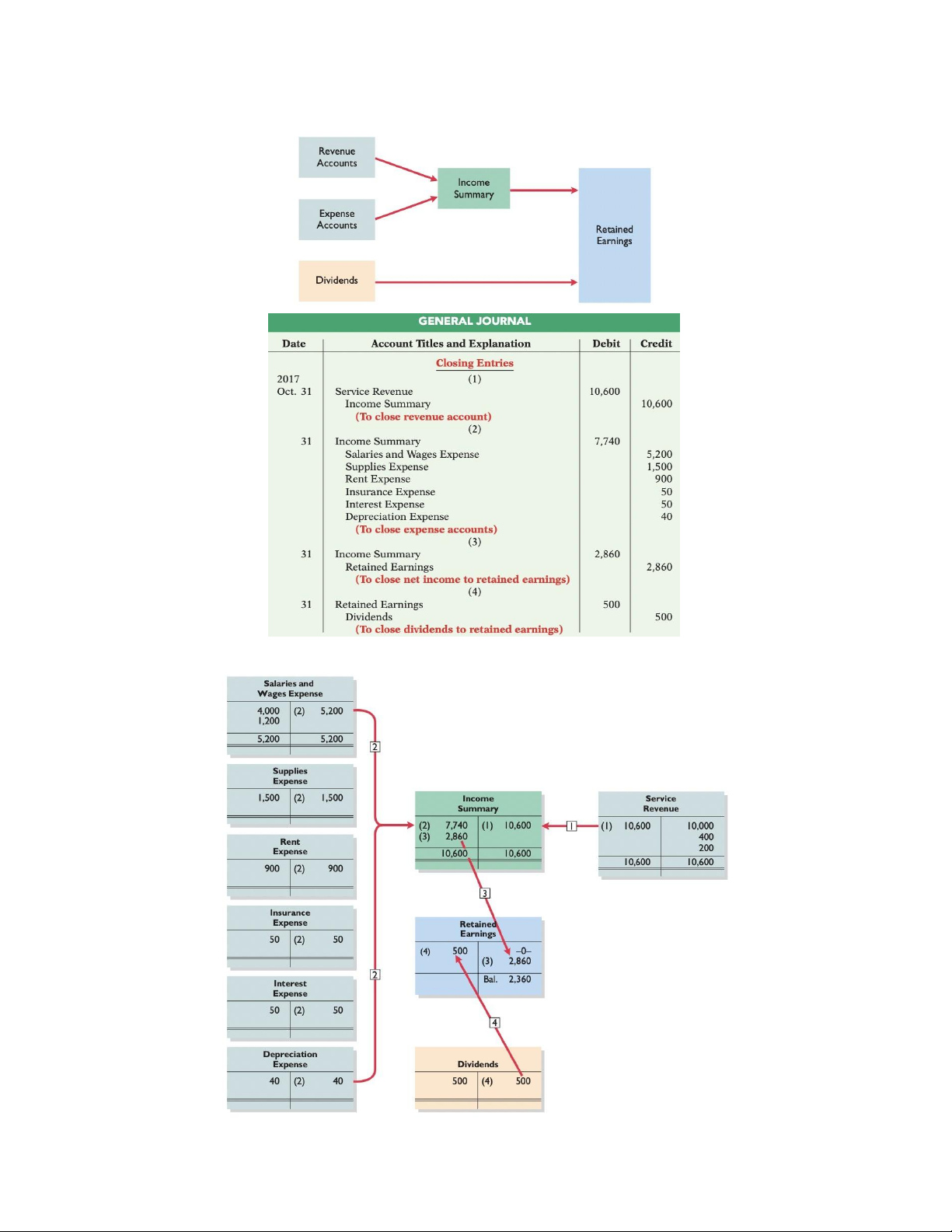

Preparing financial statement: Quality of earnings: Closing the books:

Prepare closing entries:

Preparing a Post-Closing trial balance:

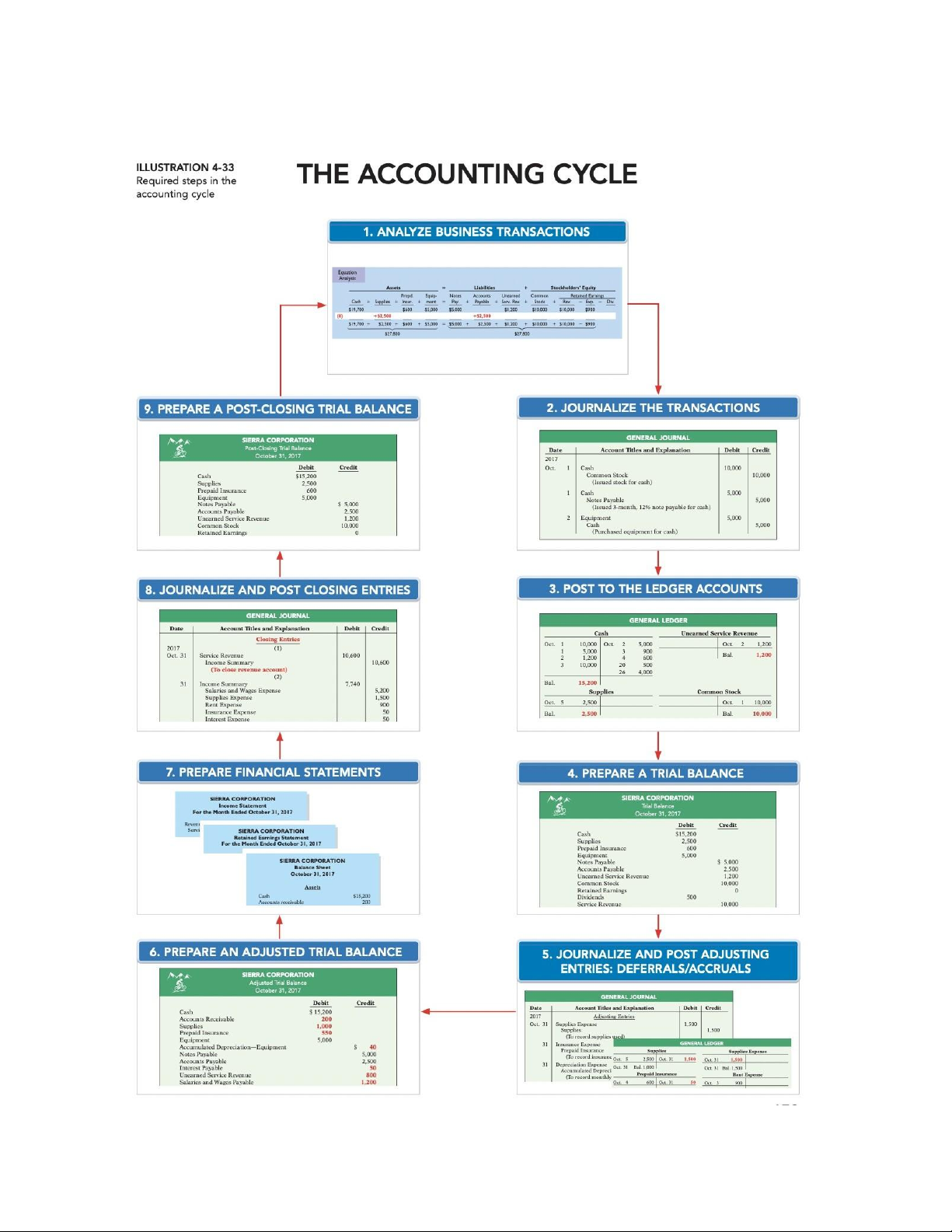

Summary of the accounting cycle:

Document Outline

- 1.Explain the accrual basis of accounting and the re

- 2.Prepare adjusting entries for deferrals:

- Summary of basic relationships: