Preview text:

lOMoAR cPSD| 58675420 ----- -----

NATIONAL ECONOMICS UNIVERSITY NEU BUSINESS SCHOOL

ORGANIZATIONAL BEHAVIOR ENRON CORPORATION

Senior lecturer: PGS.TS. Phạm Thị Bích Ngọc

Class: E-BDB 3 – Group 7 Member ID Student Lê Trần Phương Linh 11219337 Lê Thuỳ Linh 11213195 Lê Trà My 11219340 Hoàng Minh Ngọc 11214306 Đoàn Thị Hồng Ngọc 11214296 Nguyễn Thị Ánh Huyền 11218735 Ha Noi, November 2023 lOMoAR cPSD| 58675420 TABLE OF CONTENT

I. Organization Introduction ...................................................................................................... 3

II. Identify the OB’s problem or success inside an organization ............................................... 5

III. Explain the factors affecting the OB’s problem or success as well as the history of raising

................................................................................................................................................... 6

this problem/success .................................................................................................................. 6

IV. Analyze the management tools that the organizations have applied to resolve the OB’s

problem or to reach the OB’s success........................................................................................ 8

1. Sustainability ...................................................................................................................... 8

2. Stakeholder Groups ............................................................................................................ 9

3. Values and Behavior........................................................................................................... 9

4. Culture and Structure ....................................................................................................... 10

5. Design Process ................................................................................................................. 11

6. Reward System ................................................................................................................ 11

V. Suggest a change project to improve what has been applied .............................................. 11

VI. References ........................................................................................................................ 15 lOMoAR cPSD| 58675420 I.

Organization Introduction

Enron Corporation, once a shining star in the energy and commodities industry, emerged as one

of the most notorious symbols of corporate scandal and financial malfeasance in the early 21st

century. Founded in 1985 through the merger of Houston Natural Gas and InterNorth, Enron

grew rapidly to become one of the largest and most innovative companies in the world. The

company was headquartered in Houston, Texas, and its charismatic CEO, Kenneth Lay, was

seen as a visionary leader. Enron was known for its ambitious, aggressive, and innovative

business strategies. Under the leadership of CEO Kenneth Lay and later Jeff Skilling, the

company aimed to revolutionize the energy industry by shifting from a traditional energy

supplier to a company that traded energy commodities like other financial instruments.

Enron's corporate culture was highly competitive and often focused on short-term gains. The

company adopted innovative but complex financial structures that allowed it to keep significant

debts and losses off its balance sheet. Enron's success was widely celebrated, and it was lauded

as a model of modern corporate management.

Source: EWM Interactive

Enron's core business was energy trading and energy-related services, but the company

expanded aggressively into other areas, including broadband, water, and weather derivatives.

Enron was known for its pioneering work in the development of financial instruments and risk

management techniques that allowed it to profit from fluctuations in energy prices and other commodities.

One of Enron's key innovations was the creation of special-purpose entities (SPEs), which were

off-balance-sheet entities that the company used to move debt and assets off its financial

statements. By doing so, Enron was able to present a healthier financial image to investors and

analysts, reporting profits and concealing the extent of its liabilities.

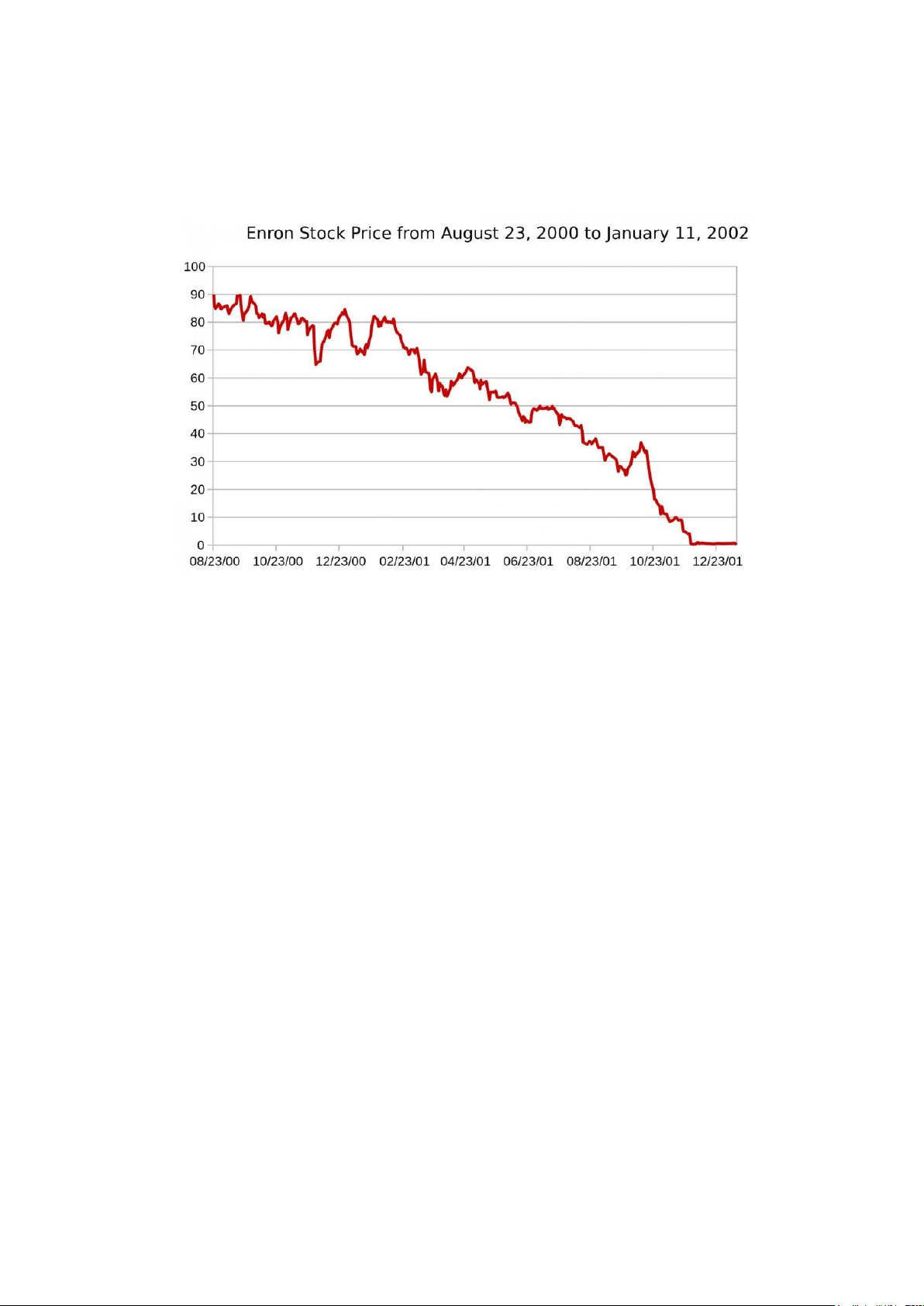

The beginning of Enron's downfall can be traced back to 2001 when its stock price began to

plummet. Concerns about the company's financial stability and accounting practices began to lOMoAR cPSD| 58675420

spread, causing a loss of confidence among investors and employees. In October 2001, Enron

revealed massive losses and debt that had been hidden in its SPEs. The shockwaves of this

disclosure led to Enron filing for bankruptcy in December 2001, marking one of the largest

bankruptcies in U.S. history at the time.

Source: Wikipedia

The Enron scandal led to a series of investigations and legal actions, including the dissolution

of the accounting firm Arthur Andersen, which was Enron's auditor. Arthur Andersen was

charged with obstruction of justice for its role in shredding Enron-related documents. The

scandal also had far-reaching implications for the accounting industry, leading to increased

regulatory scrutiny and reforms.

The Enron scandal had a profound impact on corporate governance and accounting practices

in the United States. It spurred the passage of the Sarbanes-Oxley Act in 2002, which aimed to

enhance transparency, financial reporting, and accountability in corporate America. The Act

introduced stringent regulations for corporate boards, auditors, and executives, as well as

requirements for internal controls and financial reporting. In the aftermath of the scandal,

several top Enron executives, including Kenneth Lay and Jeffrey Skilling, faced criminal

charges and were found guilty of securities fraud and other offenses. Lay passed away in 2006

before serving his sentence, while Skilling was sentenced to more than 24 years in prison,

although his sentence was later reduced on appeal.

The Enron saga serves as a cautionary tale about corporate greed, unethical business practices,

and the importance of strong regulatory oversight. It underscores the need for ethical

leadership, transparency, and accountability in the corporate world. Enron's rise and fall

continue to be studied in business schools and boardrooms as a case study in corporate

governance and business ethics. It remains a stark reminder of the devastating consequences of

financial misconduct and the enduring importance of maintaining the highest ethical standards in the business world. lOMoAR cPSD| 58675420

II. Identify the OB’s problem or success inside an organization

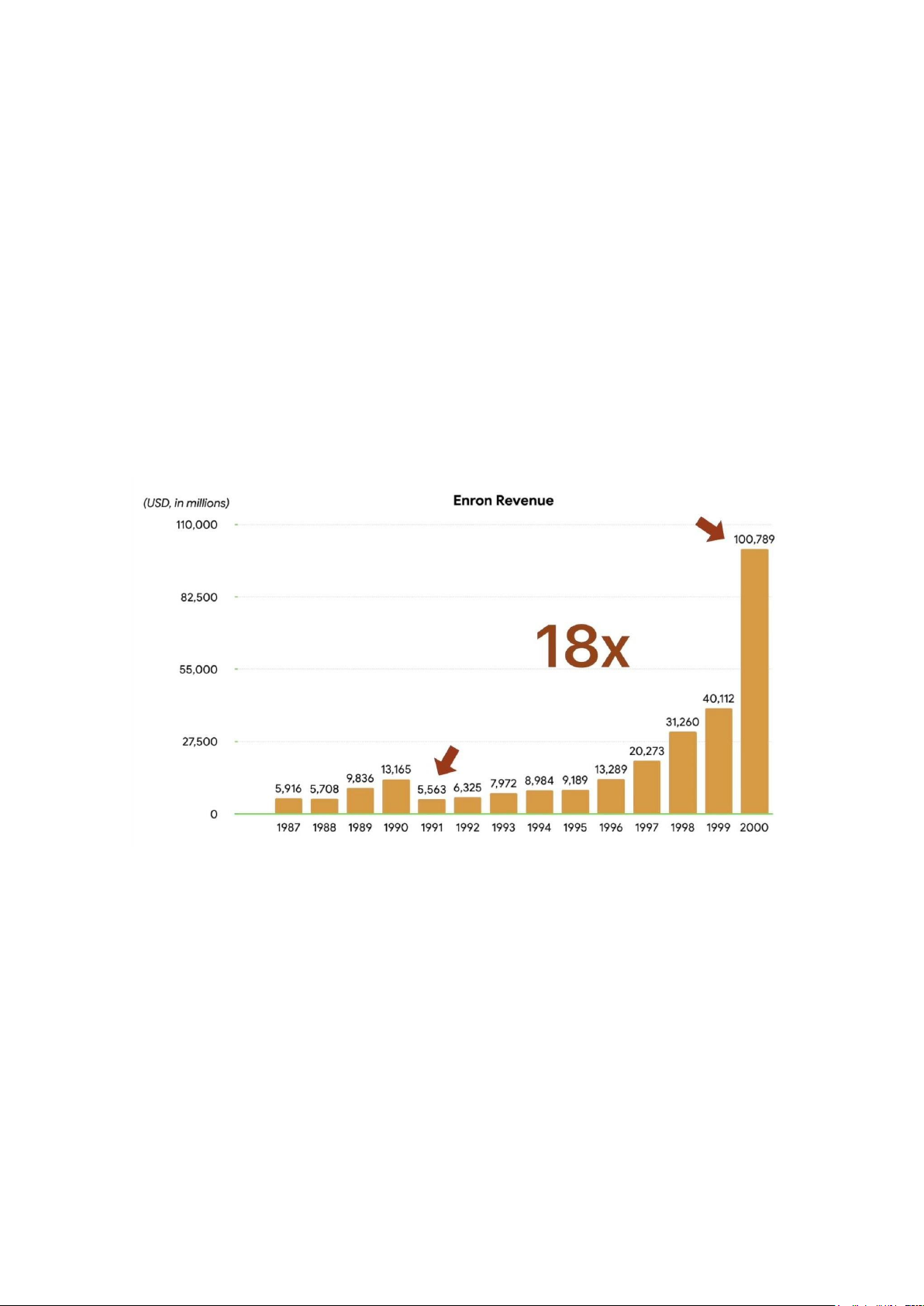

Enron's early success stemmed from its innovative and adaptable approach, transforming from

a traditional energy company into a financial powerhouse. The company's ability to diversify

its operations showcased an entrepreneurial spirit that captured market confidence. Between

January and the summer of 2000, Enron's stock price surged from $40 to $90, reflecting the

success of its groundbreaking strategies.

Key to Enron's initial triumph was the visionary leadership of individuals like Ken Lay and Jeff

Skilling. Their bold vision propelled the company's rapid growth, making Enron the 7th largest

corporation in American history with a valuation exceeding $60 billion within just a decade.

This success demonstrated the efficacy of Enron's leadership in navigating the complexities of

the business landscape and driving the company toward unprecedented achievements.

Enron's international expansion and its ability to generate a substantial portion of revenue from

global investments, about 25% of revenue, were also indicative of success in adapting to the

challenges posed by global markets. The company's strategic approach allowed it to thrive on

the international stage, showcasing organizational prowess in a dynamic and competitive environment.

Additionally, Enron's early financial engineering and use of special purpose entities (SPEs),

while later tainted by unethical practices, initially showcased a high level of financial and

organizational expertise. These innovative financial strategies played a role in positioning

Enron as a market leader before the ethical shortcomings came to light.

However, amidst its apparent successes, Enron faced severe organizational behavior problems,

particularly in its ethical conduct. The company engaged in deceptive financial practices,

fostering a culture that prioritized short-term financial gains over ethical considerations. This

unethical conduct created a toxic environment within the organization, ultimately leading to Enron's downfall.

A notable problem was the pervasive lack of accountability within Enron. Executives and

employees were not held responsible for their actions, allowing unethical practices to flourish

unchecked. The absence of ethical oversight contributed significantly to the erosion of trust

and integrity within the organization.

Enron's culture of groupthink further exacerbated its organizational problems. Critical thinking

and dissenting opinions were discouraged, leading to the normalization of unethical decisions

and behaviors. The leadership, including figures like Ken Lay and Jeff Skilling, failed in their

ethical and moral responsibilities by not only condoning but actively participating in unethical

behavior. These problems played a decisive role in Enron's fall, as a result, the stock price plummeted to $0. lOMoAR cPSD| 58675420

III. Explain the factors affecting the OB’s problem or success as

well as the history of raising this problem/success

The organizational behavior that led to Enron's success was initially propelled by several

factors that contributed to its rapid growth and recognition in the energy sector:

Firstly, Enron was known for its innovative business strategies. It transformed from a traditional

energy supplier to a company that traded energy commodities like other financial instruments.

This strategic shift was regarded as revolutionary in the energy industry, empowering Enron to

broaden its business model beyond traditional limits.

Also, Enron exhibits a varied and diversified business model. The organization diversified its

portfolio beyond energy trading, venturing into various sectors such as water, broadband, and

other industries. This diversification was initially seen as a sign of Enron's ambition and

forward-thinking approach to business.

The third factor that brought up Enron’s success is its strategic direction and visionary

leadership. Led by CEO Kenneth Lay and subsequently Jeff Skilling, Enron fostered a mission

to transform the energy market and executed assertive strategies toward this objective. Enron

had a transformative vision to reshape the energy market. They implemented aggressive

strategies to achieve this objective, which was initially perceived as visionary and led to the company's early success.

Last but not least, perceived market triumph: Enron's inventive methodologies, coupled with

its purported financial triumphs, led to a meteoric rise in its stock value, positioning it among

the most revered corporations during the late 1990s.

This success was ultimately built on deceitful accounting practices and an unsustainable

business model. The rise of Enron was marked by its innovative strategies and perceived

market success, but this success was short-lived and eventually led to one of the most

significant corporate scandals in history.

The organizational behavior problems that led to Enron's downfall were deeply rooted in the

company's culture, leadership, and practices, evolving over the course of its history. Here's an

overview of the factors affecting these problems:

The ethical deterioration within Enron was marked by a corporate culture that emphasized

financial gains above ethical standards. This prioritization of profits over ethical conduct

created an atmosphere where questionable practices were not just condoned but, in some

instances, encouraged. The company's pursuit of immediate financial success led to a pervasive

disregard for ethical considerations, culminating in widespread instances of unethical behavior,

including fraudulent financial reporting and a culture that overlooked and, in some cases,

supported dishonesty. This erosion of ethical values and the failure to prioritize integrity over

financial gain played a central role in the downfall of Enron and led to one of the most

significant corporate scandals in history. lOMoAR cPSD| 58675420

The leadership failure at Enron, particularly involving figures like Kenneth Lay and Jeff

Skilling, was marked by a significant disregard for ethical standards and the promotion of a

culture that condoned dubious and unethical conduct. Rather than upholding and setting a

precedent for ethical practices, the leadership fostered an environment that overlooked or, in

some cases, endorsed questionable behaviors. This lack of ethical leadership significantly

contributed to the erosion of the company's integrity, as the absence of ethical guidance and the

promotion of unethical practices became pervasive within the organization. The failure of top

leadership to set and model ethical standards played a pivotal role in creating an environment

where ethical considerations were subordinated to immediate financial gains, ultimately

contributing to the downfall of Enron.

Enron's struggles with transparency in financial reporting and accountability significantly

contributed to its downfall. The company's failure to maintain transparency misled stakeholders

and investors, creating a misleading perception of the company's financial health. This lack of

openness and honesty allowed fraudulent accounting practices to persist and remain

unchecked. The absence of robust checks and balances allowed fraudulent practices to continue

unchecked, without undergoing the necessary scrutiny and examination. This lack of

accountability within the organization facilitated the persistence of deceptive financial

reporting and dubious practices, ultimately contributing to the erosion of trust and credibility

in the eyes of stakeholders, investors, and the public, leading to Enron's eventual collapse.

Enron's corporate culture was characterized by a fervent emphasis on short-term financial

achievements at the expense of ethical conduct and long-term sustainability. The organization

fostered a cutthroat, hyper-competitive environment that prioritized financial gains at any cost.

This culture encouraged employees to focus on short-term financial success, often at the

expense of ethical considerations. This fixation on immediate financial gains eclipsed

considerations for ethical practices and sustainable business approaches. Consequently, a lack

of trust among employees emerged, stemming from the prioritization of financial outcomes

over ethical behavior. This cultural dissonance hindered open communication within the

company, as employees grappled with a corporate atmosphere that primarily focused on

immediate profits, resulting in a compromised work environment with diminished trust and

reduced opportunities for transparent communication.

Finally, Enron suffered from regulatory inadequacy, where the company's compliance

mechanisms and oversight proved inadequate in identifying and curbing fraudulent practices.

This insufficiency in regulatory supervision contributed significantly to the prevalent

Organizational Behavior problems within the company. The lack of effective measures to detect

and prevent fraudulent activities allowed unethical practices, such as fraudulent financial

reporting, to persist without proper detection or intervention. The shortcomings in regulatory

oversight failed to address and rectify the fraudulent practices, exacerbating the OB challenges

that ultimately led to the company's downfall.

These factors, including ethical deterioration, leadership failure, lack of transparency, cultural

dissonance, and regulatory inadequacy, collectively led to a breakdown in the company's

ethical and operational fabric. The problems grew gradually and became deeply entrenched in

the company's culture, ultimately contributing to its downfall. lOMoAR cPSD| 58675420

IV. Analyze the management tools that the organizations have

applied to resolve the OB’s problem or to reach the OB’s success 1. Sustainability

The absence of a CSR framework at Enron indicates a significant oversight in the company's

approach towards sustainability. CSR encompasses a company's responsibility towards society,

the environment, and ethical conduct. Its absence suggests a lack of long-term strategic

planning and consideration for stakeholders beyond immediate financial gains.

The absence of a unified leadership approach is a critical organizational behavior issue. A

cohesive leadership approach helps set the tone for organizational culture, values, and ethical

standards. In Enron's case, the lack of a clear leadership model likely contributed to a culture

where unethical practices could flourish without checks and balances.

The reliance on a charismatic leadership style, while effective in certain contexts, proved

inadequate in Enron's case. Charismatic leaders can inspire and motivate, but they can also

potentially create a culture of unquestioning obedience, which can be detrimental if the leader's

decisions lack an ethical foundation.

The absence of a robust ethical code allowed Enron's managers to abuse their powers and

engage in fraudulent activities. An ethical code serves as a guideline for decision-making,

providing a clear framework for ethical behavior. Without this, there were few constraints on

the behavior of managers, leading to widespread misconduct.

The emergence of a corporate cultism philosophy, driven by the strong presence of the

company's leader, created a culture of blind allegiance. This culture likely discouraged critical

thinking and questioning of decisions, contributing to the perpetuation of unethical practices.

The leadership style at Enron seemingly manipulated employees' trust in their leader, leading

them to violate established business ethics. This manipulation likely created a toxic

environment where employees felt compelled to follow the leader's directives, even if they

went against their ethical instincts.

The leadership style and the emergence of corporate cultism had a profound impact on the

behavior of employees and managers. It likely fostered an environment where unethical

practices were normalized, and dissenting voices were suppressed, leading to a breakdown of

ethical conduct within the organization.

In summary, Enron's downfall was not solely due to the absence of CSR, but also a combination

of poor leadership choices, a lack of ethical framework, and the emergence of a toxic corporate

culture. These factors collectively created an environment where unethical behavior was not

only tolerated but, in some cases, encouraged. This case serves as a stark reminder of the

importance of ethical leadership, the need for clear ethical codes, and the dangers of unchecked

charismatic leadership in organizations. lOMoAR cPSD| 58675420 2. Stakeholder Groups

With a strategy for rapid growth, Enron's Board of Directors actively acquired other companies

and assets. A significant portion of the capital was borrowed from banks, and the company also

raised capital by issuing stock to purchase shares of partner companies at a predetermined price.

Enron's leadership did not confine themselves to the production and trading of energy; they

ventured into the risky field of financial services within the energy industry. This line of

business required substantial capital. Through exclusive control in management and operation,

the company's leaders decided to produce at a higher capacity than optimal. This allowed the

company to reduce the unit cost of products by leveraging fixed costs, thereby increasing profits for the current year.

As a supplier, Enron entered into fixed-price contracts with customers in the future and

collected fees from these contracts. These costs were recorded in current revenue, while

potential future liabilities were to be borne by the subsidiary companies established by Enron

to hold assets. These subsidiary companies also absorbed and isolated financial risks.

For example, when Enron expanded its pipelines, the company could establish a subsidiary

company (SPE). This SPE unit would own the pipeline and mortgage it, generating revenue

from the pipeline to pay off the creditors. In this way, the company's balance sheet did not

reflect both the corresponding assets and liability for the debt.

The high-ranking managers' fraud occurred throughout the company. Many executives

benefited from it. A series of Enron's energy group managers were involved in fraudulent

accounting and unlawful internal transactions. Among them, mention must be made of Enron's

Chief Financial Officer, Andrew Fastow, who illicitly gained over $33 million from the

loopholes in transactions that allowed directors to profit. Here, the key was the high stock

option price for employees and the exclusivity in the company's management board. At the

beginning of 2001, Ken sold shares at $79 each. Most of these transactions were not disclosed.

By the end of 2001, the stock was only valued at $0.6. The opaque accounting procedures

concealed the company's loss situation by establishing shell companies outside.

The non-transparent financial statements, along with the high stock prices, implied the high

expectations of investors regarding the company's profit potential. This puts pressure on leaders

to generate corresponding levels of profit. On the other hand, leaders also held a large number

of shares, so they did not want the stock price to decrease. 3. Values and Behavior

At first glance, Enron appeared to have a robust set of values. According to the company's code

of ethics, it advocated for core values, along with "various ethical policies that all employees were expected to follow".

However, a closer examination of the company's internal dynamics revealed a stark

contradiction between the professed ethical principles and the actual corporate culture: "Rather

than reinforcing the code of ethics and the list of virtuous core values, the actions of leadership

established a culture with values of greed and pride". This discrepancy between stated values

and manifested behavior within the organization was a crucial factor contributing to the ethical lOMoAR cPSD| 58675420

crisis at Enron. The disconnect eroded trust and credibility, as employees and stakeholders

witnessed a misalignment between the company's professed ideals and the actual conduct of

its leadership. The values, rather than being the guiding force for behavior, became a veneer

that masked a culture of self-interest and hubris.

This disparity highlights a fundamental lesson in organizational ethics: it is not enough to have

values enshrined in official documents; they must be actively embodied and upheld by

leadership. The behavior of leaders sets the tone for the entire organization, and when actions

deviate from stated values, it undermines the integrity of the ethical framework. In the case of

Enron, the discrepancy between professed values and actual behavior had far-reaching

consequences, ultimately contributing to the company's downfall and leaving a lasting legacy

as a cautionary tale in the annals of corporate governance.

4. Culture and Structure

Enron has become an emblematic case in the business world, highlighting deception, ethical

missteps, and a failure to capture public attention. High-ranking executives such as CEO

Kenneth Lay and Jeffrey Skilling were accused (and subsequently indicted) of the company's

collapse and callous disregard for the welfare of its employees. However, the issues at Enron

go far beyond unethical behavior and illegal actions of some high-level employees. The

majority of the problems lie within the very culture that everyone within the company upholds.

The root of the issue may lie in Enron's culture characterized by absolute compliance. This

absolute compliance is manifested through the following four elements:

- Cultivation of Credible Leadership Image: The leaders of Enron progressively built

credibility through increasingly impactful self-introductions. For example, Skilling

created an image of himself akin to the character Darth Vader in Enron, even going as

far as using the term "Stormtroopers" to refer to those who traded with him. The

reputations of Skilling and some other managers at Enron were further reinforced

through methods such as strategically appearing as thought leaders in reputable

business magazines and living extravagant lifestyles.

- Comprehensive and Persuasive Vision: The use of forceful language was highly

prevalent at Enron, exemplified in the company's slogans such as "the world's leading

company." This grandiose imagery easily encouraged members to feel a sense of trust

in their rights and destinies. Employees were enticed and enraptured with messages that

they were the brightest and most brilliant. They felt responsible for the organization's

success and worked tirelessly, with 80-hour workweeks being seen as the norm.

- Transformation and Transmission: From the time employees were recruited until later

stages, communication at Enron followed the simplest and most rigid top-down

approach. In the early stages, this method had to be adhered to absolutely. A study on

the dynamics of group motivation revealed that initial rules led individuals, in their

thinking, to overemphasize collective benefits. Enron's aim in this case was to deeply

instill individual responsibility for the organization's development.

- Shared Culture: While the company went to great lengths to make new employees feel

like members of the company with various privileges, it also constructed an internal

reward and punishment system. All material and spiritual benefits that individuals lOMoAR cPSD| 58675420

currently possessed at Enron could be revoked due to the capricious preferences of the

management. Enron would swiftly discard any employee deemed "the best and the

brightest" if they did not align with the company; they could be completely blindsided

when labeled as a "failure" in the eyes of others. This issue could arise solely due to a

divergence from the company's rules and an inability to meet Enron's excessively high- performance targets. 5. Design Process

As far as the internal design processes of the organization are concerned, the incorporation of

new principles may enhance the former impressively. A closer look at Enron’s design processes

before the development of the infamous issue shows that the company’s project management,

as well as business support, left much to be desired.

The specified issues could be attributed to poor communication between the staff members;

once the information transfer started, the data transmitted was misinterpreted at some point,

which led to further confusion and the misrepresentation of the actual situation that the company had to deal with.

In retrospect, the lack of cohesive communication could be viewed as one of the key factors

contributing to the emergence of instances of fraudulence. If all company members had been

informed properly concerning the opportunities and threats faced by the organization, the

leaders and managers of Enron would have sought other avenues of managing the crisis apart

from deserting the sinking ship that Enron seemed to them at the time. 6. Reward System

Ironically enough, it was the reward system deployed into the company’s framework that

served as one of the key factors in Enron’s rapid downfall. According to the existing records,

the reward system within the organization could be defined as extravagant.

Though providing incentives for the staff is considered crucial for enhancing motivation rates,

an extravagant approach devalues the significance of a reward, turning the process of staff

encouragement into a chase for easy money: “Rising stock prices and extravagant rewards

made it easier for followers as well as leaders to overlook shortcomings in the company’s ethics and business model”. V.

Suggest a change project to improve what has been applied

To address the shortcomings in Enron's management practices, a comprehensive transformation

plan should focus on rebuilding trust, establishing a culture of ethical behavior, and

implementing robust governance and oversight mechanisms. Therefore, we recommend a

change project called Restoring Ethical Governance and Sustainable Practices at Enron 2.0 Here are some key objectives:

Rebuild Trust and Stakeholder Confidence: The first step towards Enron's recovery is the

development of a robust communication plan. This plan will ensure the transparent sharing of

information with stakeholders about the company's new direction and unwavering commitment lOMoAR cPSD| 58675420

to ethical behavior. Additionally, establishing regular forums for open dialogues with

employees, investors, regulators, and other stakeholders will address concerns and provide valuable feedback.

Cultivate an Ethical Organizational Culture: To embed ethics into the core of Enron's

operations, comprehensive ethics training must be provided to all employees. This training will

reinforce the importance of integrity, accountability, and compliance with legal and ethical

standards. Moreover, implementing a system for reporting ethical concerns or potential

violations will ensure protection for whistleblowers, fostering an environment of trust and accountability.

Enhance Governance and Oversight: A crucial aspect of Enron's transformation involves the

appointment of independent and qualified board members. These members, possessing diverse

expertise, will strengthen oversight and decision-making processes. Furthermore, rigorous

internal controls, audit procedures, and risk management practices must be implemented to

ensure compliance and prevent unethical financial practices.

Revamp Performance Management and Incentive Systems: Enron must design a balanced

performance evaluation system that emphasizes long-term value creation, customer

satisfaction, and ethical conduct, alongside financial performance. Additionally, a thorough

reevaluation of compensation structures is essential to align them with sustainable growth and responsible risk-taking.

Improve Regulatory Compliance and Reporting: To regain credibility, Enron should establish

a dedicated compliance department responsible for ensuring adherence to all relevant laws,

regulations, and industry standards. Additionally, enhancing transparency in financial reporting

and disclosure practices will provide clarity and accuracy in all financial communications.

Foster Innovation and Long-Term Sustainability: Embracing innovation with a focus on

responsible, sustainable business practices, renewable energy solutions, and environmental

stewardship is paramount. Investing in research and development initiatives will drive

technological advancements in the energy sector while adhering to ethical and legal boundaries.

Empower and Train Leadership: Providing leadership training that prioritizes ethical decision-

making, effective communication, and the cultivation of a culture of trust and accountability is

essential. Holding leaders accountable for upholding the company's values and setting an

example of ethical conduct will further solidify Enron's commitment to transformation.

Monitor and Evaluate Progress: Establishing key performance indicators (KPIs) is crucial for

measuring the success of the change project. These metrics should encompass aspects related

to ethics, governance, financial stability, and stakeholder satisfaction. Additionally, regular

audits and assessments will ensure ongoing compliance and effectiveness of the implemented changes. Implementation Plan:

This five-phase strategic plan will encompass the establishment of a Change Management

Team, and each is crucial in reshaping the company's ethos towards ethical conduct, responsible

governance, and sustainable practices. lOMoAR cPSD| 58675420

Phase 1: Establishing a Change Management Team and Conducting a Comprehensive Organizational Assessment

The initial phase involves the formation of a cross-functional Change Management Team,

comprising experts in organizational behavior, ethics, governance, finance, and legal

compliance. This team's collaborative efforts are essential in orchestrating a successful

transformation. Concurrently, a thorough organizational assessment takes place, examining the

existing culture, governance structures, financial practices, and ethical climate. This

comprehensive evaluation employs surveys, interviews, and a meticulous review of current policies and procedures.

The deliverables of this phase are twofold: a well-defined Change Management Team with

specified roles and responsibilities, and a Comprehensive Organizational Assessment Report,

which highlights the company's strengths, weaknesses, opportunities, and potential threats through a SWOT analysis.

Phase 2: Developing and Communicating the Change Vision and Objectives

In this phase, close collaboration with senior leadership is pivotal to establishing a lucid and

compelling vision for the rejuvenated Enron. The vision emphasizes ethical conduct,

sustainability, and stakeholder trust. This vision, accompanied by a detailed change roadmap,

delineates specific objectives, timelines, and the parties responsible for each initiative. This

roadmap serves as a guiding light throughout the transformation process.

The deliverables include a Change Vision Statement and Objectives Document, articulating the

company's renewed purpose, and a Change Roadmap with milestones and timelines, providing

a clear trajectory for progress.

Phase 3: Designing and Delivering Training Programs, Implementing New Policies, and

Overhauling Governance Structures

A cornerstone of Enron's transformation is the comprehensive training programs designed to

instill ethical values, compliance, leadership, and other pertinent subjects across all levels of

the organization. Simultaneously, updated policies and procedures, aligned with the new ethical

and governance standards, are communicated to the workforce. Furthermore, a reconfiguration

of governance structures is undertaken, involving the appointment of independent board

members and the establishment of specialized committees focusing on compliance, ethics, and risk management.

The deliverables of this phase encompass training materials, schedules, and attendance records,

ensuring a well-informed workforce. Additionally, revised policies and procedures manuals,

reflecting the new ethical standards, are disseminated. An updated organizational chart and

governance framework solidify the structural changes implemented.

Phase 4: Monitoring Progress, Gathering Feedback, and Making Adjustments as Necessary

To ensure the ongoing success of the transformation, mechanisms for feedback are established,

allowing employees, stakeholders, and external partners to voice their perspectives on the

changes. Regular progress reviews are conducted in collaboration with the Change lOMoAR cPSD| 58675420

Management Team and senior leadership. These reviews assess the effectiveness of

implemented initiatives. Key performance indicators (KPIs) are analyzed to track

improvements in ethical behavior, governance, financial stability, and stakeholder satisfaction.

The deliverables of this phase include comprehensive feedback reports and action plans for

improvement. Progress review reports, featuring performance metrics and insightful analyses,

offer a valuable perspective on the evolution of Enron's transformation.

Phase 5: Celebrating Milestones and Recognizing Employee Contributions to the Change Process

As milestones are achieved throughout the change project, events and activities are organized

to celebrate these accomplishments. Exceptional commitment to the new ethical and

governance standards is acknowledged and rewarded, not only at an individual level but also

within teams and departments. Communication of the project's successes, both internally and

externally, contributes to enhancing the company's reputation.

Deliverables in this phase encompass celebration events, awards, and recognition programs,

fostering a culture of appreciation and motivation. Communication materials, spotlighting the

positive impacts of the change project, solidify Enron's renewed image. Conclusion:

Enron's transformational journey is meticulously structured, focusing on ethical conduct,

responsible governance, and sustainable practices. This comprehensive approach, spanning

five essential phases, ensures a well-rounded revival, positioning the company for a successful

future in the energy sector. Through unwavering commitment and concerted effort, Enron can

emerge from its tumultuous past as a beacon of ethical excellence and sustainable business practices. lOMoAR cPSD| 58675420 VI. References

1. Stape, A.L. (2002). Ethics: Area business schools are not rushing to add courses on

ethical behavior as a result of the Enron scandal. The Providence Journal (April 7)

2. Swartz, M. (2003). Power Failure: The Inside Story of the Collapse of Enron. New York. NY: Crown Business.

3. Bethany McLean, and Peter Elkind. (2003). The Smartest Guys in the Room: The

Amazing Rise and Scandalous Fall of Enron. New York, NY: Portfolio Trade.

4. Eichenwald, K. (2005). Conspiracy of Fools: A True Story. New York, NY: Broadway Books.

5. Koehn, D. (2005). Transforming our students: Teaching business ethics post-Enron.

Business Ethics Quarterly, 15(1), 137-151.

6. Magnolia Films (2005). Enron: The smartest guys in the room. HDNET Films video

7. Enron: The smartest guys in the room. (2005). Magnolia Studios. Available on DVD at https://www.amazon.com/ 8.

Burkus, D. (Winter/ Spring 2011). A tale of two cultures: why culture trumps core values in

building ethical organizations. The Journal Of JVBL Values-Based Leadership, Volume 4, Issue 1.

9. "Enron's Organizational Behavior" (2012, February 11) Retrieved October 25, 2023,

from https://www.paperdue.com/essay/enron-organizational-behavior-114568

10. “Enron case study: one of the worst frauds in history” (2022, November 05) Retrieved October 25, 2023, from

https://www.piranirisk.com/blog/enron-case-study-one-of-the-worst-frauds-in-history