Preview text:

lOMoARcPSD| 38777299 lOMoARcPSD| 38777299

Question Personal in charge 1 Nguyễn Hồng Thắm 2 Nguyễn Hồng Thắm 3

Nguyễn Thị Quỳnh Chi Nguyễn Thị Hồng Ngọc 4 Phạm Phương Hoa Đàm Thị Minh Hương Nguyễn Thị Nguyệt

Wilkerson Company Case study

The decline in our profits has become intolerable. The severe cutting in pumps has

dropped our pre-tax margin to less than 3%, far below our historical 10% margins.

Fortunately, our competitors are overlooking the opportunities for profit in flow controllers.

Our recent 10% price increase in that line has been implemented without losing any business.

Robert Parker, president of the Wilkerson Company, was discussing operating results

in the latest month with Peggy Knight, his controller, and John Scott, his manufacturing

manager. Their competitors had been reducing prices on pumps, Wilkerson’s major product

line. Parker had seen no alternative but to match the reduced prices to maintain volume. But

the price cuts had led to declining company profits, especially in the pump line (summary

operating results for the previous month, March 2000, are shown in Exhibits 1 and 2).

Wilkerson supplied products to manufacturers of water purification equipment. The

company had started with a unique design for valves that it could produce to tolerances that

were better than any in the industry. Parker quickly established a loyal customer base because

of the high quality of its manufactured valves. He and Scott realized that Wilkerson's existing

labor skills and machining equipment could also be used to produce pumps and flow

controllers, products that were also purchased by its customers. They soon established a

major presence in the high-volume pump product line and the more customized flow controller line.

Wilkerson's production process started with the purchase of semi-finished

components from several suppliers. It machined these parts to the required tolerances and

assembled them in the company's modern manufacturing facility. The same equipment and

labor were used for all three product lines, and production runs were scheduled to match

customer shipping requirements. Suppliers and customers had agreed to just-in-time

deliveries, and products were packed and shipped as completed.

Valves were produced by assembling four different machined components. Scott had

designed machines that held components in fixtures so that they could be machined

automatically. The valves were standard products and could be produced and shipped in

large lots. Although Scott felt several competitors could now match Parker's quality in

valves, none had tried to gain market share by cutting price, and gross margins had been maintained at a standard 35%. lOMoARcPSD| 38777299

The manufacturing process for pumps was practically identical to that for valves.

Five components were machined and then assembled into the final product. The pumps were

shipped to industrial product distributors after assembly. Recently, it seemed as if each

month brought new reports of reduced prices for pumps. Wilkerson had matched the lower

prices so that it would not give up its place as a major pump supplier. Gross margins on

pump sales in the latest month had fallen below 20%, well below the company's planned gross margin of 35%.

Flow controllers were devices that controlled the rate and direction of flow of

chemicals. They required more components and more labor, than pumps or valves, for each

finished unit. Also, there was much more variety in the types of flow controllers used in

industry, so many more production runs and shipments were performed for this product line

than for valves. Wilkerson had recently raised flow controller prices by more than 10% with no apparent effect on demand.

Wilkerson had always used a simple cost accounting system. Each unit of product

was charged for direct material and labor cost. Material cost was based on the prices paid

for components under annual purchasing agreements. Labor rates, including fringe benefits,

were $25 per hour, and were charged to products based on the standard run times for

each product (see Exhibit 3). The company had only one producing department, in which

components were both machined and assembled into finished products. The overhead costs

in this department were allocated to products as a percentage of production-run direct labor

cost. Currently, the rate was 300%. Since direct labor cost had to be recorded anyway to

prepare factory payroll, this was an inexpensive way to allocate overhead costs to products.

Knight noted that some companies didn't allocate any overhead costs to products,

treating them as period, not product, expenses. For these companies, product profitability

was measured at the contribution margin level - price less all variable costs. Wilkerson's

variable costs were only its direct material and direct labor costs. On that basis, all products,

including pumps, would be generating substantial contribution to overhead and profits. She

thought that perhaps some of Wilkerson's competitors were following this procedure and

pricing to cover variable costs.

Knight had recently led a small task force to study Wilkerson's overhead costs since

they had now become much larger than the direct labor expenses. The study had revealed the following information: 1.

Workers often operated several of the machines simultaneously once they

were set up. For other operations, however, workers could operate only one machine. Thus

machinerelated expenses might relate more to the machine hours of a product than to its productionrun labor hours. 2.

A set-up had to be performed each time a batch of components had to be

machined in a production run. Each component in a product required a separate production

run to machine the raw materials or purchased part to the specifications for the product. 3.

People in the receiving and production control departments ordered,

processed, inspected, and moved each batch of components for a production run. This work

required about the same amount of time whether the components were for a long or a short

production run, or whether the components were expensive or inexpensive. lOMoARcPSD| 38777299 4.

The work in the packaging and shipping area had increased during the past

couple of years as Wilkerson increased the number of customers it served. Each time

products were packaged and shipped, about the same amount of work was required,

regardless of the number of items in the shipment.

Knight's team had collected the data shown in Exhibit 4 based on operations in

March 2000. The team felt that this month was typical of ongoing operations. Some people

recalled, however, that when demand was really heavy last year, the machines had worked

12,000 hours in a month and the factory handled up to 180 production runs and 400

shipments without experiencing delays or use of overtime.

--------------------------------------------------------------------

Exhibit 1: Wilkerson Company: Operating Result (March 2000) Sales $2,152,500 100% 271,250 Direct Labor Expense Direct Materials Expense 458,000 Manufacturing overhead Machine-related expenses $336,000 Setup labor 40,000 180,000 Receiving and product control Engineering 100,000 Packaging and shipping 150,000 Total Manufacturing Overhead 806,000 Gross Margin $617,250 29%

General, Selling & Admin. Expense 559,650 Operating Income (pre-tax) $57,600 3%

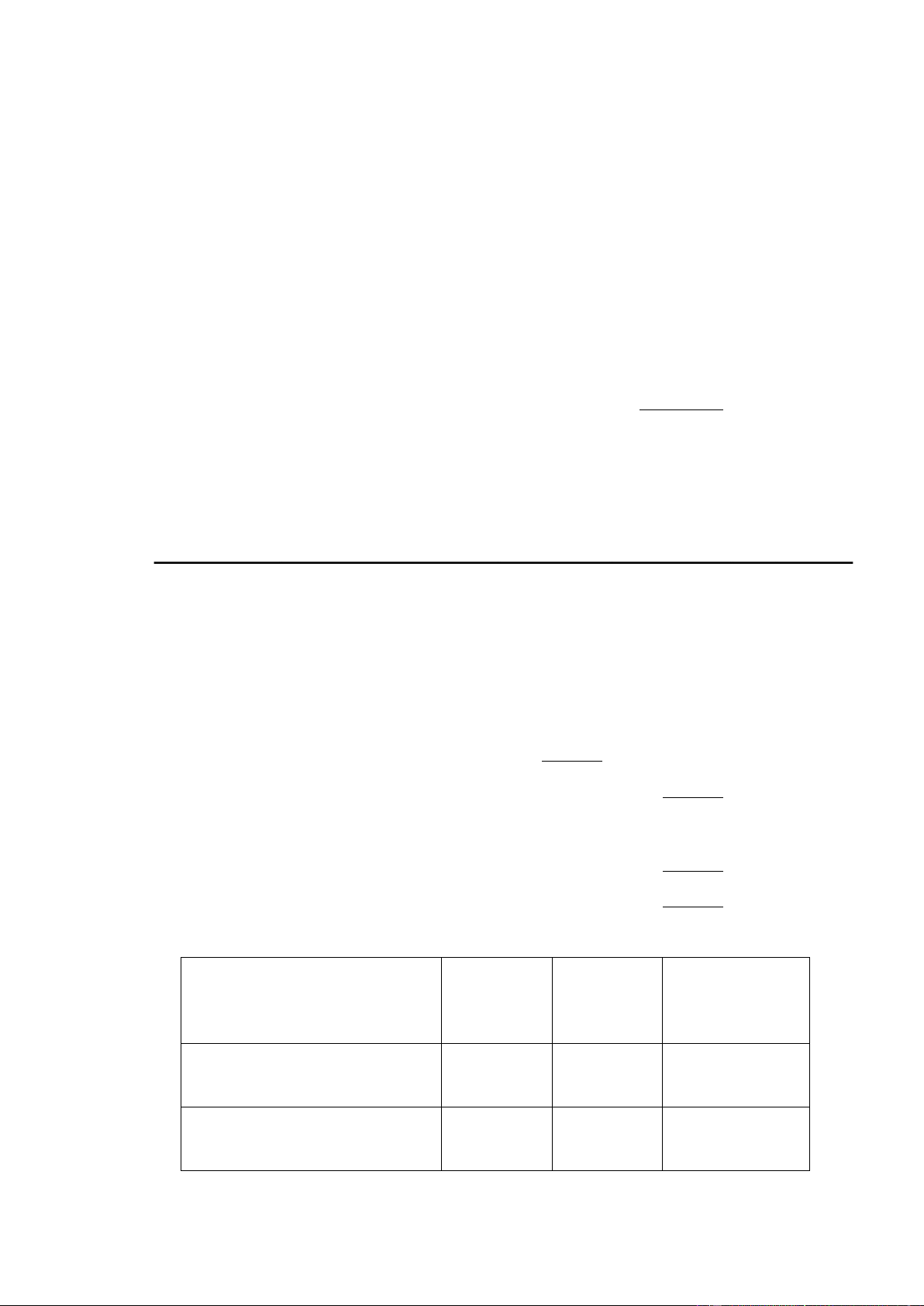

Exhibit 2 Product Profitability Analysis (March 2000) Flow Valves Pumps Controllers

Direct labor cost per unit $10.00 $12.50 $10.00

Direct material cost per unit 16.00 20.00 22.00 lOMoARcPSD| 38777299 30.00 37.5 30.00 Manufacturing overhead (x300%) Standard unit costs $56.00 $70.00 $62.00 Target selling price $86.15 $107.69 $95.38 Planned gross margin 35% 35% 35% Actual selling price $86.00 $87.00 $105.00

Actual gross margin (%) 34.9% 19.5% 41.0%

Exhibit 3 Product Data Product Lines Valves Pumps Flow Controllers 4 components 5 components 10 components Materials per unit 4x$1 = $4 2x$2 = $4 2x$2 = $4 5x 2 = 10 2x 6 = 12 2x7 = 14 1x8 = 8 Materials cost per unit $16 $20 $22 Direct labor per unit .40 DL hours .50 DL hours .40 DL hours Direct labor $/unit @ $25/DL hour (including $10 $12.50 $10.00 employee benefits) Machine hours per unit 0.5 0.5 0.3

Exhibit 4 Monthly Production and Operating Statistics (March 2000) Flow Controllers Valves Pumps Total lOMoARcPSD| 38777299 Production (units) 7,500 12,500 4,000 24,000 Machine hours 3,750 6,250 1,200 11,200 Production runs 10 50 100 160 Number of shipments 10 70 220 300 Hours of engineering work 250 375 625 1,250

Assignment Questions (Wilkerson Company) 1.

What is the competitive situation faced by Wilkerson? 2.

Given some of the apparent problems with Wilkerson's cost system, should

executives abandon overhead assignment to products entirely by adopting a contribution

margin approach in which manufacturing overhead is treated as a period expense? Why or why not? 3.

How does Wilkerson's existing cost system operate? Develop a diagram to

show how costs flow from factory expense accounts to products. 4.

Develop and diagram an activity-based cost model using the information in

the case. Provide your best estimates about the cost and profitability of Wilkerson's three

product lines. What difference does your cost assignment have on reported product costs and

profitability? What causes any shifts in cost and profitability? OUR SOLUTION Introduction

Wilkerson is a company that supplied products to manufacturers of water purification

equipment. The products that are supplied by the Wilkerson company are pumps, flow

controllers and valves. Especially, pumps are commodity products, produced in high volume

for a market with high price competition. Executive summary

Wilkerson currently faces declining profit margins related to industry competitors.

The price cutting by the competitors led to a drop of Wilkerson's pre-tax margin to under 3%

gross margin on sales for pump sales has fallen below 20%. The serve industry has price

cutting in pumps business which is Wilkerson’s major product line, has badly affected the

company's margins (Gross Margin of 19.5% as against a planned gross margin of 35% ) On

the other hand the flow controllers division was performing above the expected profits

(yielding a Gross Margin of 41%, a value higher than 35% estimated). Valves are standard,

produced and shipped in large lots and gross margin has been maintained at 35%.

Wilkerson's existing cost system is a traditional value-based costing system. Direct costs are

based on the price. Overhead costs are figured proportionately to the direct labor costs at the

rate of 300%. Wilkerson needs to identify the proper mix of its product line to regain its

profitability. This is to be done based on information provided in the case, regarding pricing

decisions, decision to discontinue or continue a product and product design. A detailed

analysis of the problems faced by Wilkerson Company is as follows. lOMoARcPSD| 38777299

Based on the operating results of March 2000, we can see that the company has

grouped its overhead into 5 cost items which is: • Machine-related expenses •

Receiving and production control • Setup labor cost • Engineering • Packaging and shipment

1. What is the competitive situation faced by Wilkerson?

The competitive situation is different between the products.

Wilkerson is operating in a highly competitive market, in the industry of valves and

pumps, where no company can control its supply and price level. In a competitive market,

each firm must sell its products at a market price; otherwise, it would lose its market share.

Similarly, Wilkerson has no alternative but to sell its products at a given market price to maintain sales volume.

Pumps are Wilkerson's major product line, produced in high volumes for a market

with high price competition. Wilkerson’s competitors have cut prices on their pumps, so

Wilkerson also cut the price of their pumps to maintain market share, which dropped the

company's pre-tax margin to under 3%, gross margin on sales for pump sales has fallen below 20%.

Conversely, Valves was the product line developed by Wilkerson with high quality

that brought it a loyal customer base. Even if several competitors could match Wilkerson's

quality of valves, none had tried to gain market share by cutting prices. Therefore, the

competitive situation for valves was not so fierce that Wilkerson could operate at more than

35% gross margin ratio as expected.

Flow controllers are customized products, sold in a less competitive market with

inelastic demand at the current price range. Therefore, Wilkerson can increase the price of

their flow controllers by 10% without apparent effect on demand.

Wilkerson is a quality leader, but this leadership may soon be contested by several

competitors. Although they are able to match Wilkerson's quality, there are no signs of price

competition yet. Nevertheless, in the long-run Wilkerson should be prepared to compete on

price. The price competition pushes Wilkerson to analyze its overhead costs, since no

reserves of cost cutting are left in its supply chain (both customer and suppliers agreed to just-in-time delivery).

2. Given some of the apparent problems with Wilkerson's cost system, should

executives abandon overhead assignment to products entirely by adopting a contribution

margin approach in which manufacturing overhead is treated as a period expense? Why or why not?

First, the biggest problem faced by Wilkerson's executives was to figure out the

profitability of each product line. Therefore, they must try to allocate overhead to each

product line as detailed as possible, which means that treating the entire overhead as a period

expense was not a wise decision. lOMoARcPSD| 38777299

Contribution margin approach is calculated by subtracting all variable costs from

sales revenues. In this case, variable costs only include direct materials and direct labor costs;

hence, all products would be generating substantial contributions to overheads. Using this

approach for the pricing of the products is flawed, as pricing would mean only to cover the variable costs.

Moreover, treatment of manufacturing overhead entirely as a period expense is

flawed. The overheads which have cost drivers, like machine hours, production runs,

production units and hours of engineering work, should be considered as product costs.

Allocating these overheads as period expense would result in high margin as most of the

product costs and variable costs are considered period costs. In addition, pricing of the

products on this contribution margin approach would result in lower sales price of the

products, negatively affecting the profits of the company.

All in all, it is not a good choice for Wilkerson to abandon overhead assignment to

products entirely by adopting a contribution margin approach in which manufacturing

overhead is treated as a period expense. 3.

How does Wilkerson's existing cost system operate? Develop a diagram to

show how costs flow from factory expense accounts to products.

Wilkerson Company currently uses the traditional volume-based costing system.

Annual purchasing agreements are used to purchase components used in the manufacture of

various products. Direct material costs are based on the cost of these components purchased

under such agreements. Direct materials and labor costs are calculated using standard prices

of materials and labor rates (from Exhibit 2). The direct labor costs, $10 per hour, were

allocated to the products based on the number of direct labor hours per unit. All the products

are assembled and machined into finished products in a single manufacturing department.

Because direct labor costs had to be recorded to prepare department payroll, the company is

using a low-cost method of allocating overhead costs in this department to the product. 300%

of the production-run direct labor cost is allocated to the products as an overhead.

Table 1 (using data from Exhibit 2) Product Valves Pumps Total Flow Controllers # of Units 7,500 12,500 4,000 24,000 Direct Labor 75,000 156,250 40,000 271,250 =7,500 x 10 Direct Material 120,000 250,000 88,000 458,000 = 7,500x16 Total Direct Costs 195,000 = 406,250 128,000 729,250 75,000 + 120,000 lOMoARcPSD| 38777299 468,750 120,000 Overhead Costs 225,000 = 813,750 (300% of DL) 75,000x3 (806,000) 875,000 248,000 1,543,000 Total Cost 420,000 = Allocation 195,000+225,000 4.

Develop and diagram an activity-based cost model using the information in

the case. Provide your best estimates about the cost and profitability of Wilkerson's three

product lines. What difference does your cost assignment have on reported product costs

and profitability? What causes any shifts in cost and profitability?

Wilkerson has used volume-based product costing systems (using a volume-based

cost driver - direct labor cost) to allocate overhead cost to products. Overhead costs are

charged as 300% of direct labor cost. This implies overheads are applied directly in relation

to labor costs. However, overheads have different components with different drivers for each

as calculated. Therefore, relating the overheads to the products on the basis of percentage of

product run direct labor cost gives unreliable information during decision making. Moreover,

since overheads are very high, they are significant contributors to decision making in this

costing method. This method is not reliable since each product varies significantly in its

overhead’s costs association.

Activity-based costing (ABC) systems allocate factory overhead to products using a

cause-and-effect criterion with multiple cost drivers, both volume-based and non-

volumebased. It reflects the relationship between the volume of production of individual

products and the level of overheads. It can be said that 'machine hours' is the appropriate

cost driver for the machine-related expenses: cost pool and setup and receiving as well

as production control activities are changed in proportion to the number of production

runs. Engineering cost is driven by hours of engineering work and lastly packaging and

shipment activity changes in proportion to the number of shipments.

Table 2 - Cost Pools -> Cost Drivers -> Activity-Based Cost Rate Cost pool

Amount ($) Cost Driver Amount Activity-Based Cost Rate Machine Related 336,000 Machine 11,200 $30 per machine hour Expenses hours machine hours (=336,000/11,200) Setup labor 40,000 Production $250 per production runs 160 production run runs 180,000 Production $1,125 per production Receiving and runs 160 production run production runs control lOMoARcPSD| 38777299 Engineering 100,000 Hours of 1,250 $80 per engineering engineering engineering hour work hours 150,000 300 shipments $500 per shipment Packaging and Number of shipping shipments

Table 2 shows us with the information about lots of activities on which we have based

the costing basically cost pools, drivers of the relevant cost pools and the rate of the costing which should be considered.

Table 3 - Activity-Based Cost Calculation per product(using data from Exhibit 4) Product Valves Pumps Flow Controllers Units 7,500 12,500 4,000 Direct Labor 75,000 156,250 40,000 =$10 x 7,500 =$12.50 x 12,500 = $10 x 4,000 Direct Material 120,000 250,000 88,000 = $16 x 7,500 = 12,500 x $20 = 4,000 x 22.00 Total Direct Costs 195,000= 75,000 406,250 128,000 + 120, 000

= 156,250 + 250,000 = 40,000 + 88,000

Manufacturing Overheads - Machine Related 112,500 187,500 36,000 Expenses = $30 x 3,750 = $30 x 6,250 = $30 x 1,200 - Setup labor 2,500 12,500 25,000 =$250 x 10 = $250 x 50 = $250 x 100 - Receiving and 11,250 56,250 112,500 production control = $1,125 x 10 = $1,125 x 50 = $1,1250 x 100 - Engineering 20,000 30,000 50,000 = $80 x 250 = $80 x 375 = $80 x 625 lOMoARcPSD| 38777299 - Packaging and 5,000 35,000 110,000 shipping = $500 x 10 = $500 x 70 = $500 x 220 Total 333,500 151,250 321,250 Manufacturing = 36,000+ 25,000 = 112,500+2,500+ =187,500+12,500+ Overheads +112,500+50,000 11,250+20,000 56,250+30,000+ +110,000 +5,000 35,000 Total Cost 346,250 = 727,500 461,500 Allocation 195,000+151,250

= 406,250+321,250 =128,000+333,500

In order to carry out an activity-based costing so that we can find the relevant costs

associated with each product, we do the Activity-Based Cost Calculation per product based

on costing for the individual cost pools (in table 3) which were defined in table 2. Exhibit 4

provides us with the data relating to the monthly product and operating statistic which can

be combined with the costs for each cost pool derived in table 2 to give us the Activity-Based Cost Calculation per product.

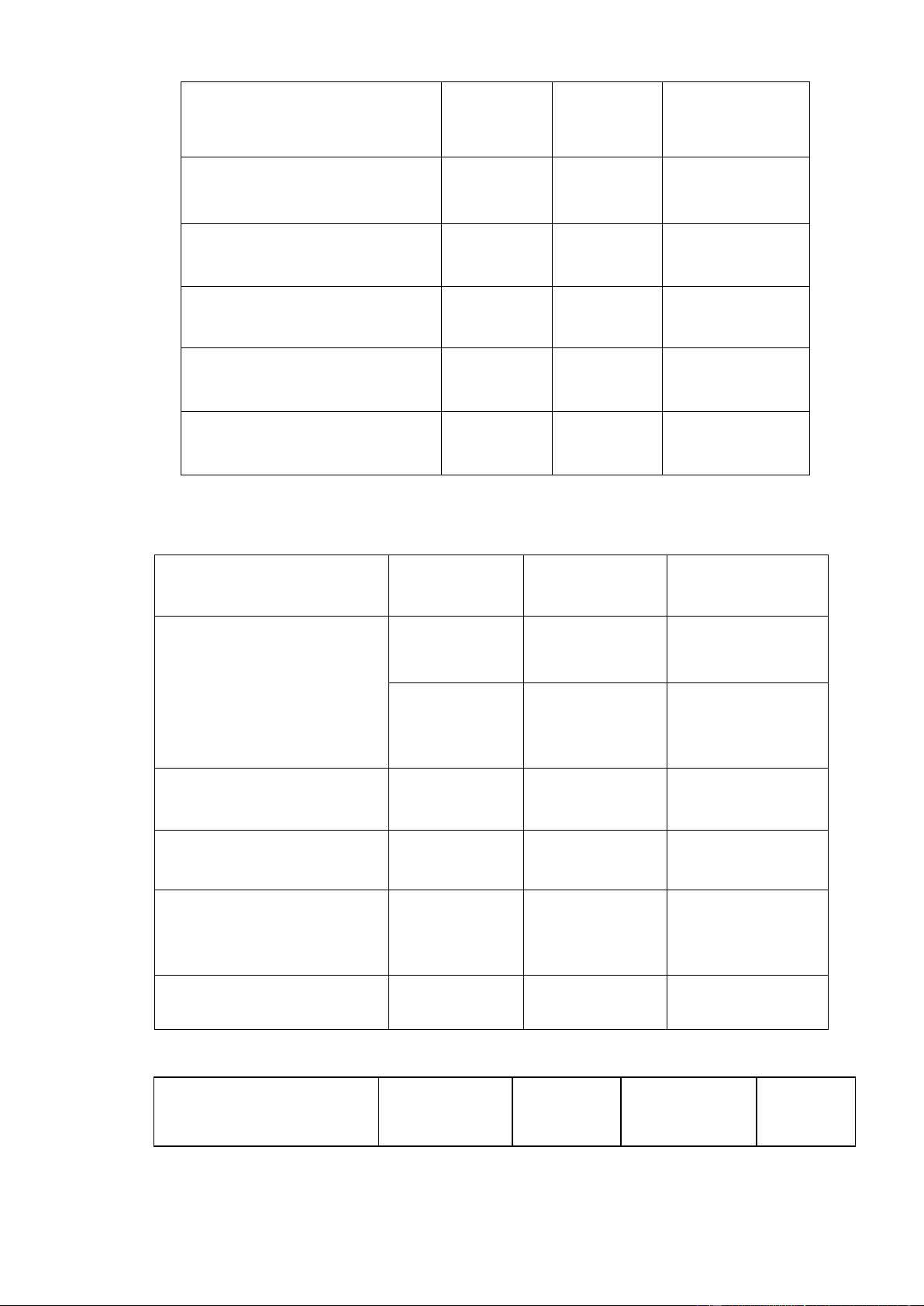

Table 4- Comparing the costings method. Flow Valves Pumps Controllers lOMoARcPSD| 38777299 Existing ABC Existing ABC Existing ABC Direct Materials $16.00 $16.00 $20.00 $20.00 $22.00 $22.00 10.00 Direct Labor 10.00 10.00 12.50 12.50 10.00 Overhead 15.00 9.00 37.50 30.00 300% of DL$ 30.00 15.00 1.00 6.25 0.33 4.50 28.13 Machine 1.50 Set-up 27.50 Receiving & Product Control 12.50 83.38 Packaging & 0.67 2.80 115.38 Shipping Planned Engineering 2.67 2.40 Gross 35% Total Overhead 20.17 35% 30.00 37.50 25.70 30.00 35% Total Cost 56.00 46.17 70.00 58.20 62.00 Margin Target Selling Price 86.15 71.03 89.54 107.69 177.50 95.38 Actual Selling Price 86.00 87.00 105.00 Actual Gross Margin 33.1% - 41% 9.9%

34.9% 46.3% 19.5%

*Note: Give Valves as an example for making clear the result in the table above.

It’s similar to the two remaining figures, pumps and flow controllers. • Overhead: (Valves)

• Machine: 15,00 = 112,500 : 7500

• Set up labor: 0,33 = 2,500 : 7500

• Receiving and production control: 1,50 = 11,250 : 7500

• Packing and shipping: 0,67 = 5000: 7500

• Engineering: 2,67 = 20,000 : 7500

• Actual Gross Margin (Valves): 46,3% = (86 - 46,17) : 86 x 100%

The data obtained from table 3 enables us to arrive at table 4 which compares two

different costing methods, existing costing system and activity-based cost system. lOMoARcPSD| 38777299

As we can see from table 4 above, Valves have the highest operating profit margin

followed by pumps earning much more than the expected margin of the company, with

46,3% for valves and 33,1% for pumps. The flow controllers which were considered

highly profitable are making losses at the given price point as they have a negative gross

margin of -9.90%. When looking at the gross margins in Exhibit 2 in this case, Valves had

a margin of 34.9%, Pumps 19.5% and Flow controllers 41%. Therefore, we can realize that

the redistribution of profit happens because of the reallocation of the overheads based on the

drivers giving a closer to reality costs.

The shifts in costs and profitability are caused by the change of cost method to

allocate the indirect costs, from the traditional system to the ABC system. Traditional costing

depends upon a single overhead pool. For this case of Wilkerson, the overhead costs to

product were allocated according to 300% of production run direct labor cost, with the

manufacturing overhead per unit of pumps was $12.50 x 300% = $37.5 while the figure for

Flow Controllers as well as valves was $10.00 x 300% = $30.00. However, with the ABC

model, there are different cost drivers due to different relationships between overheads and

production activities, and overhead costs are allocated based on resources consumed, which

means a more accurate allocation of overheads is available. In detail, the manufacturing

overhead per unit of pumps is $25.70, while that of flow controllers is $83.38, almost triple

the number under traditional costing. So, the changing of the cost method led to the result of

changing the value of overhead. However, the figure for the direct cost including direct

material cost and direct labor cost were constant. To conclude, it made a shift in cost and

profitability by using the ABC system instead of the traditional one because the total cost

was the sum of the direct cost and the overhead.