Preview text:

lOMoAR cPSD| 58511332 Test 2:

Câu 1-5 Based on Disneyland, answer the following question

1. What are the differences between corporate strategy and business strategy?

3. What are the differences between strategic alliances and joint venture

4. When should a company use related diversification and unrelated diversification?

5. What are the differences between vertical integration and horizontal integration?

Câu 6. 3 chiến lược gì đó quên rồi nhưng đáp án có vẻ là Think global, act global; Think local act

local; Think global, act local xong giải thích, đưa ví dụ

Câu 7: The key takeaway of Huy Phong lawsuit (example mà thầy nói trên lớp)

Note: Thầy yêu cầu chọn 5 trên 7 câu để làm ANSWER

Q1: Differences Between Corporate Strategy and Business Strategy through Disneyland

- Corporate Strategy: Focuses on where the firm should compete, such as industries, markets, or geographies. From the video:

+ “When asking the Corporate Strategy question ‘Where should the firm compete?’ we

are also asking: ‘Should the firm expand into new markets by offering new products and services?’”

+ Disney’s corporate strategy involved expanding into new markets by creating the

theme park Disneyland, moving beyond animated films and TV shows.

+ Additionally, Disney expanded geographically by opening Disneyland parks in

Tokyo, Paris, Hong Kong, and Shanghai, adapting the parks to local cultures.

- Business Strategy: Focuses on how the firm should compete within a specific industry. From the text:

+ Disney’s business strategy for Disneyland involved leveraging its competitive

advantage in storytelling and intellectual property:

+ “Disney can now take advantage of Star Wars characters across its corporate

platform… it can showcase the most important of these characters in its theme parks.”

+ By integrating characters like Marvel heroes and Star Wars, Disney created a unique,

differentiated experience that attracts millions of visitors worldwide.

=> Key Difference: Corporate strategy sets the direction (e.g., entering the theme park industry and

global expansion), while business strategy determines how to win within that industry (e.g., creating

differentiated customer experiences based on storytelling and iconic characters).

Q3: Differences Between Strategic Alliances and Joint Ventures through Disney - Strategic Alliances:

+ Definition: A collaboration between two or more firms to achieve mutual goals

without creating a new entity. lOMoAR cPSD| 58511332

+ Key Features: Partners remain independent and share resources without merging operations. +

From the text: Disney’s strategic alliance is exemplified in Tokyo Disneyland, where

Disney “licensed the theme park to a local operator.” This allowed Disney to expand

geographically while retaining brand control and avoiding direct operational involvement. - Joint Ventures:

+ Definition: A formal partnership where two or more firms create a jointly owned entity. + Key Features:

(1) Shared ownership, management, profits, and risks.

(2) Typically involves long-term commitments.

+ From the text: Disney formed joint ventures for Disneyland Paris and Hong Kong

Disneyland. These parks required Disney to partner with local governments or

investors to establish and manage the parks. For example, “Disney managers had to

carefully consider how to adapt the theme park experience for these different

consumers,” which highlights the deeper involvement and shared management

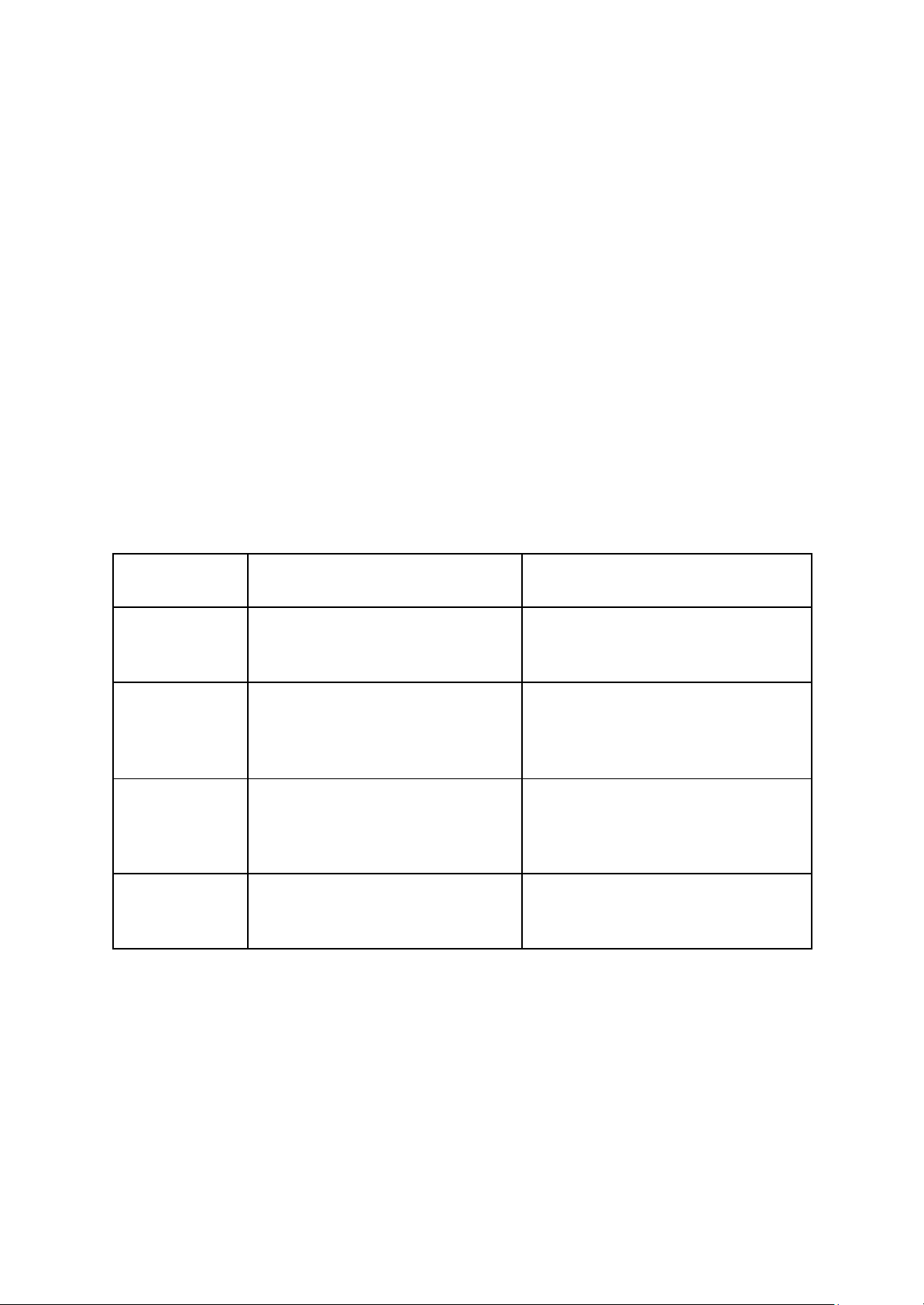

responsibilities in joint ventures. => Key Differences Aspect Strategic Alliance Joint Venture Ownership

No shared ownership; Disney retains Shared ownership with local brand and content control. governments or investors. Commitment

Licensing agreements like in Tokyo

Creation of a new entity, such as

Disneyland; less operational risk.

Disneyland Paris, requiring more resources. Control Disney’s partners operate Disney shares management and

independently while licensing its

operational decisions with its partners. brand. Example from

“Licensed the theme park to a local

Joint ventures for Disneyland Paris and Text operator” in Tokyo. Hong Kong.

This shows how Disney tailors its expansion strategy depending on the market, balancing risk and control.

Q4: When Should a Company Use Related Diversification and Unrelated Diversification? 1. Related Diversification

- Definition: Expanding into industries or markets that are closely linked to the company’s core

competencies or existing business. - When to Use:

+ When the company wants to leverage its existing resources, capabilities, or

competitive advantages in a similar industry. lOMoAR cPSD| 58511332

+ When the company can create synergies between its current operations and new ventures.

- From the Text: Disney used related diversification when it expanded from animated shorts

into feature-length films, live-action films, and theme parks.

Example: “Disney expanded into feature-length animated films and live-action films,” leveraging its

storytelling and animation expertise.Additionally, Disney extended into theme parks like Disneyland,

where its characters and stories provided the foundation for attractions, creating synergies across its

media and entertainment platforms.This approach allowed Disney to strengthen its core competitive

advantage while entering related markets. 2. Unrelated Diversification

- Definition: Expanding into industries or markets that are not directly linked to the company’s

current operations or expertise. - When to Use:

+ When the company wants to reduce overall risk by spreading its investments across unrelated industries.

+ When there are attractive opportunities in a profitable market outside the company’s core industry.

- From the Text: Disney does not primarily pursue unrelated diversification; most of its

expansion builds on its core competencies. However, its acquisitions of Marvel (2009) and

LucasFilm (2012) illustrate a partial move toward unrelated diversification:

Example: “Bringing inside the firm critical suppliers with characters and stories that Disney can leverage.”

While Marvel and LucasFilm were not part of Disney’s original expertise in animation, they

complemented its broader storytelling platform, blurring the line between related and unrelated diversification.

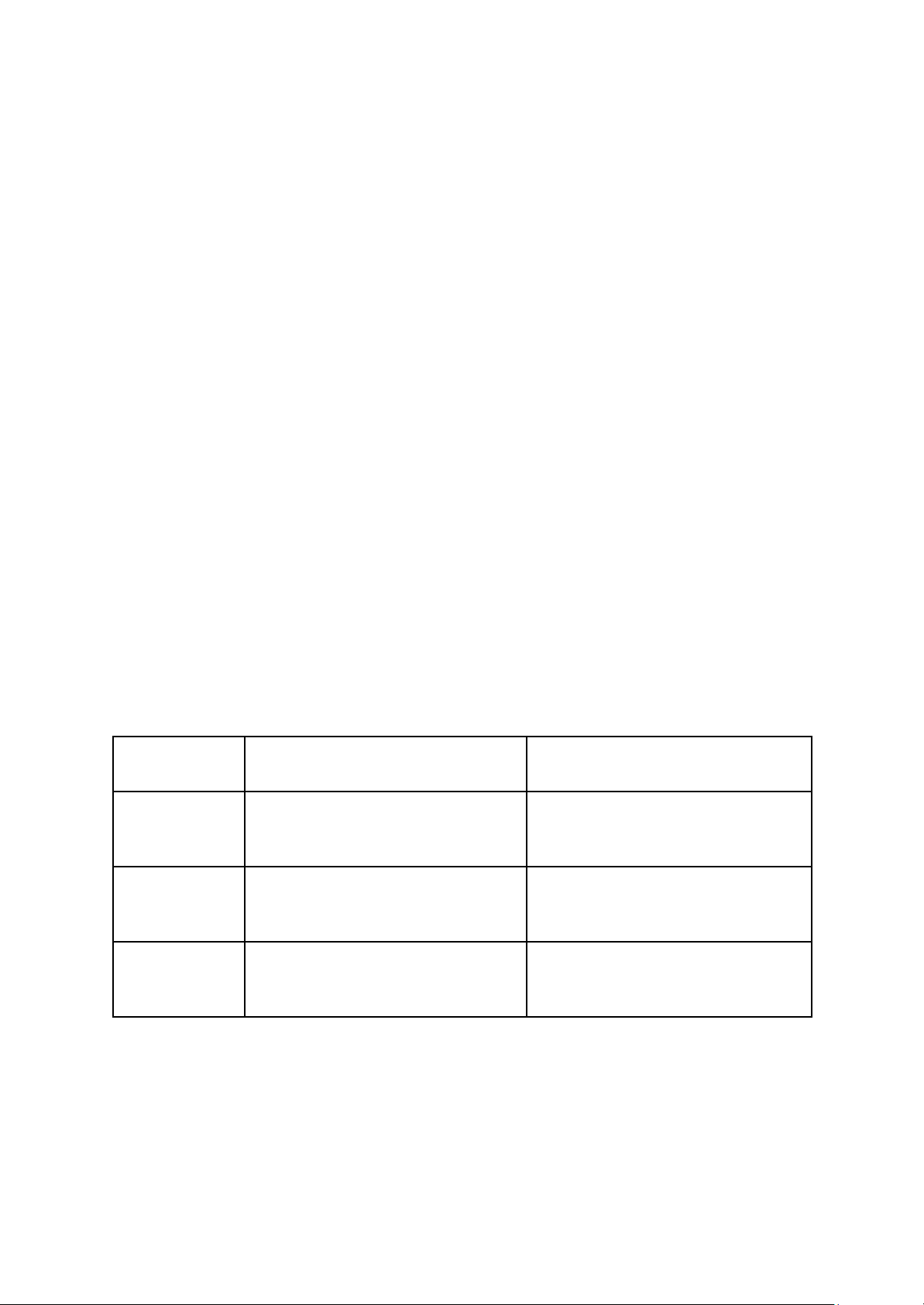

=> Key Difference Between Related and Unrelated Diversification Aspect Related Diversification Unrelated Diversification Definition

Expanding into industries linked to the Expanding into industries outside the company’s core business. company’s expertise. When to Use

To leverage core competencies and

To diversify risk and enter high- create synergies. growth or profitable markets. Example from

Feature films, live-action films, and

Marvel and LucasFilm acquisitions for Disney

theme parks (“Disneyland”). broader storytelling assets.

By aligning its strategies with the type of diversification, Disney maximizes synergies while balancing risk and reward.

Q5: Differences Between Vertical Integration and Horizontal Integration (disney) 1. Vertical Integration

- Definition: When a company expands along the value chain, taking control of activities

previously handled by suppliers (backward integration) or customers (forward integration). lOMoAR cPSD| 58511332 - Key Features:

+ Involves gaining control over production, distribution, or other stages of the supply chain.

+ Helps reduce dependency on external partners and create synergies across operations.

- From the Text: Disney's acquisition of ABC in 1995 is an example of vertical integration, as it

brought its television partner in-house to secure control over distribution.

+ Example: “As Disney became more reliant on television revenue, it moved to acquire

its former television partner ABC.”

Another example is Disney’s acquisition of Marvel (2009) and LucasFilm (2012), which brought

“critical suppliers with characters and stories that Disney can leverage” into its operations. These

acquisitions allowed Disney to use these assets across films, TV, merchandise, and theme parks,

reducing reliance on external content providers. 2. Horizontal Integration

- Definition: When a company expands by acquiring or merging with competitors or businesses

in the same level of the value chain. - Key Features:

+ Focuses on increasing market share, reducing competition, or expanding product

offerings within the same industry.

- From the Text: Disney expanded horizontally when it moved from animated shorts to feature-

length films and live-action films. These expansions were in the same content creation

industry but allowed Disney to broaden its offerings.

+ Example: “Disney expanded into feature-length animated films and live-action

films,” which helped it dominate the film production industry by covering multiple formats.

Disney's acquisition of Pixar could also be seen as horizontal integration, as both companies operated

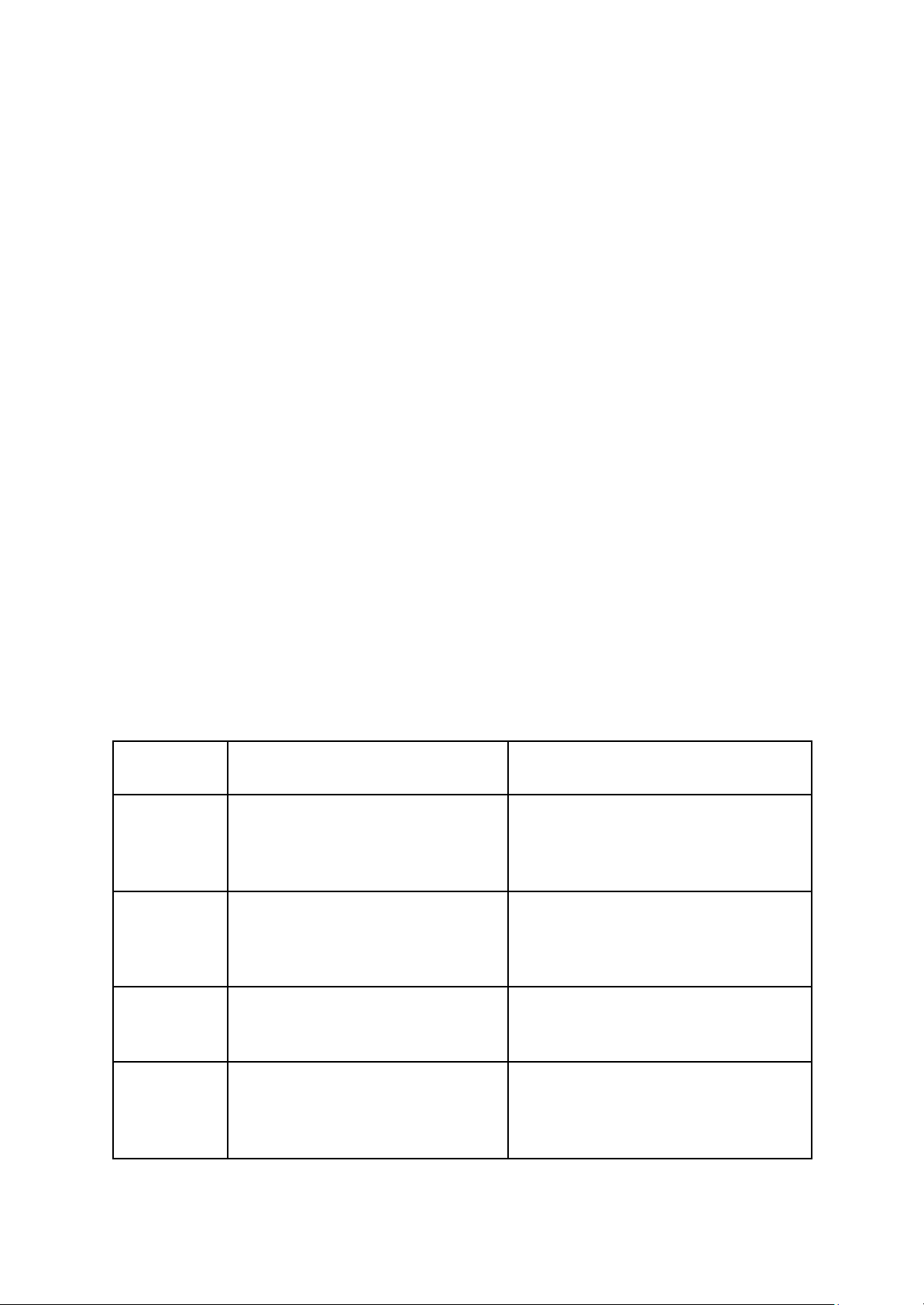

in the animation industry, allowing Disney to strengthen its market position in this area. => Key Differences Aspect Vertical Integration Horizontal Integration Definition

Expanding up or down the supply

Expanding within the same level of the

chain (e.g., supplier or distributor). supply chain (e.g., acquiring competitors). Purpose

To gain control over production,

To increase market share, reduce

distribution, or critical resources.

competition, or expand product offerings. Disney

- Acquisition of ABC for control over

- Moving from animated shorts to feature Examples TV distribution. films and live-action films. - Acquisitions of Marvel and

- Acquisition of Pixar to strengthen

position in the animation industry.

LucasFilm to secure critical content suppliers. lOMoAR cPSD| 58511332

By combining vertical integration to secure key resources (e.g., content providers) and horizontal

integration to expand within entertainment, Disney has built a comprehensive and dominant presence

in the media and entertainment industry.

Q6: What are the three global strategies a company can use to expand internationally, and how

does Disney exemplify each? (đoán)

1. Think Global, Act Global (Global strategy)

This strategy involves standardizing products and services across markets with minimal adaptation,

maintaining a consistent global brand. ● Low local responsiveness.

● Centralized decision-making.

● High standardization of products and operations.

- Disney Example: Disney applies this strategy in its media networks and branded merchandise,

ensuring that Mickey Mouse, Marvel superheroes, and Star Wars characters are recognized worldwide.

- From the Text: “Disney can now take advantage of Star Wars characters across its corporate

platform... creating new TV shows, movies, and merchandise based on these characters.” By

keeping these global franchises consistent, Disney strengthens its brand worldwide, appealing to a universal audience.

2. Think Local, Act Local (Multidomestic strategy)

This strategy focuses on tailoring products and services to meet the specific needs and preferences of local markets.

● High local responsiveness.

● Decentralized decision-making

● Limited standardization across markets.

- Disney Example: Disney adapted its theme parks in Tokyo, Paris, Hong Kong, and Shanghai

to align with local cultures and tastes.

- From the Text: “Disney’s managers had to carefully consider how to adapt the theme park

experience for these different consumers.”

For example, Tokyo Disneyland includes food and attractions that appeal specifically to Japanese

visitors, while Disneyland Paris incorporates European design and entertainment preferences.

3. Think Global, Act Local (Transnational strategy)

This strategy combines global consistency with local adaptation, balancing efficiency and responsiveness.

● Balances standardization and customization.

● Integrated operations across global and local levels.

● Focus on knowledge sharing and innovation. ●

- Disney Example: Disney uses its globally recognized franchises (e.g., Marvel and Star Wars)

but integrates local elements within its theme parks or media productions to appeal to regional markets. lOMoAR cPSD| 58511332

- From the Text: Disney maintained the global appeal of its franchises but adapted park

attractions: “To be successful in these different geographies, Disney’s managers had to

carefully consider how to adapt.”

For instance, in Shanghai Disneyland, the park features attractions designed specifically for Chinese

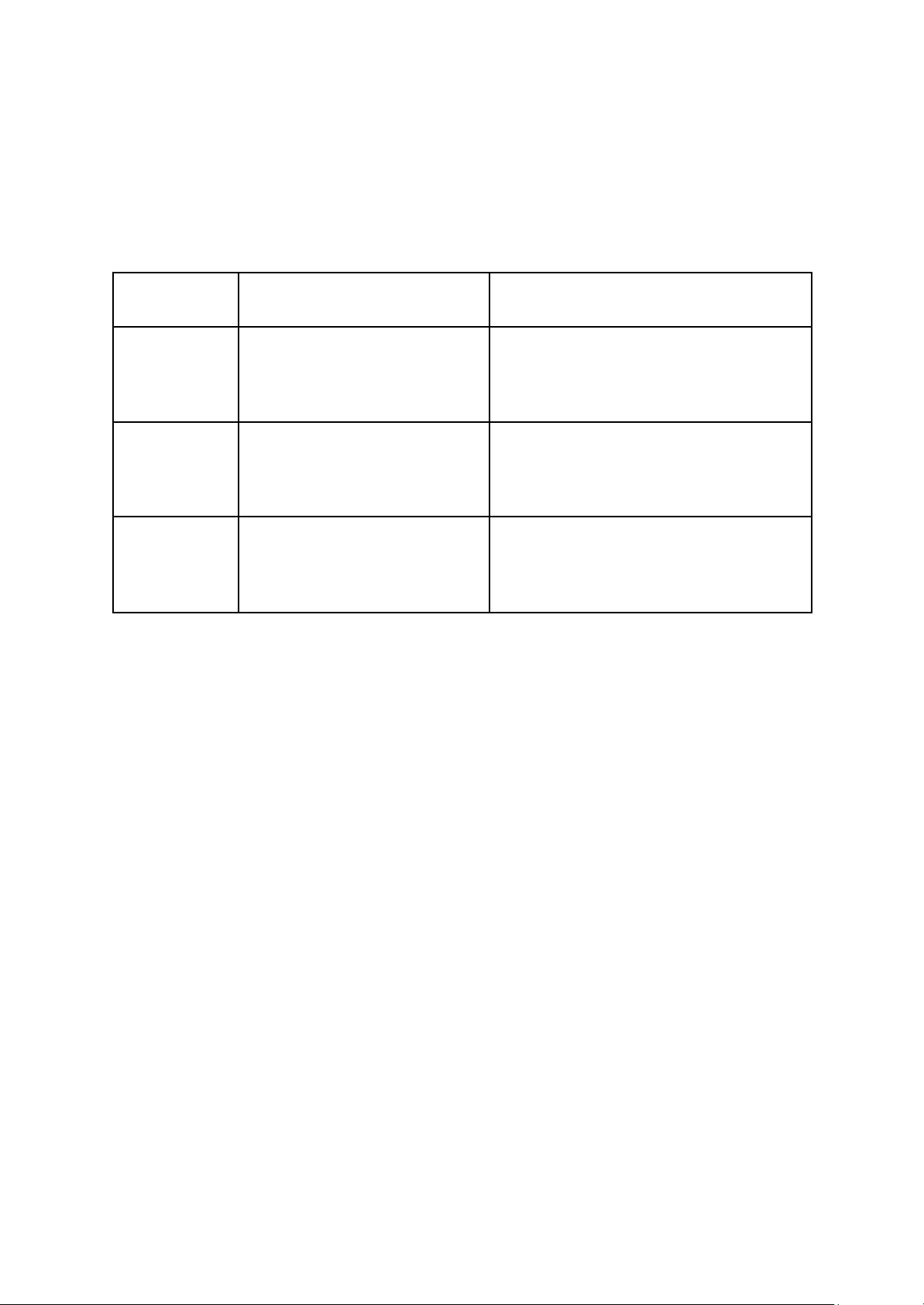

audiences, such as the "Garden of the Twelve Friends," which integrates the Chinese zodiac. => Key Differences Strategy Definition Disney Example Think Global,

Standardized products/services

Global franchises like Mickey Mouse and Act Global

globally with minimal changes.

Star Wars with consistent branding and content. Think Local,

Tailoring offerings entirely to fit

Adapting Tokyo Disneyland and Disneyland Act Local local markets.

Paris to cultural preferences and regional aesthetics. Think Global, Combining global consistency

Shanghai Disneyland blending Disney’s Act Local with localized adaptation.

franchises with local cultural elements like the Chinese zodiac.

By employing all three strategies strategically, Disney achieves a balance between global efficiency

and local responsiveness, ensuring its success in diverse international markets.

Q7: Briefly explain the 3 pillars of CSI (Corporate Social Investment) and how they are good for businesses

The three pillars of Corporate Social Investment (CSI) are environmental, social, and economic

contributions. These pillars guide businesses in creating sustainable value for both society and the

organization. A company is measured by these three dimensions of performance: economic (profit),

social (people), and environmental (planet). The goal is to achieve excellence in all three of these

performance dimensions Here's a brief explanation of each and how they benefit businesses: 1. Environmental Contribution

- Focus: Implementing sustainable practices to minimize environmental impact, such as

reducing carbon footprints, conserving resources, and managing waste effectively. Adopting

eco-friendly practices can often be more cost-effective, drawing in and benefiting consumers

who prefer environmentally conscious products and services. - Benefits for Businesses:

+ Enhances brand reputation among eco-conscious consumers.

+ Reduces operational costs through energy efficiency and waste reduction.

+ Mitigates risks associated with environmental regulations and potential liabilities. 2. Social Contribution

- Focus: Investing in community development, improving employee welfare, and ensuring fair

labor practices to enhance societal well-being. It underscores the ethical responsibility of lOMoAR cPSD| 58511332

businesses to ensure that their operations have a positive, empowering impact on society at large. - Benefits for Businesses:

+ Builds strong relationships with communities and stakeholders.

+ Attracts and retains talent by fostering a positive workplace culture.

+ Enhances customer loyalty through ethical business practices. 3. Economic Contribution

- Focus: Contributing to economic development by creating jobs, supporting local businesses,

and ensuring long-term profitability. It delves into the financial stability and long-term

viability of a business or initiative. At its core, for an entity to be sustainable, it must achieve

and maintain profitability, ensuring that it can continue to operate and contribute value to its stakeholders. - Benefits for Businesses:

+ Drives sustainable business growth and profitability.

+ Strengthens the economy, leading to a more robust market for products and services.

+ Attracts investors seeking companies with sustainable and ethical practices.

By integrating these pillars into their strategies, businesses can achieve a balance between

profitability and social responsibility, leading to long-term success and a positive impact on society.