Preview text:

BACHELOR OF BUSINESS (HONS)

SEPTEMBER 2021 SEMESTER

MID SEMESTER EXAMINATION Subject Code : FIN202 Subject Name : FINANCIAL MANAGEMENT

This examination carries 15% of the total assessment for this subject. Examiner(s): Moderator:

MR. SELVANADAN MUNIAPPAN MR. GOOI CHEE SAN

Date : 18 NOVEMBER 2021 Time : 1.00 PM 4.00 PM – Time allowed: 3 HOURS INSTRUCTION(S):

This examination consists of TWO (2) parts.

PART A – consists of TWENTY (20) multiple choice questions.

PART B – consists of TWO (2) questions covering computations and discussions.

ALL questions are compulsory and should be attempted.

(This examination paper consists of 2 parts in 6 printed pages, including cover page)

FIN202 – Financial Management – UFM September 2021 Semester – Mid Semester Examination Page 2

PART A: MULTIPLE CHOICE QUESTIONS (40 MARKS)

Answer ALL questions. Each question carries 2 marks.

1) ________ is concerned with design and delivery of advice and financial products to

individuals, businesses, and governments. A) Managerial finance B) Auditing services C) Financial services D) Cost accounting

2) Which of the following is a duty of a financial manager in a business firm? A) developing marketing plans

B) controlling the stock price

C) raising financial resources D) auditing financial records

3) Which of the following is a strength of a corporation? A) low taxes B) limited liability C) low organization costs D) less government regulation

4) Corporate owners receive return ________.

A) by realizing gains through increases in share price and interest earnings

B) by realizing gains through increases in share price and cash dividends

C) through capital appreciation and retained earnings

D) through interest earnings and earnings per share

5) The key variables in the owner wealth maximization process are ________.

A) market risk premium and risk B) cash flows and risk

C) risk-free rate and share price D) total assets and risk

6) Financial managers evaluating decision alternatives or potential actions must consider ___________. A) only risk B) only return C) either risk or return

D) risk, return, and the impact on share price

7) An ethics program is expected to have ________ impact on a firm's share price. A) a positive B) a negative C) no impact D) an unpredictable

FIN202 – Financial Management – UFM September 2021 Semester – Mid Semester Examination Page 3

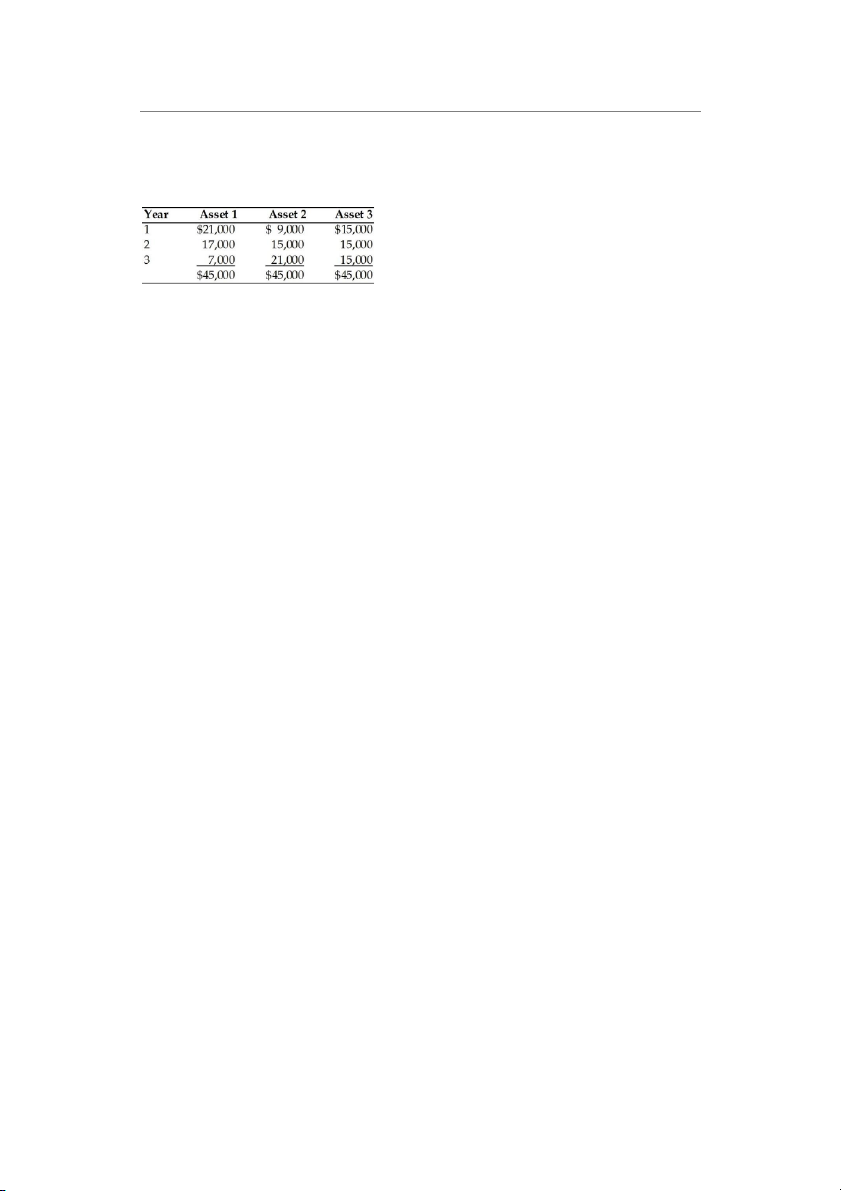

8) A financial manager must choose between three alternative investments. Each asset is

expected to provide earnings over a three-year period as described below. Based on the

wealth maximization goal, the financial manager would ________. A) choose Asset 1 B) choose Asset 2 C) choose Asset 3

D) be indifferent between Asset 1 and Asset 2

9) Which of the following is one of the positive benefits of an effective ethics program?

A) reduce potential litigation and judgment costs

B) maintain and build competitor confidence

C) gain the loyalty, commitment, and respect of the firm's competitors

D) making sure violations are penalized, while at the same time not subjecting the employee to publicity

10) A financial manager's financing decisions determine ________.

A) both the mix and the type of assets found on the firm's balance sheet

B) the most appropriate mix of short-term and long-term financing

C) both the mix and the type of assets and liabilities found on the firm's balance sheet

D) the proportion of the firm's earnings to be paid as dividend

11) The agency problem may result from a manager's concerns about ________. A) job security

B) maximizing shareholder value C) corporate goals

D) increasing credit worthiness

12) Investment banks are institutions that ________.

A) perform all activities of commercial banks and retail banks

B) are exempted from Securities and Exchange Commission regulations

C) engage in trading and market making activities

D) are only limited to capital market activities

13) Which of the following is true of a secondary market?

A) It is a market for an unlisted company to raise equity capital.

B) It is a market where securities are issued through private placement

C) It is a market in which short-term money market instruments such as Treasury bills are traded.

D) It is a market in which preowned securities are traded.

FIN202 – Financial Management – UFM September 2021 Semester – Mid Semester Examination Page 4

14) The money market is a market ________.

A) that enables suppliers and demanders of long-term funds to make transactions

B) which brings together suppliers and demanders of short-term funds

C) where smaller, unlisted securities are traded

D) where all derivatives are traded

15) The present value of an ordinary annuity of $2,350 each year for eight years, assuming an

opportunity cost of 11 percent, is ________. A) $ 1,020 B) $27,869 C) $18,800 D) $12,093

16) You have been offered a project paying $300 at the beginning of each year for the next 20

years. What is the maximum amount of money you would invest in this project if you expect

9 percent rate of return to your investment? A) $ 2,738 B) $ 2,985 C) $15,347 D) $ 6,000

17) Gina has planned to start her college education four years from now. To pay for her college

education, she has decided to save $1,000 a quarter for the next four years in a bank account

paying 12 percent interest. How much will she have at the end of the fourth year? A) $ 1,574 B) $19,116 C) $20,157 D) $16,000

18) Rational buyers and sellers use their assessment of an asset's risk and return to determine its

value. Relative to this concept, which of the following is true?

A) To a buyer the asset's value represents the minimum price that he or she would pay to acquire it.

B) To a seller the asset's value represents the maximum sale price.

C) To a buyer the asset's value represents the maximum price that he or she would pay to acquire it.

D) To a seller the asset's value represents the price at which he acquired the asset.

19) Daniel Custom Cycles' common stock currently pays no dividends. The company plans to

begin paying dividends beginning 3 years from today. The first dividend will be $3.00 and

dividends will grow at 5 percent per year thereafter. Given a required return of 15 percent,

what would you pay for the stock today? A) $25.33 B) $18.73 C) $29.86 D) $22.68

FIN202 – Financial Management – UFM September 2021 Semester – Mid Semester Examination Page 5

20) The value of any asset is the ________.

A) sum of all future cash flows it is expected to provide over the relevant time period

B) sum of the present values of all future cash flows it is expected to provide over the relevant time period

C) present value of the sum of all future cash flows it is expected to provide over the relevant time period

D) sum of all compounded future cash flows it is expected to provide over the relevant time period

FIN202 – Financial Management – UFM September 2021 Semester – Mid Semester Examination Page 6 PART B (60 MARKS) Answer ALL questions. QUESTION 1 (30 MARKS)

(A) What are the financial decisions facing the managers of firms? How are they related? (15 marks)

(B) Can our goal of maximizing the value of the shares conflict with other goals such as avoiding

unethical or illegal behaviour? In particular, do you think issues like customer and employee

safety, the environment, and the general good of society fit into this framework, or are they

essentially ignored? Support your views with specific examples. (15 marks) QUESTION 2 (30 MARKS)

(A) In six years time you wish to have $10,000 in an account that pays 5% pa. ’ a)

How much do you have to deposit today to achieve this goal? (5 marks)

b) Instead of paying a single sum into the account today, you decide to achieve your goal by

making deposits every six months (= 12 deposits), the first one being today. How much are

the deposits? (8 marks)

(B) Innes Smith bought an $80,000 Italian sports car with a 20% down payment and financed the

rest with a four year loan at 8% pa, compounded monthly. a)

What is his monthly payment if he starts the payments one month after purchase? (5 marks)

b) Immediately after the 12th payment, the interest rate rises to 10%pa.

i. If he decides to pay out the loan to avoid the higher interest rate, what is the payout amount? (6 marks)

ii. If he adjusts his monthly payments so that the loan is still paid out in the original time, what are the new monthly payments? (6 marks)

***END OF EXAMINATION PAPER***