Preview text:

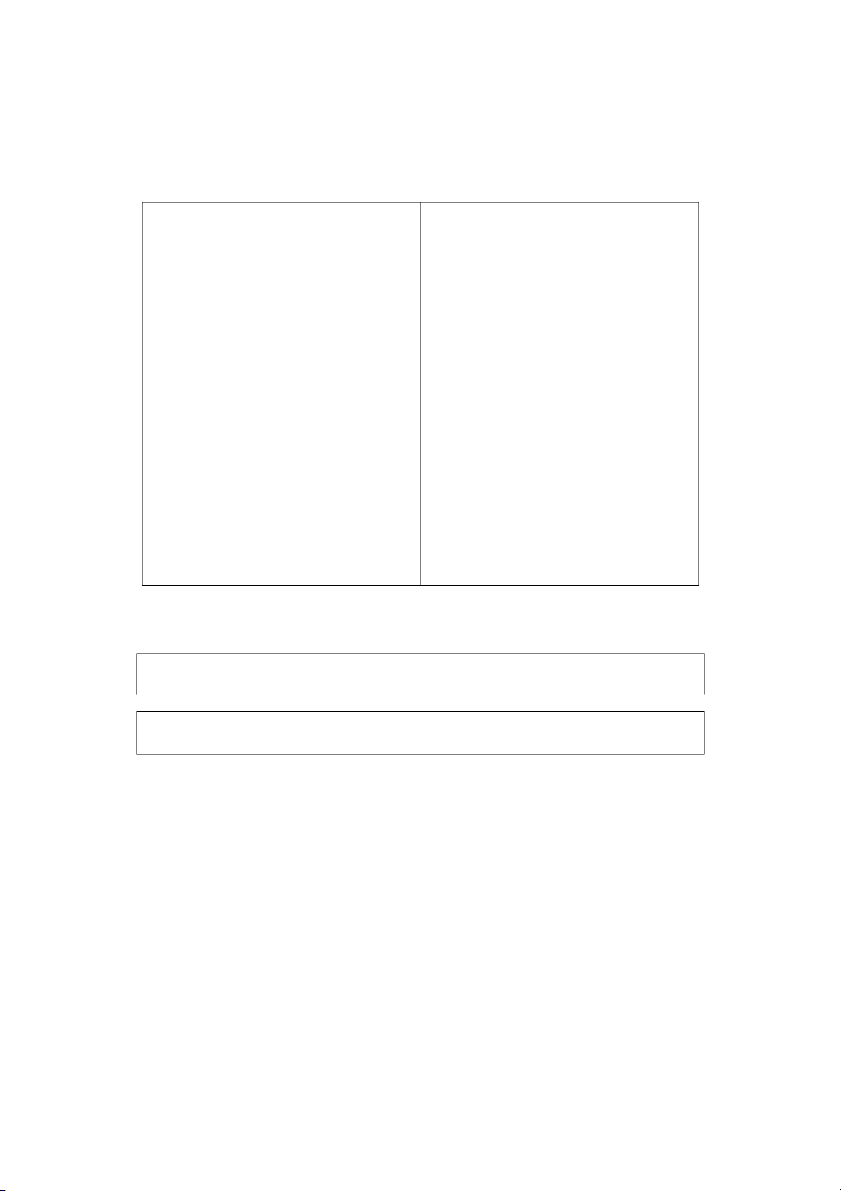

Section 1 ACROSS DOWN

3. an amount that is earned in business 1. a written account of some after expenses are paid transaction or event

7. a list of a company's employees and 2. when someone obeys the rule their wages 4. no chance of loss 9. a general repetition 5. one of bank's local office

10. investment style involves higher

6. money or other assets used to fund a

risks for potentially higher rewards business

12. a loan where the borrower's house 8. two companies become one is used as collateral company

13. adding a number to another number

9. one company buy all shares of other

16. a person who owns stock in a

11. a person that buys and sells stocks particular company in the stock market

17. income that one person receives 14. initial public offering regularly for performing a job

15. sending money into an account

18. payments made to shareholders of a

company as portions of the company's profit.

19. a person that possesses belongings in trust as a beneficiary

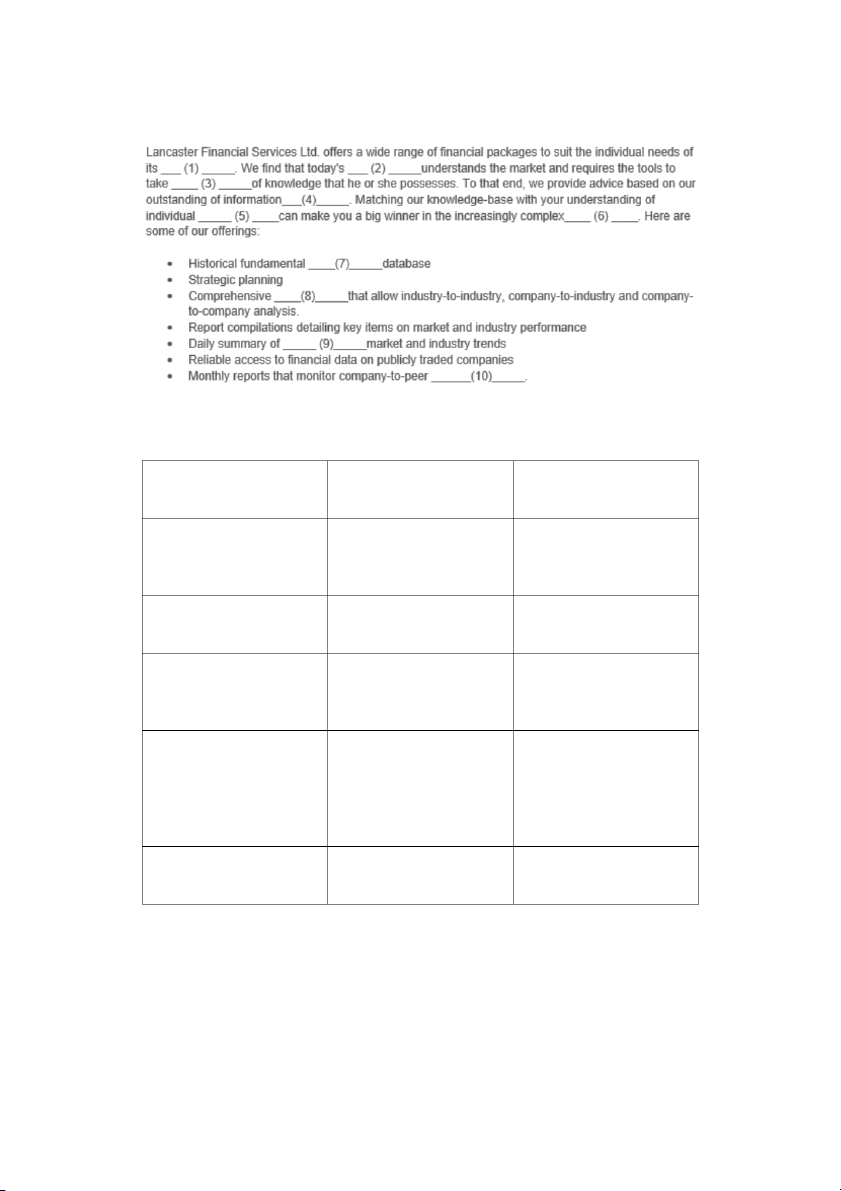

Part 2: Fill in the blank with correct word (1 point) Clients sources marketplace advantage stock

investor markets performance reports equity Is a condition where a business or person cannot pay debts Is a person that offers to pay a specific sum of money for something that is being sold Is the point at which revenue and expenses are equal Is an economic occurrence caused by the trade of products at an inflated price Is an indicator that varies directly with the changing economy and gives information about the current economic standings is the measure of the average change over time of prices paid for products and goods by consumers. is a prolonged recession that may last years and has a significant negative impact on the economic state. is the monetary value of all items and services made in a country. is the total value of products and services produced in one year by the residents of a country, and their enterprises abroad. is a company that owns enough stock in a second company to control management of the second company. is the person who is officially responsible for a business or company that is bankrupt. tries to avoid taking risks is to invest that return in another account or product. is a strategy for holding several CDs of different maturity dates is money a borrower pays if he or she pays off the loan before its term ends. is money a potential borrower pays to apply for a loan is money a borrower pays at the time a loan is given to them. is property that a borrower pledges to the lender as a guarantee in the event the loan cannot be repaid. is to invest your money in many different types of investment. is money that is paid toward the purchase of the home usually in order to qualify for a loan

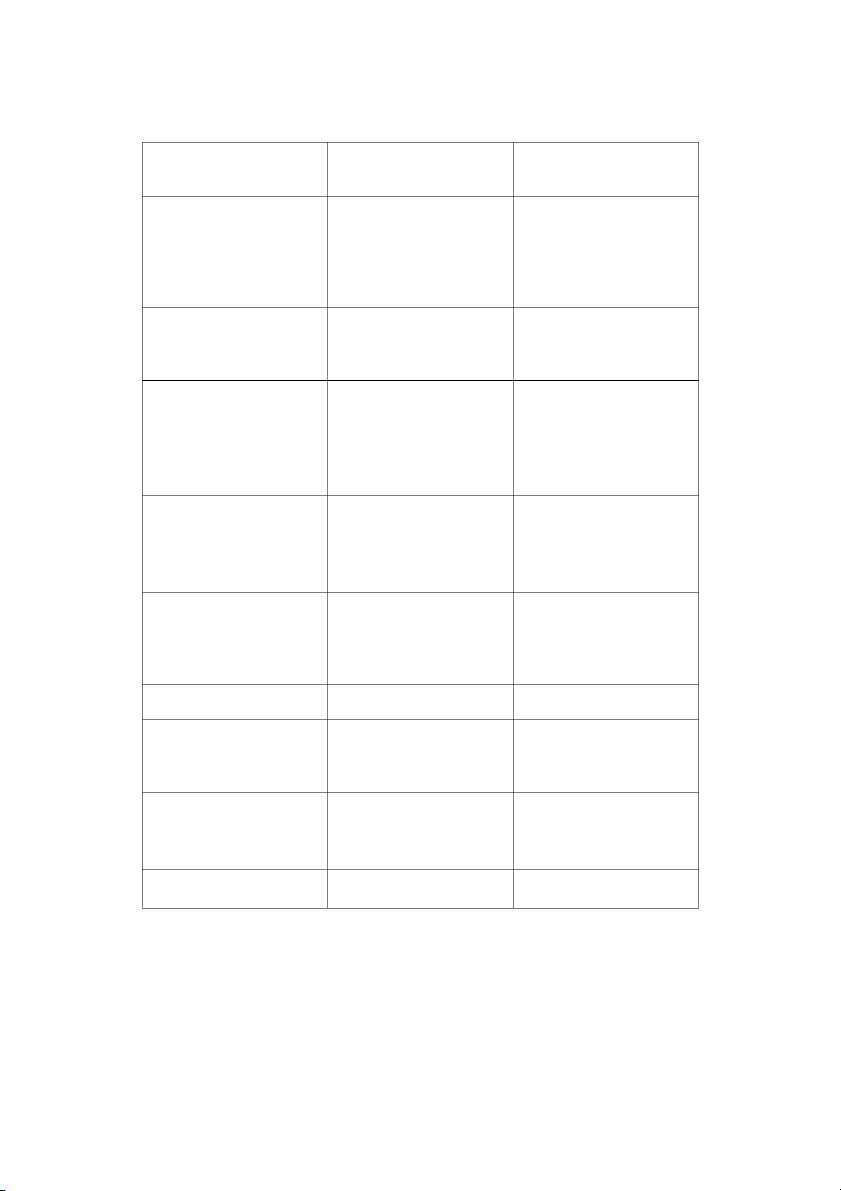

Part 3: Choose the best word (1 point)

1. When the government doesn't control the exchange rate in any way, the currency is __________. A. freely convertible B. totally convertible C. absolutely convertible

2. The Japanese yen is trading for less than its usual value. You can talk about __________. A. a small yen B. a bad yen C. a weak yen

3. The Mexican peso is trading for more than its usual value. You can talk about __________. A. a big peso B. a good peso C. a strong peso

4. A sovereign is a coin made of 7.3 grams of gold, and is worth a lot of money.

However, its __________ is just one pound. A. front value B. face value C. written value

5. Changes in the values of currencies are called __________.

a. currency fluctuations

B. currency alterations C. currency changes

6. An Internet site which does currency calculations based on the latest exchange rates is called a _________. A. currency changer B. currency converter C. currency setter

7. When you change money, you usually have to pay a __________. A. commission B. percentage C. fee

8. When changing money, banks tend to offer a _________ exchange rate than bureaus de change. A. better B. nicer C. fatter

9. Traders sometimes agree to trade currency in the future for an agreed rate. A "long position" means that

the trader will make a profit if the currency __________. A. goes up B. goes down C. stays the same

10. A "short position" means that the trader will make a profit if the currency __________. A. goes up B. goes down C. stays the same

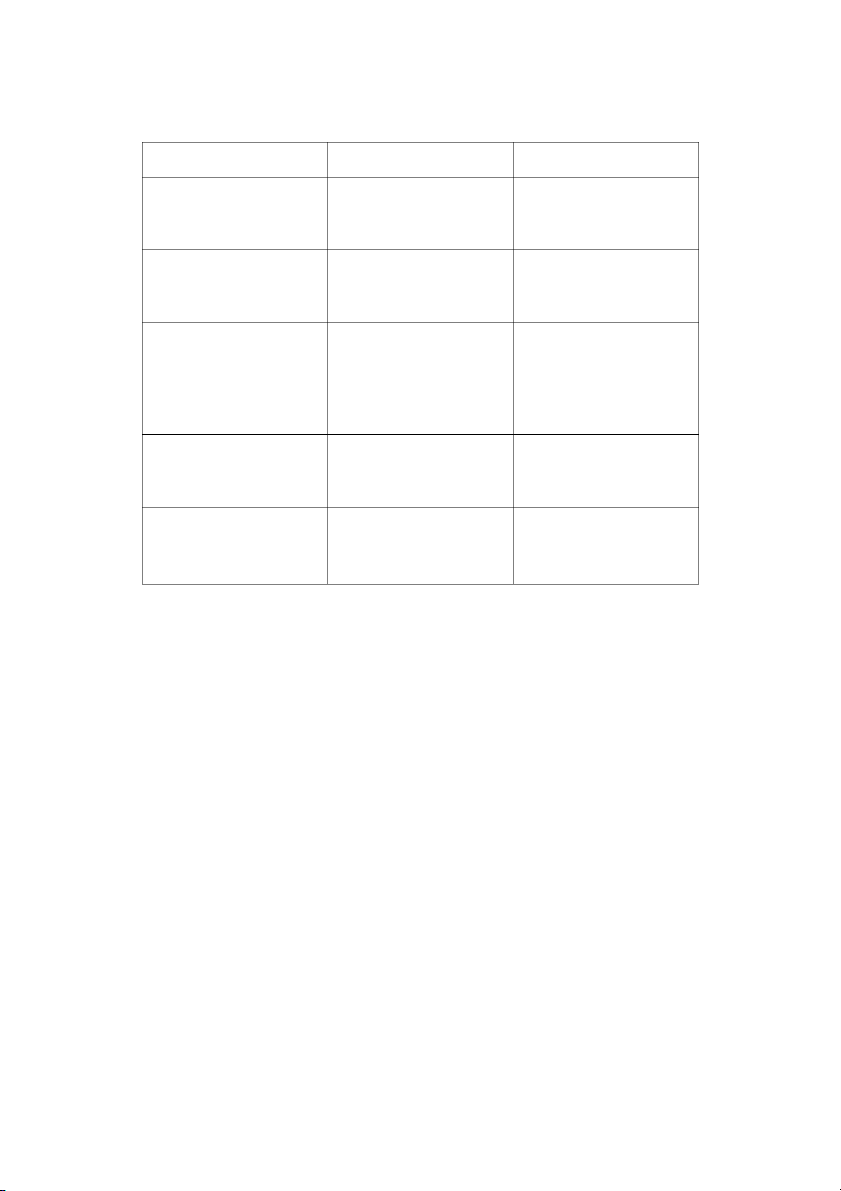

Part 4: Match the verb with the nouns (1 point) 1. Access A. a bill online 2. Carry B. a password 3. dick on C. a risk 4.type in D. an electronic payment 5. fall into E. an icon 6. make F. funds 7. pay G. the internet 8. Transder H. the wrong hands