Preview text:

lOMoAR cPSD| 47882337 28/08/2023 Asset & Liability valuations & Income recognition 1

This Photo by Unknown Author is licensed under CC BY-SA 02 2

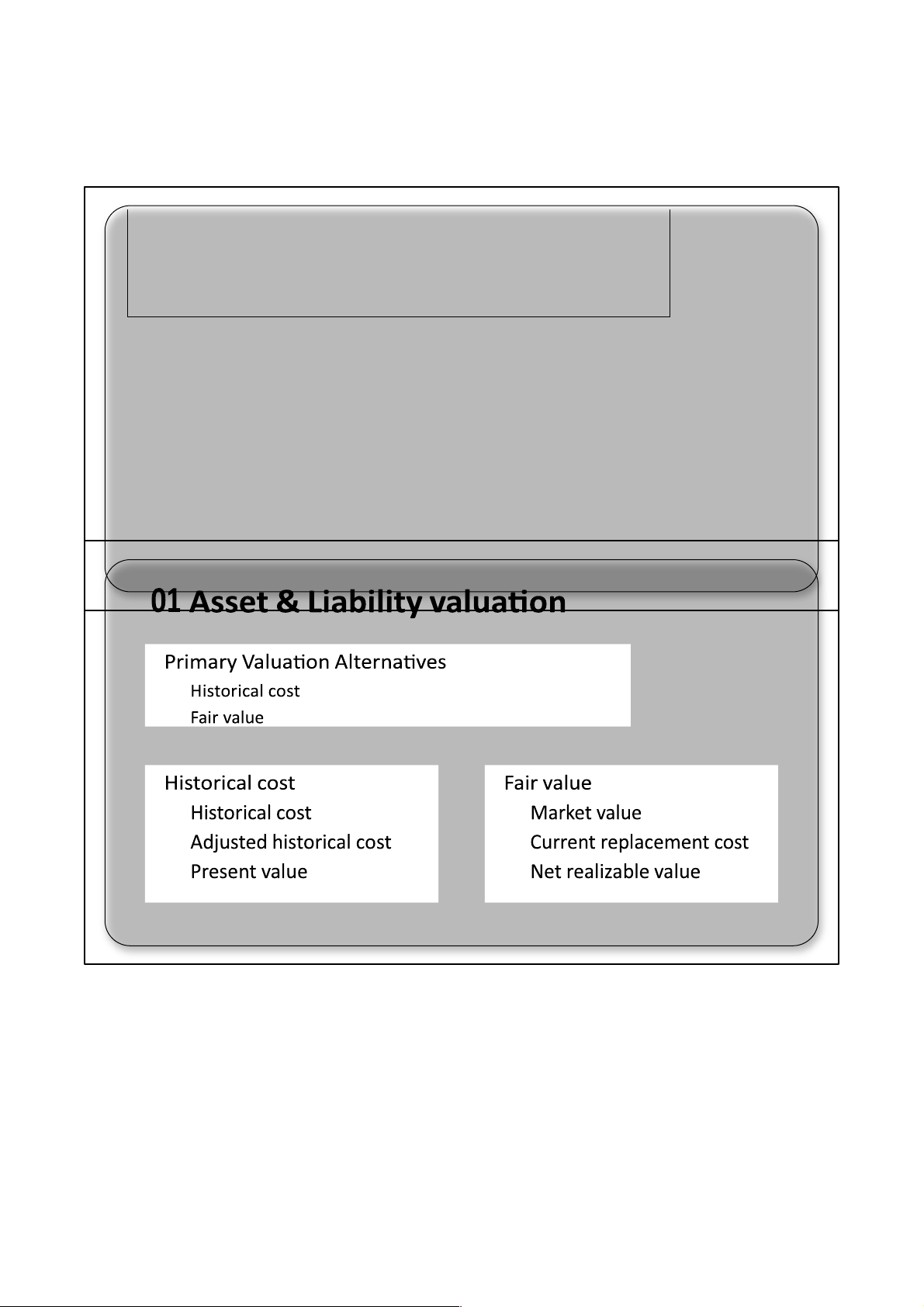

01 Asset & Liability valuation

Primary qualities of accounting information lOMoAR cPSD| 47882337 28/08/2023

o Relevance: if it can influence a user s decision based on the reported financial statements

o Representational faithfulness: if it represents what it purports to represent

Trade-Off of Relevance and Representational Faithfulness 3 o o o o o o o o 4 lOMoAR cPSD| 47882337 28/08/2023

01 Asset & Liability valuation 5

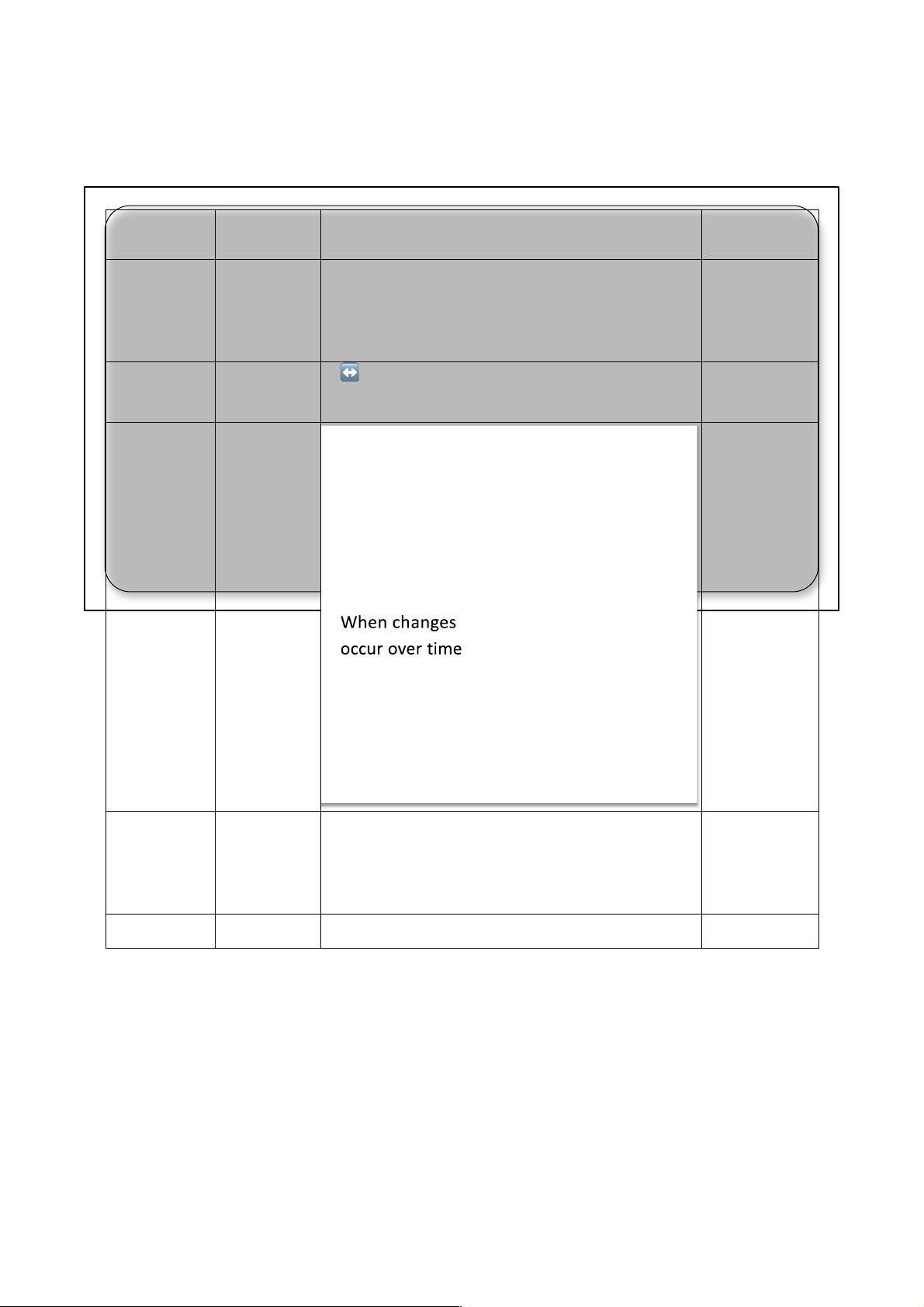

02 Income recognition 6 lOMoAR cPSD| 47882337 28/08/2023 Approach Approach 3 Approach 2 1 Reliability Maximum Maximum Vs Reliability Relevance Relevance and and Verifiability Timeliness Valuation Historical ↔ Current Approach Value Value Recognition When When in Balance realized in changes Sheet market occur over transaction time Recognition When

When realized in market transaction When in realized in changes Income market occur over Statement transaction time Nature Traditional Hybrid Conservative 7 lOMoAR cPSD| 47882337 28/08/2023

02 Income recognition - Example

ABC acquires a tract of land on January 1, 2020, for $215,000 cash. On

December 31, 2020, the current market value of the land is $230,000. On

December 31, 2021, the current market value of the land is $210,000. The

firm sells the land on December 31, 2022, for $205,000 cash.

Indicate the effect on the income statement and balance sheet using: • Approach 1 • Approach 2 • Approach 3 8 03 Revenue recognition

‘‘An entity should recognize revenue to depict the transfer of promised goods or

services to customers in an amount that reflects the consideration to which the entity

expects to be entitled in exchange for those goods or services.’’ 5 steps

o Identify the contract with a customer

o Identify the separate performance obligations in the contract o Determine the transaction price

o Allocate the transaction price to the separate performance obligations in the contract

o Recognize revenue when (or as) the entity satisfies a performance obligation 9 lOMoAR cPSD| 47882337 28/08/2023 03 Revenue recognition

Step 1: Identify the contract. Step 2: Identify separate

• The contract can be oral, written, or performance obligations

simply implied by an entitys customary •

identify whether a given good or

service is business practices as long as it has

distinct, and thus accounted for

commercial substance and creates separately, or indistinct, and thus enforceable rights and obligations

combined with other promised goods or

services until the firm is able to identify a

bundle of goods or services that is distinct 10 03 Revenue recognition Step 3: Transaction price.

Step 4: Allocate the transaction price to •

If the payment from the customer is a fixed

the separate performance obligations

amount, then that amount is the transaction price

Step 5: Recognize revenue when the entity •

The time value of money if the contract has

satisfies a performance obligation

a significant financing component •

Satisfaction occurs when the customer •

Noncash consideration either directly

obtains control of the good or service

measured at fair value or indirectly

measured by reference selling price of the goods or services exchanged •

Consideration payable to the customer 11 lOMoAR cPSD| 47882337 28/08/2023

03 Revenue recognition - Application Long term contracts 12 • Period of production may span many accounting periods.

Recognizes revenue on completion of • Customers are identified,

milestones and customers invoiced scope and price of contract

for partial completion based on: o agreed upon in advance.

Total contract price o Degree of • Customers make periodic completion payments as work progresses

o Ratio of costs incurred till date

to total expected costs Recognizes

proportion of expenses vis- -vis recognition of revenue

03 Revenue recognition - Application

Memory Ltd has a contract to build a network for a customer for a total price of €10 million. The

network will take an estimated three years to build, and total building costs are estimated to be €6 million.

The estimated percentage of completion is based on expenditure incurred as a percentage of total estimated expenditures.

➢ At the end of Year 1, the company had spent €3 million

➢ At the end of Year 2, the company had spent an additional €2.4 million for an

accumulated total of €5.4 million

➢ At the end of Year 3, the contract is complete. The company spent an accumulated total of €6 million

How much revenue and profit should be recognized each year? 13 lOMoAR cPSD| 47882337 28/08/2023 • • • 14

03 Revenue recognition - PoC Year

Percentage of completion Rev recognised Costs Profit 1 2 3 Total 15 lOMoAR cPSD| 47882337 28/08/2023 Year Rev recognised Costs Profit 1 2 3 Total 16

03 Revenue recognition — Cost recovery Year Rev recognised Costs Profit 1 2 3 Total 17 lOMoAR cPSD| 47882337 28/08/2023 o o

benefits of costs in operations (period costs). 18

04 Expense recognition - Cost of sale

o Single largest expense for most retail and manufacturing firms.

o An expense is recognized when inventory is consumed.

o Expense recognition becomes difficult when unit costs are

small and inventory items similar: o In such cases, cost of

goods sold is measured by making assumptions about the

flow of costs , i.e LIFO, FIFO, Weighted Average 19 lOMoAR cPSD| 47882337 28/08/2023

04 Expense recognition — SG&A o

Bear a less direct relationship with sales. o

Represent the consumption of assets and incurrence of liabilities

to carry on corporate functions other than production. o

Examples: Advertising, Marketing, Administration, Accounting,

Information systems, Warranty expense and Credit functions. 20 Operating Profit o

Sales revenue - Cost of sales - SG&A expenses = Operating profit before tax o

Financial revenues and expenses along with equity in the

earnings of affiliates are disclosed. o

Income tax expense is subtracted to obtain Net Income. lOMoAR cPSD| 47882337 28/08/2023 21 • • • 22 Tutorial exercises E2-12 E2- 13 E9-14 E9-18 23