Preview text:

1.

In general, elasticity is a measure of

a. the extent to which advances in technology are adopted by producers.

b. the extent to which a market is competitive.

c. how firms’ profits respond to changes in market prices.

d. how much buyers and sellers respond to changes in market conditions. 2. Elasticity is

a. a measure of how much buyers and sellers respond to changes in market conditions.

b. the study of how the allocation of resources affects economic well-being.

c. the maximum amount that a buyer will pay for a good.

d. the value of everything a seller must give up to produce a good. 3.

When studying how some event or policy affects a market, elasticity provides information on the

a. equity effects on the market by identifying the winners and losers.

b. magnitude of the effect on the market.

c. speed of adjustment of the market in response to the event or policy.

d. number of market participants who are directly affected by the event or policy. 4.

How does the concept of elasticity allow us to improve upon our understanding of supply and demand?

a. Elasticity allows us to analyze supply and demand with greater precision than would be the case in

the absence of the elasticity concept.

b. Elasticity provides us with a better rationale for statements such as “an increase in will lead to a x

decrease in ” than we would have in the absence of the elasticity conc y ept.

c. Without elasticity, we would not be able to address the direction in which price is likely to move in

response to a surplus or a shortage.

d. Without elasticity, it is very difficult to assess the degree of competition within a market. 5.

When consumers face rising gasoline prices, they typically

a. reduce their quantity demanded more in the long run than in the short run.

b. reduce their quantity demanded more in the short run than in the long run.

c. do not reduce their quantity demanded in the short run or the long run.

d. increase their quantity demanded in the short run but reduce their quantity demanded in the long run. 6.

A 10 percent increase in gasoline prices reduces gasoline consumption by about

a. 6 percent after one year and 2.5 percent after five years.

b. 2.5 percent after one year and 6 percent after five years.

c. 10 percent after one year and 20 percent after five years.

d. 0 percent after one year and 1 percent after five years. 7.

Which of the following statements about the consumers’ responses to rising gasoline prices is correct?

a. About 10 percent of the long-run reduction in quantity demanded arises because people drive less

and about 90 percent arises because they switch to more fuel-efficient cars.

b. About 90 percent of the long-run reduction in quantity demanded arises because people drive less

and about 10 percent arises because they switch to more fuel-efficient cars.

c. About half of the long-run reduction in quantity demanded arises because people drive less and

about half arises because they switch to more fuel-efficient cars.

d. Because gasoline is a necessity, consumers do not decrease their quantity demanded in either the short run or the long run. 8.

Which of the following is likely to have the most price inelastic demand?

a. white chocolate chip with macadamia nut cookies

b. Mrs. Field’s chocolate chip cookies c. milk chocolate chip cookies d. cookies 9.

If the price of natural gas rises, when is the price elasticity of demand likely to be the highest?

a. immediately after the price increase

b. one month after the price increase

c. three months after the price increase

d. one year after the price increase MSC: Applicative

10. If the price of milk rises, when is the price elasticity of demand likely to be the lowest?

a. immediately after the price increase

b. one month after the price increase

c. three months after the price increase

d. one year after the price increase 11.

For a good that is a luxury, demand a. tends to be inelastic. b. tends to be elastic. c. has unit elasticity.

d. cannot be represented by a demand curve in the usual way.

12. For a good that is a necessity, demand a. tends to be inelastic. b. tends to be elastic. c. has unit elasticity.

d. cannot be represented by a demand curve in the usual way.

13. On a graph, the area below a demand curve and above the price measures a. producer surplus. b. consumer surplus. c. deadweight loss. d. willingness to pay.

14. On a graph, consumer surplus is represented by the area

a. between the demand and supply curves.

b. below the demand curve and above price.

c. below the price and above the supply curve.

d. below the demand curve and to the right of equilibrium price.

15. Consumer surplus in a market can be represented by the

a. area below the demand curve and above the price.

b. distance from the demand curve to the horizontal axis.

c. distance from the demand curve to the vertical axis.

d. area below the demand curve and above the horizontal axis. 16. Consumer surplus is

a. a concept that helps us make normative statements about the desirability of market outcomes.

b. represented on a graph by the area below the demand curve and above the price.

c. a good measure of economic welfare if buyers' preferences are the primary concern.

d. All of the above are correct.

17. In a market, the marginal buyer is the buyer

a. whose willingness to pay is higher than that of all other buyers and potential buyers.

b. whose willingness to pay is lower than that of all other buyers and potential buyers.

c. who is willing to buy exactly one unit of the good.

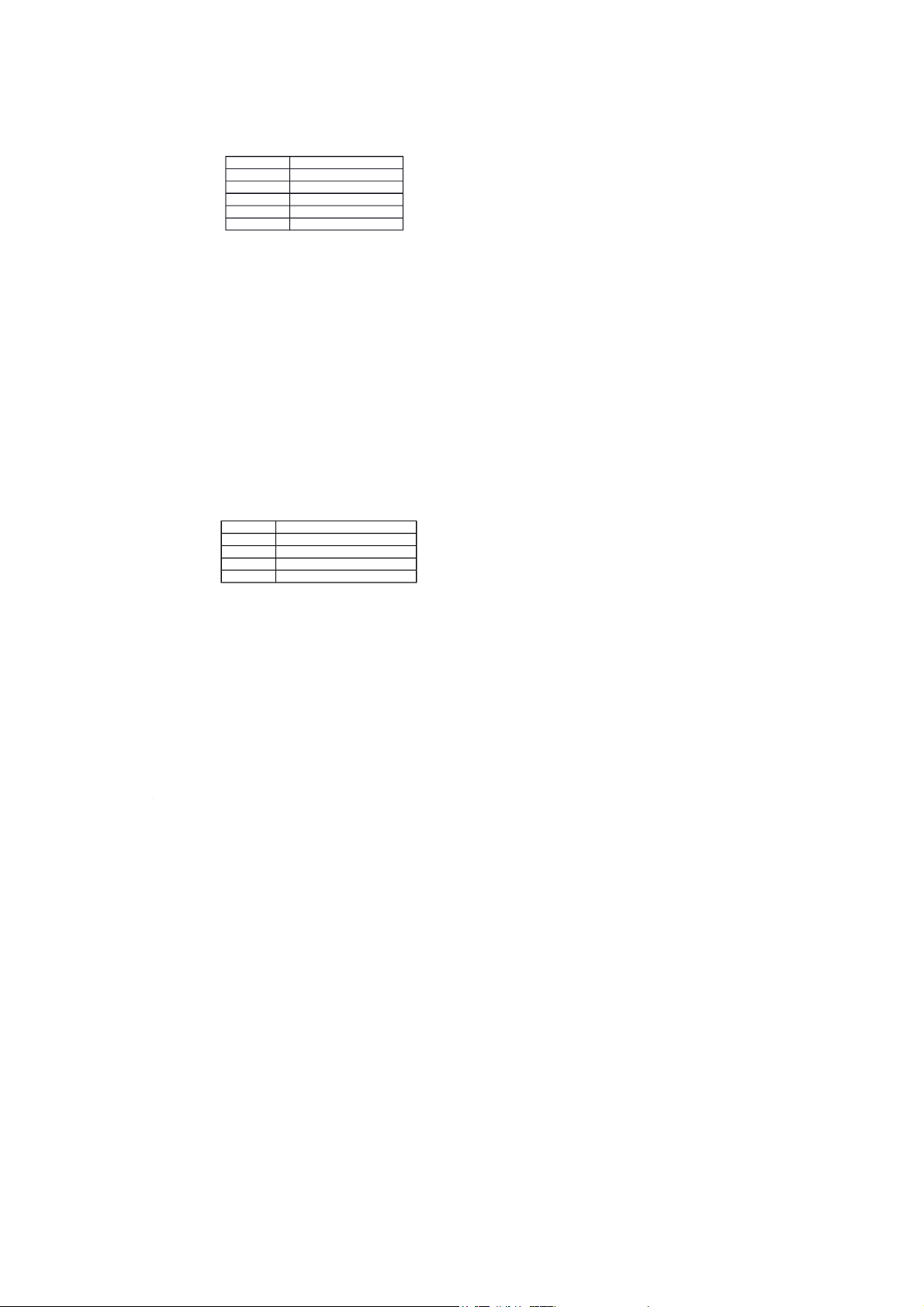

d. who would be the first to leave the market if the price were any higher. Table 7-1 Buyer Willingness To Pay Mike $50.00 Sandy $30.00 Jonathan $20.00 Haley $10.00

18. Refer to Table 7-1. If the price of the product is $15, then who would be willing to purchase the product? a. Mike b. Mike and Sandy c. Mike, Sandy, and Jonathan

d. Mike, Sandy, Jonathan, and Haley

19. Refer to Table 7-1. If the price of the product is $22, then who would be willing to purchase the product? a. Mike b. Mike and Sandy c. Mike, Sandy, and Jonathan

d. Mike, Sandy, Jonathan, and Haley

20. Refer to Table 7-1. If the price of the product is $51, then who would be willing to purchase the product? a. Mike b. Mike and Sandy c. Mike, Sandy, and Jonathan d. no one

21. Refer to Table 7-1. If the price of the product is $18, then the total consumer surplus is a. $38. b. $42. c. $46. d. $72.

22. Refer to Table 7-1. If price of the product is $30, then the total consumer surplus is a. $-10. b. $-6. c. $20. d. $30. Table 7-2

This table refers to five possible buyers' willingness to pay for a case of Vanilla Coke. Buyer Willingness To Pay David $8.50 Laura $7.00 Megan $5.50 Mallory $4.00 Audrey $3.50

23. Refer to Table 7-2. If the price of Vanilla Coke is $6.90, who will purchase the good? a. all five individuals b. Megan, Mallory and Audrey c. David, Laura and Megan d. David and Laura

24. Refer to Table 7-2. Which of the following is not true?

a. At a price of $9.00, no buyer is willing to purchase Vanilla Coke.

b. At a price of $5.50, Megan is indifferent between buying a case of Vanilla Coke and not buying one.

c. At a price of $4.00, total consumer surplus in the market will be $9.00.

d. All of the above are correct.

25. Refer to Table 7-2. If the market price is $5.50, the consumer surplus in the market will be a. $3.00. b. $4.50. c. $15.50. d. $21.00.

26. Refer to Table 7-2. If the market price is $3.80,

a. David’s consumer surplus is $4.70 and total consumer surplus for the five individuals is $9.50.

b. Megan’s consumer surplus is $1.70 and total consumer surplus for the five individuals is $9.80.

c. David, Laura, and Megan will be the only buyers of Vanilla Coke.

d. the demand curve for Vanilla Coke, taking the five individuals into account, is horizontal. Table 7-3

The only four consumers in a market have the following willingness to pay for a good: Buyer Willingness to Pay Carlos $15 Quilana $25 Wilbur $35 Ming-la $45

27. Refer to Table 7-3. If the market price for the good is $30, who will purchase the good? a. Carlos only b. Carlos and Quilana only

c. Carlos, Quilana, and Wilbur only d. Wilbur and Ming-la only ANS: D DIF: 2 REF: 7-1 NAT: Analytic LOC: Supply and demand TOP: Willingness to pay MSC: Applicative

28. Refer to Table 7-3. If there is only one unit of the good and if the buyers bid against each other for the right

to purchase it, then the good will sell for a. $15 or slightly less. b. $25 or slightly more. c. $35 or slightly more. d. $45 or slightly less.

29. Refer to Table 7-3. If there is only one unit of the good and if the buyers bid against each other for the right

to purchase it, then the consumer surplus will be a. $0 or slightly more. b. $10 or slightly less. c. $30 or slightly more. d. $45 or slightly less.

30. Refer to Table 7-3. If the price is $30, then consumer surplus in the market is

a. $20, and Wilbur and Ming-la purchase the good.

b. $20, and Carlos and Quilana purchase the good.

c. $30, and Wilbur and Ming-la purchase the good.

d. $30, and Carlos and Quilana purchase the good.