Preview text:

Macroenvironment analysis - team 2

PESTLE:

Political

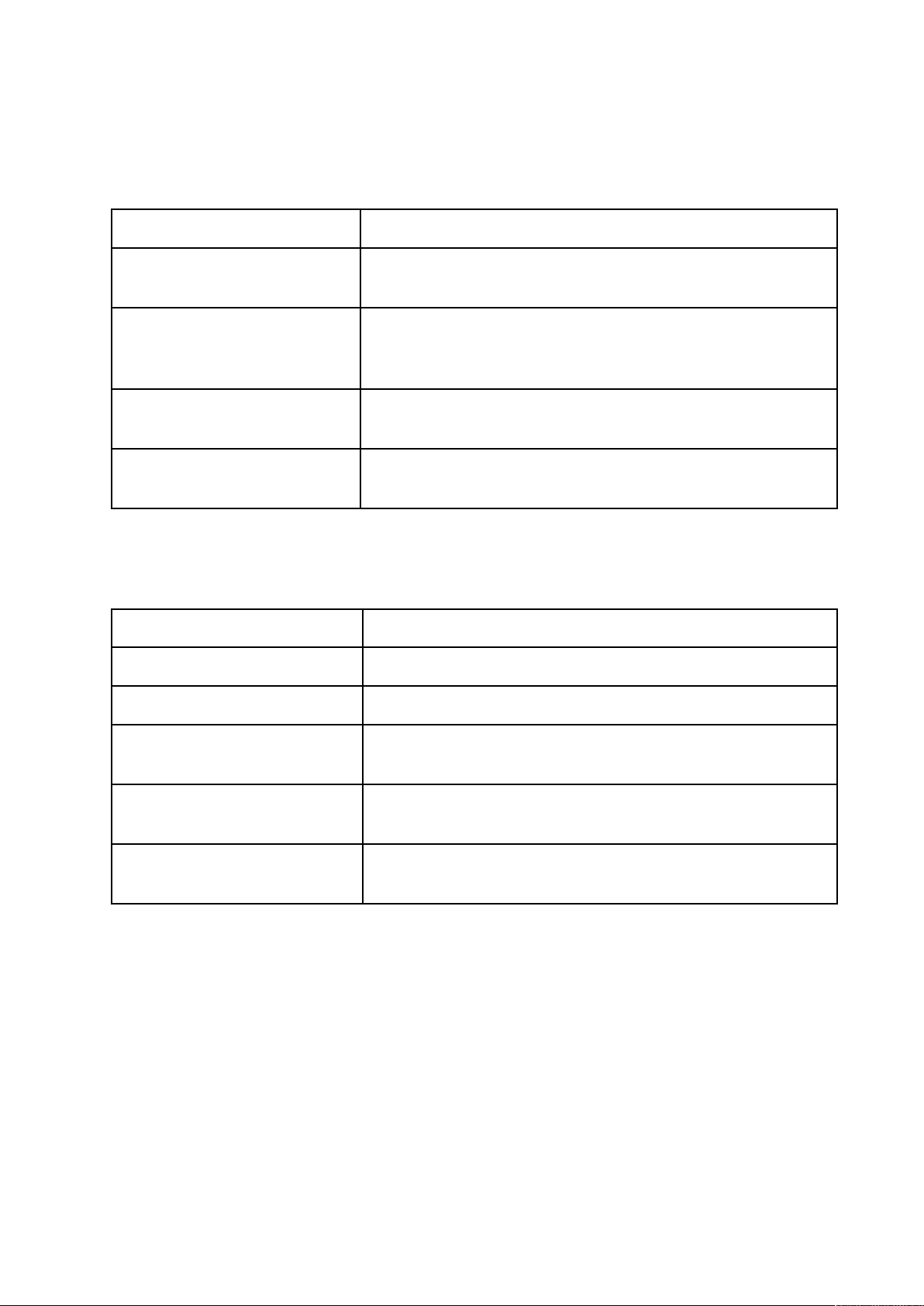

Key factors | Recent Data / Situation |

|---|---|

Stable one-party system with strong government control | Vietnam is under the leadership of the Communist Party, ensuring political continuity and stability. |

Government policies promoting FDI (foreign direct investment) | Vietnam continues to attract investment in manufacturing, technology, and renewable energy through incentives and trade agreements (e.g., CPTPP, EVFTA). |

Anti-corruption measures | Ongoing campaigns against corruption have strengthened governance, though enforcement is uneven. |

Regional geopolitics (South China Sea tensions) | Disputes with China remain a strategic risk. |

Economic

Key factors | Recent Data / Situation |

|---|---|

GDP growth | GDP growth forecast ~5.5–6% in 2025 (World Bank, ADB). |

Inflation | Average inflation ~3.5–4% in 2025. |

Trade openness | Export-driven economy; Vietnam among top global exporters of textiles, electronics, and agricultural products. |

Labor market | Large, young, and relatively low-cost workforce; however, skills gap remains. |

Currency stability | Vietnamese dong remains relatively stable, supported by foreign reserves. |

Implications

Politically, Vietnam maintains a relatively stable system of governance, which ensures continuity in policymaking and reassures investors about long-term prospects (World Bank, 2024). This stability, however, may reduce the scope for pluralistic consultation and limit transparency in certain decision-making processes. At the same time, ongoing disputes in the South China Sea remain a strategic challenge, creating uncertainties that could influence trade security and regional diplomatic alignments (IMF, 2024).

Economically, Vietnam is projected to record steady GDP growth of around 5.5–6 percent in 2025, with inflation contained at moderate levels (Asian Development Bank [ADB], 2024). These conditions strengthen the country’s appeal as a destination for manufacturing and export-oriented investment. However, Vietnam’s heavy reliance on external markets also exposes the economy to fluctuations in global demand, while a persistent shortage of high-skilled labor constrains its ability to move up the value chain (World Bank, 2025). In this context, Vietnam’s future trajectory will depend not only on maintaining political stability and economic openness but also on implementing reforms that improve governance, enhance workforce development, and encourage greater industrial diversification (ADB, 2025).

Social Factors

1. Health-conscious consumer behavior

Across major cities like Mexico City, Monterrey, and Guadalajara, people are becoming much more aware of what they eat. With about 70–80% of adults affected by lactose intolerance, many are actively choosing plant-based, lactose-free, or vegan alternatives. This shift also reflects a broader concern for sustainability, animal welfare, and environmental responsibility — values that perfectly align with Wildwood’s clean and ethical brand identity.

2. Cultural openness and taste adaptation

Even though dairy remains a strong part of Mexican cuisine, younger generations are far more adventurous with food. They’re open to international desserts that are healthy yet flavorful.

To connect with local tastes, Wildwood can create localized flavor twists — for example, coconut-lime, cajeta caramel, or chili-chocolate. This helps keep the brand authentic while making it relatable to Mexican consumers.

3. Social media and brand influence

Social media plays a huge role in how Mexican consumers discover new food brands. Platforms like Instagram, TikTok, and Facebook are the go-to places for food inspiration.

Collaborating with local food influencers, vegan cafés, and fitness creators can help Wildwood build trust, generate buzz, and encourage customers to share their own experiences online — turning the brand into a community trend.

Technological Factors

1. E-commerce and delivery platforms

Mexico’s online shopping market is growing rapidly — it reached over USD 60 billion in 2024, with frozen and grocery categories rising more than 20% per year (Statista, 2024).

Services like Rappi, Uber Eats, and Cornershop are perfect platforms for Wildwood to make its frozen desserts easily accessible.

To succeed, the brand should focus on a strong omnichannel presence, combining physical retail stores with online delivery and subscription options.

2. Digital marketing and analytics

With tools like Meta Ads Manager, Google Ads, and TikTok Ads, Wildwood can target audiences interested in healthy eating and vegan lifestyles.

Using Google Trends and Shopify Analytics also allows the brand to track which flavors or seasons drive the most demand — and adjust production or promotions in real time.

3. Innovation in packaging and logistics

Maintaining frozen quality in Mexico’s warm climate is a real challenge. That’s why Wildwood should invest in eco-friendly, insulated packaging and partner with reliable cold-chain distributors like DHL Supply Chain or Soriana’s refrigerated logistics.

This not only ensures product freshness but also reinforces Wildwood’s sustainability promise.

Digital Tactics.

To really connect with Mexican consumers, Wildwood needs to tell stories that feel real and relatable. Bilingual campaigns in Spanish and English can share what the brand truly stands for — healthy living, sustainability, and natural goodness. It’s not just about selling a dessert, it’s about inspiring people to make choices that feel good and do good. Instead of traditional ads, Wildwood can collaborate with local creators — vegan chefs, fitness influencers, and nutritionists who already have their audience’s trust. When they share fun “taste test” moments or quick recipe videos on TikTok and Instagram, it makes the brand part of people’s everyday lives.Online, we can make the experience rewarding. Offer welcome discounts through Rappi or Uber Eats and give regular fans the option to subscribe — simple, convenient, and personal. And finally, let’s build a community. By joining conversations on hashtags like #heladovegano and #sinlactosa, Wildwood can listen, respond, and engage directly with customers. When people see a brand that talks with them — not at them — they start to care, share, and become part of its story.

B. Category Analysis

1. Market Size:

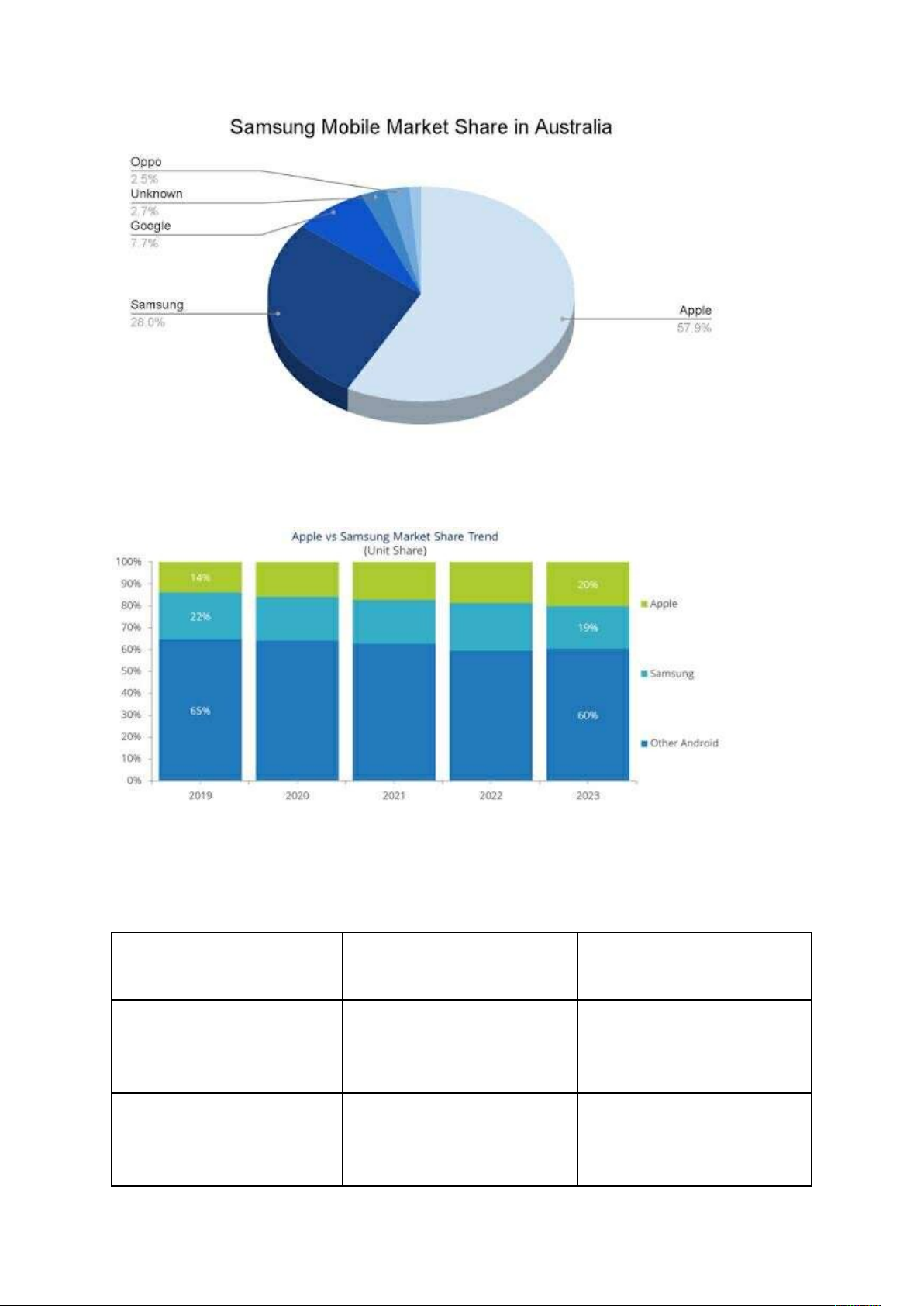

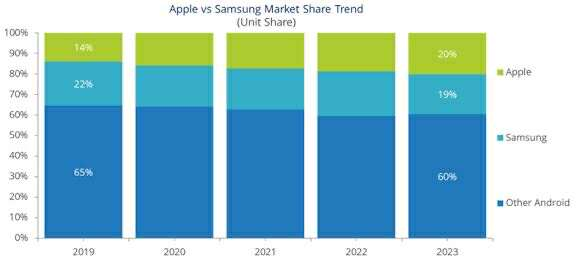

Samsung is one of the biggest players in the global smartphone and electronics market

Smartphone Segment:

In 2023, Samsung shipped approximately 226 million smartphones, capturing around 19.4% of the global market share—the largest among all brands. The global smartphone market showed signs of recovery in 2024, with over 1.1 billion units sold worldwide, and is projected to experience modest year-on-year growth in the coming years.

Other Product Categories:

Beyond smartphones, Samsung maintains a strong presence across multiple sectors:

- Large-format displays (digital signage): Estimated market size of around USD 16.5 billion.

- TVs, smart home appliances, and wearables: Samsung continues to rank among the top global brands in these categories.

To summary, Samsung demonstrates strong performance across diverse product lines. However, smartphones remain the company’s primary revenue driver and the cornerstone of its global market strength.

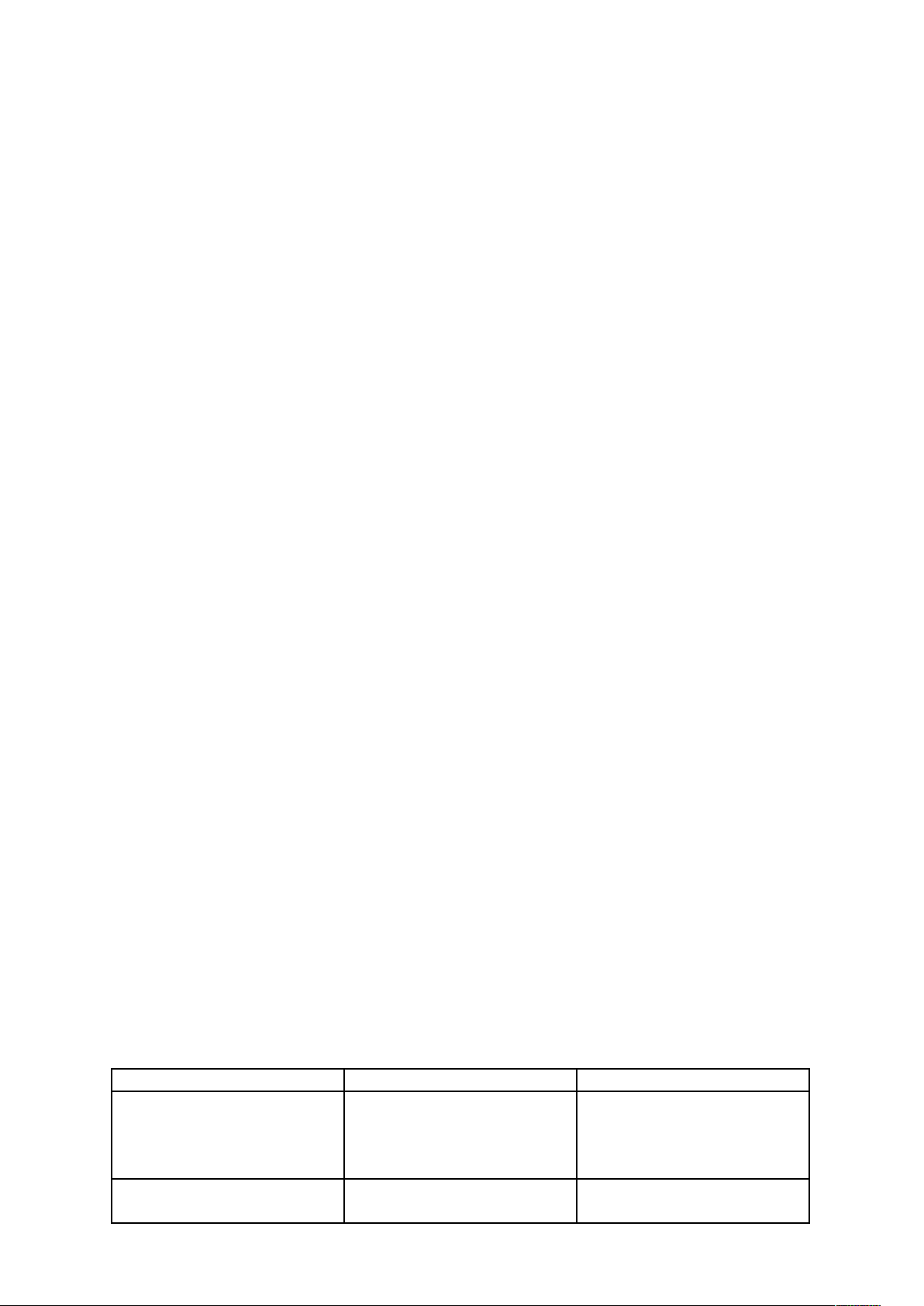

2. Competitor benchmarking

Brand | Strengths | Challenges |

|---|---|---|

Samsung | Strong R&D, full control over display/ chip supply, wide product range. | Faces price pressure from Chinese brands and premium dominance from Apple |

Apple | Premium brand, loyal user base, high profits | Only targets high-end market, relies on suppliers like Samsung for parts. |

Xiaomi | Affordable pricing, good features | Lowers profits margin, weak in premium segment |

Oppo/Vivo | Strong in Asia, stylish design | Less global recognition, weaker ecosystems |

Huawei | Still big in China, solid hardware. | Global growth blocked by sanctions & lack of Google services |

3.Pricing map

Samsung plays in every price tier—which is one of its biggest advantages:

Tier | Example Models | Price (USD) | Main Competitors |

|---|---|---|---|

Premium | Galaxy S24 Ultra, Fold5 | $1,200-$1,800 | iPhone 15 Pro Max |

Upper Mid | Galaxy S24, S23+ | $800-$1,000 | iPhone 15, Xiaomi 13 Ultra |

Mid-Range | Galaxy A54, A73 | $300-$500 | Xiaomi Redmi, OnePlus, Realme |

Budget | Galaxy A14, M14 | <&250 | Oppo A series, Vivo Y series |

4. Samsung’s Pricing Strategy

Samsung adopts a dynamic pricing strategy that positions the brand competitively across both premium and mass-market segments.

- Gradual Price Adjustment: Samsung typically launches products at a high initial price, then reduces prices over time, particularly within its mid-range and budget segments.

- Market Comparison: In contrast, Apple maintains stable, premium pricing, while Chinese manufacturers tend to enter the market with low-cost offerings from the outset.

- Strategic Flexibility: This approach allows Samsung to operate as a versatile competitor—projecting a premium image when needed, while also offering affordable options to capture price-sensitive consumers.

4. Charts

Smartphone Market Share (2023)

Xiaomi vs Samsung vs Apple Trends

C. Company Competitive Advantage

PORTER VALUE CHAIN ANALYSIS :

Activity | Description | Competitive Advantage |

|---|---|---|

Inbound Logistics | Uses Japanese ingredients such as yuzu, shiso, and sakura. | Unique and hard-to-imitate flavor profile. |

Operations | Combines traditional craftsmanship with modern technology. | Ensures consistent quality and scalability. |

Outbound Logistics | Exports through premium distributors. | Maintains a high-end brand image. |

Marketing & Sales | Relies on storytelling inspired by Japanese culture. | Attracts U.S. consumers who love “exotic” products. |

Service | Hosts tasting events and collaborates with mixologists | Provides a distinctive and immersive brand experience. |

Summary :

Current Strength:

Unique Japanese ingredients, cultural storytelling, and premium positioning collectively create strong brand differentiation and appeal to high-end consumers in the U.S. market.

Suggested Improvement:

To enhance these advantages, the company should expand its digital marketing presence, establish sustainable sourcing partnerships, and strengthen customer engagement through authentic brand experiences and collaborations with local mixologists.

Final Outcome:

Sustained growth and a long-term competitive advantage in the global premium beverage market, supported by effective localization and consistent brand identity.

VRIO ANALYSIS AND TRANSFERABILITY :

Resource/Capacity | Description | Competitive Advantage |

|---|---|---|

Japanese ingredients (yuzu, shiso, sakura) | Rare and authentic resources sourced from Japan. | Unique flavor identity, difficult for competitors to copy. |

Cultural storytelling | Uses Japanese heritage and symbolism in branding. | Builds emotional connection and brand differentiation. |

Craftsmanship & modern tech | Blends handcraft methods with advanced technology. | Ensures quality, scalability, and consistency. |

Premium distribution | Sells through luxury and exclusive channels. | Maintains brand prestige and exclusivity. |

Customer experience | Tasting events and collaborations with mixologists. | Enhances customer loyalty and brand immersion. |

Summary :

Current Value:

Ukiyo Gin leverages authentic Japanese ingredients, cultural storytelling, and refined craftsmanship to build a distinctive brand identity and maintain a premium image in the international spirits market.

Suggested Improvement:

The company should protect its exclusivity by securing long-term supplier partnerships, diversify its product line through innovative flavor development, and strengthen digital engagement to deepen consumer loyalty and sustain its competitive edge.

Final Outcome:

These strategic improvements will enable Ukiyo Gin to reinforce brand differentiation, enhance global competitiveness, and achieve sustainable long-term growth.

Transferability Summary

The brand’s main advantages—unique ingredients, cultural authenticity, and mixologist collaborations—are valuable but challenging to transfer across markets due to differences in local tastes, regulations, and cultural perceptions.

To improve transferability, the company should adapt flavors and packaging to local preferences, collaborate with local influencers or bartenders, and invest in localized marketing while maintaining its authentic Japanese identity.

D. Fit & Challenges

Market Fit Analysis

When looking at the U.S. market, Ukiyo Japanese Gin honestly has a lot of room to shine.

American consumers today are curious about international spirits, not just because they want something new to drink, but because they enjoy the story behind each brand. Ukiyo naturally stands out here, combining clean Japanese aesthetics with cultural ingredients like yuzu and shiso.

At the same time, the premiumization trend is strong in the U.S. Spirits drinkers are trading up - they want something that feels crafted, minimal, and meaningful. Add to that the growing cocktail culture, especially in cities like New York and LA, and you’ve got an audience actively looking for unique gins to experiment with.

In short: Ukiyo doesn’t need to scream for attention; it just needs to show up in the right places. Its calm, elegant brand energy fits perfectly with where U.S. drinkers’ tastes are heading.

Choosing the Right Way to Enter

There are several paths Ukiyo could take to enter the U.S. market, but the smartest move is to start small and focused. The most practical first step would be exporting through a local importer and distributor. This option keeps the initial risk low while allowing Ukiyo to test how the brand performs in different cities. It also helps build relationships with key players in the bar and retail scene.

Setting up a full local partnership or bottling facility might sound tempting for the long term, but it requires much higher investment and time. It’s better to wait until Ukiyo builds stronger market awareness. Direct-to-consumer sales, like selling online, could also be an exciting direction later on, but alcohol shipping laws across states make it complicated in the early phase.

If it were up to me, I’d recommend starting with the importer-distributor-retail route for the first year. This approach gives Ukiyo valuable real-world insights without overextending resources, while still letting the brand learn how U.S. consumers and bartenders respond.

The 4Ps Strategy

3.1. Product:

Ukiyo should lead with its 700ml bottle for retail and offer a 200ml sample size for bartenders - something easy to test in cocktails. The packaging should stay minimal yet elegant, keeping the Japanese design spirit alive. Adding a small hangtag that tells Ukiyo’s origin story and links to cocktail recipes through a QR code would make it feel even more personal.

3.2.Price:

To stay competitive in the premium segment, a retail price around 49.99 USD works well. This positions Ukiyo right next to brands like Hendrick’s or Roku Gin - not too high to scare off first-time buyers, but still premium enough to reflect the quality. With standard U.S. margins, the target landed cost should be around 20 USD per bottle, which makes sense for a handcrafted gin.

3.3.Place:

Start where the target audience already is - high-end bars, Japanese restaurants, and craft liquor stores. Focusing first on big, trendsetting cities like New York, Los Angeles, San Francisco, and Miami allows Ukiyo to reach influential bartenders and early adopters who often shape national trends.

3.4.Promotion:

Instead of going heavy on advertising, Ukiyo should rely on experience-based marketing. This could include bartender seeding programs, tasting events or “Japanese gin nights” at select bars, and collaborations with lifestyle influencers and mixologists on Instagram and TikTok. Authentic storytelling should be the heart of every campaign, because people don’t just buy the drink - they buy the feeling it gives.

Roadmap for the First Year

During the first two months, Ukiyo should focus on building the foundation. This includes finalizing contracts with importers and distributors, as well as preparing label designs that meet U.S. regulations. Once everything is legally ready, the next step is to ship the first batch and begin hosting small tasting events in New York and Los Angeles. These early events will help Ukiyo connect with bartenders, gain real feedback, and start building brand presence.

From month four to month eight, Ukiyo can analyze early results, fine-tune pricing and promotions, and expand into San Francisco and Miami. These cities have vibrant cocktail cultures and are great testing grounds for premium Asian brands. By the last quarter of the first year, the focus should shift toward strengthening awareness through online campaigns, influencer partnerships, and exploring the possibility of local bottling or co-packing in the future.

The key is to move slowly but steadily - learning from real customer reactions before making any big investment decisions.

Success Metrics (KPIs)

To know whether the first year is working, Ukiyo should monitor several key indicators. Success can be measured by the number of bars and retail stores that start carrying the brand, ideally reaching around 25 bars and 15 stores by the end of the first year. In terms of sales, the goal should be at least 1,200 bottles sold across pilot cities.

Public relations and brand visibility are also important. Earning at least three mentions in online media, cocktail blogs, or local press would be a solid indicator of growing recognition. Finally, social engagement should reach over 10,000 organic impressions on Instagram or TikTok - this shows genuine interest from consumers, not just paid visibility.

If these targets are met, Ukiyo will have a strong foundation to expand further into new markets or develop local partnerships.

Potential Challenges & How to Handle Them

Like any new brand entering a mature market, Ukiyo will face some challenges along the way. One of the biggest is navigating the complex alcohol import and distribution laws that vary between states. This can slow down rollout or limit where the gin can be sold. The solution is to work closely with a legal consultant and choose distributors who already understand the compliance landscape.

Another issue might be the higher landed cost after import, which could reduce profit margins. To manage this, Ukiyo can negotiate better distributor terms or slightly adjust its retail price without losing competitiveness. Brand awareness will also take time - people may not know Ukiyo at first, so investing in authentic storytelling, bartender partnerships, and tasting events is essential.

Competition is another challenge, as the U.S. gin market already has strong players. However, Ukiyo’s unique Japanese origin and distinct flavor profile can be its edge. Lastly, distributors might prioritize larger brands, so offering marketing support or small incentives can help maintain their commitment.

Final Recommendation

Ukiyo shouldn’t try to conquer the entire U.S. market right away - that would be too risky. The best path is to start small, learn fast, and grow with intention. Launching through a trusted importer and distributor will allow Ukiyo to test performance, build relationships, and gain local credibility without heavy upfront costs.

Once the brand builds a loyal base and earns industry buzz, it can start thinking about larger-scale expansion or even local production. In short: start small, stay authentic, and let the product speak for itself.

Reference:

- Asian Development Bank. (2024). Asian Development Outlook 2024: Transforming Growth Models. Manila: ADB.

- Asian Development Bank. (2025). Asian Development Outlook Update 2025. Manila: ADB.

- International Monetary Fund. (2024). Vietnam: 2024 Article IV Consultation Staff Report. Washington, DC: IMF.

- World Bank. (2024). Vietnam Economic Update: Sustaining Resilience. Washington, DC: World Bank.

- World Bank. (2025). Vietnam Development Report 2025: Skills for the Future. Washington, DC: World Bank.