Preview text:

lOMoARcPSD|507 130 28

Downloaded by no ce (nnc4@gmail.com) lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ ́ ̃ TABLE OF CONTENTS

CHAPTER 1 : THE DATA OF MACROECONOMICS .. 3

CHAPTER 2: PRODUCTION AND GROWTH ............ 10

CHAPTER 4: AGGREGATE DEMAND AND

AGGREGATE SUPPLY .................................................... 23

CHAPTER 5: IS – LM model ............................................ 33

CHAPTER 1 : THE DATA OF MACROECONOMICS I-

MEASURING A NATION’S INCOME

1.The Economy ‘s Income and Expenditure Income equals expenditure − For the economy as whole 2

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

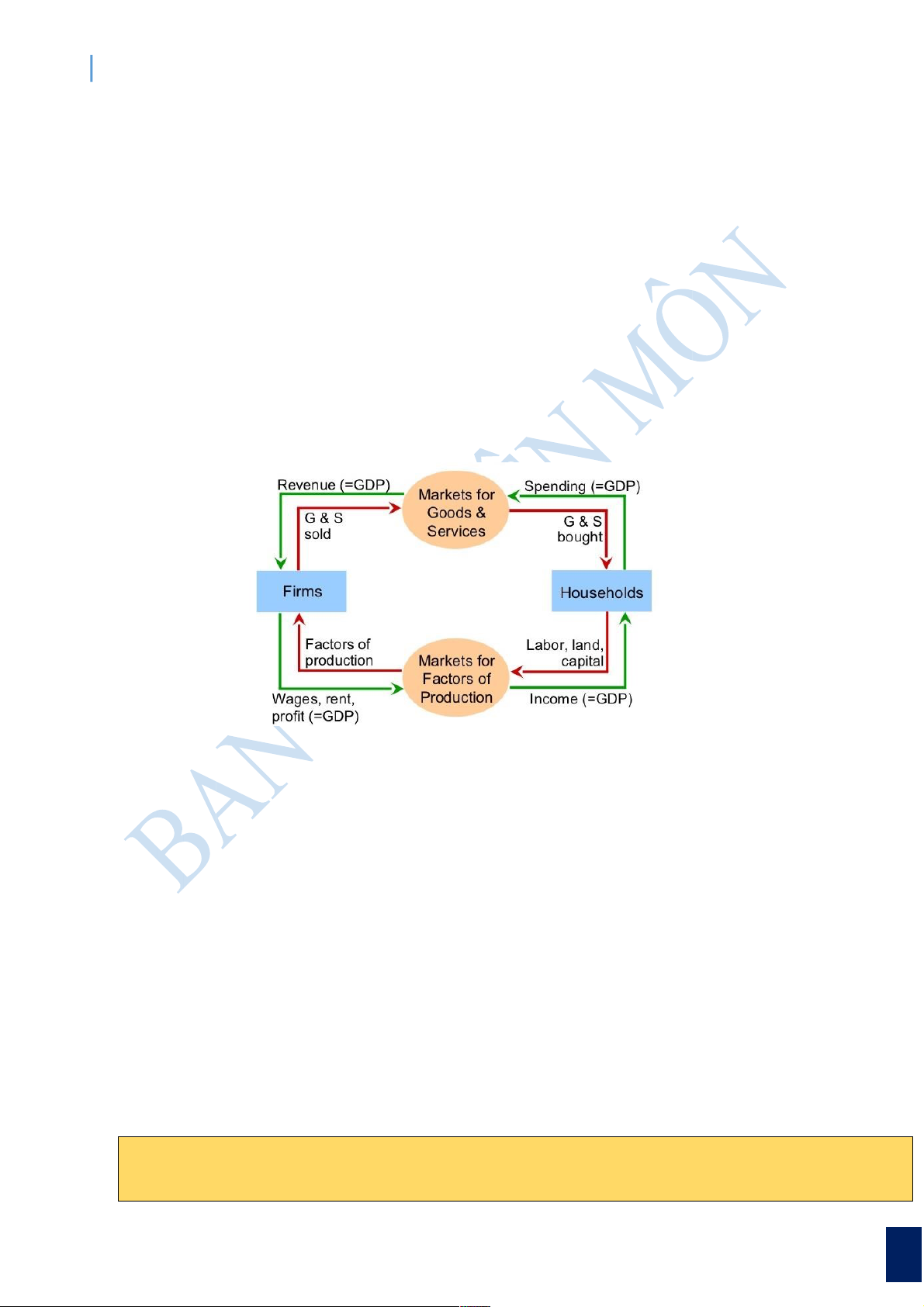

− Because every VND a buyer spends is a VND of income for the seller 1.1 The Circular-Flow • The Circular-Flow Diagram

− Simple depiction of the macroeconomy

− Illustrates GDP as spending, revenue, factor payments, and income • Preliminaries:

− Factors of production: inputs like labor, land, capital, and natural resources.

− Factor payments: payments to the factors of (e.g., wages, rent) • What this diagram omits? − The government

➢ Collects taxes, buys goods and services − The financial system

➢ Matche s savers’ supply of funds with borrowers’ demand for loans − The foreign sector

➢ Trades goods and services, financial assets, and currencies with the country’s residents

2.The Measurement of GDP 2.1 Definion and features

Gross Domestic Product (GDP) Is

…the market value of all final goods & services produced within a country

in a given period of time 3

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

❖ … the market value of all final goods & services produced within a country

in a given period of time

− Goods are valued at their market prices, so:

All goods measured in the same units (e.g., VND in Vietnam or dollars in the U.S.)

Things that don’t have a market value are excluded, e.g., housework you do for yourself.

❖ … the market value of all final goods & services produced within a country in a given period of time

− GDP includes all items produced in the economy and sold legally in markets

− GDP excludes most items produced and sold illicitly. It also excludes most items

that are produced and consumed at home

❖ … the market value of all final goods & services produced within a country in a given period of time.

− Final goods and services: are goods and services sold to the final, or end, user.

− Intermediate goods and services: are goods and services—bought from one

firm by another firm—that are inputs for production of final goods and

services (a good used in the productionof another good).

• GDP only includes final goods

- They already embody the value of the intermediate goods used in their production

❖ …the market value of all final goods & services produced within a country in a given period of time

− GDP includes tangible goods (like food, bikes, beer, mobile phones)

− GDP includes intangible services (dry cleaning, concerts, haircuts).

❖ …the market value of all final goods & services produced within a country in a given period of time

− GDP includes currently produced goods, not goods produced in the past

❖ …the market value of all final goods & services produced within a country in 4

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ a given period of time

− GDP measures the value of production that occurs within a country’s borders,

whether done by its own citizens or by foreigners located there.

❖ …the market value of all final goods & services produced within a country in a

given period of time.

− Usually a year or a quarter (3 months) Not included in GDP − Intermediate goods − Non-market transactions:

− Underground, illegal economic transactions: − International goods − Financial transaction − Second hand sales − Gov’t transfer payments 2.2 The Components of

GDP ❖ Recall: GDP is total spending. ❖ Four components: − Consumption (C) − Investment (I) − Government Purchases (G) − Net Exports (NX)

❖ These components add up to GDP (denoted Y): Y = C + I + G + NX Consumption (C)

− Total spending by households on goods and services 5

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

− Does not include purchases of new housing Note on housing costs:

− For renters, C includes rent payments.

− For homeowners, C includes the imputed rental value of the house, but not the

purchase price or mortgage payments Investment (I)

− Total spending on goods that will be used in the future to produce more goods

Business capital: business structures, equipment, and intellectual property products

Residential capital: landlord’s apartment building; a homeowner’s personal residence

Inventory accumulations: goods produced but not yet sold

“Investment” does not mean the purchase of financial assets like stocks and bonds

Government purchases (G)

− All spending on the goods and services purchased by the government

At the federal, state, and local levels. 6

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

− Excludes transfer payments

Such as Social Security or unemployment insurance benefits.

They are not purchases of goods and services Net Exports (NX)

− Net exports, NX = exports – imports

Exports: foreign spending on the economy’s goods and services

Imports: are the portions of C , I , and G that are spent on goods and services produced abroad

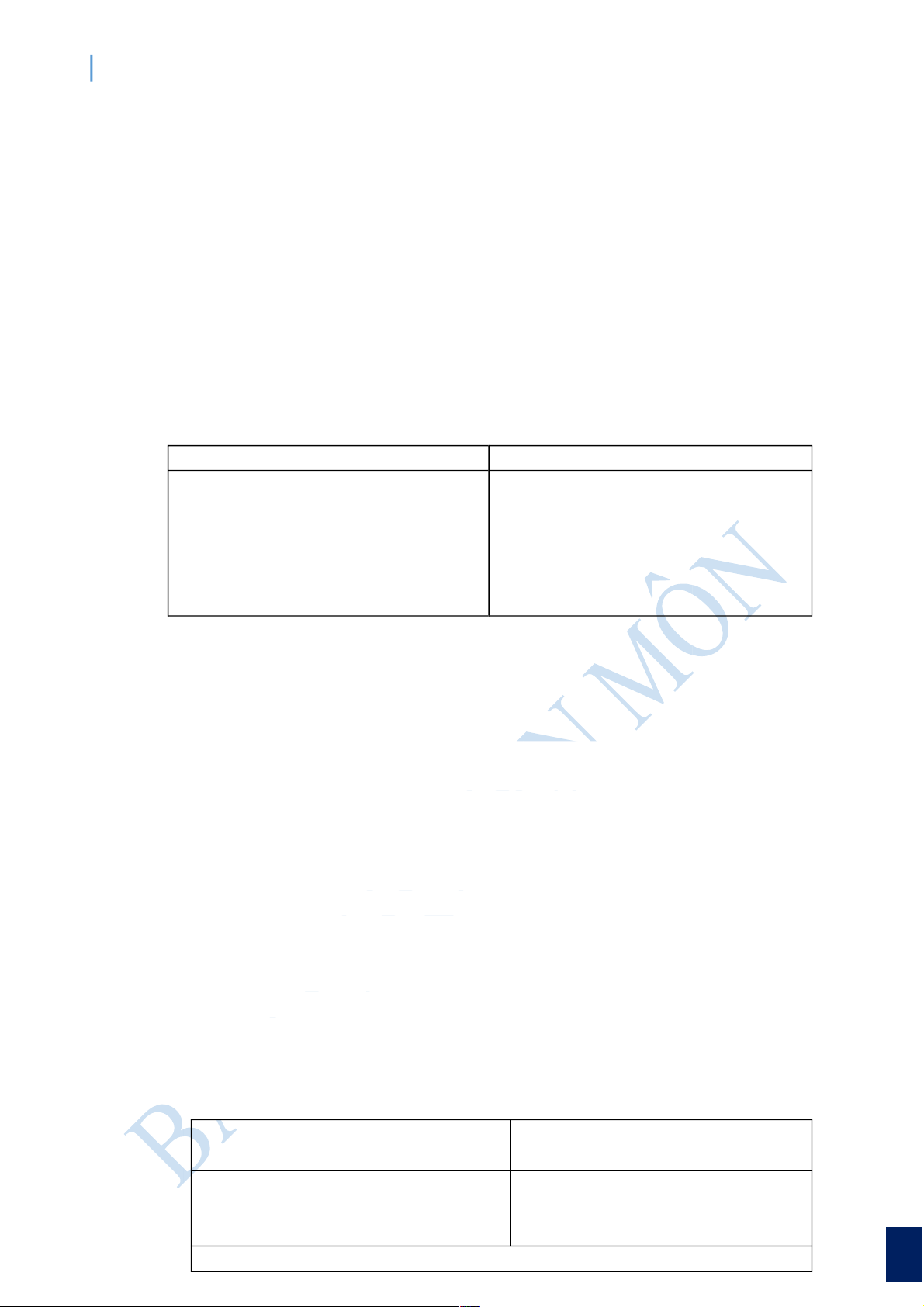

− Adding up all the components of GDP gives: Y = C + I + G + NX 2.3 Calculating GDP Expenditure approach Income approach Value added approach

The value added of a Total income earned by producer is the value of its

Total spending on final

domestically-located factors sales minus the value of its goods and services of production purchases of intermediate goods and services 2.4 Real versus Nominal GDP Nominal GDP

− Values output using current prices

− Not corrected for inflation Real GDP

− Values output using the prices of a base year

− Is corrected for inflation For the base year − Nominal GDP = Real GDP 2.4.1 The GDP Deflator

The GDP deflator is a measure of the overall level of prices. - Definition: 7

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ nominal GDP GDP deflator = 100 x real GDP

- One way to measure the economy’s inflation rate is to compute the

percentage increase in the GDP deflator from one year to the next. year Nominal GDP Real GDP GDP Deflator 2011 $6000 $6000 100.0 14.6 2012

$8250 $7200 114.6 2013 $10,800 $8400 128.6 12.2

Compute the GDP deflator in each year:

2011: 100 x (6000/6000) = 100.0

2012: 100 x (8250/7200) = 114.6

2013: 100 x (10,800/8400) = 128.6

II- MEASURING THE COST OF LIVING

1.The Consumer Price Index 1.1 Definition

The Consumer Price Index (CPI) a measure of the overall cost of the

goods and services bought by a typical consumer

A consumer price index measure changes in the price level of a basket of

consumer goods and services purchased by households

𝑐𝑜𝑠𝑡 𝑜𝑓 𝑏𝑎𝑠𝑘𝑒𝑡 𝑖𝑛 𝑐𝑢𝑟𝑟𝑒𝑛𝑐𝑦 𝑦𝑒𝑎𝑟 CPIin that unit = 100 x

𝑐𝑜𝑠𝑡 𝑜𝑓 𝑏𝑎𝑠𝑘𝑒𝑡 𝑖𝑛 𝑏𝑎𝑠𝑒 𝑡𝑖𝑚𝑒 Notes

* When the CPI >100, prices increase * CPI of base year =100 1.2 How the CPI calculated 1.2.1 Fix the basket

Determine what ‘s in the typical consumer’s “Shopping basket” 1.2.2 Find the prices

Collects data on the prices of all the goods in the basket

1.2.3 Compute the basket ‘s goal

Use the prices to compute the total cost of the basket

1.2.4 Choose the base year and calculate CPI 8

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

2.Problems in using the CPI to measure the cost of living

The CPI is not a perfect measure of the “ cost of living “ Three reason :

• Substitution bias

The Cpi uses fixed weights, so it cannot reflect consumer’s ability to

substitution toward goods whose relative prices have fallen Consumer

subsitution toward goods that have become relatively less expensive

• Unmeasured quality change

• Introduction of new goods .

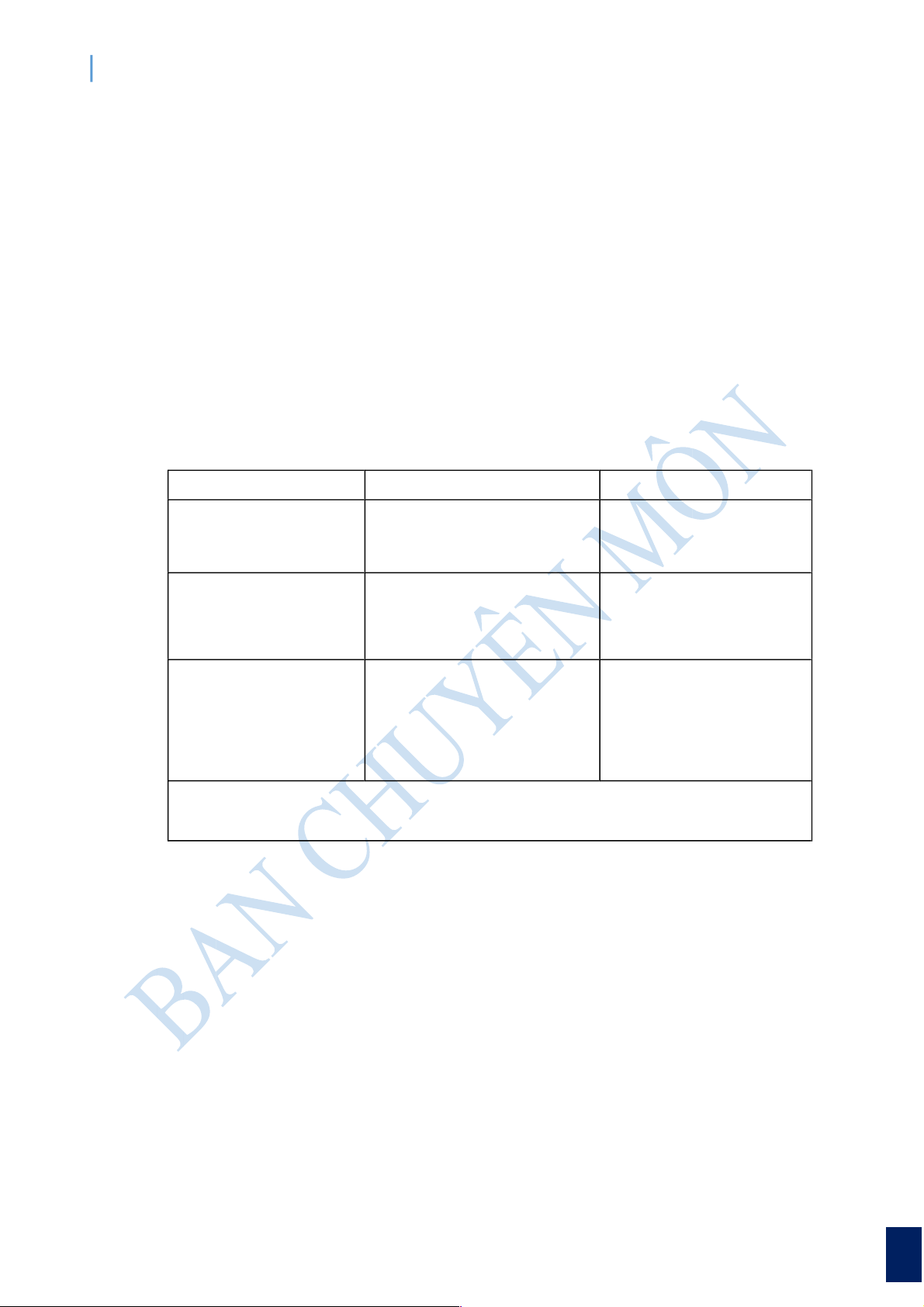

3 CPI and GDP deflator GDP deflator CPI

Imported consumer excluded Included goods: Capital goods included(if produced Excluded domestically) The basket: deflator uses basket of uses fixed basket currently produced goods and services

This matters if different prices are changing by different amounts. Example:

In each scenario, determine the effects on the CPI and GDP deflator.

A. Starbucks raises the price of Frappuccinos.

B. Caterpillar raises the price of the industrial tractors it manufactures at its Illinois factory.

C. Armani raises the price of the Italian jeans it sells in the U.S. Answers

A. The CPI and GDP deflator both rise.

B. The GDP deflator rises, the CPI does not.

C. The CPI rises, the GDP deflator does not. 9

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

4.CPI and the Inflation rate

* Inflation is a sustained increase in the prices level

Inflation makes it harder to compare dollar amounts from different times.

=) CPI is one of the most popular index to represent the average of prices

Amount in today’s dollars = Amount in year T dollars x Price level today Price level in year T

For example o “year T” is 12/1963, “today”

is 12/2013 o Min wage was $1.25 in year

T o CPI = 30.9 in year T, CPI = 234.6 today

The minimum wage in 1963 was $9.49 in 2013 dollars: 234.6 $9.49 = $1.25 x 30.9 NOTES

• Researchers, business analysts, and policymakers often use this technique to

convert a time series of current-dollar (nominal) figures into constant-dollar (real) figures.

• They can then see how a variable has changed over time after correcting for inflation.

5. Real vs. Nominal Interest Rates

The nominal interest rate:

- the interest rate not corrected for inflation

- the rate of growth in the dollar value of a deposit or debt

The real interest rate: - corrected for inflation

- the rate of growth in the purchasing power of a deposit or debt

Real interest rate = (nominal interest rate) – (inflation rate) Example:

- Deposit $1,000 for one year.

- Nominal interest rate is 9%.

- During that year, inflation is 3.5%. - Real interest rate

= Nominal interest rate – Inflation = 9.0% – 3.5% = 5.5%

- The purchasing power of the $1000 deposit has grown 5.5% 10

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

CHAPTER 2: PRODUCTION AND GROWTH

I. ECONOMIC GROWTH AROUND THE WORLD

Economic Growth is the increase in the real output in real output over time National income: GDP GDP growth rate GDP Per person Represent how rapidly - Represent for Living GDP grew in the typical standard Year - GDP/person vary widely from country to country II. PRODUCTIVITY 2.1

Definition

Productivity is represented by quantity of goods and services produced from each unit of labor input

2.2 Determinants of productivity •

Physical capital (or just capital): The stock of equipment and

structures that are used to produce goods and services. Note that these

tools and machines are themselves the output from prior human production. •

Human capital: The knowledge and skills that workers acquire through

education, training and experience. Note that human capital, like

physical capital, is a human-made or produced factor of production. •

Natural resources: Inputs provided by nature’s bounty such as land,

rivers and mineral deposits. Natural resources come in two forms: renewable and non-renewable. •

Technological knowledge: The understanding about the best ways to

produce goods and services. Examples of advances in technology are

the discovery and application of herbicides and pesticides in

agriculture and of the assembly line in manufacturing.

? Technological knowledge vs human capital TECHNOLOGICAL HUMAN CAPITAL KNOWLEDGE 11

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

Refers to society ‘understanding

Results from the effort people of how to produce goods and expend to services acquire this knowledge

Results from the effort people expend to acquire this knowledge

2.3 The Production Function Production function Y = A × F(L, K, H, N)

– A graph or equation showing the relation between output and inputs

– F( ) is a function that shows how inputs are combined to produce output

– “A” is the level of technology

– “A” multiplies the function F( ), so improvements in technology

(increases in “A”) allow more output (Y) to be produced from any

given combination of inputs. NOTES

If we multiply each input by 1/L, then output is multiplied by 1/L:

Y/L = A × F(1, K/L, H/L, N/L) • This equation shows that

productivity (Y/L, output per worker) depends on:

– The level of technology, A

– Physical capital per worker, K/L

– Human capital per worker, H/L

– Natural resources per worker, N/L

CONSTANT RETURNS TO SCALE

Changing all inputs by the same percentage causes output to change by that percentage.

Doubling all inputs (multiplying each by 2) causes output to double:

2Y = A × F(2L, 2K, 2H, 2N)

2.4. Economic Growth and Public Policy

• Saving and investment: To raise future productivity

• Diminishing Returns and the Catch-‐Up Effect: Policies that raise saving and investment

– Fewer resources are used to make consumption goods

– More resources: to make capital goods The catch-up effect:

– The property whereby countries that start off poor tend to grow

more rapidly than countries that start off rich 12

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ • Investment from broad:

–Another way for a country to invest in new capital –Foreign direct investment

• Capital investment that is owned and operated by a foreign entity

–Foreign portfolio investment: Investment financed with foreign

money but operated by domestic residents

• Education = investment in human capital

–Gap between wages of educated and uneducated workers

–Opportunity cost of education: wages forgone

–Confers positive externalities

–Subsidies to human-capital investment: public education.

• Health and Nutrition: a type of investment in human capital: healthier workers are more productive

• Property Rights and Political Stability: markets are usually a good way to organize economic activity. 13

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ - To foster economic growth

- Major problem: lack of property rights - Political instability

• Free Trade: Trade can make everyone better off - Political instability - Outward-oriented policies

- Trade has similar effects as discovering new technologies

- Countries with inward-oriented policies

- Countries with outward-oriented policies • Research and Development

- Technological progress: main reason why living standards rise over the long run - Knowledge is a public good

- Policies to promote technological progress • Population Growth - Large population

- Population growth may affect living standards in different way

CHAPTER 3: MONEY GROWTH AND INFLATION I. THE MONEY SYSTEM 1. The meaning of money

Money is the stock of assets that can be readily used to make transactions 1.1 The two types of money 14

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

- Fiat money : something that serves as money but has no intrinsic value

(has no other important uses). Examples: Coins, currency..

- Commodity Money: something that performs the function of money and

has intrinsic value Examples: Gold, silver...

2. The Functions of Money

a) Medium of Exchange: acceptable as payment, we use it to buy stuff

b) Store of Value: a way to keep some of our wealth in a readily spendable

form for future needs. You can transfers purchasing power from the

present to the future. Money retains its value over time, so you need not

spend all your money as soon as you receive it

c) Unit of Account: the common unit by which everyone measures prices and values FOR EXAMPLE: Which of these are money? a. Currency b. Checks

c. Deposits in checking accounts (“demand deposits”) d. Credit cards ANSWER a. Currency – yes

b. Checks - no, not the checks themselves, but the funds in checking accounts are money.

C. Deposits in checking accounts- yes (see b)

D. Credit cards - no, credit cards are a means of deferring payment.

II. MONEY SUPPLY AND BANKING SYSTEM 1.Central bank 1.1 Definition

An institution designed to oversee the banking system and regulate

the quantity of money in the economy

1.2 Features off central banks

- Currencies/banknotes are issued by the Central Bank

- Act as a banker’s bank, making loans to other commercial banks

- Control the money supply with monetary policy.

- Monetary Base is Currencies/bank notes issued by the Central Bank

1.3 Central bank and the Monetary base 15

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

Monetary base is the money issued by the central bank, including Currency and Reserves MB = C + R C: Currency R: Reseveres

=) MB is controlled by the central bank

2 .Money supply 2.1 Definition

The money supply is the quantity of money available in the economy

The money supply equals currency plus deposits MS = C + D C:Currency D:Deposits 2.2 Money creation MS= MB* mm 𝑀𝑆 = 𝑚𝑚 = 𝑀𝐵 cr + rr cr + 1 Notes

cr is cash ratio to demand deposits in payment

rr is actual reserve ratio of commerical banks

rr = required reserve + excess reserve For example: 16

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

Assume that the banking system has total reserves of $100 billion.

Assume also that required reserves are 10 percent and banks hold

no excess reserves and households hold no currency. What are the

money multiplier and the money supply? Answer

Calculate money mutilplier: rr= 0,1 cr = 0

Therefore, mm = (1+cr)/(rr+ cr) = 10

Calculate MS: rr = R/D, so 0,1=100/D

therefore, D = 1000 MS = C + D = 0 + 1000 = 1000

D = 1000 therefore, R = 0,2 . 1000 = 200 II.MONEY POLICY 1.Definition

Monetary policy: the setting of the money supply by policymakers in the central bank

- An active contractionary policy restricts the size of the money supply.

- An active expansionary policy increases the size of the money supply.

2.Monetary Policy Tools

A central bank has three traditional tools to implement monetary policy in the economy:

Open-Market Operations: the purchase and sale of government bonds by the central bank

- When the central bank buys government bonds, each newly-created dollar

held as currency increases the money supply by $1. But each newly-created

dollar held as a deposit increases the money supply by even more, because of the money multiplier.

- And when the central bank sells government bonds, if the buyer pays for the

bond with currency, the money supply decreases by $1. But if the buyer pays

for the bond using funds from a bank deposit, the money supply decreases by

even more, as the process of multiple deposit creation works in reserve.

The Discount Rate: the interest rate on the loans that the central bank makes to banks 17

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

- A higher discount rate discourages banks from borrowing from the central

bank, decreasing the quantity of reserves in the banking system and in turn the money supply.

- A lower discount rate encourages banks to borrow from the central bank,

increasing the quantity of reserves and the money supply.

Reserve Requirements: the regulations on the minimum amount of reserves that

banks must hold against their deposits

- An increase in reserve requirements raises the reserve ratio, lowers the money

multiplier, and decreases the money supply.

- A decrease in reserve requirements lowers the reserve ratio, raises the money

multiplier, and increases the money supply.

Problems and Applications in Textbook

1. (5 – p.330) You take $100 you had kept under your mattress and deposit it in

your bank account. If this $100 stays in the banking system as reserves and if

banks hold reserves equal to 10 percent of deposits, by how much does the

total amount of deposits in the banking system increase? By how much does the money supply increase?

Answer

If you take $100 that you held as currency and put it into the banking system,

then the total amount of deposits in the banking system increases by $1,000,

because a reserve ratio of 10% means the money multiplier is 1/0.10 = 10.

Thus, the money supply increases by $900, because deposits increase by

$1,000 but currency declines by $100.

2. (7 – p.330) The Fed conducts a $10 million open market purchase of

government bonds. If the required reserve ratio is 10%, what are the largest

and smallest possible increases in the money supply that could result?

Answer

With a required reserve ratio of 10%, the money multiplier could be as high

as 1/0.10 = 10, if banks hold no excess reserves and people do not keep some

additional currency. So, the maximum increase in the money supply from a

$10 million open-market purchase is $100 million. The smallest possible

increase is $10 million if all of the money is held by banks as excess reserves.

3. (8 – p.330) Assume that the reserve requirement is 5 percent. All other things

being equal, will the money supply expand more if the Fed buys $2,000 worth 18

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

of bonds or if someone deposits in a bank $2,000 that she had been hiding in

her cookie jar? If one creates more, how much more does it create? Support your thinking.

Answer The money supply will expand

more if the Fed buys $2,000 worth of bonds. Both deposits will lead to

monetary expansion. But the Fed’s deposit is new money. The $2,000 from

the cookie jar is already part of the money supply.

4. (9 – p.331) Suppose that the reserve requirement for checking deposits is 10

percent and that banks do not hold any excess reserves. a.

If the Fed sells $1 million of government bonds, what is the effect on

the economy’s reserves and money supply? b.

Now suppose the Fed lowers the reserve requirement to 5 percent, but

banks choose to hold another 5 percent of deposits as excess reserves. Why

might banks do so? What is the overall change in the money multiplier and

the money supply as a result of these actions?

Answer a.

With a required reserve ratio of 10% and no excess reserves, the money

multiplier is 1/.10 = 10. If the Fed sells $1 million of bonds, reserves will

decline by $1 million and the money supply will contract by 10 x $1 million = $10 million. b.

Banks might wish to hold excess reserves if they need to hold the

reserves for their day-to-day operations, such as paying other banks for

customers' transactions, making change, cashing paychecks, and so on. If

banks increase excess reserves such that there is no overall change in the total

reserve ratio, then the money multiplier does not change and there is no effect on the money supply.

5. (10 – p.331) Assume that the banking system has total reserves of $100 billion.

Assume also that required reserves are 10 percent of checking deposits and

that banks hold no excess reserves and households hold no currency a. What

is the money multiplier? What is the money supply?

b. If the Fed now raises required reserves to 20 percent of deposits, what are

the change in reserves and the change in the money supply? 19

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH lOMoARcPSD|50713028

ĐỀ CƯƠNG KINH TẾ VĨ MÔ

Answer a.

With banks holding only required reserves of 10%, the money

multiplier is 1/0.10 = 10. Because reserves are $100 billion, the money supply

is 10 x $100 billion = $1,000 billion. b.

If the required reserve ratio is raised to 20%, the money multiplier

declines to 1/0.20 = 5. With reserves of $100 billion, the money supply would

decline to $500 billion, a decline of $500 billion. Reserves would be unchanged.

6. (11 – p.331) Assume that the reserve requirement is 20 percent. Also assume

that banks do not hold excess reserves and there is no cash held by the

public. The Fed decides that it wants to expand the money supply by $40

million. a. If the Fed is using open-market operations, will it buy or sell bonds?

b. What quantity of bonds does the Fed need to buy or sell to accomplish the goal? Explain your reasoning.

Answer

a. To expand the money supply, the Fed should buy bonds.

b. With a reserve requirement of 20%, the money multiplier is 1/0.20 = 5.

Therefore, to expand the money supply by $40 million, the Fed should buy

$40 million/5 = $8 million worth of bonds.

7. (12 – p.331) The economy of Elmendyn contains 2,000 $1 bills.

a. If people hold all money as currency, what is the quantity of money?

b. If people hold all money as demand deposits and banks maintain 100

percent reserves, what is the quantity of money?

c. If people hold equal amounts of currency and demand deposits and banks

maintain 100 percent reserves, what is the quantity of money?

d. If people hold all money as demand deposits and banks maintain a reserve

ratio of 10 percent, what is the quantity of money?

e. If people hold equal amounts of currency and demand deposits and banks

maintain a reserve ratio of 10 percent, what is the quantity of money?

Answer

a. If people hold all money as currency, the quantity of money is $2,000. 20

CHƯƠNG TRÌNH “HỖ TRỢ HỌC TẬP”- BAN CHUYÊN MÔN LCĐ CHẤT LƯỢNG CAO HVNH