Preview text:

FINANCIAL MANAGEMENT CHAPTER 8: FINANCIAL ANALYSIS Question 1:

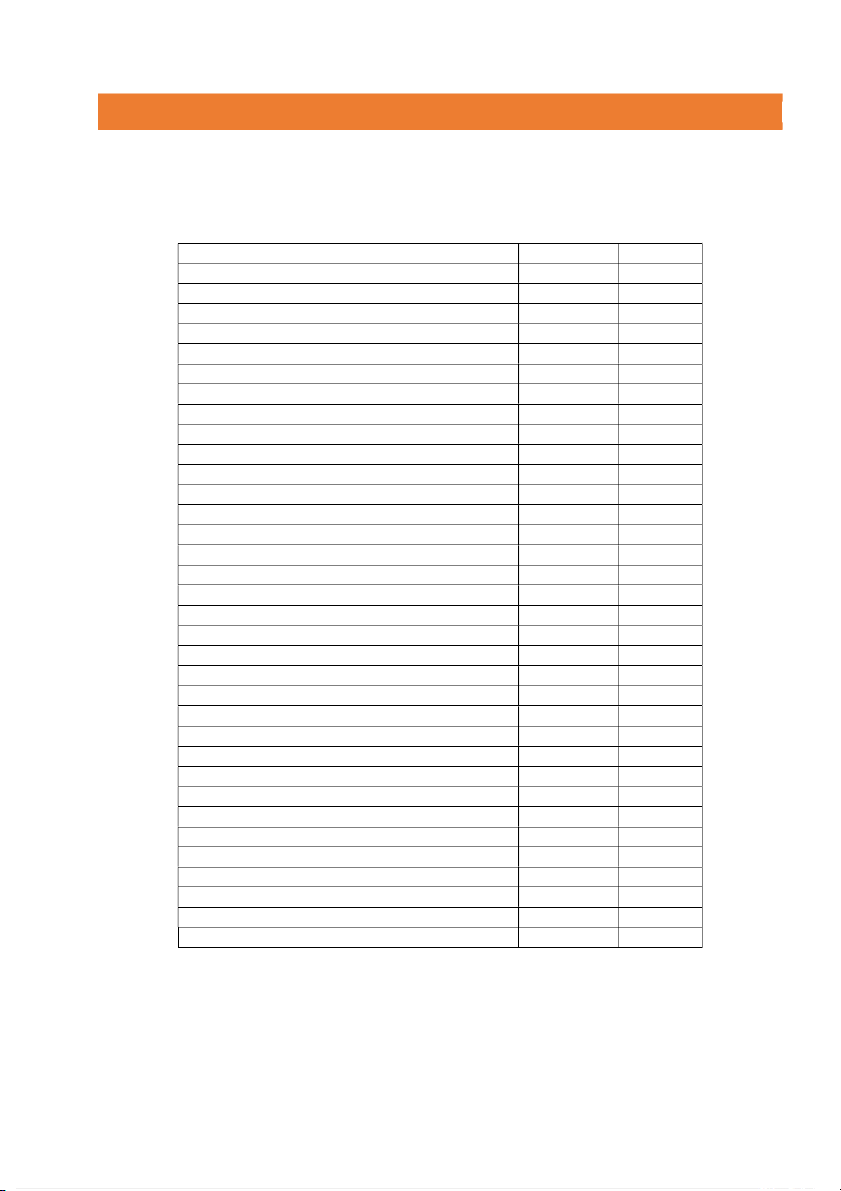

Balance sheet for Lowe’s Companies: Year 2008 2007 Assets Current assets:

Cash and marketable securities 661 530 Accounts receivable 166 247 Inventories 8,209 7,611 Other current assets 215 298 Total current assets 9,251 8,686 Fixed assets: Tangible fixed assets

Property, plant, and equipment 31,477 28,836

Less accummulated depreciation 8,755 7,475 Net tangible fixed assets 22,722 21,361 Long-term investments 253 509 Other long-term assets 460 313 Total assets 32,686 30,869

Liabilities and Shareholders' Equity: Current liabilities: Debt due for repayment 1,021 1,104 Accounts payable 4,543 4,137 Other current liabilities 2,458 2,510 Total current liabilities 8,022 7,751 Long-term debt 5,039 5,576 Deferred income taxes 660 670 Other long-term liabilities 910 774 Total liabilities 14,631 14,771

Common Stock and other paid-in capital 735 729

Retained earnings and capital surplus 17,320 15,369 Total shareholders' equity 18,055 16,098

Total liabilities and shareholders' equity 32,686 30,869

Market price per share (2008): $18.19/share

Total number of oustanding shares (2008): 1,470 shares

GVTH: TS. Le Bao Thy - Page 1 of 5 FINANCIAL MANAGEMENT Income statement: 2008 Net sales 48,230 Cost of goods sold 31,729

Selling, general, and administrative expenses 11,158 Depreciation 1,539

Earning before interest and tax (EBIT) 3,804 Interest expense 298 Taxable income 3,506 Tax 1,311 Net Income 2,195 Dividends 491 Addition to retained earnings 1704

Calculate the following financial ratios:

Performance: Market to book ratio, Market value added (MVA)

Profitability: ROA, ROE, and ROS.

Efficiency: asset turnover, receivable turnover, inventory turnover, and payable turnover.

Leverage: Long-term debt ratio, Debt-Equity ratio, and Debt ratio.

Liquidity: Net working capital, Net working capital to Total Asset, Current ratio, Quick ratio and Cash ratio.

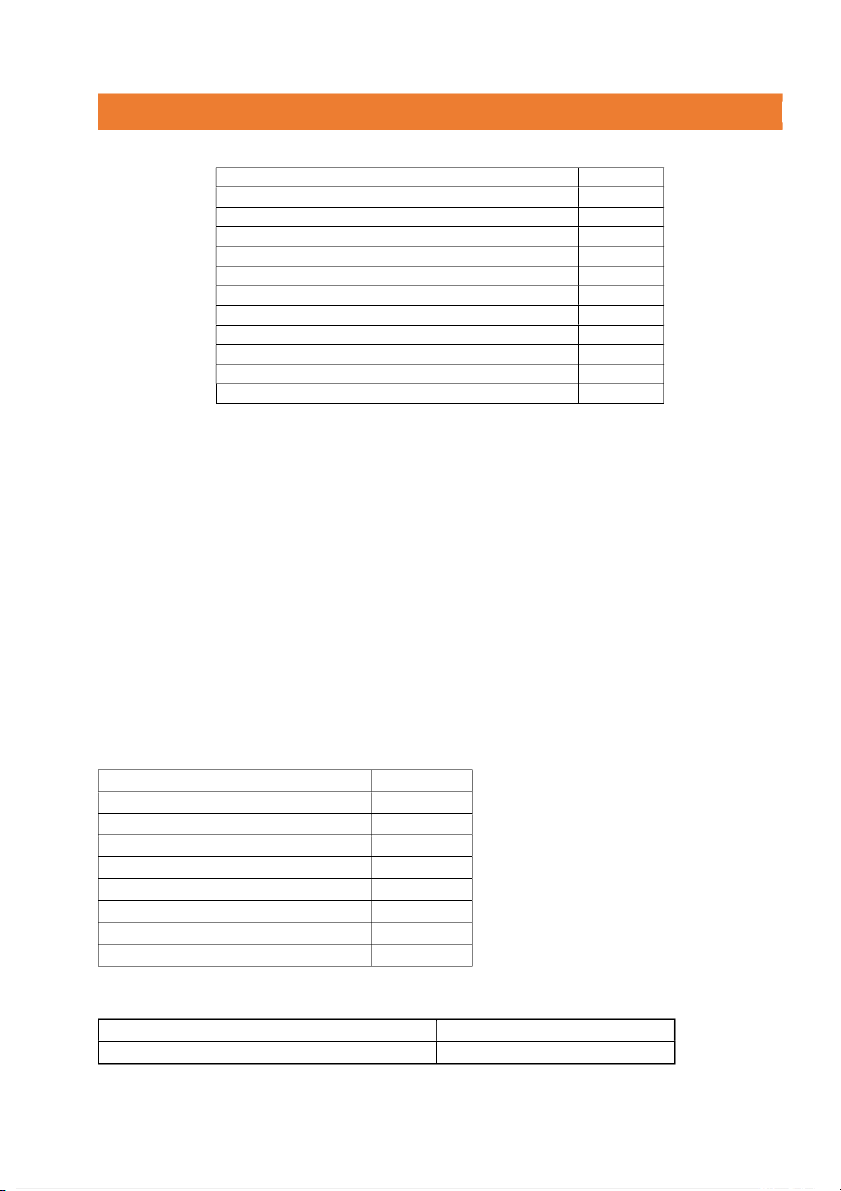

Cash cycle (Average Days in Inventory, Average collection period, Average payment period). Question 2: Income Statement 2018 Cost of goods sold $ 6,220.00 Depreciation $ 890.00 Interest $ 460.00 Dividend paid $ 140.00 Selling and general expenses $1,950.00 Addition to retained earnings $ 330.00 Tax rate 34% What are the sales for 2018? Question 3: Net Sales ???? Cost of Goods Sold $6,800

GVTH: TS. Le Bao Thy - Page 2 of 5 FINANCIAL MANAGEMENT Depreciation $500 Tax 20%

Selling and Administrative Expense $2,300 Interest Payment $347 Dividend Paid $1,400 (30% of net income) Question 4:

As you can see, someone has spilled ink over some of the entries in the balance sheet and

income statement of Transylvania Railroad (Table 1 and Table 2). Can you use the following

information to work out the missing entries? Times-interest-earned 8.0 Current ratio 2.5 Quick ratio 1 Cash ratio 0.8 ROE 0.9 Inventory turnover ratio 5 Receivable turnover ratio 12.2 Receivables collection period 30

Table 1: Balance sheet of Transylvania Railroad Balance sheet Dec-09 Dec-08 Cash 150 Account Receivable 180 Inventory 250 Total current assets 580 Net fixed assets 1290 Total assets 1870 Notes payable 130 180 Accounts payable 268 234 Total current liabilities 414 Long-term debt 500 Equity 956 Total liability and equity 1580 1870

Table 2: Income statement of Transylvania Railroad Sales Cost of goods sold

Selling, general, and administrative expenses 89 Depreciation 120 EBIT Interest Earnings before tax

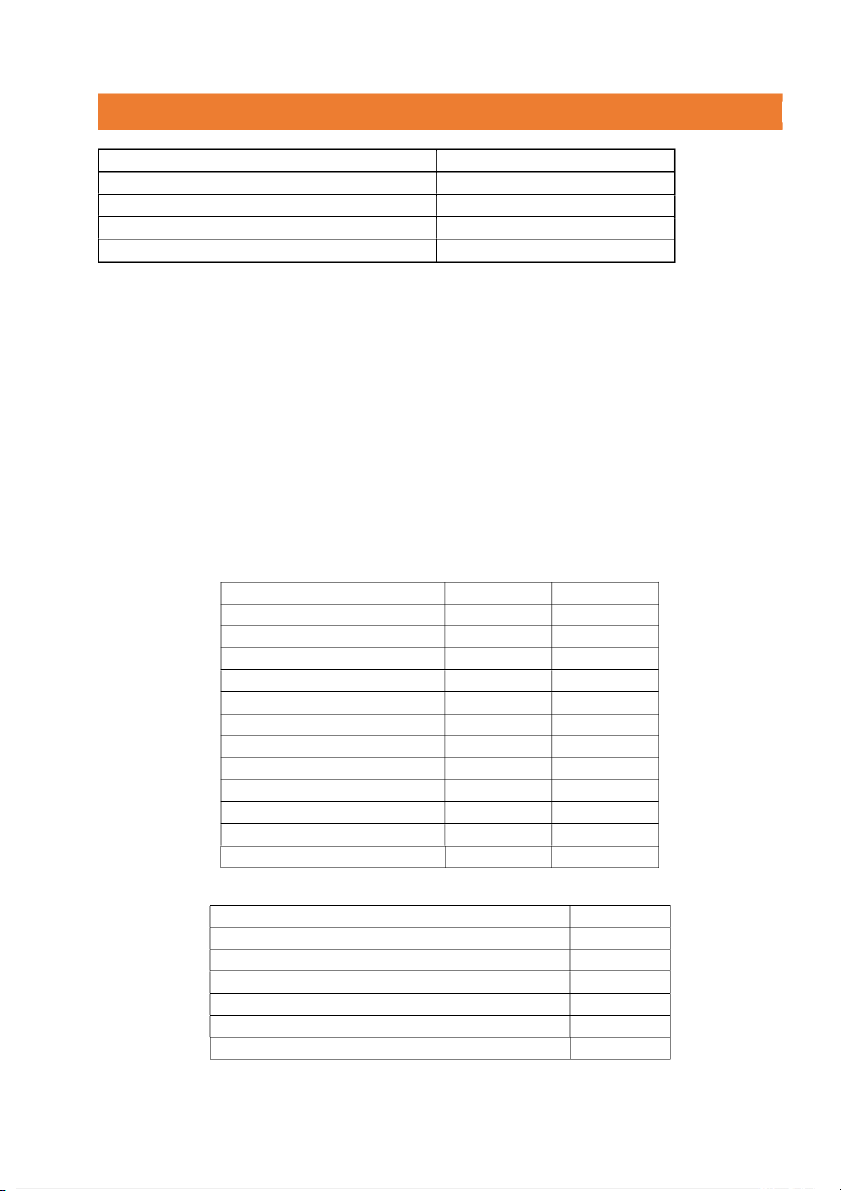

GVTH: TS. Le Bao Thy - Page 3 of 5 FINANCIAL MANAGEMENT Tax (20%) Net income Question 5: Balance Sheet Assets 2018 2017 Current assets

Cash and marketable securities 661 530 Accounts receivable 166 247 Inventories 8,209 7,611 Other current assets 215 298 Total current assets 9,251 8,686 Fixed assets Tangible fixed assets

Property, plant, and equipment 31,477 28,836 Less accumulated depreciation 8,755 7,475 Net tangible fixed assets 22,722 21,361 Long term investments 253 509 Other long-term assets 460 313 Total assets 32,686 30,869

Liabilities and Shareholders' Equity 2018 2017 Current liabilities Debt due for repayment 1,021 1,104 Accounts payable 4,543 4,137 Other current liabilities 2,458 2,510 Total current liabilities 8,022 7,751 Long term debt 5,039 5,576 Deferred income taxes 660 670 Other long term liabilities 910 774 Total liabilities 14,631 14,771

Common Stock and other paid-in- 735 729 capital

Retained earnings and capital surplus 17,320 15,369 Total shareholders' equity 18,055 16,098

Total liabilities and shareholders' 32,686 30,869 equity Income Statement 2018 Net sales 48,230

GVTH: TS. Le Bao Thy - Page 4 of 5 FINANCIAL MANAGEMENT Cost of goods sold 31,729

Selling, general, and administrative 11,158 expenses Depreciation 1,539

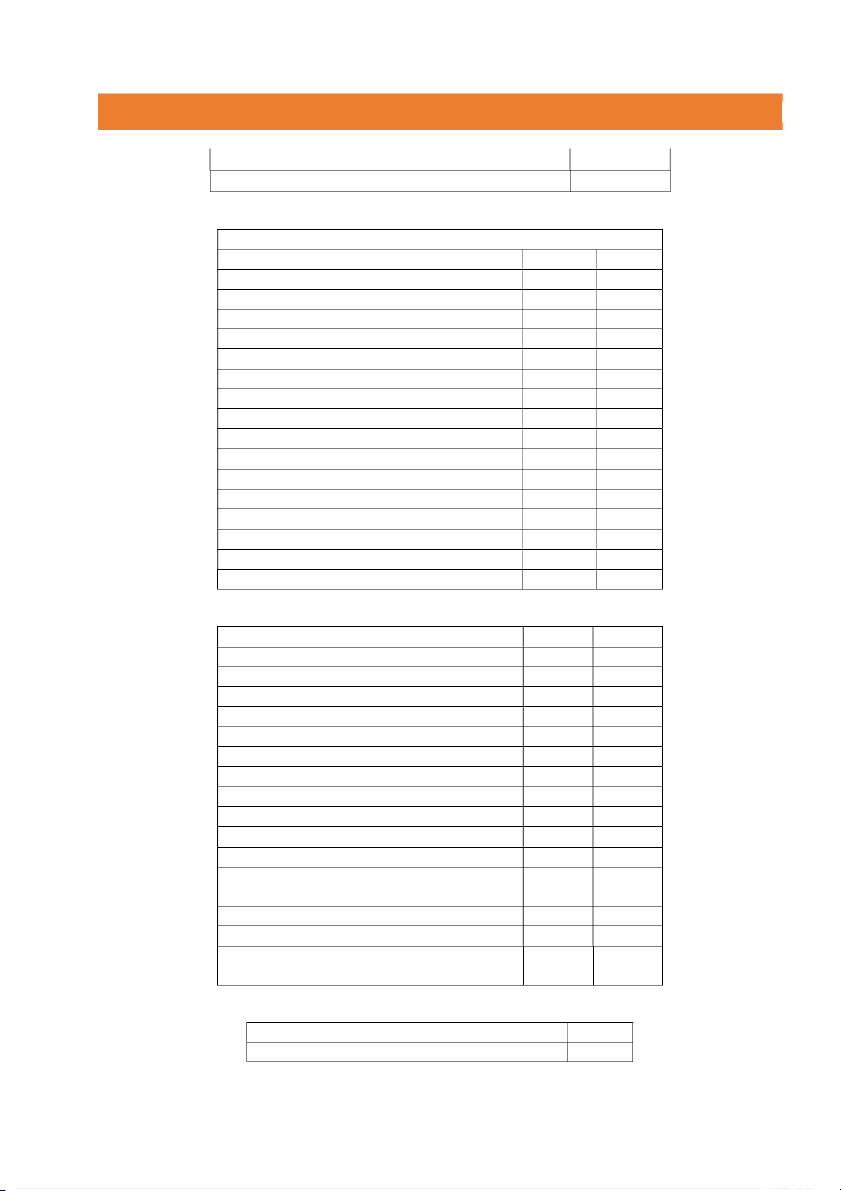

Earning before interest and taxes (EBIT) ? Interest expense 298 Earning before taxes (EBT) ? Tax (20%) ? Net Income ? Dividends (30%) ?

Addition to retained earnings (70%) ?

Look up the latest financial statement for a company:

a. Fill in the blank (?) of Income statement.

b. Calculate the following financial ratios:

Return on asset (ROA), return on equity (ROE)

Current ratio, quick ratio

Cash cycle (Average Days in Inventory, Average collection period, Average payment period). THE END

GVTH: TS. Le Bao Thy - Page 5 of 5