Preview text:

TER

M 22.1A - SCHOOL YEAR 2022 - 2023

SUBJECT: ACCOUNTING PRINCIPLES

COURSE CODE: KT204DV02 (2021_2233) CLASS ID: 3300 REPORT

THE FINAL TERM GROUP DISCUSSION Instructor: Ms. Đỗ Thị Lệ Thu Group: 8 Students: Hoàng Minh Anh Bùi Thanh Huyền Nguyễn Lê Hoàng Khang Phan Thu Ngân Phạm Bảo Nhi Nguyễn Vũ Như Quỳnh Ho Chi Minh City, July 2023 Group Report Accounting Principles TER

M 22.1A - SCHOOL YEAR 2022 - 2023

SUBJECT: ACCOUNTING PRINCIPLES

COURSE CODE: KT204DV02 (2021_2233) CLASS ID: 3300 REPORT

THE FINAL TERM GROUP DISCUSSION Instructor: Ms. Đỗ Thị Lệ Thu Students:

List Of Students Who Made The Report Student First & Last name Work division % of ID Contribution 22205946 Hoàng Minh Anh Part I - Case 2 100% Support Part III 22202725 Bùi Thanh Huyền Part II 100% Support Part III

22205338 Nguyễn Lê Hoàng Khang Part IV 100% Word Report 22116980 Phan Thu Ngân Part I - Case 1 100% Word Report 22203130 Phạm Bảo Nhi Part III. c,d 100%

22202478 Nguyễn Vũ Như Quỳnh Part III. a,b 100% Semester 2233, 15th July 2023

Report submission date: 16/7/2023

Report recipient (signature & ful name):

_________________________________ Page ii Group Report Accounting Principles TABLE OF CONTENTS

TABLE OF CONTENTS ..................................................................................... i i

PLEDGE STATEMENT ...................................................................................... iv

THANK YOU MESSAGES ................................................................................. v

OVERVIEW ......................................................................................................... vi

PART I. CASES .................................................................................................... 1

I.1. Case 1 .......................................................................................................... 1

I.2. Case 2 .......................................................................................................... 1

PART II. COSTING AND DEPRECIATION ...................................................... 3

PART III. ACCOUNTING CYCLES ................................................................... 4

PART IV. LEARNING OUTCOME .................................................................. 11

CONCLUSION ................................................................................................... 12 Page iii Group Report Accounting Principles PLEDGE STATEMENT

We declare that the entire content presented in this essay on Accounting

Principles is presented by our group, not copied from any documents. If it is not true,

we would like to take al responsibility before the teachers and the school. Page iv Group Report Accounting Principles THANK YOU MESSAGES

First of al , we would like to express our sincere thanks to Hoa Sen University

for introducing Accounting Principles subject into the curriculum, especial y we would

like to express our deep gratitude to the lecturer of Accounting Principles subject –

Ms. Đỗ Thị Lệ Thu has taught and imparted valuable knowledge to us during the past

study period. We have received your care, help, and guidance very passionately. From

the knowledge you conveyed, we have been practicing, as wel as gradual y applying

skil s in study and work. That is not only useful in university student life but also helps a lot in our future.

Perhaps knowledge is limitless, but each person’s knowledge acquisition always

has certain limitations. Therefore, in the process of completing the project, it is

inevitable that there wil be shortcomings. We look forward to receiving your

comments to improve our report.

Wishing you health, happiness, and success in your teaching career path! July 15, 2023 Group 8 Page v Group Report Accounting Principles OVERVIEW

Accounting principles are fundamental guidelines and concepts that govern the

practice of accounting. They provide a framework for recording, summarizing, and

reporting financial transactions and events. So this report al ows our group to share our

research findings and perspectives on accounting principles. It helps create a

comprehensive understanding of the subject matter by combining various viewpoints and knowledge.

In addition, this group discussion fosters col aboration and teamwork among us.

It provides an opportunity to exchange ideas, brainstorm, and work together to develop

a wel -rounded report on accounting principles.

In brief, the final term group discussion on the Accounting Principle report

plays an important role in many aspects and skil s, it also contributes to the production

of a wel -informed and comprehensive report on accounting principles. Page vi Group Report Accounting Principles PART I. C ASES I.1. Case 1

In 2022, Apache transfers the land to the buyer and revenue is recognized at

this point. Gross profit is calculated as the difference between the sel ing price and the

book value of the land. The sel ing price agreed upon between Apache (the sel er) and

the construction company (the buyer) is $3,000,000. The book value of the land on Apache's books is $1,200,000.

The gross profit recognized in 2022 is calculated as the sel ing price minus the book value:

Gross Profit 2022 = Sel ing Price – Book Value

Gross Profit 2022 = $3,000,000 – $1,200,000

Gross Profit 2022 = $1,800,000

→ Apache wil recognize a gross profit of $1,800,000 in 2022.

In 2023, the terms of the sale require a down payment of $150,000 and 19

annual payments of $150,000 plus interest at an appropriate interest rate due on each July 1 beginning in 2023.

Since Apache recognizes revenue at the point of delivery, no additional gross

profit wil be recognized in 2023. The gross profit of $1,800,000 was recognized in 2022.

→ Apache wil not recognize any additional gross profit in 2023. I.2. Case 2

1. If AuctionCo.com purchases the used bicycle for $20 from a supplier and takes

control before the sale, the company would recognize revenue of $30.

→ In this case, AuctionCo is a principal because it takes control of this used bicycle

before sale. Therefore, AuctionCo would recognize revenue of $30.

2. The customer pays $30 to AuctionCo.com, and AuctionCo.com pays $20 to the

supplier for the bicycle. AuctionCo.com's revenue would be the difference

between the amount received from the customer and the amount paid to the

supplier. So, the revenue recognized by AuctionCo.com would be $10 ($30 - $20). Page 1 Group Report Accounting Principles

→ In this case, AuctionCo is an agent because it does not take control of this used

bicycle before sale. Therefore, AuctionCo would recognize revenue of $10 (commission fees) Page 2 Group Report Accounting Principles PART II. C OSTING AND DEPRECIATION

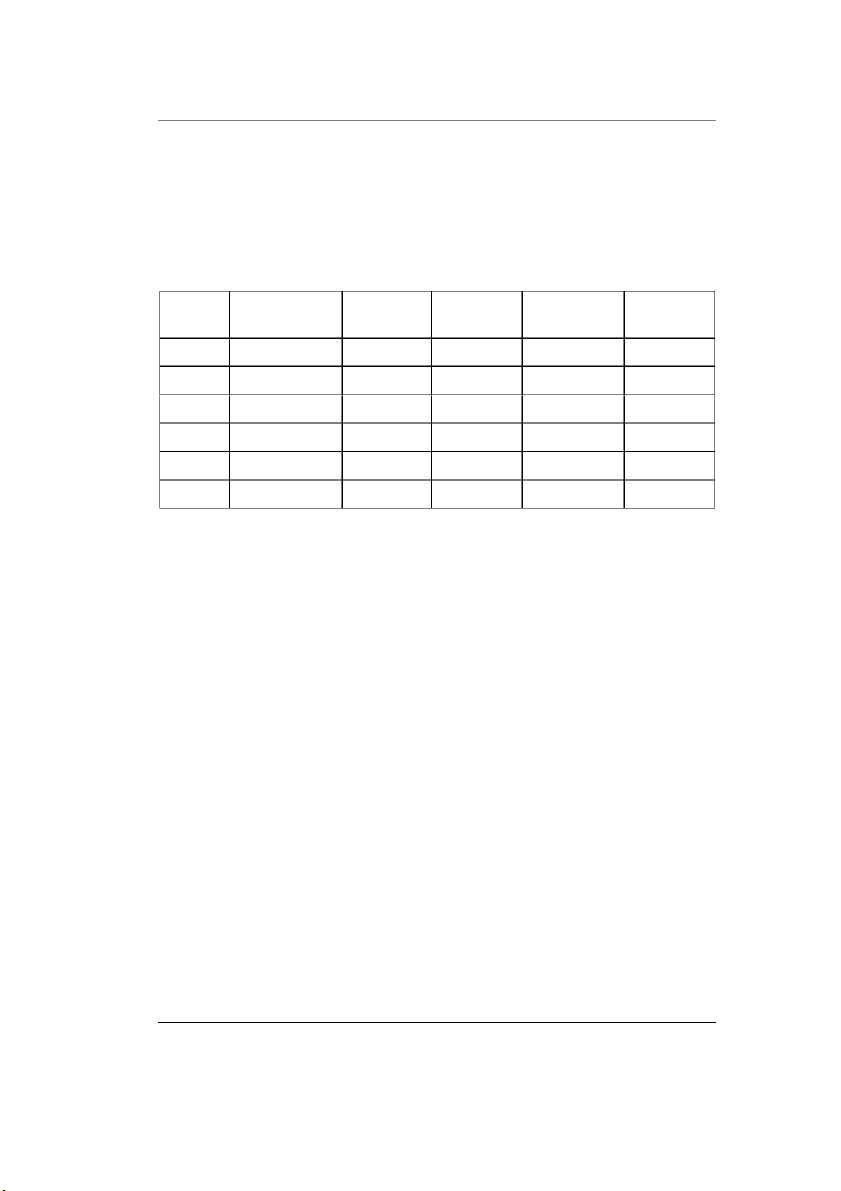

Determine the cost of equipment and complete the table of depreciation from

2019 to 2024 using the straight-line method:

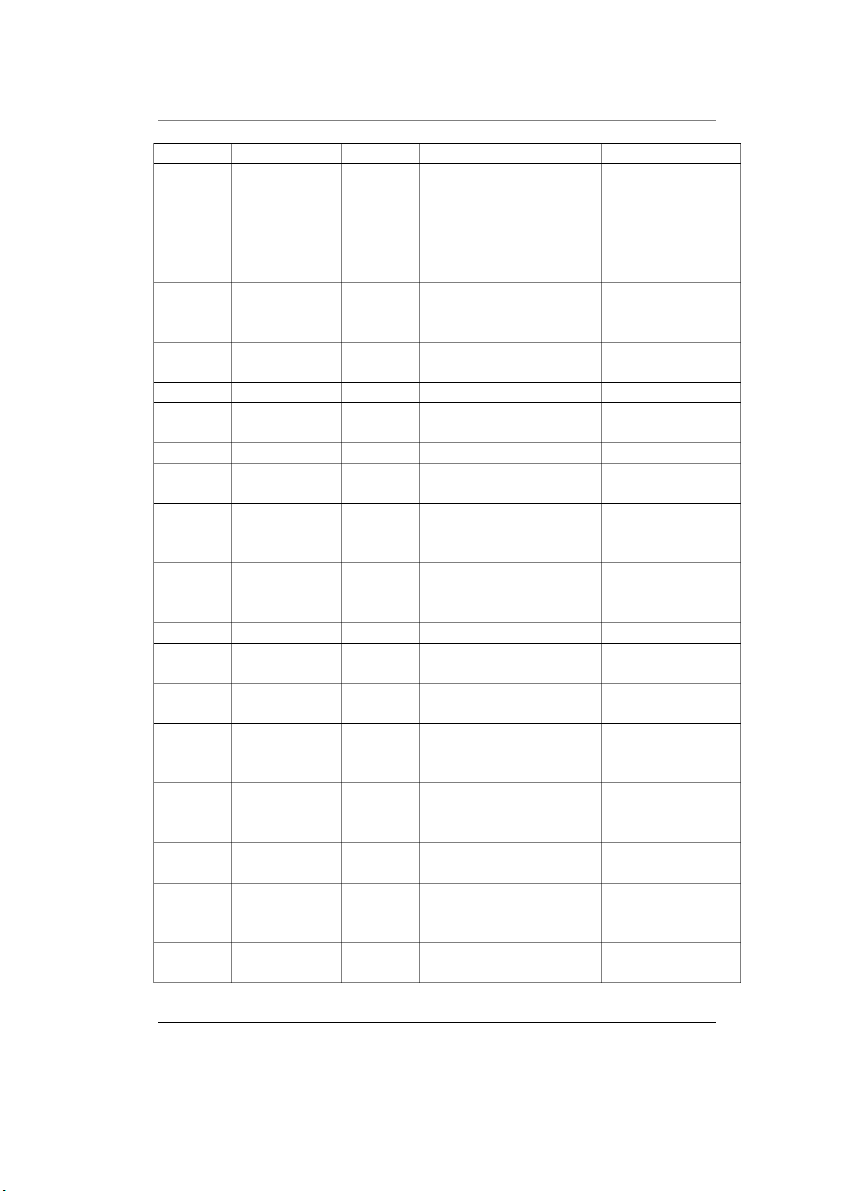

Depreciable DepreciationDepreciation Accumulated Year amount Rate

Expenses Depreciation Book value 2019 450 20% 15 15 500 2020 450 20% 90 105 485 2021 450 20% 90 195 395 2022 450 20% 90 285 305 2023 450 20% 90 375 215 2024 450 20% 75 450 140 Page 3 Group Report Accounting Principles PART III. ACCOUNTING CYCLES • Require a: We have:

Total Assets = Cash + Supplies + Equipment + Merchandise inventories –

Accumulated Depreciation + Accounts receivable

→ Total Assets = 5.693.363.362 + 345.723.100 + 4.894.263.600 + 791.530.000 – 843.959.400 + X

Total assets = 10.880.920.662 + X We have:

Total Capital = Salary Payables + Notes Payable + Account Payable + Owner's Capital + Retained Earnings

→ Total Capital = 312.417.546 + 2.200.000.000 + 675.300.000 + 8.000.000.000 + 252.160.116

Total Capital = 11.439.877.662

So we have: Total Assets = Total Capital

10.880.920.662 + X = 11.439.877.662 X = 558.957.000 • Require b :

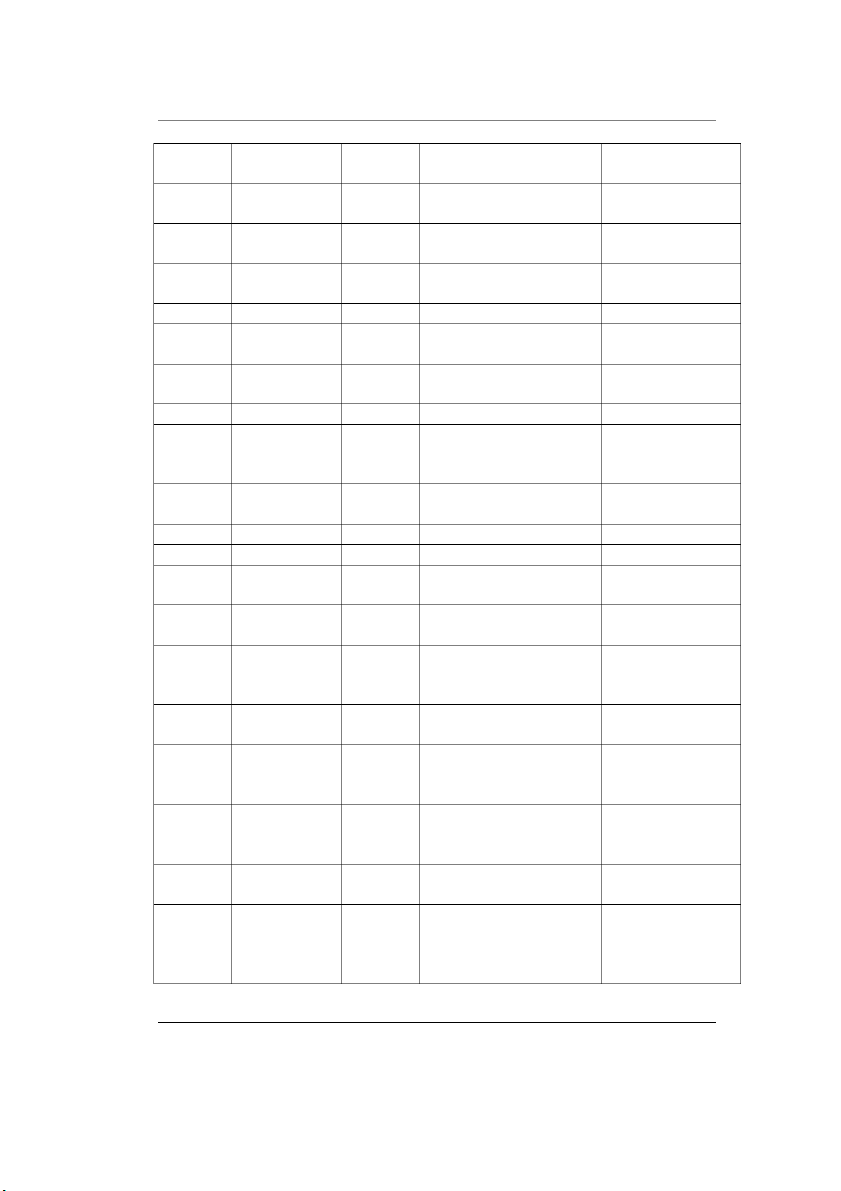

Record the transactions to the General Journal Date Account Title REF NO. Credit Debit 1/1/2023 Cash 111/112 1.201.000.000 Notes Payable 341 1.201.000.000 5/1/2023 Merchandise 156 400.000.000 Inventories (=5.000*80.000) Cash 111/112 400.000.000 7/1/2023 Cash 111/112 245.200.000 Account 131 245.200.000 Receivable 7/1/2023 Rent Expense 641 20.000.000 Cash 111/112 20.000.000 10/1/2023 Cash 111/112 1.680.000.000 (=12.000*140.000) Page 4 Group Report Accounting Principles Service 511 1.680.000.000 Revenue COGS 632 951.530.000 (=10,000*79,153) Merchandise 156 951.530.000 Inventories 12/1/2023 Accounts 331 452.430.000 Payable Cash 111/112 452.430.000 15/1/2023 Merchandise 156 724.500.000 Inventories (=9.000*80.500) Accounts 331 724.500.000 Payable 18/1/2023 Cash 111/112 300.000.000 Owner's 411 300.000.000 Investment Capital 20/1/2023 Utility 642 107.812.000 Expense Cash 111/112 107.812.000 25/1/2023 Cash 111/112 450.000.000 Accounts 131 300.000.000 Receivable Service 511 750.000.000 Revenue (=5.000*150.000) COGS 632 401.000.000 (=3.000*80.000+2.000* 80.500) Merchandise 156 401.000.000 Inventories 31/1/2023 Employees 641 75.483.000 Salary Expense Administration 642 128.540.000 Salary Expense Salary 334 204.023.000 Expense 31/1/2023 Accrued 641 55.000.000 Depreciation Expense At The Sel ing Page 5 Group Report Accounting Principles Division Accrued 642 140.000.000 Depreciation Expense At The Administration Division Depreciation 214 195.000.000 Of Fixed Assets 31/1/2023 Interest 635 12.010.000 Expenses Cash 111/112 12.010.000 31/1/2023 Sel ing 641 12.000.000 Expenses Cash 111/112 12.000.000 31/1/2023 Service 511 2.430.000.000 Revenue Determine 911 2.430.000.000 Business Performance Determine 911 1.903.375.000 Business Results COGS 632 1.352.530.000 Financial 635 12.010.000 Expenses Sel ing 641 162.483.000 Expenses Enterprise 642 376.352.000 Cost Management Cost Of 821 105.325.000 Corporate (526.625.000*20%) Income Tax Compulsory 333 105.325.000 Tax Determining 911 105.325.000 Business Performance Cost Of 821 105.325.000 Corporate Page 6 Group Report Accounting Principles Income Tax Determining 911 421.300.000 Business Performance Retained 421 421.300.000 Earnings

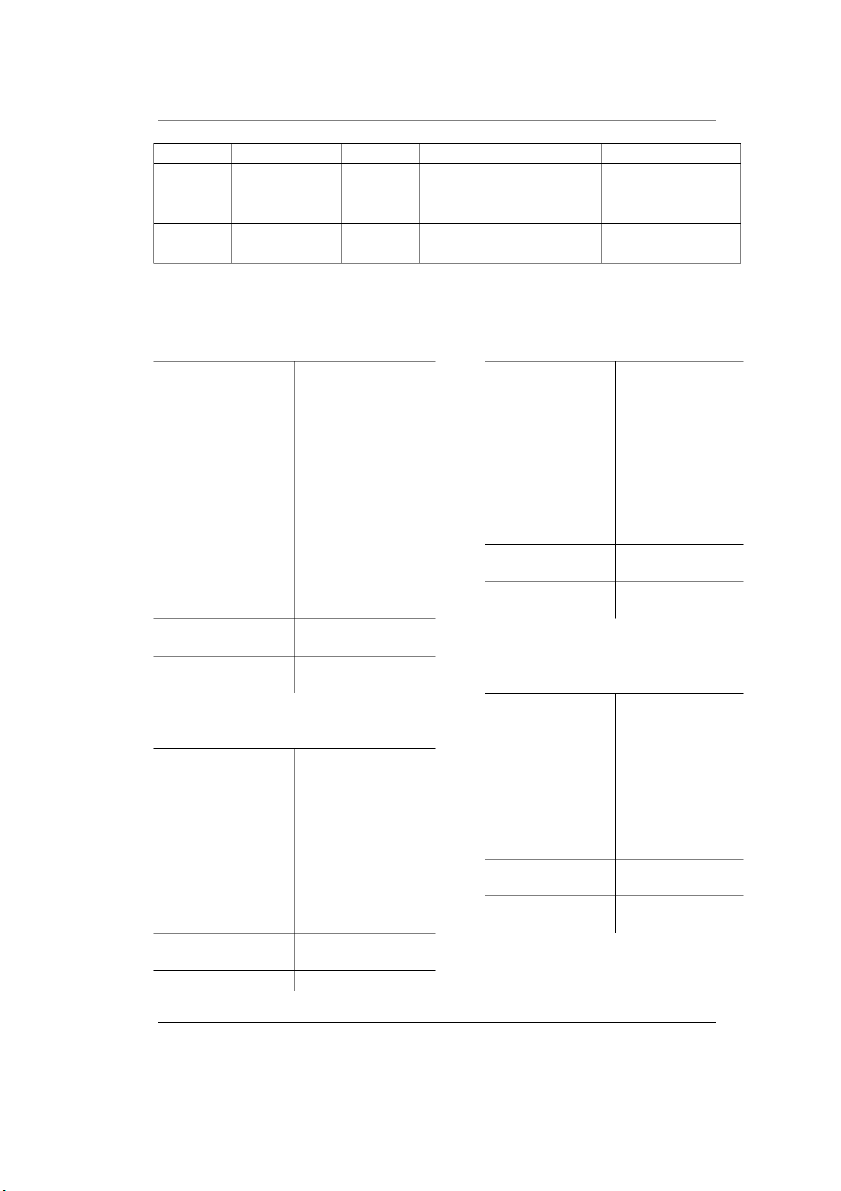

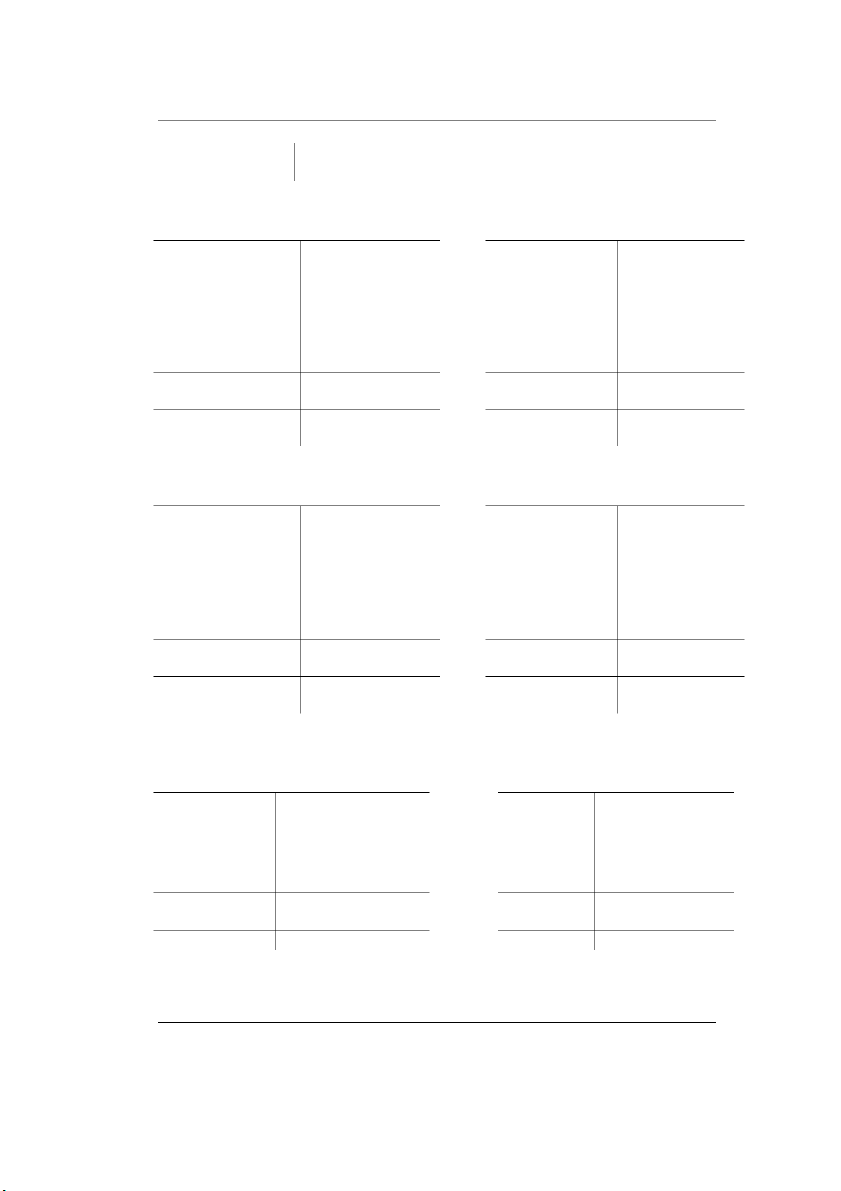

Transfer the data to the T accounts Dr. Cash Cr. Dr. Account Receivable Cr. 5.693.363.362 558.957.000 1.201.000.000 400.000.000 300.000.000 245.200.000 245.200.000 20.000.000 1.680.000.000 452.430.000 300.000.000 107.812.000 450.000.000 12.010.000 300.000.000 245.200.000 12.000.000 613.757.000 3.876.200.000 1.004.252.000 8.565.311.362 Dr. Supplies Cr. 345.723.100 Dr. Merchandise Inventories Cr. 791.530.000 400.000.000 951.530.000 724.500.000 401.000.000 - - 345.723.100 1.124.500.000 1.352.530.000 Page 7 Group Report Accounting Principles 563.500.000 Dr. Fixed Assets Cr. Dr. Account Payable Cr. 4.894.263.600 675.300.000 452.430.000 724.500.000 - - 452.430.000 724.500.000 4.894.263.600 947.370.000 Dr. Accumulated Depreciation Cr. Dr. Salary Expense Cr. 843.959.400 312.417.546 195.000.000 204.023.000 - 195.000.000 - 204.023.000 1.038.959.400 516.440.546 Dr. Notes Payable Cr. Dr. Retained Earnings Cr. 2.200.000.000 252.160.116 1.201.000.000 421.300.000 - 1.201.000.000 - 421.300.000 3.401.000.000 673.460.116 Page 8