Preview text:

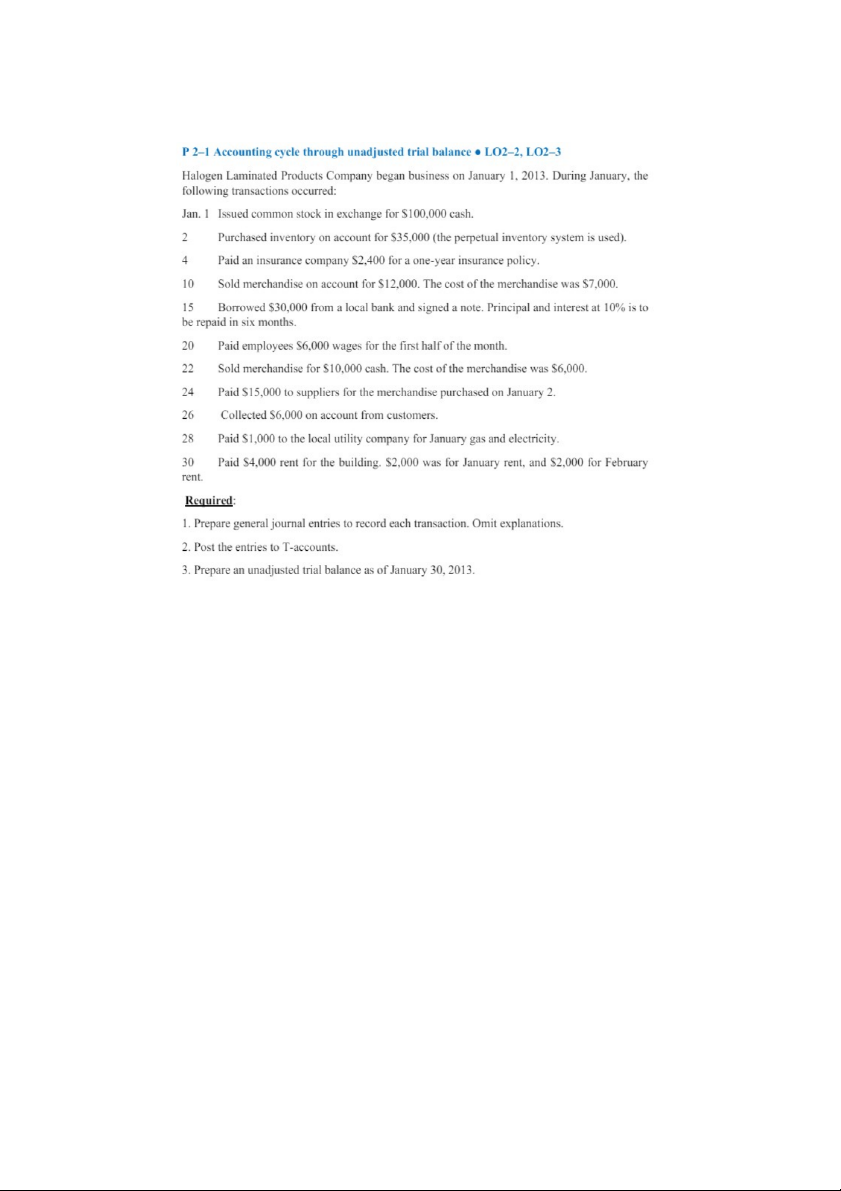

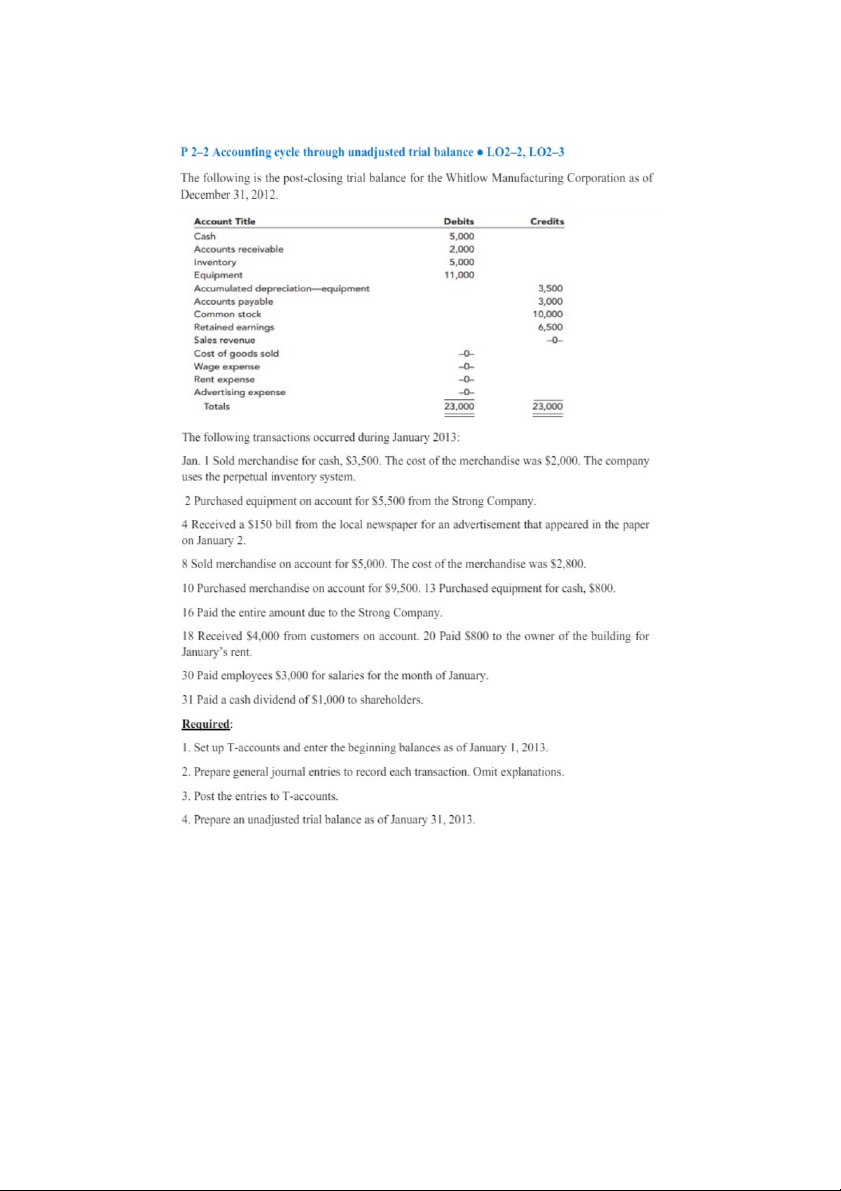

Date Decription Dr Cr Jan – 1 (1) Cash 100.000 Common Stock 100.000 Jan – 2 (2) Merchandise 35.000 Account Payable 35.000 Jan – 4 (3) Prepaid Insurance 2.400 Cash 2.400 Jan – 10 (4) Account Receivable 12.000 COGS 7.000 Merchandise 7.000 Revenue 12.000 Jan – 15 (5) Cash 30.000 Note payable 30.000 Jan – 20 (6) Salaries and Wages 6.000 Expense 6.000 Jan – 22 (7) Cash 10.000 COGS 6.000 Revenue 10.000 Merchandise 6.000 Jan – 24 (8) Account Payable 15.000 Cash 15.000 Jan – 26 (9) Cash 6.000 Account Receivable 6.000 Jan – 28 (10) Ultilities Expense 1.000 Cash 1.000 Jan – 30 (11) Prepaid 2.000 Rent Expense 2.000 Cash 4.000 Cash Account Payable COGS (1) 100.000 2.400 (3) (8) 15.000 35.000 (2) (4) 7.000 (5) 30.000 6.000 (6) Total: 15.000 35.000 (7) 6.000 (9) 6.000 15.000 (8) BAL: 20.000 Total: 13.000 (7) 10.000 1.000 (10) BAL: 13.000 4.000 (11)

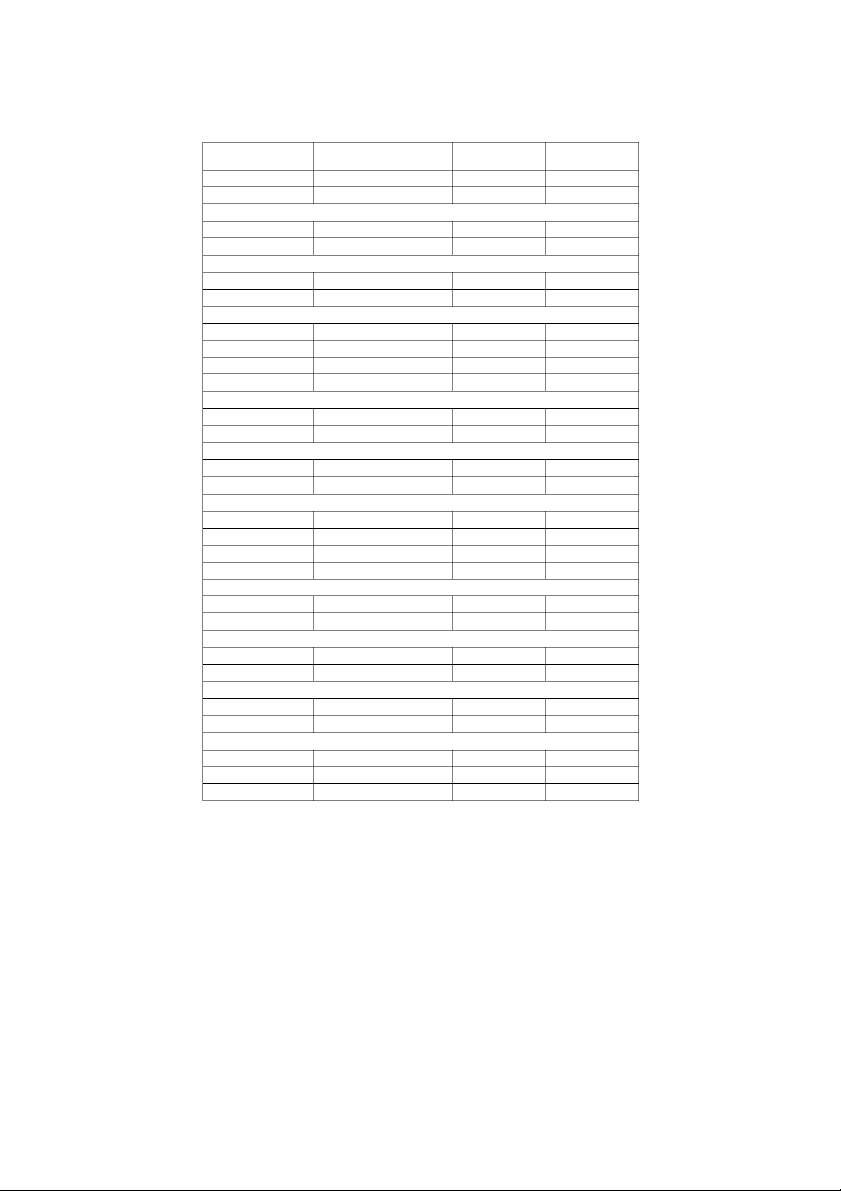

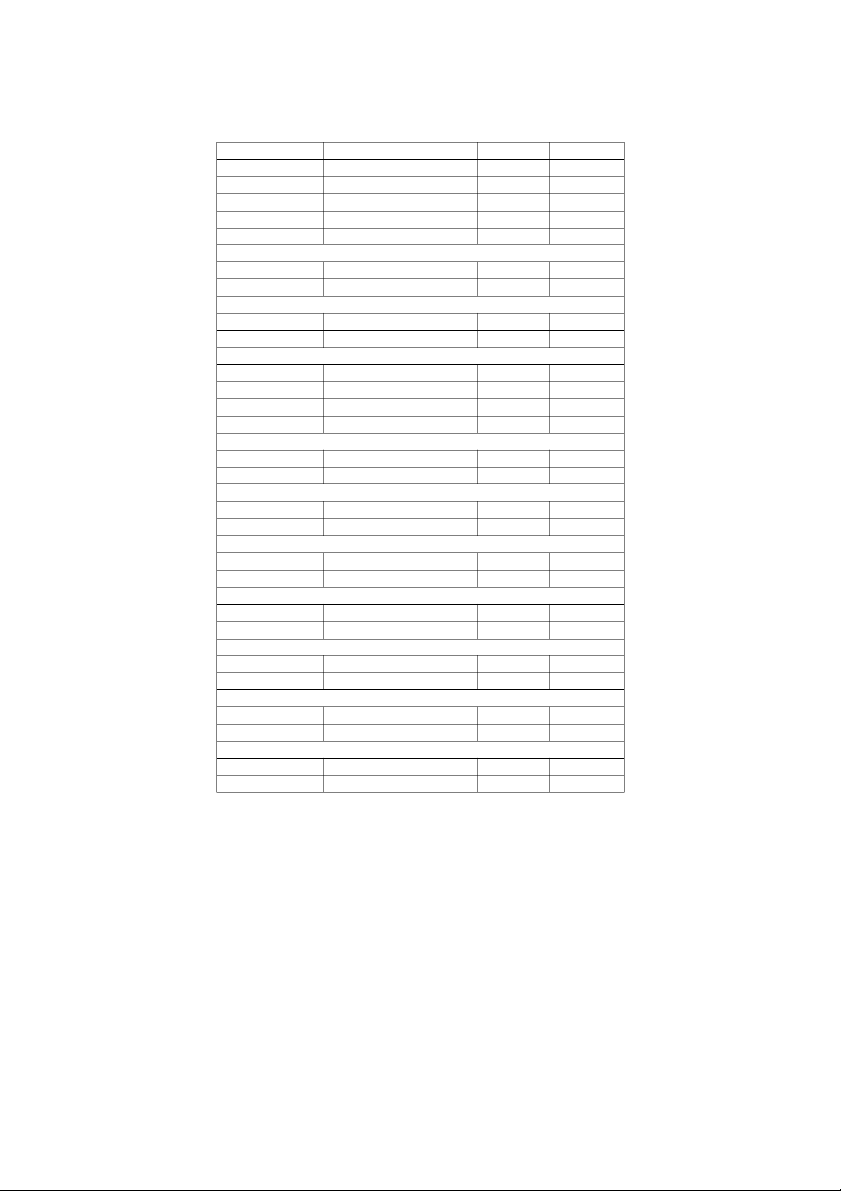

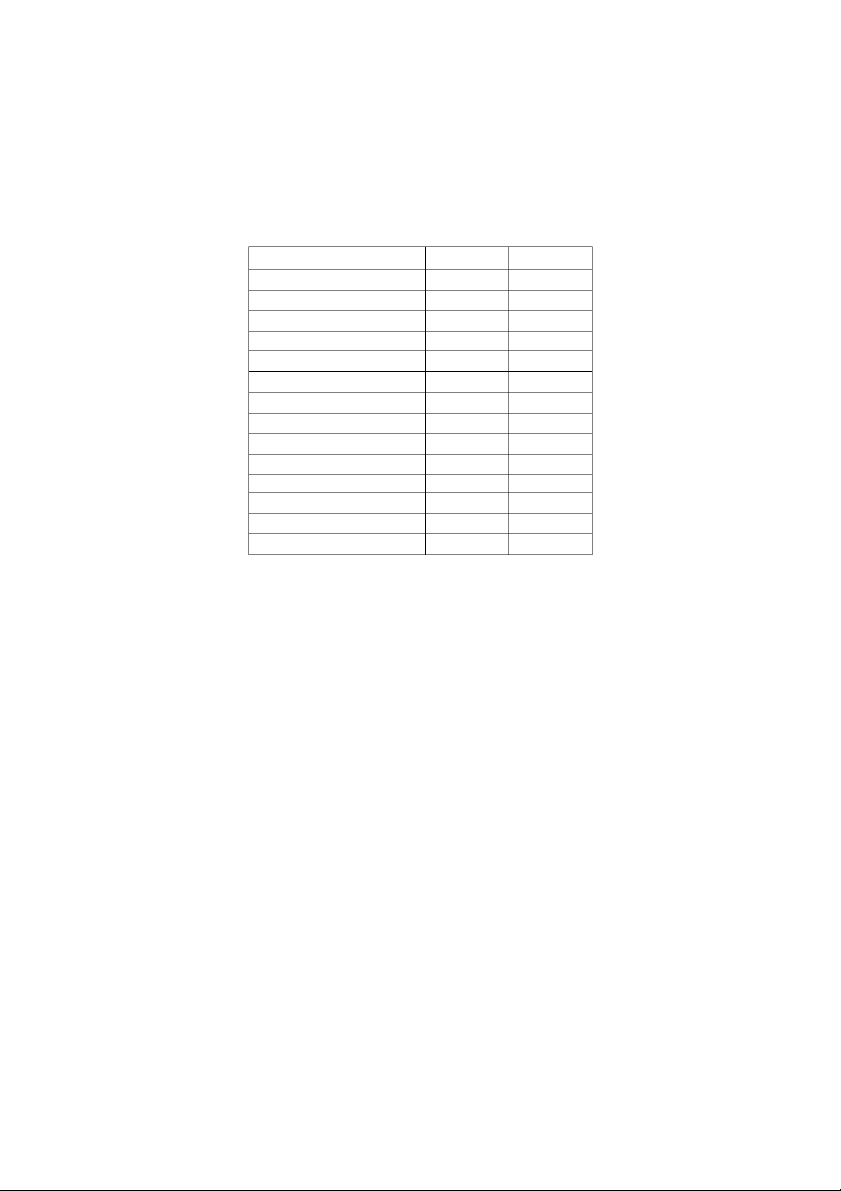

Salaries & Wage Expense Total: 146.000 28.400 (6) 6.000 Prepaid Rent BAL: 117.600 Total: 6.000 (11) 2.000 BAL: 6.000 Total: 2.000 Revenue BAL: 2.000 12.000 (4) Common Stock 10.000 (7) 100.000 (1) Merchandise Total: 22.000 Total: 100.000 (2) 35.000 7.000 (4) BAL: 22.000 BAL: 100.000 6.000 (7) Total: 35.000 13.000 Prepaid Insurance Account Receivable BAL: 22.000 (3) 2.400 (4) 12.000 (9) 6.000 Total: 2.400 Total: 12.000 6.000 Note Payable BAL: 2.400 BAL: 6.000 30.000 (5) Total: 30.000 Ultilities Expense Rent Expense BAL: 30.000 (10) 1.000 (11) 2.000 Total: 1.000 Total: 2.000 BAL: 1.000 BAL: 2.000 Hologen Laminated Unadjust Trial Balance January 31th, 2013 Account tittle Dr Cr Cash 117.600 Common Stock 100.000 Merchandise 22.000 Account Payable 20.000 Prepaid Insurance 2.400 COGS 13.000 Account Receivable 6.000 Revenue 22.000 Note Payable 30.000 Salaries & Wage Expense 6.000 Utilities Expense 1.000 Prepaid Rent 2.000 Rent Expense 2.000 Total 172.000 172.000 Date Decription Dr Cr Jan – 1 (1) Cash 3.500 Sales Revenue 3.500 COGS 2.000 Merchandise Inventory 2.000 Jan – 2 (2) Equipment 5.500 Account Payable 5.500 Jan – 4 (3) Advertising Expense 150 Account Payable 150 Jan – 8 (4) Account Receivable 5.000 Sales Revenue 5.000 COGS 2.800 Merchandise Inventory 2.800 Jan – 10 (5) Merchandise Inventory 9.500 Account Payable 9.500 Jan – 13 (6) Equipment 800 Cash 800 Jan – 16 (7) Account Payable 5.500 Cash 5.500 Jan – 18 (8) Cash 4.000 Account Receivable 4.000 Jan – 20 (9) Rent Expense 800 Cash 800 Jan – 30 (10) Salaries Expense 3.000 Cash 3.000 Jan – 31 (11) Retained Earning 1.000 Cash 1.000 Cash Merchandise Inventory Equipment BAL: 5.000 BAL: 5.000 BAL: 11.000 (1) 3.500 800 (3) (5) 9.500 (2) 5.500 (8) 4.000 5.500 (6) 2.000 (1) (6) 800 800 (8) 2.800 (4) Total: 17.300 3.000 (10) Total: 4.800 BAL: 17.300 14.500 1.000 (11) BAL: 9.700 Total: 12.500 11.100 Advertising Expense BAL: 1.400 Sale Revenue (3) 150 3.500 (1) Total: 150 Account Payable 5.000 (4) BAL: 150 BAL: 3.000 Total: 8.500 (7) 5.500 BAL: 8.500 Receivable 5.500 (2) BAL: 2.000 BAL: 2.000 150 (3) COGS (4) 5.000 9.500 (6) (1) 2.000 Total: 5.500 18.150 (4) 2.800 Total: 7.000 Total: 7.000 BAL: 12.650 Total: 4.800 BAL: 3.000 BAL: 3.000 BAL: 4.800

Accumulated Depreciation Salaries Expense BAL: 3.500 Rent Expense (10) 3.000 Total: 3.500 (9) 800 Total: 3.000 BAL: 3.500 Total: 800 BAL: 3.000 BAL: 800 Commom Stock BAL: 10.000 Retained Earning Total: 10.000 BAL: 6.500 BAL: 10.000 (11) 1.000 Total: 1.000 6.500 BAL: 5.500

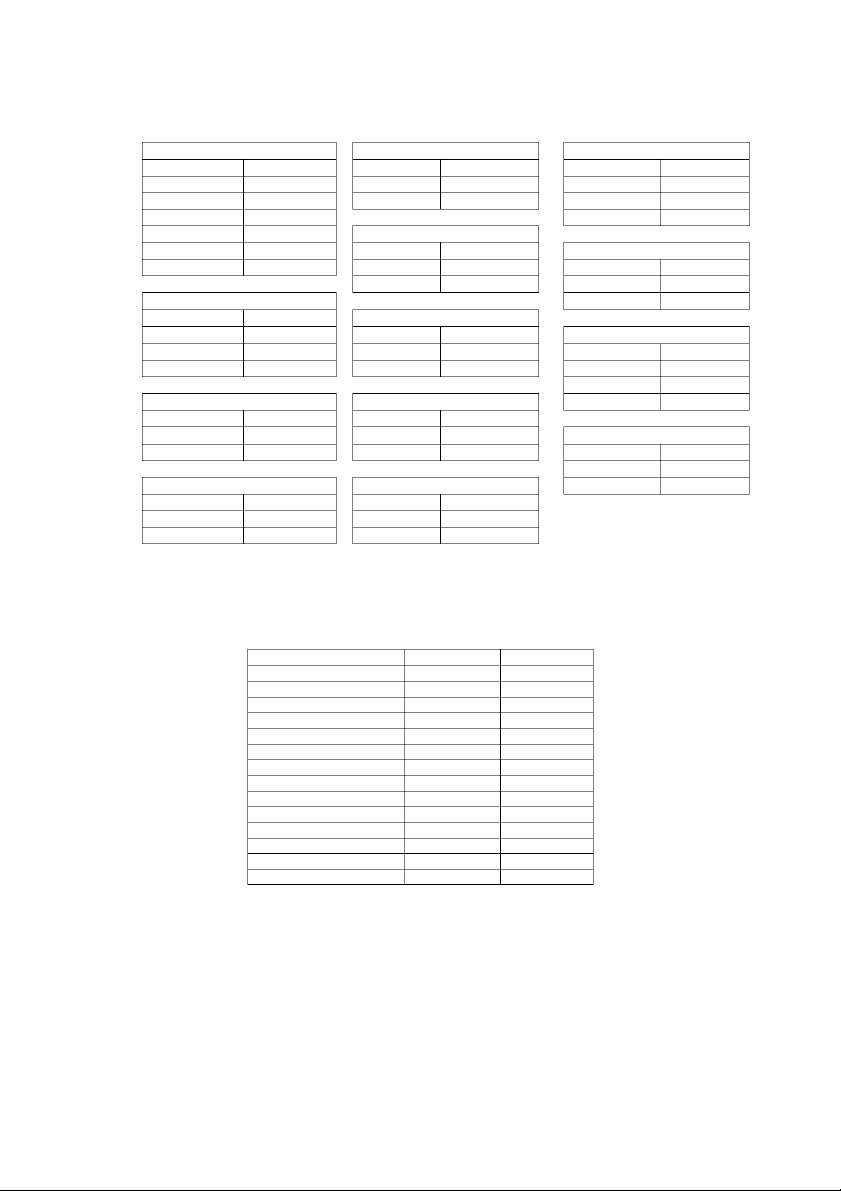

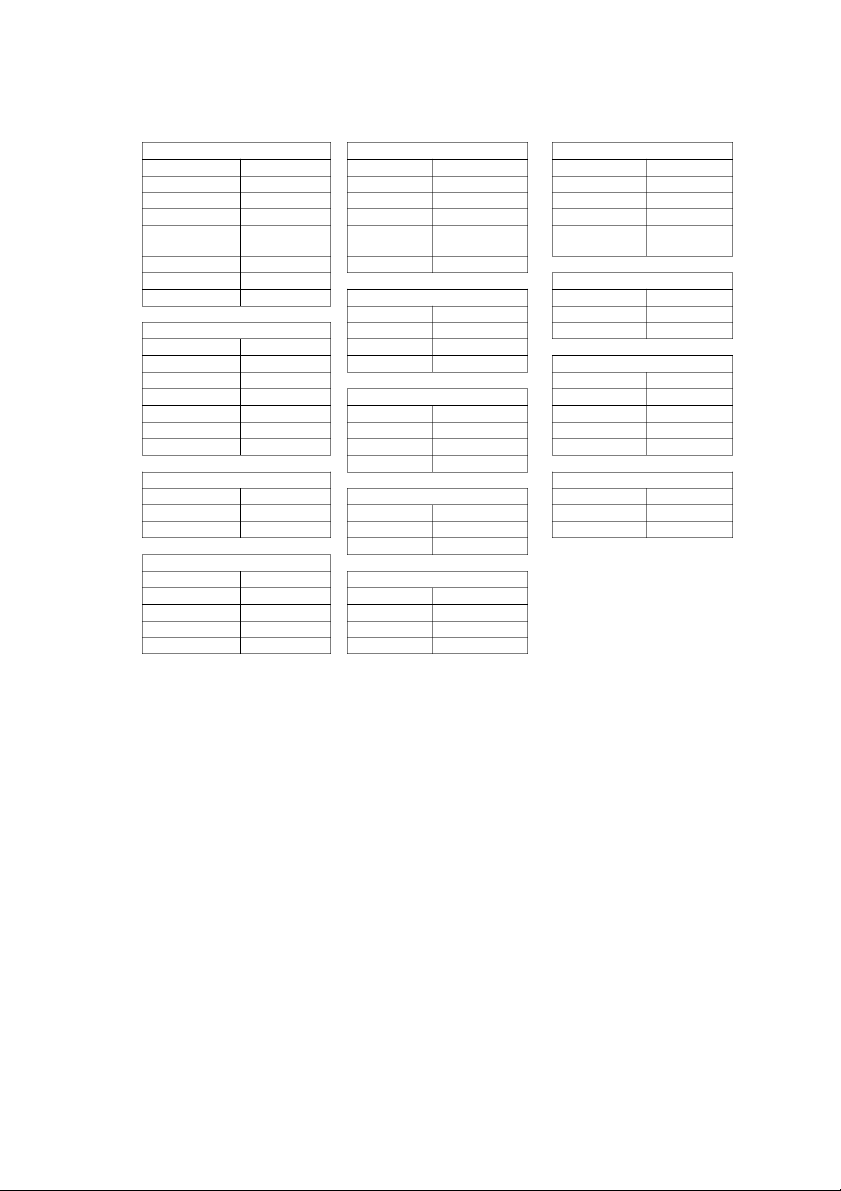

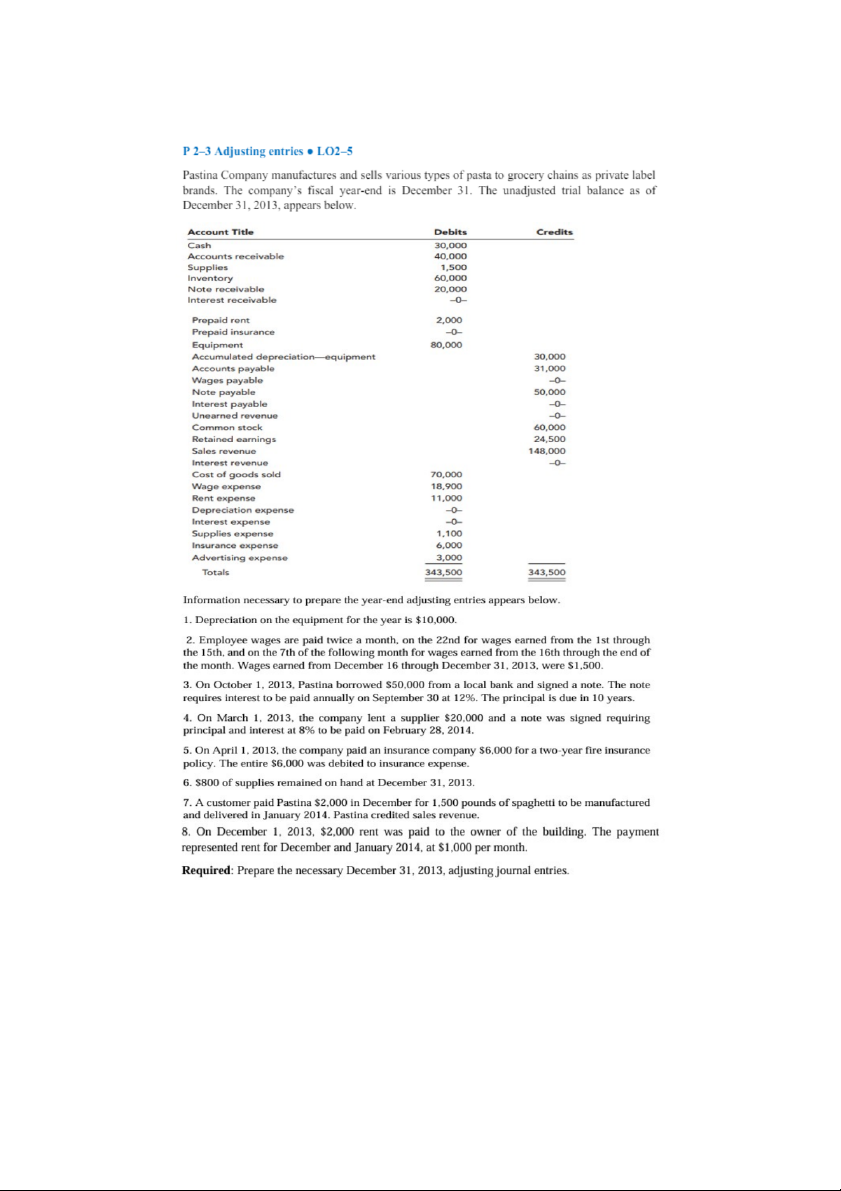

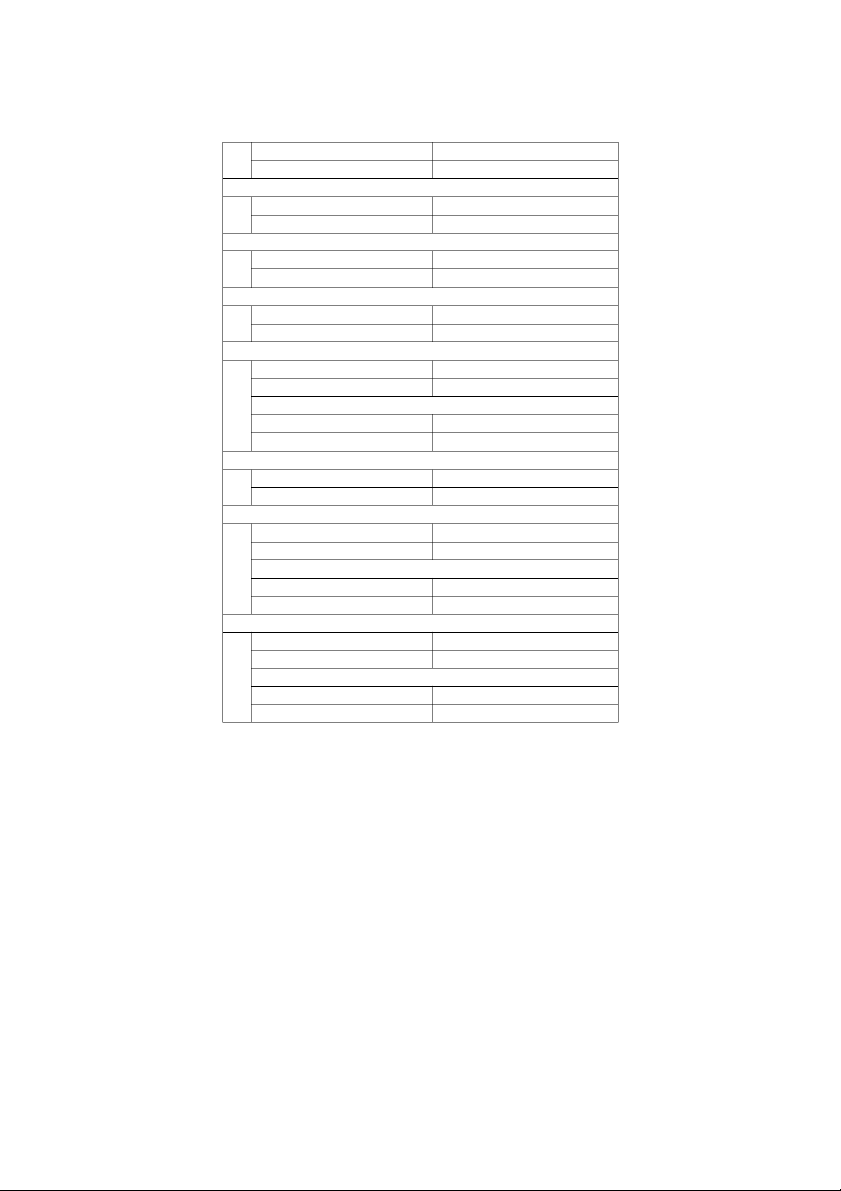

Whitlow Manufacturing Corporation Unadjust Trial Balance January 31th, 2013 Account tittle Dr Cr Cash 1.400 Common Stock 10.000 Merchandise Inventory 9.700 Account Payable 12.650 Equipment 17.300 COGS 4.800 Account Receivable 3.000 Sale Revenue 8.500 Advertising Expense 150 Salaries Expense 3.000 Accummulated Decription 3.500 Retain Earning 5.500 Rent Expense 800 Total 40.150 40.150 Dr Depreciation Expense $10.000 1 Cr Accumulated Depreciation $10.000 Dr Wages Expenses $1.500 2 Cr Wages Payable $1.500 Dr Interest Expenses $1500 = (50.000 x 12% x 3)/12 3 Cr Interest Payable $1.500 Dr Interest Receivable $1.333 = (20.000 x 8% x10)/12 4 Cr Interest Revenue $1.333 Dr Prepaid Insurance $3.750 = (6.000 x 15)/24 Cr Insurance Expense $3.750 5 =>Prior entries Dr Insurance Expense $6.000 Cr Cash $6.000 Dr Supplies Expense $700 = 1.500 - 800 6 Cr Supplies Dr Sale Revenue $2.000 Cr Unearned Revenue $2.000 7 => Prior entries: Dr Cash $2.000 Cr Sale Revenue $2.000 Dr Rent Expense $1.000 Cr Prepaid Rent $1.000 8 => Prior entries Dr Prepaid Rent $2.000 Cr Cash $2.000 Receivable Sale Revenue Rent Expense BAL: 1.500 BAL: 148.000 BAL: 11.000 700 (6) (7) 2.000 (8) 1.000 Total: 1.500 700 Total: 2.000 148.000 Total: 12.000 BAL: 800 BAL: 146.000 BAL: 12.000 Supplies Expense Prepare Rent Wage Expense BAL: 1.100 BAL: 2.000 BAL: 18.900 (6) 700 1.000 (8) (2) 1.500 Total: 1.800 Total: 2.000 1.000 Total: 20.400 BAL: 1.800 BAL: 1.000 BAL: 20.400 BAL: 2.000 Prepreciation Expense COGS BAL: 0 Prepreciation Expense BAL: 70.000 (1) 10.000 BAL: 0 Total: 70.000 Total: 10.000 (3) 1.500 BAL: 70.000 BAL: 10.000 Total: 1.500 BAL: 1.500

Accumulated Despreciation Insurance Expense BAL: 30.000 BAL: 6.000 Advertising Expense 10.000 (1) Total: 6.000 BAL: 3.000 Total: 10.000 BAL: 6.000 Total: 3.000 BAL: 10.000 BAL: 3.000 Unearned Payable Prepaid Insurance BAL: 0 Interest Payable BAL: 0 2.000 (7) BAL: 0 (5) 3.750 Total: 2.000 1.500 (3) Total: 3.750 BAL: 2.000 Total: 1.500 BAL: 3.750 BAL: 1.500