Preview text:

Page 89 CHAPTER 3

Ethics, independence and corporate governance LEARNING OBJECTIVES (LO) 3.1

Explain the nature and importance of professional ethics, and

describe the three main categories of ethical theory. 3.2

Outline the essence of the accounting bodies’ code of ethics. 3.3

Apply sound ethical decision-making techniques. 3.4

Explain the concept and importance of auditor independence. 3.5 Explain fee determination. 3.6

Explain the concept of corporate governance. RELEVANT GUIDANCE ASA 102

Compliance with Ethical Requirements when Performing

Audits, Reviews and Other Assurance Engagements ASA 200/ISA 200

Overall Objectives of the Independent Auditor and the

Conduct of an Audit in Accordance with Australian

(International) Auditing Standards ASQC 1/ISQC 1

Quality Control for Firms that Perform Audits and Reviews

of Financial Reports and Other Financial Information,

Other Assurance Engagements and Related Services Engagements APES 110/IFAC

Code of Ethics for Professional Accountants

Copyright © 2018. McGraw-Hill Australia. All rights reserved. APES 320 Quality Control for Firms

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46. CHAPTER OUTLINE As discussed in Chapters 1 and 2

, the auditor is a member of a time-

honoured profession, and the status of the profession and the responsibilities

that accompany this status affect the audit and assurance services function and

the structure of the profession. The independent auditor is subject to regulation

imposed by the profession and by society in general. The imposition of ethical

standards on members by a profession is one aspect of this regulation.

This chapter outlines the nature and importance of ethics, and the

responsibilities imposed on auditors by the profession through the code of

professional ethics. One fundamental ethical requirement for an auditor is

independence. This chapter explains the concept of independence and how it is

supported by legislation and the ethical rules. The major threats to auditor

independence are explained. Also discussed is the concept of corporate

governance and the part played by audit committees in this function.

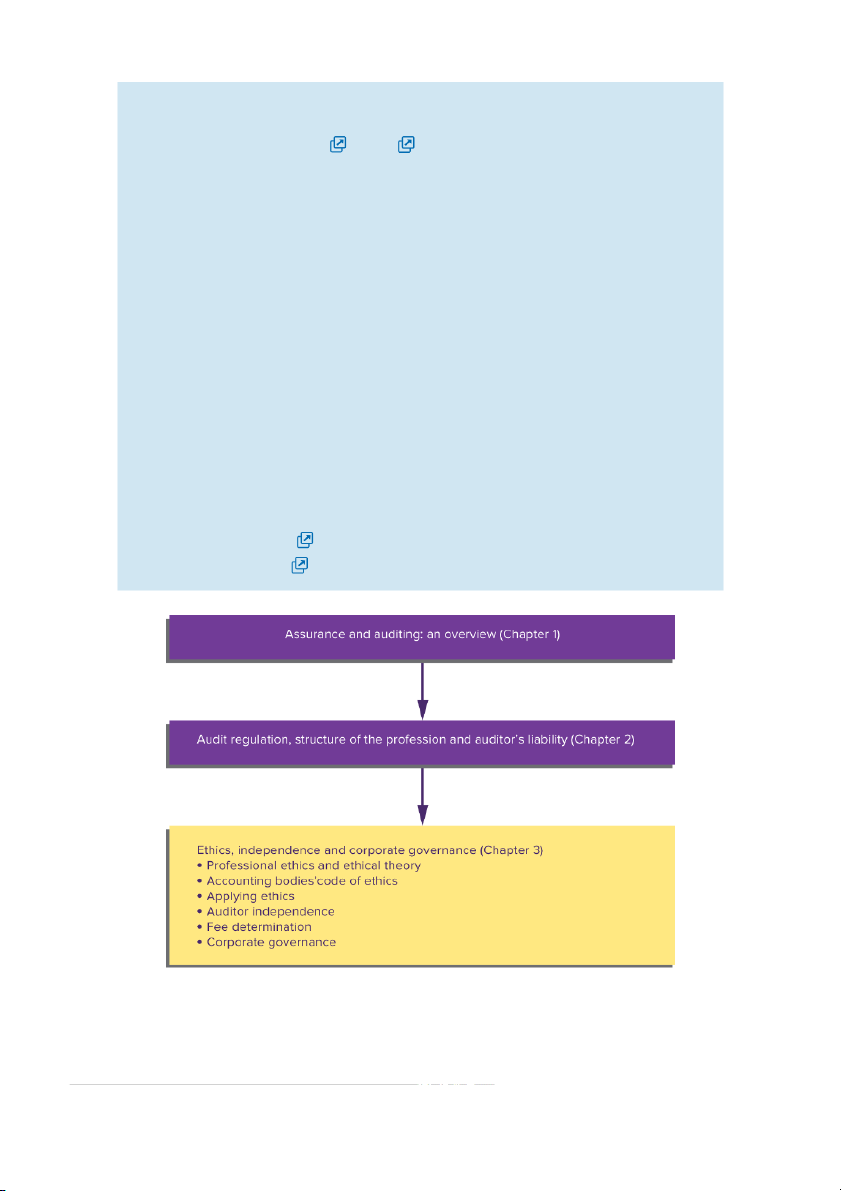

How this chapter fits into the overall auditing and assurance profession is illustrated in Figure 3.1

, which is an expansion of part of the overall flowchart provided in Chapter 1 .

Copyright © 2018. McGraw-Hill Australia. All rights reserved.

FIGURE 3.1 Flowchart of auditing and assurance profession

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46. Page 90

LO 3.1 Professional ethics and ethical theory

The nature and importance of professional ethics Ethics

are concerned with the requirements for the general wellbeing, prosperity, health

and happiness of people, and with things that promote or prevent them.

Paragraph 3(f) of the Supplemental Royal Charter of Chartered Accountants Australia and

New Zealand (Chartered Accountants ANZ) states that one of its principal objects is to do

all things that may advance the profession of accountancy, whether in relation to the

practices of public accountants or in relation to industry, commerce, education or the

public service. Similarly, paragraph 3(1) of the constitution of CPA Australia establishes

one of its objects as protecting, supporting and advancing the status, character and interests

of the accountancy profession generally. The Institute of Public Accountants (IPA) has

similar objectives. Community wellbeing includes the flourishing of business and industry.

The objectives of the accounting bodies support an environment of personal and corporate

integrity that promotes community wellbeing. This necessarily involves defining what is right and what is wrong.

Chartered Accountants ANZ’s Royal Charter, CPA Australia’s constitution and the IPA’s

constitution give these bodies the power to prescribe high standards of practice and

professional conduct for their members, and to prescribe disciplinary procedures and sanctions.

In practice, ethics require both knowledge of moral principles and skill in applying them to

problems and decisions. In addition, sound ethical practice presupposes the development in

individuals and society of the virtues or good habits that ensure the moral health of the community.

Establishing codes of ethics and disciplinary rules does not necessarily create an ethical

culture in an organisation or business, nor does it ensure the moral integrity of its

individual members. It is necessary to promote not only competence in ethics but also the

personal qualities of responsibility and moral conscientiousness. Codes of ethics, rules,

regulations and laws do not have meaning or moral legitimacy in themselves. Rather, their

Copyright © 2018. McGraw-Hill Australia. All rights reserved.

authority and legitimacy depend on whether they are perceived as helping to promote

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46.

people’s wellbeing. If rules are considered to be unjust, discriminatory or oppressive,

people are likely to disregard them or demand they be changed.

APES 110 indicates that the Code of Ethics for Professional Accountants does not Page 91

cover all aspects of ethical conduct and that members are expected to comply with

the spirit as well as the letter of the rules. They recognise that ethics are principally

attitudes of mind rather than compliance with written rules of conduct.

Society is governed by rules, regulations and laws. From an auditing viewpoint, this tends

to place the focus on ‘black letter’ law. However, it needs to be remembered that it is

always possible to question whether a rule is a good rule. Value judgments need to be made

as to whether rules are fair, whether they respect the rights of all parties and whether they

protect those parties who are unable to defend their rights. Sound statutory law must be

based on and consistent with common law and natural justice if it is to promote human wellbeing. Ethical theory

There are three main categories of ethical theory that will be discussed in this chapter:

teleological ethics, deontological ethics and virtue ethics. Teleological ethics Teleological ethics

are also called consequential ethics because they deal with the

consequences or outcomes of actions. Generally, if the benefits of a proposed action

outweigh the costs, then the decision is considered morally correct. The most important

theory of teleological ethics is utilitarianism.

Jeremy Bentham (1784–1832) and John Stuart Mill (1806–73) are generally acknowledged

as having developed the theory of utilitarianism

, which states that ethical decision

making should maximise the greatest good for the greatest number. This involves an

assessment of costs and benefits, not only in economic terms but also in terms of human

costs and benefits. Therefore, it involves a value judgment and needs to consider all the

stakeholders who will be affected by a decision. The outcomes are measured both in

economic terms and in psychological terms, such as pain and happiness. Therefore,

Copyright © 2018. McGraw-Hill Australia. All rights reserved.

measuring and assigning a numeric value to the consequences of an action is often difficult.

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46. Deontological ethics Deontological ethics

are based on duties and rights. Duties are obligations and are

actions that a person is expected to perform, while rights are entitlements and are actions

that a person expects of others. These duties and rights are set down in rules that must be

followed regardless of the consequences. Hence, deontological ethics are also sometimes

called non-consequential ethics. Deontological ethics are particularly important to auditors

in understanding their duties based on the ethical rules of the accounting bodies.

Immanuel Kant (1724–1804) placed high value on personal rights and personal moral

autonomy, and the basis of his ethical theory was the principle of respect for persons. This

acknowledges the intrinsic value of all persons and recognises that we should not use

people to achieve our own ends. Further, we should recognise a duty of care to others, as

expressed in the golden rule or principle of reciprocity: ‘do unto others as you would have them do unto you’.

This rule leads to the principle of beneficence, which advocates that we should do good to

others rather than harm. Kant suggested the categorical imperative as a universal ethical

law. This means that, when considering the validity of a rule, we need to consider whether

we would be happy to have this action applied in all similar circumstances regardless of the

consequences. This leads to the need for the principle of justice.

John Rawls (1957) argued that the fundamental idea underlying the concept of justice is

that of fairness. He argued that there are two principles that serve as the basis of justice and fairness:

The first principle is that each person participating in a practice,

or affected by it, has an equal right to the most extensive liberty

compatible with a like liberty for all; and the second is that

inequalities are arbitrary unless it is reasonable to expect that they

will work out for everyone’s advantage and unless the offices to

which they attach, or from which they may be gained, are open to all.

Thus, Rawls argued that ethical rules should seek equality and the maximum Page 92

degree of liberty that does not conflict with the liberty of others or increase

inequalities or disadvantage to others.

Copyright © 2018. McGraw-Hill Australia. All rights reserved. Virtue ethics

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46. Virtue ethics

, which date back to Aristotle, are concerned primarily with integrity,

which is an essential characteristic of an auditor. Virtue ethics focus on the person

undertaking the action. Virtues are personal qualities that enable us to do what is ethically

desirable, and generally include traits of character such as courage, fairness, honesty,

integrity, loyalty, courtesy and fidelity. Virtue ethics emphasise what makes up a morally

good person, but do not necessarily make it clearer what should be done to solve an ethical conflict.

The relevance of these three ethical theories to the accounting bodies’ code of ethics and to

ethical decision making by auditors will be discussed later in this chapter. QUICK REVIEW

1. The accounting bodies require their members to behave ethically.

2. Behaving ethically requires knowledge of moral principles and decision- making skills.

3. Teleological ethics are based on ethical outcomes.

4. Deontological ethics are based on ethical duties and rights.

5. Virtue ethics are based on personal ethical qualities.

Copyright © 2018. McGraw-Hill Australia. All rights reserved.

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46.

LO 3.2 Accounting bodies’ code of ethics

APES 110 Code of Ethics for Professional Accountants sets out the main ethical pronounc ements

for members of Chartered Accountants ANZ, CPA Australia and the IPA. ASA

200.14 (ISA 200.14) requires that auditors comply with relevant ethical requirements.

Further, ASA 102.5 and A1–A7 specifically require the auditor to comply with APES 110.

The code consists of the following three sections:

1. Part A: General Application of the Code Sections 100–150 set out the fundamental

principles of professional ethics and provide a conceptual framework for applying these principles.

2. Part B: Members in Public Practice Sections 200–291 illustrate how the conceptual

framework is to be applied to specific situations in public practice.

3. Part C: Members in Business Sections 300–350 illustrate how the conceptual framework

is to be applied to specific situations in business.

The ethical rules play an important part in an auditor’s behaviour. The written code of

appropriate professional conduct is designed to enable members to arrive at the proper

conclusion when making ethical decisions. As a result, the ethical rules comment upon

different types of relationships faced by auditors and spell out some of the auditor’s

responsibilities. The preface to APES 110 states that compliance with the code is mandatory for all members.

There are also a number of APES standards, not all of which are relevant to auditors but

which are mandatory for members of the three accounting bodies. In general, these

statements seek to promote the fundamental principle of ‘competence’.

The APES 200 series is applicable to all members of the accounting bodies and includes: APES 205

Conformity with Accounting Standards APES 210

Conformity with Auditing and Assurance Standards APES 215 Forensic Accounting Services APES 220 Taxation Services APES 225 Valuation Services

Copyright © 2018. McGraw-Hill Australia. All rights reserved. APES 230 Financial Planning Services.

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46. Page 93

The APES 300 series is applicable to members of the accounting bodies in public practice and includes: APES 305 Terms of Engagement APES Dealing with Client Monies 310 APES

Compilation of Financial Information 315 APES Quality Control for Firms 320 APES Risk Management for Firms 325 APES Insolvency Services 330 APES

Reporting on Prospective Financial Information Included in a 345 Disclosure Document APES

Participation by Members in Public Practice in Due Diligence 350

Committees in Connection with a Public Document

The purpose of the code of ethics A code of ethics

is a formal and systematic statement of rules, principles, regulations or

laws developed by a community to promote its wellbeing and to exclude or punish any

undermining behaviour. Therefore, a code of ethics may serve several purposes. It may:

make explicit those values that may be implicitly required (for example, the underlying

core values or principles in sections 100–150 of APES 110, which are discussed later in this chapter)

indicate how members should act towards one another (for example, the responsibilities

to professional colleagues exhibited through the protocol to be followed when

superseding another auditor (section 210 of APES 110) and permissible forms of

advertising (section 250 of APES 110), both of which are discussed in Chapter 5 .)

Copyright © 2018. McGraw-Hill Australia. All rights reserved.

provide an objective basis for sanctions against people who violate the rules (for example,

disciplinary action under Chartered Accountants ANZ’s Supplemental Royal Charter,

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46.

CPA Australia’s constitution and the IPA’s constitution, discussed in Chapter 2 , or by

the Australian Securities and Investments Commission (ASIC)). A member’s behaviour

can be judged, in part, by reference to the rules laid down in APES 110. An established

code of ethics is one mechanism of self-regulation.

In addition, APES 110 communicates the profession’s responsible attitude of

accountability to the community at large.

Like many professional codes, the ethical rules of the accounting bodies endeavour to

promote standards of competence, proficiency and personal moral integrity in their

members. These qualities are similar to those that Thomson et al. (1976) referred to as

Aristotle’s intellectual and moral virtues. Aristotle’s intellectual virtues included science

(knowledge), techne (practical skill and competence, intelligence, judgment, understanding,

persistence and resourcefulness) and wisdom. His moral virtues included courage (loyalty

and integrity), temperance (discipline, friendliness, generosity, magnanimity,

communication and social skills) and justice. Thomson et al. indicated that these virtues

can be depicted as an arch, with intellectual values on one side and moral virtues on the

other. The keystone holding them together is the virtue of prudence or acquired practical wisdom.

However, written codes of conduct should not be viewed as the panacea for the profession’s

ethical problems. As mentioned previously, these codes do not by themselves make people behave ethically. The virtues of an auditor

In line with the discussion of the professional status of an auditor in Chapter 2 , APES

110 section 100.1 states that a distinguishing mark of the audit profession is its acceptance

of the responsibility to act in the public interest

. The public interest is defined as the

collective wellbeing of the community of people that the members serve. Therefore, the

auditing profession’s ‘public’ consists of clients, credit providers, governments, employers,

employees, investors, the business and financial community and others who rely on the

objectivity and integrity of the auditor. The public interest principle recognises that

conflicts occur between the various stakeholder interests and that when such conflicts

occur, the auditor’s primary responsibility is to the public interest, not to himself or herself

or to the client. Rather, the auditor is required to advance the interests of their Page 94

client, provided that it does not conflict with the obligation to safeguard the public

Copyright © 2018. McGraw-Hill Australia. All rights reserved. interest.

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46.

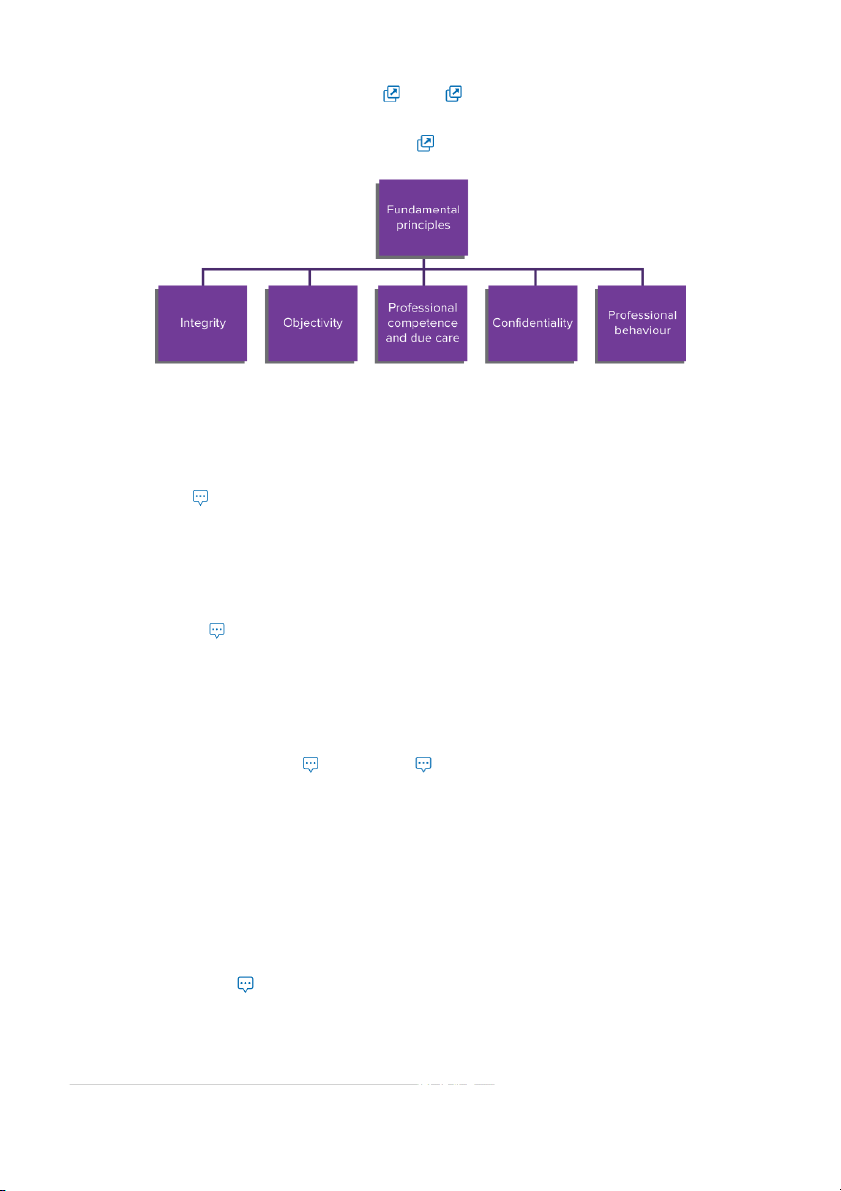

Further to the discussion in Chapters 1 and 2

regarding the fundamental ethical

principles that an auditor must follow, APES 110 section 100.5 sets out the following five

fundamental principles, shown in Figure 3.2 , that apply to all members.

FIGURE 3.2 Fundamental principles

These fundamental principles are discussed in more detail in sections 110–150 of APES 110: 1. Integrity

Auditors should act with consistency, treating like cases in a like manner.

Honesty is an integral part of this value. The principle of integrity therefore imposes an

obligation on an auditor to be straightforward and honest in all professional and business

relationships and requires fair dealing and truthfulness. As a result, in accordance with

APES 110 section 110.2, an auditor should not be associated with any reports or other

communications that are false, misleading or recklessly prepared.Integrity is supported

by the ethical principle of respect for persons. 2. Objectivity

In accordance with APES 110 section 120, auditors must be fair and must

not allow bias, conflict of interest or the undue influence of others to override their

objectivity. They need to maintain an impartial attitude and not represent vested interests

when auditing a financial report. Therefore, relationships that bias or unduly influence

the auditor’s professional judgment should be avoided. As fairness is an important

behavioural implication of this value, objectivity can be justified by the ethical principle of justice. 3. Professional competence and due care

Section 130.1 of APES 110 indicates that

auditors have a duty to attain and maintain their level of professional competence and

should only undertake work that they can expect to complete with professional

competence and due care in accordance with applicable technical and professional

standards. Auditors have a duty to maintain their level of competence throughout their

professional career through continuing professional development. Clearly, a client’s

interests cannot be adequately served by auditors who do not possess the necessary skills

for the tasks that they undertake. This requires appropriate training and supervision.

Accepting work for which the auditor is not competent could lead to damage to the client.

The maintenance of high standards of technical proficiency is designed to protect clients,

and so the value of competence and due care is supported by the ethical principle of beneficence.

Copyright © 2018. McGraw-Hill Australia. All rights reserved. 4. Confidentiality

Auditors hold positions of trust and have access to many valuable and

private pieces of information in the course of their work. Section 140.1 of APES 110

indicates that they should respect the confidentiality of information obtained during the

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46.

course of their work and should not disclose such information to a third party without

authority or unless there is a legal or professional duty that is not prohibited by law to do

so, as outlined in section 140.7. However, as discussed in Auditing in the global news 3.1

, as a result of international developments and amendments to APES 110 in

September 2017, to include a new section 225, ‘Responding to non-compliance with laws

and regulations’ (NOCLAR), auditors now need to consider their reporting Page 95

obligations if they uncover or suspect illegal acts such as fraud, corruption,

bribery or money laundering during the course of their professional work. APES 110 now

permits accountants to set aside the principle of confidentiality where such illegal acts are

suspected. Where an auditor is considering disclosing confidential information of a client

without the client’s consent, on the basis that that disclosure is required by law or

professional requirements, they are strongly advised under section AUST 140.7.1 to first

obtain legal advice. This duty to protect the interests of clients means that confidentiality

reflects the ethical principle of beneficence. 5. Professional behaviour

Section 150.1 of APES 110 indicates that auditors should

comply with relevant legislation and conduct themselves in a manner consistent with the

good reputation of their profession and refrain from any conduct that could bring

discredit to it. Agood reputation is fundamental to the ability of the profession to

continue to enjoy its rights and privileges. Therefore, in addition to their duty to the

public interest and to their clients, auditors have a duty to the profession and must act in a

way that promotes the good reputation of the profession. Section 150.2 of APES 110

indicates that in marketing and promoting themselves auditors must not bring the

profession into disrepute by making exaggerated claims or by disparaging competitors.

Consequently, the value of professional behaviour can be justified by reference to the

ethical principles of beneficence and respect for persons.

Copyright © 2018. McGraw-Hill Australia. All rights reserved.

Gay, Grant E., and Roger Simnett. Auditing and Assurance Services in Australia, McGraw-Hill Australia, 2018. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cdu/detail.action?docID=5729228.

Created from cdu on 2020-08-04 20:19:46.