Preview text:

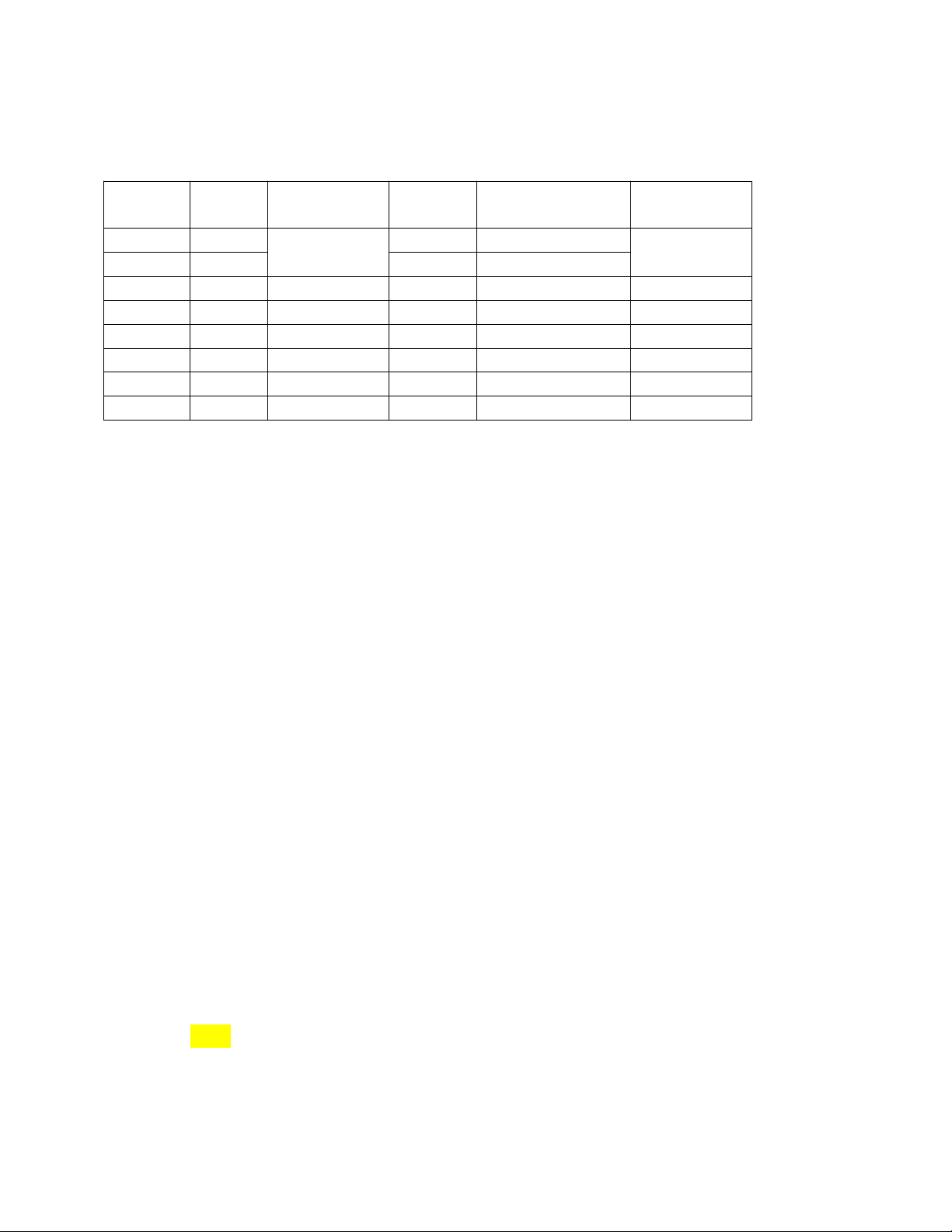

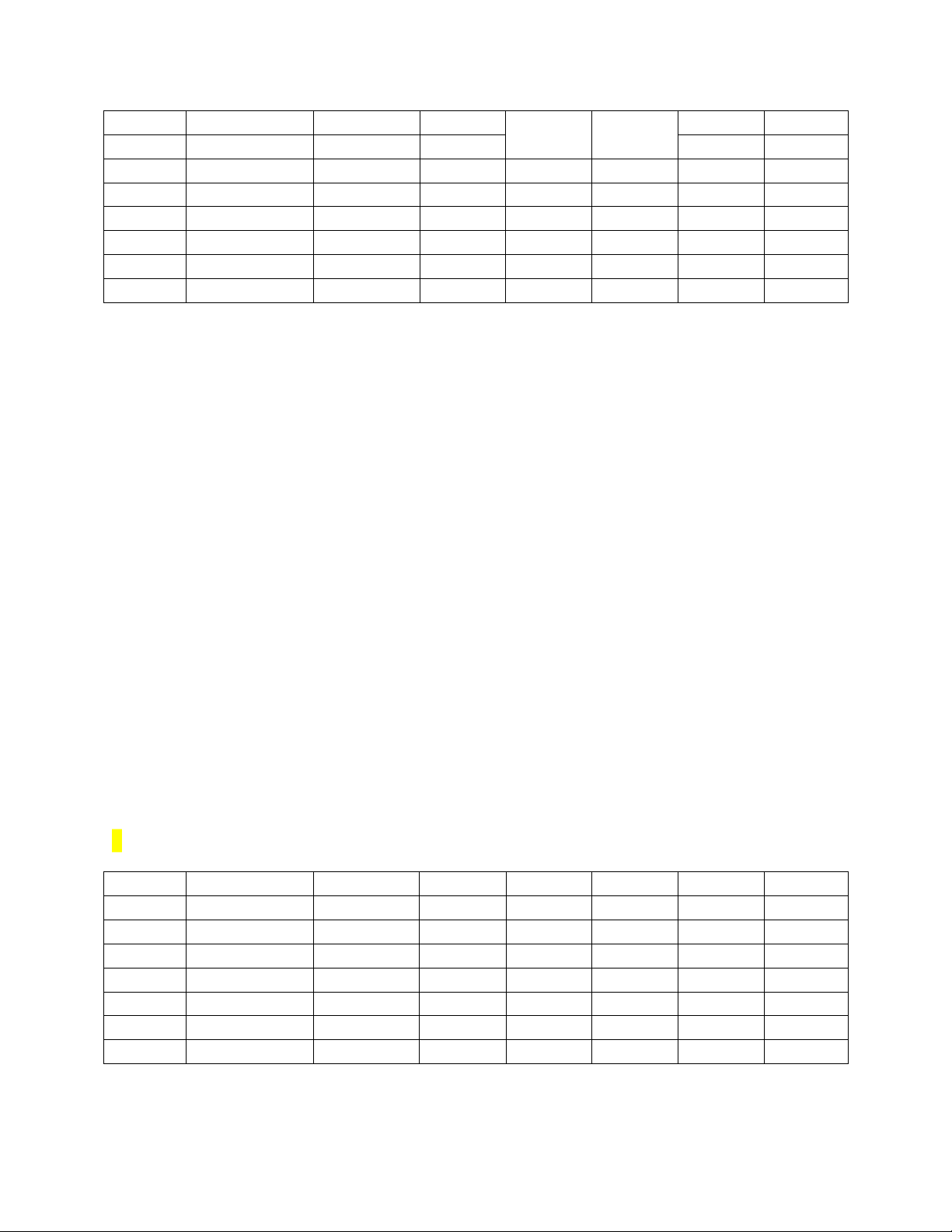

4. Nimbus, Inc., makes brooms and then sells them door-to-door. Here is the relationship

between the number of workers and Nimbus’s output in a given day: Workers Output Marginal Total Average total Marginal cost cost cost 0 0 20 200 ------- 5 1 20 300 15 2 50 30 400 8 3.33 3 90 40 500 5.56 2.5 4 120 30 600 5 3.33 5 140 20 700 5 5 6 150 10 800 5.33 10 7 155 5 900 5.81 20

a. Fill in the column of marginal products. What pattern do you see? How might you explain it?

b. A worker costs $100 a day, and the firm has fixed costs of $200. Use this information

to fill in the column for total cost.

c. Fill in the column for average total cost. (Recall that ATC = TC/Q.) What pattern do you see?

d. Now fill in the column for marginal cost. (Recall that MC = ∆TC/∆Q.) What pattern do you see?

e. Compare the column for marginal product and the column for marginal cost. Explain the relationship.

f. Compare the column for average total cost and the column for marginal cost. Explain the relationship.

a. The marginal product increase until the third worker, then decrease

Explain: When we have just one worker, he or she needs to work by himself, then

when we have more people we can have a divided work => the second one is even more

productive than the first and the third is even more productive than the previous two.

Next stage, we face the rule of the diminishing marginal product. Because after litle

peak of 40, this starts to decrease the value basically because they are not as productive as before ……

c. Average total cost is U-shaped. When quantity is low, average total cost declines as

quantity rises; when quantity is high, average total cost rises as quantity rises.

d. Marginal cost is also U-shaped, but rises steeply as output increases. This is due to diminishing marginal product.

e. There is inverse relationship between marginal product and marginal cost. When

marginal product increases (decreases), marginal cost decreases (increases). This happens since, wagerate

Marginal cost = Marginal product

f. When marginal cost is less than average total cost, average total cost is falling; the cost

of the last unit produced pulls the average down. When marginal cost is greater than

average total cost, average total cost is rising; the cost of the last unit produced pushes the average up.

Marginal cost = Average cost + Q x d Average cost dQ

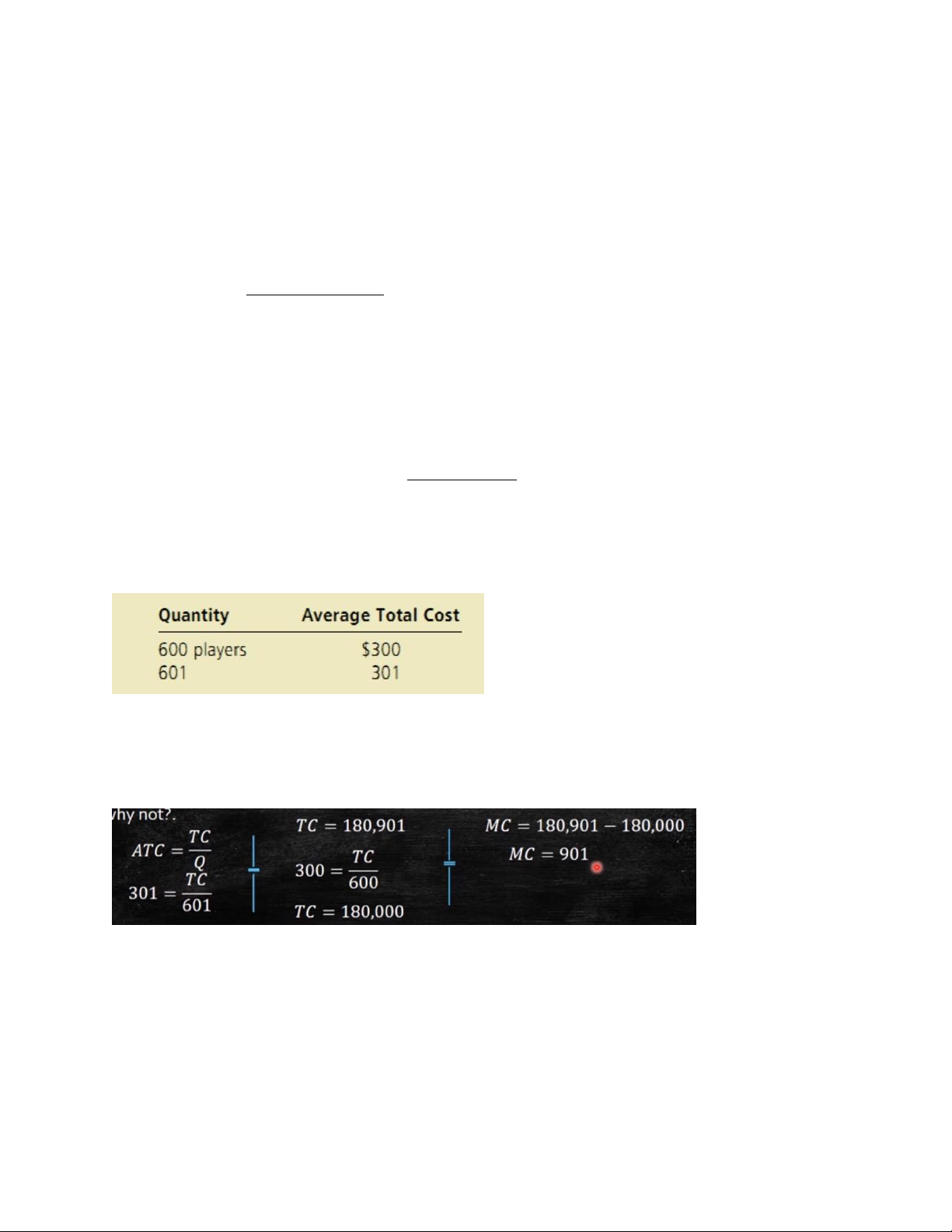

5. You are the chief financial officer for a firm that sells digital music players. Your firm

has the following average-total-cost schedule

Your current level of production is 600 devices,all of which have been sold. Someone

calls, desperate to buy one of your music players. The caller offers you $550 for it.

Should you accept the offer? Why or why not?

Compare this marginal cost: if these marginal cost is higher than this one, you won’t sell

that. But if this on is smaller than this value then is going to be profitable. Here the

marginal cost is the cost of this new unit, so it means that this person pays more than this

one is going to be proud to profit. So the extra cost of production of 1 music player is

901 dollars. I should not accept the offer of 550 dollars for that one music player.

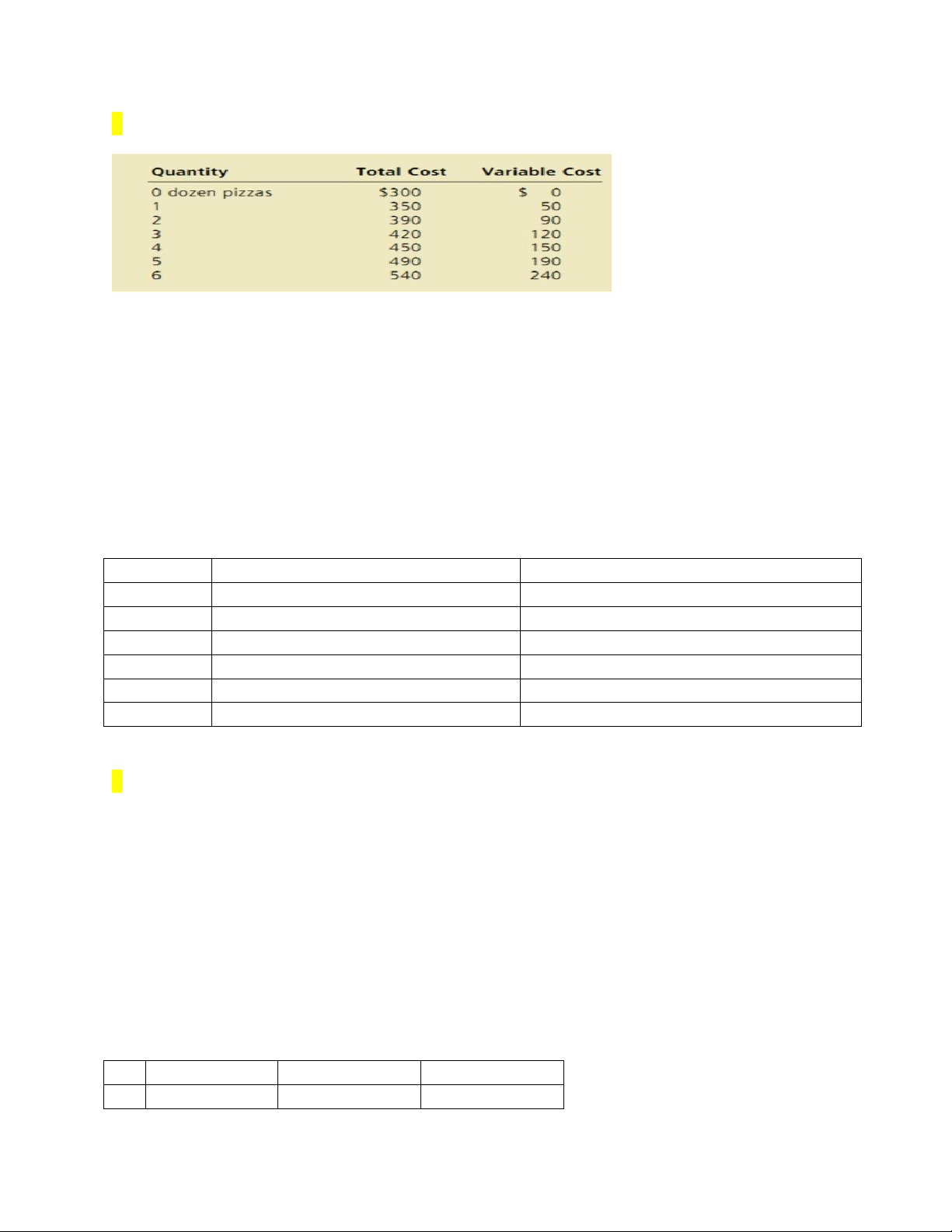

6. Consider the following cost information for a pizzeria:

a. What is the pizzeria’s fixed cost?

b. Construct a table in which you calculate the marginal cost per dozen pizzas using the

information on total cost. Also, calculate the marginal cost per dozen pizzas using the

information on variable cost. What is the relationship between these sets of numbers? Comment.

a. fixed cost= total cost when 0 pizza is produced = 300 b. Quantity

Marginal cost on basis of total cost

Marginal cost on basis of variable cost 1 50 50 2 40 40 3 30 30 4 30 30 5 40 40 6 50 50

The two sets of numbers are same as the above formulae for marginal cost are equivalent.

7. You are thinking about setting up a lemonade stand. The stand itself costs $200. The

ingredients for each cup of lemonade cost $0.50

a. What is your fixed cost of doing business? What is your variable cost per cup?

b. Construct a table showing your total cost, average total cost, and marginal cost for

output levels varying from 0 to 10 gallons. (Hint: There are 16 cups in a gallon.) Draw the three cost curves.

a. fixed cost = 200 Variable cost per cup = 0.50 b. Q Total cost Average cost Marginal cost 1 208 208 8 2 216 108 8 3 224 74,6 8 4 232 58 8 5 240 48 8 6 248 41,3 8 7 256 36,57 8 8 264 33 8 9 272 30,2 8 10 280 28 8 450 400 350 300 250 Marginal cost Averagecost 200 Total cost 150 100 50 0 1 2 3 4 5 6 7 8 9 10

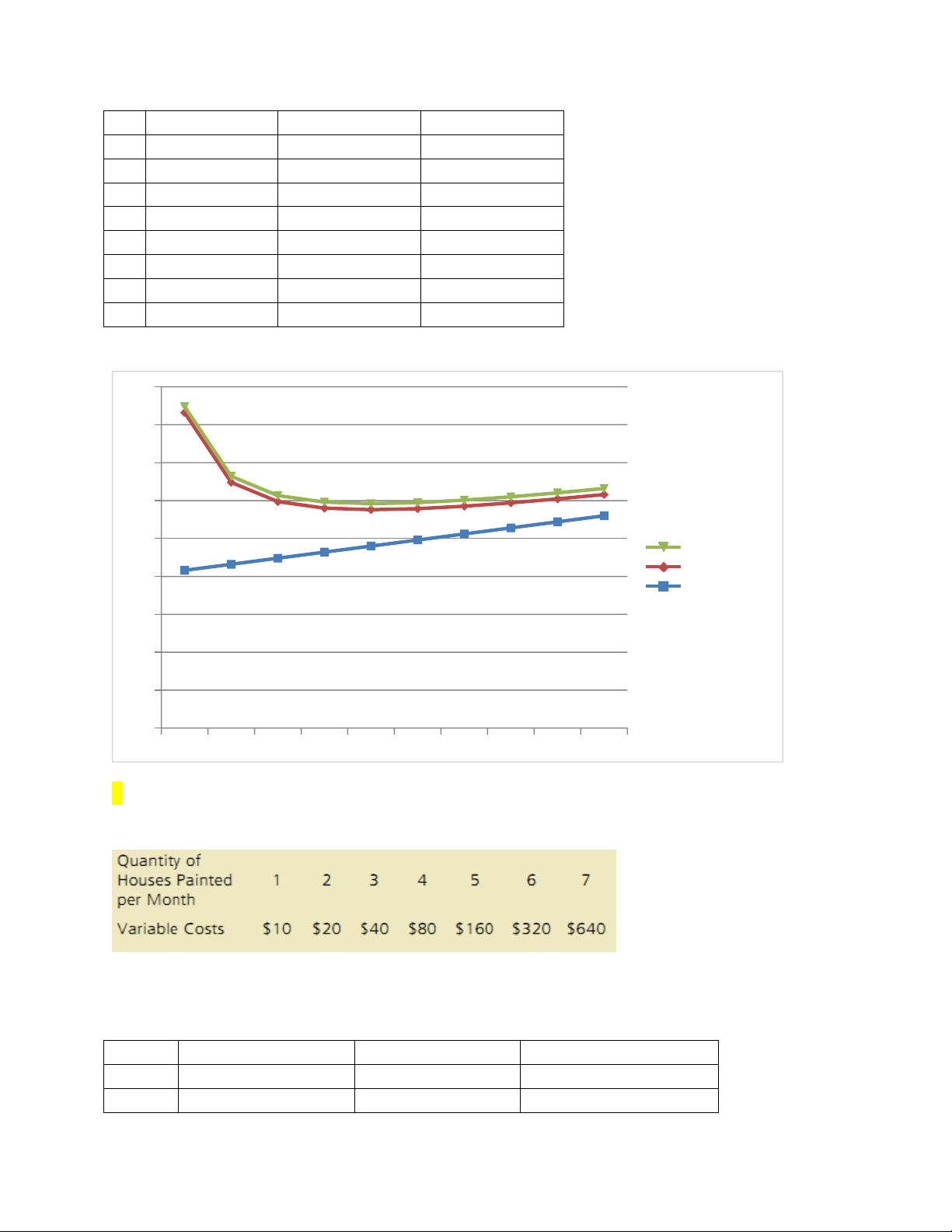

8. Your cousin Vinnie owns a painting company with fixed costs of $200 and the

following schedule for variable costs:

Calculate average fixed cost, average variable cost, and average total cost for each

quantity. What is the efficient scale of the painting company? Q AFC AVC ATC 1 200 10 210 2 100 10 110 3 66.6 13.3 79.9 4 50 20 70 5 40 32 72 6 33.3 53.3 86.6 7 28.57 91.43 120

Efficient scale of painting company is where ATC is minimum => paiting 4 houses per month is the efficient scale.

CHAPTER 14: COMPETITIVE FIRM

2. Explain the difference between a firm’s revenue and its profit. Which do firms maximize?

- Firm's revenue is the product of the price (marginal cost in case of perfect competition) and output quantity (PxQ)

- Profit is average cost for that level of output quantity times output quantity subtracted from revenue. (P-ATC)

=> Firms maximize the profit.

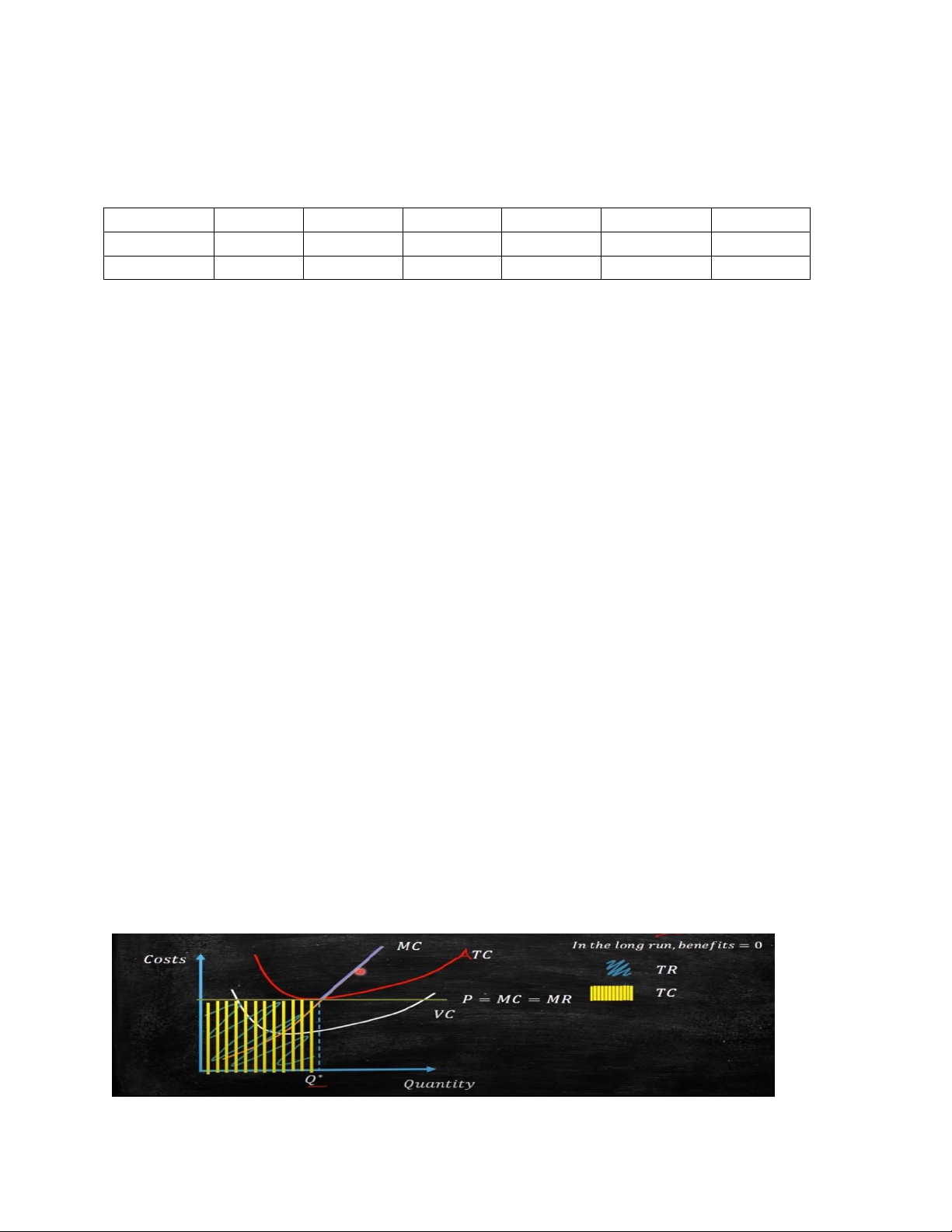

3. Draw the cost curves for a typical firm. For a given price, explain how the firm

chooses the level of output that maximizes profit. At that level of output, show on your

graph the firm’s total revenue and total costs. MC AC profit For profit maximization: MR=MC When MR=MC, TR-TC is maximum Total cost

4. Under what conditions will a firm shut down temporarily? Explain.

When the price falls below the average variable cost the firm exercises shut down. This

happens when the marginal cost (equal to the price) is equal to the average variable cost.

This point the minimum of average variable cost curve. MC = P = AVC P < AVC

5. Under what conditions will a firm exit a market? Explain.

A firm will exit the market when the revenue it would receive is less than its TC. This

can be simply expressed as when TR is less than TC which in turn can then be simplified

to when price is less than ATC. P < ATC

6. Does a firm’s price equal marginal cost in the short run, in the long run, or both? Explain.

In the short run, price is equal to the marginal cost of production and the firms earn some economic profit. (P = MC)

In the long run, this economic profit lures other investors into the market and that leads to

a rightward shift in the supply curve as the production increases for approximately

similar demand. This phenomena occurs until the price equals the minimum of the

average cost curve or there is no further incentive for more capital inflow.

7. Does a firm’s price equal the minimum of average total cost in the short run, in the long run, or both? Explain.

A competitive firm's price equals the minimum of its average total cost in the long run. In

the long run this economic profit lures other investors into the market and that leads to a

rightward shift in the supply curve as the production increases for approximately similar

demand. This phenomena occurs until the price equals the minimum of the average cost

curve or there is no further incentive for more capital inflow

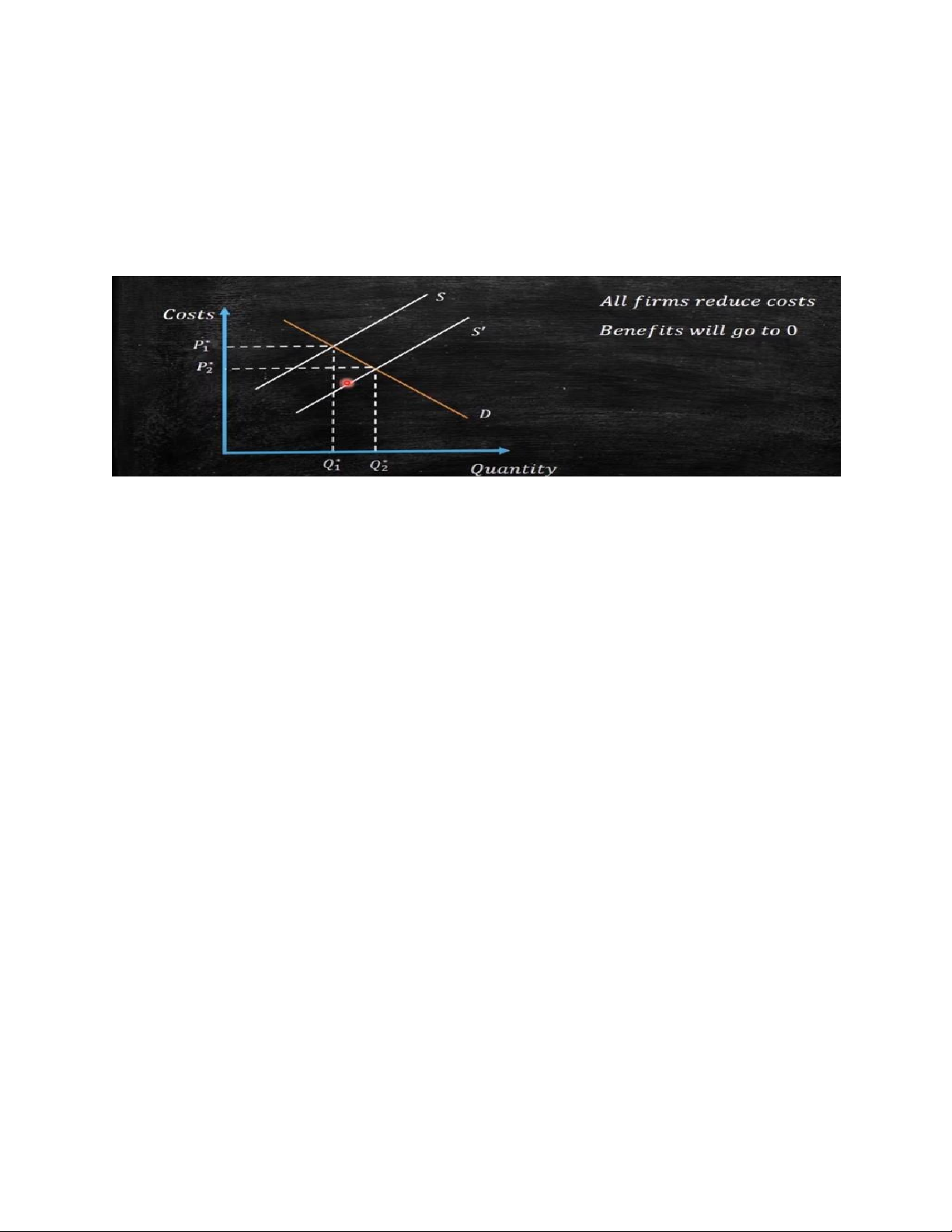

8. Are market supply curves typically more elastic in the short run or in the long run? Explain.

Market supply curves are typically more elastic in the long run than in the short run. Over

a long period of time many changes are realized that could not be done in the short run.

On the demand side it could be changes in the consumer preferences etc. On the supply

side it could be more firms entering the market.

PROBLEMS AND APPLICATIONS

1. Many small boats are made of fiberglass, which is derived from crude oil. Suppose that the price of oil rises.

a. Using diagrams, show what happens to the cost curves of an individual boat-making

firm and to the market supply curve.

b. What happens to the profits of boat makers in the short run? What happens to the

number of boat makers in the long run?

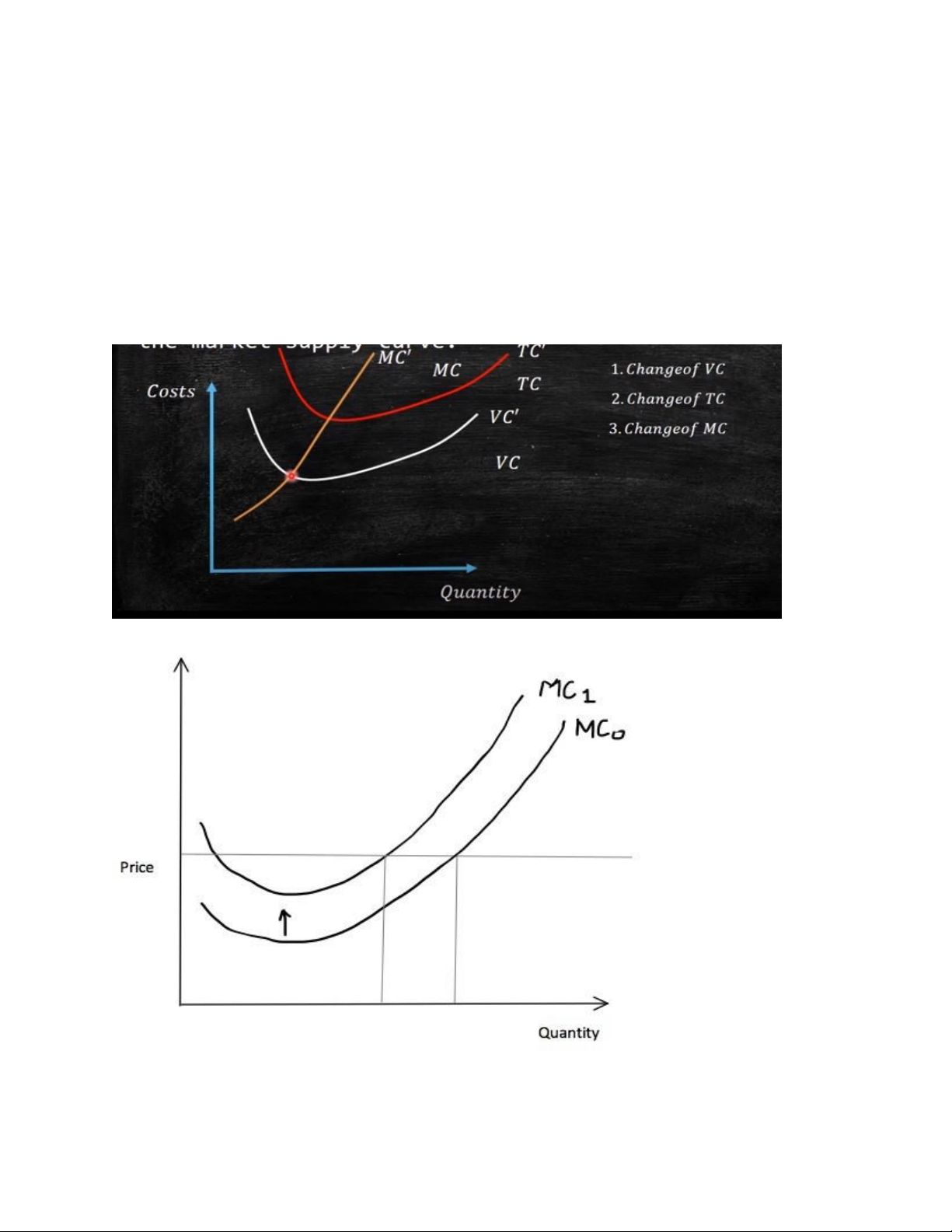

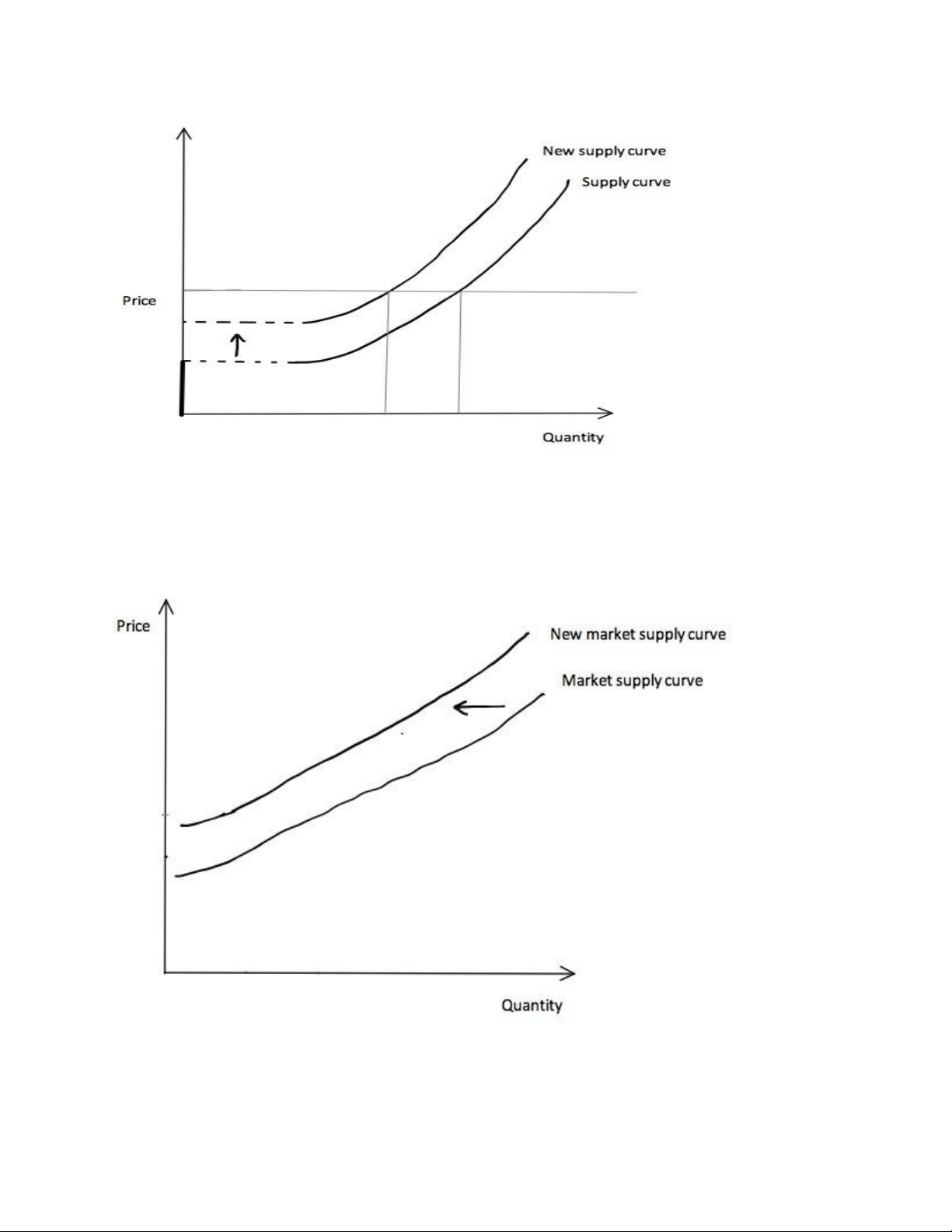

a. Increase in price of crude oil would shift the VC upward => TC rises => MC rises and

move to the left. As a result, each individual firm would be supplying less boats at a given price.

Similar to individual firms shift in curve, industry supply curve would shift to the left

since it is sum of quantities supplied by each firm a price => P , Q

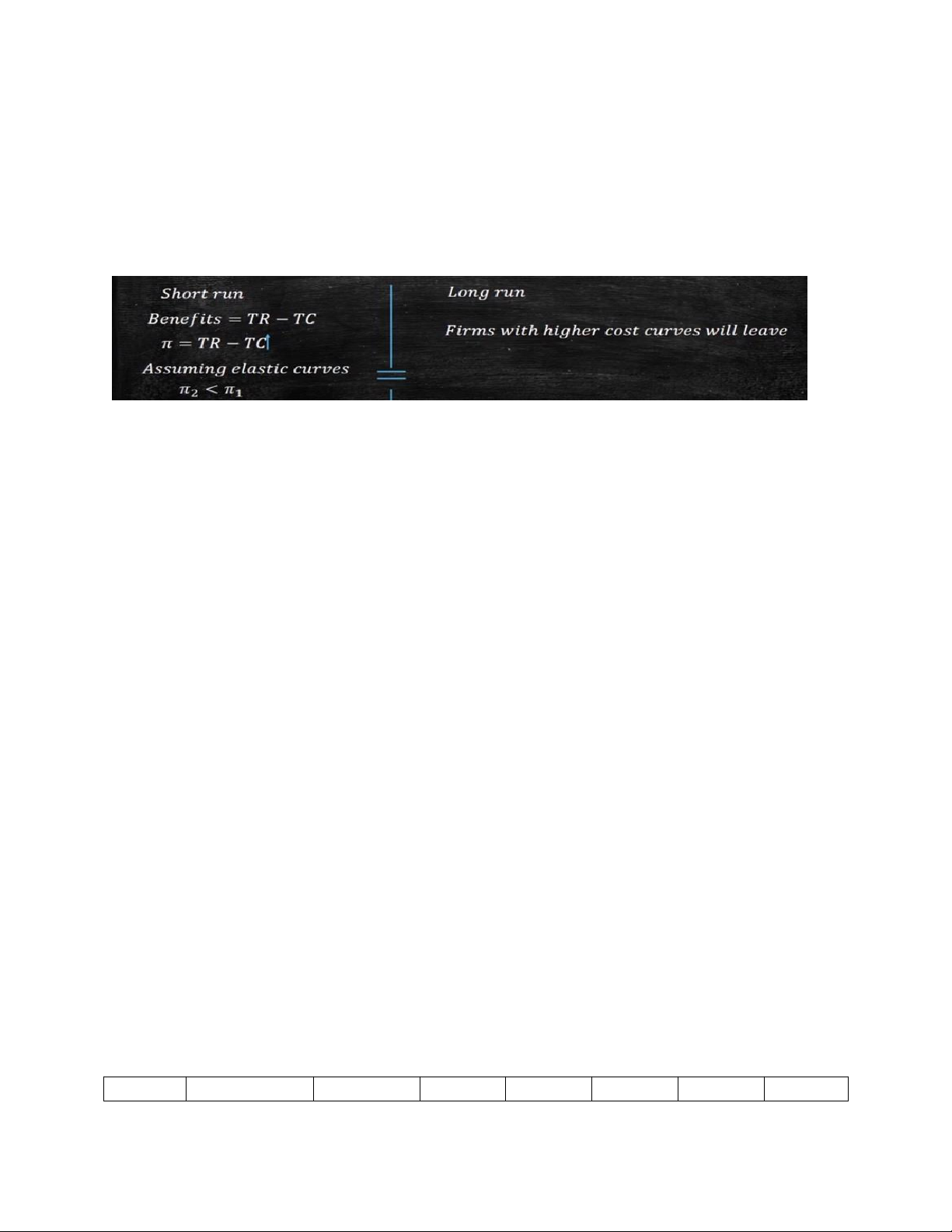

b. Profit of boat makers decrease. In short run, the number of boatmakers remains

unchanged but the eq’m demand for boats would decrease. The total producer surplus

decreases and each individual firm makers lower profit.

In long run, firms keep entering till zero profits are generated. Since, the profits are

lower, the condition of zero profit would reached for lower number of firms.

2. You go out to the best restaurant in town and order a lobster dinner for $40. After

eating half of the lobster, you realize that you are quite full. Your date wants you to finish

your dinner because you can’t take it home and because “you’ve already paid for it.”

What should you do? Relate your answer to the material in this chapter.

Anytime you eat dinner it is an incurred cost and irrelevant in decision making because

the cost so far is unavoidable and considered a sunk cost. You cant’t get your money

back and now it’s either eat it or don’t. Your date isn’t going to force you to eat sth if the

meal only cost $4 instead of $40, at this point, he/she is just frustrated (feel annoyed) at

paying for sth not fully consumed. Sunk cost can even pertain (gan lien voi, di doi voi) to

leftovers (thuc an thua) at home though.

3. Bob’s lawn-mowing service is a profit-maximizing, competitive firm. Bob mows

lawns (cut grass) for $27 each. His total cost each day is $280, of which $30 is a fixed

cost. He mows 10 lawns a day. What can you say about Bob’s short-run decision

regarding shutdown and his long-run decision regarding exit? P= $27 Q=10 units per day =>TR=PxQ= $270 TC= $280 FC= $30

=> VC= TC – FC= $250; AVC=$25

=> P > AVC => Bob should not shutdown, instead he should focus on increasing the number of lawns he mows.

In long run, because P < ATC ($28) => should exit

4. Consider total cost and total revenue given in the following table: Q TC TR Pofit MR MC ATC AR 0 $8 $0 -8 ---- 1 ---- --- 1 9 8 -1 9 8 2 10 16 6 8 1 5 8 3 11 24 13 8 2 3,6 8 4 13 32 19 8 2 3,25 8 5 19 40 21 8 6 3,8 8 6 27 48 21 8 8 4,5 8 7 37 56 19 8 10 5,28 8

a. Calculate profit for each quantity. How much should the firm produce to maximize profit?

The firm gets the maximum profit when MR=MC => When the firm produce 6,

MR=MC=8, its profit is maximum.

b. Calculate marginal revenue and marginal cost for each quantity. Graph them. (Hint:

Put the points between whole numbers. For example, the marginal cost between 2 and 3

should be graphed at 2(1⁄2.) At what quantity do these curves cross? How does this relate to your answer to part (a)?

c. Can you tell whether this firm is in a competitive industry? If so, can you tell whether

the industry is in a long-run equilibrium?

- MR=AR=P for competitive industry

Here AR(5) =8=MR or AR(6)=8=MR => It is in competitive industry

- The industry is not in a long run eq’m. For long run eq’m, ATC=P. Here there is no units that make ATC=P

5. Ball Bearings, Inc. faces costs of production as fol ows: Q Total FC Total VC TC MC AFC AVC ATC 0 $100 $ 0 --- --- ---- ---- ---- 1 100 50 150 150 100 50 150 2 100 70 170 20 50 35 85 3 100 90 190 20 33.3 30 63.3 4 100 140 240 50 25 35 60 5 100 200 300 60 20 40 60 6 100 360 460 160 16.6 60 76.6

a. Calculate the company’s average fixed costs, average variable costs, average total

costs, and marginal costs at each level of production.

b. The price of a case of ball bearings is $50. Seeing that she can’t make a profit, the

Chief Executive Officer (CEO) decides to shut down operations. What are the firm’s

profits/losses? Was this a wise decision? Explain. Q 1 2 3 4 5 6 Revenue $50 100 150 200 250 300 MR=AR=P 50 50 50 50 50 50

Here P < ATC at all number of units produced => get loss Firms loses fixed costs $100

When Q= 4 units, ATC is minimum so we consider this case

It was not a wise decision since the firm could have produced 4 units.

Profit = Revenue – TC =200 -240 = -40 => loss

If you shutdowns, you still pay FC ($100) which is larger than the loss

The operating profit (profit+ fixed costs) of the firm would have been $60, relative to

zero operating progit if firm is shut down

c. Vaguely remembering his introductory economics course, the Chief Financial Officer

tells the CEO it is better to produce 1 case of ball bearings, because marginal revenue

equals marginal cost at that quantity. What are the firm’s profits/losses at that level of

production? Was this the best decision? Explain.

Produce 1 case of ball bearings: TR=50x1= 50 TC=150 => loss=100

=> It is not the best decision

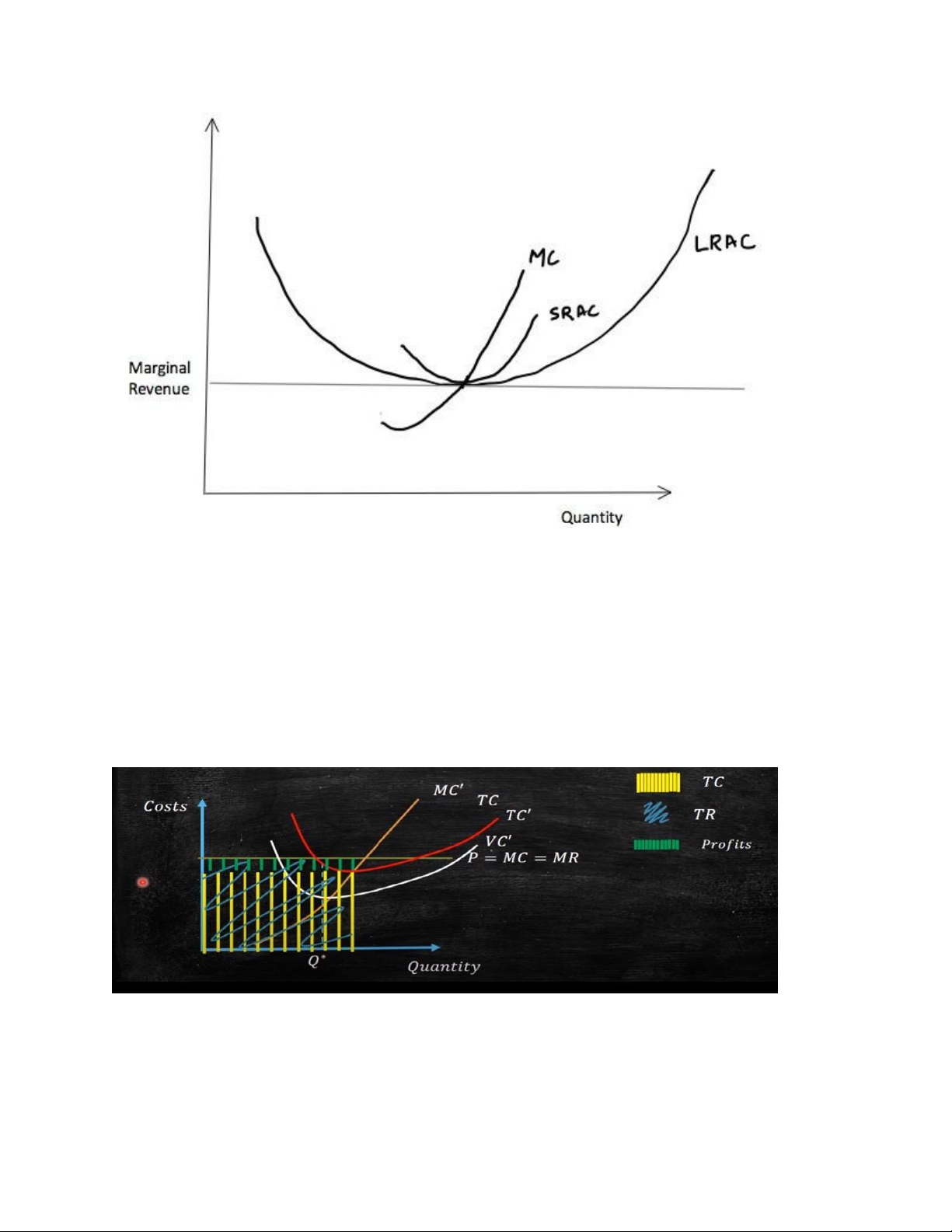

6. Suppose the book-printing industry is competitive and begins in a long-run equilibrium.

a. Draw a diagram describing the typical firm in the industry.

Long run: there are not virable cost and the benefits of the firms are zero Ignore VC curve because in long run it does not exit

b. HiTech Printing Company invents a new process that sharply reduces the cost of

printing books. What happens to Hi-Tech’s profits and the price of books in the short run

when Hi-Tech’s patent prevents other firms from using the new technology?

TC reduces => MC reduces and shifts to the right

P unchanged because in compeitive market, no one is strong enough to set the price => the profit increases

c. What happens in the long run when the patent expires and other firms are free to use the technology?

When patent expires, there would be no entry barrier. The firms would operate at

efficient level and new firms would keep on entering till price falls to average cost at

efficient scale of operation. Thus, in eq’m, firms make zero profit.

13. Suppose there are 1,000 hot pretzel stands operating in New York City. Each stand

has the usual U-shaped average-total-cost curve. The market demand curve for

pretzelsslopes downward, and the market for pretzels is in long-run competitive equilibrium.

a. Draw the current equilibrium, using graphs for the entire market and for an individual pretzel stand.

b. The city decides to restrict the number of pretzel-stand licenses, reducing the number

of stands to only 800. What effect will this action have on the market and on an

individual stand that is still operating? Draw graphs to illustrate your answer.

c. Suppose that the city decides to charge a fee for the 800 licenses, all of which are

quickly sold. How will the size of the fee affect the number of pretzels sold by an

individual stand? How will it affect the price of pretzels in the city?

d. The city wants to raise as much revenue as possible, while ensuring that all 800

licenses are sold. How high should the city set the license fee? Show the answer on your graph