Preview text:

African Journal of Business Management Vol. 7(2), pp. 125-134, 14 January 2013

Available online at http://www.academicjournals.org/AJBM DOI: 10.5897/AJBM12.886

ISSN 1993-8233 ©2013 Academic Journals Full Length Research Paper

Global banking survey: A new era of customer

satisfaction with reference to India

S. Suriyamurthi1*, V. Mahalakshmi2 and M. Arivazhagan1

1Shivani School of Business Management, Naval ur kuttapattu, Trichy-9, India.

2JJ College of Engineering and Technology, Trichy, India. Accepted 9 October, 2012

Banking sector in India is facing a rapidly changing market. In today’s competitive environment

relationship marketing is critical to banking corporate success. Banking is a customer oriented

services industry and Indian banks have started realizing that business depends on client service and

the satisfaction of the customer. The banking system occupies an important place in nation’s economy.

It plays a pivotal role in the economic development of a country and forms the core of the money

market in an advanced country. Banks have to deal with many customers every day and render various

types of services to its customer. It's a well known fact that no business can exist without customers.

“In recent years, the banking industry around the world has been undergoing a rapid transformation. To

address the challenge of retention of customers, there have been active efforts in the banking circles to

switch over to customer-centric business model. The success of such a model depends upon the

approach adopted by banks with respect to customer data management and customer relationship

management. Over the years, Indian banks have expanded to cover a large geographic and functional

area to meet the developmental needs. They have been managing a world of information about

customers - their profiles, location, etc. They have a close relationship with their customers and a good

knowledge of their needs, requirements and cash positions. The main objective of this study is to find

the interrelationships between service quality attributes, customer satisfaction and customer loyalty

banking sector, close relationship.

Key words: Service quality, customer satisfaction, customer loyalty. INTRODUCTION

Indian banking industry is one of the largest in the world.

more and more interaction with customers to build

There has been a great surge in efficient customer

customer relationship banking. But to deliver an improved

services. A highly satisfied and delighted customer is a

and in-depth understanding of customers needs, and fully

very vital non-financial assest for the banks in the emer-

integrated customer management system is required

ging IT era. The curtsey, accuracy an d speed are like a

along with complete transparency.

crown factors for a bank. The liberalization, privatization

In the emerging market scenario, for survival and

and globalization has ushered the customer relationship

growth, it is critical for a bank to align its vision, mission,

management in banks. The process of globalization and

goals and objectives with customer‘s satisfaction.

our move towards global standards changed the

perception of customer service, and the banking endea-

vor to serve the customer better, resulted in innovative Literature review banking services and

products. Banks are looking for

Without a sound and effective banking system in India it

cannot have a healthy economy. The banking system of

India should not only be hassle free but it should be able

*Corresponding author. E-mail: deansuriya@yahoo.com.

to meet new challenges posed by the technology and any 126 Afr. J. Bus. Manage.

other external and internal factors. For the past three

marketing activity (Oliver, 1980; Surprenant and

decades, India's banking system has several outstanding

Churchill, 1982; File and Prince (1992) argued that the

achievements to its credit. The most striking is its

customers who are satisfied tell others about their

extensive reach. It is no longer confined to only metro-

experiences and this increases WOM advertising. In this

politans or cosmopolitans in India. In fact, Indian banking

way, banks can increase customers. Spreng and Mackoy

system has reached even to the remote corners of the

(1996) and Mick and Fournier. (1997) argued that profit

country. This is one of the main reasons of India's growth

and growth are stimulated primarily by customer loyalty

process. The government's regular policy for Indian bank

and loyalty is a direct result of customer satisfaction. In

since 1969 has paid rich dividends with the nationa-

the competitive banking industry, customer satisfaction is

lization of 14 major private banks of India. Not long ago,

considered as the essence of success. Caruana et al

an account holder had to wait for hours at the bank

(2000) developed a meditational model that links the

counters for getting a draft or for withdrawing his own

service quality and service loyalty via customer

money. Today, he has a choice. Gone are days when the

satisfaction and applied this model in the retail banks in

most efficient bank transferred money from one branch to

Malta. The results appear to prove the links between

other in two days. Now it is simple as instant messaging

service quality, customer satisfaction and customer or dials a pizza. Money ha

s become the order of the day.

loyalty. According to Hofstede (2001), most of the Asian

The first bank in India, though conservative, was

cultures (like India, Pakistan) are collectivist [People in

established in 1786. From 1786 till today, the journey of

the collective cultures discriminate in groups (relatives,

Indian banking system can be segregated into three

institutions and organizations) and out-groups]. In this distinct phases.

case, word of mouth (WOM) advertisements are

important for the banks. Prabhakaran and Satya (2003)

mentioned that the customer is the king. High customer

INDIAN BANKING SECTOR IN 2010

satisfaction is important in maintaining a loyal customer

base. To link the service quality, customer satisfaction

The last decade has seen many positive developments in

and customer loyalty is important. Kumar et al. (2009)

the Indian banking sector. The policy makers, which

stated that high quality of service will result in high

comprise the Reserve Bank of India (RBI), Ministry of

customer satisfaction and increases customer loyalty,

Finance and related government and financial sector

and Naeem and Saif (2009) found that customer

regulatory entities, have made several notable efforts to

satisfaction is the outcome of service quality.

improve regulation in the sector. The sector now com-

pares favorably with banking sectors in the region on

metrics like growth, profitability and non-performing CUSTOMER SATISFACTION

assets (NPAs). A few banks have established an out-

standing track record of innovation, growth and value

―Customer satisfaction, a business term, is a measure of

creation. This is reflected in their market valuation. How-

how products and services supplied by a company meet

ever, improved regulations, innovation, growth and value

or surpass customer expectation. It is seen as a key

creation in the sector remain limited to a small part of it.

performance indicator within business and is part of the

The cost of banking intermediation in India is higher and

four of a balanced scorecard. In a competitive market-

bank penetration is far lower than in other markets.

place where businesses compete for customers,

India‘s banking industry must strengthen itself signifi-

customer satisfaction is seen as a key differentiator and

cantly if it has to support the modern and vibrant

increasingly has become a key element of business

economy which India aspires to be. While the onus for

strategy‖. According to Oliver (1980), the customer

this change lies mainly with bank managements, an

satisfaction model explains that when the customers

enabling policy and regulatory framework will also be

compare their perceptions of actual products/services

critical to their success. The failure to respond to

performance with the expectations, then the feelings of

changing market realities has stunted the development of

satisfaction have arisen. Any discrepancies between the

the financial sector in many developing countries. A weak

expectations and the performance create the discon-

banking structure has been unable to fuel continued

firmation. The working of the customer's mind is a

growth, which has harmed the long-term health of their

mystery which is difficult to solve and understanding the

economies. In this ―white paper‖, we emphasize the need

nuances of what customer satisfaction is, a challenging

to act, both decisively addressed, could seriously weaken

task. This exercise in the context of the banking industry

the health of the sector. Further, the inability of bank

will give us an insight into the parameters of customer

managements (with some notable exceptions) to improve

satisfaction and their measurement. This vital information

capital allocation, increase the productivity of their service

will help us to build satisfaction amongst the customers

platforms and improve the performance ethic in their

and customer loyalty in the long run which is an integral

organizations could seriously affect future performance.

part of any business. The customer's requirements must

Customer satisfaction is one of the important outcomes of

be translated and quantified into measurable targets. This Suriyamurthi et al 127

provides an easy way to monitor improvements, and

Service quality and customer satisfaction

deciding upon the attributes that need to be concentrated

on in order to improve customer satisfaction. We can

There is a great deal of discussion and disagreement in

recognize where we need to make changes to create

the literature about the distinction between service quality

improvements and determine if these changes, after

and satisfaction. The service quality school view satis-

implemented, have led to increased customer satis-

faction as an antecedent of service quality - satisfaction

faction. It serves to link processes culminating purchase

with a number of individual transactions "decay" into an

and consumption with post purchase phenomena such as

overall attitude towards service quality. The satisfaction

attitude change, repeat purchase, and brand loyalty

school holds the opposite view that assessments of

(Surprenant and Churchill, 1982). This definition is

service quality lead to an overall attitude towards the

supported by Jamal and Nasser (2003) and Mishra

service that they call satisfaction. There is obviously a (2009).

strong link between customer satisfaction and customer

retention. Customer's perception of service and quality of

"If you cannot measure it, you cannot improve it." - Lord

product will determine the success of the product or

William Thomson Kelvin 1824-1907.

service in the market. If experience of the service greatly

exceeds the expectations clients had of the service then

satisfaction will be high, and vice versa. In the service

quality literature, perceptions of service delivery are

The need to measure customer satisfaction

measured separately from customer expectations, and

the gap between the two provides a measure of service

Satisfied customers are central to optimal performance quality.

and financial returns. In many places in the world,

business organizations have been elevating the role of

the customer to that of a key stakeholder over the past

Expectations and customer satisfaction

twenty years. Customers are viewed as a group whose

satisfaction with the enterprise must be incorporated in

Expectations have a central role in influencing satis-

strategic planning efforts. Forward-looking companies are

faction with services, and these in turn are determined by

finding value in directly measuring and tracking customer

a very wide range of factors; lower expectations will result

satisfaction (CS) as an important strategic success

in higher satisfaction ratings for any given level of service

indicator. Evidence is mounting that placing a high priority

quality. This would seem sensible; for example, poor

on CS is critical to improved organizational performance

previous experience with the service or other similar

in a global marketplace. With better understanding of

services is likely to result in it being easier to pleasantly

customers' perceptions, companies can determine the

surprise customers. However, there are clearly circum-

actions required to meet the customers' needs. They can

stances where negative preconceptions of a service

identify their own strengths and weaknesses, where they

provider will lead to lower expectations, but will also

stand in comparison to their competitors, chart out path

make it harder to achieve high satisfaction ratings – and

future progress and improvement. Customer satisfaction

where positive preconceptions and high expectations

measurement helps to promote an increased focus on

make positive ratings more likely. The expectations

customer outcomes and stimulate improvements in the

theory in much of the literature therefore seems to be an

work practices and processes used within the company. oversimplification.

When buyers are powerful, the health and strength of

the company's relationship with its customers – its most

critical economic asset – is its best predictor of the future. Banking in India

Assets on the balance sheet – basically assets of pro-

duction – are good predictors only when buyers are

Over the last four years, India‘s economy has been on a

weak. So it is no wonder that the relationship between

high growth trajectory, creating unprecedented oppor-

those assets and future income is becoming more and

tunities for its banking sector. Most banks have enjoyed

more tenuous. As buyers become empowered, sellers

high growth and their valuations have appreciated signi-

have no choice but to adapt. Focusing on competition

ficantly during this period. Looking ahead, the most

has its place, but with buyer power on the rise, it is more

pertinent issue is how well the banking sector is

important to pay attention to the customer. Customer

positioned to cater for continued growth. A holistic

satisfaction is quite a complex issue and there is a lot of

assessment of the banking sector is possible only by

debate and confusion about what exactly is required and

looking at the roles and actions of banks, their core

how to go about it. This article is an attempt to review the

capabilities and their ability to meet systemic objectives,

necessary requirements, and discuss the steps that need

which include increasing shareholder value, fostering

to be taken in order to measure and track customer

financial inclusion, contributing to GDP growth, efficiently satisfaction.

managing intermediation cost, and effectively allocating 128 Afr. J. Bus. Manage.

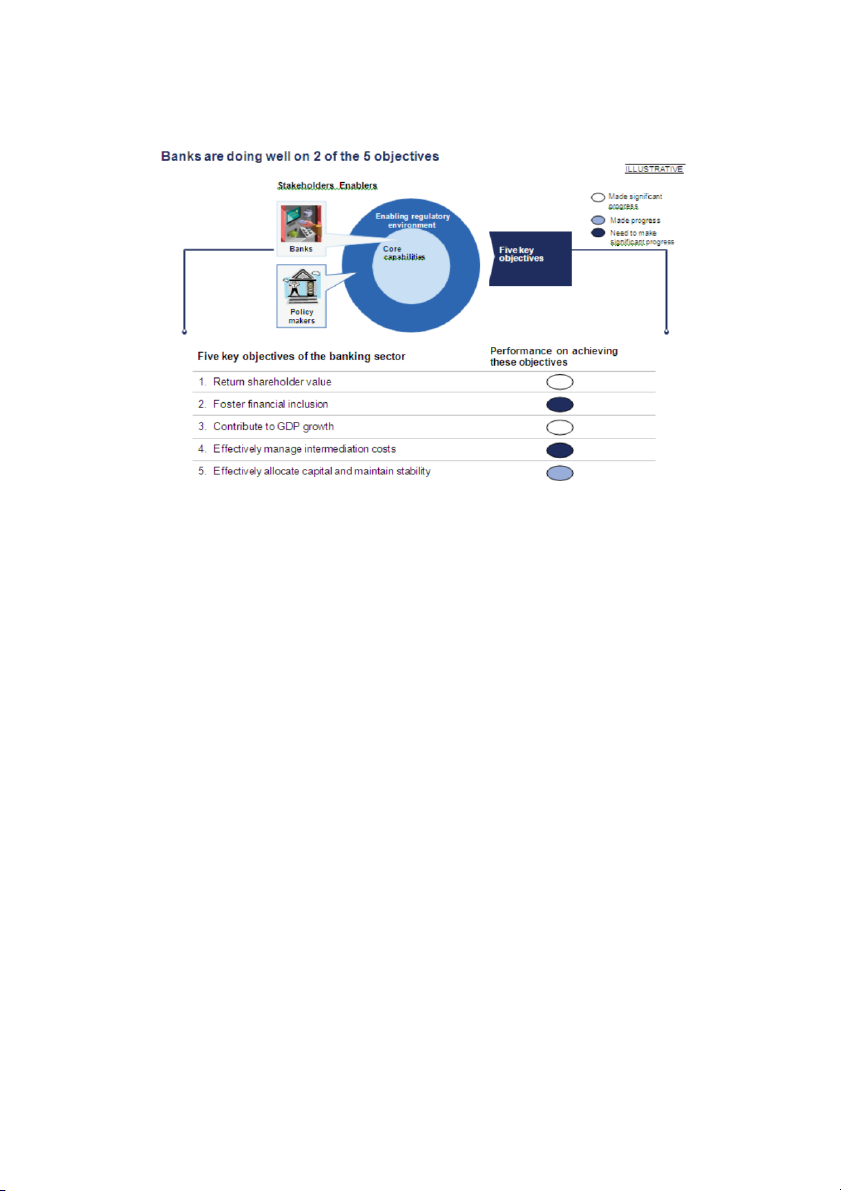

Figure 1. Performance assessment of Indian banking sector.

capital and maintaining system stability (Figure 1). METHODOLOGY

Our survey of 14 leading banks in India shows that

banks have done remarkably well in increasing share- Methods of data collection

holder value, allocating capital effectively, and contri-

In case of data collection, there are two types of data that is primary

buting to GDP growth (Figure 2). However, in comparison data and secondary data.

to international peer‘s, Indian banks could do more to

foster financial inclusion and manage intermediation

Primary data: Information obtained from the original sources by

costs. Our findings also highlight the clear divide between

researcher is called primary data. In this study primary data was

the performance of incumbents, that is, public sector and

collected using a Questionnaire and Interview with experts.

Secondary data: Secondary data was collected from various

old private banks, and attackers that is new private and

reference books, websites and newspaper articles.

foreign banks, a reflection of the underlying shifts in the

Sampling segments: Customers, Bankers, Industry expert. banking sector. Sample size: 100 respondents. Objectives Data collection procedures Sample design

The objective of this research is to analyze what is

relevant in achieving a successful and banking relation-

A sample of 100 customers who are directly associated with the

ship, so that banks can accomplish and maintain

banks in Chennai that is at least having accounts with the banks

customer‘s satisfaction in the new climate.

and operating the same on a regular basis, were selected for the

Identifying and commenting in what we see is the key

purpose of the study. An equal, 50 each, number of respondents

that is persons who are directly associated with banks both from

actions that bank must take to retain and expand their

rural and urban areas were considered. The information has been

customer ease in this challenging and increasingly

collected through structured questionnaire. Since the banks refused sophisticated market.

to provide the list of customers, the questionnaires were got filled

The main objective of this research is on the inter-

up from the customer personally visiting the bank premises (Indian

relationships among service quality, customer satisfaction

Overseas Bank, Indian Bank, State Bank, Icici, Canara Bank, Axis

Bank, Bank of Baroda, Karur Vysya Bank).

and customer loyalty in the banking sector. Therefore, the

The data were collected from the banks during the month of May

sample for this study was selected from the bank

to June 2011. Ten customers who came out of the banks on the customers.

very day were contacted. The purposes of the study were explained Suriyamurthi et al 129

Figure 2. Performance evaluation of banking sector based on five key objectives.

and then the customer was requested to provide his/her responses

and maximum value ranges from 2 to 7. Asurance ranges

with regard to the items of the questionnaire.

from 3.67 to 7 and the mean and standard deviation is

The first part of the questionnaire consists of the general

5.65 and 0.73, respectively. Empathy ranges from 3 to 7

information of the respondent. Service quality attributes were used

and the mean is 5.49 and the standard deviation is 0.86.

in the second part, which is the independent variable of this

research. The third part of the questionnaire explains the

The minimum and maximum value for customer

customer‘s satisfaction and this is the independent/dependent

satisfaction is 3 to 7 and the mean and standard

variable of this research. The final part consists of customer‘s

deviation is 5.64 and 0.90, respectively. Customer loyalty

loyalty and this is the dependent variable of this research. The

ranges from 2 to 7 and the mean and standard deviation

interviewers explained each part of the questionnaire to the

is 5.44 and 1.02, respectively. It has been observed in respondents.

Based on the 100 sample- bank customers, the percentage of

Table 1 that almost all the mean are similar. High

male and female respondents were 77 and 23 respectively, which

standard deviation means that the data are wide spread,

shows the male dominancy of bank customers. In the whole

which means that customers give variety of opinion and

sample, 53% of respondents fell in the age range of 21 to 30, and

the low standard deviation means that customers express

32% fell in the range of 31 to 40. In terms of qualification, the close opinion.

respondents are almost equal and that is, Undergraduate (31%),

Graduate (33%), and Post Graduate (35%). 63% of respondents

are service holder and 43% of respondents earn more. Hypotheses test

DESCRIPTIVE STATISTICS FOR EACH STUDY

Pearson correlation CONSTRUCTS

A correlation coefficient is a very useful way to Descriptive statistics

summarise the relationship between two variables with a

single number that falls between -1 and +1 (Welkowitz et

Tangibility ranges from 2 to 7 with a mean of 5.64 and

al., 2006). Morgan et al. (2004) stated that:

standard deviation of 0.769. Reliability ranges from 3 to 7

and the mean and standard deviation is 5.57 and 0.82,

-1.0 (a perfect negative correlation)

respectively. For responsiveness, mean and standard 0.0 (no correlation)

deviation is 5.31 and 1.03 respectively with the minimum

+1.0(a perfect positive correlation) 130 Afr. J. Bus. Manage.

Table 1. Descriptive statistics. Parameter N Minimum Maximum Mean Std. deviation Customer satisfaction 100 3 7 5.64 .90 Tangibles 100 2 7 5.60 .77 Reliability 100 3 7 5.57 .82 Responsiveness 100 2 7 5.31 1.03 Assurance 100 3.67 7 5.65 .73 Empathy 100 3 7 5.49 .86 Customer loyalty 100 2 7 5.44 1.02 Valid N (listwise) 100

Table 2. Pearson correlation analysis obtained for the three intervals scaled variables. Parameter Variable CS Tangibles Reliability

Responsiveness Assurance CL Pearson correlation 1 .491** .488** .493** .526** .673** Customer Sig. (1-tailed) - .000 .000 .000 .000 .000 satisfaction N 100 100 100 100 100 100 Pearson correlation .491** 1 .632** .560** .500** .560** Tangibles Sig. (1-tailed) .000 - .000 .000 .000 .000 N 100 100 100 100 100 100 Pearson correlation .488** .632** 1 .759** .626** .680** Reliability Sig. (1-tailed) .000 .000 - .000 .000 .000 N 100 100 100 100 100 100 Pearson correlation .493** .560** .759** 1 .566** .660** Responsiveness Sig. (1-tailed) .000 .000 .000 - .000 .000 N 100 100 100 100 100 100 Pearson correlation .526** .500** .626** .566** 1 .439** Assurance Sig. (1-tailed) .000 .000 .000 .000 - .000 N 100 100 100 100 100 100 Pearson correlation .673** .560** .680** .660** .439** 1 Customer loyalty Sig. (1-tailed) .000 .000 .000 .000 .000 - N 100 100 100 100 100 100 Correlation

relationship between tangibles and customer satisfaction in the banking sector.

The Pearson correlation analysis obtained for the three

intervals scaled variables are shown in Table 2. The

sample size (N) is 100 and the significant level is 0.01 Reliability (p˂0.01).

H1ba: There is a positive correlation between reliability

H1a0: There is no correlation between tangibles and

and customer satisfaction in the banking sector.

customer‘s satisfaction in the banking sector.

In Table 2, it can be seen that the correlation (r) of

H1b0: There is no correlation between reliability and

tangibles is 0.491 and the significant level is 0.01 (p˂.01).

customer satisfaction in the banking sector.

Table 2 shows that the p-value is 0.000, which is less

Table 2 shows that the correlation (r) is 0.488 for

than 0.01. We therefore reject the null hypothesis, and

reliability and the p-value is 0.000, which is less than the

concluded that there is a medium positive (r = .491)

significant level (0.01). Therefore, the null hypothesis is Suriyamurthi et al 131

rejected and concluded that reliability and customer

products with their main bank.

satisfaction is positively (medium) related in the banking

Statistic: The average customer holds 3.1 products with sector.

the main bank, compared with a global average of 2.9.

15% of customers hold one product with the main bank, and 20% hold five or more. Responsiveness

H1ca: There is a positive correlation between respon- Reasons for attrition

siveness and customer satisfaction in the banking sector.

Finding: Despite general y high levels of satisfaction with

H1c0: There is no correlation between responsiveness

banks, Indian customers are generally leaving their main

and customer satisfaction in the banking sector bank because of poor service.

It can be observed in Table 2 that the correlation (r) of

Statistic: 48% of customers who decided to leave their

responsiveness is 0.493 and the p-value is 0.000, which

main bank did so because of general levels of service

is less than 0.01. Therefore, the null hypothesis is

quality, while 35% cited product and service offerings.

rejected and it can be concluded that responsiveness is

positively (medium) related to customer satisfaction in the banking sector. Personalized service

Finding: Out of al the countries we surveyed, Indian Assurance

customers are the most satisfied with the level of

personalized attention they receive from their main bank,

H1da: There is a positive correlation between assurance

and the majorities are willing to pay extra for independent and customer‘

s satisfaction in the banking sector. financial advice.

H1d0: There is no correlation between assurance and

Statistic: 80% consider the level of personalized attention

customer satisfaction in the banking sector.

their bank offers to be good or very good. 48% would not

Table 2 shows that there is a large positive correlation

pay for independent financial advice, but 45% would do

between assurance and customer‘ s satisfaction in the

so for high-end investments, and a further 15% would

banking sector where p˂0.01 (p=0.000) and r=0.526. So,

pay for independent advice on all their investments.

the nul hypothesis is rejected. Channel experience Trust and satisfaction

Finding: Customers in India are very satisfied with

Finding: In India, the credit crisis has had minimal impact

branches, internet banking and ATMs, and are more

on customer confidence in the banking industry, and

satisfied than most with mobile banking.

customers‘ confidence in the industry appears to have

Statistic: 85% are satisfied with the branch experience,

grown in the past 12 months. The majority of customers

80% are satisfied with ATMs and 78% are satisfied with

are also very satisfied with the service they get from their

internet banking. 60% are satisfied with mobile banking – banks.

the highest percentage in our survey.

Statistic: 80% say their trust in banks has increased in

the past 12 months, and 20% say their confidence has

not changed. 65% score their bank four or five out of five

Impact of the crisis on trust levels in financial

when asked about their degree of satisfaction. institution

- How has your confidence towards the banking industry Main bank relationship

changed over the past 12 months?

Finding: Indian customers tend to bank with multiple

In India, the credit crisis has had minimal impact on providers.

customer confidence in the banking industry and

Statistic: 90% of Indian customer‘s bank with more than

customer‗s confidence in the industry appears to have

one bank, and 45% bank with three or more providers.

grown in the last 12 months. The majority of the

customers are also very satisfied with the service they get from their banks. Product holdings

Stat: 75% say their trust in banks has increased in the

last 12 months and 17% say their confidence has not

Finding: Indian customers tend to hold a high number of changed. 68% score their ban k four or five out of five 132 Afr. J. Bus. Manage.

when asked about their degree of satisfaction.

banks with strong regional franchises will divest loss-

making divisions and instead focus on their core markets

and customer segments. We anticipate that many Euro-

AGENCIES: TAGS: CUSTOMERS, BANKS INDIAN

pean players may eventual y fall into this category.

BANKS CUSTOMER EXPECTATIONS

Indeed, soundness and solvency, balanced with gene-

rating returns, are the banking industry‘s new impe-

A survey farm global consultancy firm, Ernst and young

ratives. And we believe that most commercial banks in

has found that majority of retail customers is satisfied

developed markets will settle for lower risk and moderate

with the countries banking system and that trust has

growth in their quest to achieve high performance by

increased after its state handling of the 2008 global crisis.

2012. We estimate that at least 30% of the banks‘ cost

Unlike many other countries, India was less affected by

base will be variable by 2012, as successful banks use

the meltdown, mainly an account of conservative banking

alliances, shared services and sourcing to manage

policies followed by the Reserve Bank of India. According

noncore capabilities more competitively. For example,

to the survey, a new era of customer expectation, 75% of

shared services arrangements with telecommunications

the retail banking customers in India said that their trust

companies and energy utilities could improve economies

in banking industry grow in 2010. Indians have the

of scale (for both partners) and lower costs.

highest level of trust and satisfaction in their banking

Product innovations like so-called green mortgages,

industry. The credit crisis has had minimal impact on

which offer discounts for energy-efficient homes, will

customer‘s confidence in the Indian banking industry, the

address consumers‘ growing environmental and social

survey said. It surveyed more than 20500 global retail

concerns; surveys indicate, for instance, that customers

banking customers of which 1000 respondents were from

are prepared to pay a premium for products and services

India. The objective of the survey was to gauge what

that help cut carbon emissions. These and similar

drives customer relationship with this banks.

customer- and community-focused product initiatives will

The banking industry in mature markets has witnessed

not only create new income streams but also provide

a wholesale and ongoing shift in confidence, and never

banks with the opportunity to build and improve customer

before has loyalty management and personal customer relationships.

attention been such an issue for the sector. In contrast,

For example, microfinance (providing financial services

the emerging markets now offer huge opportunities for

to low-income customers and small- and medium-size

banks looking to expand internationally, as most have felt

enterprises, mostly in the developing world) is a low-

less of an impact from the credit crisis and instead have a

volatility lending model with limited risk that more banks

growing middle class of customers looking to diversify

are likely to adopt. Currently, between 50 and 80% of

their bank relationships. Rebuilding trust is a challenge

adults in many developing countries have inadequate

for individual banks and for the industry as a whole, in

access to financial services, along with up to 10% of the

particular across mature markets. Negative customer

population in developed economies, according to The

perceptions of the disruption banks have caused to the

World Bank. So the extension of services to the bottom of

wider economy, through the under-capitalized and over-

the pyramid represents a market with significant growth

leveraged practices that led to the credit crisis continue to potential.

prevail. In recent years, we have seen that being pro-

Another example of an emerging new business: Islamic

fitable is not enough. The role that banks play in

banking, the provision of financial products and services

supporting the wider economy has been highlighted, and

in compliance with Sharia law, which prohibits charging

a wide variety of stakeholders are now demanding a

interest. The Asian Development Bank estimates that the

more responsible banking industry if there is to be a

combined global value of Islamic assets held by

restoration of customer confidence.

governments (including sovereign wealth funds), financial

In evaluating the survey findings, the following are

institutions and individuals is approaching $1 trillion and

three key areas of focus for banks: (1) Rebuilding

growing at an annual rate of 10 to 15% (Table 3).

customer confidence; (2) Preventing customer attrition;

(3) Enhancing the customer experience through service

quality and use of remote channels. Global consolidation

In today's globally competitive and highly regulated

environment, managing risk effectively while satisfying an

By 2012, the world‘s banks will be managing profitability

array of divergent stakeholders is a key goal of banks

and growth under significantly higher capital, risk, liquidity

and securities firms. The Center works to anticipate

and balance sheet constraints (Table 3). They will also be

market trends, identify the implications and develop

competing with some strong emerging-market players—

points of view on relevant industry issues. Ultimately, it

banks from Brazil, Russia, China and India that have helps in meeting one‘ s goals and f or better competing. By

performed better during the current crisis and that will

2012, most banks will be retail and commercial banking

leverage the higher growth of their domestic and regional

institutions serving regional o r local markets. Some big

markets over the next three years to consolidate their Suriyamurthi et al 133

Table 3. Dramatic changes in banking sector between 2008 and 2012. Area 2008 2012 • Lower capital ratio • Higher capital ratio Capital • Low cost of equity • Higher cost of equity • Securitized assets • On-balance sheet assets

• Low market / credit risk premiums • Higher risk premiums Risk

• Basel II Accords, International

• Counter-cyclical provisions

Accounting Standards—pro-cyclical

• Innovation in risk derivatives

• Regulated risk derivatives

• High leverage / rapid expansion • Lower leverage Assets

• Off balance sheet / innovation

• Higher risk premiums / returns • Low yield / ROA • Transparency Liabilities

• Reliance on wholesale funding • Focus on retail deposits

• Low cost of retail deposits

• Wholesale funding costs rising Liquidity • High market liquidity • Higher liquidity reserves • Low average cost of funds • Counter-party risk focus

• Thin capital / high leverage

• Higher capital / lower leverage Return on equity

• High performers (20 - 25%)

• High performers (10 - 15%)

• Reputation and capability based, core Growth model • Leverage based

capabilities substantial y strengthened

Note: Pro-cyclical: The regulatory system magnifies the impact of the business cycle by allowing capital

requirements to fall in periods of economic growth and strong credit quality, and rise when credit quality

deteriorates. Counter-cyclical: The regulatory system requires banks to hold capital or make additional provisions

against default in good times to protect against losses in bad times. Source: Accenture analysis. strengths.

is critical to banking corporate success. Banking is a

To be successful, al players will need to redefine their

customer oriented services industry and Indian banks

business scope—bolstering core businesses and finding

have started realizing that business depends on client

optimal exit strategies for the rest. This will demand

service and the satisfaction of the customer. This is

exceptional post-merger integration skills for the next

compelling them to improve customer service and build three years and beyond.

relationships with customers. It is a well known fact that

Beyond 2012, we foresee a fundamentally reconfigured

no business can exist without customers. In a developed

banking industry: an environment of technology-enabled

country, customer service, like any aspect of business, is

banking ―ecosystems,‖ where non-bank players and peer-

a practiced art that takes time and effort to master. All we

to-peer networks will compete with mainstream providers

need to do to achieve this is to stop and switch roles with

to service the needs of ever more demanding consumers.

the customer. What would you want from your business if

The high performers will be those that can overcome the

you were the client? How would you want to be treated?

immediate challenges and maximize the opportunities

Treat your customers like your friends and they w lil

presented by the dramatically changed banking

always come back. In short, the domestic economy is an landscape of 2012.

increasing pie which offers extensive economies of scale

In the more distant future, the new banking virtues—

that only large banks will be in a position to tap. With the

sustainable profitability, renewed customer-centricity and

phenomenal increase in the country's population and the

a more realistic approach to risk—will be more important

increased demand for banking services; speed, service than ever.

quality and customer satisfaction are going to be key

differentiators for each bank's future success. Thus it is

imperative for banks to get useful feedback on their Conclusion

actual response time and customer service quality

aspects, which in turn wil help them take positive steps

In today‘s competitive environment relationship marketing

to maintain a competitive edge. The competitive land- 134 Afr. J. Bus. Manage.

scape. It is clear from our research that enhancing indivi-

Morgan GA, Leech NL, Gloeckner GW , Barret KC (2004). SPSS for

introductory Statistics: Use and Interpretation Second Edition.

dual customer relationships is critically important to future

Lawrence Erlbaum Associates, Publishers:111-124.

competitive success. In the wake of the credit crisis,

Naeem H, Saif I (2009). Service Quality and its impact on Customer

banks need to continually review their strategies,

Satisfaction: An empirical evidence from the Pakistani banking

business models and routes to market to ensure that they sector. Int. Bus. E con. Res. J. 8(12):99.

are responding to customer expectations.

Prabhakaran S, Satya S (2003). An insight into Service Attributes in

Banking Sector. J. Serv. Res. 3(1):157-169.

Spreng R, Mackoy R (1996). ‗An Empirical Examination of Perceived

Service Quality and Satisfaction‘, J. Retail. 72(2):201-215. REFERENCES

Surprenant C, Churchill G (1982), ―An investigation into the

determinants of customer satisfaction‖, J. Market. Res. 19(4):491.

Caruana A, Money AH, Berthon PR, (2000). Service quality and

Welkowitz J, Cohen BH, Ewen RB (2006). Introductory statistics for the

satisfaction- the moderating role of value. Eur. J. Market.

Behavioral Sciences. (6th ed.). New Jersey: John Wiley & Sons, Inc. 34(11/12):1338-1352.

File KM, Prince RA (1992). Positive word-of-mouth: Customer

satisfaction and buyer behavior. Inter. J. Bank Market. 10(1):25-29.

Hofstede G (2001) Culture‘s Consequences: Comparing Values,

Behaviors, and Organizations Across Nations (2nd ed.). Thousand Oaks, CA: Sage.

Jamal A, Nasser K (2003). Factors influencing customer satisfaction in

the retail banking sector in Pakistan. Int. J. Commerce Manag. 13(2):29.

Kumar M, Kee FT, Manshor AT (2009). Determining the relative

importance of critical factors in delivering service quality of banks: an

application of dominance analysis in SERVQUAL model. Manag. Serv. Qual. 19(2):211-228.

Mick D, Fournier S (1999),‖ Rediscovering Satisfaction‖, J. Market. 63(4):5.

Mishra AA (2009). A study on Customer Satisfaction in Indian Retail

Banking. IUP J. Manag. Res. 8(11):4 - 5 61.