Preview text:

INTERNATIONAL UNIVERSITY – HCM UNIVERSITY

BUSINESS ADMINISTRATION DEPARTMENT GROUP ASSIGNMENT

STATISTICS FOR BUSINESS

Class: Statistics for Business_S1_2022-23_G02 Lecturer: Mr. Nguyễn Bá Trung Full name

Student ID Contribution

Lê Ngọc Khánh Đoan BABAIU20033 100%

Huỳnh Ngọc Hoàng Ly BABAIU20299 100% Nguyễn Xuân Mai BABAIU20074 100%

Ngô Ngọc Thủy Tiên BABAIU20152 100%

Nguyễn Minh Thùy BABAIU20345 100% Lê Hoài Thy BABAIU20151 100%

Submission Date: 15th January 2023 1

Topic: Analyzing the housing market in Ho Chi Minh City Table of Contents

I. INTRODUCTION ............................................................................................ 3

1. Introduce foreign investors' concerns ............................................................ 3

2. Summarize our approach to solving problem ............................................... 3

II. MAIN FEATURES OF THE HOUSING MARKET IN HO CHI MINH

CITY ..................................................................................................................... 3

III. FACTORS THAT AFFECT HOUSING PRICES IN HO CHI

MINH CITY ......................................................................................................... 4

1. Classifying and finding ways to process data ................................................ 4

Bathrooms ............................................................................................................. 6

Sqft_living ............................................................................................................. 6

Waterfront ............................................................................................................ 8

Grade ..................................................................................................................... 9

Sqft_above ............................................................................................................ 9

Sqft_basement .................................................................................................... 10

Latitude ............................................................................................................... 11

IV. HOUSING PRICES PREDICTION .......................................................... 11

V. CONCLUSION .............................................................................................. 12

VI. REFERENCES ............................................................................................ 12 2 I. INTRODUCTION

1. Introduce foreign investors' concerns

The client representing a cohort of foreign investors has expressed interest in investing in real

estate in Ho Chi Minh city. They encountered a complex problem when considering investment

decisions. The client needs to be based on the major features of the housing market and factors

that affect housing prices in Ho Chi Minh city to figure out which estate they should invest in.

As business analysts, we are requested to make a report analyzing the housing market in Ho

Chi Minh City and present the results of the analysis to our client. The client did not have too

much data to review and assess risk, so they need our analysis to make it easier to find an estate to invest in.

2. Summarize our approach to solving the problem

The dataset we have taken is Housing data in Ho Chi Minh city. The data contains the prices of

houses against a variety of parameters. The objective of the study is to use statistical analysis

to find the dependence of the price of houses on these variables, the main features of the housing

market, and factors that affect housing prices in Ho Chi Minh city. The statistical tools used are

Correlation, Regression, Coefficient, Descriptive Statistics, and chart types such as scatter (X Y), pie chart, …

II. MAIN FEATURES OF THE HOUSING MARKET IN HO CHI MINH CITY

The housing market in Ho Chi Minh City currently has one of the highest potentials and attracts

the greatest investment money in the region. Locations in the city center district are regarded

as advantageous for investment and business. Also, there are some principal features of the

housing market in Ho Chi Minh City:

Ho Chi Minh City has been widely known as the centerpiece, a significant economic center in

the Southern area and the entire country so far. When it is widely known as the land that attracts

numerous both domestic and foreign investors. Hence, the demand for human resources from

businhavees and corporations in Ho Chi Minh City has risen sharply.

This mentioned city is also the most populated city in Vietnam with a current population of

about 13 million people. All of this has resulted in a flood of settlements and employment in

the city, increasing demand for flats in Ho Chi Minh City's present housing market. Also,

people's living standards and per capita income are rising as well. Furthermore, the selling price

of apartments in Ho Chi Minh City's suburbs and satellite areas still has a lot of potentials to

suit people's basic as well as advanced living standards.

However, the price of construction materials jumped after the Covid-19 pandemic, which

causes many enterprises to postpone new projects due to worries about additional expenses; as

a result, the prices of projects - apartments. previously constructed homes - have climbed.

According to data from the Ho Chi Minh City real estate market in 2021, housing market prices

reached a new high of 70-75 million VND/m2 for apartments and more than 170 million VND/m2 for land.

The rate of price growth and inflation has made it difficult, if not impossible, for middle-income

employees to access the Ho Chi Minh City housing market. 3

III. FACTORS THAT AFFECT HOUSING PRICES IN HO CHI MINH CITY

1. Classifying and finding ways to process data Name Main-variable Measurement Level bathrooms Ratio bedrooms Ratio sqft_living Ratio sqft_lot Ratio floors Ratio waterfront Nominal view Nominal condition Ordinal grade Ordinal sqft_above Ratio sqft_basement Ratio lat Interval long Interval sqft_living15 Ratio sqft_lot15 Ratio

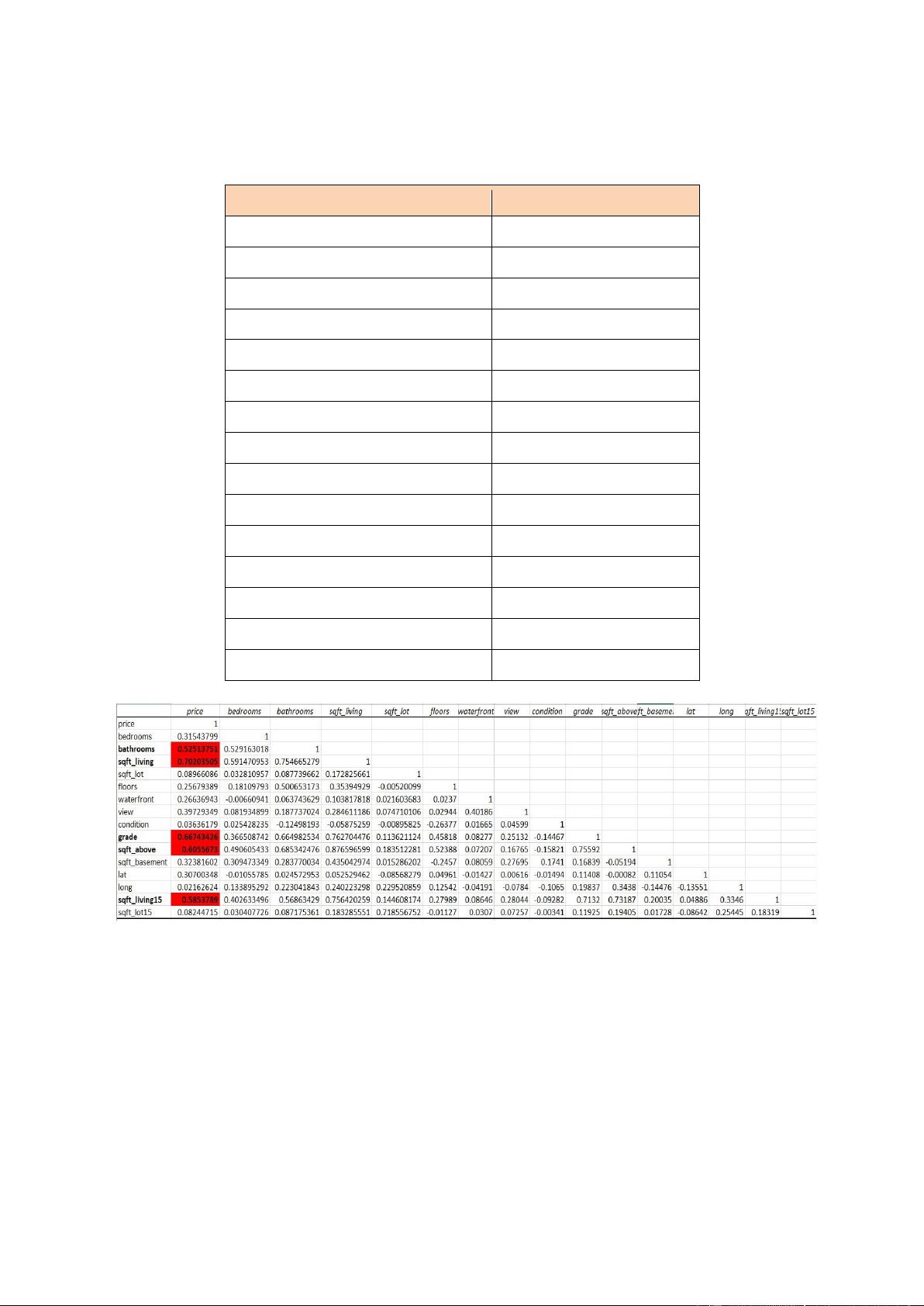

Figure 1: The correlation between all the factors

The table above shows the correlation between factors in the housing market. Correlation

means the degree to which two variables correlate with each other linearly, either through direct,

or indirect causality or statistical probability. According to the table, we can see that 5 factors

are highly correlated (proportional) to the price of the bag which is above 0.5 including

“bathrooms”; “sqft_living”; “sqft_living15”; “grade”; and “sqft_above”. That means that as

these variables increase, so do housing prices. “Grade” is described as the index of building

construction and design, while the remaining 4 factors can be understood as the size of the

house and land space. Because the more bathrooms there are, the larger the house area is to have construction space. 4

The above table only shows the correlation between the variables, but to know more about the

dependencies and which factors have the main influence on housing prices, we must rely on

the linear regression model and random forest regression model. Regression is an analysis by

fitting a regression equation (or a mathematical relation) to a set of data points, usually by the

ordinary least squares method, to establish relationships. econometric systems (estimate

values of parameters), or to test economic hypotheses. The effectiveness of the two models is

compared using R-squared, which measures a model's capacity for accurate prediction. The

random forest regression model has an r-squared score of 87.6% compared to the linear

regression model's 70.8%. The higher coefficient means that a higher effect to the price.

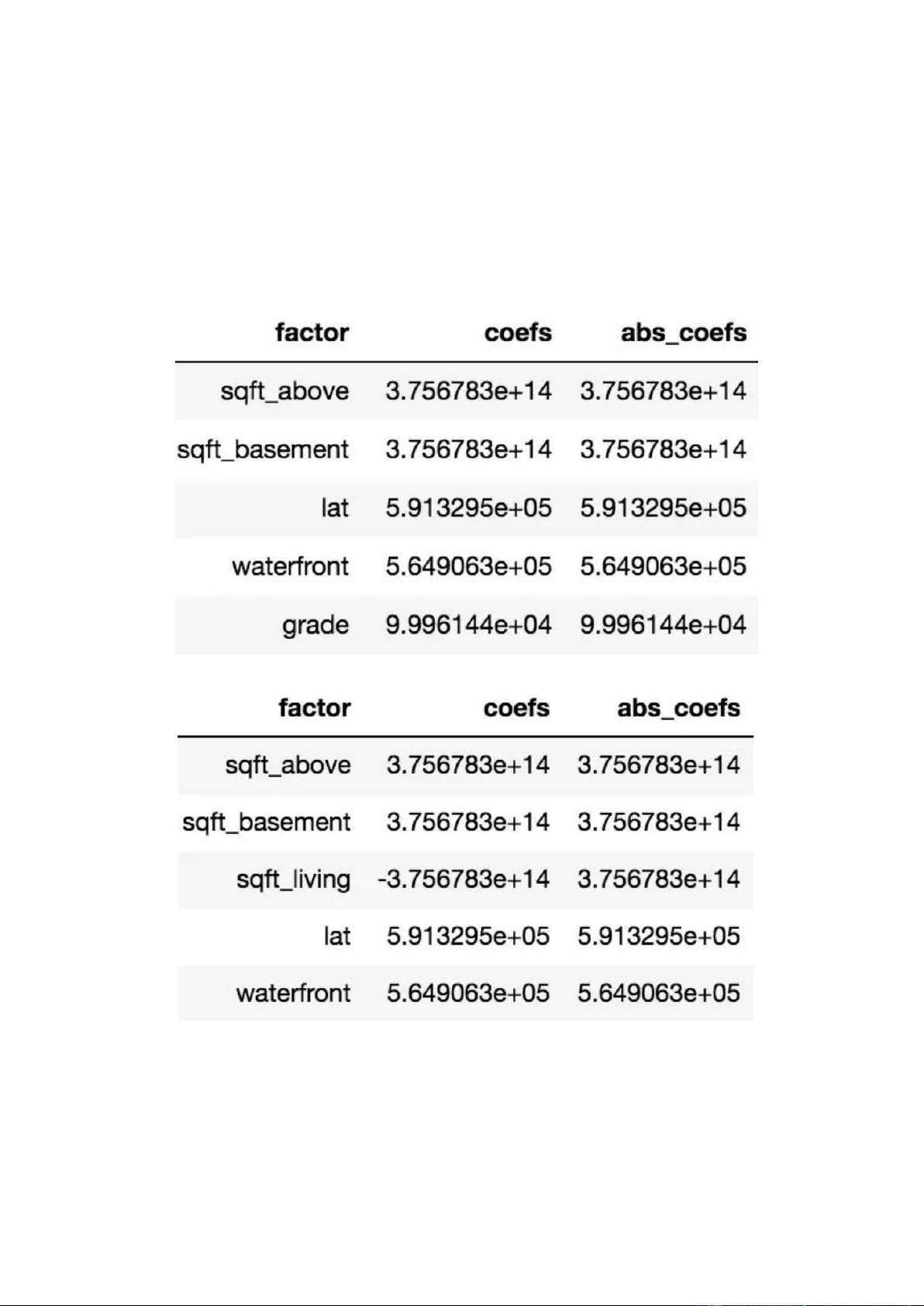

Figure 2: The coefficient of the factors based on the linear regression model

Figure 3: The coefficient of the factors based on the random forest regression model

Through data analysis, these are the factors that have the most influence compared to other

factors on housing prices. Both tables give the same results on factors affecting house prices,

in which, the factor of house size (sqft_above, sqft_basement) and house location (lat) are

two important factors. These are outcomes that can easily predict the cause. The larger the

house size, the more money it takes to buy land and build, in addition, each geographical 5

location has different land prices that affect the total cost of the house. For example, building

a house in a central location will cost much more than in the suburbs. The grade is also one of

the influencing factors. The grade is a judgment of a home's atmosphere, infrastructure, and

safety. These factors are undoubtedly significant, and people take them into account when

purchasing a home. Finally, the most surprising factor is the waterfront. Through the average

house price increase significantly, if the house has a view of the waterfront, we can conclude

that people in Ho Chi Minh City pay special attention to this factor

In conclusion, 4 main factors affect the increase in house prices: the size of the house, the

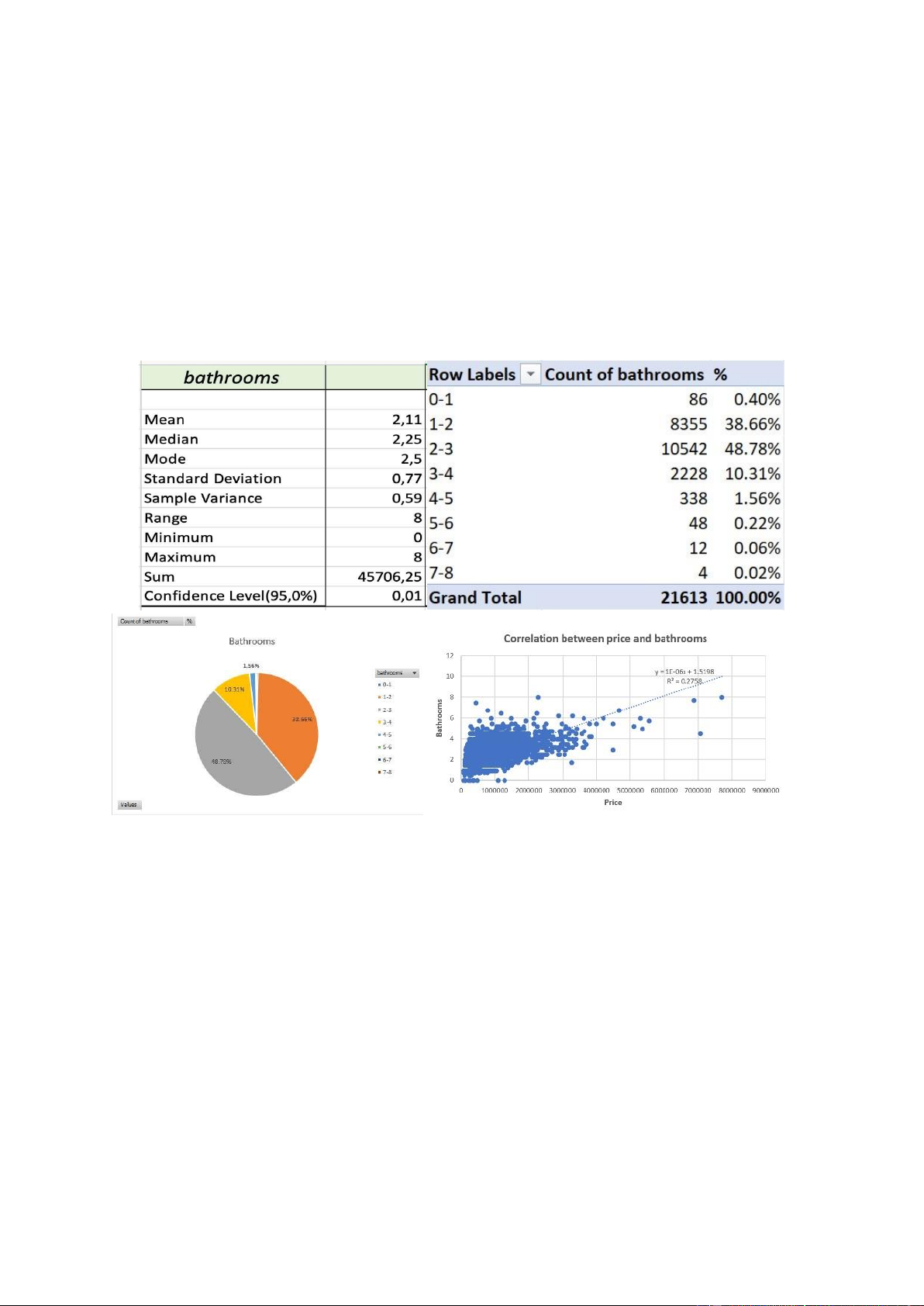

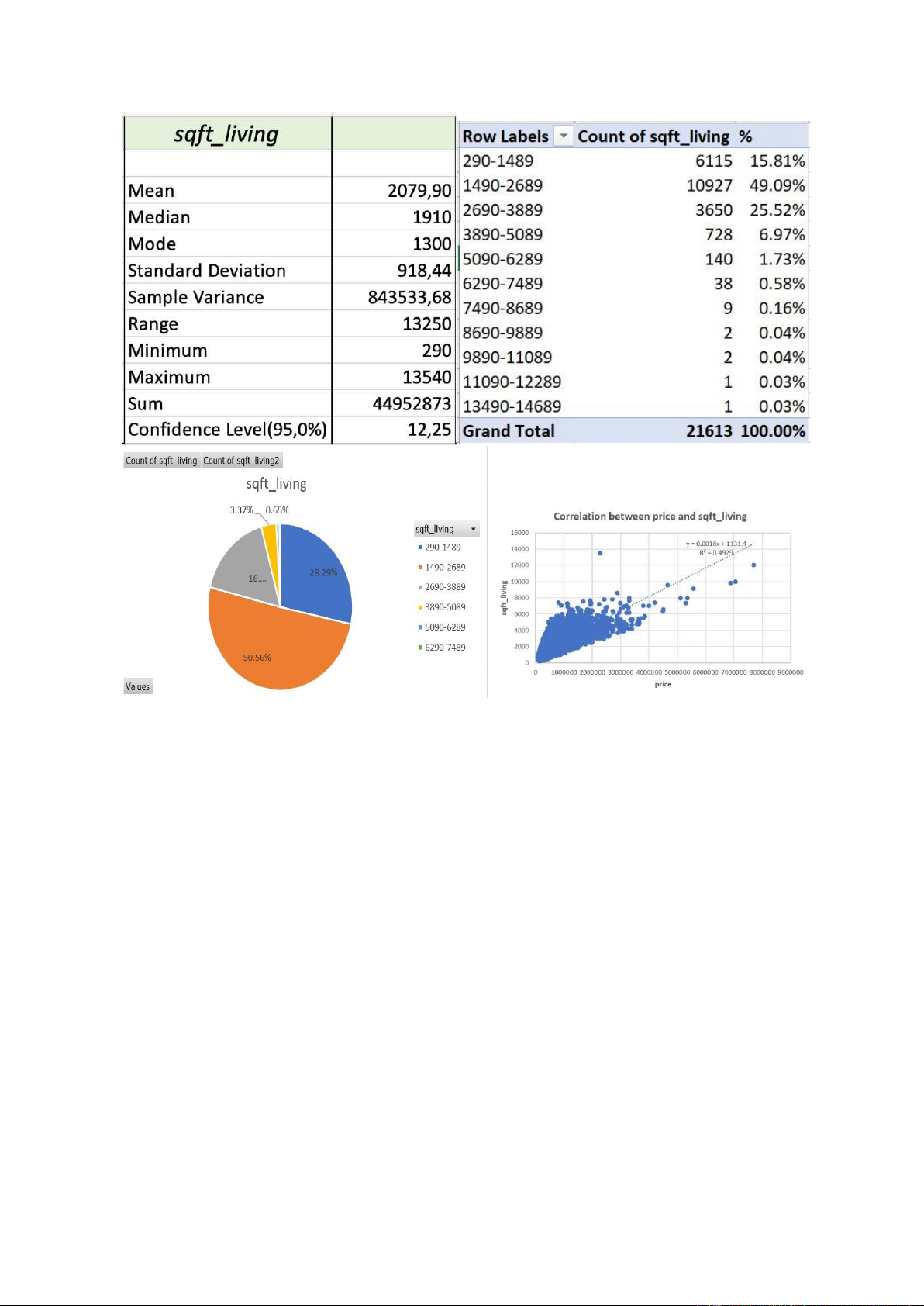

location (latitude), the existence of the waterfront, and the grade of the house. Bathrooms Sqft_living 6

As an example, it may be said that a house will cost more money the bigger it is. This makes

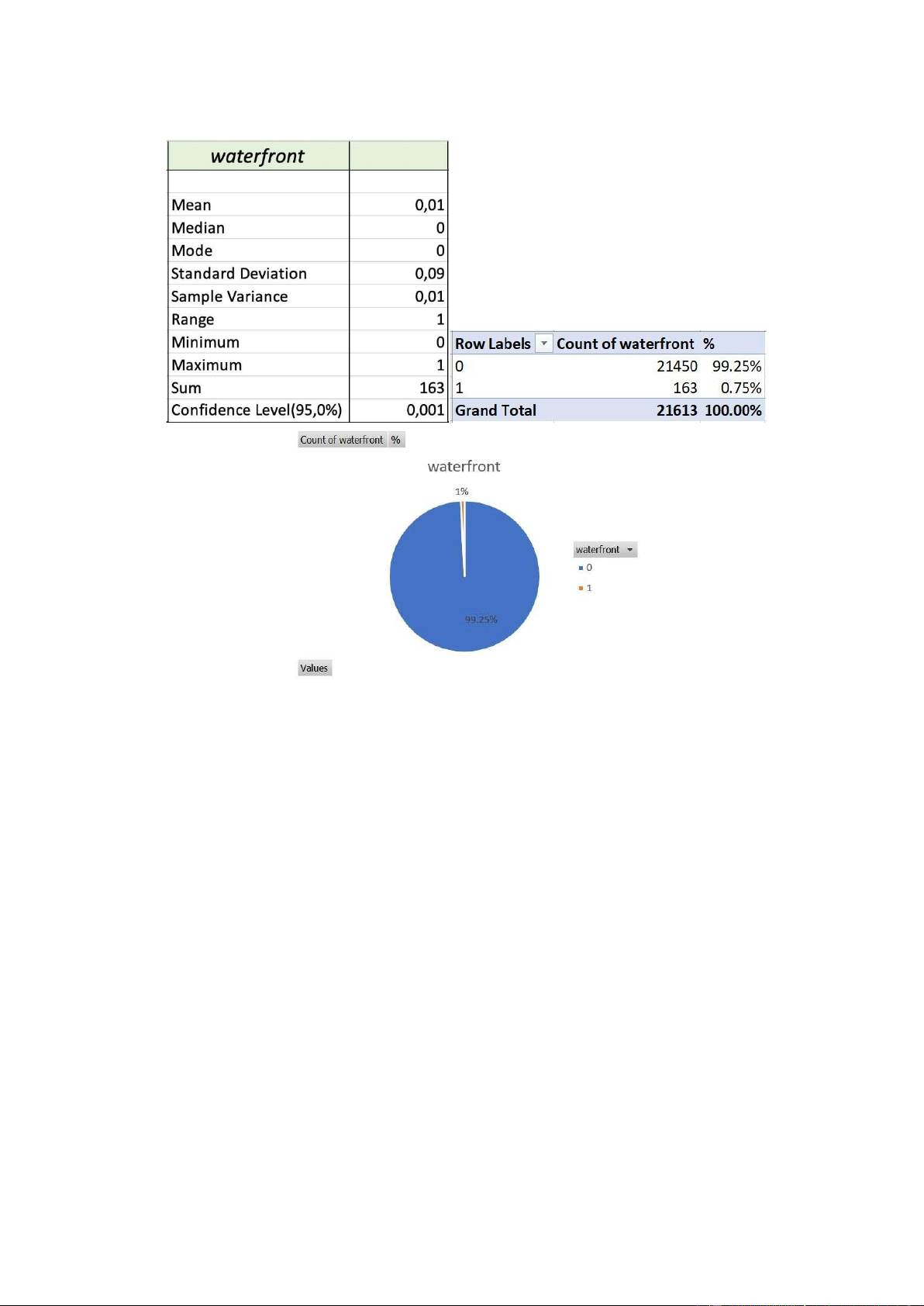

sense because the more space a person uses, the more money they must pay. 7 Waterfront

A surprising fourth aspect that is also significant. It might be argued that the neighborhood

affects the cost and that people value waterfront views. It is more relaxing to have a spacious

view from a home than a scene with busy streets or tall buildings. And walking around the

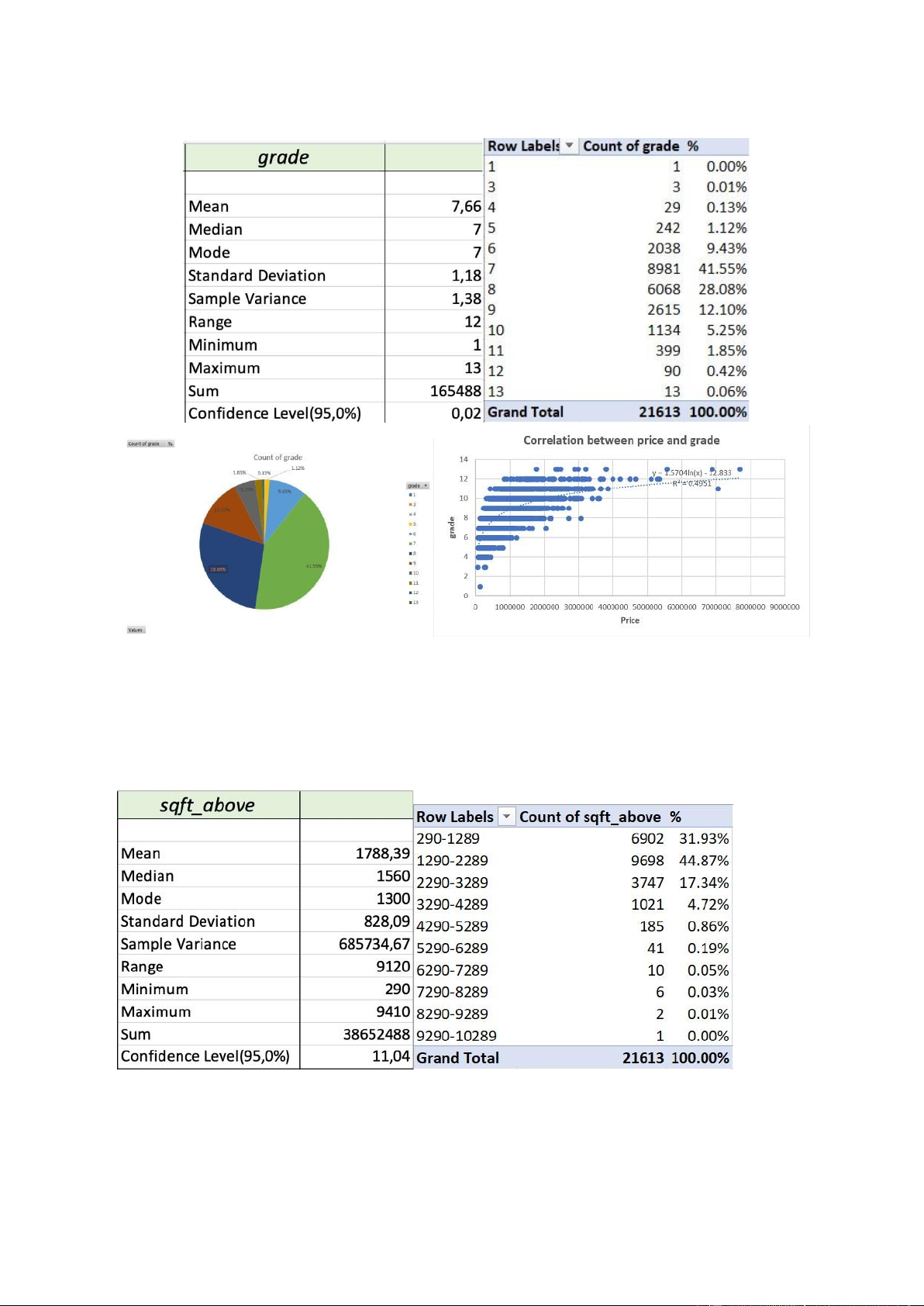

waterfront helps me to clear my head. These are most likely the rationales for why the waterfront is crucial. 8 Grade

A house's grade is also important. The grade is a judgment on a home's atmosphere,

infrastructure, and safety. These factors are undoubtedly significant, and people take them into

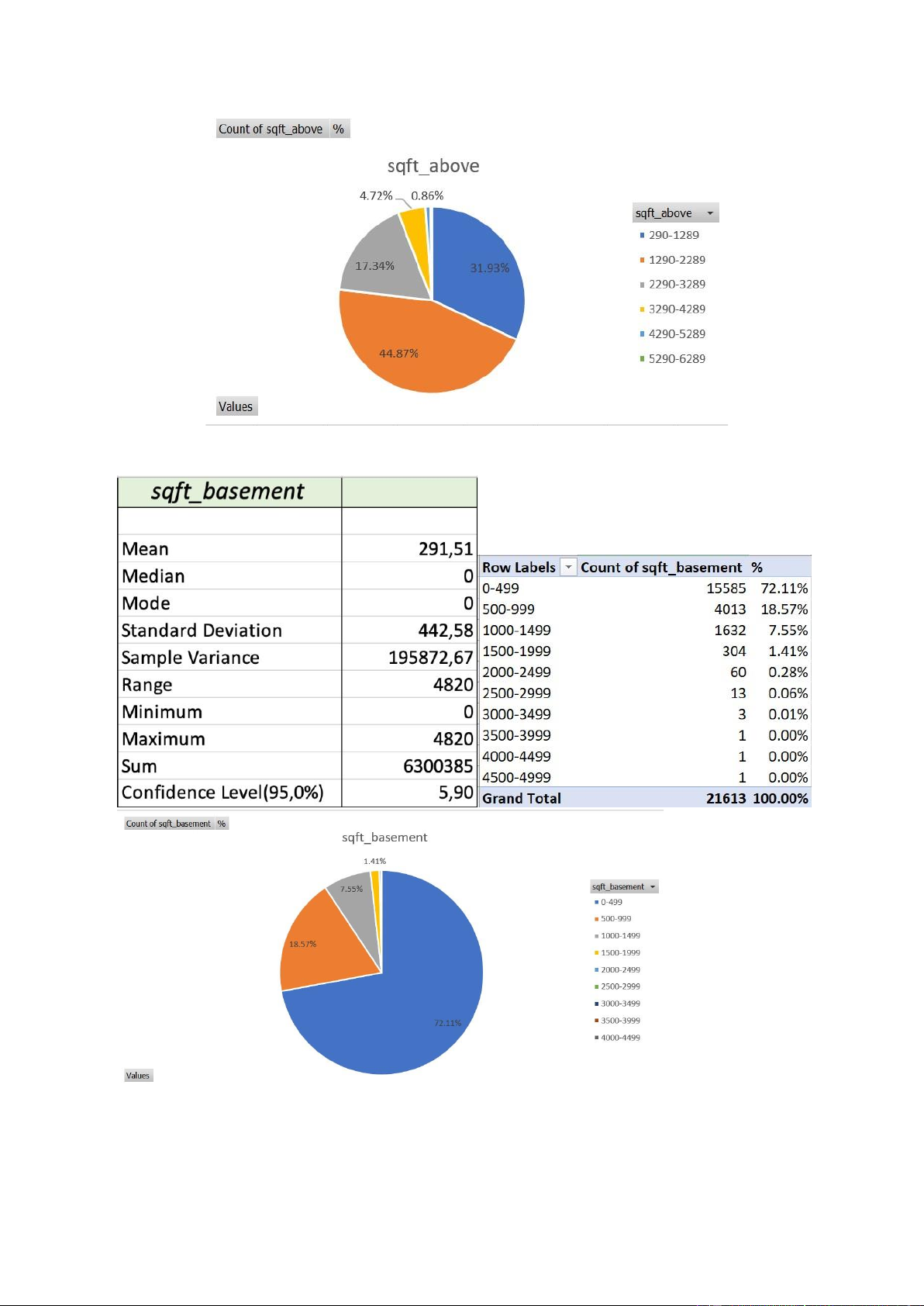

account when purchasing a home. Sqft_above 9 Sqft_basement 10 Latitude

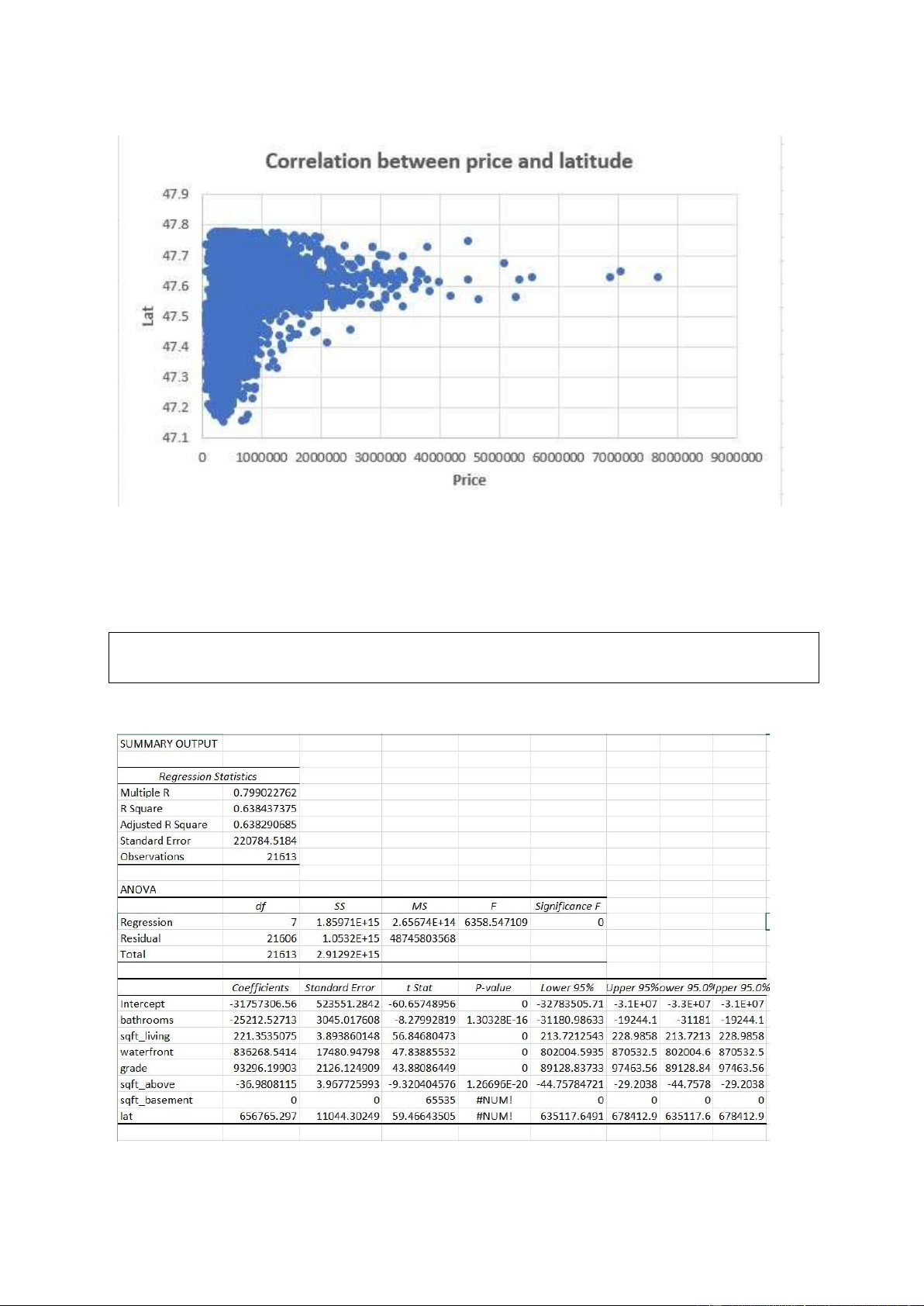

The higher the housing price in the northern area. This should be analyzed further in order to

better understand the geographic influence on house prices in Ho Chi Minh City.

IV. HOUSING PRICES PREDICTION The model we propose is

Price = 𝛼0 + 𝛼1 ∗ 𝑏𝑎𝑡ℎ𝑟𝑜𝑜𝑚𝑠 + 𝛼2 ∗ 𝑠𝑞𝑓𝑡 𝑙𝑖𝑣𝑖𝑛𝑔 + 𝛼3 ∗ 𝑤𝑎𝑡𝑒𝑟𝑓𝑟𝑜𝑛𝑡 + 𝛼4 ∗ 𝑔𝑟𝑎𝑑𝑒 +

𝛼5 ∗ 𝑠𝑞𝑓𝑡 𝑎𝑏𝑜𝑣𝑒

We estimate the model using the least square method and observe the p-value, the R-squared

error, and the coefficients to judge the prices.

Price_predict = -31757306.56 + (-25212.52713) *bathrooms + 221.3535075 * sqft living +

836268.5414 * waterfront + 93296.19903 * grade + (-36.9808115) * sqft above + 11 656765.297 * lat V. CONCLUSION

This research was driven by the need to analyze the effect of various factors on home prices.

This paper seeks to contribute to understanding and forecasting home prices based on many

criteria, as well as identifying the correct components that assist us in creating accurate

projections of housing prices. This report may help foreign investors determine whether to

invest in real estate in Ho Chi Minh City VI. REFERENCES

Giải mã thị trường nhà ất TPHCM 2022- Những thông tin quan trọng. (n.d.). Retrieved from

https://nhatnamgroup.com.vn/giai-ma-thi-truong-nha-dat-

tphcm2022/?fbclid=IwAR1HTyUJaFcxucMS9MdeUutnU5fzNSjg9zzAM65Ev71vL9 UzT5kTlCz4pQ

HCM City real estate market: apartment prices on the rise. (n.d.). Retrieved from

https://vietnamnet.vn/en/hcm-city-real-estate-market-apartment-prices-on-the- rise2039592.html

Housing prices in Ho Chi Minh City hit record highs. (n.d.). Retrieved from

https://tuoitrenews.vn/news/business/20220630/housing-prices-in-ho-chi-minh-

cityhit-record-highs/67869.html 12