Preview text:

MINISTRY OF EDUCATION AND TRAINING HOA SEN UNIVERSITY

FACULTY OF ECONOMICS & ADMINISTRATION ------------ FINAL REPORT TOPIC

MAIN MACRO FACTORS OF VIET NAM AFFECTING

THE VARIATION OF USD/VND EXCHANGE RATE IN

RECENT YEARS AND HOW DOES COVID-19 PANDEMIC EFFECTS ON IT ĐIỂM 9

LECTURER : LAM THANH PHI QUYNH

Subject: International Payment

Class’ ID: NT317DE01 - 0100 Semester: 2034 Students list:

1. TRẦN PHƯƠNG UYÊN 2199126 2. THÁI HUỲNH NHƯ 2194133 3. PHẠM THIÊN KIM 2192836

4. NGUYỄN NGỌC KHÁNH 2192575 5. TRẦM NGỌC LOAN 2196870 6. TRẦN CẨM TIÊN 2190949

7. PHẠM CỔ MINH VÂN 2191289

Ho Chi Minh city, August 2021 Hoa Sen University ACKNOWLEDGEMENT

First of all, our group would like to express our sincere thanks to lecturer Lam

Thanh Phi Quynh - who has been with us for the past 15 days studying . He has

conveyed extremely useful information in the subject as well as practical

knowledge so that we can apply it to our future work. Although in the process of

learning was affected by the Covid-19 pandemic, but whether the it is offline or

online, he has always been dedicated to instructing.

Besides, we also thank Hoa Sen University for constantly upgrading online

learning tools so that the process of study is more easily.

Finally, thank you to all members of group 6 for their serious cooperation and

high sense of responsibility in the process of completing this report. Your sincerely.

Final Report - International Payment Page | i Hoa Sen University TABLE OF CONTENTS

ACKNOWLEDGEMENT...................................................................................i

LIST OF FIGURES...........................................................................................iii

INTRODUCTION..............................................................................................iv

ABSTRACT.........................................................................................................v

1. MACRO FACTORS IMPACTS ON EXCHANGE RATE...........................1

1.1. Inflation........................................................................................................1

1.1.1. Relationship between inflation and interest rates.................................1

1.1.2. The effects of inflation on the exchange rate.......................................2

1.1.3. Inflation in the 2000s in Vietnam.........................................................2

1.2. Relative Value..............................................................................................5

1.3. Interest rate Differential...............................................................................5

1.4. Relative income level...................................................................................6

1.4.1. Direct impact.......................................................................................6

1.4.2. Indirect impact.....................................................................................7

1.5. Government Intervention.............................................................................7

1.5.1. Direct Intervention...............................................................................9

1.5.2. Indirect Intervention..........................................................................10

1.5.3. Exchange rate adjustment policy of Vietnam.....................................10

1.6. Other factors...............................................................................................12

1.6.1. Psychological factors.........................................................................12

1.6.2. Investors’ expectations.......................................................................14

2. HOW COVID-19 PANDEMIC EFFECTS ON EXCHANGE RATE........14

2.1. The exchange rate of USD/VND before Covid-19.....................................14

2.2. Covid-19 effects on the exchange rate of USD/VND.................................15

2.3. Forecast and recommendations..................................................................18

CONCLUSION..................................................................................................20

REFERENCES..................................................................................................20

Final Report - International Payment Page | ii Hoa Sen University LIST OF FIGURES

Figure 1 - Work assignment table........................................................................iv

Figure 2 - Factors affecting exchange rates..........................................................1

Figure 3 - Table of inflation and economic growth chart (1996-2007).................3

Figure 4 - Inflation data sheet...............................................................................3

Figure 5 - State Bank of Viet Nam (SBV)............................................................8

Figure 6 - Central rate (USD/VND) of Viet Nam 2019......................................15

Figure 7 - Table of exchange rate (USD/VND) in Viet Nam 2014-2020............16

Figure 8 - The exchange rate of USD/VND in 2020..........................................17

Final Report - International Payment Trang | iii Hoa Sen University INTRODUCTION Objectives

A brief system of information on exchange rates, get more information of

the macro-factors that effect on the exchange rate and how does the

Covid-19 pandemic impact on it.

Find out the exchange rate regime being applied in Vietnam and find out how

the bank updates the exchange rate on a daily basic.

Provide recommendations to limit risks from exchange rate fluctuations

Work assignment table Student’s ID Student’s full name Perform the work Completion rat 2192575 Nguyễn Ngọc Khánh

1.3. Interest rate Differential 100% 1.6. Other factors 2192836 Phạm Thiên Kim 100% Conclusion 2196870 Trầm Ngọc Loan 1.1. Inflation 100% 1.4. Relative income level 2194133 Thái Huỳnh Như 100% Conclusion 2191289 Phạm Cổ Minh Vân

2.2. Covid-19 effects on the exchange 100% rate of USD/VND

Final Report - International Payment Trang | iv Hoa Sen University

2.3. Forecast and recommendations 2199126 Trần Phương Uyên Abstract 100% 1.5. Government’s Roles 2190949 Trần Cẩm Tiên 1.2. Relative Value 100%

2.1. The exchange rate of USD/VND before Covid-19.

Figure 1 - Work assignment table ABSTRACT

An exchange rate is the value of one country's currency in terms of another

country's currency and is a value that fluctuates frequently and is difficult to

predict. It affects the economy and people's daily life because when the value of

the local currency increases, the price of goods will increase. Domestic goods are

expensive relative to foreign goods. Therefore, the exchange rate is a good tool

for creating favorable conditions, while maintaining the competitiveness of the economy.

For the above reasons, exchange rate policy can be considered as one of the most

important monetary policies of an open economy. On the other hand, currently,

USD is still considered the strongest currency in the world with nearly 80% of

transactions on the foreign exchange market using USD. In Vietnam, the USD

plays a similar role as it accounts for 60% of the foreign exchange reserves of the

State Bank (SBV) (Le Thi Tuan Nghia, Pham Thi Hoang Anh 2013), and is the

main currency used in import and export activities in Vietnam. Therefore, the

management and control of the USD exchange rate has been one of the focuses

of the State Bank towards the goal of long-term and stable growth.

Final Report - International Payment Trang | v Hoa Sen University

1. MACRO FACTORS IMPACTS ON EXCHANGE RATE

The exchange rate is the relative ratio of the currency of one country with another

country's currency (Chen, 2020). It is the price of one unit of this country's currency

expressed in units of another country's currency.

Figure 2 - Factors affecting exchange rates 1.1. Inflation

1.1.1. Relationship between inflation and interest rates

The inflation rate is highly monitored by central banks. They examine inflation to

direct their monetary policy and set their policy interest rates. Each central bank

generally sets itself an inflation threshold that it does not want to exceed and seeks

to avoid deflation (often synonymous with economic recession).

If inflation is moderate, the central bank sets its interest rates according to the level

of inflation and also according to the economic growth rate (GDP). Of course, many

other factors are also taken into account by central banks, but this is to simplify things.

Final Report - International Payment Page | 1 Hoa Sen University

Inflation therefore has an impact on the level of interest rates, but the opposite is also true.

1.1.2. The effects of inflation on the exchange rate

The level of inflation has a direct impact on the exchange rate between two currencies on several levels:

Purchasing power parity: Changes in purchasing power parity (and therefore

inflation) affect the exchange rate. If inflation is the same in both countries,

the exchange rate does not change. If it is higher in one country than in the

other, this is when inflation affects the exchange rate. The currency with the

higher inflation rate then loses value and depreciates, while the currency with

the lower inflation rate appreciates on the Forex market.

Interest rates: Too high inflation pushes interest rates up, which has the effect

of depreciating the currency (less remunerative) on Forex. On the other hand,

inflation that is too low (or deflation) pushes interest rates down, which has

the effect of appreciating the currency on the Forex market. However,

inflation has a much more frequent negative effect than a positive one. A

high rate of inflation is likely to have a negative impact on the exchange rate,

while low inflation is far from a guarantee of an increase in the exchange rate.

1.1.3. Inflation in the 2000s in Vietnam

Final Report - International Payment Page | 2 Hoa Sen University

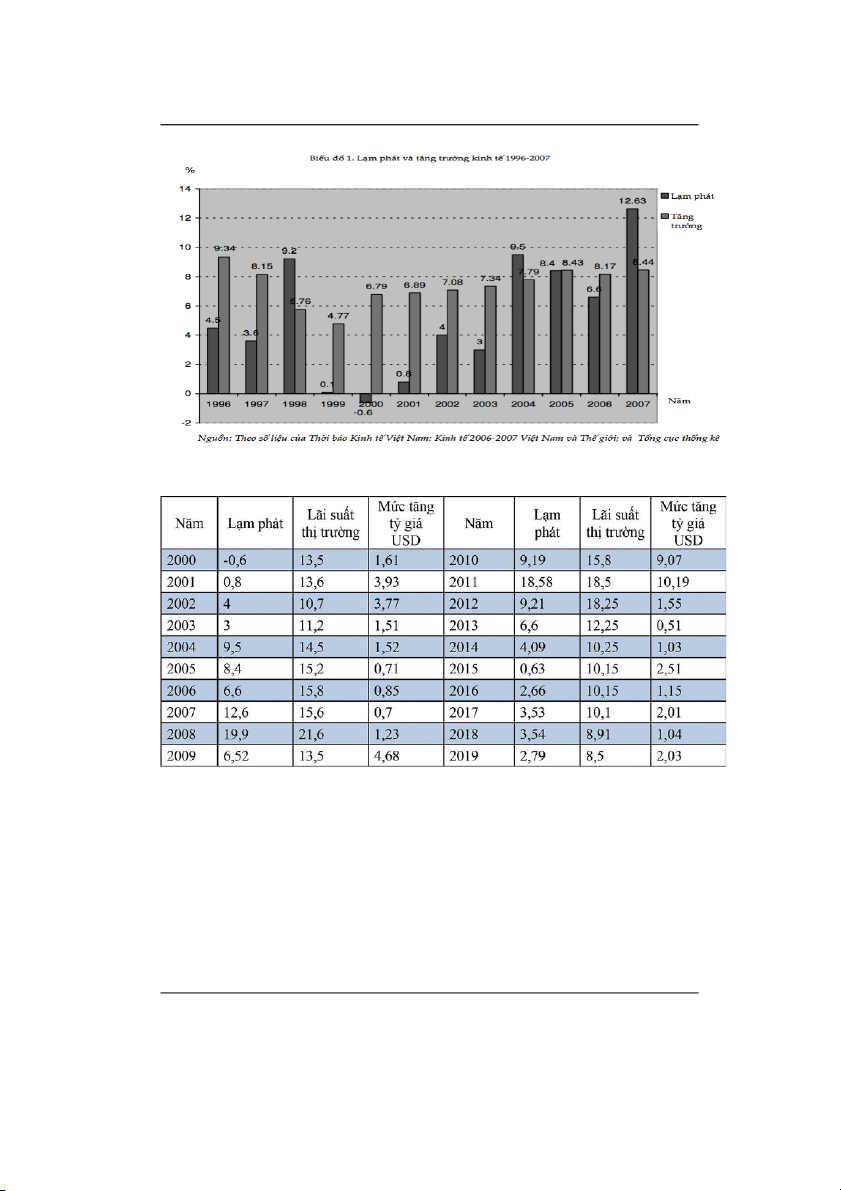

Figure 3 - Table of inflation and economic growth chart (1996-2007)

Figure 4 - Inflation data sheet

In the years 2000-2006, inflation was stable at single digit, interest rates were stable

at 13-15% per year. In the years 2007-2011, when inflation was at a high double-

digit rate, the interest rate increased from 18% to over 21%/year. Therefore, in the

period of 2000-2006. Applying the fixed anchor exchange rate mechanism, the

average inter-bank exchange rate announced by the SBV was kept around from

Final Report - International Payment Page | 3 Hoa Sen University

14,000 VND/USD to 16,000 VND/USD. In 2005, the SBV published the Ordinance

on Foreign Exchange and the International Monetary Fund (IMF) officially

recognized Vietnam to fully liberalize current transactions. In 2006, Vietnam's

foreign exchange market began to come under pressure from the process of

international economic integration. The amount of foreign currency poured into

Vietnam began to increase sharply. The World Bank and the IMF have warned the

SBV to increase the flexibility of the exchange rate in the context of increasing capital inflows into Vietnam.

The period 2007 to 2011. This is the period when the USD/VND exchange rate

fluctuates strongly. After Vietnam joined the WTO, the liberalization of the capital

account was expanded, leading to an increase in capital flows to Vietnam, which

greatly affected exchange rate fluctuations. Starting from April 2018, the amount of

loans in USD, the balance of payments due to the high trade deficit and the sharp

decrease of the total foreign exchange reserves created a strong demand for USD.

The State Bank continuously sold foreign currency to intervene when the official

exchange rate and the black market rate appeared with a large gap for a long time.

At the end of 2011, the SBV used many solutions to control and stabilize the market.

In the years 2012-2019, inflation dropped to a low level, averaging about 4%/year,

then the interest rate dropped significantly, averaging about 10%/year. Thus, in the

period 2000-2019, interest rates tend to move in a positive direction with inflation.

In the period from 2012 to 2019. The USD/VND exchange rate has been somewhat

more stable, the exchange rate management policy of the State Bank is more in line

with market movements. Monetary solutions of the State Bank have created positive

changes for the foreign currency market, the free market has almost stopped

working. The difference between the interbank exchange rate and the listed

exchange rate of commercial banks is narrowed (difference from 100 to 300

VND/USD), thereby reducing the psychology of holding foreign currency of organizations and individuals.

Final Report - International Payment Page | 4