Preview text:

1

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING CHAPTER 6: INVENTORIES I)

Classifying and Determining Inventory

1. Classifying Inventory

- Merchandisers need only one inventory classification, merchandise inventory, to describe

the many different items that make up the total inventory.

- In a manufacturing company, manufacturers usually classify inventory into 3 categories:

finished goods, work in process, and raw materials.

2. Determining Inventory Quantities 2.1. Perpetual System

(1) Check accuracy of inventory records.

(2) Determine amount of inventory lost due to wasted raw materials, shoplifting, or employee theft. 2.2. Periodic System

(1) Determine the inventory on hand.

(2) Determine the cost of goods sold for the period.

3. Determining Ownership of Goods

3.1. Goods in Transit (hàng trên đường vận chuyển, hàng quá cảnh)

- Purchased goods not yet received.

- Sold goods not yet delivered.

- Included in inventory of company that has legal title to goods.

- FOB Shipping Point (buyer pays freight costs): Ownership of goods passes to buyer when

public carrier accepts goods from seller.

- FOB Destination (seller pays freight costs): Ownership of goods remains with seller until the goods reach buyer. 2

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

3.2. Consigned Goods (hàng ký gửi)

- To hold the goods of other parties and try to sell the goods for them for a fee, but without

taking ownership of the goods. II) Inventory Methods

Beginning Inventory + Cost of Goods Purchased – Ending Inventory = Cost of Goods Sold

1. Specific Identification

- Specific identification requires that companies keep records of the original cost of each individual inventory item.

- Specific identification was possible only when a company sold a limited variety of high-

unit-cost items that could be identified clearly from the time of purchase through the time of sale.

2. First-in, first-out (FIFO)

- The first-in, first-out (FIFO) method assumes that the earliest goods purchased are the first to be sold.

- The costs of the earliest goods purchased are the first to be recognized in determining cost

of goods sold. (This does not necessarily mean that the oldest units are sold first, but that

the costs of the oldest units are recognized first).

3. Last-in, first-out (LIFO)

- The last-in, first-out (LIFO) method assumes that the latest goods purchased are the first to be sold.

- The costs of the latest goods purchased are the first to be recognized in determining cost of goods sold. 4. Average-cost

- The average-cost method allocates the cost of goods available for sale on the basis of the

weighted-average unit cost incurred. 3

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝐴𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑆𝑎𝑙𝑒

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 − 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑈𝑛𝑖𝑡 𝐶𝑜𝑠𝑡 =

𝑇𝑜𝑡𝑎𝑙 𝑈𝑛𝑖𝑡𝑠 𝐴𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑆𝑎𝑙𝑒 III)

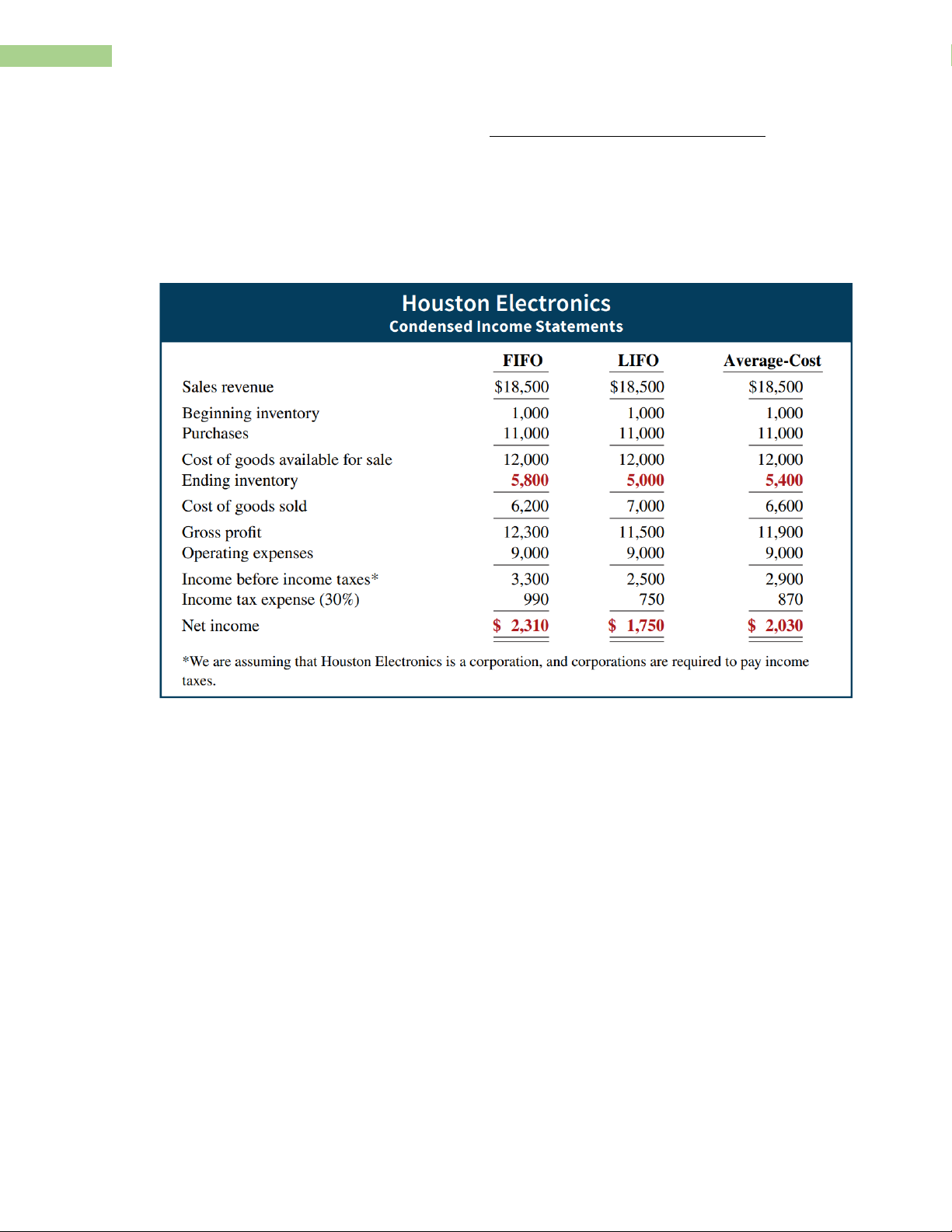

Financial Statement and Tax Effects of Cost Flow Methods

1. Income Statement Effects

In periods of changing prices, the cost flow assumption can have significant impacts both on

income and on evaluations of income, such as the following.

- In a period of inflation, FIFO produces a higher net income because lower unit costs of

the first units purchased are matched against revenue.

- In a period of inflation, LIFO produces a lower net income because higher unit costs of

the last goods purchased are matched against revenue.

- If prices are falling, the results from the use of FIFO and LIFO are reversed. FIFO will

report the lowest net income and LIFO the highest.

- Regardless of whether prices are rising or falling, average-cost produces net income between FIFO and LIFO. 4

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

2. Statement of Financial Position Effects

- A major advantage of the FIFO method is that in a period of inflation, the costs allocated

to ending inventory will approximate their current cost.

- A major shortcoming of the LIFO method is that in a period of inflation, the costs allocated

to ending inventory may be significantly understated in terms of current cost. 3. Tax Effects

- Both inventory on the balance sheet and net income on the income statement are higher

when companies use FIFO in a period of inflation.

- LIFO results in the lowest income taxes (because of lower net income) during times of rising prices. IV)

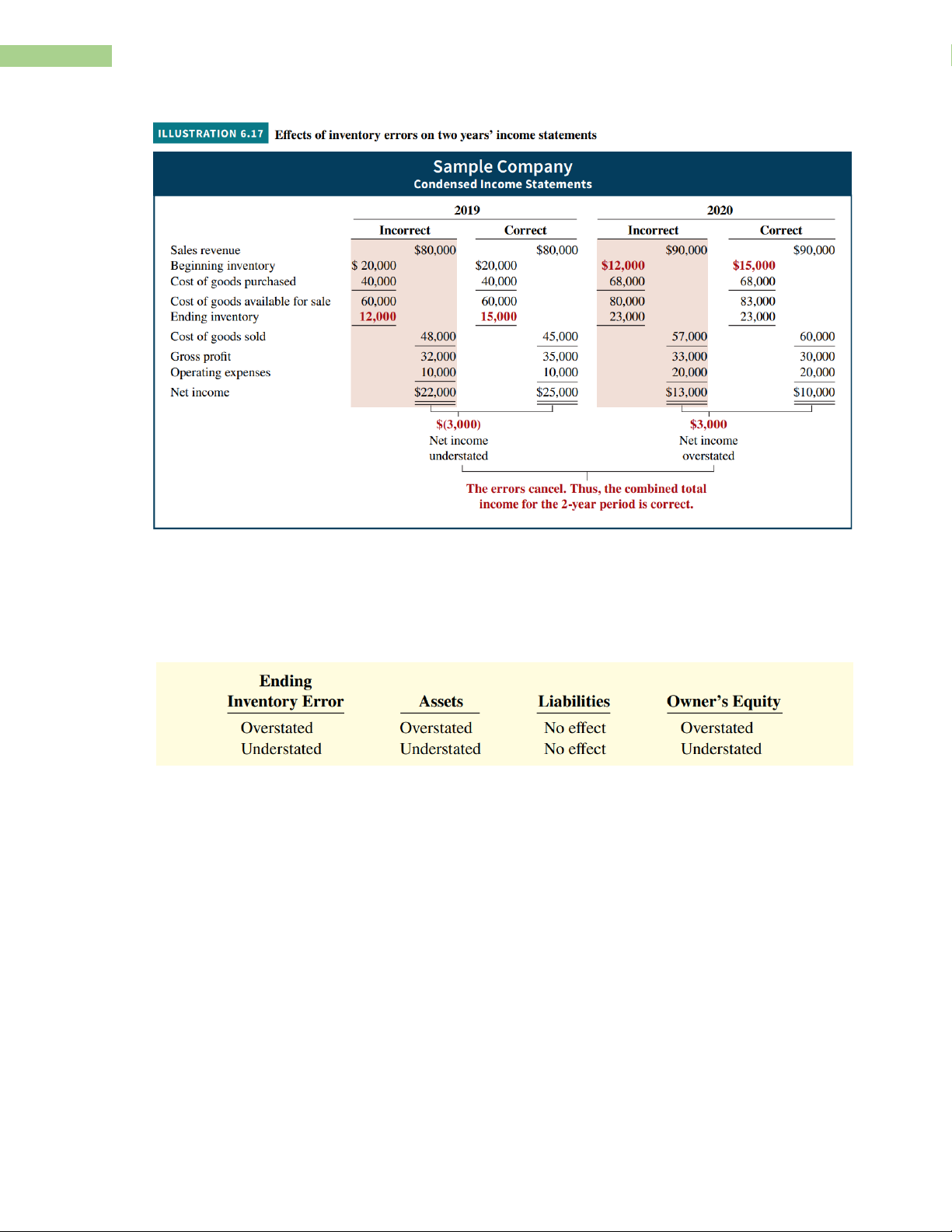

Effects of Inventory Errors

1. Income Statement Effects

- The ending inventory of one period automatically becomes the beginning inventory of the

next period. Thus, inventory errors aff ect the computation of cost of goods sold and net income in two periods.

- An error in the ending inventory of the current period will have a reverse effect on net

income of the next accounting period.

- Over the two years, though, total net income is correct because the errors offset each other. 5

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

2. Statement of Financial Position Effects

Assets = Liabilities + Owner’s Equity V)

Inventory Statement Presentation and Analysis

1. Lower-of-Cost-or-Net Realizable Value

- Net realizable value refers to the net amount that a company excepts to realize (receive)

from the sale of inventory. Specifically, net realizable value is the estimated selling price

in the normal course of business, less estimated costs to complete and sell.

- When the value of inventory is lower than its cost, companies must “write down” the

inventory to its net realizable value. 2. Analysis 6

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

- Inventory turnover measures the number of times on average the inventory is sold during

the period. Its purpose is to measure the liquidity of the inventory.

𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑

𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 =

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦

- Days in inventory measures the average number of days inventory is held. 365

𝐷𝑎𝑦𝑠 𝑖𝑛 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 =

𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟

MULTIPLE-CHOICE QUESTIONS

1. When is a physical inventory usually taken?

a. When the company has its greatest amount of inventory.

b. When a limited number of goods are being sold or received.

c. At the end of the company’s fiscal year. d. Both (b) and (c).

2. Which of the following should not be included in the physical inventory of a company?

a. Goods held on consignment from another company.

b. Goods shipped on consignment to another company.

c. Goods in transit from another company shipped FOB shipping point. d. None of the above.

3. As a result of a thorough physical inventory, Railway Company determined that it had

inventory worth $180,000 at December 31, 2020. This count did not take into consideration

the following facts: Rogers Consignment store currently has goods worth $35,000 on its

sales floor that belong to Railway but are being sold on consignment by Rogers. The selling

price of these goods is $50,000. Railway purchased $13,000 of goods that were shipped on

December 27, FOB destination, that will be received by Railway on January 3. Determine

the correct amount of inventory that Railway should report. 7

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING a. $230,000. b. $215,000. c. $228,000. d. $193,000.

4. Cost of goods available for sale consists of two elements: beginning inventory and a. ending inventory. b. cost of goods purchased. c. cost of goods sold.

d. All of the answer choices are correct.

5. Poppins Company has the following:

Units Unit Cost Inventory, Jan. 1 8,000 $11 Purchase, June 19 13,000 12 Purchase, Nov.

8 5,000 13 If 9,000 units are on hand at December 31, the cost of the ending inventory under FIFO is: a. $99,000. b. $108,000. c. $113,000. d. $117,000.

6. Using the data in Question 5, the cost of the ending inventory under LIFO is: a. $113,000. b. $108,000. c. $99,000. d. $100,000.

7. Hansel Electronics has the following: 8

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING Units Unit Cost Inventory, Jan. 1 5,000 $8 Purchase, April 2 15,000 $10 Purchase, Aug. 28 20,000 $12

If Hansel has 7,000 units on hand at December 31, the cost of ending inventory under the average-cost method is: a. $84,000. b. $70,000. c. $56,000. d. $75,250.

8. In periods of rising prices, LIFO will produce:

a. higher net income than FIFO.

b. the same net income as FIFO.

c. lower net income than FIFO.

d. higher net income than average-cost.

9. Considerations that affect the selection of an inventory costing method do not include: a. tax effects. b. balance sheet effects. c. income statement effects.

d. perpetual vs. periodic inventory system.

10. Falk Company’s ending inventory is understated $4,000. The effects of this error on the

current year’s cost of goods sold and net income, respectively, are: a. understated, overstated. 9

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING b. overstated, understated. c. overstated, overstated. d. understated, understated.

11. Pauline Company overstated its inventory by $15,000 at December 31, 2019. It did not

correct the error in 2019 or 2020. As a result, Pauline’s owner’s equity was:

a. overstated at December 31, 2019, and understated at December 31, 2020.

b. overstated at December 31, 2019, and properly stated at December 31, 2020.

c. understated at December 31, 2019, and understated at December 31, 2020.

d. overstated at December 31, 2019, and overstated at December 31, 2020.

12. In a perpetual inventory system:

a. LIFO cost of goods sold will be the same as in a periodic inventory system.

b. average costs are a simple average of unit costs incurred.

c. a new average is computed under the average-cost method after each sale.

d. FIFO cost of goods sold will be the same as in a periodic inventory system.

13. King Company has sales of $150,000 and cost of goods available for sale of $135,000. If

the gross profit rate is 30%, the estimated cost of the ending inventory under the gross profit method is: a. $15,000. b. $30,000. c. $45,000. d. $75,000. ANSWER 1. D 10

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING 2. A 3. B 4. B 5. C 6. D 7. D 8. C 9. D 10. B 11. B 12. D 13. B

CHAPTER 9: ACCOUNTING FOR RECEIVABLES A) ACCOUNTS RECEIVABLE I)

Recognition of Accounts Receivable

1. Types of Receivables

- Accounts receivable are amounts customers owe on account. They result from the sale of

goods and services. Companies generally expect to collect accounts receivable within 30

to 60 days. They are usually the most significant type of claim held by a company.

- Notes receivable are a written promise (as evidenced by a formal instrument) for amounts

to be received. The note normally requires the collection of interest and extends for time

periods of 60–90 days or longer. Notes and accounts receivable that result from sales

transactions are often called trade receivables. 11

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

- Other receivables include nontrade receivables such as interest receivable, loans to

company officers, advances to employees, and income taxes refundable. These do not

generally result from the operations of the business. Therefore, they are generally classified

and reported as separate items in the balance sheet.

2. Recognizing Accounts Receivable - Record sales on account: Accounts Receivable xxx Sales Revenue xxx

- Record merchandise returned:

Sales Returns and Allowances xxx Accounts Receivable xxx

- Record collection of accounts receivable: Cash xxx Sales Discounts xxx Accounts Receivable xxx

- Record interest on amount due: Accounts Receivable xxx Interest Revenue xxx II)

Valuation and Disposition of Accounts Receivable

1. Valuing Accounts Receivable

1.1. Direct Write-Off Method For Uncollectible Accounts Bad Debt Expense xxx Accounts Receivable xxx 12

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

- Companies often record bad debt expense in a period different from the period in which they record the revenue.

- The method does not attempt to match bad debt expense to sales revenue in the income

statement and show accounts receivable in the balance sheet at the amount the company actually expects to receive.

- Unless bad debt losses are insignificant, the direct write-off method is not acceptable for financial reporting purposes.

1.2. Allowance Method For Uncollectible Accounts

- The allowance method of accounting for bad debts involves estimating uncollectible

accounts at the end of each period.

- This provides better matching of expenses with revenues on the income statement and

ensures that companies state receivables on the balance sheet at their cash (net) realizable value.

- Cash (net) realizable value is the net amount the company expects to receive in cash. It

excludes amounts that the company estimates it will not collect.

- Companies must use the allowance method for financial reporting purposes when bad debts

are material in amount.

a) Recording estimated uncollectibles Bad Debt Expense xxx

Allowance for Doubtful Accounts xxx

b) Recording the write-off of an uncollectible account

Allowance for Doubtful Accounts xxx Accounts Receivable xxx

c) Recovery of an uncollectible account Accounts Receivable xxx 13

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

Allowance for Doubtful Accounts xxx Cash xxx Accounts Receivable xxx

d) Estimating the allowance

- Companies estimate the allowance as a percentage of the outstanding receivables.

Management establishes a percentage relationship between the amount of receivables and

expected losses from uncollectible accounts. For example, it estimates that 5% of its

accounts receivable will eventually be uncollectible.

- A company often prepares a schedule, called aging the accounts receivable. This schedule

classifies customer balances by the length of time they have been unpaid. It determines the

expected bad debt losses by applying percentages, based on past experience, to the totals of each category.

- Total estimated uncollectible accounts represent the required balance in Allowance for

Doubtful Accounts at the balance sheet date. Accordingly, the amount of bad debt expense

that should be recorded in the adjusting entry is the difference between the required balance

and the existing balance in the allowance account.

- If the unadjusted trial balance shows Allowance for Doubtful Accounts with a credit

balance of $528, then an adjusting entry for $1,700 ($2,228 – $528) is necessary: Bad Debt Expense 1,700

Allowance for Doubtful Accounts 1,700

- If there was a $500 debit balance in the allowance account before adjustment, the adjusting

entry would be for $2,728 ($2,228 + $500) Bad Debt Expense 2,728

Allowance for Doubtful Accounts 2,728

2. Disposing of Accounts Receivable 14

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

2.1. Sale of Receivables to a Factor

- A factor is a finance company or bank that buys receivables from businesses and then

collects the payments directly from the customers.

- Record the sale of accounts receivable: Cash xxx Service Charge Expense xxx Accounts Receivable xxx

2.2. National Credit Card Sales

- Record Visa credit card sales Cash xxx Service Charge Expense xxx Sales Revenue xxx B) NOTES RECEIVABLE

- A promissory note is a written promise to pay a specified amount of money on demand or at a definite time.

- The party making the promise to pay is called the maker.

- The party to whom payment is to be made is called the payee.

1. Determining the Maturity Date

- Assume that today is July 17: Term of note 60 days July (31 – 17) 14 August 31 45 Maturity date: September 15 15

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING 2. Computing Interest

Face Value of Note x Annual Interest Rate x Time in Terms of One Year = Interest

- Example: $1,000 x 12% x 6/12 = $45

3. Recognizing Notes Receivable - Record acceptance of note: Notes Receivable xxx Accounts Receivable xxx

4. Valuing Notes Receivable

4.1. Honor of Notes Receivable

- A note is honored when its maker pays in full at its maturity date.

- Record collection of note and interest: Cash xxx Notes Receivable xxx Interest Revenue xxx

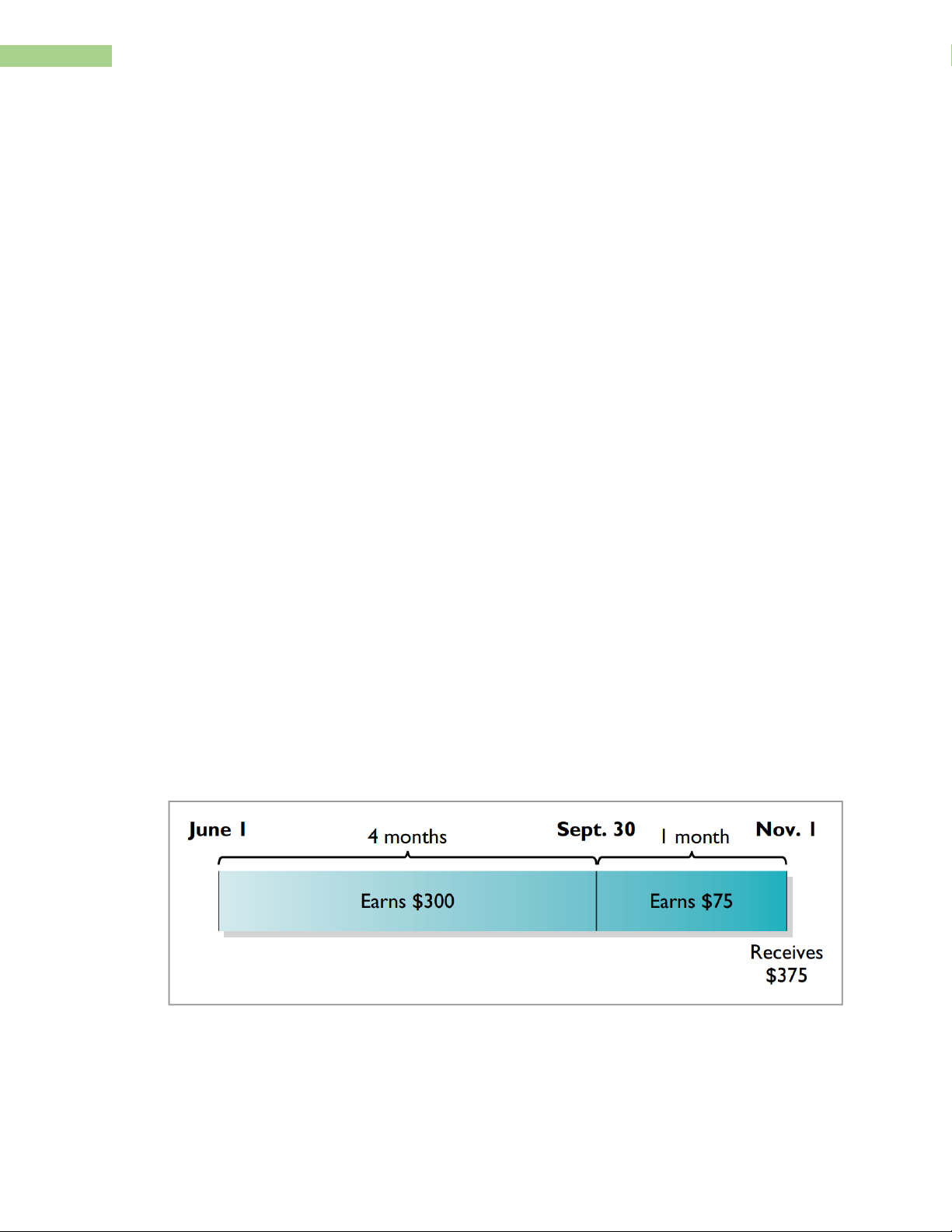

4.2. Accrual of Interest Receivable

- Record the accrual of 4 months’ interest on note: Interest Receivable 300 16

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING Interest Revenue 300

- Record collection of note and interest: Cash 10,375 Notes Receivable 10,000 Interest Receivable 300 Interest Revenue 75

4.3. Dishonor of Notes Receivable

- A dishonored (defaulted) note is a note that is not paid in full at maturity.

- Record the dishonor of note: Accounts Receivable xxx Notes Receivable xxx Interest Revenue xxx

- If instead there is no hope of collection, the note holder would write off the face value of

the note by debiting Allowance for Doubtful Accounts. No interest revenue would be

recorded because collection will not occur.

MULTIPLE-CHOICE QUESTIONS

1. Receivables are frequently classified as:

a. accounts receivable, company receivables, and other receivables.

b. accounts receivable, notes receivable, and employee receivables.

c. accounts receivable and general receivables.

d. accounts receivable, notes receivable, and other receivables.

2. Buehler Company on June 15 sells merchandise on account to Chaz Co. for $1,000, terms

2/10, n/30. On June 20, Chaz Co. returns merchandise worth $300 to Buehler Company. 17

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

On June 24, payment is received from Chaz Co. for the balance due. What is the amount of cash received? a. $700. b. $680. c. $686. d. None of the above.

3. Hughes Company has a credit balance of $5,000 in its Allowance for Doubtful Accounts

before any adjustments are made at the end of the year. Based on review and aging of its

accounts receivable at the end of the year, Hughes estimates that $60,000 of its receivables

are uncollectible. The amount of bad debt expense which should be reported for the year is: a. $5,000. b. $55,000. c. $60,000. d. $65,000.

4. Use the same information as in Question 3, except that Hughes has a debit balance of

$5,000 in its Allowance for Doubtful Accounts before any adjustments are made at the end

of the year. In this situation, the amount of bad debt expense that should be reported for the year is: a. $5,000. b. $55,000. c. $60,000. d. $65,000. 18

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

5. Accounts receivable at the end of the month are $800,000. Bad debts are expected to be

1.5% of accounts receivable. If Allowance for Doubtful Accounts has a credit balance of

$1,000 before adjustment, what is the balance after adjustment? a. $7,000. b. $11,000. c. $12,000. d. $13,000.

6. At December 31, 2020, Roso Carlson Company had accounts receivable of $750,000. On

January 1, 2020, Allowance for Doubtful Accounts had a credit balance of $18,000. During

2020, $30,000 of uncollectible accounts receivable were written off. Past experience

indicates that 3% of accounts receivable become uncollectible. What should be the bad debt expense for 2020? a. $10,500. b. $22,500. c. $30,000. d. $34,500.

7. Which of the following statements about Visa credit card sales is incorrect?

a. The credit card issuer makes the credit investigation of the customer.

b. The retailer is not involved in the collection process. c. Two parties are involved.

d. The retailer receives cash more quickly than it would from individual customers on account.

8. Blinka Retailers accepted $50,000 of Citibank Visa credit card charges for merchandise

sold on July 1. Citibank charges 4% for its credit card use. The entry to record this 19

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING

transaction by Blinka Retailers will include a credit to Sales Revenue of $50,000 and a debit(s) to:

a. Cash $48,000 and Service Charge Expense $2,000

b. Accounts Receivable $48,000 and Service Charge Expense $2,000 c. Cash $50,000

d. Accounts Receivable $50,000

9. One of the following statements about promissory notes is incorrect. The incorrect statement is:

a. The party making the promise to pay is called the maker.

b. The party to whom payment is to be made is called the payee.

c. A promissory note is not a negotiable instrument.

d. A promissory note is often required from high-risk customers.

10. Foti Co. accepts a $1,000, 3-month, 6% promissory note in settlement of an account with

Bartelt Co. The entry to record this transaction is as follows. a. Notes Receivable 1,015 Accounts Receivable 1,015 b. Notes Receivable 1,000 Accounts Receivable 1,000 c. Notes Receivable 1,000 Sales Revenue 1,000 d. Notes Receivable 1,030 Accounts Receivable 1,030

11. Ginter Co. holds Kolar Inc.’s $10,000, 120-day, 9% note. The entry made by Ginter Co.

when the note is collected, assuming no interest has been previously accrued, is: 20

TRƯƠNG THANH HOA – FINANCIAL ACCOUNTING a. Cash 10,300 Notes Receivable 10,300 b. Cash 10,000 Notes Receivable 10,000 c. Accounts Receivable 10,300 Notes Receivable 10,000 Interest Revenue 300 d. Cash 10,300 Notes Receivable 10,000 Interest Revenue 300

12. Accounts and notes receivable are reported in the current assets section of the balance sheet at:

a. cash (net) realizable value. b. net book value.

c. lower-of-cost-or-net realizable value. d. invoice cost ANSWER 1. D 2. C 3. B 4. D 5. B 6. D