Preview text:

12:44 18/1/25 Ggwp - accounting Group Assignment CUSTOMER RELATIONSHIP MANAGEMENT

Subject: Analyze and evaluate CRM strategies of VP Bank Group: 2 Class: CN19 – NTA

Course code: 25100BMKT0617E Tutors:

Ms. Nguyen Thi Thuy Duong Hanoi, August 2024 Contents 4 about:blank 1/23 12:44 18/1/25 Ggwp - accounting

I. Overview of VP Bank:........................................................................................ 4

1.1. Introducing VP Bank and Its Products:...............................................................4

a. Introduce about VP Bank:....................................................................................4

b. Products and Services:..........................................................................................4

1.2 Customer Segments and Characteristics of Target Customers:.........................5

a. Retail Customers:.................................................................................................. 5

b. Corporate Customers:........................................................................................... 5

c. High-Net-Worth Individuals (HNWIs):...............................................................5

d. Digital Natives:...................................................................................................... 5

e. Characteristics of Target Customers:..................................................................5

II. Analyze the current status of VPbank's CRM activities:...............................6

2.1. Current CRM Strategies at VPBank:..................................................................6

a. CRM Strategies Used by VPBank:.......................................................................6

b. Detailed Analysis of Each Strategy:.....................................................................7

2.2. Evaluate the current status of VPbank's CRM activities:................................10

a. The CRM strategy of VPBank offers several advantages and strengths over

other banks in the industry:....................................................................................10

b. Some indicators directly affect VP bank's CRM performance........................10

c. The remaining limitations in VPBank's CRM strategy include:.....................14

III. Solution and proposal for Vpbank’s CRM activities:.................................15

3.1 Solutions for VP Bank's CRM activities in the future:......................................15

a. Strengthening the CRM Vision:.........................................................................15

b. Fostering a Culture of Customer Orientation:..................................................15

c. Aligning Organizational Processes:....................................................................16

d. Leveraging Data and Technology for Personalized CRM:..............................16

e. Effective Implementation of CRM:...................................................................17

3.2. Proposals for VP Bank's CRM Activities in the Future:..................................18

a. Collaboration with Potential Partners:..............................................................18

b. Expanding and Adjusting Existing Policies:.....................................................18 2 about:blank 2/23 12:44 18/1/25 Ggwp - accounting MEMBERS OF GROUP Number Name Student code Tasks 19 Vũ Hoàng (Leader) 22K660023 11 Phùng Phương Anh 21K660015 12 Phạm Thùy Dịu 22K660015 13 Phạm Thùy Dương 21K660031 14 Nguyễn Như Đạt 21K660023 15 Nguyễn Hương Giang 21K660033 16 Nguyễn Lam Giang 21K660032 17 Nguyễn Diệu Hà 22K660018 18 Bùi Thu Hoài 22K660022 20 Nguyễn Quang Huy 22K660027 3 about:blank 3/23 12:44 18/1/25 Ggwp - accounting I. Overview of VP Bank:

1.1. Introducing VP Bank and Its Products: a. Introduce about VP Bank:

- VP Bank (Vietnam Prosperity Joint Stock Commercial Bank), established in 1993, is

one of the leading commercial banks in Vietnam. With a focus on innovation and

customer-centric services, VP Bank has grown to become a prominent financial institution in the country.

With a mission to enhance customer experiences and meet the diverse needs of its

clients, VP Bank continues to grow its market presence, serving a wide array of

customer segments, from individual consumers to large corporations and high-net-

worth individuals. The bank's focus on customer satisfaction, combined with its strong

financial foundation, positions it as a trusted financial partner in Vietnam. •

History of Formation and Development

1993: VPBank was established as Vietnam Joint Stock Commercial Bank for Non-State Enterprises.

2006: VPBank changed its name to Vietnam Prosperity Joint Stock Commercial Bank.

2012-2017: The run-up period with many improvements and strong development.

2018-2022: The breakthrough period, VPBank became one of the banks with

the largest charter capital in Vietnam.

2023: VPBank continued to expand and develop, aiming to be in the Top 3

leading banks in Vietnam and the Top 100 largest banks in Asia • Current Leadership

VPBank has an experienced and talented leadership team, including: o

Chairman of the Board of Directors: Mr. Ngo Chi Dung o

General Director: Mr. Nguyen Duc Vinh o

Deputy General Directors: Ms. Nguyen Thi Thu Huong, Mr. Nguyen Thanh Binh, and many other leaders • Vision and Mission

VPBank aims to become a powerful financial institution, contributing to the

sustainable development and prosperity of the country and the community. The Bank

is committed to providing modern financial products and services, meeting the diverse

needs of individual and corporate customers.

VPBank constantly innovates and improves to adapt to new trends and opportunities,

while affirming its position in the international financial market b. Products and Services: - Retail Banking:

+ Personal Loans: Unsecured loans, auto loans, mortgage loans, and education loans.

+ Savings Accounts: Regular savings, fixed-term deposits, and children's savings.

+nCards: Debit cards, credit cards, and prepaid cards with various features and benefits.

+ Digital Banking: Online banking, mobile banking, and electronic payment solutions. 4 about:blank 4/23 12:44 18/1/25 Ggwp - accounting - Corporate Banking:

+ Corporate Loans: Working capital loans, trade finance, and project finance.

+ Cash Management: Payment services, payroll management, and cash flow optimization.

Investment Banking: Mergers and acquisitions advisory, capital markets, and investment products. - Wealth Management:

+ Investment Products: Mutual funds, bonds, and structured products.

+ Private Banking: Tailored financial services for high-net-worth individuals,

including portfolio management and estate planning. - SME Banking:

+ Business Loans: Short-term and long-term financing for small and medium enterprises.

+ Trade Services: Export-import financing, letters of credit, and guarantees.

+ Advisory Services: Business consulting and financial planning for SMEs.

1.2 Customer Segments and Characteristics of Target Customers: a. Retail Customers:

- General Consumers: Individuals seeking personal banking services, including

savings, loans, and credit cards.

- Mass Affluent Segment: Customers with significant disposable income looking for

wealth management and investment products.

- Millennials and Young Professionals: Tech-savvy individuals who prefer digital

banking solutions, online payments, and lifestyle-oriented banking products. b. Corporate Customers:

- Large Enterprises: Businesses requiring complex financial solutions, including

project finance, trade finance, and corporate advisory services.

- Small and Medium Enterprises (SMEs): Companies needing access to business

loans, cash management services, and trade support to grow and expand their operations.

c. High-Net-Worth Individuals (HNWIs):

- Affluent Individuals: Customers with high investable assets seeking personalized

financial advice, private banking services, and tailored investment products.

- Business Owners and Entrepreneurs: Individuals looking for comprehensive

financial services, including succession planning, wealth management, and business advisory. d. Digital Natives:

- Tech-Savvy Customers: A growing segment of customers who prefer digital

banking services, such as mobile banking, online transactions, and instant access to

financial products and services. 5 about:blank 5/23 12:44 18/1/25 Ggwp - accounting

e. Characteristics of Target Customers:

- Urban Population: VP Bank's primary customers are typically located in urban

areas, with access to modern banking facilities.

- Tech-Oriented: Many target customers are digitally inclined, favoring online

banking and mobile apps for their convenience and accessibility.

- Income Level: The bank targets a diverse range of income groups, from average

earners to high-net-worth individuals, offering customized products to suit their financial needs.

- Entrepreneurial Spirit: For corporate and SME customers, VP Bank focuses on

supporting entrepreneurial ventures, providing them with the necessary financial tools to thrive.

This segmentation allows VP Bank to cater to a wide range of customers while

focusing on the specific needs and preferences of each group.

II. Analyze the current status of VPbank's CRM activities:

2.1. Current CRM Strategies at VPBank:

As an effort to enhance customer satisfaction and better managing customer

relationship management activities, VPBank has applied many idea of the CRM. Important tactics consist of:

Improving Customer Experience: Ranging from product consultation to product usage

and other services, VPBank aims at providing the highest level of service and personalisation.

Enhancing Customer Engagement and Increasing Accessibility: through the social

media, customer support services through calls, mobile applications and through websites.

Technology in Analyzing Data applying sophisticated analysis tools to interpret the

need of the clients and their trend analysis to tailor services or sell products to them.

Staff Development and Training: guaranteeing that the staff members who possesses

the necessary know-how to deliver the highest quality customer service to the patrons are taken care of.

a. CRM Strategies Used by VPBank:

VPBank employs several key CRM strategies:

- Strategic CRM: This involves using customer insights to shape the company's

overall strategy. VPBank's approach of creating specialized loan packages, savings

accounts, and promotional offers based on analyzing customer needs falls under this

category. The bank’s focus on targeting specific segments with services like YOLO,

CAKE, and UBank also aligns with strategic CRM.

- Operational CRM: Operational CRM focuses on automating and improving

customer-facing processes. VPBank's use of HubSpot CRM to manage customer

relationships, automate marketing campaigns, and streamline sales processes fits into

this category. Additionally, their deployment of eKYC technology for customer

onboarding, making the process quicker and more efficient, is a good example of 6 about:blank 6/23 12:44 18/1/25 Ggwp - accounting operational CRM.

- Analytical CRM: Analytical CRM involves analyzing customer data to gain insights

and improve decision-making. VPBank uses big data analytics and artificial

intelligence (AI) to forecast trends and customer needs, which is a clear example of analytical CRM

- Collaborative CRM: Collaborative CRM focuses on enhancing communication and

collaboration between the bank and its customers. VPBank’s strong multichannel

communication approach, including its presence on mobile apps, social media, and

customer service hotlines, represents collaborative CRM. VP bank also collaborates

with other enterprises and fintech companies to offer enhanced services and solutions

- Customer retention: Include both negative and possitive strategies, VPBank has

affirmed its position in the Vietnamese banking industry thanks to its smart and

effective customer retention strategies. In addition to the Customer Club program, the

bank also applies many other tactics to build customer loyalty and satisfaction.

b. Detailed Analysis of Each Strategy: Strategic CRM: • Implementation:

To evaluate client data, including transaction history, preferences, and needs, VPBank

employs a CRM system. The bank creates specialized loan packages, savings accounts

with favorable interest rates, and exclusive promotional offers based on this research

of customer needs.VPBank differentiates its services by targeting specific customer

segments. For example, they launched digital-only banks like YOLO, CAKE, and

UBank to cater to different demographics, such as the younger generation and

financially underserved customers. 1. YOLO:

YOLO integrates various lifestyle services such as food delivery, taxi booking,

entertainment, and travel services directly into the banking app. This makes YOLO

more than just a banking app, providing a holistic digital lifestyle experience. YOLO

offers a range of digital banking products including virtual Mastercard, savings

accounts, and loan products. These products are designed to be easily accessible and

convenient for users. The app supports various digital payment methods, including

QR code payments, online transfers, and bill payments. This makes it convenient for

users to manage their finances on the go. Users can apply for a virtual or physical

YOLO Mastercard, which can be used for online and offline purchases worldwide. 2. CAKE:

VPBank partnered with Be Group, the company behind the Be ride-hailing app, to

launch Cake. This collaboration leverages Be Group’s technology and customer base

to offer a seamless digital banking experience. Cake is integrated into the Be ride-

hailing app, making it the first digital bank to appear on a ride-hailing platform in

Vietnam. This integration allows users to access banking services directly from the Be

app. With e-KYC technology, users can open a CAKE account in just 2 minutes. This

quick setup process is designed to attract users who value convenience and speed.

CAKE provides a high-interest savings account with rates up to 3.6% per year, which 7 about:blank 7/23 12:44 18/1/25 Ggwp - accounting

is considerably higher than traditional savings accounts. This feature is attractive to

users looking to maximize their savings. 3. UBANK:

UBank focuses on providing accessible banking solutions to financially underserved

customers, including those in rural areas and low-income groups. UBank includes

initiatives to educate customers about financial management and promote financial

inclusion. This helps customers make informed financial decisions and improve their

financial well-being. The UBank app is designed with a focus on user experience,

offering an intuitive and easy-to-navigate interface. This ensures that users of all ages

and tech-savviness levels can use the app comfortably. Operational CRM: • Implementation:

VPBank deploys integrated CRM systems that work with other banking systems to

gather data from various sources. The system utilizes big data analytics and artificial

intelligence (AI) to forecast trends and customer needs. VPBank also use of HubSpot

CRM to manage customer relationships, automate marketing campaigns, and

streamline sales processes fits into this category: 1. eKYC

- VPBank also utilizes electronic know-your-customer (eKYC) technology to

streamline the onboarding process. This makes it easier and faster for new

customers to open accounts and access banking services

- In 2020, VPBank is the first bank to develop eKYC - online customer

identification.The eKYC process is entirely online, allowing customers to open

accounts and access banking services without visiting a physical branch. This is

particularly beneficial for customers in remote areas.

- Customers can complete the eKYC process in just a few minutes using their

smartphones. This involves taking photos of their identity documents and a selfie

for facial recognition. Moreover, VPBank’s eKYC solution complies with the

regulations set by the State Bank of Vietnam, ensuring that all processes meet legal and security standards. 2. Hubspot CRM

- VPBank uses HubSpot CRM to track and manage leads efficiently. The CRM

system helps in capturing leads from various sources, assigning them to the

appropriate sales representatives, and tracking their progress through the sales

pipeline. The CRM helps in planning, executing, and measuring the

effectiveness of marketing campaigns. This includes tracking metrics such as

open rates, click-through rates, and conversion rate.

- HubSpot CRM automates repetitive tasks such as follow-up emails, meeting

scheduling, and data entry. This allows the sales team to focus more on

building relationships and closing details. VPBank utilizes HubSpot’s email

marketing tools to create, send, and analyze email campaigns. This includes

personalized email content based on customer segmentation and behavior Analytical CRM: • Implementation:

Analytical CRM involves analyzing customer data to gain insights and improve 8 about:blank 8/23 12:44 18/1/25 Ggwp - accounting

decision-making. VPBank uses the Enterprise Data and Analytical Division (EDA).

Towards the goal of turning VPBank into one of the leading banks in the region in

terms of data management and application, enhancing our competitiveness in the

digital era, in June 2023, VPBank launched the Enterprise Data and Analytics Division (EDA), focusing on: -

Developing and governing the next generation cloud-based of Enterprise data platform & data analytics -

Enhancing the application of AI and Machine learning to promote business

performance, optimize management efficiency & minimize operational risks -

Overseeing data strategy, architecture, and advanced analytics project/initiatives

across subsidiaries in VPBank's ecosystem. Collaborative CRM: • Implementation:

Collaborative CRM’s main concern is on the process that involves communication

with the customers of the bank. Through its connecting to mobile apps, social

networks and customer service phone numbers, the organization of VPBank reflects

the concept of multichannel collaboration of CRM. VP bank also partners with

InvestCloud and FWD Insurance company to provide the best services and products. 1. InvestCloud

InvestCloud is a global company specializing in digital platforms for financial

solutions. VPBank has partnered with InvestCloud to develop an innovative Open

Wealth Service platform. Here are the key details:

- Objective: The partnership aims to build a highly personalized wealth

management service delivered via ecosystems and facilitated by the Open Wealth Service platform.

- Features: The platform will bundle VPBank’s in-house and third-party offerings

to create customized financial solutions. This includes services for both

VPBank’s clients and wealthy individuals served by financial intermediaries within the ecosystem.

- Benefits: This collaboration allows VPBank to significantly expand its market

reach without substantial client acquisition costs. The platform’s open service

architecture ensures scalability and flexibility across all of VPBank’s locations1.

- Strategic Alignment: This partnership aligns with VPBank’s Strategy 2026,

which focuses on becoming an international Open Wealth Service provider for

intermediaries and wealthy private clients. 2. FWD Company

FWD is a leading insurance company in Asia. VPBank’s partnership with FWD

focuses on integrating insurance products into its banking services. Here are the key details:

- Objective: The collaboration aims to provide customers with easy access to a

range of insurance products, enhancing the overall customer experience.

- Integrated Services: VPBank offers FWD’s insurance products through its

digital platforms, making it convenient for customers to purchase and manage

their insurance policies alongside their banking services.

- Customer Benefits: This integration allows customers to benefit from 9 about:blank 9/23 12:44 18/1/25 Ggwp - accounting

comprehensive financial solutions, including both banking and insurance services, in one place.

- Strategic Focus: The partnership with FWD supports VPBank’s goal of

providing holistic financial services and improving customer satisfaction

through seamless integration of banking and insurance products.

Customer retention strategies:

VPBank has affirmed its position in the Vietnamese banking industry thanks to its

smart and effective customer retention strategies. Below is a detailed analysis of the

tactics that VPBank has applied: 1. A loyalty scheme

VPBank's Active Customer Retention Strategy: A Typical Loyalty Program

VPBank has been developing a variety of strategies to motivate customers, build

loyalty and create outstanding customer experiences. Here are some highlights

of the bank's loyalty programs:

“The quality of experience at VPBank has also been significantly improved

through the implementation of the Customer Listening Program - VoC Program

(Voice of Customer Program). Accordingly, "customer listening" points are

located at all transaction channels of the bank such as branches, transaction

offices, automatic transaction point system Kiosk - VPBank NEO Express,

website, VPBank NEO/VPBank NeO BIZ app, channels to receive opinions

such as phone, email, Facebook, Zalo, Customer Care Portal... Currently,

VPBank collects and processes nearly 1 million customer opinions each month through this program.”

Ref: “https://www.vpbank.com.vn/tin-tuc/thong-cao-bao-chi/2023/vpbank-nang- cao-trai-nghiem-khach-hang”

1. Understanding and Personalizing Customer Experience: 10 about:blank 10/23 12:44 18/1/25 Ggwp - accounting

Personalize services: Based on customer data, VPBank provides suitable

products, services and incentives for each individual. For example, customers

who frequently use international money transfer services will be prioritized with more competitive fee packages.

Customizable Interface: The Bank has applied AI and Machine Learning

technologies to personalize the mobile application interface, helping customers

easily find the products and services they are interested in.

2. Improve Service Quality Reduce waiting time: VPBank has focused on

minimizing customer waiting time at branches and when contacting the call center.

Improve interaction quality: Staff are professionally trained to provide the best

customer service, solving problems quickly and effectively.

Enhance online transaction channels: VPBank has developed mobile

applications and other online transaction channels so that customers can make

transactions anytime, anywhere.

3. Promotions and Incentives Programs Exclusive offers for loyal customers:

VPBank regularly develops promotional programs, gifts, and fee reductions

exclusively for loyal customers.

Cooperate with partners: The bank cooperates with many partners to provide

attractive incentives such as discounts on shopping, dining, traveling, etc.

Loyalty program: Customers will accumulate points when using the bank's

products and services. Accumulated points can be exchanged for gifts or discounts.

4. Build a Customer Community Organize events: VPBank regularly organizes

events such as seminars and workshops for customers to have the opportunity to

interact and share experiences.

Create a group community: The bank builds groups on social networks so that

customers can interact with each other and with the bank.

5. Invest in Technology Applying AI and Big Data: VPBank uses modern

technologies to analyze customer behavior, predict needs and personalize experiences.

Develop mobile applications: The bank constantly improves mobile applications

to provide new, more convenient features for customers. 2. Customer club

The Customer Club program is one of the important tools that VPBank uses to

build long-term and sustainable relationships with customers. By creating a

community of loyal customers, VPBank not only retains current customers but

also encourages them to introduce more relatives and friends to use the bank's services. 11 about:blank 11/23 12:44 18/1/25 Ggwp - accounting

“Accordingly, from July 2015, spouses of existing Priority Customers will be

designated as Priority Customers without having to maintain a minimum balance

in their checking or savings account and without having to pay any service fees.

In addition, customers will enjoy many special privileges, specifically:

Priority Transactions: receive separate service and no waiting

Priority Care: receive care from VPBank's senior financial consultants

Priority Treatment: Happy Birthday, gratitude events, experience events

organized by VPBank Gold Club exclusively for Priority Customers with many

topics such as: investment, finance, health... Priority Products:

• Receive a free Gold Club Debit MasterCard international debit card with a

high transaction limit of up to 300 million VND

• Receive a free Priority Platinum MasterCard international credit card with an

interest-free period of up to 55 days and a maximum pre-approval limit of 12 about:blank 12/23 12:44 18/1/25 Ggwp - accounting

300,000,000 VND. Pre-approved limit is based on the request of the supplementary cardholder

• Pre-approved unsecured loan, preferential interest rate from 6% to 10%

compared to regular customers and fast disbursement time

• Highest Internet banking transaction limit on the market: 2 billion VND/day

• Premium family care insurance package

• Flexible investment products”

Ref: “https://www.vpbank.com.vn/en/tim-kiem?search=customer+club”

1. Membership classification: VPBank divides customers into different levels

based on transaction levels and service usage time. Each level will enjoy

different benefits, motivating customers to upgrade to higher levels.

2. Diverse incentives: The program offers a series of attractive incentives such as:

Fee reduction: Reduced transaction fees, annual card fees, money transfer fees, etc.

Point accumulation: Customers will accumulate points when using the bank's

products and services. Accumulated points can be exchanged for gifts, shopping vouchers or used to pay bills.

Partner incentives: VPBank cooperates with many partners to provide special

incentives for loyal customers such as discounts on shopping, dining, traveling, etc.

3. Exclusive events and activities: VPBank regularly organizes events, seminars,

and workshops exclusively for loyal customers. This is an opportunity for

customers to interact, connect and experience the bank's premium services.

4. Specialized customer care: Loyal customers will enjoy specialized customer

care services with a team of experienced consultants, ready to support anytime, anywhere.

2.2. Evaluate the current status of VPbank's CRM activities:

a. The CRM strategy of VPBank offers several advantages and strengths over other banks in the industry:

VPBank's CRM (Customer Relationship Management) strategy brings many

competitive advantages and advantages to the bank compared to its competitors in the

same industry. Here are some of the outstanding advantages and advantages:

- Enhanced Customer

Engagement: Through the Voice of Customer (VoC) program,

VPBank has a better ability to listen to and understand customer needs compared to

competitors. This helps the bank build stronger relationships with customers, increase

loyalty, and reduce churn rates. According to this program, "Voice of Customer"

touchpoints are placed at all of the bank's transaction channels, including branches,

transaction offices, automated transaction kiosks - VPBank NEO Express, website,

VPBank NEO/VPBank NEO BIZ app, and feedback channels such as phone, email,

Facebook, Zalo, and the Customer Care Portal. Currently, VPBank collects and 13 about:blank 13/23 12:44 18/1/25 Ggwp - accounting

processes nearly 1 million customer feedbacks each month through this program.

- Optimized Multi-Channel Customer Experience: VPBank synchronizes the

customer experience across all transaction channels (branches, VPBank NEO, digital

channels, etc.). This creates convenience and consistency, making it easier for

customers to use services and feel more satisfied.

- Advanced Technology for Automation and Personalized Services: VPBank is also

the first bank to implement the VoC Solution technology, which automates the process

of collecting customer feedback and reduces processing time by 90%, aiming to

synchronize the customer experience across all transaction channels. In the future,

customer feedback processing will be integrated with Artificial Intelligence (AI),

enabling VPBank to proactively evaluate, understand, and predict each customer's

behavior and needs to create the most personalized experiences.

- Development of Loyalty Programs and Special Offers: With data collected from

CRM, VPBank can develop loyalty programs and tailored offers for different customer

segments, enhancing customer retention and strengthening long-term relationships.

- Improved Operational Efficiency and Cost Reduction: Automating CRM processes

helps VPBank reduce operational costs, optimize resources, and improve employee

productivity, allowing the bank to focus on high-value activities.

- Proactive in Competitive Strategy and Product Development: Through analyzing

customer data and feedback from the VoC program, VPBank can quickly identify

market trends and adjust product and service strategies accordingly, maintaining its

competitiveness in the banking sector.

Overall, VPBank's CRM strategy helps the bank enhance operational efficiency,

increase customer satisfaction and loyalty, and create a solid competitive advantage

over other banks in the industry.

b. Some indicators directly affect VP bank's CRM performance

Through VPbank's financial statements for the past 4 years, these are the most

important indicators that directly affect VPbank's CRM activities: Net Profit: o

Impact on Customer Retention and Acquisition: A higher net profit can

indicate successful CRM strategies that enhance customer retention and

acquisition. Effective CRM can lead to increased customer satisfaction,

loyalty, and repeat business, all of which contribute to higher net profits. o

Cost Efficiency: By analyzing net profit, VPBank can assess whether their

CRM initiatives are cost-effective. If CRM costs are high but net profit

remains low, it may indicate inefficiencies in their CRM processes.The

increase in Net Profit during the initial years could suggest that VP Bank's

CRM activities, such as customer retention strategies, cross-selling, and

upselling, were effective. The decline in 2023 may signal the need for a

renewed focus on CRM, especially on retaining high-value customers and

improving customer satisfaction. o

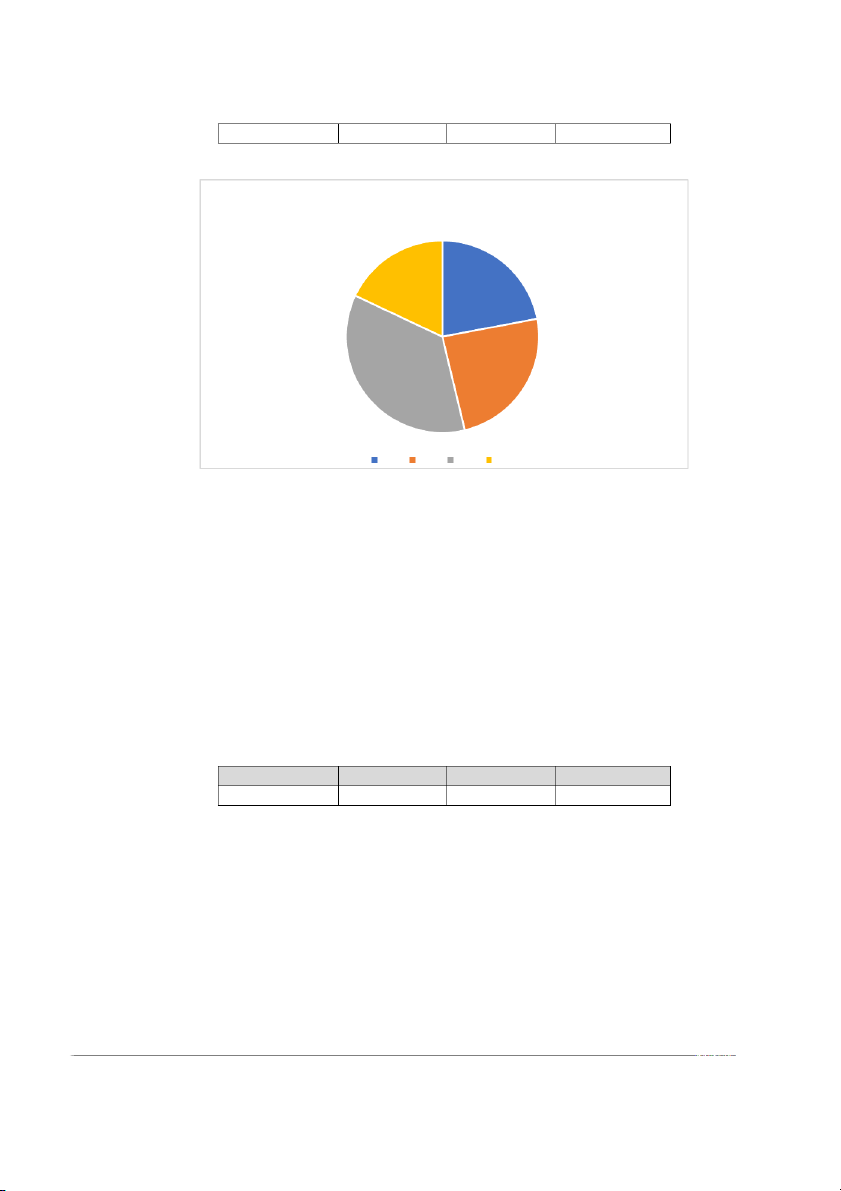

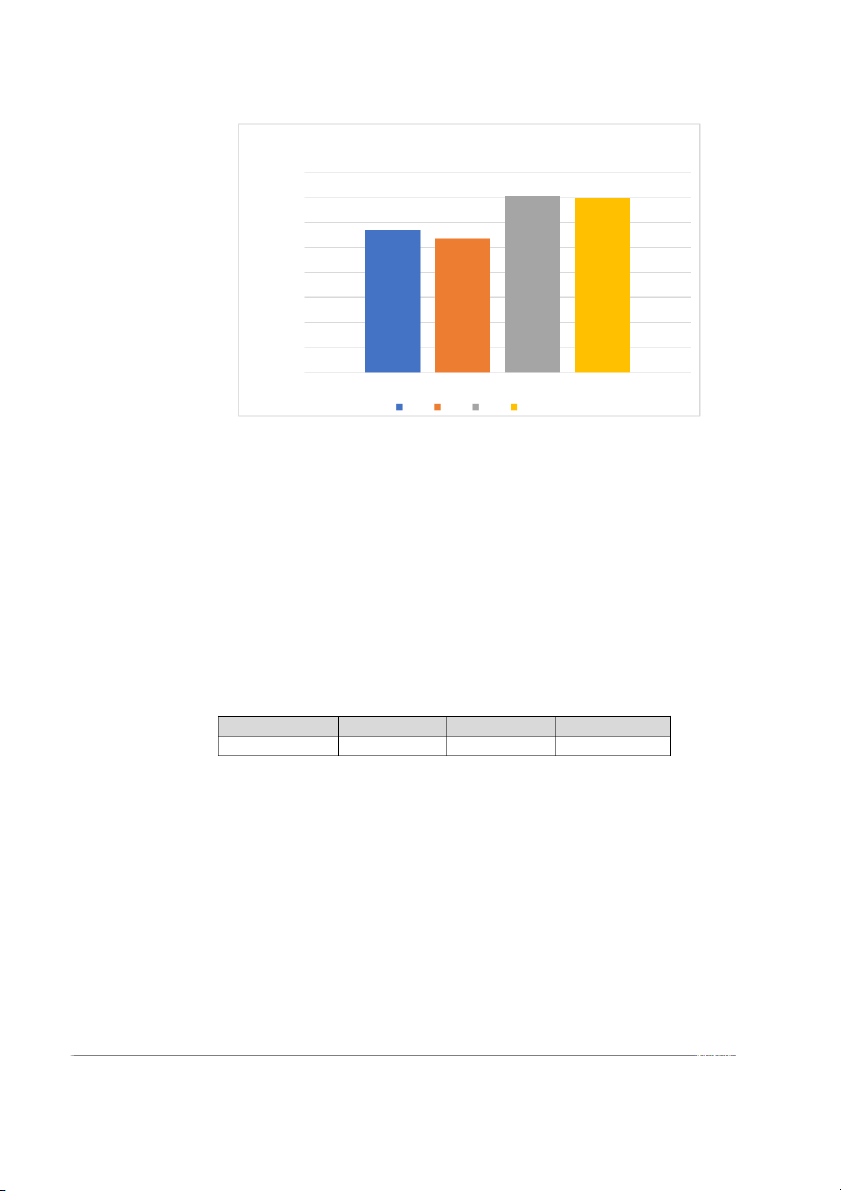

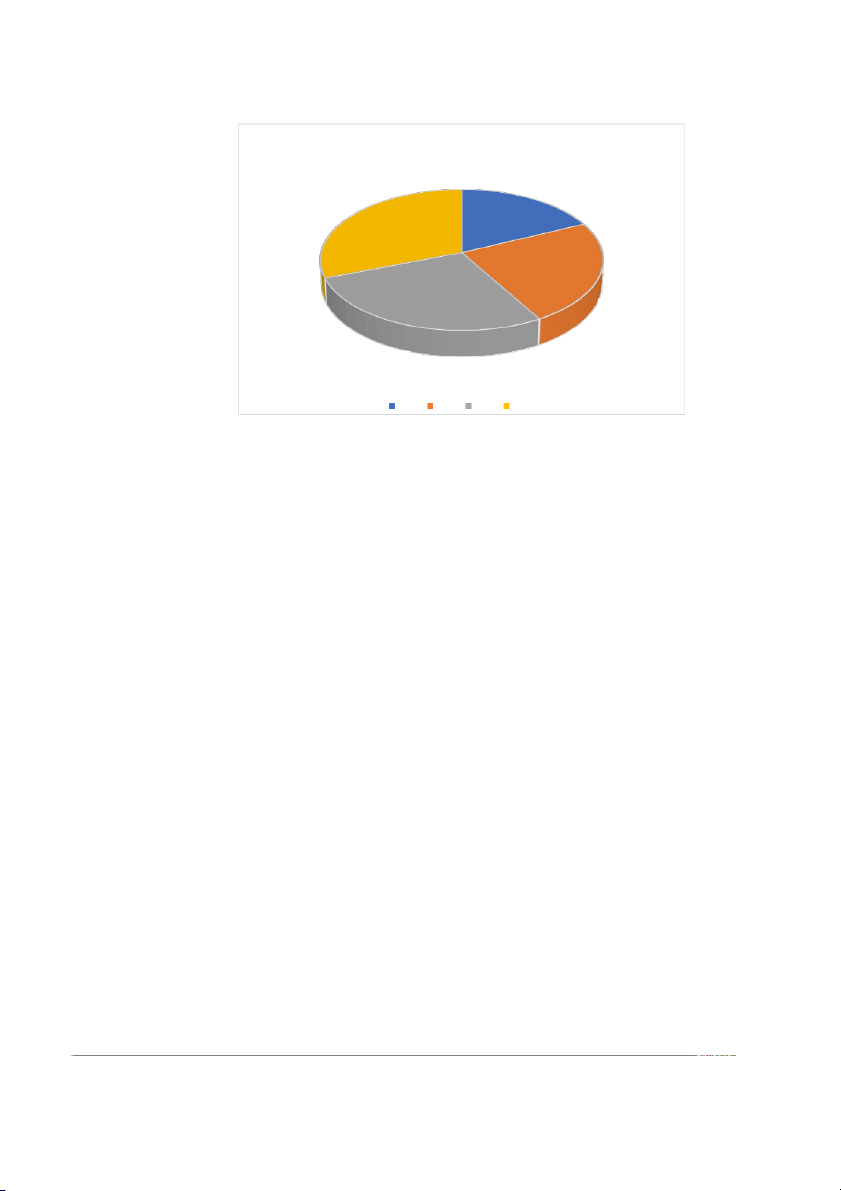

This is VP bank's Net Profit from 2020 to 2023 (Million VNĐ) 2020 2021 2022 2023 14 about:blank 14/23 12:44 18/1/25 Ggwp - accounting

10,413,760 11,477,170 16,908,807 8,494,171 Net Profit 2023 2020 18% 22% 2021 2022 24% 36% 2020 2021 2022 2023 Operating Expense: o

Cost Management: High operating expenses can indicate increased spending

on CRM tools, customer service, and marketing efforts. Monitoring these

expenses helps VPBank ensure that CRM initiatives are not overly costly and are delivering value. o

Resource Allocation: By evaluating operating expenses, VPBank can

determine if they are allocating resources effectively to different CRM

activities. This can help in optimizing spending and improving overall CRM

performance. The bank needs to ensure that these expenses are translating into

tangible customer benefits, such as improved service quality and customer

satisfaction. The slight decrease in 2023 could reflect attempts to optimize

spending, but further efficiency improvements might be necessary o

This is VP bank's Operating Expense from 2020 to 2023 (Million VNĐ) 2020 2021 2022 2023

11,392,021 10,718,937 14,115,731 13,941,218 15 about:blank 15/23 12:44 18/1/25 Ggwp - accounting Operating expense 16,000,000 14,000,000 12,000,000 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 - Operating expense 2020 2021 2022 2023 Operating Income: o

Revenue Generation: Operating income reflects the bank’s earnings from core

operations, excluding non-operating income and expenses. Effective CRM

strategies should contribute to higher operating income by driving revenue

growth through improved customer relationships and increased sales.

Increasing Operating Income typically reflects successful CRM initiatives, as it

indicates higher customer engagement and loyalty o

Operational Efficiency: Analyzing operating income can help VPBank

identify areas where CRM strategies are enhancing operational efficiency,

leading to better financial performance. Increasing Operating Income typically

reflects successful CRM initiatives, as it indicates higher customer engagement and loyalty o

This is VP bank's Operating Income from 2020 to 2023 (Million VNĐ) 2020 2021 2022 2023

39,340,321 44,301,475 57,797,089 49,739,488 16 about:blank 16/23 12:44 18/1/25 Ggwp - accounting Operating income(sales) 70,000,000 60,000,000 50,000,000 40,000,000 30,000,000 20,000,000 10,000,000 - Operating income 2020 2021 2022 2023

Credit Loss Provision: o

Risk Management: The provision for credit losses represents potential losses

from delinquent or defaulted loans. Effective CRM can help in better

understanding customer creditworthiness and managing credit risk, thereby

reducing the need for high credit loss provisions. o

Customer Segmentation: By analyzing credit loss provisions, VPBank can

identify segments of customers that pose higher credit risks. This information

can be used to tailor CRM strategies to mitigate risks and improve customer portfolio quality. o

This is VP bank's Credit Loss Provision from 2020 to 2023 (Million VNĐ) 2020 2021 2022 2023

14,621,638 19,218,768 22,461,226 24,994,374 17 about:blank 17/23 12:44 18/1/25 Ggwp - accounting Credit Loss Provision 2020 18% 2023 31% 2021 24% 2022 28% 2020 2021 2022 2023

c. The remaining limitations in VPBank's CRM strategy include:

While VPBank's CRM strategy brings many advantages and values, there are still

some limitations that need to be considered and improved to optimize effectiveness.

Here are some of the remaining limitations in VPBank's CRM strategy:

- Data Accuracy and Analysis: Although VPBank collects a lot of customer data, the

accuracy and consistency of this data are not always guaranteed. If the data is not

properly cleaned and synchronized, the analysis results could lead to incorrect decisions.

- Complex System Integration: With the deployment of multiple channels and

different technologies, integrating CRM systems to ensure seamless and consistent

customer information can be challenging. This may affect work efficiency and the customer experience.

- High Initial Investment Costs: Building and maintaining a comprehensive CRM

system requires significant investment in technology, staff training, and operational

management. This can create financial pressure for the bank and requires a long time to see tangible benefits.

- Limited Interaction and Response Capabilities: Even with automation and AI

systems in place, the ability to quickly respond to complex customer requests or

complaints can still be limited, especially in situations that require human intervention.

- Dependency on Tec :

hnology Over-reliance on technology in CRM can pose risks if

technical issues occur, or when flexibility is needed to adjust the CRM strategy over time.

- Lack of Deep Personalization: Although VPBank has applied AI to personalize

customer experiences, there is still room for deeper development. Currently, some

customer segments may feel that the programs and services are not personalized

enough or do not fully meet their specific needs.

- Challenges in Training and Implementation: Training staff to use the CRM system

effectively and consistently can be challenging, especially with a large workforce and

complex processes in the bank. This can lead to inconsistencies in customer approach and care. 18 about:blank 18/23 12:44 18/1/25 Ggwp - accounting

These limitations need to be addressed by VPBank to ensure that the CRM strategy not

only maintains current advantages but also continues to develop and enhance competitiveness in the market.

III. Solution and proposal for Vpbank’s CRM activities:

3.1 Solutions for VP Bank's CRM activities in the future:

As VP Bank continues to evolve within the competitive landscape of the banking

sector, the importance of a robust Customer Relationship Management (CRM) strategy

cannot be overstated. CRM serves as the foundation for nurturing customer loyalty,

increasing profitability, and maintaining a customer-centric focus in all operations.

While VP Bank has made significant strides in its current CRM initiatives, there are

several areas for enhancement that can support its long-term goals. By addressing key

elements within the CRM framework—CRM vision, customer orientation culture,

organizational process alignment, data and technology support, and CRM

implementation—VP Bank can refine its approach and achieve greater success in the future.

a. Strengthening the CRM Vision:

- A well-defined CRM vision provides strategic direction, setting the tone for how an

organization will manage and cultivate relationships with its customers. While VP

Bank has demonstrated a commitment to customer satisfaction, a more explicit and

forward-thinking CRM vision can drive sustained growth. The CRM vision should

clearly articulate how VP Bank envisions its customer relationships evolving over

time, while also aligning with its larger corporate mission of becoming a leading financial institution.

- Solution: VP Bank can set a long-term CRM vision that emphasizes the seamless

integration of personalized services and digital innovation. This vision should project

an image of VP Bank as a pioneer in customer experience, utilizing data-driven

insights to anticipate customer needs. A potential CRM vision statement could be: "By

2030, VP Bank aims to be the preferred banking partner for all customer segments,

offering personalized, proactive financial solutions that simplify lives and foster

enduring trust." Such a vision would inspire the organization to continually invest in

technologies that provide individualized services, including real-time financial advice,

predictive loan offers, or tailored wealth management solutions.

For example, VP Bank could implement personalized financial health reports for

customers, generated using data analytics tools. These reports could suggest specific

actions based on each customer’s unique financial behavior—whether that involves

refinancing a loan, adjusting a savings strategy, or recommending investment

opportunities. By proactively delivering value in this way, VP Bank will strengthen its

position as a trusted advisor, not just a transactional institution.

b. Fostering a Culture of Customer Orientation:

- While VP Bank places significant emphasis on customer-centric initiatives, a

deeper cultural alignment is necessary to ensure that every employee embodies a

customer-first mentality. Fostering a strong culture of customer orientation is not only

about providing good service but also about making customers feel genuinely

understood and valued. In today's competitive banking environment, customers expect 19 about:blank 19/23 12:44 18/1/25 Ggwp - accounting

personalized experiences at every touchpoint. Therefore, customer orientation must

extend beyond front-line staff to encompass the entire organization, from leadership to back-office functions.

- Solution: To cultivate a stronger customer orientation culture, VP Bank should

implement continuous, organization-wide training programs focused on empathy,

active listening, and personalized problem-solving. These programs could be

supplemented with experiential learning, such as role-playing scenarios that allow

employees to navigate complex customer interactions. Additionally, establishing a

rewards and recognition program for employees who consistently deliver exceptional

customer experiences will incentivize and reinforce positive behavior across the organization.

- For instance, a Customer Champion Award could be introduced, recognizing

employees who receive consistently high customer satisfaction scores. Publicly

acknowledging and celebrating these successes will help build a culture where

employees are motivated to exceed customer expectations. Furthermore, creating a

system where customer feedback is looped back into staff development plans can help

employees continuously improve and adapt their service approaches.

c. Aligning Organizational Processes:

- One of the key challenges in CRM is ensuring that all organizational processes are

aligned to support the bank’s overarching customer relationship goals. Inconsistencies

in internal processes can lead to delays, inefficiencies, and a fragmented customer

experience. For VP Bank, optimizing process alignment is critical to streamlining

operations, reducing service times, and ensuring that customers receive a consistent

level of service across all channels.

- Solution: VP Bank should undertake a thorough review of its existing processes to

identify bottlenecks and inefficiencies that hinder smooth customer interactions.

Automating routine, repetitive tasks and workflows will free up employees to focus on

more complex and high-value customer interactions. For example, automating the

approval process for routine transactions, such as loan applications or account

upgrades, can reduce customer wait times and improve satisfaction. By integrating

CRM systems with back-office operations, VP Bank can ensure that all departments

have real-time access to customer data, allowing for quicker, more informed decision- making.

- Additionally, VP Bank can implement a centralized case management system that

tracks all customer interactions, ensuring that issues are escalated and resolved in a

timely manner. For instance, if a customer raises a complaint about an overdraft fee,

the system should automatically route the issue to the appropriate team, with

notifications sent to the customer at each stage of resolution. This kind of process

optimization not only improves efficiency but also enhances the overall customer

experience by making interactions more transparent and responsive.

d. Leveraging Data and Technology for Personalized CRM:

- With increasing digitalization in the banking industry, VP Bank has an

opportunity to leverage data and technology to offer more personalized and relevant

customer experiences. Customers today expect their banks to understand their needs

and preferences, delivering solutions tailored specifically to them. VP Bank’s current 20 about:blank 20/23