Preview text:

TỔNG HỢP THUẬT NGỮ TACN

1. Consumers: người tiêu dùng

Workers= labors: người lao động

Firms= corporations= companies: doanh nghiệp

2. Economic models: các loại hình KT

- Planned economy: KT kế hoạch

- Market economy: KT thị trường

- Mixed economy: KT hỗn hợp

Economic model of VietNam is the market economy under the

State’s control/ under socialism orientation: nền KT thị trường định hướng XHCN

3. Economic trends: những xu hướng KT Inflation: lạm phát

Employment rates(levels): tỉ lệ việc làm

Economic growth: sự tăng trưởng KT

Balance of payments: cán cân thanh toán

4. Economic sectors: các chủ thể trong nền KT

State companies: cơ quan, doanh nghiệp nhà nước

Private companies: cơ quan, doanh nghiệp tư nhân

Joint-ventures: cty, doanh nghiệp liên kết nc ngoài( cty liên doanh)

Foreign companies: cty 100% vốn nc ngoài

5. Resources: nguồn lực

- Human resources: nhân lực

- Natural resources: tài nguyên thiên nhiên

Scarce resources= limited resources: nguồn lực khan hiếmà the

allocation of scarce resources: phân bổ nguồn lực khan hiếm 6. Tools : công cụ

7. Money supply: cung tiền

8. Quantiative tools: công cụ định lượng

9. Reserve requirement: dự trữ bắt buộc

Discount rate: lãi suất tái chiết khấu

Open market operations: nghiệp vụ thị trường mở 10.Taxation: thuế

Direct tax: thuế trực thu

Indirect tax: thuế gián thu

Progressive tax: thuế lũy tiến

- Corporation income tax: thuế thu nhập của doanh nghiệp

- Personal income tax= individual income tax: thuế thu nhập cá nhân

- Payroll tax: thuế quĩ lương

- Excise tax: thuế tiêu thụ đặc biệt

- VAT ( value-added tax) : thuế GT gia tăng

- Estate tax: thuế BĐS, thuế nhà đất

- Property tax: thuế tài sản

11. Trust funds: quỹ ủy thác

Federal funds: quỹ liên bang

Mutual fund: quỹ tương hỗ

Unit investment trusts(UIT): quỹ ủy thác đầu tư

Initial public offering(IPO): quỹ mở

12.Government entities= public authorities: cơ quan nhà nước

The federal government: chính phủ liên bang

Government: chính phủ

Ministry of finance: bộ tài chính

Central banks: ngân hàng trung ương

Commercial banks: ngân hàng thương mại

Private banks: ngân hàng tư nhân

Investment banks: ngân hàng đầu tư

13.Economy’s state/ economy’s situations: tình hình nền KT

Overheated economy: nền KT tăng trưởng nóng

Economic slowdowns: suy thoái KT( nền kT suy thoái)

14.Public finance: tài chính công

Principle of public finance: nguyên lý tài chính công

15.Component of public finance: các thành tố của tài chính công

16. Government income and expenditure

= Government revenue and spending: thu và chi của chính phủ

17. Government spending: chi chính phủ

- Capital spending: chi cố định

- Current government spending: chi thường xuyên

- Transfer payment: thanh toán chuyển nhượng

18.Financial market: thị trường tài chính

The security market: thị trường trao đổi ngoại hối

Debt market and equity market: thị trường nợ và thị trường vốn cổ phần

Money market and capital market: thị trường tiền tệ( ngắn hạn) và thị trường vốn( dài hạn)

Primary market and secondary market: thị trường sơ cấp và thị trường thứ cấp

Exchange and over- the – counter( OTC) markets: thị trường ngoại hối

và thị trường CK phi tập trung

Forex market: thị trường ngoại hối

19. Debt instruments: công cụ nợ - Bonds: trái phiếu

- Mortgages: vay có thế chấp

- Certificates of deposits( CDs): giấy vay nợ

Financial instruments: công cụ tài chính

20. Security: chứng khoán

- New issues of a security=fresh securities: chứng khoán mới phát hành

- Securities that have been previously issued= outstanding securities=

previously issued securities: chứng khoán hiện hành

- Underwrite securities: bảo lãnh chứng khoán Bonds: trái phiếu

Treasury bonds: trái phiếu kho bạc

Treasury bills: tín phiếu kho bạc Interest: lãi suất

Commercial paper: thương phiếu

Bill of exchange: hối phiếu

Shares = Stocks= equities: cổ phiếu

- Stocks holder= shares holders=equity holders: cổ đông - Dividend: cổ tức - Stake: cổ phần

21. Financial intermediaries: trung gian tài chính

The insurrer= insurance companies: cty bảo hiểm

Insurance premiums: phí bảo hiểm

22. Brokers: pháp nhân( môi giới) Dealers: thế nhân

23.The lender- savers: người có tiền nhàn rỗi

The borrower- spenders: người cần vốn/ người vay tiền để chi tiêu

24.Deposit: tiền gửi có kì hạn

Mortgage: khoản vay có thế chấp TOPIC QUESTION

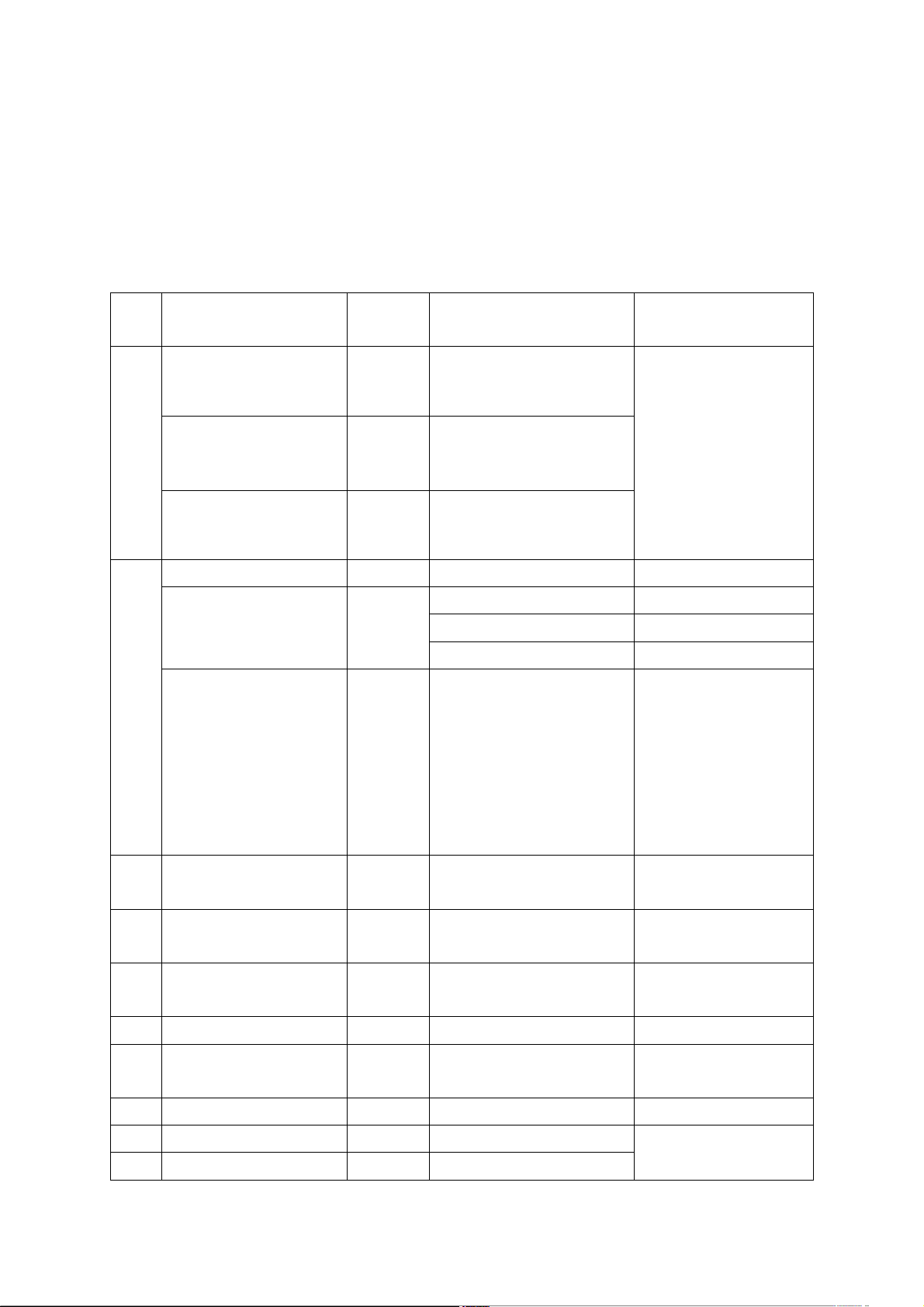

UNIT 1: MICROECONOMICS & MACROECONOMICS MICROECONOMICS A. VOCABULARY STT TỪ LOẠI NGHĨA VÍ DỤ TỪ 1 Consumer n Người tiêu dùng Microeconomics studies about behaviors of each Worker=labor n Người lao động consumer, workers and firms about decisions Firm n Doanh nghiệp on particular commodities 2 Economic models Các loại hình KT Planned economy KT kế hoạch Market econonmy KT thị trường Mixed economy KT hỗn hợp Economic model KT thị trường định of Viet Nam: the hướng XHCN market economy under the State’s control/ under socialism orientation 3 Economic sector Các chủ thể trong nền kT State companies Cơ quan, doanh nghiệp nhà nước Private companies Cơ quan, doanh nghiệp tư nhân Joint- ventures Cty liên doanh Foreign companies Cty 100% vốn nước ngoài 4 Good and services Hàng hóa và dịch vụ 5 Resources n Nguồn lực Human resources Nhân lực Natural resources Năng lượng tự nhiên Capital resources 6 Limits= contraints n Giới hạn, hạn chế Limited adj Có hạn Limited resources Các nguồn lực có giới hạn 7 Scarce resources Các nguồn lực khan Microecomomics hiếm is about the allocation of scarce resources 8 Allocate v Phân bổ A large sum has been allocated for buying new books for the library Allocation n Sự phân bổ Microeconomics The allocation of Sự phân bổ các is about the scarce resources

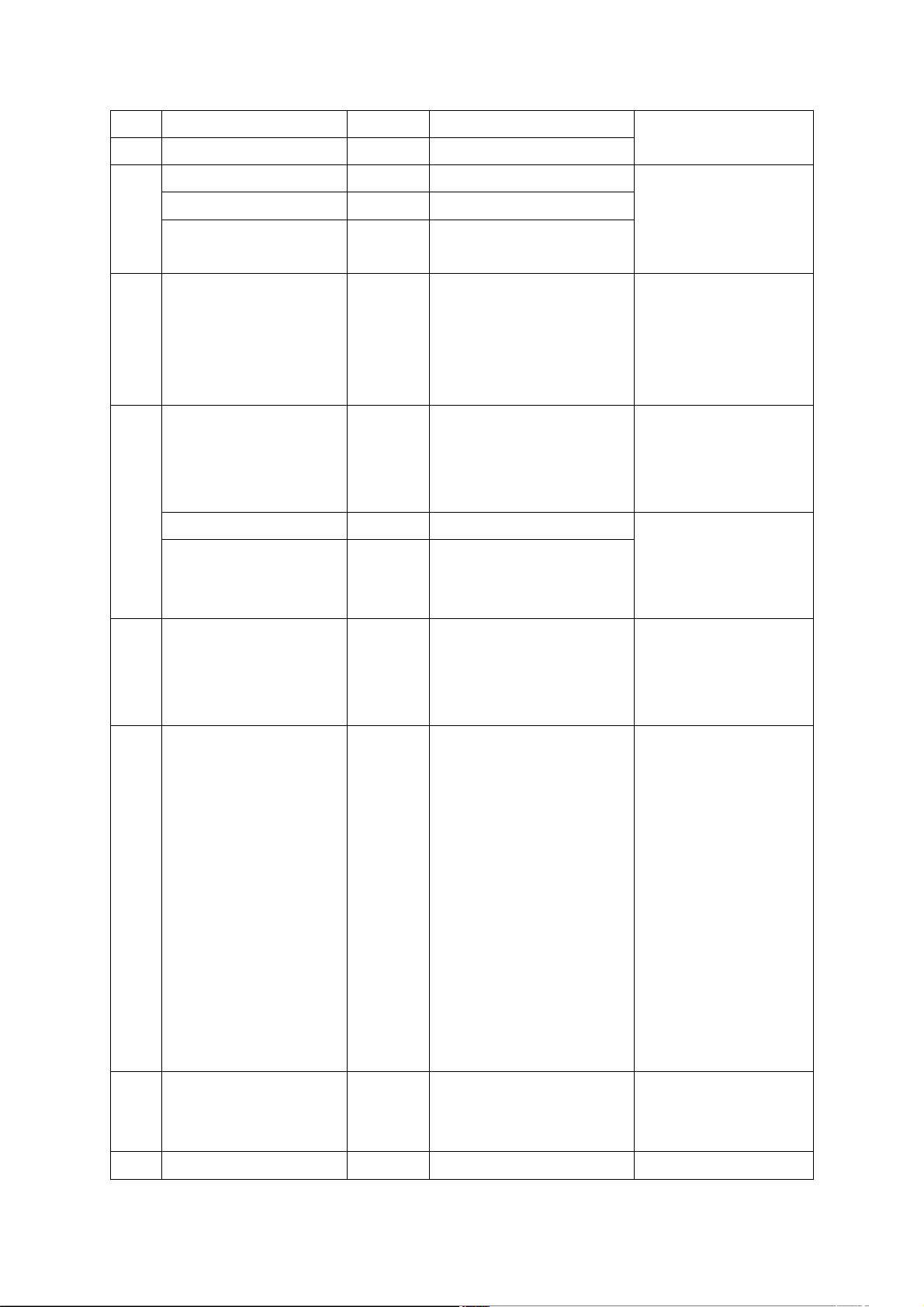

nguồn lực khan hiếm allocation of scarce resources 9 Budget = financial n Ngân sách resources= capital= funds= finance 10 Trade- off v Trao đổi( mua bán Consumers theory HH,DV) describes how consumers, based Make trade-off Thực hiện trao đổi on their preferences, maximine their well- being by trading off the purchases of more of some goods with the purchase of less of others 11 Well- being= n Phúc lợi We try to ensure satisfaction the well- being of our employees 12 Accumulate v (1) Tích lũy By investing wisely, she accumulated a fortune v (2) Tích tụ Dust and dirt soon accumulate if a house is not cleaned regularly Accumulated skills Kĩ năng tích lũy 13 Economist n Nhà kinh tế học Economic adj Thuộc về kinh tế Economy n Nền kinh tế 14 Produce V Sản xuất Product N Sản phẩm Production n Sự sản xuất Productive Adj Năng suất Productivity n Khả năng năng suất 15 Make the most of Tận dụng tối đa, Microeconomics sth= make full use phát huy hết hiệu is about ways to of sth quả của cái gì make the most of scarce resources 16 Substitute good= n Mặt hàng thay thế When prices of a substitutes good increase, consumers tend to buy substitutes even thay don’t prefer them B. TOPIC QUESTIONS 1. What does economics study?

Economic studies how ppl choose to use limited resources to produce

goods and services in order to best satisfy human demand.

2. What does microeconomics studies?

Microeconomics is a branch of economics that deals with how

consumers, workers and firms behave while making decisions on the

allocation of their scarce resources. Because their resources are limited

so all consumers, workers and firms have to make trade-offs.

Microeconomics also studies other important themes such as the role of prices and the role of markets

3. What are 3 themes of microeconomics?

Three themes of microeconomies includes the allocation of scarce

resources, the role of prices and the role of the market.

4. Why do consumers/ workers of firms have to make trade- offs?

Consumers, workers and firms have to make trade- offs because the

resources are limited while their demand is unlimited

5. What are resources of consumers? How do they allocate

their resources? What are examples for trade- offs made by consumers?

The resources of consumers are their limited incomes. As the consumer

theory describes, the consumers allocate their resources based on their

limited incomes and preferences. For example, they may trade off the

purchase of more of some goods with the purchase of less of others.

Another example may be trading off current consumption for future consumption.

6. What are resources of workers? How do they allocate their

resources? What are examples for trade- offs made by workers?

The resources of workers are their time and talent, knowledge, working

experience, etc. All these resources are limited so they have to make

trade- offs. For example, they have to decide when to enter the

workforce (when finishing high school or graduating from universities),

which job to do, who to work for. They can choose to work for large

companies with job security but limited potential for advancement or for

small companies with more opportunities for advancement but less

security. They also have to decide how many hours for work and how

many hours for leisure time and so on.

7. What are resources of firms? How do they allocate their

resources? What are examples for trade- offs made by firms?

Resources of firms are human resources, financial resources, production

capacity, technology, management ability, reputation and so on. These

resources are scarce so companies have to make trade- offs. They have

to decide what to produce, how to produce and whom to produce.

Taking Ford Motor Company as an example- a company that is good at

manufacturing and producing airplanes, computers, etc… Concerning

about the financial resources and current production capacity of its

factories, Ford has to decide the number of each type of vehicle to

produce or decide whether to hire more workers if they want to produce

a larger number. Thus theory of the firm describes how companies can best make trade- offs. 8. How are prices important?

Prices have an influence on all trade- offs made by consumers, workers

and firms. When prices of goods increase, consumers tend to buy

substitutes even they don’t prefer them. Workers choose employment

depending partly on salaries paid to them. And, a firm’s decision such as

buying more machinery or employing more workers depend partly on

prices of those machine or salaries paid to those workers. 9. What based on prices?

All of the trade- offs made by consumers, workers and firms are based on prices. 10. What is the role of markets?

The central role of the market in the economy refers to the

self-regulation of the market via the interaction between prices of goods and services

and their supply and demand. When

other things are constant, if the price of goods increase, its

demand will decrease and its supply will increase. 11.

How are prices determined in a planned economy?

In a centrally planned economy, prices are set by the government, for

example, in some countries such as North Korea, Cuba or the former

SoViet Union, the allocation decisions are made by the government.

Firms are told what and how much to produce and how to produce it,

workers have little flexibility in choosing jobs and consumers have littler set of goods to choose.

12.How are prices determined in a market economy?

Price depends on the interaction between demand and supply

components of the market. Demand and supply represent the

willingness of consumers and producers to engage in buying and selling.

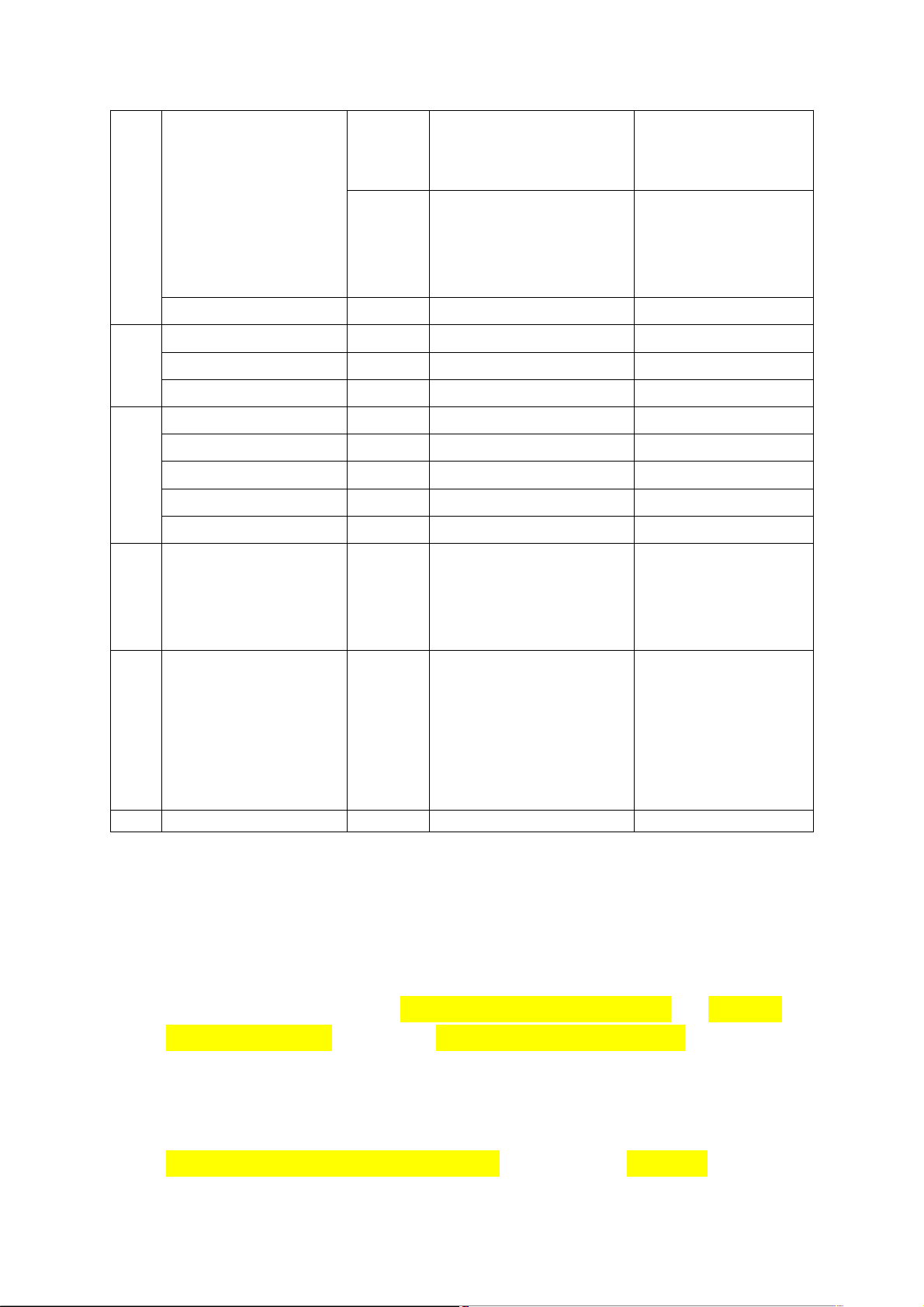

An exchange of a product takes place when buyers and sellers can agree upon a price MACROECONOMICS A. VOCABULARY B. TOPIC QUESTIONS

1. What does macroeconomics study?

Macroeconomics is the branch of economics that studies the role of both

markets (the invisible hand) and governments (the visible hand) in the

economy. Specifically, macroeconomics studies interactions among all

economic factors such as economic growth, inflation, employment and

so on, as well as economic relations among different countries in the

world. / as well as international marketplace.

Moreover, macroeconomics also studies the regulation of the economy

by the government. Usually, the government uses macroeconomics

policies such as fiscal policy and monetary policy to promote the

economic growth, to reduce unemployment and to control inflation.

2. What are two major of macroecomomic policies?

Two major of macroeconomic policies including monetary policy and fiscal policy.

3. What are the tools of fiscal policy?

The tools of fiscal policy are government spending and taxation

4. Who supervise the fiscal policy?

The fiscal policy is in the hand of the Ministry of Finance.

5. What does fiscal poilicy control?

Fiscal policy controls government’s revenue and spending.

6. What is the tool of monetay policy?

The tool of monetary policy is the reserve requirement, discount rate and open market operations

7. Who supervise monetary policy?

Central banks is the one that supervise monetary policy.

8. What does monetary policy control?

Monetary policy controls nation’s money supply

9. What is the diference between macoreconomics and microeconomics?

Microeconomics is the study of decisions that people and businesses

make regarding the allocation of resources and prices of goods and

services while macroeconomics studies the behavior of the economy as a

whole, not just on specific companies. UNIT 2: PUBLIC FINANCE A. VOCABULARY B. TOPIC QUESTIONS 1. What is public finance?

Public finance is the management of a country’s revenue,

expenditures and debt by government at all levels, central and local governments.

2. What are components of public finance?

The main components of public finance include government tax

revenue, government spending and government borrowing.

3. Where does the government’s revenue come from?

The government’s revenue come from borrowing and collecting tax.

4. Give some examples for different types of taxes?

There are different types of taxes such as payroll taxes, individual

income taxes, corporate income taxes, etc,… 5. What is payroll taxes?

Payroll taxes include social insurance and health insurance as

percentages of wages and salaries and they are paid jointly by workers and employers

6. What is personal income tax?

Personal income tax is the tax paid by pple on the money they earn/

personal income tax is the tax imposed on personal incomes

7. What is corporate income tax?

Corporate income tax is the tax imposed on corporate income 8. What are progressive taxes?

Progressive taxes are the taxes imposed at higher tax rates on higher incomes. 9. What are customs duties?

Customs Duty is levied when goods are transported across borders

between countries. It is the tax that governments impose on export

and import of goods. Customs Duty is beneficial for many reasons. For

instance, it ensures a country’s economic stability, jobs, environment,

among others. It regulates the movement of goods in and out of the

country. It keeps a check on restricted items. 10.What are excise taxes?

An excise tax is a tax imposed on a specific goods or activity. Excise

taxes are commonly levied on cigarettes, alcoholic beverages, soda,

gasoline, insurance premiums, amusement activities, and betÝng, and

make up a relatively small and volatile (unstable) portion of state and local tax collections.

11.Where does the government’s tax revenue come from?

The government’s tax revenue comes from the collection of different

types of taxes such as sale tax, income tax, estate tax and property

tax. Other types of revenue in this category include duties and tariffs on

imports and revenue from any type of public services that are not free.

12.What does the government spend tax revenues on?

Once tax revenues are paid into the Treasury, income taxes and

corporate taxes are designated as federal funds, while payroll taxes become trust funds.

13.What are 2 main types of the government’s tax revenue?

2 main types of the government’s tax revenue are trust funds and federal funds.

14. What is Trust funds? How is it used?

Trust funds are generated from payroll taxes and it can be used only

for very specific programs. The vast majority of trust funds revenues

pay for Social Security and Medicare including paying pension for

retired ppl, giving subsidies for the poor, supporting the victims of

accidents and disasters, free medical services to children...

15.What is Federal funds? How is it used

Income taxes and corporate taxes are designated as the Federal

funds. Federal funds are used for government’s projects and

programs, including capital spending and current spending.

16.Why does the government have to borrow?

Because the government wants to spend more money than it can collect from taxation

17.What are 2 types of government debts?

2 types of government debts are debts held by federal accounts and debts held by the public

18.What are debts held by federal accounts?

Debt held by federal accounts is the amount of money that the

Treasury has borrowed from itself. In more details, when trust funds

accounts run a surplus, the Treasury takes the surplus and uses it to

pay for other kinds of federal spending. But that means the Treasury

must pay that borrowed money back to the trust fund at a later date.

That borrowed money is called “ debt held by federal accounts”

19.What are debts held by the public?

Debts held by the public is the total amount of money that the

government owes to all of its creditors in the general public. That

include that country itself as well as foreign individuals and the

governments of foreign countries.

20. How can the federal government borrow more money?

The federal government can borrow more money by issuing and

selling bonds and other types of securities. They can either sell bonds

directly or sell indirectly. Selling directly means the Treasury will

ofÏcially issue bonds and sell them through its website while selling

indirectly means that the Treasury will sell bonds through banks or brokers.

21.From whom can the government borrow money?

The government can borrow money from domestic investors and

international investors. Domestic investors include private investors,

federal reserve such as the Central bank, and the state and local

governments. Foreign investors include foreign private investors,

other central banks from other countries and international financial

institutions such as IMF ( international monetary funds) and WB( world bank). UNIT 3: FISCAL POLICY A. VOCABULARY B. TOPIC QUESTIONS 1. What is fiscal policy?

Fiscal policy is a government policy related to taxation and public spending. It is

one of the most important components of a government’s overall economic

policy and the government uses them in an attempt to maintain economic

growth, high employment and low inflation

2. What are 2 main tools of fiscal policy?

two main tools of fiscal policy are government spending (G) and taxation(T)

2 In what way do government spending and taxation affect the economy? Give examples

Government spending and taxation directly affect the overall performance of

the economy. For example, if the government increase spending to build a new

high way, construction of those plans will create more jobs. Jobs increase

income that pple spend on purchases and the economy tends to grow. 3 What is deficit spending?

Deficit spending means spending funds obtained by borrowing or printing instead of taxation 4 What is budget defitcit?

Budget deficit is a situation in which government spending is more than government’s revenue

5 Is deficit spending helpful or harmful for the economy?

Deficit spending can be either helpful or harmful for the economy depending

on specific economic situation.

6 In which situation is deficit spending helpful for the economy?

Deficit spending is helpful for the economy when the unemployment rate is

high or the economic growth rate is low because more money is being pumped

into the economy by the way government undertake projects that use workers

who would otherwise be idle. Jobs increase income that pple spend on

purchases and the economy tends to grow.

7 In which situation is deficit spending harmful for the economy and why?

Deficit spending is harmful when the unemployment rate is low and inflation

rate is high. When unemployment rate is low, a deficit may result in rising

prices or inflation. This is due to the fact that the additional government

spending creates more competition for scarce workers and resources. As the

result, this will inflate wages and prices.

8 What are major objectives of fiscal policy and monetary policy?

The government uses them in an attempt to reduce unemployment rate,

promote economic growth and keep inflation under control.

9 What is expansionary fiscal policy?

A fiscal policy is expansionary when taxation is reduced and public spending is

increased, or the government can combine both of them .

10 Under what circumstances should the fiscal policy be expansionary?

The government should run expansionary fiscal policy when the economic

growth is still low or the unemployment is too high.

11 Why should the government run expansionary fiscal policy when the

economic growth rate is still low or the unemployment rate is high?

The fiscal policy should be expansionary when low economic growth rate or

high unemployment rate occur because expansionary fiscal policy will put more

money into firms and consumers hand. By increasing spending or cutÝng taxes,

the government leaves individuals and businesses with more money to

purchase goods or invest in new equipment. When individuals or firms increase

their purchases, they raise demand, which requires additional production,

creating jobs, generating more spending. The result is higher employment and a growing economy.

12 What is contracionary fiscal policy?

Fiscal policy is contractionary is contractionary when the taxation is increased

and the public spending is reduced, or when the government combine both of them

13 Under what circumstances should the government run contractionary fiscal policy ?

The government should run contractionary fiscal policy when the inflation is high

14 Why should the government run contractio nary fiscal policy when the inflation is high?

The government should run contractionary fiscal policy when the inflation is

high because by increasing tax and reducing public spending, or combining

both of them, the firms’ and individual’s income will be lower. As the result,

they will spend less money and the aggregate demand will decrease. This

ultimately puts pressure on prices.

15 What factors should the government consider when making decisions on its fiscal policy? Why?

In order to make decisions, the government should consider a number of

factors, consisting of inside factors and outside factors because these factors

will affect the amount of revenue raise through taxes and the amount of

money require for government programs. Once these determinations are

made, the government can decide how to raise revenue and how to allocate it.

Another important decision a government must make regarding fiscal policy is

whether or not to run a budget deficit by spending more money than the government raises. 16 What is inside factors?

Internal factors or inside factors include economic factors and non- economic

factor. Some economic factors can be mentioned are economic growth rate,

unemployment rate, inflation rate,… non- economic factors can be politic

consideration, natural disasters, wars,.. and so on 17 What is outside factors?

External factors or outside factors may have a great influence on the fiscal

policy of a country. These factors can be fiscal policies of other countries or

requirement of the International Monetary Fund( IMF).

19.Why should the government consider fiscal polices of other countries ?

In today’s global economy, a government also needs to consider the

fiscal polices of other countries because it may tempt companies to

relocate by offering them generous tax programs or other government- controlled benefits.

20. Why are the fiscal policy decisions influenced by the requirements of the

International Monetary Fund( IMF) ?

Some countries may find their fiscal policy decisions constrained by the

requirements of the International Monetary Fund because it often grants

aid packages subject to conditions relating to fiscal policy. UNIT 4: MONETARY POLICY A. VOCAB B. TOPIC QUESTIONS 1. What is monetary policy?

Monetary policy is a central bank’s actions and communications that control

the money supply. Money supply includes credit, cash, checks, and money

market mutual funds. The most important of these forms of money is credit. It

includes loans, bonds and mortgages.

2. What are objectives of monetary policy?

Three major objectives of monetary policy are to manage inflation, to reduce

unemployment, to promote moderate long-term interest rates.

3. What are 3 tools of monetary policy?

Three main tools of monetary policy are reserve requirements, discount rates and open market operations.

4. What is reserve requirements?

Reserve requirement is a percentage of deposits that the central bank sets as

the minimum amount of reserves as banks must have.

5. What is the significance of RR?

RR plays a central role in how much money that banks have to lend out. By

changing RR, the central bank can increase or decrease the money supply. 6. What happen if RR increase?

If the central bank increases the RR, lending capacity of member banks will

decrease, money supply in the market will decrease 7. What happen if RR decrease?

If the central bank decrease the RR, lending capacity of member banks will

increase, money supply in the market will increase. 8. What is discount rate?

The discount rate is the rate of interest that the central bank of a country

charges on the loans that it makes to other banks. 9. What happen if DR increase?

An increase in DR makes it more expensive for banks to borrow from the

central bank, leading to decrease in money supply. 10.What happen if DR decrease?

A decrease in DR makes it less expensive for banks to borrow from the central

bank, leading to an increase in money supply.

11. Why are RR & DR not used in day-to-day operations?

Changes in discount rate and reserve requirement are not used in day-to-day

Fed operations because they are used mainly for major changes. For day-to-day

Fed operations, the Fed used third tool: open market operations a – the Fed’s

buying and selling government securities.

12.What is Open market operations?

Open market operations mean the central bank’s buying and selling

government securities on the open market.

13. What happen if central bank buying G. securities?

When central bank buys G.securities, banking system reserves will increase and the money supply will expand.

14. What happen if central bank selling G. securities?

When the central bank sells Treasury bonds, it collects back some of its IOUs,

reducing banking system reserves and decreasing the money supply.

15.What is Expansionary monetary policy?

Monetary policy is expansionary when the Central Bank lowers reserve

requirements or discount rates or buy more bonds

16.When should MP be expansionary?

MP should be expansionary when the G wants to reduce unemployment, to promote economic growth.

17. Give one example to illustrate

By offering lower interest rates or easier approvals, the banks can encourage

people to borrow and spend more money. In this way, an increase in the

money supply will result in a rightward shift of the aggregate demand curve.

An increase in the aggregate demand requires additional production of goods

and services, leading to more incomes for both workers and firms. As a result,

the economy tends to grow, and more jobs are created.

18. What is a restrictive monetary policy?

Monetary policy is restrictive when the central bank increases reserve

requirements or discount rates or sell more bonds.

19.When should MP be restrictive?

Monetary policy should be restrictive when the G wants to cool an overheating

economy or reduce inflation rate.

20. Give one example to illustrate

the central bank can reduce the money supply by raising reserve requirements,

increasing the discount rate, or selling bonds in the open market. All of these