Preview text:

lOMoAR cPSD| 59994889

Chapter 21: Preparation of Statement of Cash Flows

Activity 1: Thorstved Co

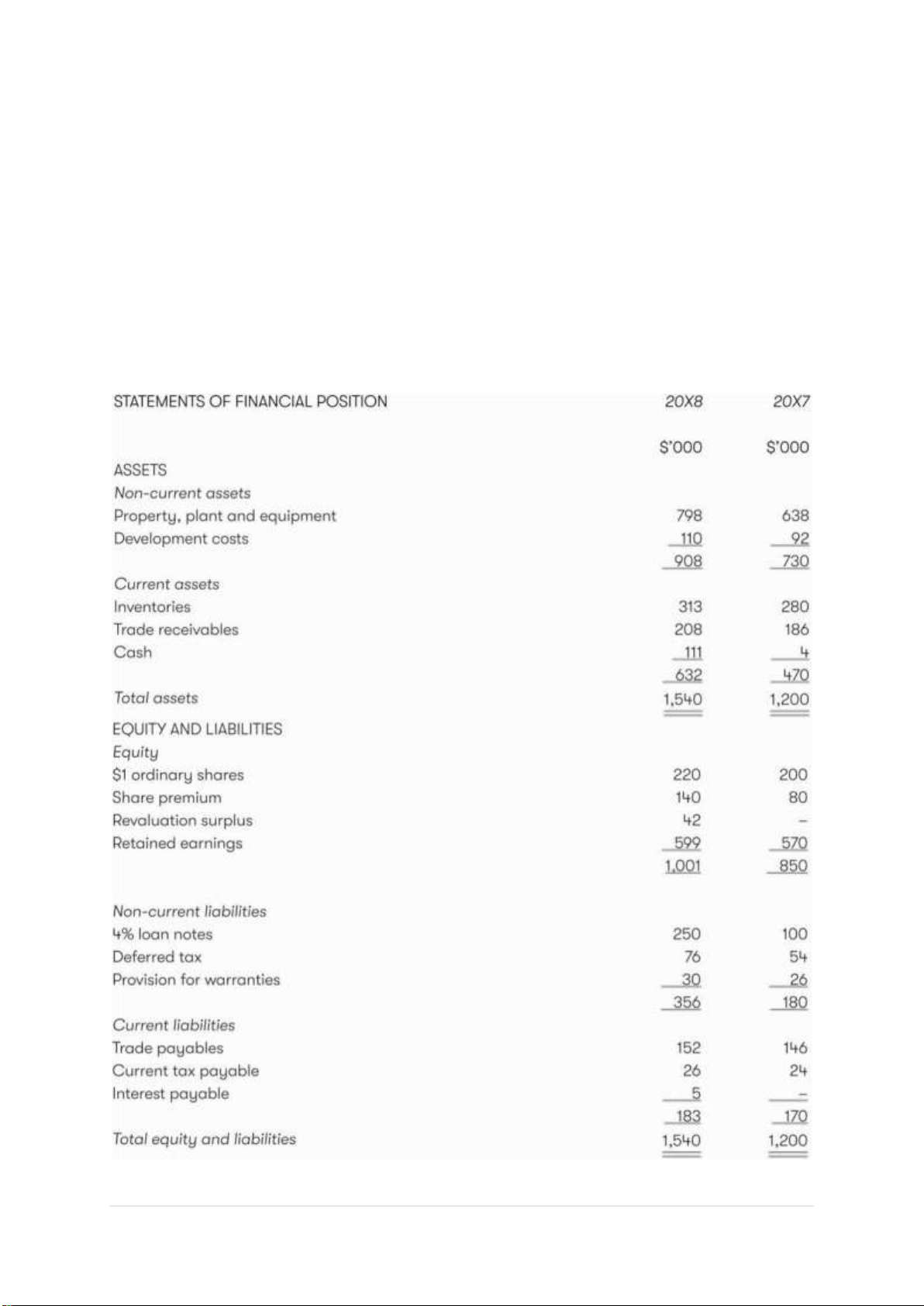

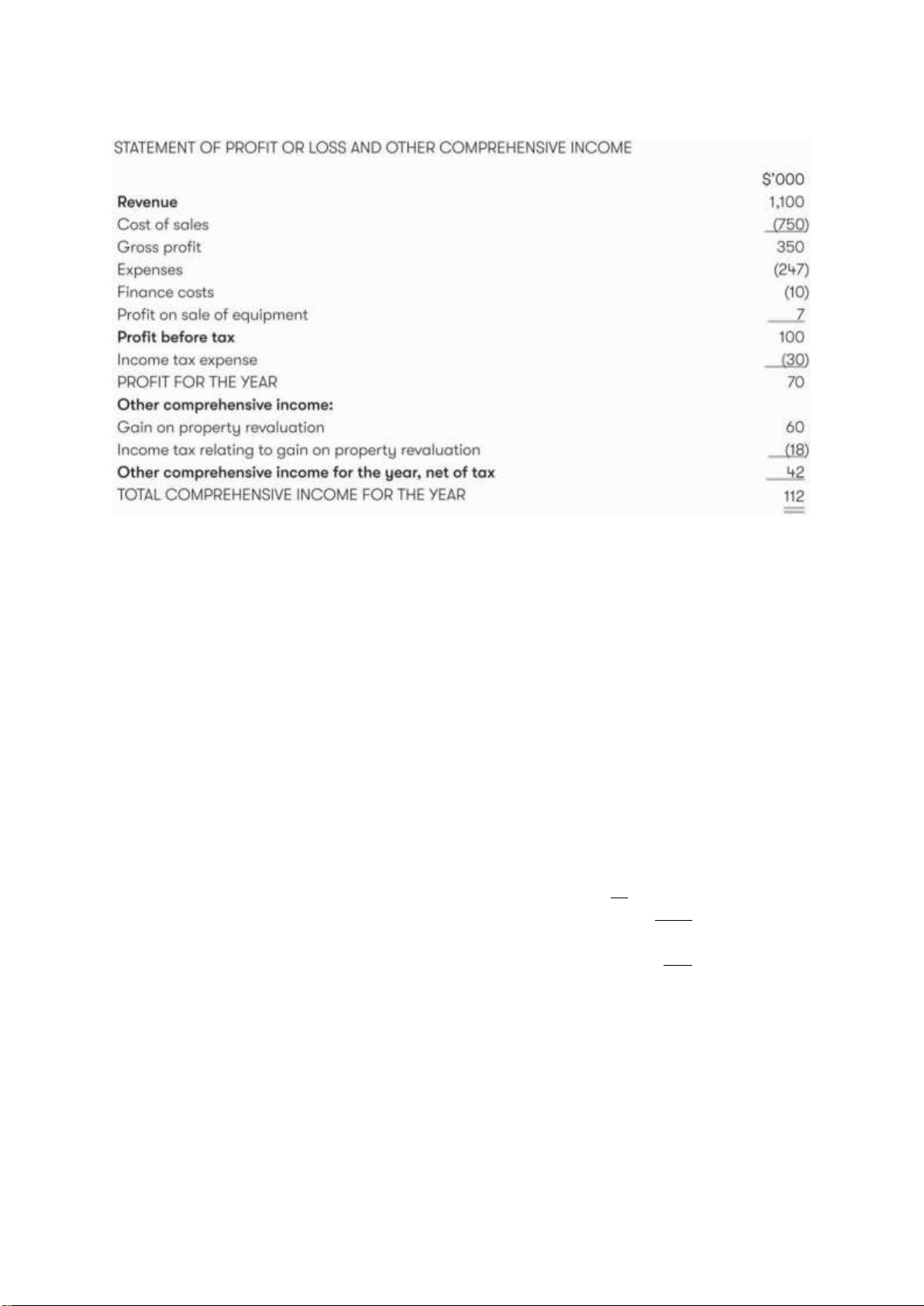

Below are the statements of financial position for Thorstved Co at 31 December 20X7 and 31

December 20X8 and the statement of profit or loss and OCI for the year ended 31 December 20X8.

a) Depreciation of property, plant and equipment during 20X8 was $54,000 and deferred

development expenditure amortised was $25,000.

b) Proceeds from the sale of equipment were $58,000, giving rise to a profit of $7,000. No other

items of property, plant and equipment were disposed of during the year.

c) Finance costs represent interest paid on the loan notes. New loan notes were issued on 1 January 20X8.

d) The company revalued its property at the year end. Company policy is to treat revaluations as

realised profits when the asset is retired or disposed of. | P a g e lOMoAR cPSD| 59994889 1

Required: Prepare a statement of cash flows for Thorstved Co for the year ended 31 December 20X8,

using the indirect method in accordance with IAS 7. Activity 2: Colby Co

Colby Co's statement of profit or loss for the year ended 31 December 20X2 and statements of

financialposition at 31 December 20X1 and 31 December 20X2 were as follows.

• During the year, the company paid $90,000 for a new piece of machinery.

• Dividends paid during 20X2 totalled $66,000 and interest paid was $28,000. Colby Co

Statement of Profit or Loss for the year ended 31 Dec 20X2 $’000 $’000 Revenue 720 COGS (70) Gross profit 650 Wages expense 94 Depreciation Expense 118

Loss on disposal of Non-current Asset 18 (230) 420 Interest expense (28) Profit before tax 392 Income tax expense (124) Profit for the year 268 Colby Co

Statement of Financial Position as at 31 December 20X2 20X1

$’000 $’000

$’000 $’000 Assets | P a g e lOMoAR cPSD| 59994889 Property, plant and equipment Cost 1,596 1,560 Accumulated depreciation 318 224 1,278 1,336 Current Assets Inventory 24 20 2 Trade receivables 76 58 Bank 48 56 148 134 Total Assets 1,426 1,470 Equity and liabilities Equity Share Capital 360 340 Share Premium 36 24 Retained Earnings 716 514 Total Equity 1,112 878 Liabilities Non-current loans 200 500 Current liabilities Trade payables 12 6 Tax payable 102 86 114 92 Total liabilities 314 592 Total equity and liabilities 1,426 1,470

Required: Prepare a statement of cash flows for Colby Co for the year ended 31 December 20X2 in

accordance with the requirements of IAS 7, using the indirect method.

Activity 3: Helium Co had the following transactions during the year.

a) Purchases from suppliers were $19,500, of which $2,550 was unpaid at the year end. Brought forward payables were $1,000.

b) Wages and salaries amounted to $10,500, of which $750 was unpaid at the year end. The

accounts for the previous year showed an accrual for wages and salaries of $1,500.

c) Interest of $2,100 on a long term loan was paid in the year. ·

d) Sales revenue was $33,400, including $900 receivables at the year end. Brought forward receivables were $400.

e) Interest on cash deposits at the bank amounted to $75.

Required: Calculate the cash flow from operating activities using the direct method. | P a g e lOMoAR cPSD| 59994889 3 | P a g e