Preview text:

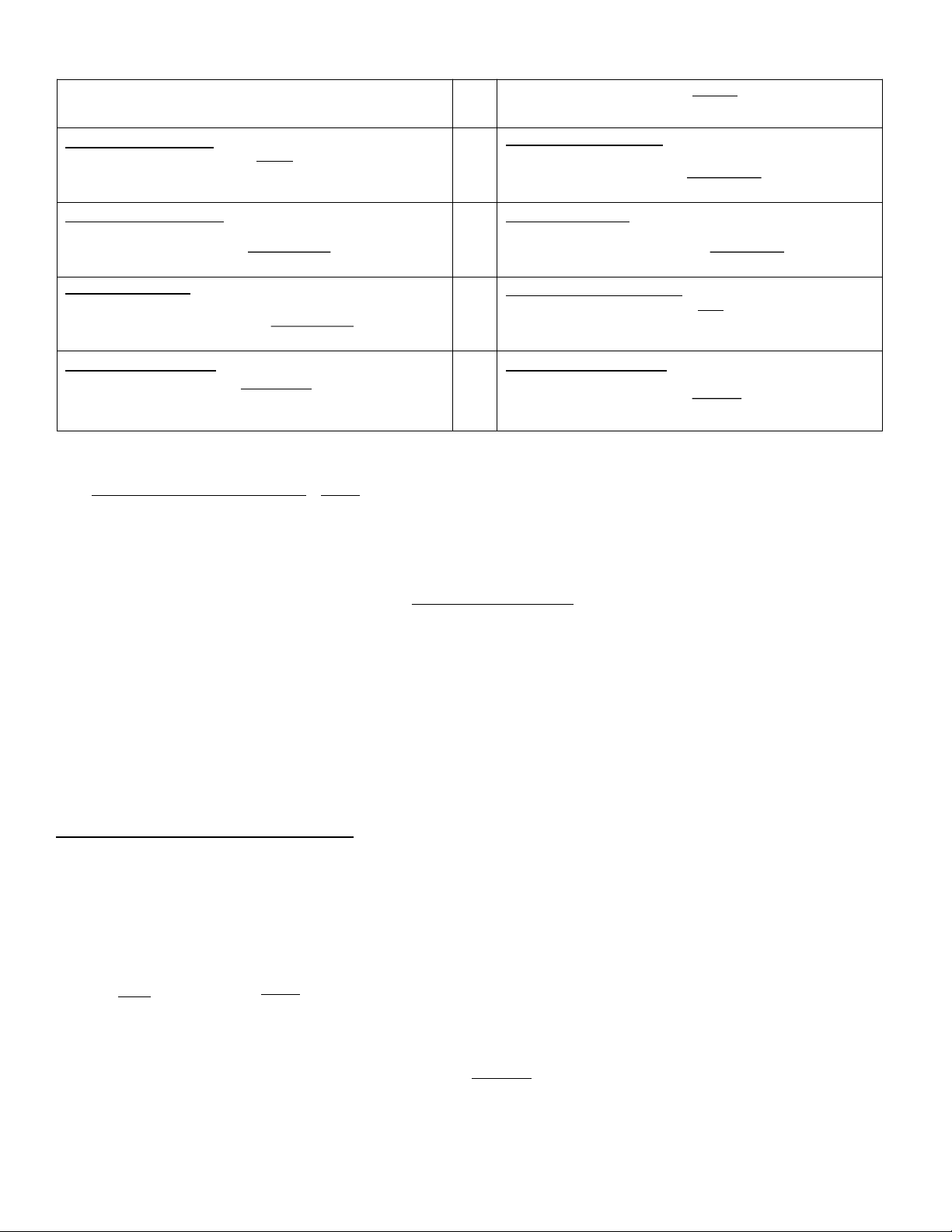

FORMULA SHEET CASH FLOWS

Operating cash flow (OCF) = EBIT + depreciation – taxes

Net capital spending (NCS) = purchases of fixed assets – sales of fixed assets

NCS = ending net fixed assets – beginning net fixed assets + depreciation

Changes in NWC = ending NWC – beginning NWC

Cash flow to creditors = interest paid + retirement of debt – proceeds from new debt

h flow to creditors = interest paid – net new borrowing=

terest paid – (ending long-term debt – beginning long-term debt)

Cash flow to stockholders = dividends paid + stock repurchases – proceeds from new stock issues

sh flow to stockholders = dividends paid – net new equity raised = dividends paid – (ending common stock, capital

surplus & Treasury stock – beginning common stock, capital surplus & Treasury stock)

SHORT-TERM SOLVENCY RATIOS

Current ratio = Current assets ÷ Current liabilities

Quick ratio = (Current assets – Inventory) ÷ Current liabilities

Cash ratio = Cash ÷ Current liabilities

FINANCIAL LEVERAGE RATIOS

Total debt ratio = Total debt ÷ Total assets = (Total assets – Total equity) ÷ Total assets

Debt-equity ratio = Total debt ÷ Total equity

Equity multiplier = Total assets ÷ Total equity = 1 + debt-equity ratio

Times interest earned = Earnings before interest and taxes ÷ Interest

Cash coverage = (Earnings before interest and taxes + depreciation + amortization) ÷ Interest TURNOVER RATIOS

Inventory turnover = Cost of goods sold ÷ Inventory

Days sales in inventory = 365 ÷ Inventory turnover

Receivables turnover = Sales ÷ Receivables

Days’ sales in receivables= 365 ÷ Receivables turnover

Total asset turnover = Sales ÷ Total assets

Days in inventory = Days in period ÷ Inventory turnover PROFITABILITY MEASURES

Profit margin = Net income ÷ Sales

Return on assets = Net income ÷ Total assets

Return on equity = Net income ÷ Total equity

EBITDA margin = EBITDA ÷ Sales MARKET VALUE RATIOS

Price-to-earnings ratio = Market price per share ÷ Earnings per share

Market-to-book ratio = Market price per share ÷ Book value per share

Market capitalization = Market price per share x Shares Outstanding

Enterprise Value (EV) = Market capitalization + Market value of interest bearing debt – cash EV Multiple = EV ÷ EBITDA DUPONT IDENTITY

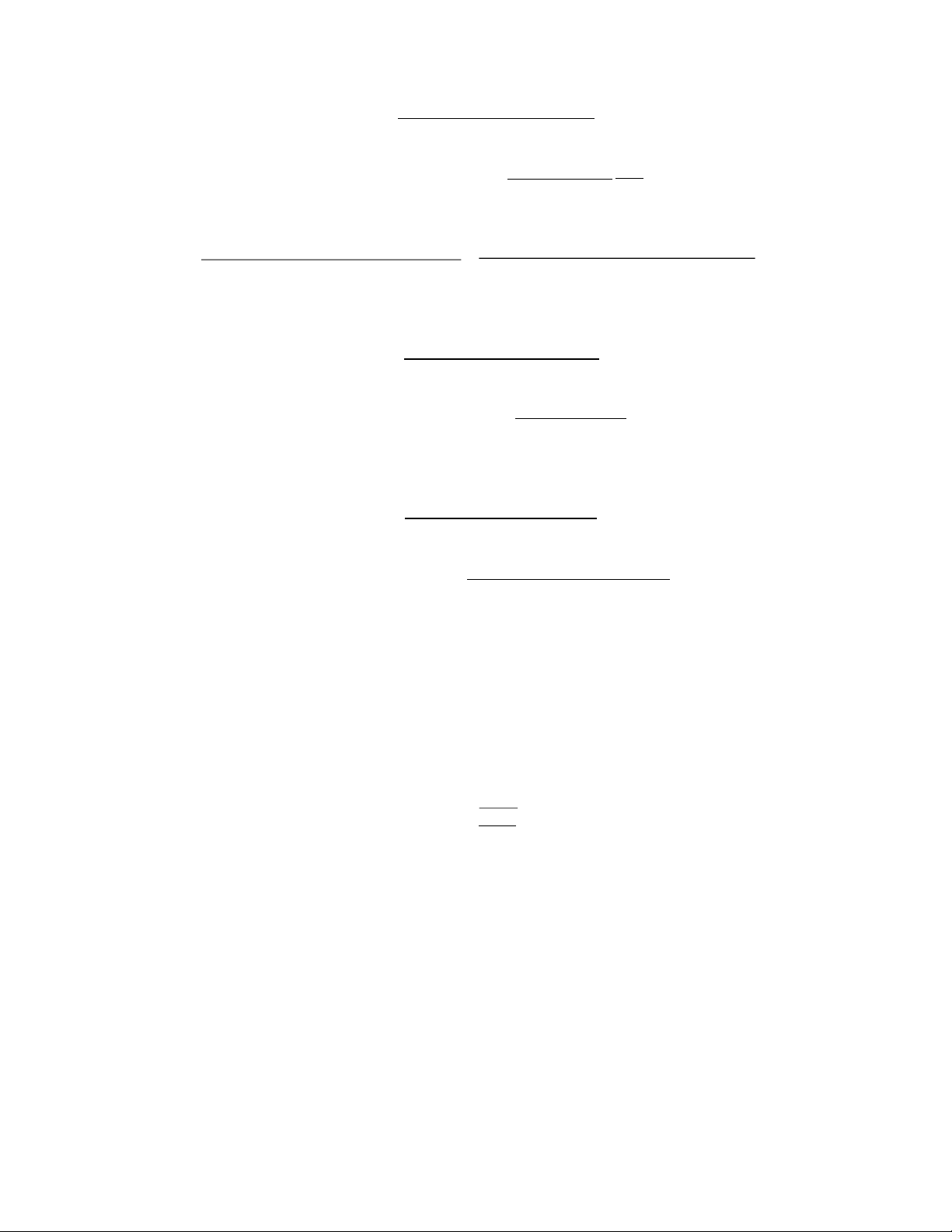

ROA= Net income x Sales Sales Total assets

RO E= Net income x Sales x Totalassets Sales

Totalassets Total equity

ROE=Profit margin xTotal asset turnover x Equity multiplier

COMPOUNDING AND DISCOUNTING

FV =PV (1+r )t PV = FV (1+r )t Effective annual rate FV of Ordinary Annuity APR m

FV =CF [(1+ r)t−1 ] EAR=(1+ m ) −1 PV of Ordinary Annuity 1 FV of Annuity Due −(1+r )−t (1+r )t−1 PV =CF PV of Annuity Due [ FV r ] =CF (1+ r) PV of Ordinary Perpetuity [ r ]

PV =CF (1+ r)[1−( r1+r)−t] PV =CF r PV of Perpetuity Due

General asset valuation n PV CF = CF (1+r ) t r V =∑

t =1 (1+r )t

NPV = - Cost + Present Value of Cash inflows

PI = Present value of cash∈flows = NPV +1

Cost of investment (I) I

+ Straight – line depreciation:

Dep= Installed cost of asset Useful life of asset + MACRS depreciation

Dep=MACRS rate∗Installed cost of asset

After tax salvage value =Sales of asset – tc% * (Sales of asset – Book value of asset

Book value of asset = Instal ed cost of asset – Accumulated depreciation

Value of unlevered and levered firm: VU=EBIT ∗¿¿ VL = VU + B*tc% and VL = B + SL

Expected return of equity capital (with tax):

RS = R0 + (R0 – RB)(B/S)(1-tc%)

The weighted average cost of capital (with tax): R = B R % + S R WACC )

B+ S B(1−tc B+ S s

Operating break-even point (OBP): OBP= FC P−VC

Degree of operating leverage (DOL):

DOL= Percentagechange ∈EBIT

Percentage change∈Sales

DOL at base sales level Q Qx = ( P−VC )

Qx ( P−VC )−FC

Financial break-even point (Break even EBIT): EBIT (1−tc %)

(EBIT −Interest exprense )∗(1−t = c %)

¿outstanding shares(without debt)

¿outstanding shares(with debt)

Degree of financial leverage (DFL):

D F L= Percentage change∈EPS

Percentage change∈EBIT D FLat baselevel EBIT = EBIT

EBIT −I −¿¿ Total leverage (DTL):

D T L= Percentage change∈EPS

Percentage change∈Sales

D T Lat base sales level Q = ∗( P−VC)

Q∗( P−VC )−FC−I −¿¿

DTL=DOL∗DFL

Operating cycle = inventory period + accounts receivable period

Cash cycle = operating cycle – accounts payable period

Economic order quantity of inventory (EOQ) Q¿ 2 = √ TFcc

Document Outline

- CASH FLOWS

- SHORT-TERM SOLVENCY RATIOS

- FINANCIAL LEVERAGE RATIOS

- TURNOVER RATIOS

- PROFITABILITY MEASURES

- MARKET VALUE RATIOS

- NPV = - Cost + Present Value of Cash inflows

- + Straight – line depreciation:

- After tax salvage value =Sales of asset – tc% * (S

- VU=EBIT ∗¿¿VL = VU + B*tc%and VL = B + SL

- Expected return of equity capital (with tax):

- The weighted average cost of capital (with tax):

- Operating break-even point (OBP):

- Financial break-even point (Break even EBIT):

- Degree of financial leverage (DFL):

- Total leverage (DTL):

- Economic order quantity of inventory (EOQ)