Preview text:

FIN202 – FINANCIAL MANAGEMENT

PART A : - MCQ – SAMPLE QUESTIONS SEMESTER , 2021

1) ________ is concerned with design and delivery of advice and financial products to

individuals, businesses, and governments. A) Managerial finance B) Auditing services C) Financial services D) Cost accounting Answer: C 2) Finance is ________.

A) the system of verifying, analyzing, and recording business transactions

B) the science of the production, distribution, and consumption of goods and services

C) the art and science of managing money

D) the art of merchandising products and services Answer: C

3) Under which of the following legal forms of organization is ownership readily transferable? A) sole proprietorships B) partnerships C) limited partnerships D) corporations Answer: D

4) Which of the following is a strength of a corporation? A) low taxes B) limited liability C) low organization costs D) less government regulation Answer: B

5) Which of the following is the purest and most basic form of corporate ownership? A) bond B) notes C) common stock D) preferred stock Answer: C 1

6) The wealth of the owners of a corporation is represented by ________. A) profits B) earnings per share C) share value D) cash flow Answer: C

7) The key variables in the owner wealth maximization process are ________.

A) market risk premium and risk B) cash flows and risk

C) risk-free rate and share price D) total assets and risk Answer: B

8) Cash flows and risk are the key determinants in share price. Increased risk, other things

remaining the same, results in ________. A) a lower share price B) a higher share price C) an unchanged share price D) an undetermined share price Answer: A

9) An ethics program is expected to have ________ impact on a firm's share price. A) a positive B) a negative C) no impact D) an unpredictable Answer: A

10) Which of the following is true of a cash flow?

A) Profits do not necessarily result in cash flows available to the stockholders.

B) It is guaranteed that the board of directors will increase dividends when net cash flows increase.

C) A firm's income statement will never show a positive profit when its cash outflows exceed its cash inflows.

D) An increase in revenue will always result in an increase in cash flow. Answer: A

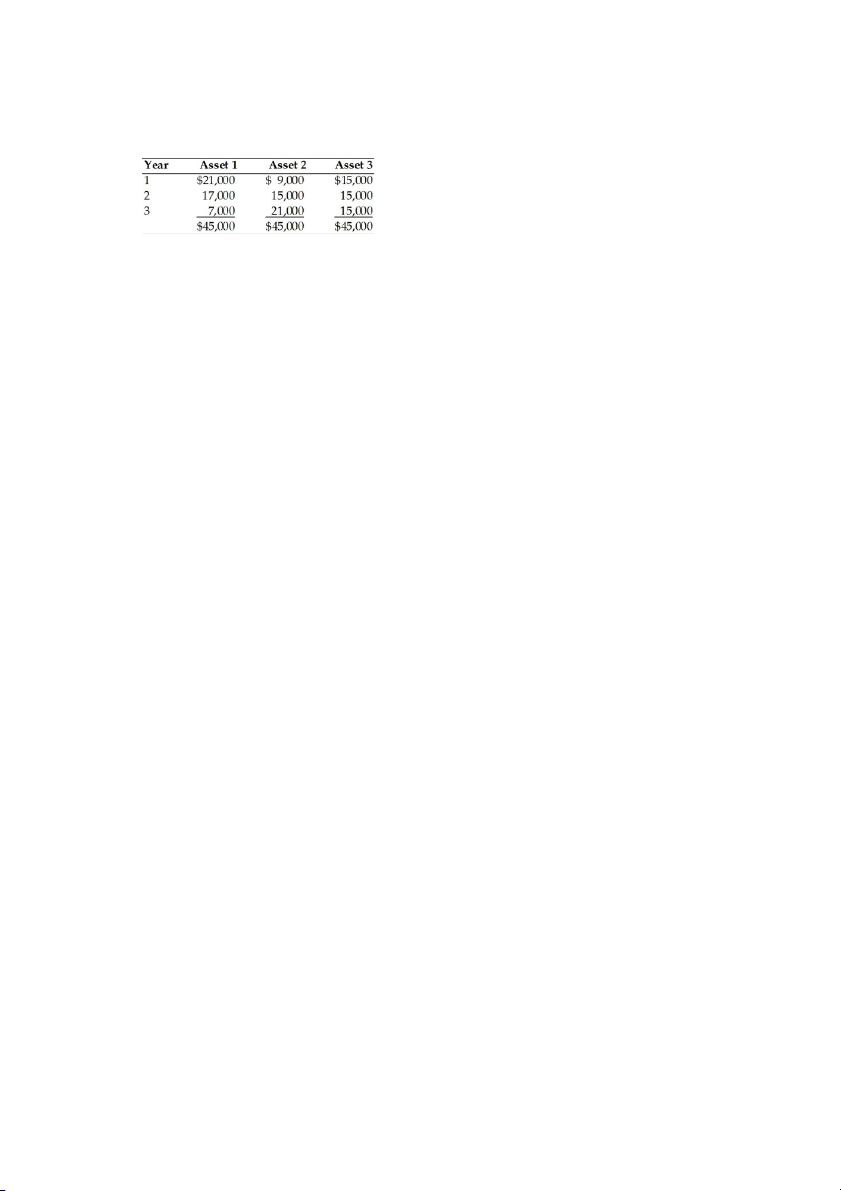

11) A financial manager must choose between three alternative investments. Each asset is

expected to provide earnings over a three-year period as described below. Based on the wealth

maximization goal, the financial manager would ________. 2 A) choose Asset 1 B) choose Asset 2 C) choose Asset 3

D) be indifferent between Asset 1 and Asset 2 Answer: A

12) Which of the following is one of the positive benefits of an effective ethics program?

A) reduce potential litigation and judgment costs

B) maintain and build competitor confidence

C) gain the loyalty, commitment, and respect of the firm's competitors

D) making sure violations are penalized, while at the same time not subjecting the employee to publicity Answer: A

13) The primary economic principle used in managerial finance is ________. A) purchase power parity B) asset pricing theory

C) Porter's theory of five forces

D) marginal cost-benefit analysis Answer: D

14) Which of the following activities of a finance manager determines how the firm raises money

to pay for the assets in which it invests?

A) financial analysis and planning B) investment decisions C) financing decisions

D) analyzing and planning cash flows Answer: C

15) In planning and managing the requirements of a firm, the financial manager is concerned with ________.

A) the mix and type of assets, but not the type of financing utilized

B) the type of financing utilized, but not the mix and type of assets

C) the acquisition of fixed assets, allowing someone else to plan the level of current assets

required, and the market value of the share

D) the mix and type of assets, the type of financing utilized, and analysis in order to monitor the 3 financial condition Answer: D

16) A financial manager's financing decisions determine ________.

A) both the mix and the type of assets found on the firm's balance sheet

B) the most appropriate mix of short-term and long-term financing

C) both the mix and the type of assets and liabilities found on the firm's balance sheet

D) the proportion of the firm's earnings to be paid as dividend Answer: B

17) The responsibility for managing day-to-day operations and carrying out corporate policies belongs to the ________. A) board of directors B) chief executive officer C) stockholders D) creditors Answer: B

18) Incentive plans usually tie management compensation to ________. A) share price B) dividends C) coupon payments D) inventory turnover Answer: A

19) The agency problem may result from a manager's concerns about ________. A) job security

B) maximizing shareholder value C) corporate goals

D) increasing credit worthiness Answer: A

20) Government is typically a ________.

A) net provider of funds because it borrows more than it saves

B) net demander of funds because it borrows more than it saves

C) net provider of funds because it can print money at will

D) net demander of funds because it saves more than it borrows Answer: B

21) Firms that require funds from external sources can obtain them ________.

A) through financial institutions 4 B) from central bank directly C) through forex market D) by issuing T-bills Answer: A

22) Investment banks are institutions that ________.

A) perform all activities of commercial banks and retail banks

B) are exempted from Securities and Exchange Commission regulations

C) engage in trading and market making activities

D) are only limited to capital market activities Answer: C

23) Which of the following assists companies in raising capital, advise firms on major

transactions such as mergers or financial restructuring, and engage in trading and market making activities? A) investment banks B) securities exchanges C) mutual funds D) commercial banks Answer: A

24) Which of the following is a means of selling bonds or stocks to the public? A) private placement B) public offering C) organized selling D) direct placement Answer: B

25) The sale of a new security directly to an investor or a group of investors is called ________. A) arbitraging B) short selling

C) a capital market transaction D) a private placement Answer: D

26) Which of the following is true of a secondary market?

A) It is a market for an unlisted company to raise equity capital.

B) It is a market where securities are issued through private placement

C) It is a market in which short-term money market instruments such as Treasury bills are traded.

D) It is a market in which preowned securities are traded. Answer: D 5

27) A market that establishes correct prices for the securities that firms sell and allocates funds to

their most productive uses is called a(n) ________. A) future market B) forex market C) efficient market D) weak-form market Answer: C

28) The ________ is created by a number of institutions and arrangements that allow the

suppliers and demanders of long-term funds to make transactions. A) forex market B) capital market C) money market D) commodities market Answer: B

29) The money market is a market ________.

A) that enables suppliers and demanders of long-term funds to make transactions

B) which brings together suppliers and demanders of short-term funds

C) where smaller, unlisted securities are traded

D) where all derivatives are traded Answer: B

30) The future value of $100 received today and deposited at 6 percent for four years is ________. A) $126 B) $ 79 C) $124 D) $116 Answer: A FV = 100 (1 + 0.06)4

31) The present value of $100 to be received 10 years from today, assuming an opportunity cost of 9 percent, is ________. A) $236 B) $699 C) $ 42 D) $ 75 Answer: C PV = 100 (1 + 0.09)-10 6

32) The future value of a dollar ________ as the interest rate increases and ________ the further

in the future an initial deposit is to be received. A) decreases; decreases B) decreases; increases C) increases; increases D) increases; decreases Answer: C

33) The future value of a $2,000 annuity due deposited at 8 percent compounded annually for

each of the next 10 years is ________. A) $28,974 B) $31,291 C) $14,494 D) $13,420 Answer: B

FV = 2000 [ (1 + 0.08)10 - 1] / 0.08] =

34) The present value of an ordinary annuity of $2,350 each year for eight years, assuming an

opportunity cost of 11 percent, is ________. A) $ 1,020 B) $27,869 C) $18,800 D) $12,093 Answer: D

35) You have been offered a project paying $300 at the beginning of each year for the next 20

years. What is the maximum amount of money you would invest in this project if you expect 9

percent rate of return to your investment? A) $ 2,738 B) $ 2,985 C) $15,347 D) $ 6,000 Answer: B

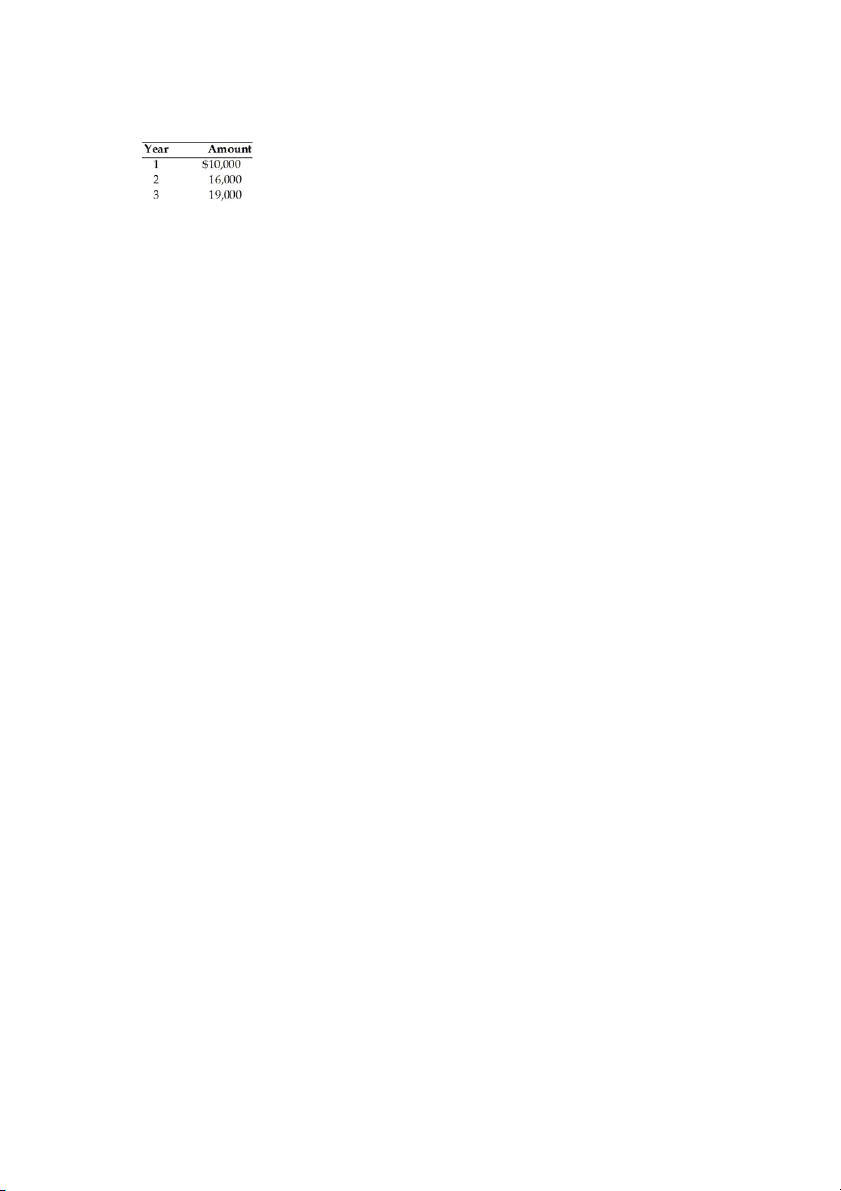

36) Find the future value at the end of year 3 of the following stream of cash flows received at

the end of each year, assuming the firm can earn 8 percent on its investments. 7 A) $45,000 B) $53,396 C) $47,944 D) $56,690 Answer: C

37) The rate of interest actually paid or earned, also called the annual percentage rate (APR), is the ________ interest rate. A) effective B) nominal C) discounted D) continuous Answer: A

38) The future value of an annuity of $1,000 each quarter for 10 years, deposited at 12 percent

compounded quarterly is ________. A) $17,549 B) $75,401 C) $93,049 D) $11,200 Answer: B

39) Thelma is planning for her son's college education to begin five years from today. She

estimates the yearly tuition, books, and living expenses to be $5,000 per year for a four-year

degree, assuming the expenses incur only at the end of the year. How much must Thelma deposit

today, at an interest rate of 8 percent, for her son to be able to withdraw $5,000 per year for four years of college? A) $20,000 B) $13,620 C) $39,520 D) $11,270 Answer: D 8

40) Aunt Butch borrows $19,500 from the bank at 8 percent annually compounded interest to be

repaid in 10 equal annual installments. The interest paid in the third year is ________. A) $1,336.00 B) $1,560.14 C) $2,906.11 D) $1,947.10 Answer: A

41) The legal contract setting forth the terms and provisions of a corporate bond is a(n) 9 ________. A) indenture B) debenture C) loan document D) promissory note Answer: A

42) The value of any asset is the ________.

A) sum of all future cash flows it is expected to provide over the relevant time period

B) sum of the present values of all future cash flows it is expected to provide over the relevant time period

C) present value of the sum of all future cash flows it is expected to provide over the relevant time period

D) sum of all compounded future cash flows it is expected to provide over the relevant time period Answer: B

43) Calculate the value of a $1,000 bond which has 10 years until maturity and pays quarterly

interest at an annual coupon rate of 12 percent. The required return on similar-risk bonds is 20 percent. A) $656.82 B) $835.45 C) $845.66 D) $2,201.08 Answer: A

44) If the required return is greater than the coupon rate, a bond will sell at ________. A) par B) a discount C) a premium D) book value Answer: B 10