Preview text:

24/07/2023 FOREIGN TRADE OPERATIONS PHAN VŨ NGỌC LAN – MDE

International Business Administration Department lanpvn@huflit.edu.vn 1 INTERNATIONAL SALES CONTRACT CHAPTER 3 PART 3 2 1 24/07/2023 IN THIS CHAPTER

1. Concept of International sales contract

2. Requisites to the effect of an international sales contract

3. Main contents of an international sales contract

4. Major terms and conditions in international sales contracts

5. Execution of International sales contracts 3

4. MAJOR TERMS AND CONDITIONS IN INTERNATIONAL SALES CONTRACTS

1. [Description of ] Goods/Commodity/Scope of supply 2. Quality and specifications 3. Quantity 4. Packing and marking 5. Price 6. Terms of delivery/Shipment 7. Transportation 8. Insurance

9. Terms of payment and documents

10. Non-conformity/Inspection and claims Jul-23 BY PVNLAN 4 4 2 24/07/2023

4. MAJOR TERMS AND CONDITIONS IN INTERNATIONAL SALES CONTRACTS 11. Warranty

12. Force majeure (excuse for non-performance)

13. Dispute resolution/Dispute settlement/Arbitration 14. Applicable law 15. Damages/Penalty 16. Performance guarantee

17. Transfer of risk and title/Transfer of property/Retention of title (optional)

18. Entire agreement & effectiveness (optional) 19. Non-performance (optional)

20. Pre-shipment inspection [Inspection of the Goods] (optional)

21. Limitation of liability (optional)

22. Avoidance of contract and restitution (optional) Jul-23 BY PVNLAN 5 5 4.7. TRANSPORTATION TERMS

Stating how the goods will be transported.

Including mode of transportation and related problems. (by

road, rail, ocean, air or, in other cases, a combination of these modes (multi-modal transport))

In sea transport: Define the mode of vessel chartering: Liner,

Voyage chartering or Time chartering.

define the vessel, time of loading, loading/discharging cost,

freight rate and payment, demurrage/dispatch money… 7 3 24/07/2023 4.8. INSURANCE

Liability of obtaining insurance: To be fulfilled by the

seller or the buyer? -> closely relates to the terms of delivery, based on: -Characteristics of goods -Means of transportation -The voyage -Possible risks…

Regulations related to obtaining insurance: Insurance terms, Amount insured. 8

4.9 PAYMENT TERMS [PAYMENT CONDITIONS] Time of payment Method of payment (When payment is (How payment will be due?) made?) Details of Amount to be paid Beneficiary’s bank (How much?) account (Where payment is going?) The documents to be presented Jul-23 BY PVNLAN 9 9 4 24/07/2023

PAYMENT BY CASH IN ADVANCE & OPEN ACCOUNT

1. Method of payment: Telegraphic transfer (T/T) in advance

2. Amount to be paid (total price or part of the price and/or

percentage of contract value] . . . . . . . . .

3. Latest date for payment to be received by Seller’s bank. . . . . . . . .

4. Bank details of Beneficiary . . . . . . . . . . . . . . . . . .

5. Documents:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Documents shall be sent by fast courier to the following address

not later 3 days after shipment:. .. . . . . . . . . . . . . .

7. Special conditions applying to this payment [if any] . . . . . . . . . . .Jul.-23 . . BY PVNLAN 10 10 4.9.1. TIME OF PAYMENT

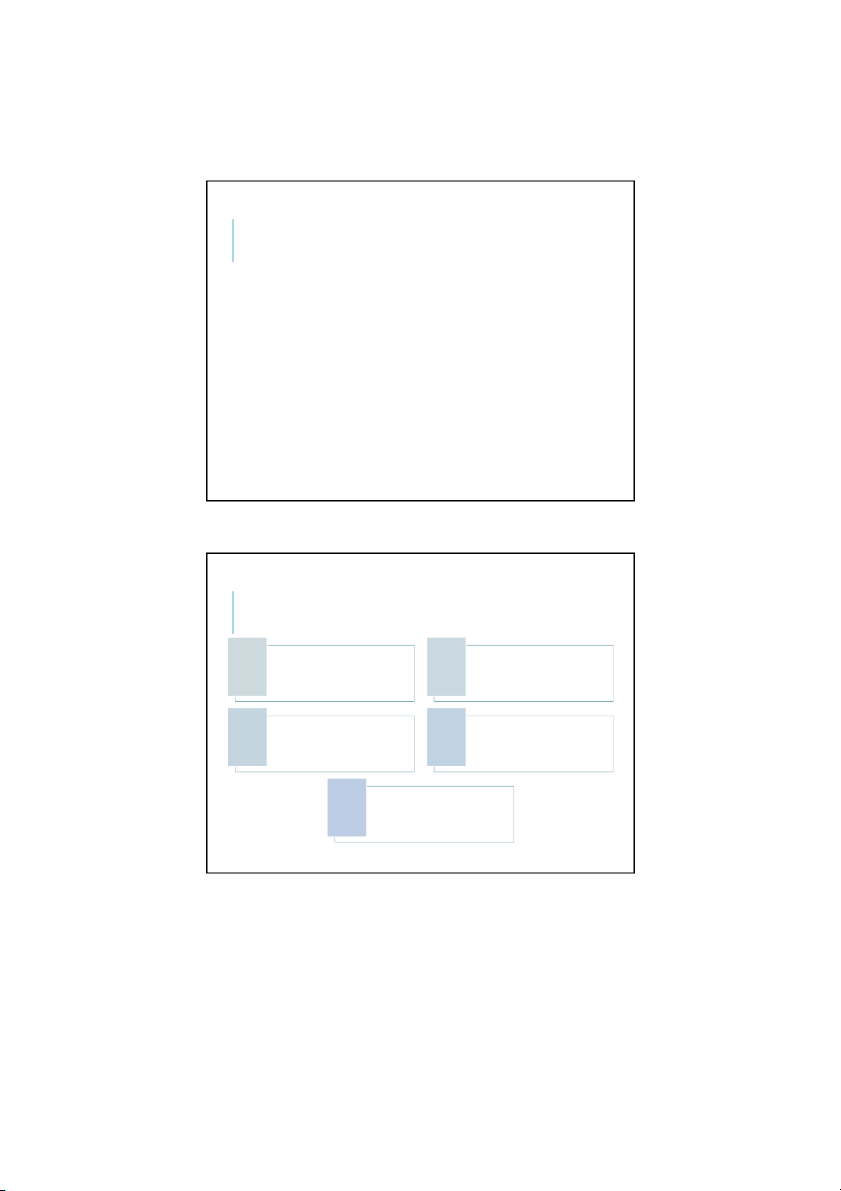

-Advance payment / Down payment -Prompt / Immediate payment -Deferred payment 11 11 5 24/07/2023 Risk Comparison INTERNATIONAL METHODS OF PAYMENT 4.9.1. TIME OF PAYMENT

• Within [period] after signing the contract 1

• Within [period] before shipment

• Upon receipt of documents or goods, which would 2

invariably (always) be sent direct to the buyer.

• After a period of typically 30, 60, or 90 days after a 3

specified date (eg date of invoice.) 12 ADVANCE PAYMENT

Advance payment: payment made after the contract

signing but before delivery date

credit offered by Buyer (Seller is short of capital)

Purpose: as Performance Bond, guaranteeing the contract performance.

e.g. Paymentbeforethe deliverydatexdays (shorttime, usually10to 15 days). 13 13 6 24/07/2023 PROMPT PAYMENT

Prompt payment: with many points of time to

identify: from the time goods are ready for

dispatch to the time the goods reach Buyer. 4 types:

a. After the Seller fulfils his obligations to deliver

the goods to carrier at the named place of

delivery, Seller issues order for payment. Upon

receipt of such order, Buyer makes payment: C.O.D (Cash on Delivery). 15 15 PROMPT PAYMENT

b. The Seller fulfils his obligations to deliver the goods on

board of the transport means, Buyer makes payment after

getting the notice from the shipmaster that the goods

have been on board at the port of departure

c. C.A.D (Cash Against Documents) // D/P (Documents against Payment)

d. Payment made after taking delivery of the goods 16 16 7 24/07/2023 DEFERRED PAYMENT

- Payment shall be made x days after: + the delivery date

+ the date of document presentation + the date of taking delivery

+ the date of guarantee completion 17 17 COMBINED/MIXED TIME OF PAYMENT

-X1 days after the contract becomes effective, the Buyer shall pay 3% of the contract value.

-X2 days before the first shipment, the Buyer shall pay 5% of the contract value.

-Right after the first shipment, the Buyer shall pay 5% of the contract value.

-Right after the last shipment, the Buyer shall pay 10% of the contract value.

The Buyer will keep 10% of the contract value and pay that upon

the completion of guarantee obligation. The remaining shall be

paid in 4 years, each year an equal amount. 18 18 8 24/07/2023 4.9.2. METHOD OF PAYMENT Means of Payment: Cash Cheque Payment cards Bill of Exchange / Draft Promissory Note 19 4.9.2. METHOD OF PAYMENT Modes of Payment: Cash payment Open account On consignment Remittance / Transfer (T/T)

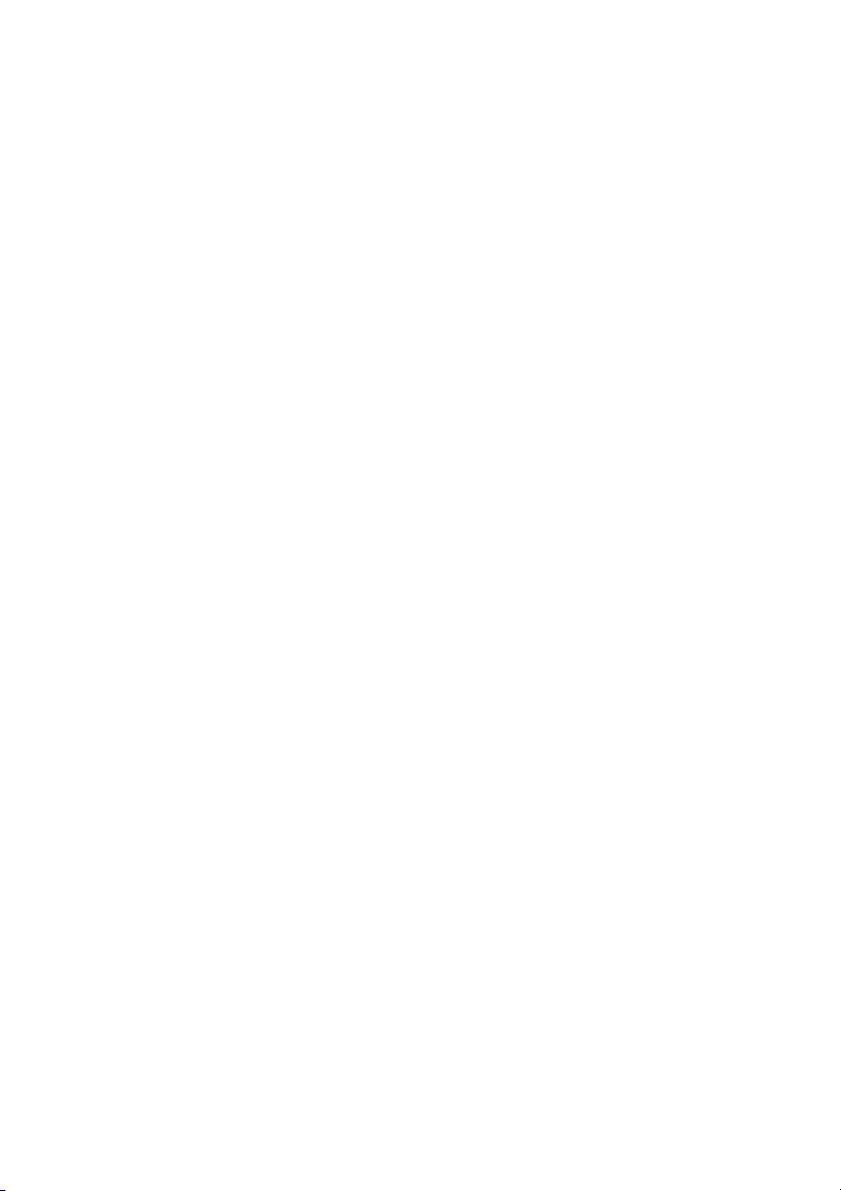

Collection (Clearn or Documentary) Documentary Credit (L/C) 20 9 24/07/2023 4.9.2. METHOD OF PAYMENT 3 popular modes:

Remittance / Transfer: Telegraphic transfer – T/T (not TTR)/ mail transfer -M/T

Collection: clean, documentary collection (D/P or D/A)

Documentary credit: Letter of credit L/C 21 21 Risk Com Rparison REMITTANCE: T/T IN ADVANCE INTERNATIONAL M (4) (4) Ships/Deli vers the goods (5) (5) Sends Sends out tthe e docs EXPORTER/ IMPORTER SELLER /BUYER (1) Sets up (3) (3) P ays to wire the transfer/re beneficiary mittance order (2) Transfers/Remits 22 Jul-23 Exporter’s bank ank Importer BY PV ’ NL s AN bank 22 10