Preview text:

Class exercises – Ch 12 – Solutions – Acct 161

Quick Study 12-5 (10 minutes)

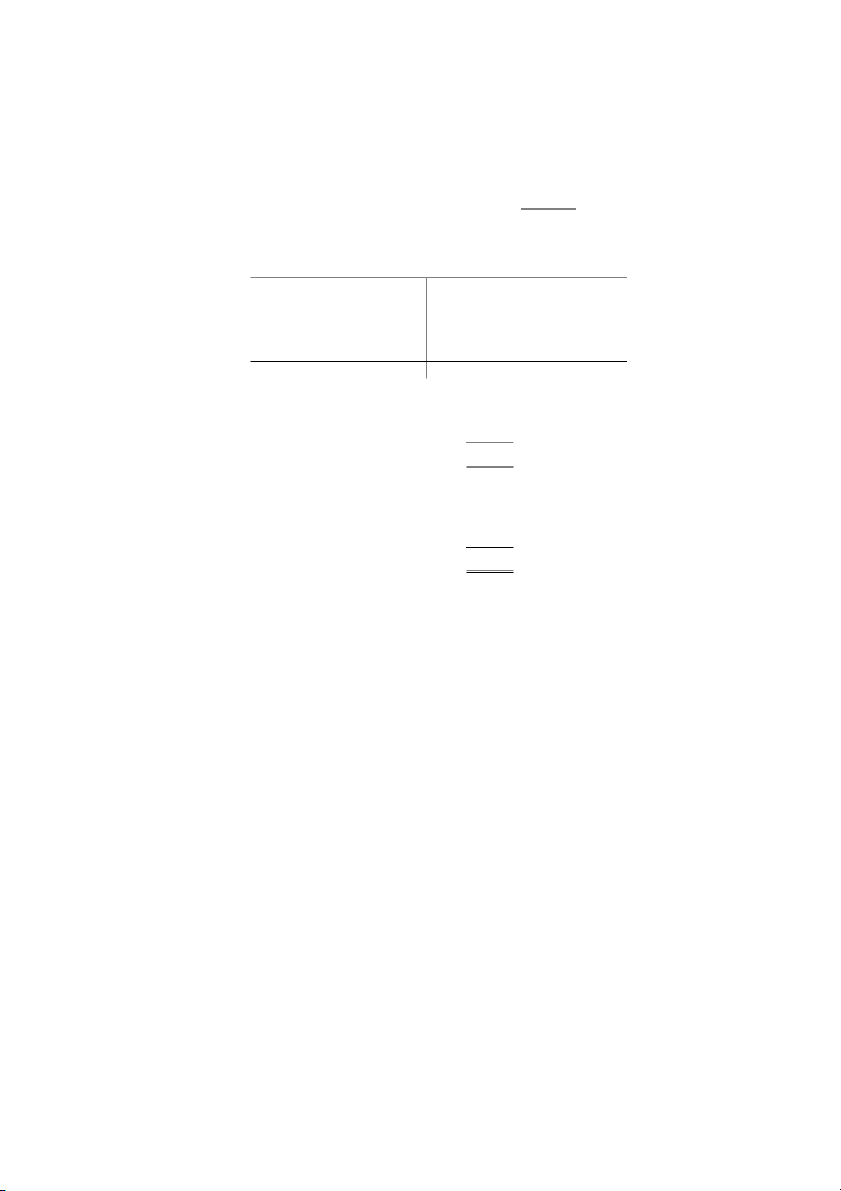

$48,000 + $146,000 – $47,000 – $15,000 = $132,000 OR

Retained Earnings 48,000 Bal. Dec. 31/20 146,000 Profit, 2021 Dividends, 2021 47,000 Loss, 2022 15,000 132,000 Bal. Dec. 31/22

Quick Study 12-12 (10 minutes)

a. Total dividend ............................................. 108,000

To preferred shareholders........................ 60,000*

Remainder to common shareholders...... $48,000

*75,000 shares × $0.40 × 2 years = $60,000

b. Total dividend ............................................. 108,000

To preferred shareholders........................ 30,000*

Remainder to common shareholders...... $78,000

*75,000 shares × $0.40 for current year only = $30,000

Quick Study 12-13 (10 minutes)

a. The preferred shares are entitled to receive $0.50 per share when the board of

directors declares dividends; if dividends are not declared, the undeclared

dividends do not become a liability but go into arrears; arrears mean that the

undeclared dividends must be paid to the preferred shareholders in the future along

with any current dividends before the common shareholders receive dividends.

b. The total amount contributed, or given to the corporation, in exchange for

ownership in the corporation.

c. The corporation is allowed to issue 20,000 shares based on its articles of incorporation.

d. 150,000 common shares have been sold and are held by shareholders.

e. Accumulated profit less any losses and dividends. f.

An unlimited number of common shares may be issued by the corporation based

on its articles of incorporation.

Exercise 12-2 (15 minutes) 2020 Jan. 15

Organization Expenses (or other various expenses)......... 31,700

Common Shares............................................................ 31,700

Issued common shares to promoters. Feb. 21

Cash....................................................................................... 208,000

Common Shares............................................................ 208,000

Issued common shares for cash;

16,000 shares x $13/share = $208,000. Mar. 9

Cash....................................................................................... 111,600

Preferred Shares............................................................ 111,600

Issued preferred shares for cash. Aug. 15

Land....................................................................................... 317,000

Building................................................................................. 422,000

Equipment............................................................................. 114,000

Common Shares............................................................ 853,000

Issued common shares in exchange for land,

building, and equipment.

Exercise 12-4 (10 minutes) March

1 Cash Dividends or Retained Earnings........................... 88,900

Common Dividends Payable................................. 88,900

To record declaration of cash dividend on common

shares of $0.70 per share. 10 No entry.

31 Common Dividends Payable........................................... 88,900

Cash...................................................................... 88,900

Paid the dividends declared on March 1.

Exercise 12-9 (20 minutes)

1. $6/share × 8,000 shares = $48,000

2. Yes. Calculation is $48,000 × 2 years = $96,000

3. a) ($6 × 8,000 shares) = $48,000 × 3 years = $144,000

b) $4.80 × 45,000 = $216,000

4. $126,000 + $408,000 – $144,000 – $216,000 = $174,000

5. $192,000 + $540,000 = $732,000

6. $732,000 + $174,000 = $906,000

7. 10,000 – 8,000 = 2,000

8. $192,000/8,000 shares = $24/share

Exercise 12-11 (20 minutes)

NOTE: The holders of the cumulative preferred shares

are entitled to no more than $412,800 of dividends in

any year ($9.60 × 43,000 shares) plus any dividends in arrears. Common 2018 ($0):

Preferred—current..................................................... $ 0

Common—remainder.................................................

....................................................

Total for the year........................................................

$ 0.................................................... 2019 ($440,000):

Preferred—arrears..................................................... $ 412,800

Preferred—current ($440,000 –

$412,800)..................................................................... 27,200

Common—remainder.................................................

....................................................

Total for the year........................................................

$ 440,000.................................................... 2020 ($1,058,000):

Preferred—arrears ($412,800 – $27,200).................. $ 385,600

Preferred—current..................................................... 412,800

Common—remainder ($1,058,000 –

$798,400).....................................................................

....................................................

Total for the year........................................................

$ 798,400................................................... 2021 ($440,000):

Preferred—current..................................................... $ 412,800

Common—remainder ($440,000 –

$412,800).....................................................................

.....................................................

Total for the year........................................................

$ 412,800....................................................

Total for four years....................................................

$1,651,200....................................................

Exercise 12-12 (20 minutes)

NOTE: The holders of the noncumulative preferred

shares are entitled to no more than $412,800 of

dividends in any year ($9.60 × 43,000 shares). Common 2018 ($0):

Preferred—current..................................................... $ 0

Common—remainder.................................................

....................................................

Total for the year........................................................

$ 0.................................................... 2019 ($440,000):

Preferred—current..................................................... $ 412,800

Common—remainder ($440,000 –

$412,800).....................................................................

......................................................

Total for the year........................................................

$ 412,800.................................................... 2020 ($1,058,000):

Preferred—current..................................................... 412,800

Common—remainder ($1,058,000 –

$412,800).....................................................................

......................................................

Total for the year........................................................

$ 412,800................................................... 2021 ($480,000):

Preferred—current..................................................... $ 412,800

Common—remainder ($440,000 –

$412,800).....................................................................

......................................................

Total for the year........................................................

$ 412,800....................................................

Total for four years....................................................

$1,238,400....................................................

Exercise 12-11 (20 minutes)

NOTE: The holders of the cumulative preferred shares

are entitled to no more than $412,800 of dividends in

any year ($9.60 × 43,000 shares) plus any dividends in arrears. Common 2018 ($0):

Preferred—current..................................................... $ 0

Common—remainder.................................................

....................................................

Total for the year........................................................

$ 0.................................................... 2019 ($440,000):

Preferred—arrears..................................................... $ 412,800

Preferred—current ($440,000 –

$412,800)..................................................................... 27,200

Common—remainder.................................................

....................................................

Total for the year........................................................

$ 440,000.................................................... 2020 ($1,058,000):

Preferred—arrears ($412,800 – $27,200).................. $ 385,600

Preferred—current..................................................... 412,800

Common—remainder ($1,058,000 –

$798,400).....................................................................

....................................................

Total for the year........................................................

$ 798,400................................................... 2021 ($440,000):

Preferred—current..................................................... $ 412,800

Common—remainder ($440,000 –

$412,800).....................................................................

.....................................................

Total for the year........................................................

$ 412,800....................................................

Total for four years....................................................

$1,651,200....................................................

Exercise 12-12 (20 minutes)

NOTE: The holders of the noncumulative preferred

shares are entitled to no more than $412,800 of

dividends in any year ($9.60 × 43,000 shares). Common 2018 ($0):

Preferred—current..................................................... $ 0

Common—remainder.................................................

....................................................

Total for the year........................................................

$ 0.................................................... 2019 ($440,000):

Preferred—current..................................................... $ 412,800

Common—remainder ($440,000 –

$412,800).....................................................................

......................................................

Total for the year........................................................

$ 412,800.................................................... 2020 ($1,058,000):

Preferred—current..................................................... 412,800

Common—remainder ($1,058,000 –

$412,800).....................................................................

......................................................

Total for the year........................................................

$ 412,800................................................... 2021 ($480,000):

Preferred—current..................................................... $ 412,800

Common—remainder ($440,000 –

$412,800).....................................................................

......................................................

Total for the year........................................................

$ 412,800....................................................

Total for four years....................................................

$1,238,400....................................................

Exercise 12-13 (10 minutes) 1. B 4. E 2. A 5. D 3. F 6. C

Exercise 12-19 (20 minutes) 127,650 + 44,500 = 172,150 ending shares

(127,650 + 172,150)/ 2 = 149,900 average shares outstanding

$3,222,850/ 149,900 = $21.50 book value

The book value was $21.50 on December 31, 2020 and

the market value of $32.50 is an indication that the

shareholders are willing to pay more for the shares,

anticipating higher dividends or growth in the

company. If the marketing plan does not work out,

the market value could quickly drop below the book

value amount of $21.50. Market values of a firm’s

shares are typically higher than the book value, as

investors take into consideration a variety of factors

that go beyond reported net assets, such as revenue

growth, cash flow, profitability, as well as current and future market conditions.

Problem 12-4A (25 minutes)

1. $540,000/$18 per share = 30,000 shares

2. 325,000 shares × $9.60 per share = $3,120,000

3. $540,000 + $3,120,000 = $3,660,000

4. $3,660,000 – $3,468,000 = $192,000 Deficit

5. 384,000 Beginning R/E Balance + 192,000 Ending

Deficit Balance = 576,000 Loss

6. a) $3.00/share × 30,000 shares = $90,000 to preferred shareholders

b) $120,000 – $90,000 paid to preferred

shareholders = $30,000 to common shareholders

7. a) $90,000/30,000 shares = $3.00/share

b) $30,000/325,000 shares = $.0923/share

8. No, because the preferred shares are non- cumulative.

9. Retained Earnings result when cumulative net

earnings are greater than cumulative losses and

dividends. A deficit results when cumulative

earnings are less than cumulative losses and dividends.

10. Dividends in arrears represent undeclared

dividends that must be paid to preferred

shareholders before any dividends are given to

common shareholders but only if dividends are

declared. Dividends payable, in contrast, are

dividends that have been declared but not yet paid.