Preview text:

lOMoAR cPSD| 59691467

NATIONAL ECONOMIC UNIVERSITY

SCHOOL OF ADVANCED EDUCATION PROGRAMS 2nd

PROJECT – DEVELOP AN INTERNATIONAL

MARKETING PLAN FOR PHE LA GROUP 2 – KOREA Group members: Vu Quynh Trang Doan Thi Mai Linh Khuc Pham Bang Chau Do Nguyen Kim Ngan Doan Ba Viet Anh HA NOI, 11/2022 lOMoAR cPSD| 59691467 MỤC LỤC

Introduction...............................................................................................................................................3

Part I. Marketing opportunities analysis.................................................................................................4

1. Micro environment analysis..........................................................................................................4

2. Macro-environment analysis.........................................................................................................5

3. Customer analysis..........................................................................................................................6

4. SWOT analysis...............................................................................................................................7

5. Five force model.............................................................................................................................7

Part II. Segmentation, Targeting, Positioning.......................................................................................10

1. Segmentation................................................................................................................................10

2. Targeting......................................................................................................................................10

3. Positioning....................................................................................................................................10

Part III. Marketing strategy...................................................................................................................11

1. Vision............................................................................................................................................11

2. Mission..........................................................................................................................................11

3. Current situation.........................................................................................................................11

4. Marketing goal.............................................................................................................................11

5. Entry mode...................................................................................................................................12

Part IV. Marketing plan..........................................................................................................................12

1. Product.........................................................................................................................................12 Featured

product.........................................................................................................................12

2. Price..............................................................................................................................................14

3. Place..............................................................................................................................................15

4. Promotion.....................................................................................................................................16

Part V. Evaluation and control...............................................................................................................18

1. Risk management.........................................................................................................................18

2. Evaluation....................................................................................................................................18

3. Budget...........................................................................................................................................19

REFERENCE..........................................................................................................................................2 0 lOMoAR cPSD| 59691467 Introduction

Since the emergence about a decade ago from HongKong, milk tea or bubble tea has become a

worldwide phenomenon, especially in East Asian countries. Founded in a competitive East Asian

milk tea market - Vietnam, Phe La - a brand which sells milk tea with premium ingredients has

gained the attention from customers and become one of the most popular milk tea brands in the

local area within 1 year. Realizing the promising potential and familiarity in the oversea market,

Phe La has decided to penetrate Korean - which is a low-psychic market with a large proportion

of young population - the main targeted segment of Phe La. Even though the milk tea market is a

fierce one, it still shows several benefits, especially for those brands that offer exquisite products

or service, Phe La with their first introduced premium oolong tea leaves is believed to be able to conquer the Korean customers.

In this report, the team has shown several analyses related to Phe La’s international marketing

strategy and the action plan in order for the brand to gain success in the Korean market. lOMoAR cPSD| 59691467

Part I. Marketing opportunities analysis

1. Micro environment analysis 1.1 The company

Established in 3/2021 by Tra La JSC, Phe La is proud to be the first and only brand in Vietnam

that focuses on developing specialty oolong tea from Dalat and bringing them closer to the

community. Phe La was born with the honor of accompanying farmers to bring premium specialty

Oolong tea and help raise the bar for Vietnamese agricultural products in the domestic and international markets. 1.2 Suppliers

Korea is a potential market for milk tea as they have a wide range of products available for making

milk tea. Moreover, the Korean government has made a website for suggesting wholesalers and

producers for business to connect. There are several representative for each ingredient and good such as:

ILJIN Business Co., Ltd: Supplier of Skimmed Milk powder, Demineralized Whey powder, Kaffa

Int Co., Ltd: Supplier of Cocoa and Chocolate product, Sugar 1.3 Market

The "Milk Tea market" (2022-2028) is expected to grow rapidly. According to a South Korean

TFIS (Food Information Statistics System) report, sales growth accelerated as more premium tea

and ready-to-drink tea products were introduced to the market. The sale of liquid tea in Korea

increased by 71.4 percent from 18.4 tons in 2010 to 31.5 tons in 2017. Tea consumption grew

faster than any other beverage category.

According to Statista, the Korean tea industry is expected to generate around US$370 million in

2023, while milk tea is expected to generate $5 billion. Tea drinks with herbs are in high demand

in Korean coffee shops, as many younger people are venturing into the tea market. Furthermore,

as coffee has become more popular, many people want to have a wider variety of drinks to choose from and to try new things. 1.4 Customers

Phe La targets customers from 16 to 30 years old, namely students or office workers. These people

like to go outside to work, study or gather with their friends. They prefer a relaxing atmosphere,

great space and like to try different kinds of drinks and enjoy the convenience of takeaway. In

addition, Phe La's customers are tourists who want to experience the culture from another country

or Vietnamese customers who want to support products from their home country.

1.5 Marketing intermediaries •

Food delivery apps in Korea such as Baedal Minjok Food Delivery (Baemin) (Phe La's

partner in Vietnam), Shuttle Food Delivery, Yogiyo Food Delivery, Ttangyeoyo Food

Delivery, Coupang Eats Food Delivery, etc •

Shipping companies in Korea such as DeliveryK, N Delivery, Yogiyo Express, etc

Convenience stores in Korea such as 7 eleven, Ministop, CU, GS25, No Brand, etc

Supermarket systems such as E-Mart, Home Plus, Lotte Mart, and others. •

Stalls at food fairs or provide drinks for events to bring Phe La closer to the Korean people 1.6 Competitors

There are two types of competitors that Phe La has to face while entering Korean Market •

Direct competitor: Milk tea brands, especially GongCha, The Alley and Asmavin. The

distinguishing feature of these 3 brands is: substantial presence in the Korean market and

offer beverages that are appealing to consumers' tastes ( fatty, milky and without strong tea

flavor). Their drinks come in a wide variety of tastes, but the three most popular drinks

consist of black sugar pearl milk, taro milk tea, and cookie n' cream. lOMoAR cPSD| 59691467 • Indirect competitors: •

Coffee and other beverages: Koreans prefer coffee, each person consumes about 12-13

cups of coffee per week on average. With more than 18,000 coffee shops in the Korean

market, improving the awareness and consumption habits of consumers must be a challenging task for Phe La. •

Mass-produced milk tea: This type of tea is frequently purchased in supermarkets or

convenience stores in a plastic milk tea bottle or tin can. It is quite portable and practical,

perfect for those who are overworked and need something they can simply take with them.

2. Macro-environment analysis 2.1. Demographic

Korea currently has a population of more than 51 million, of which the young and middle-aged

makeup more than 72% (or 36 million people). The age group of 16 to 30 consumes considerably

less tea and other beverages than coffee (each person will likely consume 0.07 kg of tea in 2022,

compared to 1.71 kg of coffee annually). If Phe La wants to enter the Korean market, it has to

figure out how to alter Koreans' tea and coffee consumption patterns.

2.2. Political and legal •

The Korean government has imposed several laws for the F&B industry as well as for

foreign brands to follow. These laws require high quality products, in order to meet these

requirements, companies need to follow a very strict process in producing and exporting

ingredients to the Korean market. Moreover, the laws can limit the ability of foreign brands

to promote their product as the government would prioritize domestic brands, therefore Phe

La may have to pay more for the taxes, this will affect the brand’s pricing strategy. •

Furthermore, since August 2018, the Korean government has banned the use of singleuse

plastics like straws and cups, but due to the Covid-19 outbreak, this law has been relaxed

to reduce the risk of infection. The use of single-use plastic will be prohibited in Korea

starting on January 1, 2022, particularly in cafes and restaurants, according to a government decree. •

Once Phe La has decided to export oolong tea leaves to Korea, there are several acts to

follow in order to meet the government’s requirement for imported products, including:

The Food Sanitation Act, Special Act on Imported Food Safety Management, The Special

Act on Children’s Dietary Life Safety Management, The Livestock Product Sanitary Management Act,etc… 2.3. Culture •

Koreans are ethnocentric and conservative, they value their own culture and home

products, and they have little faith in the utilization of products that have been imported from overseas. •

Koreans prefer sweet, fatty, and spicy flavors since they live in a temperate region with cold temperatures. •

Korea and Vietnam share the same Sinosphere culture, this means they appreciate their

close relationships includes the family and friends •

In Korea, the most popular social media service includes Meta, Instagram, Tiktok and

Youtube. Korean internet users prefer short-form advertising videos and Youtube vlog. •

Longer working hours: There is a culture of working for longer hours in metropolitan such

as Seoul, therefore the workers usually crave for drink that can boost their energy during long working day •

There is an increasing demand for healthy safe food and organic products. One of the first

priorities of the Koreans is their health as a result of an aging population. Therefore

products that can convey their origins are likely to be well-trusted lOMoAR cPSD| 59691467 Tea culture •

Tea has been cultivated in Korea since the 9th century, therefore Koreans are familiar with

tea culture and aware of its benefits. •

Consumers look for healthy and functional teas that promote weight loss, boost hydration or enhance the immune system •

Besides coffee, milk tea is also one of the favorite drinks of Korean people. There are many

milk tea companies located in the center of Seoul, each has different ways of preparing, but

based on the popularity of the signature drinks of each shop, it can be seen that Koreans

love milk tea which has a slightly greasy taste, rich in milk and cream. 2.4. Economic •

Korea's GDP is on an upward trend. However, this country is facing inflation, by the end

of the year prices are likely to escalate, because Koreans are tightening their spending. •

The applicable personal income tax rates are from 6.6% to 46.2%. •

Corporate income tax. All types of resident companies are subject to corporate income tax,

with the rates ranging from 11% to 27.5%. •

Value added tax (VAT). VAT is imposed at 10% on services and goods provided by a business. 3. Customer analysis

3.1 Identify Phela’s customers and their need

Phe La's customers are mainly young people aged 16-30, students and office workers, who

like to sit in bars and spend time with friends in their spare time during the day, especially on weekends. 3.2 Customer behavior •

Korea's economy is on the verge of a crisis, due to high inflation, young Koreans are

tightening their spending, it can be seen that they are cutting spending on substitutes for

cheaper ones. This is a very sensitive time for Phela in reaching out to young Korean

customers. However, not all young Koreans are tightening their spending. They can still

spend 2600-3000 won for milk tea, coffee, drink... to satisfy their need to meet their friends

in the afternoon or the weekend. •

Koreans are known as tech-savvy and they are influenced by the internet and shopping

online. They use social media to search for information before making a buying decision

and post their product reviews there. •

Reference groups such as KOLs, testers sharply affect the consumers' decision making. •

With the development of social media and the effects of influencers/celebrities, the number

of young Koreans concerned about the environment is increasing and their usage

of green label products is a little bit stronger than any other generation. So there is a huge

benefit for Phe La by continually utilize the paper cups and straws •

Korean customers tend to be brand loyal, the rationale may be the concern for food safety

and can be a barrier for foreign brands. However, there’s an increasing trend of exposing

foreign culture (hence beverages) from the young customers. 4. SWOT analysis 4.1 Strength •

Densely brewed tea creates unique taste comparing to other milk-tea brand with strong flavor •

Premium and limited products makes customers have a sense of privilege •

The warm and cozy decoration of Phe La original’s store can match Korean customers’

preference for cool and cozy spaces lOMoAR cPSD| 59691467 •

Phe La interior design resembles Da Lat - A mountainous area in Vietnam which has the

same atmosphere in Korea - Customers may find the familiarity here. 4.2 Weakness •

Phe La is a new brand in the international therefore has little experience in dealing with international business issues •

Some customers may find it a bit abnormal when tasting the strong Oolong tea at first 4.3 Opportunities •

The Korean is accustomed to drinking milk tea •

There are not many premium milk tea brand available in Korea •

Customers who want to boost their energy without using coffee can purchase Phe La’s

products instead as according to customers' experience, the tea from Phe La is proven to be

able to determine their performance. •

Non-plastic regulation in Korea is also a benefit for Phe La as they use paper cups and rice- made straws. 4.4 Threats •

Korean customers are ethnocentric and do not highly appreciate products from

“lessdeveloped” countries (including Vietnam) •

Korean legal and policies are strict therefore it may took a while for Phe La’s business to be approved in Korea •

Fierce competition from domestic or “already-existed” competitors •

Difference in culture may lead to failure in the business 5. Five force model 5.1 Supplier power

In order to provide Korean customers with the most exquisite flavor from Phe La milk tea, it is

necessary to import 100% of the tea ingredients to make milk tea from Vietnam. Which means the

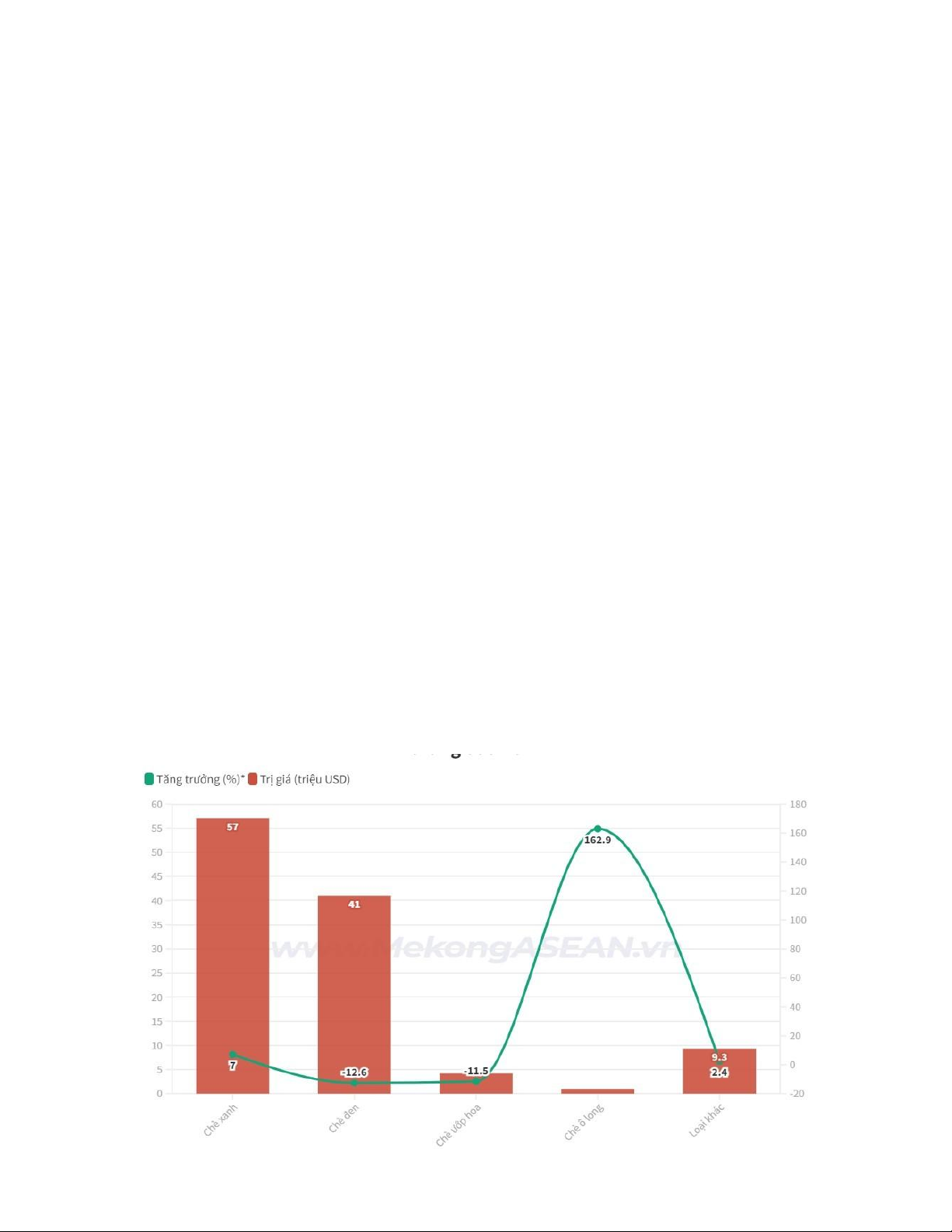

Oolong tea leaf produced in Dalat is the most important ingredient. According to MekongAsean,

Oolong tea (main ingredient of Phe La products) exported is growing by >162% in price and

>69% in volume compared with last year. lOMoAR cPSD| 59691467

The tea leaves suppliers in Vietnam exclusively cooperate with Phe La and the number of suppliers

is limited, therefore in order to guarantee the quality of tea leaves ingredients, Phe La needs to

keep along with these suppliers as most of their activity would depend on tea leaves suppliers.

Other ingredients can be supplied by Korean business, there is a wide range of business for Phe

La to cooperate with, however the company should make a careful research as well as field trip

before selecting suppliers from Korea. 5.2 Buyer power

With the targeted customer that Phela aims for when opening a branch in Korea is young people,

it can be seen that Korean customers are willing to pay money for a high quality product as long

as their needs are satisfied. However, they can quickly switch to another beverage brand once they

are offered with more benefit. Therefore, when entering the Korean market, Phela needs to

establish strategies that create a good impression with customers and make them become loyal to the brand. 5.3 Direct competitors •

GONG CHA: Gong Cha is the most famous milk tea brand in Korea. After Gong Cha has

officially become a Korean brand in 2017, you can easily find Gong Cha stores in

metropoles like Seoul, Busan, Sejong, Daejeon.Gong Cha has a diverse menu with 60

different types of Korean milk tea that are favored for good taste and creativity. Gong cha

Not only offers customers a wide selection of teas and toppings, but also regularly launches

seasonal or holiday special drinks. The price of Gong Cha is suitable for young customers’ income. •

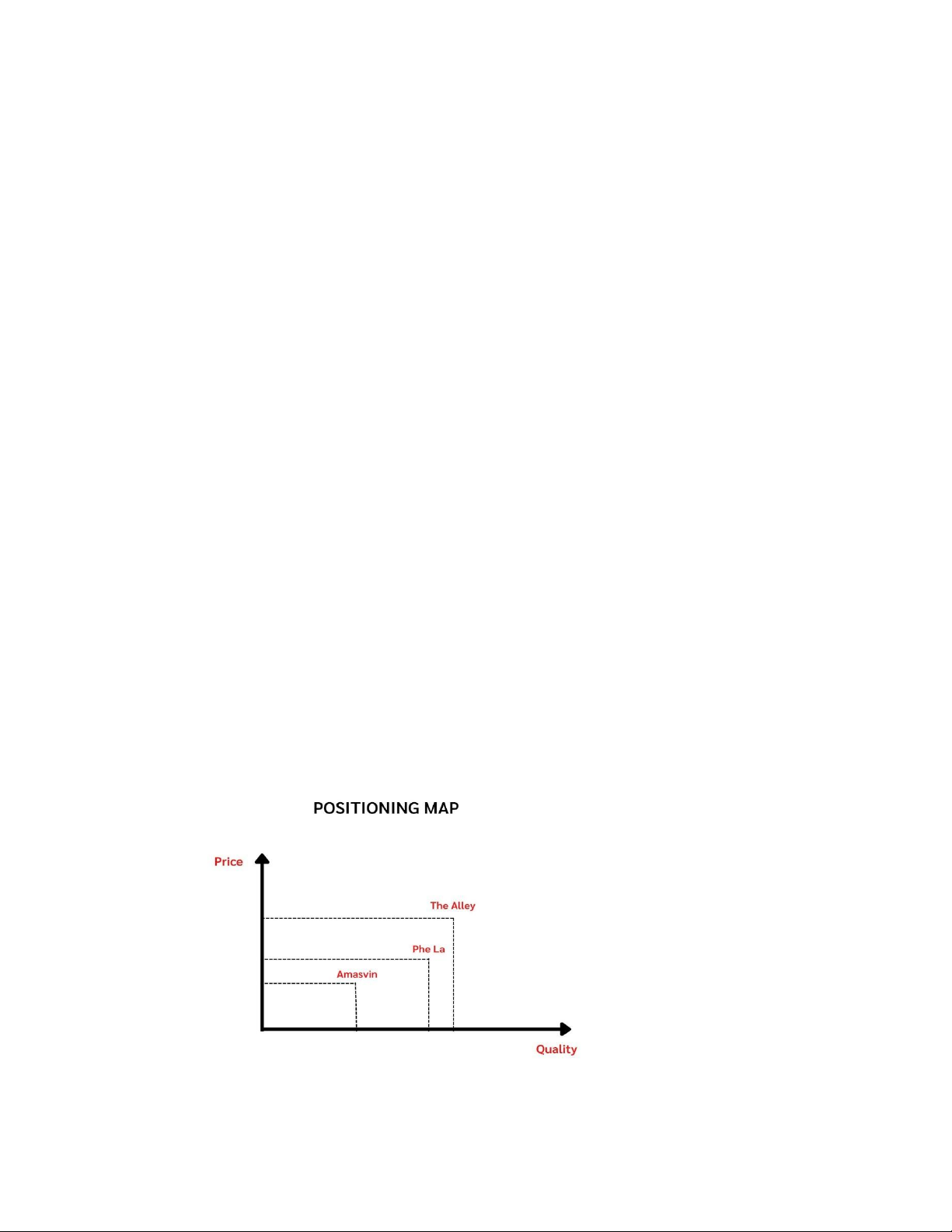

THE ALLEY: The Alley is considered to be a premium milk tea brand in Korea. The Alley

originates from Hong Kong and has been introduced in Korea since 2018. Instead of

offering a menu that includes coffee like many other brands, The Alley only sells milk tea

exclusively as the main theme and has developed a variety of flavors. The Alley is famous

for drinks that are not only delicious but also carefully decorated, giving customers a great experience. •

AMASVIN: Amasvin is widely known as a Korean milk tea company with a wide network

of stores, affordable prices. With a youthful style and affordable price, Amasvin is

extremely popular among young Korean customers. Beside milk tea, Amasvin is famous

for its special waffles. Another feature from Amasvin that appeals to customers is its free charge for pearls

5.4 Potential Competitors

Currently, Phe La's potential competitors are traditional coffee shops that are planning to expand their product portfolio.

In addition, there are a lot of convenience stores that sell a variety of bottled milk tea. Although

bottled milk tea does not taste as good as traditional milk tea, it is still popular with young people

all over the world thanks to its suitable price and convenience.

5.5 Threat of substitute products

The beverage market is increasingly developed. Therefore, the number of products such as tea,

coffee, fruit juices, etc., which have the potential to substitute for milk tea is high. Since milk tea

appeared, fruit juices, coffee, alcoholic beverages and similar products have been available in the

market. These substitutes are all major threats to Phe La

Part II. Segmentation, Targeting, Positioning 1. Segmentation lOMoAR cPSD| 59691467

The team decide to segment the market based on 2 main criterias: Demographic and Behavioral • Demographic •

Age group from 16-25 years old: Mainly students and undergraduates with low income as

well as This customer group frequently spends money on themselves, and has a habit or

hobby of drinking soft drinks, milk tea,... •

Age group from 26 - 35 years old: People in both genders who have stable jobs and steady

income above the average income. This group begins to be more concerned about health

and pay more attention to the quality of the drinks. •

Age group above 35 years old: Mostly married women with high and stable income. These

customers are concerned about their own and their families' health and pay a lot of attention

to product quality. They have high brand loyalty willing to pay a high price in return for a

high quality product. They go to the coffee shop mainly for meeting purpose, especially

with a group of customers. They would prefer coffee shops with outdoor space where they can talk freely. • Behavioral •

Group 1: Students and office workers demand for a place to study, work, and gossip with their friends. •

Group 2: Customers who want to enjoy a high-quality tea with a relaxing ambien and cozy place. 2. Targeting

Phe La's targeted market is customers at the age from 16 to 35. Those customers include

students or office workers who prefer coffee or milk tea stores that offer large space for meeting.

They frequently gather with friends and coworkers at places like Phe La to entertain.

Furthermore, they enjoy visiting the store to take pictures or check-in with the space. These

customers prefer places with high-quality drinks, comfortable spaces, and excellent service.

Besides that, this group enjoys new experiences and feels more open to foreign products. 3. Positioning

Phe La creates a brand image in customer’s mind : high quality product with affordable price • Difference in products •

Instead of using ordinary tea leaves, Phe La uses Oolong tea leaves - a

specialty from Dalat Vietnam. The tea leaves are carefully selected from

highly reliable suppliers that will bring Korean people a delicious cup of milk tea. lOMoAR cPSD| 59691467 •

For bottled Phe La milk tea, the packaging is made from environmentally

friendly materials which can be recycled or reused instead of plastic. The

packaging is designed to be minimalistic with the color of beige and brown,

suiting the style of Korean youngsters.

Part III. Marketing strategy

1. Vision: To create the best tasting milk tea and be the milk tea of choice, giving people a

great tea experience one cup at a time.

2. Mission: Phe La aims to provide customer quality milk tea and comfort space that would

exceed their expectations making us one of the top milk tea stores in the country. 3. Current situation

Recent market trend

Milk tea, having a short culinary profile in the Korean market, is now being regarded as a beverage

for customers to consume at their free time or during meetings.

The milk tea market is now led by some domestic brand or famous foregin brand (Gongcha, The

alley), it also has to face competition from other beverage products such as coffee or pressed juice.

Generally speaking, high quality milk tea consumption is associated with customer’s demand for

drink satisfaction and at the same time does no harm to their health. Besides, female customers at

a young age show particular interest in sweet beverages. It can be seen that more and more

customers are demanding brands that not only satisfy their need for beverages but also their sense

of exquisiteness and relaxation. 4. Marketing goal

Phe La will enter the Korean market in early 2023. In order to provide a framework on the

basis of which to assess the success of the market entry in focus, Phe La has identified the

following goals. The goal will consist of qualitative goals and quantitative goals: • Qualitative goals: •

Becoming the market leader in milk tea field in Korea •

Becoming a top of mind brand in hearts of consumers •

Establishing long time value collaboration with local companies and organizations •

Succeed in earning expected revenue • Quantitative goals •

Increasing returning customer rate to 30% 5. Entry mode

Phe La aims to become one of top-of-mind milk tea brands in Seoul, Korea, therefore the

job is to create influence on the customers. In order to achieve this target, it’s better that

the Korean branches should be managed by an experienced Korean team with deep

knowledge about Korean customers’ insights and needs. The most suitable entry mode for

this strategy would be Franchising mode.

This means upstream activities such as R&D or Production will be carried out in the home

country - Vietnam, oolong tea leaves must be grown and processed in Vietnam. Meanwhile

downstream function is going to be placed in the host country, Korea is where Marketing,

Sale and Service activities will be taken.

By doing this, the Phe La team can fully identify and fulfill local needs at the same time

react to local competition forefront. Once the team has identified the entry mode for Phe

La, the marketing plan is going to be planned based on this strategy. lOMoAR cPSD| 59691467

Part IV. Marketing plan

1. Product Featured product •

Jasmine milktea: Consists of jasmine, milk and oolong tea, jasmine tea brings to

customers the flavor of the very first and original milk tea in the world. •

Smoke B’lao: B’lao is the name of an area in Dalat - the origin of Phe La’s oolong

tea leaves, consisting of several products that create the scent of smoke and at the

same time having a sweet and soft taste. •

Tấm: Named after a fictional character in a Vietnamese fairy tale, Tam is the

combination of rice water (which was first popular in the Korean market and then

was exported to Vietnam) , milk and oolong tea. Tam brings to Korean customers a

sense of belonging as they are familiar with rice water. • Product line

Phe La sells not only milk tea but also other popular handcrafted drinks such as press juice or coffee. •

There are several product types in Phe La's menu, they are differentiated by the way

Phe La's team progresses. There are 5 types of drink available in Phe La’s stores at

the moment: Syphon, French press, Moka pot, Nitro cold brew, V60. For the first 4

types, each is a different technique of making coffee and drink from different tools

and V60 is handcrafted coffee made from grounded coffee beans mixed with hot

water and then filtered through paper. •

Phe La also offers handmade pearls (normally made from corn starch and served

with milk tea). Two types of pearls are oolong pearl (made from oolong extract and

starch) and rice pearl (made from grounded rice starch) Phe La plus: •

Dried oolong tea leaves: Phe La has decide to export the tea leave for milk tea

making process and a part of proceed tea leaves can be sold individually for

customers who want to try out tea •

Canned milk tea: For take-away and storing purposes, the most popular ones is

going to be sold in cans for customers •

Recently Phe La has introduced packed oolong tea boxes to the market. Each box

consists of oolong tea powder pack, milk powder. Therefore customers may have

more opportunities to enjoy Phe La’s milk tea even if they are not able to find a store.

All products from Phe La are packed in white and brown packaging, this is suitable for the Korean

market as white is considered to be the country’s color, therefore products in white are likely to be more favorable 1.1 Product level •

Core value: Phe La wants to bring a milk tea that is characteristic of Vietnamese culture to a picky market like Korea. • Actual product •

The beverage used by Phe La is made from oolong tea leaves; pure tea is combined with

fresh milk and condensed milk to create a tea-flavored beverage that is both gently bitter and sweet. •

Pearls are another special characteristic of Phe La, in addition to milk tea. With the softness

and faint aroma of Oolong tea and roasted rice, Phe La's pearls become a bright spot in

every drink that Phe La brings to customers. lOMoAR cPSD| 59691467 •

In addition to the specialties of oolong milk tea and jasmine oolong, Phe La also uses Nitro

Cold Brew technology with brewed cold tea, without milk, mixed with nitro gas to create a different and novel taste •

Phe La also offers fruit teas to chill down in the summer or hot drinks with greasy egg

cream suited for the fall and winter •

Due to the policies in Korea, all drinks are served in paper cups with paper straws,

promoting Phe La's environmental protection philosophy. • Augmented product •

Regarding the delivery service, each order comes with milk tea and pearls, which are

always kept separate to maintain their softness and stickiness. Additionally, ice is kept

separate so that clients can choose the amount of sweetness they desire. •

If a consumer purchases a drink from Phe La and there are any issues with the product, Phe

La is prepared to provide a satisfying reimbursement. •

Customers at Phe La's store feel much more at ease thanks to the open interior design with

brown beige and folding chairs and tables that give off the vibe of a campsite.

1.2 Brand identification •

Packaging: With the identification feature is a paper cup cover with an upside down musical

note logo like oolong tea leaves, creating a unique and easy-to-recognize feeling. •

Unique flavor: Phe La offers a traditional Vietnamese flavor, in contrast to other industrial

milk tea products. Phe La's milk tea is made with oolong tea leaves that are imported from

Dalat farms and is made according to a special recipe by skilled bartenders, which further

distinguishes and uniqueness of Phe La's beverages. greater than those of its industrial

rivals in terms of competition, with a special brewing method resulting in a different

beverage that offers customers a unique experience. •

Store's concept: Following the concept of Camping - different from other brands on the

market, Phe La has made a strong impression on customers thanks to its own qualities and

unique design. This is not the right place for you to work or study, but a place where you

can be yourself, relieve pressure, relax and chill out. 1.3 Product adaptation •

The taste of Koreans is different from that of Vietnamese people since they live in a cool

climate and love hot and spicy foods and sweets. They also prefer creamy drinks with mild

tea or coffee flavor. Therefore, Phe La may have to change their drink flavor to fit the target

market's preferences, reducing the strong tea flavor and increasing the amount of milk and cream in their beverages. •

In order to adapt to the difference in Korean weather and drinking habits, the brand is going

to add soybean milk tea for the menu in Korea, instead of using cream/condensed milk in

Vietnam as soybean is considered as a feature agriculture product from Korea. •

Phe La offers beverages manufactured from coffee in regards to milk tea, Smoke B'Lao,

V60, or Tam for instance. Phe La will undoubtedly tone down the strong flavors of these

drinks as the Koreans prefer their coffee with light flavor. •

Phe La used to offer milk tea plastic bottle in Viet Nam, however, they will change the

material to glass within the paper cups and straps to meet the requirements of packaging from the Korean government •

Phe La provides the oolong milk tea kit with 10 sets, including: the signature oolong tea,

creamy milk, sugar for those customers who want to make themselves their own favorite

taste of milk-tea or for traveling purposes. lOMoAR cPSD| 59691467 2. Price

Phe La will select the Market Pricing Strategy which means the team is going to evaluate the price

of similar products that are on the market to set the price of its products. The price of Phe La’s

products will depend on the features which its product has more than the competitors, specifically

the Oolong tea leaves. Phe La’s products are priced at medium to high cost, higher than that of

popular milk tea brands such as Asmavin, and lower than Gong Cha and The Alley milk tea brands.

The price of Phe La’s products ranges from 4000W to 6000W.

The important thing is: Compared to the price that customers have to pay, when choosing Phe La,

customers can fully experience the high quality drinks with a beautiful and cozy space. That is

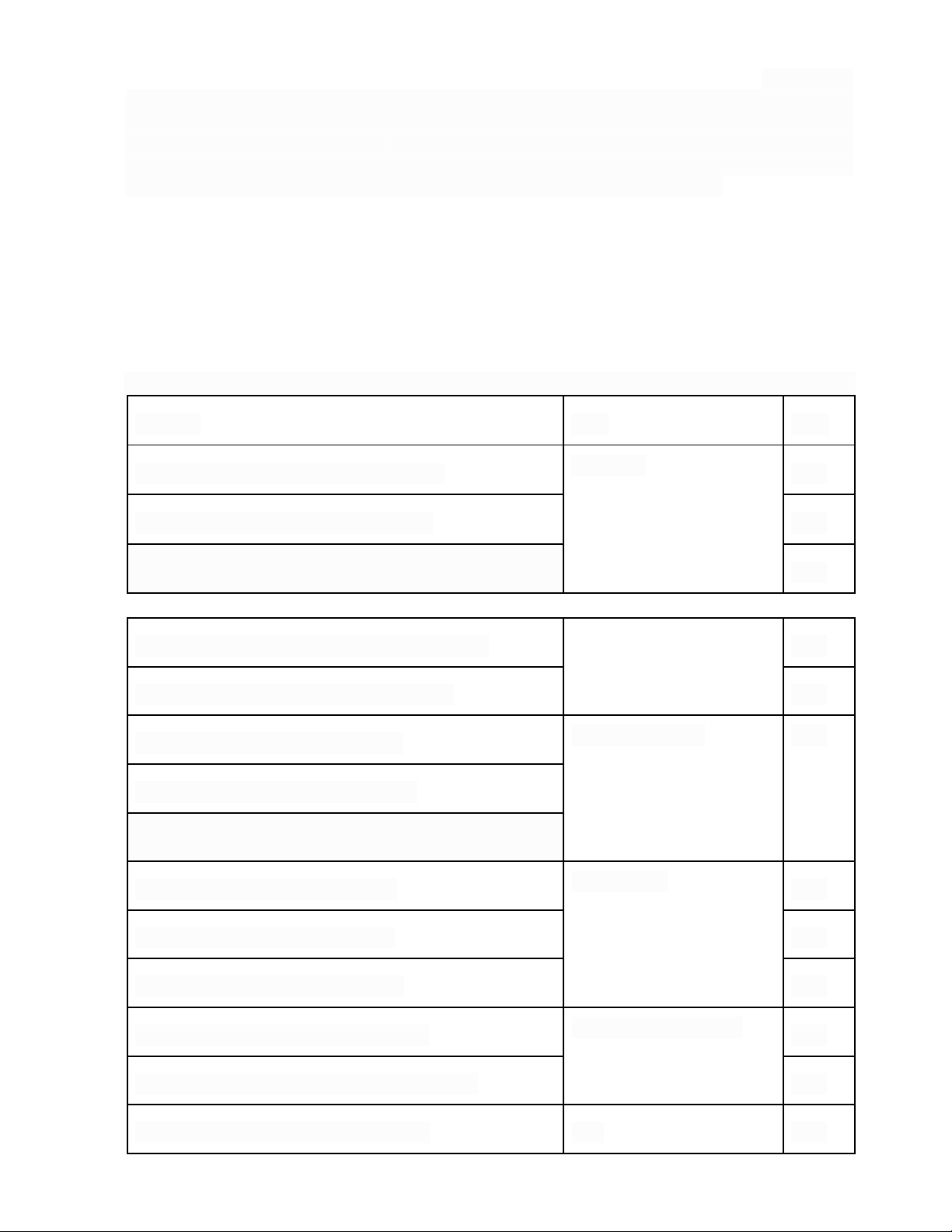

what makes them feel extremely satisfied. *Suggested price Products Type Price

Phu Van ( Whipping cream, Oolong Tea ) SYPHON 5kW

Oolong Trung Bong ( Egg, Oolong Tea) 4kW

Oolong Sua Phe La ( Milk, Oolong Tea ) 6kW

Oolong Nhai Sua ( Jasmine, Milk, Oolong Tea) 5kW

Phan Xi Pang ( coconut milk, Oolong Tea) 6kW

Gam ( Jasmine, Litchi, Oolong Tea) FRENCH PRESS 6kW

Oolong Dao Do ( Peach, Oolong Tea)

Tra Vo Ca Phe ( Yellow Lemon, Coffee Shell)

Da Lat ( Whipping Cream, Coffee) MOKA POT 4kW

Ca Phe Trung Bong ( Egg, Coffee) 4kW

Tam ( Fried Rice, Milk, Oolong Tea 5kW

Lang Biang (Jasmine jam, Oolong Tea) NITRO COLD BREW 6kW

Oolong Nhiet Doi ( Mixed Fruit, Oolong Tea) 6kW

Signature Coffee ( Ethiopia, Colombia) V60 6kW lOMoAR cPSD| 59691467 TOPPING 500W Oolong Pearl Fried Rice Pearl 300W lOMoAR cPSD| 59691467 3. Place

3.1. Direct distribution channels

Phe La franchises in Korea can be found in major urban centers of Seoul such as Yongsan,

Yangcheon, Songpa, Seongdong, and others. The store can be located close to subway

stations, where many people pass by daily. In addition, at the store the process of making

takeaway orders in the morning needs to be speeded up to match the drinking habits of

Koreans. Phe La's unique design will attract customers to visit the place and enjoy high quality tea.

3.2. Indirect distribution channels •

Online distribution is a potential distribution channel for Phe La. The brand's target

customers are young people aged 17 to 30, who are routinely using the internet on a regular

basis. Therefore, products can be distributed online on famous food delivery apps in Korea. •

Besides, the Phe La Plus product line includes cold brewed bottled teas or Phe La tea leaf

packs that can be sold on e-commerce platforms or small convenience stores.

3.3.Hybrid distribution channels

Furthermore, products can be distributed directly through Phe La’s Korea website or

Facebook Page. After customers make their purchase, products will be delivered to them by the shipping agent. 4. Promotion 4.1 Strategy Viet Nam

This strategy was created to help Phe La reach customers who are Korean tourists as well as

Koreans living and working in Vietnam. At the same time, the strategy will be deployed before

Phe La opens and penetrates the Korean market.

This plan has 2 parts and is implemented at the same time. Part 1 is to introduce Phe La to Korean

tourists, and part 2 is to run traditional advertising in areas where many Koreans live and work

such as: Nam Tu Liem, My Dinh,...

For Korean visitors: Even though the Korean customers are quite conservative and do not

easily accept products from other inferior countries, they do, believe their compatriot,

therefore it’s better that Phe La is introduced to customers in Korea by the ones who have

visited and tried out the product in Viet Nam. This part will be done by the Phe La who

will link up with the parties to do tours for Korean guests. A tour guide was hired to

introduce Phe La and unique Oolong tea products at the shop. When leading tourists to Phe

La's shops, the tour provider will receive a share of the profit on the total number of

products purchased by tourists.

This strategy aims to bring Phe La closer to Korean people, when Phe La's products bring

satisfaction to them, it will increase brand awareness for these tourists. When Phe La appears in

Korea, these tourists will likely stop by and buy the product again. This campaign can also

stimulate the curiosity of Korean customers, who want to see if the taste of Phe La in Korea is

similar to the drink they have experienced in Viet Nam. 4.1.1. Part 2

In this section, we will target customers who are living and working in Viet Nam, Phe La does not

have branches in locations where many Koreans live, so the Marketing campaign here will be

simple. simply rent a place to hang banners, posters, etc. announcing Phe La's launch in Korea.

The main goal of the campaign is to help Koreans know about Phe La's products before Phe La

comes to the Korean market. Many people in this country are not too fond of products and services lOMoAR cPSD| 59691467

from abroad, but they trust the recommendation from their relatives. Therefore, Phe La will take

advantage of this point thereby initially gaining the attention of indigenous people

4.2 Strategy for Phe La in Korea • General strategy

Korea is considered to be one of the most connected markets as both the internet penetration and

smartphone ownership are recorded at a high rate. Therefore social media provides several

promotion opportunities for the brand. This campaign will be implemented after completing the campaign in Vietnam

Phe La is a milk tea product made from high quality oolong tea leaves with special production

progress, this will be the key feature for Phe La’s team to promote their products

Koreans, especially young people, love going to coffee shops to gather and enjoy drinks.

Therefore, Phe La may be the suitable option for the customers by offering premium oolong

teabased beverages with cozy and modern space. •

Big Idea: The specialty oolong tea at Phe La is cultivated with organic fertilization,

completely with chicken eggs, soybeans and hand-picked to get the freshest and youngest

tea buds, making a strong difference compared to other brands. It can be said that the

specialty tea line of Phe La always retains the most original delicious taste and is known

by many customers as a source of quintessential ingredients from Dalat, VietNam. •

Key message: Phe La wants to be everyone's closest companion. 4.2.1 Detail strategy

The strategy will take place in 2 months since Phe La started to penetrate the Korean market and

will be divided into 2 phases, both phases will be completed, the difference lies in the content of

each phase and must be done by Phe La's Marketing department in Korea. Phase 1 •

Set up an Instagram account for the Korean market in order to connect with the customers.

There are also other social networking sites, for instance: Tik Tok or Youtube's short video

platform. Phe La team is going to post short videos/reels about Phe La such as: introduction

to Phela, restaurant space, drink menu, hygienic preparation, etc. In order for Phe La to hit

the targeted audience, the team may need to purchase paid advertising on these sites. The

algorithm of paid ads helps businesses to reach their customers and increase conversion

rate. In addition, social networking channels such as TikTok and Phela's Youtube will

upload a series of videos with the content of how employees at Phela go to work every day,

this type of content is very popular in Korea, who Young people of this country watch

videos with such content in large numbers. •

Announce the opening event of Phe La on Vietnamese fanpage, take advantage of e-word

of mouth, and entice Vietnamese customers to experience first Phase 2 •

Affluent groups contribute to many successful marketing campaigns in Korea, especially

where food-bloggers' careers bloom. Therefore the brand can select several KOLs or KOC

to make videos about Phe La's products. Previously, Cong coffee’ video review videos

posted by a Korean youtuber have quite a high amount of interaction. •

Apply a buying incentive program for customers such as: “buy 2 get 1 free”, free sample.

Phe La also has a line of packaged milk tea products, therefore the brand can offer giveaway

promotions such as: 1 tea pack for every cup ordered at the shop. Later customers can

experience Phe La's products at home. By doing so, Phe La can create a stronger impression in consumers’ mind, •

As mentioned above, throughout this campaign, it is necessary to promote advertising

campaigns through social networking platforms lOMoAR cPSD| 59691467 •

Korea is famous for its entertainment industry, this means the studios are always full with

crews and busy everyday. This also can be an opportunity for brands to promote their

images. When Korean film crews work, there are often coffee and beverage brands that

provide sponsorship for the crew by sending a drink-truck to the studio, this way of

sponsorship is far more cheaper that the normal sponsorship and the brand is still able to

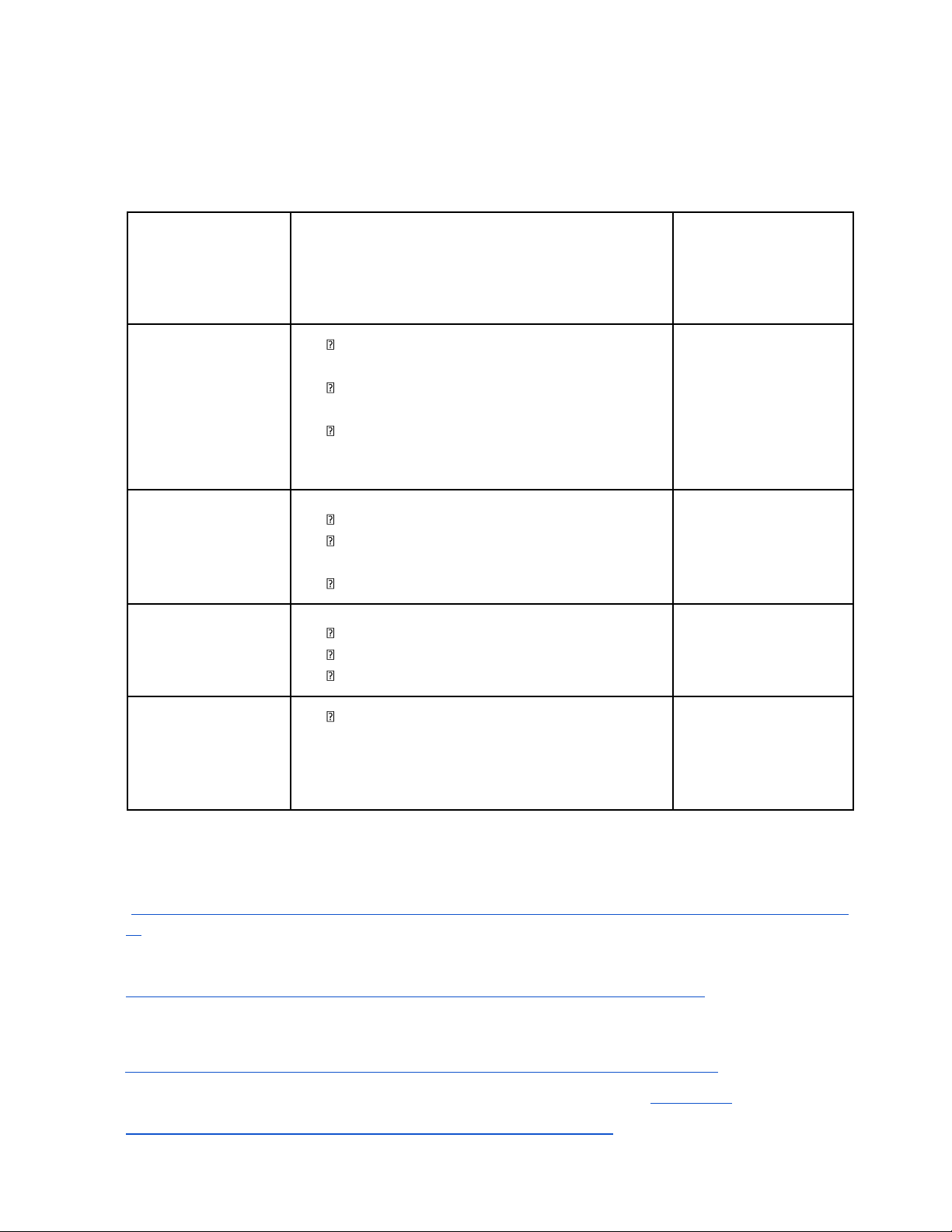

raise the awareness of customers Part V. Evaluation and control 1. Risk management Risks Solution Rent in Seoul's central

Seek funding from investors; eliminate superfluous

business district is relatively investments. expensive

Coffee has become a part of Emphasis on Phe La's USP: The robust tea flavor will increase the young customers'

drinkers' alertness to work more than ever. drinking habit Risk of Covid-19 illness

Customers should be asked to complete a thorough medical reoutbreak

declaration, be sure to receive 2 or more shots of the vaccination,

and strictly follow the instructions for donning a mask and

washing their hands before entering Phe La. Not keeping up with the

Hire young Korean staff to easily catch up with beverage

latest trends of Korean youth consumption trends and social media trends

The brewing technology in Develop a thorough training program with the guidance of senior

Phe La is quite complicated managers of Phe La in Vietnam with many special processes 2. Evaluation

Evaluation activities will be summarized after the marketing campaign is implemented.

There are some evaluation criterias: -

Sale performance:. This evaluation method is based on Phe La's sales at the end of the

secondmonth to the end of the first month. If the revenue achieves a positive growth of at least

20% or more, the marketing campaign has a certain success, and if that number is less than 20%,

it is necessary to consider implementing another more effective campaign. -

Output measuring: that is, evaluating the production output such as the number of articles,

thecoverage of the message to the public, the brand recognition by hashtags on social networks (instagram, tiktok, youtube). -

Measure performance evaluation: •

Customer interactions with social media posts, reach posts or conversion rate from online campaigns. lOMoAR cPSD| 59691467 •

Additionally, particular tools that compare client purchase volumes before and after the

campaign are used to measure the public's behavior after the campaign. -

Assess the level of consumer satisfaction with Phe La's products. -

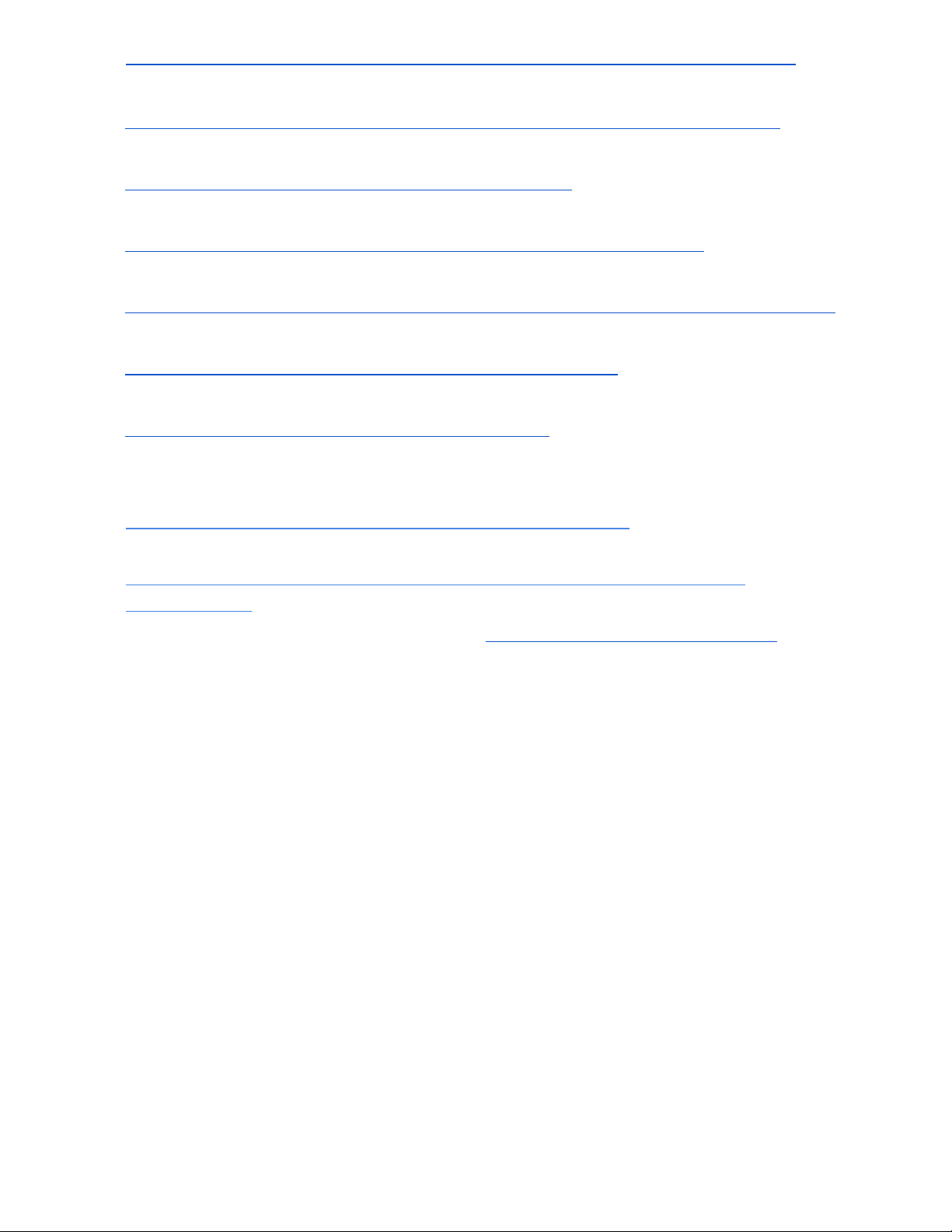

Track the public's reaction to social marketing campaigns. 3. Budget

*Estimated budget for promotion campaigns Types of Activities included Total cost promotion activity Affiliate marketing

5 Korean Macro Influencers ( mulbada, 880.000 krW kim.a.hyun, hyeoksang,..... )

5 Korean Micro Influencers : nampurple, a.ssom,... )

Vietnamese Macro Influencer : Thao Kem Sale programme 1.050.000 krW Buy 2 get 1 free

Give-away promotion: Buy 1 get 1 free tea pack Free sample Advertising 1.790.000 krW Video production

Paid advertising on social media Free coffee bus/kiosk. PR campaigns

For Vietnamese travel agencies 100.000VND/70 customers REFERENCE English

Jani Toivanen, Market analysis - South Korea

(https://www.businessfinland.fi/globalassets/food/fff_coachingday_korea_presentation_final_jt.p df)

Bubble Tea Market - Global Opportunity Analysis & Industry Forecast 2021-2026 (2021)

https://www.industryarc.com/Research/Bubble-Tea-Market-Research-507319

The Food and Beverage Market Entry Handbook: South Korea: a Practical Guide to the Market in

South Korea for European Agri-food Products (2019)

https://ec.europa.eu/chafea/agri/sites/default/files/handbook-korea-2019_en.pdf

Joel Petersson Ivre - Premium Tea On the Rise in South Korea (2020) https://stir-

tea-coffee.com/features/premium-tea-on-the-rise-in-south-korea/ South Korean consumers turn to tea (2017) lOMoAR cPSD| 59691467

https://wedc.org/export/market-intelligence/posts/south-korean-consumers-turn-tea/

Top 5 Most Famous Milk Tea Brands in Korea (2021)

https://weshopfromkorea.com/article/top-5-most-famous-milk-tea-brands-in-korea.html

Santander trade market_ Reaching the South Korean customers (2022)

Reaching the South Korean consumer - Santandertrade.com Tiktok Ads Cost (2022)

https://www.businessofapps.com/marketplace/tiktok/research/tiktok-ads-cost/ Facebook Ads Cost (2022)

https://www.businessofapps.com/marketplace/facebook-marketing/research/facebook-ads-cost/ Private Bus Service in Seoul

https://www.koreaetour.com/product/private-bus-service-in-seoul/

Video Production Cost Estimator

https://promo.com/tools/video-production-cost-estimator Vietnamese

Phê La điều chỉnh giá một số loại đồ uống - Trang chủ Phê La (2021)

https://phela.vn/2021/11/30/phe-la-dieu-chinh-gia-mot-so-do-uong/

Giá xuất khẩu chè Việt Nam tăng hơn 50% trong tháng 8 - Mekong Asean (2022)

https://mekongasean.vn/gia-xuat-khau-che-cua-viet-nam-tang-hon-50-trong-thang- 8post10769.html

Mạng xã hội phổ biến ở Hàn Quốc - Zila (2022) https://www.zila.com.vn/sns-la-gi.html