Preview text:

FX Derivatives

Forwards, Futures & Options Phan Vũ Ngọc Lan 1

Interest Rate Parity (IRP)

• Interest Rate Parity suggests that spot rates, forward rates

and interest rates are linked together by the following model: (1 R ) d F t 1

S t (1 R )f

Note that all variables in this equation are observed at time t 2 1

Forward Premium/Discount of the Base Currency F 0,T S0 360 R R d(0, ) T f (0, ) ( )

Forward (Prm / Disc) T d S 1 Rf (0,T) 0

Note that Forward rate has maturity T at time 0.

Interest rates are expressed in annualized terms.

Forward Premium or Discount is annualized with the Factor (360/d). 3

Forward Premium/Discount of the Terms Currency S 0 F 0,T 360 R R f (0,T ) d (0,T ) Forward (Prem/Disc) ( ) d F T 1 Rd (0,T ) 0,

Note that Forward rate has maturity T at time 0.

Interest rates are expressed in annualized terms.

Forward Premium or Discount is annualized with the Factor (360/d). 4 2 Forward Bid/Offer Rates • => F =FV /FV d f (1 R ) = d, Bid F PVd (1+Rd t) S Bid Bid PVf (1 +Rf t) (1 R ) f ,Offer = (1+Rd t) S* (1 +Rf t) (1 R ) d ,Offer F S Offer Offer (1 R ) f , Bid 5 Currency Futures 6 3 Forward Contract

• Forward is just a contract to deliver at a future date

(exercise date or maturity date) at a specified exercise price.

• Example: Rice farmer sells rice to warehouser.

• Example: Foreign Exchange (FX) forward. Contract to sell £ for ¥.

• Both sides are locked into the contract, no liquidity.

• What will warehouse think if rice farmer tries to get out of the contract? 7 Futures Contracts

• Futures contracts differ from forward contracts in that

contractors deal with an exchange rather than each other,

and thus do not need to assess each others’ credit.

• Futures contracts are standardized retail products, rather than custom products.

• Futures contracts rely on margin calls to guarantee performance. 8 4 Chapter 7 Introduction to Futures

• Futures are very similar to forwards

• A futures contract is an agreement to buy (if you are long)

or sell (if you are short) something in the future, at an

agreed upon price (the futures price).

• Futures exist on finan (de cial assets bt instruments,

currencies, stock indexes), and (g

real assets old, crude oil, wheat, cattle, cotton, etc.) 9

A Comparison of Futures Contracts and Forward Contracts

• Both types of contracts specify a trade between two counter- parties:

– There is a commitment to take delivery of an asset (this is the buyer, or the long)

– There is a commitment to deliver an asset (this is the seller, or the short)

• Many times, futures contracts and forward contracts are substitutes.

• However, at specific times, the relative costs, liquidity, and

convenience of using one market versus the other will differ. 10 5

Futures and Forwards: A Comparison Table Futures Forwards Default Risk: Borne by Clearinghouse Borne by Counter-Parties What to Trade: Standardized Negotiable The Forward/Futures Agreed on at Time Agreed on at Time Price of Trade Then, of Trade. Payment at Marked-to-Market Contract Termination Where to Trade: Standardized Negotiable When to Trade: Standardized Negotiable Liquidity Risk: Clearinghouse Makes it Cannot Exit as Easily: Easy to Exit Commitment Must Make an Entire New Contrtact How Much to Trade: Standardized Negotiable What Type to Trade: Standardized Negotiable Margin Required Collateral is negotiable Typical Holding Pd. Offset prior to delivery Delivery takes place 11

Other Unique Features of Futures Contracts

• Some futures contracts have daily price limits.

• Some futures contracts (Euro$, T-bills, stock index futures,

currencies) have one specific delivery date; others (T-bonds, crude

oil) give the short the option of choosing which day (usually in the

delivery month) to make delivery.

• Some futures contracts (e.g., T-bonds) let the seller choose the

quality of good to deliver, within a specified quality range.

• Some futures contracts (Euro$, stock index futures, feeder cattle) are cash settled.

• Note that a futures contract is like a portfolio of forward

contracts (time series). 12 6 Futures and Forwards

• A number of characteristics set Futures apart from Forward Contracts:

– Trading Environment (Organized Exchange)

– Cash Flows (Variation Settlement)

– Collateral (Initial Margin, Maintenance Margin)

– Early Exit (Contract reversal)

– Delivery Conditions (non-delivery)

– Cost (Brokerage Commissions) 13 CME Contracts • Australian dollar •

Euro FX/Japanese Yen cross rate • Brazilian real • Euro FX/Swiss Franc cross rate • British pound • Japanese Yen • Canadian dollar • Mexican Peso • Euro dollar • New Zealand Dollar • E-mini Euro FX • Russian Ruble • E-mini Japanese yen • South African Rand • Euro FX • Swiss franc •

Euro FX/British Pound cross rate 14 7 CME Contract Specs: A Sample Contract Size Initial-Margin Maintenance Margin Euro 125,000 $2,160 $1,600 JPY 12,500,000 $2,295 $1,700 Pound 62,500 $1,485 $1,100 CAD 100,000 $743 $550 CHF 125,000 $1,755 $1,300 MXP 500,000 $3,125 $2,500 15 Margin Requirements Contract Exchange Initial Margin Maintance Margin Australian Dollar (6A) Globex $1,148 $850 British Pound (6B) Globex $1,688 $1,250 Canadian Dollar (6C) Globex $1,148 $850 E-mini Euro FX (E7) Globex $1,418 $1,050 Euro FX (6E) Globex $2,565 $1,900 Japanese Yen (6J) Globex $2,430 $1,800 E-Mini Japanese Yen Globex $1,215 $900 Swiss Franc (6S) Globex $1,755 $1,300 16 8 Futures Prices

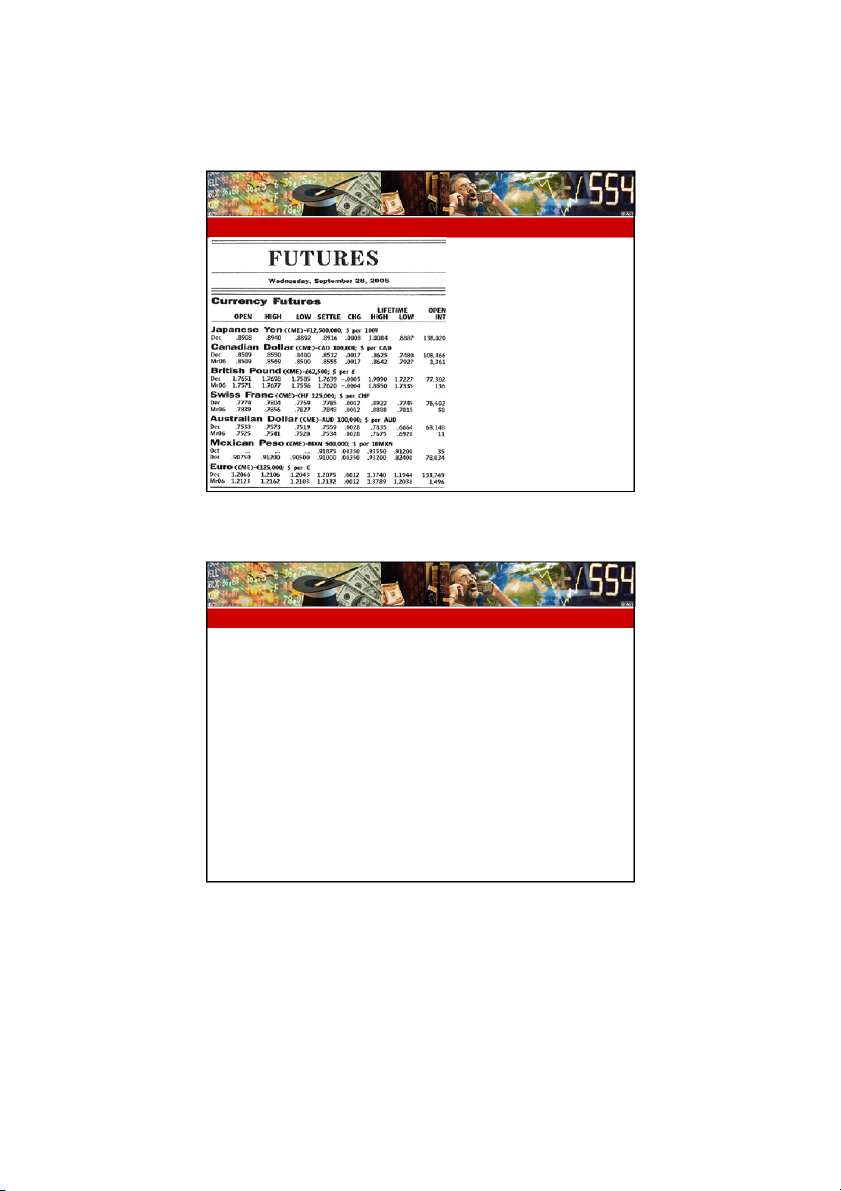

The open or opening price is the price or range of prices for

the day's first trades, registered during the period designated

as the opening of the market or the opening call.

The word high refers to the highest price at which a

commodity futures contract traded during the day.

Low refers to the lowest price at which a commodity futures

contract traded during the day.

Some publications show a close or closing price in their

tables. The closing price is the price or range of prices at

which the commodity futures contract traded during the brief

period designated as the market close or on the closing

call—that is, the last minute of the trading day.

Because the last few minutes of trading are often the busiest

part of the day, with many trades occurring simultaneously,

the exchange computes a settlement price from the range

of closing prices. The settlement price, which is abbreviated

as settle in most pricing tables, is used by the clearing

house to calculate the market value of outstanding positions

held by its members. It is also frequently used

synonymously with closing price; although they may, in fact, differ.

The change refers to the change in settlement prices from

the previous day's close to the current day's close.

The lifetime high and low refer to the highest and lowest

prices recorded for each contract maturity from the first day it traded to the present.

Open interest refers to the number of outstanding contracts

for each maturity month. Some newspapers do not include this information. 17 Futures Prices

• The open or opening price is the price or range of prices for the

day's first trades, registered during the period designated as the

opening of the market or the opening call.

• The word high refers to the highest price at which a

commodity futures contract traded during the day.

• Low refers to the lowest price at which a commodity futures

contract traded during the day.

• Some publications show a close or closing price in their tables.

The closing price is the price or range of prices at which the

commodity futures contract traded during the brief period

designated as the market close or on the closing call—that is,

the last minute of the trading day. 18 9 Futures Prices

• Because the last few minutes of trading are often the busiest part of the

day, with many trades occurring simultaneously, the exchange computes a

settlement price from the range of closing prices. The settlement price,

which is abbreviated as settle in most pricing tables, is used by the

clearing house to calculate the market value of outstanding positions held

by its members. It is also frequently used synonymously with closing

price; although they may, in fact, differ.

• The change refers to the change in settlement prices from the previous

day's close to the current day's close.

• The lifetime high and low refer to the highest and lowest prices recorded

for each contract maturity from the first day it traded to the present.

• Open interest refers to the number of outstanding contracts for each

maturity month. Some newspapers do not include this information. 19 Mark-to-Market

• Part of the daily cash flow system used by U.S.

futures exchanges to maintain a minimum level

of margin equity for a given futures or option contract

position by calculating the gain or loss in each contract

position resulting from changes in the price of

the futures or option contracts at the end of each trading

session. These amounts are added or subtracted to each account balance. 20 10