Preview text:

big trends DOI:10.1145/3587264

BY JI-HOON KIM, SUNGYEOB YOO, AND JOO-YOUNG KIM South Korea’s Nationwide Effort for AI Semiconductor Industry

AS GLOBAL COMPETITION in the semiconductor industry has

intensified with trade conflicts and semiconductor

with the paradigm shift in comput-ing.

shortages, major countries worldwide have started to work South Korea aims to become a

comprehensive semiconductor power-

on their government policy and investment plan to win

house from this colossal opportunity. In

technological hegemony. South Korea’s semiconductor

this article, we report recent nation-wide

industry, which makes up almost 20% of the nation’s gross efforts taking place in South Korea to

challenge the emerging AI semiconductor

domestic product (GDP), is heavily concentrated on the

industry. We organize these efforts in

memory semiconductor sector.5 It dominates the global

four sections (govern-ment, major

companies, fabless startups, and

memory semiconductor market with a 56.9% share but has

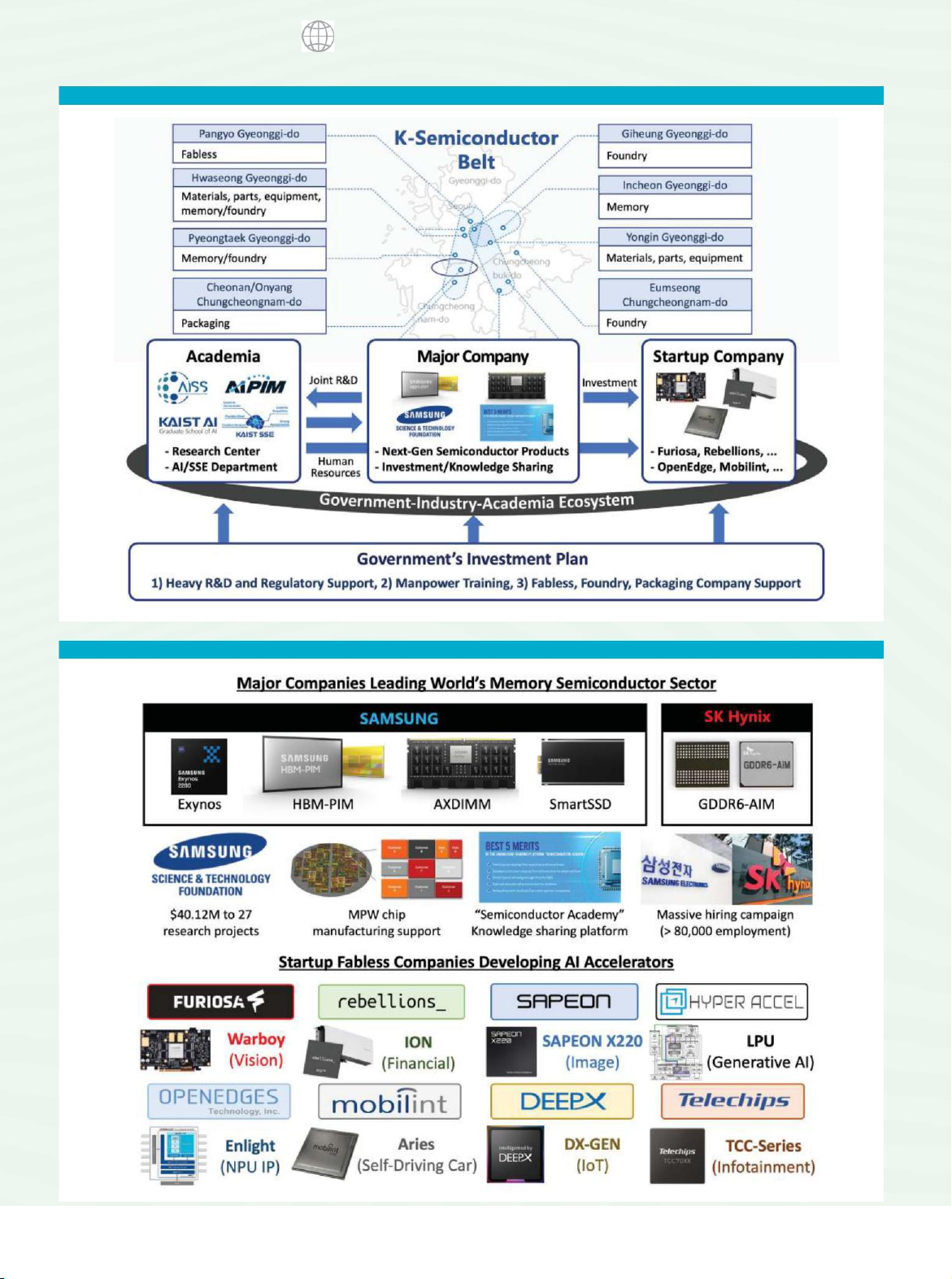

academia), while Figure 1 overviews the

little influence on the other sectors of the industry, overall efforts.

The South Korean government’s K-

including logic, analog, and optical discrete, where it has

semiconductor strategy is to build the

less than a 3% market share. To grow the nation’s biggest

world’s best semiconductor supply chain

industry further, South Korea has put a priority on non-

by 2030 with a $450B investment plan.2

Learning from the semiconductor crisis,

memory sectors. The emerging AI chip market is an

the goal is to stabilize and internalize the

especially great opportunity for them, as demand is

semi-conductor supply chain by gather-

ing fabless, foundry, and packaging

expected to increase exponentially

companies in a clustered area called

46 COMMUNICATIONS OF THE ACM | JULY 2023 | VOL. 66 | NO. 7 lOMoARcPSD|396 510 89 big trends

east asia & oceania region

the K-Semiconductor Belt for seam-less

The government also is trying to

experts at all levels (junior colleges,

silicon product manufacturing. The

build a collaborative ecosystem that

undergraduate schools, and gradu-ate

government has also announced nearly

helps once-segmented academia and

schools) by 2030. It also plans to

$260B-worth of tax deduc-tions for

industry work together to make

establish new research centers and

semiconductor facilities and R&D

competitive products for the global

university departments to develop

competent researchers and experts in the

funding,3 in addition to making the

market. It has set up national pro-grams

approval process for the expansion of

to facilitate collaboration between semiconductor field.

semiconductor manufacturing facilities

university labs and startup companies by

Major countries, including the U.S.

faster and more flexible, and subsidizing

funding technology transfer and

and China, also have announced support

up to 50% of the construction cost of the

commercialization. The government

policies for their semicon-ductor

facility’s power infrastructure. The

also is subsidizing startup fabless

industries. The U.S. passed the CHIPS

government pledged to invest in

companies to use the latest EDA tools

Act in 2022, which promis-es 25% tax and semiconductor process

strategically important semicon-ductor

credits and a $52B invest-ment to

sectors, including power, automotive, and technologies.

enhance domestic semi-conductor

AI semiconductors, as part of its long-

Lastly, the government is heavily

manufacturing. China’s “Made in China M

term R&D road-map. With the above

focused on fostering high-quality

2025” initiative an-nounced in 2015 has CO. CK

financial and regulatory support, the

manpower for the semiconductor

aimed to lift the country’s chip O T RS

government set a goal of doubling E

industry. Based on a survey that found

production from less than 10% of demand T T U H

semiconductor production to $245B, with

at least 270,000 persons will be needed

to 70% in 2025, fostering government- S M

an export target of $200B, by 2030.

backed fabless and manufacturing RO

to sustain the industry in 10 years, the F Y R

companies. In contrast, South Korea’s E

government aims to foster 150,000 G A IM more semiconductor plan is more

JULY 2023 | VOL. 66 | NO. 7 | COMMUNICATIONS OF THE ACM 47 lOMoAR cPSD| 39651089

east asia & oceania region big trends

Figure 1. Overview of South Korea’s nationwide efforts for the AI semiconductor industry.

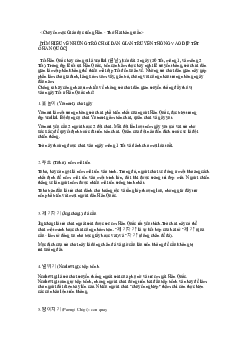

Figure 2. Summary of South Korea’s AI semiconductor products. 48

COMMUNICATIONS OF THE ACM | JULY 2023 | VOL. 66 | NO. 7 lOMoARcPSD|396 510 89 big trends

east asia & oceania region

concentrated and streamlined, em-

and research communities to learn the

phasizing human resource develop-

latest AI technologies and engage with ment overall.

well-educated researchers. For example,

the Samsung Science & Technology Major Companies

Foundation announced grants totaling

South Korea’s chip companies work-ing

$40.12 million to 27 high-profile research

in AI semiconductors can be divided into

projects, bolster-ing collaboration with

two groups: major com-panies leading

academia.4 SK Hynix also launched a

the world’s memory semiconductor

knowledge-shar-ing platform named

market, and newly founded fabless

“Semiconductor Academy,” which

startup companies developing AI

provides online/ offline lectures to Once secretly

accelerators. Figure 2 summarizes their

university students, job seekers, and focusing solely on

major products and activities related to

employees, covering a diverse range of AI semiconductor development.

topics including semi-conductor basics, their own product

devices, and design. Moreover, both development,

Samsung Electronics and SK Hynix,

Samsung and SK Hynix continuously

the world’s leading memory semi-

provide multi-project wafer (MPW) major companies

conductor companies, have launched

services for startup fab-less, design are starting to

investment and employment plans for

houses, and academia. This allows greater

their AI semiconductor and foundry

foundry selection for domestic fabless open up relations

businesses. Samsung Electronics is trying

companies and enables competitive to develop next-generation AI

prototyping of their AI chips with the with the academia

semiconductor products by leveraging its

latest process technologies. Samsung has and research

strengths in mobile chipset design and

announced a massive hiring plan to memory manufacturing. Samsung

employ more than 80,000 people in new communities to

develops its own neural processing units

jobs, as the demand for AI semiconductor learn the latest AI

(NPUs) and integrates them into multiple

prod-ucts continues to increase.

processing platforms, includ-ing the technologies and

Exynos mobile processor and the Exynos engage with well- auto processor series. Fabless Startups

Another notable product develop-ment

Ever since it launched the Ministry of educated

direction is putting AI com-putation logic

SMEs and Startups in 2017, South Ko-rea researchers.

into memories. Both Samsung and SK

has been investing heavily in build-ing a

Hynix are developing intelligent memory

startup ecosystem to pivot from a

chips using in/ near-memory processing

conglomerate-based to a startup-based

technol-ogy, which can mitigate the

industry. With successful supporting

system bandwidth bottleneck of

programs such as K-Unicorn and Tech

conventional von Neumann architecture.

Incubator Program for Startups (TIPS),

Samsung released the HBM-PIM, which

South Korea has become a good place for

incor-porates the AI processing function

startups, surpassing $6.4B in ven-ture

into the HBM2 memory stack, and the

capital funding in 2021.6 Benefit-ing from

AXDIMM, which adds an AI engine in-

this environmental change, more than 10

side the buffer chip of the traditional

fabless startups targeting AI hardware

DIMM form factor. The company also

accelerators have been founded in South

developed SmartSSD, which integrates

Korea in the past five years. Unlike the

Samsung’s solid-state drive (SSD) and

major companies that develop next-

Xilinx’s field-programmable gate array

generation AI products based on existing

(FPGA) chip on a single card, with a fast

products, the fab-less startups develop AI

direct data path between them for near-

accelerators from scratch for specific

data processing. SK Hynix recently

application domains. They can be

released the GDDR6-Accelerator-in-

segmented into two groups: the

Memory (AiM) chip that integrates

companies targeting datacenter

processing units in the lat-est GDDR6,

applications (FuriosaAI, Rebellions,

which can provide a total of 1TFLOPS

Sapeon, and HyperAccel) and companies processing throughput.

targeting edge appli-cations (OpenEdge,

Mobilint, DeepX, and Telechips).

In addition, once secretly focusing

solely on their own product develop-

FuriosaAI is one of the first fabless

ment, major companies are starting to

startups to develop AI accelerators for

open relations with the academia

high-performance vision tasks such

JULY 2023 | VOL. 66 | NO. 7 | COMMUNICATIONS OF THE ACM 49 lOMoAR cPSD| 39651089

east asia & oceania region big trends

Table 1. Industry-contracted semiconductor departments in universities.

oping low-power, high-performance

NPU IP and related high-speed memory University Contracting Company # of Students Year of Establishment

systems. The company’s strength in Sungkyunkwan University Samsung Electronics 70 2016

memory controllers and subsystems Yonsei University Samsung Electronics 50 2019 makes them promis-ing for NPU Korea University SK Hynix 30 2021

development. Last year, OpenEdges Sogang University SK Hynix 30 2022

released Enlight, an AI accelerator IP Hanyang University SK Hynix 40 2022

with an optimized net-work model POSTECH Samsung Electronics 40 2022

compiler that minimizes DRAM traffic. KAIST Samsung Electronics 100 2022

Established in 2019, Mobilint is an AI

semiconductor startup develop-ing high-

Table 2. Technical challenges.

performance AI inference NPUs for edge

devices and cars. Its NPU implementation AI Accelerators

Processing-in-Memory (PIM) Semiconductors

on FPGA took first place in the global

High-performance Tensor Hardware Design,

In-Memory Logic/Circuit Design,

benchmark MLPerf for two consecutive

Full-stack Software Development,

System Software for PIM Hardware,

Latest Logic Process (< 14nm)

Memory Process (Especially DRAM)

years (2020 and 2021). Mobilint last year

unveiled its Aries chip, which delivers up to 80

as image classification and object

namic voltage-frequency scaling. Sapeon

TOPS of AI performance at maximum

detection in datacenters. The com-pany also is developing its own AI capacity.

released the Warboy prototype in 2021,

inference chip for low-latency AI infer-

DeepX is a startup company devel-

proving it could achieve 1.5x higher

ence on image data. In 2022, Sapeon

oping power-efficient NPU chips for performance and 4x higher

released the X220, the first commer-

Internet of Things (IoT) devices. The

performance per price than a com-

cialized AI semiconductor chip, show-

company’s DX-L1 system on a chip

parable GPU, NVIDIA’s T4, for target

ing 2.3x and 2.2x higher performance

targets relatively simple IoT applica- applications.

and power efficiency than NVIDIA’s A2,

tions, such as smart camera sensors and

Rebellions is a fabless startup

respectively, in the MLPerf data-center

security cameras, while the DX-H1

company developing an AI accelerator inference benchmark.

targets huge IoT applications, such as

for high-frequency trading (HFT). That

HyperAccel is the newest of the

smart factories and smart buildings.

company released its first accelerator

startups, founded this year to target the

Lastly, Telechips is a medium-sized

card for intelligent HFT, called Light-

acceleration of hyperscale AI mod-els

company developing intelligent auto-

Trader, in 2022; it achieves 64 trillion

such as OpenAI’s GPT. HyperAccel uses

motive solutions for autonomous vehi-

operations per second (TOPS)/16 trillion

multiple AI accelerators with memory-

cles. The company has released various

floating-point calculations per second

bandwidth maximization for emerging

infotainment application processors for

(TFLOPS) peak performance, with generative AI workloads.

audio, digital cluster, and cockpit systems workload scheduling and dy-

OpenEdges Technology is devel- with low power requirements

Figure 3. Research outcomes of South Korean universities and IDEC’s educational support. 50

COMMUNICATIONS OF THE ACM | JULY 2023 | VOL. 66 | NO. 7 lOMoARcPSD|396 510 89 big trends

east asia & oceania region and a high level of security.

center and the Processing-in-Memory

and academia. Table 2 summarizes

South Korean fabless startups aim

(PIM) research center. Involving more

technical challenges for their two tar-get

beyond the domestic market to enter

than 10 research labs and 100 gradu-ate

products: AI accelerators and PIM

overseas markets with their AI acceler-

students, each research center conducts

semiconductors. For AI accelerators,

ators, leveraging the country’s com-

innovative research over a long-term

efficient software and hardware execu-

petitive IT infrastructure as a testbed.

period, nurturing human resources with

tion through full-stack development and

They are targeting developed markets technical competence.

high fabrication costs are the challenges.

such as the U.S. and Europe, but also are

South Korean universities show top-

For PIM semiconductors that integrate

looking at lucrative emerging mar-kets,

notch research capabilities in the areas of

logic inside the memory, low-level circuit

such as India and Southeast Asia.

AI semiconductors. As illus-trated in

innovation and sys-tem software to enable

Figure 3, they result in strong research

their adapta-tion in the system are

Universities and Education

outcomes in AI accelerator architecture

important, while their fabrication is

Korean universities are making great

and design, server-scale AI systems,

primarily possible only by memory

efforts to expand their research on AI

processing-in-memory chips, and near- vendors.

chips and on next-generation semicon-

data processing. They publish many

To this end, the government has a

ductor technology. Since Sungkyunk-wan

papers in top-tier conferences and

bold investment plan with both finan-cial

University established its contract-ed

journals, such as the International Solid-

and regulatory support, promot-ing the

semiconductor department with the help

State Circuits Con-ference, the

development of a collaborative

of Samsung Electronics in 2006, Yonsei

International Symposium on Computer

ecosystem by 2030 in which fabless,

and Korea universities have im- Architecture, the IEEE/ ACM

foundry, and packaging companies, as

plemented similarly contracted depart- International Symposium on Mi-

well as universities, will work together to

ments with Samsung in 2019, and with

croarchitecture, and the IEEE JOURNAL

enable seamless silicon product

SK Hynix in 2021. In such industry-con-

OF SOLID-STATE CIRCUITS.

manufacturing. The govern-ment also

tracted semiconductor departments, the

The IC Design Education Center

plans to aggressively foster AI

curriculum is focused on semicon-ductor

(IDEC) is the unsung hero of South

semiconductor experts by initiat-ing

engineering, including its basic devices,

Korea’s semiconductor industry, help-ing

school departments and research centers.

design, and system integra-tion, to

universities pursue research in the chip

Memory chip giants such as Samsung

educate students to be ready for work in

design field, which is expensive due to

and SK Hynix are diversify-ing their

the domain at graduation. They also get

manufacturing costs. Since 1995, IDEC

product lines with their own NPU IPs

hands-on project experience and

has supported MPW pro-grams and

and in/near-memory process-ing

mentorship opportunities from industry

access to essential electron-ic design

technology. More than 10 fabless startup

experts. After graduation, the students are

automation (EDA) tools at low cost, as

companies have been founded recently

guaranteed mployment by the contracting

well as providing practical education to

and are actively developing AI

company, allowing many talented experts

universities. It manages sensitive non-

acceleration solutions for various ap-

to work in the domestic industry. As

disclosure agreements (NDAs) and plication domains.

summarized in Table 1, seven major

process design kit (PDK) distribution

universities in South Korea have

between universities and foundry References

industry-contracted semiconductor

1. Kim, D-W. The Godfather of South Korea’s chip

companies such as Samsung, TSMC, and

industry: Kim Choong-Ki’s “Engineer’s Mind” helped

departments, and more than 350 students

Magnachip. More specifi-cally, they serve

make the country a semiconductor superpower. IEEE

Spectrum 59, 10 (2022), 32–38.

will be raised to the level of AI

more than 10 MPW shuttles and 50 EDA

2. Kim, J. South Korea plans to invest $450bn to become semiconductor experts soon.

chip ‘powerhouse’. NIKKEI Asia, http://bit.ly/3Yvbm02.

tools from over 15 vendors to universities

3. Lee, J-Y. S. Korea targets W340tr investment for

The influence of the Korea Ad-vanced

every year. In addition, IDEC annually

chip supremacy. The Korea Herald; https://www.

Institute of Science and Tech-nology

holds a chip design contest to exhibit

koreaherald.com/view.php?ud=20220721000751.

4. Lee, S. Samsung announces research projects for

(KAIST) is especially critical to South

silicon chips produced through its MPW

$40.12 million sponsorship. Pulse News; https://

Korea’s semiconductor indus-try, as

programs to the community and industry,

pulsenews.co.kr/view.php?year=2022&no=305553.

5. Rousselot, S. The ambiguous position of the South

described in the biographic article of

sharing the latest research outcomes for

Korean semiconductor industry in the US-China tech

war. Asia Power Watch; http://bit.ly/3mrFeNz.

Choong-Ki Kim.1 KAIST founded its

enhancing domestic chip design

6. Yoon, S. This is how South Korea can become a global

semiconductor system engineering

competitiveness. It has been operating

innovation hub. The World Economic Forum; http://bit. ly/3ZuRSKm.

department, including 50 prominent

more than 50 online/offline lectures on

professors, in 2022, with three specialized

chip design every year, and recently

Ji-Hoon Kim is a Ph.D. student in the School of

tracks—semiconduc-tor device/process,

started an accelerated degree program for

Electrical Engineering at Korea Advanced Institute of

Science & Technology (KAIST), Daejeon, South Korea.

chip design and VLSI, and system industry practitioners.

software and algo-rithms—to lead and

Sungyeob Yoo is a Ph.D. student in the School of

Electrical Engineering at Korea Advanced Institute of

transform the in-dustry towards

Science & Technology (KAIST), Daejeon, South Korea.

AI/system-focus, rather than remaining Conclusion memory-focused.

Joo-Young Kim is a professor in the School of Electrical

South Korea is striving to become a

Engineering at Korea Advanced Institute of Science &

The school also has attracted gov-

comprehensive semiconductor power-

Technology (KAIST), Daejeon, South Korea.

ernmental research centers in the AI

house by preempting the emerging AI

semiconductor domain, such as the AI

semiconductor market via nationwide

This work is licensed under a Creative

Commons Attribution-NonCommercial-

Semiconductor System (AISS) research

efforts among government, industry,

NoDerivs International 4.0 License

JULY 2023 | VOL. 66 | NO. 7 | COMMUNICATIONS OF THE ACM 51