Preview text:

11/22/2021 Chapter 7 • Cost of goods sold

• Accounting for opening and closing inventories Inventory • Counting inventories • Valuing inventories • IAS 2 Inventories Syllabus learning outcomes

• Recognise the need for adjustments for inventory in

preparing financial statements.

• Record opening and closing inventory.

• Identify the alternative methods of valuing inventory.

• Understand and apply the IASB requirements for valuing inventories.

• Recognise which costs should be included in valuing inventories. BP P L EA RN IN G M ED IA 1 11/22/2021 Syllabus learning outcomes

• Calculate the value of closing inventory using 'first in,

first out' and 'average cost' (both periodic weighted

average and continuous weighted average).

• Understand the use of continuous and period end inventory records.

• Understand the impact of accounting concepts on the valuation of inventory.

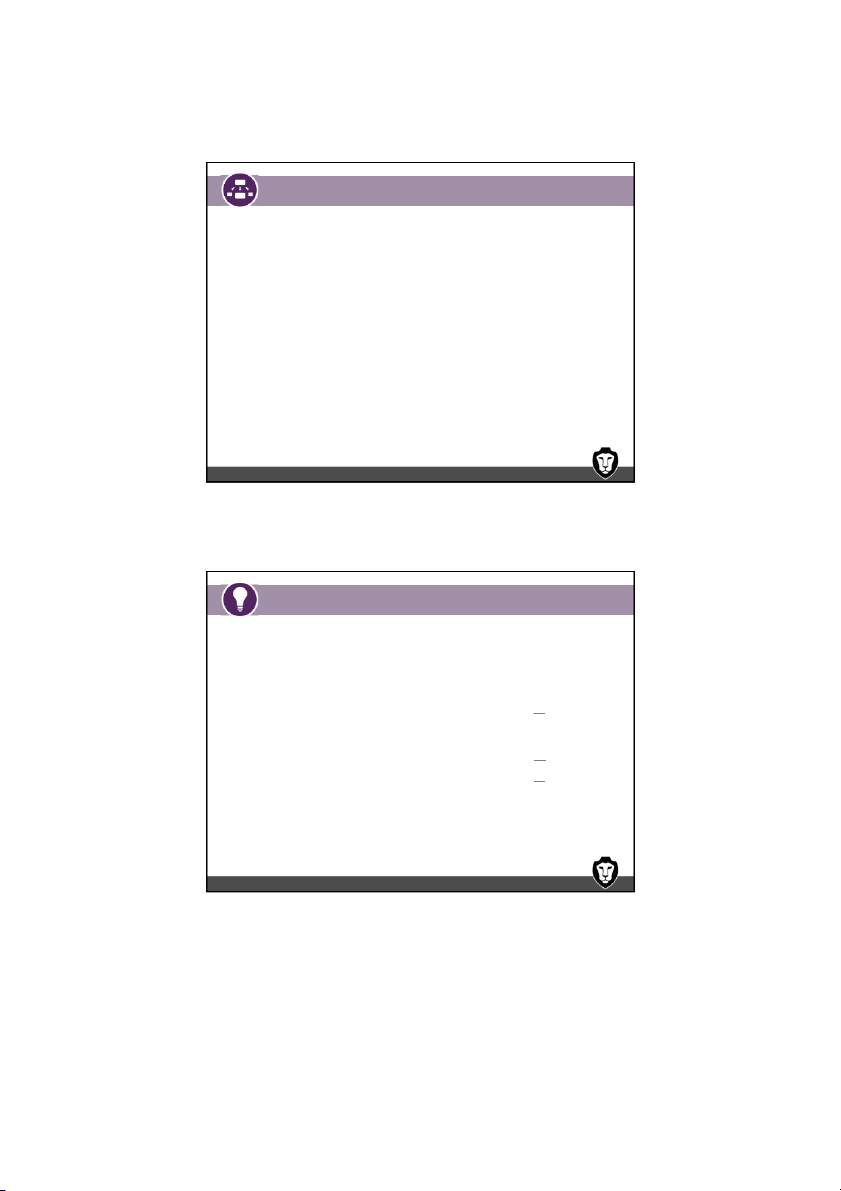

• Identify the impact of inventory valuation methods on profit and on assets. BP P L EA RN IN G M ED IA Overview Accounting adjustments Inventory Valuation Effects on profit Cost Net realisable value Methods of estimating cost FIFO AVCO BP P L EA RN IN G M ED IA 2 11/22/2021 Inventories Inventories are assets:

• Held for sale in the ordinary course of business

• In the process of production for such sale; or

• In the form of materials or supplies to be consumed in the

production process or in the rendering of services

Inventories can include raw materials, work in progress,

finished goods, goods purchased for resale BP P L EA RN IN G M ED IA Cost of goods sold 1

• Formula for the cost of goods sold $ Opening inventory value X

Add: purchases (or production costs) X X Less: closing inventory value (X) Cost of goods sold X BP P L EA RN IN G M ED IA 3 11/22/2021 COGS example 1

Perry P Louis, trading as the Umbrella Shop, ends his

financial year on 30 September each year. On 1 October

20X4 he had no goods in inventory. During the year to 30

September 20X5, he purchased 30,000 umbrellas costing

$60,000 from umbrella wholesalers and suppliers. He resold

the umbrellas for $5 each, and sales for the year amounted

to $100,000 (20,000 umbrellas). At 30 September there were

10,000 unsold umbrellas left in inventory, valued at $2 each.

What was Perry P Louis's gross profit for the year? BP P L EA RN IN G M ED IA Solution Calculation of COGS $ Opening inventory value 0

Add: purchases (30,000units@$2) 60,000 60,000

Less: closing inventory (10,000units@$2) (20,000) Cost of goods sold 40,000 Calculation of gross profit Sales (20,000 units) 100,000

Cost of goods sold (20,000 units) 40,000 Gross profit 60,0000 BP P L EA RN IN G M ED IA 4 11/22/2021 COGS example 1 (cont)

We shall continue the example of the Umbrella Shop

into its next accounting year, 1 October 20X5 to 30

September 20X6. During the course of this year, Perry

P Louis purchased 40,000 umbrellas at a total cost of

$95,000. During the year he sold 45,000 umbrellas for

$230,000. At 30 September 20X6he had 5,000

umbrellas left in inventory, which had cost $12,000.

What was his gross profit for the year? BP P L EA RN IN G M ED IA Solution Calculation of COGS $

Opening inventory value (10,000unit@$2) Add: purchases (40,000units)

Less: closing inventory (5,000units@) Cost of goods sold Calculation of gross profit Sales (20,000 units)

Cost of goods sold (20,000 units) Gross profit BP P L EA RN IN G M ED IA 5 11/22/2021 Cost of goods sold 2 Carriage inwards

• Cost paid by purchaser of having goods transported to his business • Added to cost of purchases Carriage outwards

• Cost to the seller, paid by the seller, of having goods transported to customer

• Is a selling and distribution expense BP P L EA RN IN G M ED IA COGS example 2

• Clickety Clocks imports and resells clocks. On 1 July

20X5, he had clocks in inventory valued at $17,000.

During the year to 30 June 20X6 he purchased more

clocks at a cost of $75,000. Carriage inwards amounted to

$2,000. Sales for the year were $162,100. Other expenses

of the business amounted to $56,000 excluding carriage

outwards which cost $2,500. The value of the goods in

inventory at the year end was $15,400.

• Required: Prepare the statement of profit or loss of

Clickety Clocks for the year ended 30 June 20X6 BP P L EA RN IN G M ED IA 6 11/22/2021 Solution Calculation of COGS $ Opening inventory value Add: purchases Add: Carriage inwwards Less: closing inventory Cost of goods sold BP P L EA RN IN G M ED IA Solution CLICKETY CLOCKS

STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 30 JUNE 20X6 $ Revenue 162,100 Cost of goods sold Gross profit Carriage outwards Other expenses Profit for the year BP P L EA RN IN G M ED IA 7 11/22/2021

• Formula for the cost of goods sold $ Opening inventory value X

Add: purchases (or production costs) X

(Purchases + carriage in – Purchases returns) X Less: closing inventory value (X) Cost of goods sold X BP P L EA RN IN G M ED IA

Goods written off or written down 1

• (a) Goods might be lost or stolen.

• (b) Goods might be damaged, become worthless and so be thrown away.

• (c) Goods might become obsolete or out of fashion. These

might be thrown away, or sold off at a very low price in a clearance sale. BP P L EA RN IN G M ED IA 8 11/22/2021

Goods written off or written down 2

When goods are lost, stolen or thrown away as worthless,

the business will make a loss on those goods because their 'sales value' will be nil.

• If, at the end of an accounting period, a business still has

goods in inventory which are either worthless or worth less

than their original cost, the value of the inventories should be written down to:

• (a) Nothing, if they are worthless

• (b) Their net realisable value, if this is less than their original cost BP P L EA RN IN G M ED IA Example

• Storm, an entity, had 500 units of product X at 30 June

20X7. The product had been purchased at a cost of $18

per unit and normally sells for $24 per unit. Recently,

product X started to deteriorate but can still be sold for

$20 per unit, provided that some rectification work is

undertaken at a cost of $3 per unit

• What was the value of closing inventory at 30 June 20X7?

• Cost = $18 per unit > NRV = $20 - $3 = $17 per unit

• Inventory is therefore valued at $17 per unit, giving a

valuation for 500 units of $8,500 BP P L EA RN IN G M ED IA 9 11/22/2021 Example

• Lucas Wagg, trading as Fairlock Fashions, ends his

financial year on 31 March. At 1 April 20X5 he had goods

in inventory valued at $8,800. During the year to 31 March

20X6, he purchased goods costing $48,000. Fashion

goods which cost $2,100 were still held in inventory at 31

March 20X6, and Lucas Wagg believes that these could

only now be sold at a sale price of $400. The goods still

held in inventory at 31 March 20X6 (including the fashion

goods) had an original purchase cost of $7,600.Sales for the year were $81,400.

• Required: Calculate the gross profit of Fairlock Fashions

for the year ended 31 March 20X6. BP P L EA RN IN G M ED IA Solution INVENTORY COUNT At cost $

Realisable value $ Amount written down $ Fashion goods 2,100 400 1,700 Other goods 5,500 7,600 GROSS PROFIT CALCULATION Sales Value of opening inventory Purchases Less closing inventory Cost of goods sold Gross profit BP P L EA RN IN G M ED IA 10