Preview text:

10/18/2022

I n s t r u c t o r : N g u y e n H a L i e n C h i , M . A .

E m a i l : n g u y enh a l i e nc hi . c s 2 @ f t u . e du . v n 1

I. AN OVERVIEW OF INTERNATIONAL INVESTMENT

II. FOREIGN DIRECT INVESTMENT Ths.Nguyễn Hạ Liên Chi 2 1 10/18/2022

Chapter 1: An overview of International Investment

Chapter 2: Economic aspect of Foreign Direct Investment

Chapter 3: International production: long-term trends and current patterns

Chapter 4: Determinants of Foreign Direct Investment

Chapter 5: Policy aspect of FDI in developing countries Ths.Nguyễn Hạ Liên Chi 3

(1) Moosa, Foreign Direct Investment: Theory Evidence and Practice, Palgrave, NY, 2002

(2) UNCTAD, Virtual Institute Teaching Material on Economic and

Legal Aspects of Foreign Direct Investment, New York and Geneva, 2010

(3) UNCTAD, World Investment Report, New York and Geneva, 2019-2022

(4) Loc, V. C. (2012). International Investment. Hanoi: NXB Giaoduc. Ths.Nguyễn Hạ Liên Chi 4 2 10/18/2022 Assessment Rate [%] Time allowance Class participation 10% NA Mid-term assessment 30%

Assignment (report + presentation) 15% 20 mins/group Mid-term exam 15% 50 mins Final-term exam 60% 50 mins Ths.Nguyễn Hạ Liên Chi 5 6 3 10/18/2022 7

The concepts of Investment, Foreign

Investment and International Investment

Main categories of international

financial flows (introduction) Ths.Nguyễn Hạ Liên Chi 8 4 10/18/2022 INVESTMENT

You sacrifice something of value now, expecting to

benefit from that sacrifice later. Ex: Ths.Nguyễn Hạ Liên Chi 9 INVESTMENT Curren(t r C e a s p o it u a rlc ) es Future benefits • Financial benefits • Social benefits Ths.Nguyễn Hạ Liên Chi 10 5 10/18/2022 INVESTMENT

“An investment is the current commitment of money or other

resources in the expectation of reaping future benefits.”

(Z. Bodie, A. Kane and A. J. Marcus, Investments, 8th edition, Mc Graw-Hill Irwin, 2009)

“A sum of money or other resources (including e.g. knowledge or

time) spent with the expectation of getting a future return from it.”

(UNCTAD, Virtual institute teaching Material on ECONOMIC AND LEGAL ASPECTS OF

FOREIGN DIRECT INVESTMENT, United Nations: New York and Geneva, 2010) Ths.Nguyễn Hạ Liên Chi 11 INVESTMENT

3 approached according to UNCTAD:

In macro-economics and national accounts: expenditure on new capital goods

(goods that are not consumed but instead used in future production). Such investment is

the source of new employment and economic growth.

In finance: investment refers to the purchase or ownership of a financial asset with the

expectation of a future return either as income (such as dividends), or as capital gain

(such as a rise in the value of the stock).

Legal definitions of investment: found in laws and legal agreements, focus on the

issue of property, notwithstanding the productive or financial nature of the investment,

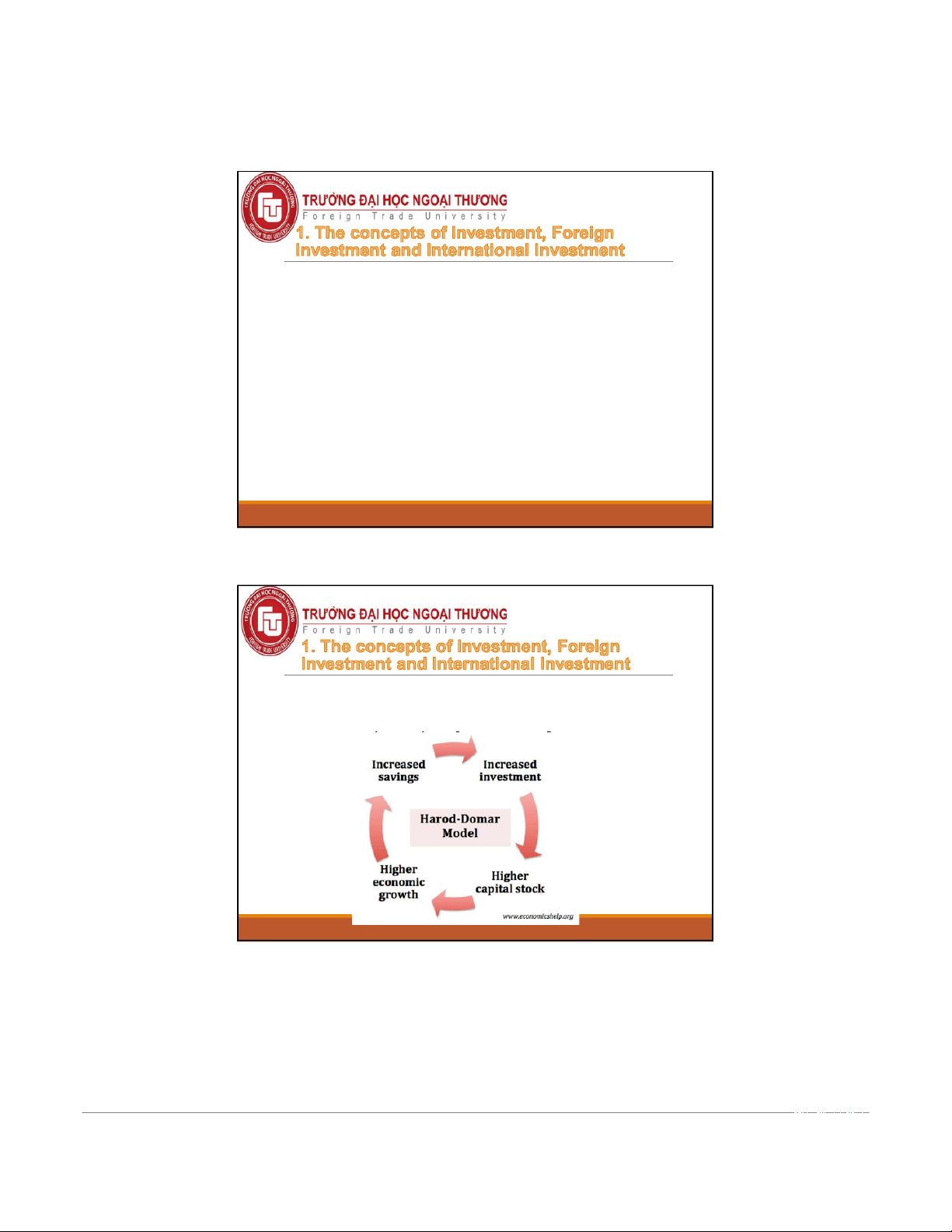

unless specific limitations are made. Ths.Nguyễn Hạ Liên Chi 12 6 10/18/2022 Charateristics of Investment Capital Return Risk factor Ths.Nguyễn Hạ Liên Chi 13 Charateristics of Investment Capital: Resources Investible Mobilization of capital Invested capital Ths.Nguyễn Hạ Liên Chi 14 7 10/18/2022 Charateristics of Investment

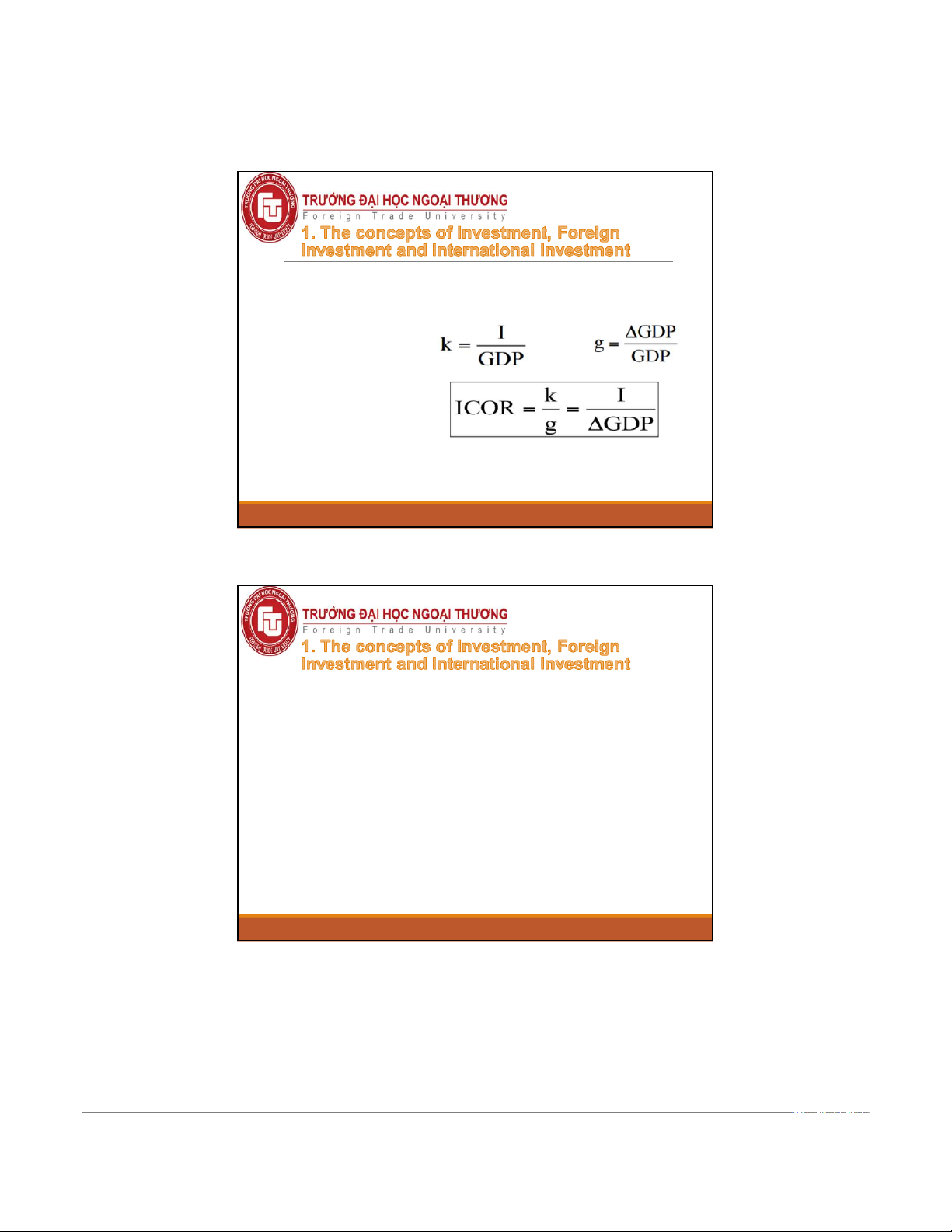

Evaluate the effective use of capital:

An individual project: ROI (Return on Investment) ROI = Profit/Total Investment (Profit = Turnover – Cost)

A country: ICOR (Incremental Capital Output Ratio) ICOR = Total Investment/ GDP ( GDP = GDPt – GDPt-1) Ths.Nguyễn Hạ Liên Chi 15 Charateristics of Investment

Harrod-Domar Model, developed by Hollis Chenery Ths.Nguyễn Hạ Liên Chi 16 8 10/18/2022 Charateristics of Investment Harrod-Domar Model g = k/ICOR

(Total investment = Domestic investment + Foreign investment) Ths.Nguyễn Hạ Liên Chi 17 International investment

Capital movement across border Ths.Nguyễn Hạ Liên Chi 18 9 10/18/2022 Foreign investment

Capital movement across a certain country’s borders Ths.Nguyễn Hạ Liên Chi 19 Invesment taxonomy Official Flows of Investment Private Investment Domestic Investment Foreign Investment Direct Investment Indirect Investment

Fixed capital formation – Productive investment (contribute directly to the productive capacity of the economy)

Financial investment (do not contribute directly to the productive capacity of the economy) Ths.Nguyễn Hạ Liên Chi 20 10 10/18/2022 INTERNATIONAL FLOW OF FINANCIAL RESOURCES Official Flows Private Flows Foreign Aid FDI FPI Private loans ODA OA OOFs Non- Portfolio Bond Commercial Grants Concessional Concessional Equity Debt loans loans loans Flows Flows Ths.Nguyễn Hạ Liên Chi 21

2.1. International Private Flows

Foreign Direct Investment – FDI:

IMF - Balance of Payments Manual, 5th edition (Washington, 1993):

“Direct investment is the category of international investment that reflects

the objective of a resident entity in one economy obtaining a lasting

interest in an enterprise resident in another economy.”

The resident entity is the direct investor and the enterprise is the direct investment enterprise. Ths.Nguyễn Hạ Liên Chi 22 11 10/18/2022

2.1. International Private Flows

Foreign Direct Investment – FDI:

OECD - Detailed Benchmark Definition of FDI, 3rd edition (Paris, 1996):

“Foreign direct investment reflects the objective of establishing a lasting

interest by a resident enterprise in one economy (direct investor) in an

enterprise (direct investment enterprise) that is resident in an economy

other than that of the direct investor.” Ths.Nguyễn Hạ Liên Chi 23 Ths.Nguyễn Hạ Liên Chi 24 12 10/18/2022

2.1. International Private Flows

Foreign Portfolio Investment – FPI:

FPI: the investment by individuals, firms, or public bodies in foreign financial

instruments (stocks, bonds, other forms of debt)

FPI is a form of international investment in which the investor of one country

buys securities of companies and issuers in another country with a certain

amount of control to earn profits but does not hold direct control over the securities issuer.

Differs from FDI, which is the investment in physical assets. Ths.Nguyễn Hạ Liên Chi 25

2.1. International Private Flows

Foreign Portfolio Investment – FPI: Why does investors choose FPI?

International correlation structure and risk diversification

Portfolio investment income in different countries is less correlated than in one country:

Economic, political factors, structures and even psychological factor

affecting portfolio investment income in each country are different,

Business circles are different among countries,

therefore, international correlation is very low. Ths.Nguyễn Hạ Liên Chi 26 13 10/18/2022

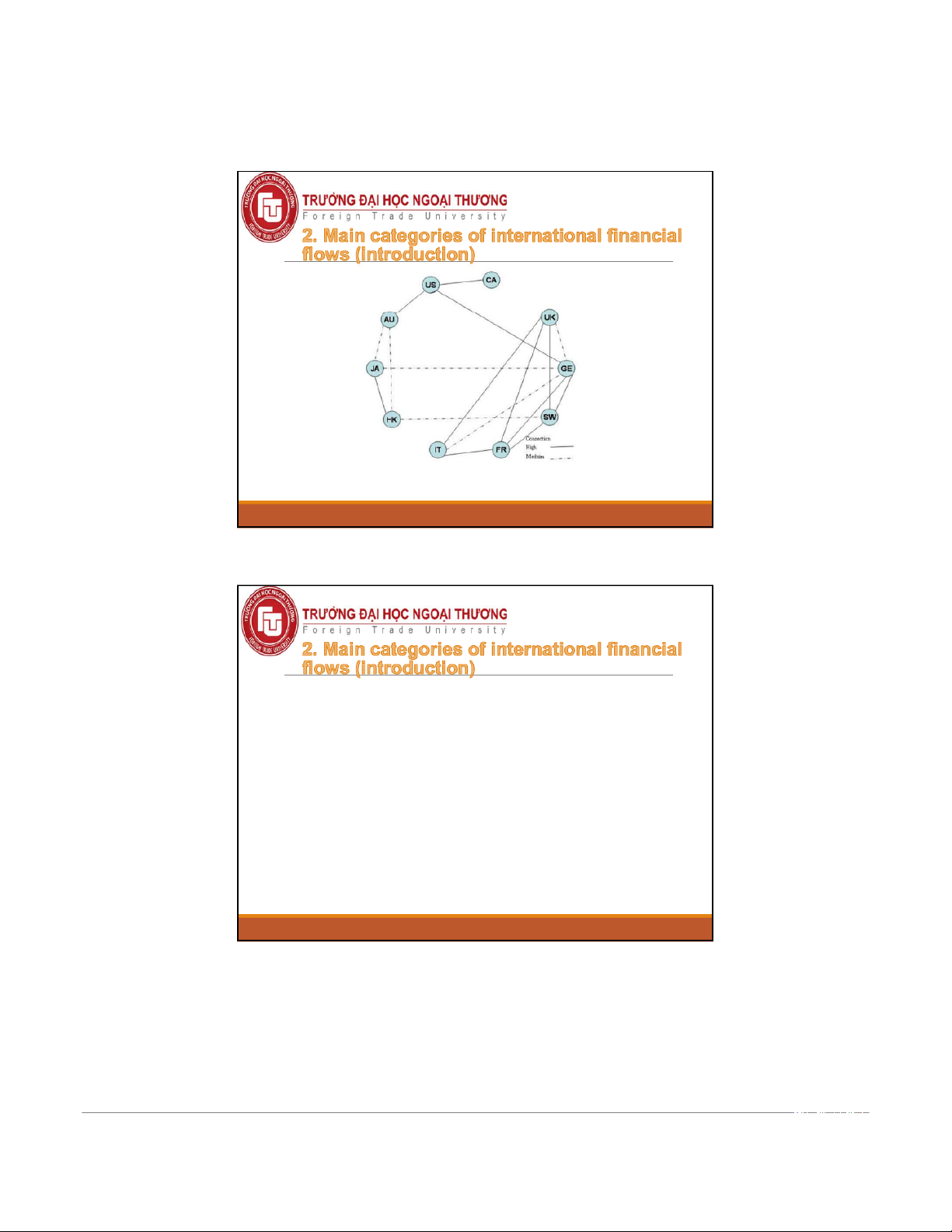

The partial correlation graph for the international financial stock returns data

(Abdelwahab, A., Amor, O., & Abdelwahed, T. (2008)) Ths.Nguyễn Hạ Liên Chi 27

2.1. International Private Flows

Foreign Portfolio Investment – FPI: Characteristics

The amount of securities that foreign companies can buy can be

controlled to a certain extent.

Foreign investors do not hold control over the activities of securities issuers

The investor's income depends on the type of securities that the

investor buys, which can be fixed or not

Host countries do not have the ability and opportunity to absorb

modern technology, techniques, machinery and equipment and management experience. Ths.Nguyễn Hạ Liên Chi 28 14 10/18/2022 Portfolio Equity Flows Bond Debt Loans Financial Stocks (equity/share): certificate of Bond: debt certificate instruments ownership Investor- - Ownership

- Credit relations (creditor & borrower) Issuing

- Investor is the share-owner/owner of the

- Investor is the bond bearer/creditor of the organization company company relationship Income

- Divident: is the company's profit divided

- Interest: is the interest corresponding to the

in proportion to the capital contribution loan amount. payable by Issuing => Non-fixed income* => Fixed income organizations

Income of the Not only dividends, but also income from

Not only bonds, but also income from buying investors buying and selling securities (the

and selling securities (the difference between

difference between the buying and selling

the buying and selling prices – Spread) prices – spread)

*Only applicable to common stock, not applicable to preferred stock.

2.1. International Private Flows

Foreign Portfolio Investment – FPI: Factors contribute to the

strong growth in international portfolio investment Demographic changes

The increasing securitisation of the global flows of funds easier to invest on

The worldwide privatization trend foreign market

The benefits of diversifying internationally become more apparent Ths.Nguyễn Hạ Liên Chi 30 15 10/18/2022

2.1. International Private Flows

Foreign Portfolio Investment – FPI: Benefit-Cost Analysis For investors Benefits Cost • Provide income to • Financial risk owners. • Risks due to speculative • Help investors make factors investments in any field • Risk of insider trading • Help investors make • Interest rate risk investments in foreign • Currency buying power companies in a simple risk way. • Buying and selling is quick and easy Ths.Nguyễn Hạ Liên Chi

2.1. International Private Flows

Foreign Portfolio Investment – FPI: Benefit-Cost Analysis

For capital users – securities issuers Benefits:

Capital users – issuers of securities can raise capital at a lower

cost than borrowing directly from banks.

Stimulate securities issuers to perform better.

Control of a foreign-invested company always belongs to the host country. Ths.Nguyễn Hạ Liên Chi 32 16 10/18/2022

2.1. International Private Flows

Foreign Portfolio Investment – FPI: Benefit-Cost Analysis

For capital users – securities issuers Cost:

Sometimes seen as purely speculative, the country's balance of

payments is very sensitive to volatile capital flows such as foreign portfolio investment.

Bringing to the host country only capital (money), no chance to

absorb modern technology and techniques. Ths.Nguyễn Hạ Liên Chi 33

2.1. International Private Flows Private Loans: Definition

International private loan is a form of international investment in which

the investor of one country lends money to businesses or economic

organizations in another country and earns a profit through interest on the loan. Ths.Nguyễn Hạ Liên Chi 34 17 10/18/2022

2.1. International Private Flows

Private Loans: Characteristics

- The investor is not the owner of the recipient.

- Investment recipients only have the right to use capital for a certain period of

time and then have to repay both principal and interest when due.

- The investor earns profit through the lending interest rate according to the loan agreement/contract.

- Loans are usually in cash, without equipment, technology, know-how or technology transfer. Ths.Nguyễn Hạ Liên Chi 35

2.2. International Official Flows – Foreign Aid Kinds of Foreign Assistance Development Aid:

•Transfer of finance, commodities etc. •Technical co-operation •Debt relief Humanitarian Aid: •Disaster relief assistance Military Assistance Food Aid

•offered to countries facing food shortages Ths.Nguyễn Hạ Liên Chi 36 18 10/18/2022

2.2. International Official Flows – Foreign Aid Foreign Aid consists of: Financial Flows Technical Assistance Commodities

given by the residents of one country to the residents of

another country, either as grants or as subsidized loans. Ths.Nguyễn Hạ Liên Chi 37

Kimberly Smith, Administrator,

Development Cooperation Directorate, OECD, Moscow, Russia, 2008 19 10/18/2022

2.2. International Official Flows – Foreign Aid ODA: The origin of today ODA

(Story of official development assistance – Helmut Fuhrer – OECD – Paris 1996)

The establishment of the UN, WB, IMF The Marshall Plan:

- Post-World War II reconstruction plan for Europe, initiated by U.S.

Secretary of State George Marshal (Nobel Prize winner) in 1947.

- European Recovery Program (1948-1952): USD13.3 billion to 16 countries

(1.5% of U.S. GDP, >1% of major recipients’ GDP) Ths.Nguyễn Hạ Liên Chi 39

2.2. International Official Flows – Foreign Aid ODA: What is the DAC?

The Organization for Economic Cooperation and Development (OECD)

was established on December 14, 1960 in Paris.

The OECD established the Development Assistance Committee (DAC).

22 Bilateral Donors, plus European Commission (EC).

Objective: improve development assistance through coordination and

collaboration with major stakeholders.

Collect and synthesize data on aid and foreign assistance and deliver the data to the public. Ths.Nguyễn Hạ Liên Chi 40 20