Preview text:

01/08/2020

Ton Duc Thang University

Finance and Banking Faculty Banking Department INTERNATIONAL PAYMENT CHAPTER 2: EXCHANGE RATE Course Code: B01031

Prepared by: Banking Department Chapter 2: Exchange Rate Chapter 2_ The Exchange Rate

Chapter 2: Exchange Rate Chapter Objectives

Describe the background and corporate use of the

following knowlegde: Forign exchange marketreign - Exchange rate

- What foreign exchange (FX) market is and participants on FX market.

- Tools to limit the exchange rate risks Chapter 2: Exchange Rate Chapter 2_ The Exchange Rate 1 01/08/2020

Chapter 2: Exchange Rate Contents

2.1. Exchange Rate and Foreign exchange market

2.2. Tools to limit the Exchange Rate Risk Chapter 2: Exchange Rate Chapter 2_ The Exchange Rate

Chapter 2: Exchange Rate

2.1. Exchange rate and Foreign exchange market 2.1.1. Exchange rate 2.1.2. Foreign exchange market Chapter 2: Exchange Rate Chapter 2_ The Exchange Rate 2 01/08/2020 2.1.1. EXCHANGE RATE

Exchange rate specifies the rate at which one

currency can be exchanged for another.

v History of Foreign Exchange

1. Gold Standard (1876 – 1913)

Each currency was convertible into gold at a specified rate. When

World War I began in 1914, the gold standard was suspended.

2. Agreements on Fixed Exchange Rates

a. Bretton Woods Agreement 1944 - 1971

b. Smithsonian Agreement 1971 - 1973

3. Floating Exchange Rate System

Widely traded currencies were allowed to fluctuate in accordance with market forces Chapter 2: Exchange Rate Chapter 2_ The Exchange Rate

Exchange rate quotation Spot exchange rate x/ y commodity/base currency term/quote currency x/y 1 = y/x Reciprocate rate Chapter 2: Exchange Rate 3 01/08/2020 Methods of quotation

v Direct/ indirect quotation

§ Direct quotation: shows how many units of

home currency per one unit of foreign currency.

§ Indirect quotation: shows how many units of

foreign currency per one unit of home currency. Chapter 2: Exchange Rate

Buying – selling price ÒSelling price (Ask exchange 23000 USD/VND rate): the price at which quoting bank commits to sell base currency. Spread ÒBuying price (Bid exchange rate) : the price at which quoting bank commits to buy 22500 USD/VND base currency. Chapter 2: Exchange Rate 4 01/08/2020 Spread

§ Spread is the difference between bid and ask prices.

§ The bid/ask spread covers the bank’s cost of

conducting foreign exchange transactions § Calculating spread: ü In absolute number: Spread = Ask Rate – Bid Rate ü In percentage number

Askrate - Bidrate Spread (%) = 1 * 0 % 0 Askrate Chapter 2: Exchange Rate Spread (cont)

v Factors That Affect the Spread

1. Order costs: Costs of processing orders, including

clearing costs and the costs of recording transactions.

2. Inventory costs: Costs of maintaining an inventory of a particular currency.

3. Competition: The more intense the competition, the

smaller the spread quoted by intermediaries.

4. Volume: Currencies that have a large trading volume are

more liquid because there are numerous buyers and sellers at any given time.

5. Currency risk: Economic or political conditions that

cause the demand for and supply of the currency to change abruptly. Chapter 2: Exchange Rate Chapter 2_ The Exchange Rate 5 01/08/2020 Point/Pip

ÒA point is the minimum change of exchange rate.

ÒPoint is calculated in term of term currency. GBP/USD 1,9537 – 1,9540 0,0001 USD/CHF 1,2201 – 1,2204 0,0001 EUR/USD 1,3103 – 1,3105 0,0001 USD/JPY 119,79 – 119,82 0,01 USD/VND 22873 – 23160 1

à A point is the last digit of quotation Chapter 2: Exchange Rate Reading exchange rate Big figure figure point EUR/USD = 1 30 50 One Third-ty fifty Chapter 2: Exchange Rate 6 01/08/2020 Writing exchange rate § Full writing: USD/JPY 119,79 – 119,82 § Short writing: USD/JPY 119,79/82

§ Professional writing: USD/JPY 79/82 Chapter 2: Exchange Rate Cross exchange rate

§ Cross exchange rate is the exchange rate calculated from the exchange rates quoting its relevant

currencies against another currency (third currency).

§ The currency exchange rate between two currencies,

both of which are not the official currencies of the

country in which the exchange rate quote is given in É SGD/USD É CAD/USD è SGD/CAD

§ USD is the third currency when calculating cross exchange rate. Chapter 2: Exchange Rate 7 01/08/2020

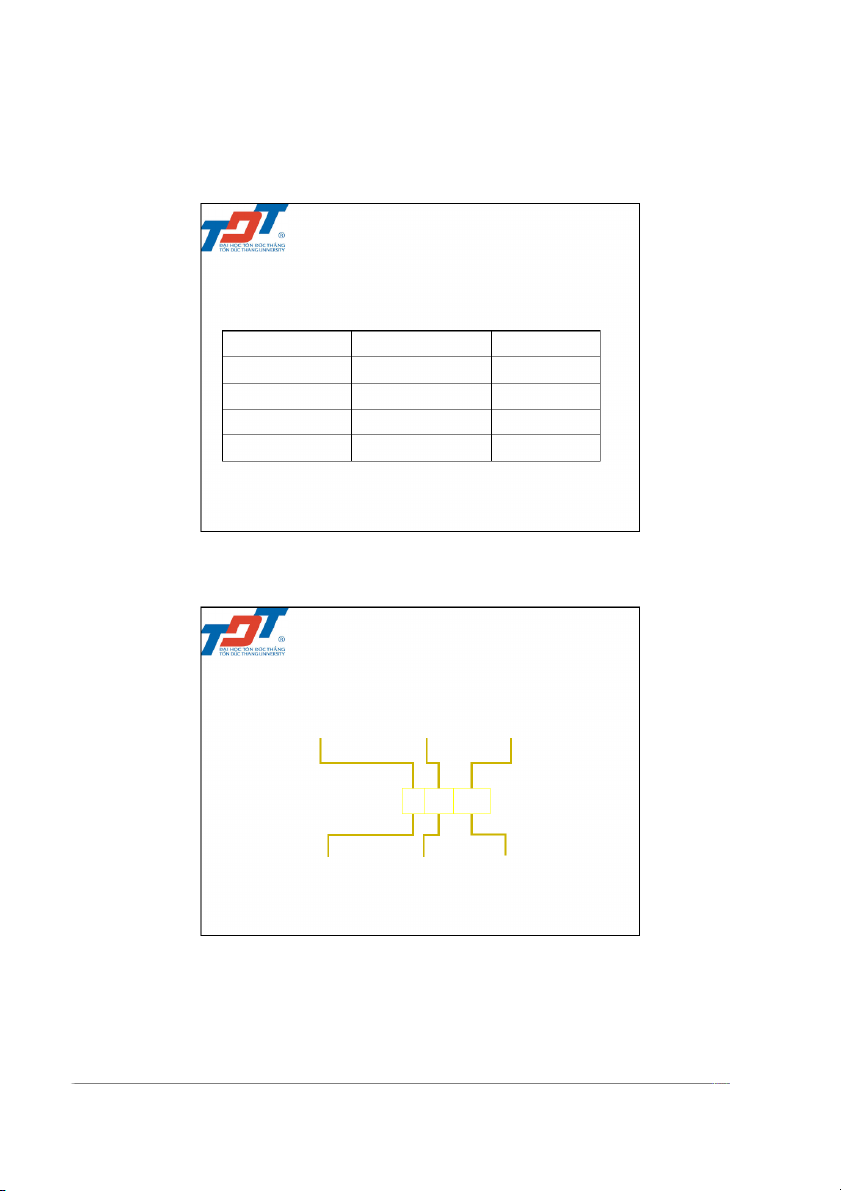

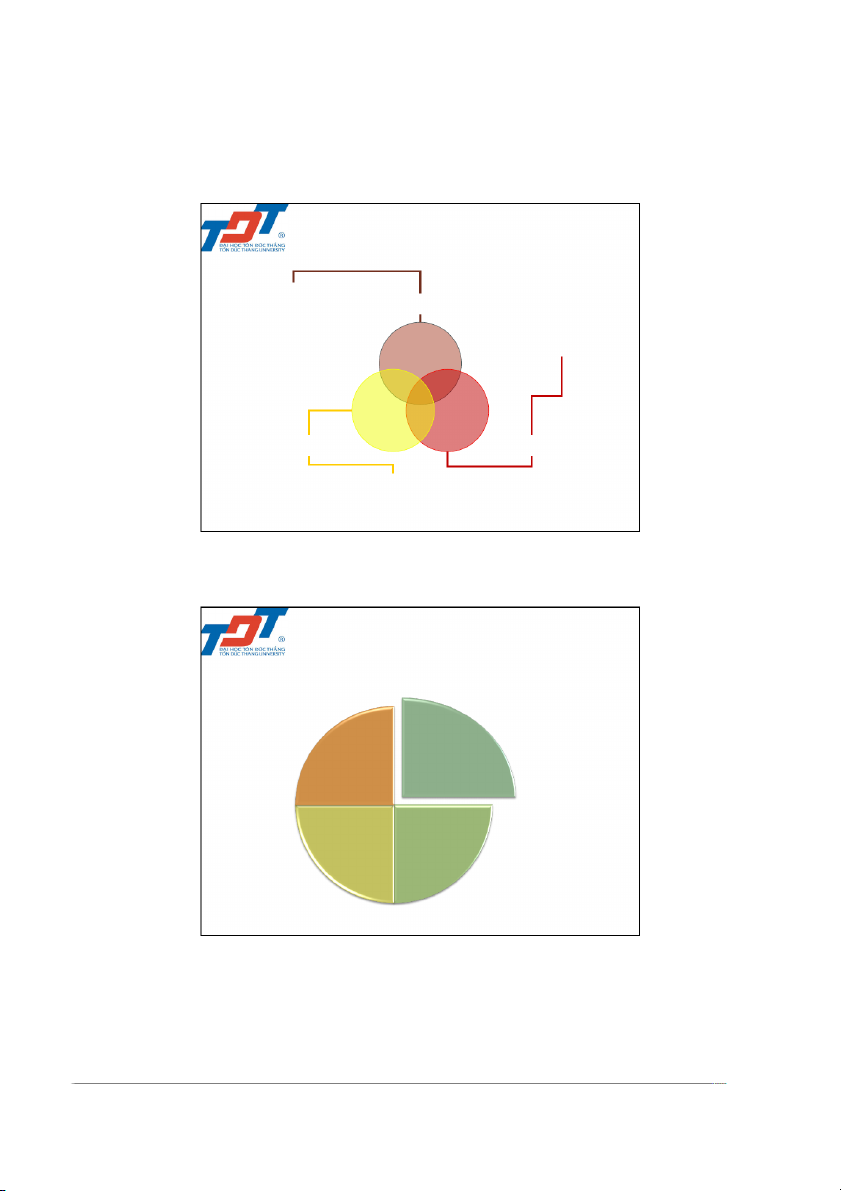

Main determinants of exchange rate Natural Inlation calamity Interest rate Fundamental Environmental GDP growth… economic factors factors Exchange rate Psychology Act of Wars.. speculators Human Terrorism… Political beings factors Chapter 2: Exchange Rate

2.1.2. FOREIGN EXCHANGE MARKET

§ Foreign exchange market is the market where currencies are exchanged.

§ FX market concerns only about bank deposits (not including bank notes) Chapter 2: Exchange Rate 8 01/08/2020

Characteristics of FX market

" It’s a twenty-four-hour market

" The market is made up of an international network of dealers

" The market’s most widely traded currency is USD

" It’s the most perfect market.

" It’s the most effective market.

" It is an over-the-counter market with an exchange- traded segment.

" Dealers trade by telephone, fax and electronic trading system. Chapter 2: Exchange Rate Function of FX market

" Transfer purchasing power from one currency into another

" Specify external value of a currency (exchange rate)

" Provide hedging instruments against exchange rate risk Chapter 2: Exchange Rate 9 01/08/2020

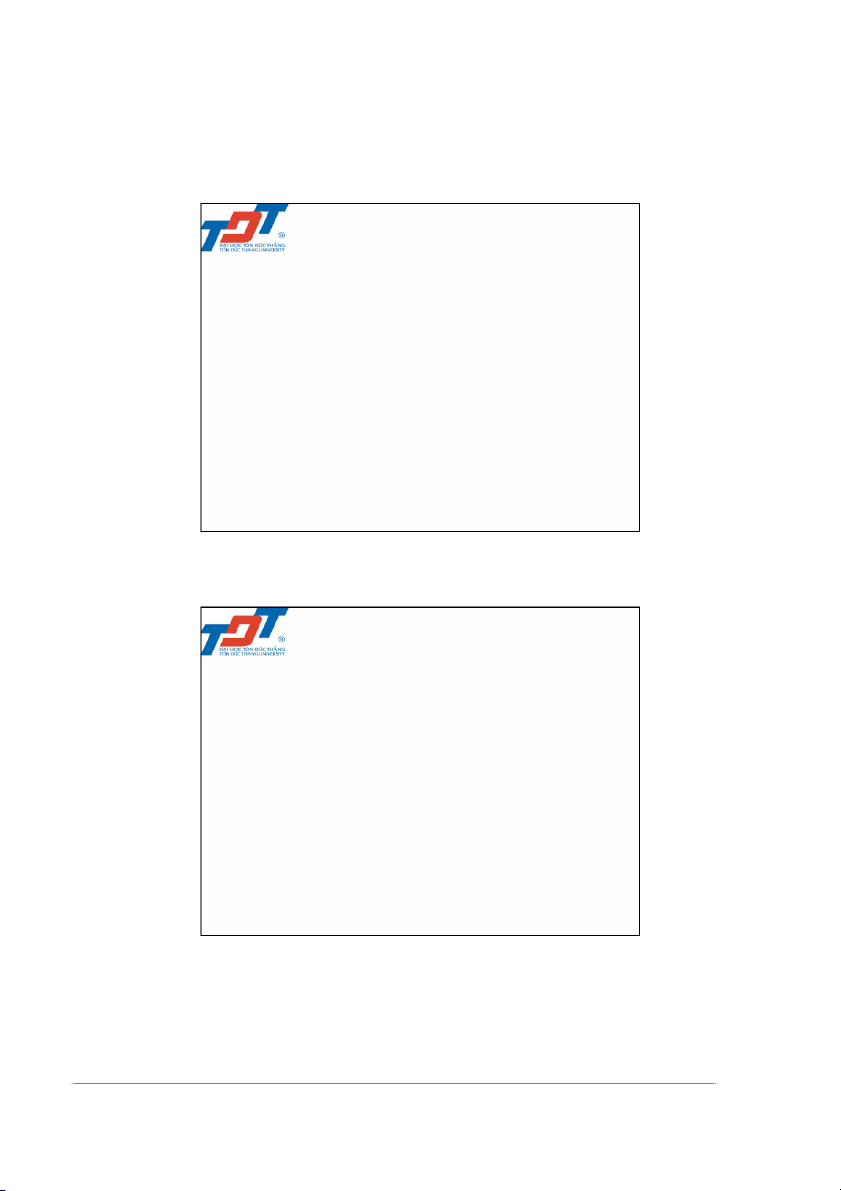

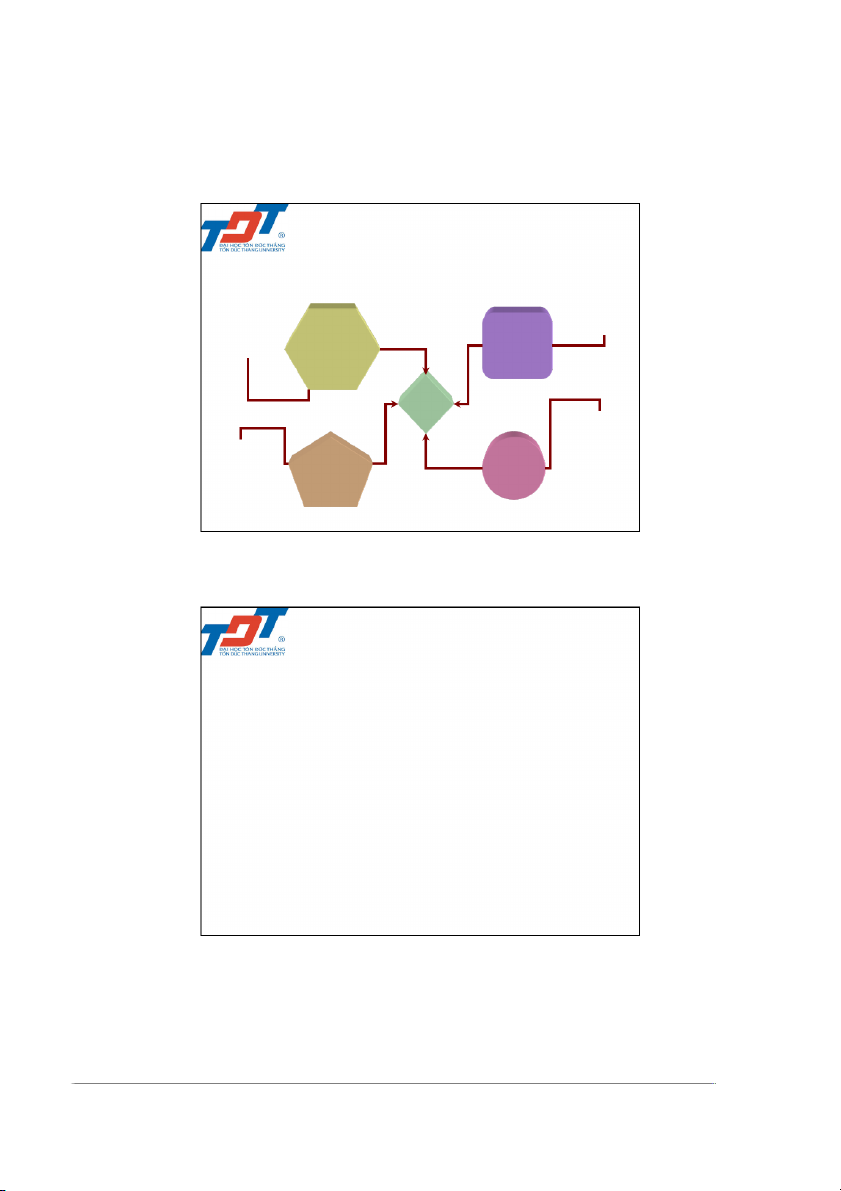

Main participants in FX market By purpose earn profit by taking earn profit by buying Arbitragers advantages from the and selling the same difference in exchange currencies at different rate quotation time between markets. Hedgers Speculators

protect themselves against foreign exchange rate risk

by using foreign exchange derivatives (instruments to he Ch d aptg er e 2: a Excg haa ng ien R s at t e foreign exchange risk)

Main participants in FX market By organization Commercial Central banks banks Financial and non- Brokers financial customers Chapter 2: Exchange Rate 10