Preview text:

Page 3 CHAPTER 1

Assurance and auditing: an overview LEARNING OBJECTIVES (LO) 1.1

Understand the framework for assurance engagements and the

types of assurance engagements that can be provided. 1.2

Define auditing and appreciate the fundamental principles underlying an audit. 1.3

Appreciate the attributes of accounting information and

understand the reasons giving rise to demand for assurance and resulting benefits. 1.4

Explain the concept of the expectation gap, especially in the areas

of auditor’s report messages, corporate failures, fraud and

communicating different levels of assurance, and appreciate the

relationships between the auditor, the client and the public. 1.5

Appreciate the role of auditing standards and their authority under the Corporations Act 2001. 1.6

Obtain an overview of other applications of the assurance function,

including compliance engagements, performance engagements,

comprehensive engagements, internal auditing and forensic . d

auditing, as well as of providing assurance on subject matter other ver se er s

than historical financial information. t h gir llA .ailarstuA lliH-war cG M .8102 © thgiyrpoC

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21. RELEVANT GUIDANCE ASA 102

Compliance with Ethical Requirements when

Performing Audits, Reviews and Other Assurance Engagements ASA 200/ISA 200

Overall Objectives of the Independent Auditor and

the Conduct of an Audit in Accordance with

Australian (International) Auditing Standards ASA 220/ISA 220

Quality Control for an Audit of a Financial Report

and Other Historical Financial Information ASAE 3000/ISAE 3000

Assurance Engagements Other than Audits or

Reviews of Historical Financial Information APES 210

Conformity with Auditing and Assurance Standards AUASB

Foreword to AUASB Pronouncements AUASB/IAASB

AUASB Glossary/Glossary of Terms AUASB/IAASB Framework for Assurance

Engagements/International Framework for Assurance Engagements IAASB

Preface to the International Standards on Quality

Control, Auditing, Review, Other Assurance and Related Services Page 4 . d ver se er

s thgir llA .ailarstuA lliH-war cG M .8102 © thgiyrpoC

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21.

CHAPTER OUTLINE AND REVIEW OF CURRENT AUDITING ENVIRONMENT

Entities achieve their goals through the use of human and economic resources.

In order to account for the use of these human and economic resources, entities

issue reports explaining the use of the resources entrusted to their control.

These reports can take a number of forms, including financial reports, which are

prepared in accordance with accounting standards in order to provide

information on the financial position and performance of an entity, and

environmental reports, which are prepared in accordance with environmental

standards to provide information on the environmental performance of an entity.

A primary function of the auditing and assurance profession is to provide

independent and expert opinions on these reports based on an examination of

the evidence underlying the information reported, in order to improve the credibility of these reports.

Auditors usually bring two major types of expertise to an audit. One of these is

an expertise on the subject matter of the underlying report. For example, if the

audit is of a financial report, this requires expertise on the accounting standards

and regulations that underpin the financial report. Students will have started to

develop this expertise by undertaking the financial accounting subjects

contained in an accounting degree, and will further develop it in practice.

The second major type of expertise is auditing and assurance expertise. This

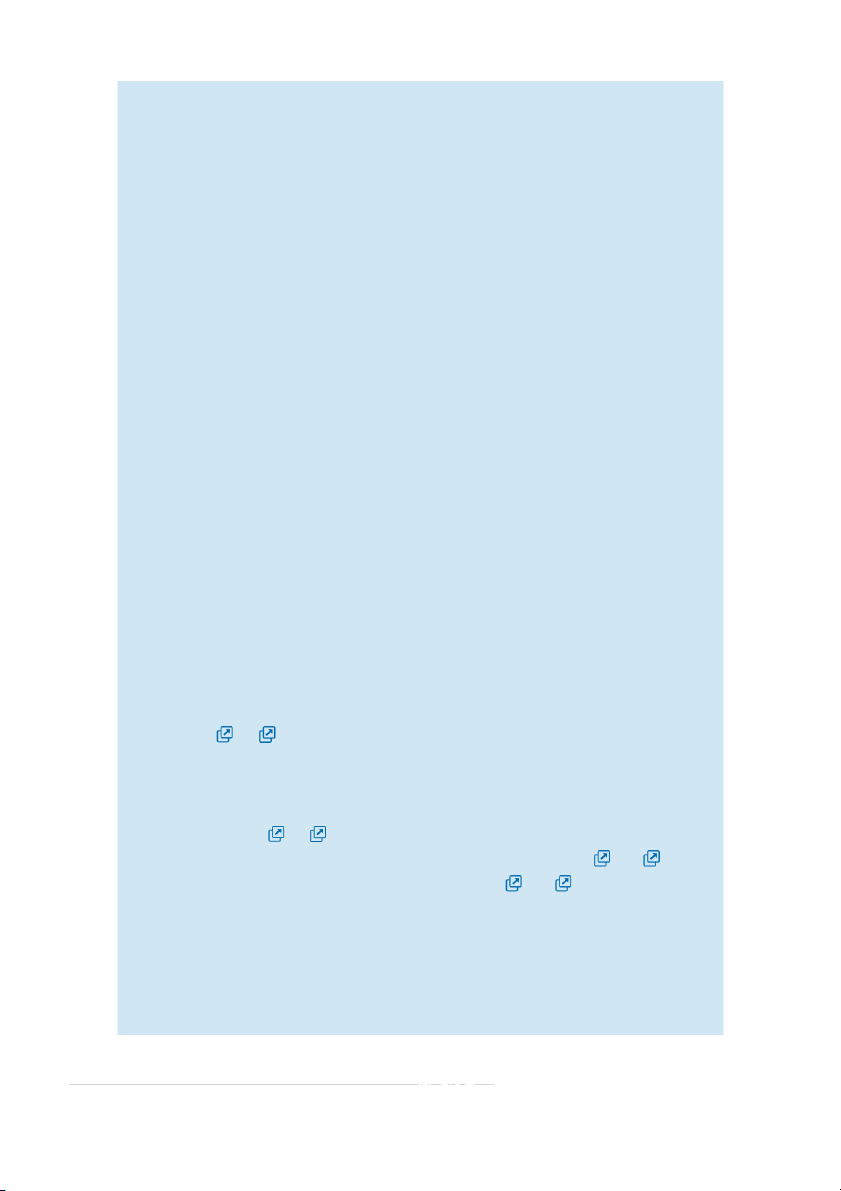

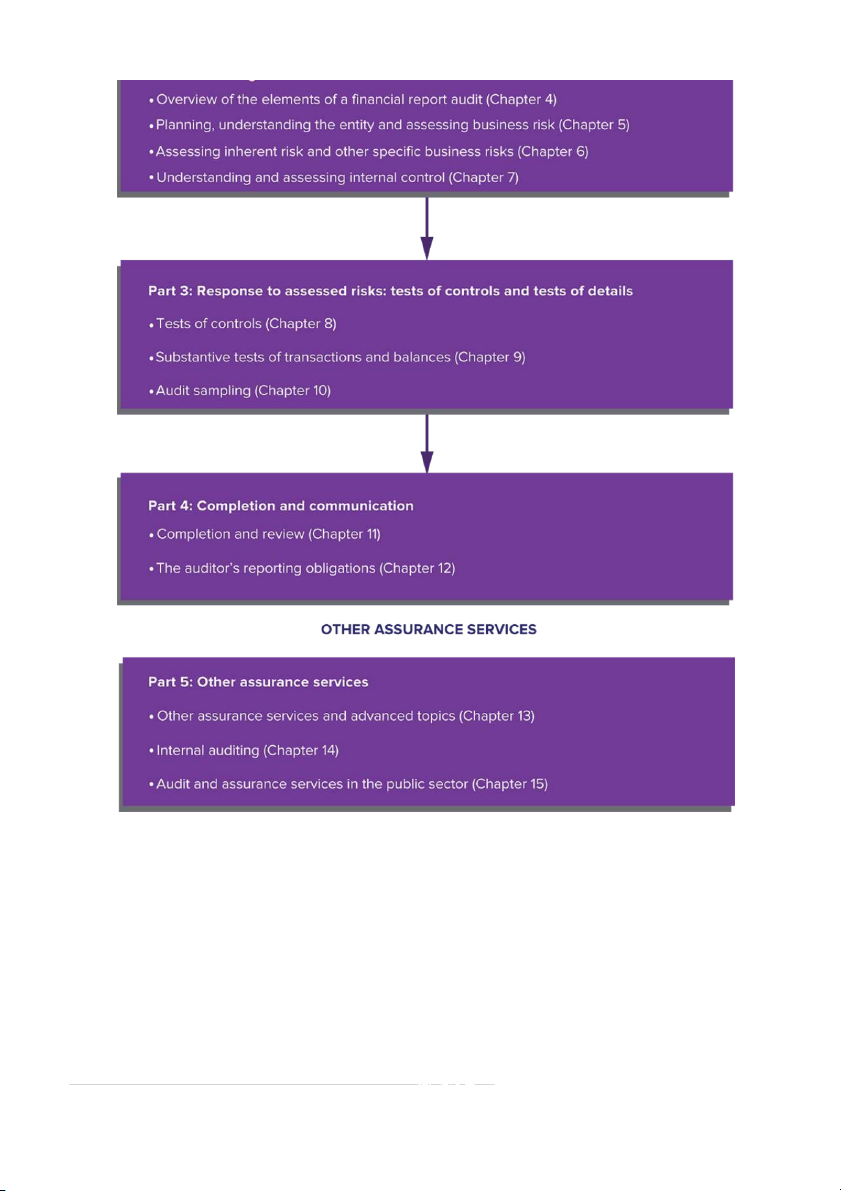

involves, firstly, understanding the auditing and assurance services profession (Chapters 1 –3

). Further, for any particular engagement, it involves

appropriately planning and assessing risk, including developing an . d

understanding of the reporting entity and of the industry and environment in ver se er s

which it operates, assessing the major risks of misstatement in the underlying t h gir llA report (Chapters 4 –7

), collecting audit evidence so that the risk of .ailarst

misstatement is reduced to an acceptably low level (Chapters 8 –10 ) and u A lliH-

effectively communicating the findings (Chapters 11 –12 ). This book w ar cG M

explains this process and helps to develop this expertise. .8102 © thgiyr

The auditor has developed the audit process and their own expertise and p o C

reputation in the area of auditing financial reports. However, this process and

expertise can be applied to areas other than financial reports, such as providing

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21.

assurance on an entity’s disclosure of its corporate social responsibility or its

level of carbon emissions. The concept of applying the audit process more

broadly is introduced in this chapter and discussed further in Chapters 13 –15 . Figure 1.1

outlines the way the text works through the various stages of the

audit process in a logical manner. Each step in the process builds on the steps

that precede it. This framework is expanded upon in each chapter of the text. Page 5 . d ver se er

s thgir llA .ailarstuA lliH-war cG M .8102 © thgiyrpoC

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21. . d ver se er s thgir

Flowchart of overall auditing and assurance framework ll A .ailarstuA lliH-war cG M .8102 © thgiyrpoC

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21. Page 6

LO 1.1 The framework for assurance engagements and

the types of assurance engagements

Framework for assurance engagements

In many situations in today’s society, people who are responsible for a specific task (called

responsible parties or managers) need to account for their performance with respect to that

task. There may be many groups who will rely on this accounting for performance as an aid

to their decision making. These groups may be either resource providers or third parties to

the process (other users). There are many examples of such relationships, including:

shareholders relying on financial reports produced by a company’s management

government agencies relying on reports produced by entities to account for environmental considerations

parents relying on information produced by schools or contained on websites, when

deciding where to send their children.

In order for users to be able to judge the performance of the responsible party, they may

ask the responsible party to provide them with a report of how the resources under their

care have been used in achieving the aims of the relationship. However, it is recognised that

the report by the responsible party is potentially biased, as the responsible party may have

an incentive to prepare a report that reflects their own performance in the best possible

light. Thus, before the report is made available to the user, the credibility of the report is

enhanced by having someone who is both independent and expert (called the auditor or

assurance service provider) examine that the of the report is

prepared and presented in accordance with an agreed reporting framework (called . d ver

) and provide an assessment (the audit or assurance report) that accompanies the se er s th

report prepared by the responsible party. gir llA .ailarstuA The , issued by the International lli H- w a

Auditing and Assurance Standards Board (IAASB) (and in Australia by the Australian r cG M .8

Auditing and Assurance Standards Board (AUASB) as the 1 0 2 © t

), covers both audits and reviews of historical financial information and all h gi yr p o

other assurance engagements. This initiative therefore recognises the increasing demand C

for assurance over a wide range of subject matter.

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

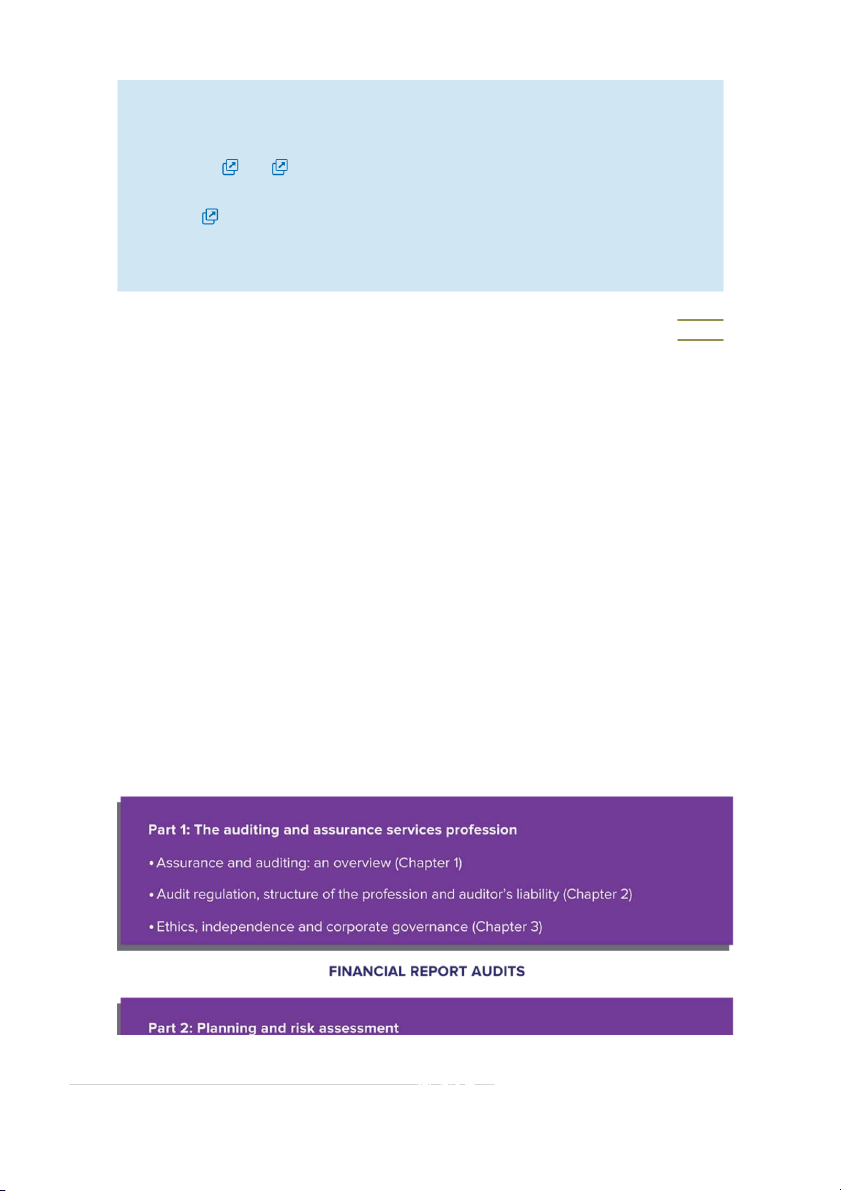

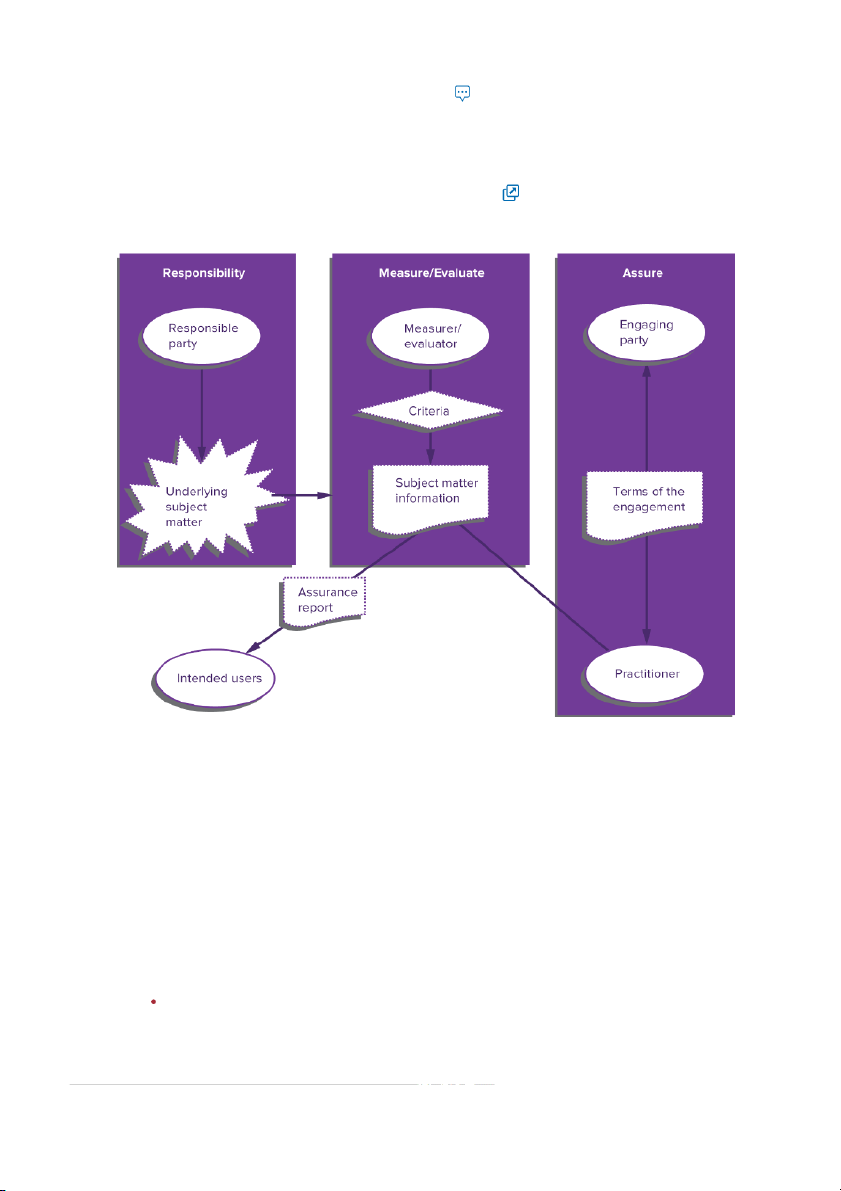

Created from cdu on 2020-07-21 22:31:21. The framework defines an

as ‘an engagement in which a

practitioner aims to obtain sufficient appropriate evidence in order to express a conclusion

designed to enhance the degree of confidence of the intended users other than the

responsible party about the outcome of the measurement or evaluation of an underlying

subject matter against criteria’ (paragraph 10). is a diagrammatic summary

of the interrelationship of the five components, which are discussed below.

The parties to an assurance engagement

Source: ASAE 3000 Appendix 1/ISAE 3000 Appendix 1. (c) 2018 Auditing and Assurance Standards Board

(AUASB). The text, graphics and layout of this publication are protected by Australian copyright law and the . d ver

comparable law of other countries. No part of the publication may be reproduced, stored or transmitted in any se er s

form or by any means without the prior written permission of the AUASB except as permitted by law. For t h gir l

reproduction or publication permission should be sought in writing from the Auditing and Assurance Standards l A .ail

Board. Requests in the first instance should be addressed to the Technical Director, Auditing and Assurance ar st u

Standards Board, PO Box 204, Collins Street West, Melbourne, Victoria, 8007. A lliH-war cG M

The following five elements of an assurance engagement are identified (paragraph 26 of . 8 1 0 2 © the assurance framework): thgiyrpoC 1.

This is the individual(s) undertaking the

assurance engagement. In Australia this would normally be a member of a

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21.

recognised accounting body (CPA Australia, Chartered Accountants Australia and

New Zealand (Chartered Accountants ANZ) or the Institute of Public Accountants

(IPA)), and one who is bound by the profession’s code of ethics.

This is the person or persons responsible for the underlying

subject matter. For example, the board of directors (responsible party) is

responsible for the financial position and performance of the entity, which is

communicated by a financial report. In many attestation engagements, the

responsible party may also be the or and the

. Where the financial report is the subject matter information, management

isdesignatedas the measurer/evaluator.

These are the persons expected to use the assurance practitioner’s

report. Often the intended users will be the addressees of the report by the

assurance practitioner, although there will be circumstances where there will be other identified users. Page 7 2.

The underlying subject matter of an assurance

engagement can take many forms, such as:

financial position and performance (for example, historical or prospective financial information)

non-financial performance (for example, information aimed at efficiency and

effectiveness of use of resources or level of carbon emissions)

physical characteristics (for example, capacity of a facility)

systems and processes (for example, internal controls)

behaviour (for example, corporate governance, compliance with regulation, human resource practices).

Thus, the definition of assurance engagements is very broad in its coverage and

includes both existing assurance engagements and newly evolving assurance

engagements. The framework also draws a distinction between the underlying subject

matter (such as the underlying financial position and performance of an entity) and

the report on the subject matter, which is called subject matter information (such as

the statements of financial position and income statements). . d ver se er s th 3.

Suitable criteria are the standards or benchmarks used to measure and gir ll

evaluate the underlying subject matter of an assurance engagement. Criteria are A .aila

important in the reporting of a conclusion by an assurance practitioner, as they r st u A

establish and convey to the intended user the basis on which the conclusion has been lliH-

formed. For example, the criteria used for preparing a financial report may be w Page 8 ar

International Financial Reporting Standards. The auditor then assesses cG M .8

whether the financial report is prepared in accordance with these criteria. Without 1 0 2 ©

this frame of reference any conclusion is open to individual interpretation and thgi misunderstanding. yr p o C 4.

The engagement process for an assurance

engagement is a systematic methodology requiring specialised knowledge, a skill

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21.

base and techniques for evidence gathering and evaluation to support a conclusion,

irrespective of the nature of the underlying subject matter. Underlying the process is

the assurance practitioner gathering sufficient appropriate evidence that the subject

matter information (e.g. the financial report) has been prepared in accordance with

the criteria (e.g. the accounting standards and relevant legislation) and appropriately

portrays the underlying subject matter (the financial position and performance of the

entity). The process involves the assurance practitioner and appointing party agreeing

to the terms of the engagement. Within that context, the assurance practitioner

considers materiality and the relevant components of engagement risk when planning

the engagement and collecting sufficient and appropriate evidence. 5.

The assurance practitioner presents a written conclusion

that provides a level of assurance about the underlying subject matter.

Independence and expertise: professional

judgment and professional scepticism

The assurance practitioner will seek to obtain sufficient appropriate evidence as the basis

for the provision of the level of assurance. In conjunction with the nature and form of the

underlying subject matter, criteria and procedures, the reliability of the evidence itself can

impact on the overall sufficiency and appropriateness of the evidence available.

There are a number of characteristics that make it appropriate for the profession to provide

assurance on a range of underlying subject matter. As mentioned earlier, the profession is

leveraging off its reputation as a high-quality professional provider of assurance services.

In particular, it is the independence and expertise of the assurance practitioner that are sought after.

Users derive value from the knowledge that the assurance provider has no interest in the

information other than to enhance its credibility. Assurance independence is an absence of

interests that create an unacceptable risk of material bias with respect to the quality or . d ver se

content of information that is the subject of an assurance engagement. Independence er s thgir

remains the cornerstone on which the assurance function is based, and will be discussed in llA .ailar more detail in . st u A lliH-war

The exercise of professional judgment permeates the notion of professional service. An cG M .810

assurance service engagement requires the exercise of (ASA 2 © thg

200.16/ISA 200.16), which involves the application of relevant training, knowledge and i yr p o C

experience in making informed decisions about the courses of action that are appropriate in

the circumstances of the assurance engagement. The auditor should also plan and perform the assurance engagement with , which is an attitude that

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21.

includes a questioning mind, being alert to conditions that may indicate possible

misstatement due to error or fraud, and a critical assessment of audit evidence (ASA

200.15/ISA 200.15). The provision of a professional service requires the assurance

practitioner to offer only those services that they have the competence to complete, to

exercise due care in the performance of the service, to adequately plan and supervise the

performance of the service and to obtain sufficient relevant information to provide a

reasonable basis for conclusions or recommendations. Consideration must also be given to

the appropriateness of measurement criteria and to the need to communicate the

engagement results. Users can obtain assurance from the service only if they are aware of

the assurance practitioner’s involvement.

It could be argued that professional reputation is the critical factor that adds value to the

assurance services offered by the professional accountant. As a profession, we need to

protect or even improve the profession’s brand name, thus enhancing the value of the

assurance services. A further advantage to having members of the accounting profession

provide assurance is that accountants are subject to many professional quality Page 9

controls and disciplining mechanisms, and this should provide assurance to users

about the quality of the inputs to and processes of our services, and therefore the quality of

the final report, the output. It is through this process that assurance services add value.

Whether the accounting profession is successful in becoming the most appropriate group

for providing assurance in a wide range of areas will depend on a number of factors,

including whether society sees accountants as experts in the underlying subject matter of

the assurance engagement. Financial report auditors are expert in the subject matter of

accounting information prepared in accordance with accounting standards, and have

developed processes and a reputation as high-quality assurance providers. Whether this

reputation easily transfers to other areas—such as providing assurance on environmental

reports (or, as argued in Huggins et al., 2011, greenhouse gas reports), and possibly as a . d ve

high-cost provider given the necessity of having high-level ethical standards and quality r se er s t

controls in place associated with being a member of the accounting profession—will be the h gir llA test of success. .

ailarstuA lliH-war Types of assurance engagements cG M .8102 © thgi

Reasonable, limited and agreed-upon procedures yr p o C engagements

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-07-21 22:31:21.