Preview text:

MINISTRY OF EDUCATION AND TRAINING HOA SEN UNIVERSITY

FACULTY OF ECONOMICS AND BUSINESS FINAL REPORT INTERNATIONAL PAYMENT Lectures : Lâm Thanh Phi Quỳnh Class : NT317DE01 Group : 03 Members : Trần Bích Nhân (2183674)

Trần Nguyễn Quỳnh Mai (2181692) Châu Thị Băng Châu (2182699) Nguyễn Vy Trâm Anh (2170439)

Phạm Thị Ngọc Thắm (2001819) Võ Minh Duy (2181790) Nguyễn Lý Minh Thư (2172866)

Hồ Chí Minh City, August, 2021

MINISTRY OF EDUCATION AND TRAINING HOA SEN UNIVERSITY

FACULTY OF ECONOMICS AND BUSINESS FINAL REPORT INTERNATIONAL PAYMENT Lectures : Lâm Thanh Phi Quỳnh Class : NT317DE01 Group : 03 Members : Trần Bích Nhân (2183674)

Trần Nguyễn Quỳnh Mai (2181692) Châu Thị Băng Châu (2182699) Nguyễn Vy Trâm Anh (2170439)

Phạm Thị Ngọc Thắm (2001819) Võ Minh Duy (2181790) Nguyễn Lý Minh Thư (2172866) ĐIỂM 7.5 2

Hồ Chí Minh City, August, 2021 3 DISCLAIMER

“We have read and understand violations of academic integrity.

We pledge with personal honor that this work was done on our own

and does not violate academic integrity.”

Date____ month ____ year ______ (Student's name and signature) 4 INTRODUCTION

Facing the trend of the world economy becoming increasingly

internationalized, Vietnam is developing a market economy, opening up,

cooperating and integrating. In the first scenario, international trade and

investment activities emerge as a bridge connecting the domestic economy with

the outside world. To perform this function, connect international banks such as

Import-Export Finance, Foreign Exchange Business, Bank Guarantees in Foreign

Trade, International Payments, especially payments by L/ C… serves as an

essential tool and is becoming increasingly important. On this day, international

payment is an increasingly important service for Vietnamese commercial banks,

an important link in promoting the development of other business activities of the

bank, and ending support and supporting the export - import business activities of

developed enterprises. International payment was born on the basis of

international trade, but whether international trade exists and develops or not

depends on and the payment manager has all information, time, safety. and

correct or not. International trade and payments is inherently complex and risky

compared to domestic trade and payments, because it is governed by local laws

and customs, but also international and national laws.

Therefore, stakeholders and participants in the process of International Trade and

Payment need to have a thorough understanding of not only the technical and

professional processes but also local and international practices, customs, and

laws. economic. The essay with the topic "Causes for commercial banks to

evaluate solvency" of the group 03-08, we study the concepts as well as the

causes of one of the international payment methods- with the goal of helping

people understand and grasp and apply this method in a reasonable and accurate

way. Although we have tried to collect and concentrate our knowledge, our team

still cannot avoid mistakes. We sincerely thank you and look forward to receiving your comments! TABLE OF CONTEN 5

INTRODUCTION...............................................................................................4

TABLE OF CONTENT......................................................................................5

PART 1. THEORETICAL BASIS......................................................................6

1.1. The concept of a bank's credit line, classification......................................6

1.2. What issues do banks usually consider when appraising credit lines

(conditions when appraising limits for businesses)...........................................6

1.3. What is escrow? Classification....................................................................7

Definition:.......................................................................................................... 7

Types of deposit:................................................................................................7 a)

L/C Open Margin:....................................................................................8

b) Guarantee deposit for contract execution:................................................8

c) Margin for multi-industry business purposes:..........................................8

1.4. Conditions when opening Escrow L/C? Notes when depositing to open

LC?....................................................................................................................... 9

Condition:..........................................................................................................9

Notes:............................................................................................................... 10

1.5. The process of depositing funds.................................................................11

It should be noted that:.....................................................................................11

Step 1: Apply for a letter of credit (L/C)..........................................................12

Step 2: The main bank accepts the application and opens a letter of credit for

the business...................................................................................................... 14

Step 3: The banking system operates, transferring letters of credit to partners

and beneficiaries..............................................................................................15

1.6. The benefits when depositing L/C.............................................................15

PART 2. ANSWER THE QUESTION.............................................................18

CONCLUSION..................................................................................................19 6

PART 1. THEORETICAL BASIS

1.1. The concept of a bank's credit line, classification.

A committed credit line is a monetary spending loan balance offered by a

financial institution that cannot be suspended without notifying the borrower. A

committed credit line is a legal agreement outlining the conditions of the credit

line between the financial institution and the borrower.

1.2. What issues do banks usually consider when appraising credit lines

(conditions when appraising limits for businesses)

Depending on each bank, there will be different conditions, but there will be the following main conditions:

● Domestic enterprises have a continuous business period of 12 months or

more from the time of registration. Or have local confirmation of the

actual business time from 12 months.

● Business registration lines are suitable for borrowing loans, business plans,...

● Have a viable business plan, have the full financial capacity, and clear source of repayment.

● Having secured assets with loan security value.

● There are no bad debts at banks or other credit institutions.

Banks often consider what issues to consider when evaluating credit limit commitments :

● First, pay attention to the determining side of the business: grasp the

capacity of the operator, the competitive power of the product, the technical strength…

● Second, quantitative analysis without depending on financial information:

even if financial information is not available, by various methods it is

necessary to grasp and analyze the financial situation of the business. 7

Moreover, it is required to check the suitability between items, the

suitability of the quantitative side compared to quantitative numbers.

● Thirdly, analyze the purpose of using loans: after grasping the situation of

the enterprise, conducting a project analysis based on short-term forecasts.

1.3. What is escrow? Classification. Definition:

An escrow is an amount of money, gemstone or some related important

papers taken into an account, then blocked, strictly controlled in the bank for the

purpose of guaranteeing companies and organizations, when doing projects or investing.

Escrow deposits can be money or precious metals, gems, or valuable papers

that are frozen in banks or credit institutions to ensure the performance of obligations.

Escrow is a legal concept describing a financial instrument whereby an

asset or escrow money is held by a third party on behalf of two other parties that

are in the process of completing a transaction. Escrow accounts might include

escrow fees managed by agents who hold the funds or assets until receiving

appropriate instructions or until the fulfillment of predetermined contractual

obligations. Money, securities, funds, and other assets can all be held in escrow.

It is often suggested as a replacement for a certified or cashier's check.

Escrow is a process used when two parties are in the process of completing

a transaction, and there is uncertainty over whether one party or another will be

able to fulfill their obligations. Contexts that use escrow include Internet

transactions, banking, intellectual property, real estate, mergers and acquisitions, and law, and many more.

Types of deposit: 8

There are 3 most common types of deposit that are commonly seen as L/C

Open Margin, Guarantee deposit for contract execution, Margin for multi- industry business purposes. 9

a) L/C Open Margin:

A letter of credit, or "credit letter" is a letter from a bank guaranteeing that a

buyer's payment to a seller will be received on time and for the correct amount.

In the event that the buyer is unable to make a payment on the purchase, the bank

will be required to cover the full or remaining amount of the purchase. It may be offered as a facility.

Due to the nature of international dealings, including factors such as

distance, differing laws in each country, and difficulty in knowing each party

personally, the use of letters of credit has become a very important aspect of international trade.

L/C is made by the bank and is valid as a letter at the mutual request of the

parties. Contents of L/C are agreements and commitments to pay goods to the exporter.

b) Guarantee deposit for contract execution:

This form is often applied to large-scale construction works with huge

costs. The deposit will be agreed between the investor and the contractor.

Usually, the owner will be forced to deposit with the bank to ensure that the

project is done with the right quality and on schedule. During the construction

process, if there is a problem that is not self-resolved, the investor will use this

deposit to fix and compensate for the damage to the work.

This is a fairly secure form of deposit for both the investor and the project.

This is a safe transaction for both parties to ensure that all issues are followed in a predictable order.

c) Margin for multi-industry business purposes:

A formal technique to secure business and in case of disruption or

production in some fields and other industries.

The reason for this escrow format is because throughout the business

process, the investor must ensure to maintain the minimum amount. 10

1.4. Conditions when opening Escrow L/C? Notes when depositing to open LC? Condition:

- Ensure sufficient capital to pay the LC open fund: Ensure that the LC open fund

can be paid and meet the requirements of the bank:

- In case the Customer does not need to sign 100% or is required to waive or

reduce the deposit, you need to contact the credit side for approval and approval by an authorized person.

- Open-ended fund LC is issued with loan capital of the bank. For this request,

the customer must also contact the credit appraisal department.

Provide complete information in the application file for opening LC: The

application form for opening LC includes: - Application for opening LC.

- For businesses using the service for the first time, it is necessary to provide a

business establishment decision. - Business license.

- Import and export registration number.

- Original foreign trade contract. (In case the contract is signed via FAX, it is

necessary to sign and stamp on the photocopy).

- Import entrustment contract (if any).

- Import license from the Ministry of Trade (For imported items under the

management list specified in the Prime Minister's annual import and export management decision). 11

- Commitment to implementation and payment, credit contract (in case of loan),

official letter approving the opening of the bank's deferred payment LC fund.

- Foreign currency transaction contract (if any).

- An explanation for opening LC made by the credit department of the bank

branch and approved by the authorized director (For the case of deposit under 100% of the LC value).

The above required documents need to submit a photocopy with the

enterprise's stamp and present the original for verification. Documents required to provide originals are: + Commitment to pay + Loan contract

+ Foreign currency trading contract

+ Application for opening LC of the importing side + LC . open explanation Notes : - Escrow object:

According to Vietnam's Civil Law, the approved LC depositors are gems,

money, metals or valuable papers. In particular, the objects when deposited in

the bank must have a value much larger than the scope of the obligation required

to perform. If the customer does not perform the obligations properly, the value

of this account will only be used to solve the arising problems. The remaining

amount will be applied to calculate interest after performing the remaining obligations. 12

- Carrying out escrow measures:

This method of depositing escrow proves the existence of an intermediary

in a legal relationship.In which, the bank is an intermediary to protect the

interests of the exporter and importer. In addition, the bank is also the place

where each party is required to strictly comply with the contractual agreement

and is entitled to collect a service fee from the escrow subject to open the LC.

1.5. The process of depositing funds.

A letter of credit ( L/C ) is a legal document issued by a financial institution

(usually a bank) to provide a guarantee of payment to a beneficiary or accepts

draft drawn by him to the extent that it is on the basis that the beneficiary must

meet the terms of the letter of credit.

And if you are a domestic Importer, you must be interested in learning

about how to open a letter of credit to a foreign exporter. In this article, I will

detail the steps in practice for you to successfully open LC right from the first transaction with the bank.

In fact, the process of opening L/C is very simple with only three steps: Step 1: Apply open L/C

Step 2: The main bank accepts the application and opens a letter of credit for the business

Step 3: The banking system operates, transferring letters of credit to partners and beneficiaries.

Although there are only three simple steps, it is not easy to open an L/C in

both business and banking positions. Why is that? To understand that we will go deeper into the above steps.

It should be noted that:

1. Each bank has its own, different credit opening application form. Enterprises

wishing to open letters of credit must first select the bank they want to open L/C

with. That bank may be a very familiar bank and have transacted with businesses 13

many times, or it may be a strange bank. At that time, the procedure for applying

to open a business may be very different. Therefore, businesses must carefully

study the application form of the selected bank, and carefully read the procedures

and regulations that the bank has prescribed.

2. Application for opening letter of credit must be in writing at least 2 copies.

After the Bank stamps and returns to the unit a copy

3. It is necessary to pay attention to the type of letter of credit that the business

needs and wants to open. Banks will have different ways of providing L/C

services. Most banks have deferred L/C, L/C at sight. Besides, there are also

types of L/C backup, transferable, back-to-back, cyclical, reciprocal ....

Therefore, businesses need to carefully select and complete them in accordance

with the requirements, procedures and documents of the bank.

4. Be careful and consider carefully when setting out the conditions binding on the exporting party.

Avoid conflicts with the terms signed in the contract. “Because the bank opens

L/C at the request of the importer, so you should carefully review the contract

content to ensure that there are no conflicts when putting it in the L/C.”

5. The application for credit is the legal basis for settling disputes between the

applicant for the letter of credit and the issuing bank and the basis for the opening

bank to send the credit to the exporter.

6. In addition, when conducting registration to open L/C, businesses need to pay

attention to their bank's requirements on deposit, guarantee, authorization.

Step 1: Apply for a letter of credit (L/C)

Based on the foreign trade contract (or offer invoice), the importing

organization shall actively write an application for opening a letter of credit and

send it to the serving bank. Profiles usually include: 14

Application for opening L/C

Foreign trade contract (original/copy)

Import license of the Ministry of Trade (if the imported goods are on the

list of management specified in the Prime Minister's annual import and export management decision)

Foreign currency purchase and sale contract (if any) 15

Step 2: The main bank accepts the application and opens a letter of credit for the business.

If agree, the bank stamps the application for opening letter of credit and

returns one copy to the unit. After that, the bank deducts the account of the credit

account opening unit (deposit 100% of the value of the letter of credit in case of

immediate payment or X% of the value of the letter of credit in the case of term 16

payment). The Bank then writes a letter of credit to the exporting organization

through the advising bank in the country of the exporting country.

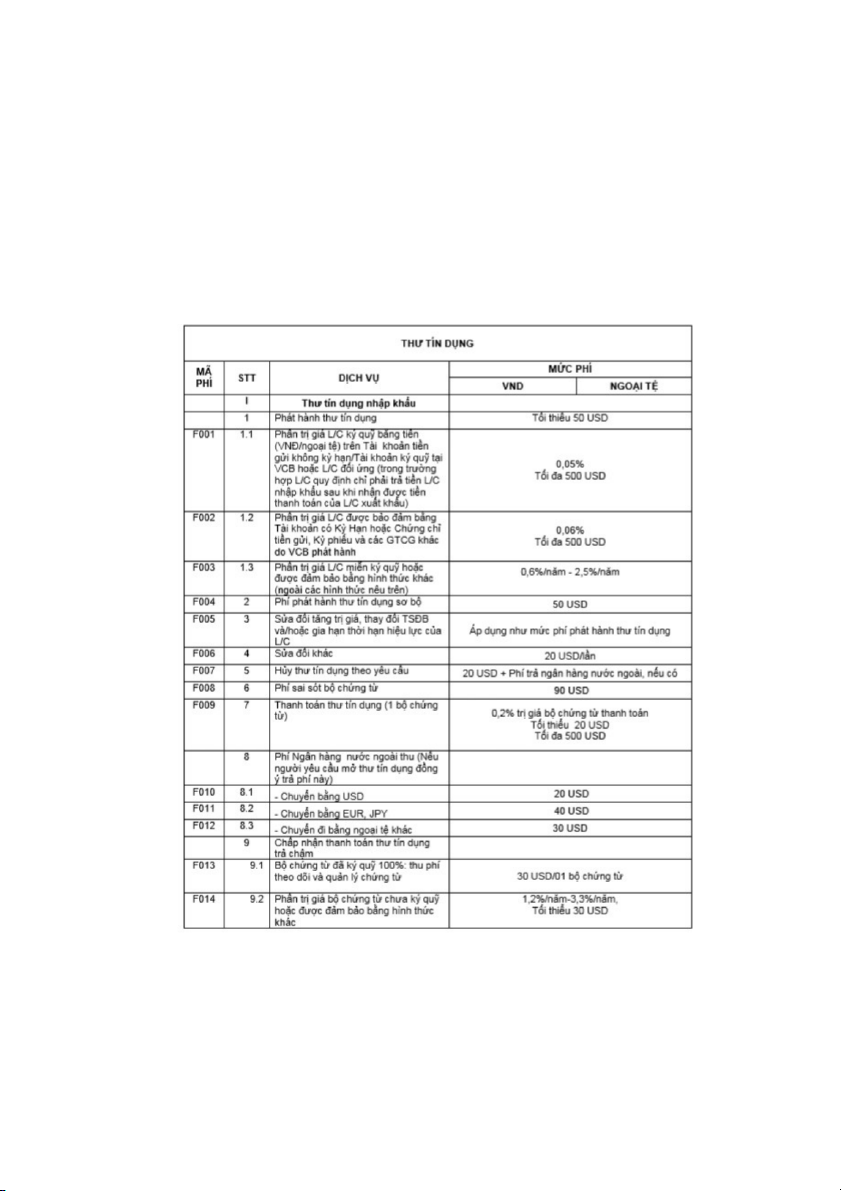

The opening of a letter of credit can be done by air, by post or by telegram, using the Swift system. Attention:

After the bank has approved, one thing that businesses need to pay attention

to is the transaction fee. Each bank, each type of transaction has different fees

depending on the regulations and nature. Therefore, businesses must consider the

choice to best suit their own ability to meet.

Step 3: The banking system operates, transferring letters of credit to partners

and beneficiaries.

The bank opening the L/C sends a letter of credit to the exporter's

representative bank, the exporter through the system of advising banks (2 advising banks).

It is the responsibility of all banks that belong to the intermediary position

to check the authenticity of the L/C.

At the advising bank, when receiving the letter of credit, it must check and

confirm the L/C opening and then transfer the original to the exporter in verbatim form.

Any L/C must be strictly checked for authenticity, content, signature, test

code before it is delivered to the beneficiary. If there is any error, the advising

bank has the right not to transfer the L/C and must immediately contact the bank

opening the L/C, re-transfer the L/C as quickly as possible, without delay.

These are the three steps in the L/C opening process. Of these three steps,

step one is an important premise of the remaining steps. this requires the

attention, care, effort ... of both businesses and banks. This is also the reason why

opening L/C seems simple, but it's not simple at all. 17

1.6. The benefits when depositing L/C

a. Characteristics

● Currency: VND or foreign currency like USD, EUR, GBP.

● Margin deposit amount: Flexible based on the nature of each type of deposit.

● Interest payment term: Margin can be paid interest within 1 to 36 months.

The longer the payment term, the higher the interest rate.

● Interest rate: Margin deposit is charged at interest rate with term or

demand. Deposit products apply interest payment in the form of deposit

with flexible principal withdrawal. The principal part will be withdrawn if

the interest rate is indefinite and the remaining principal will still enjoy the original interest rate.

● Interest payment method: For accounts with demand interest rate, interest

will be paid on the 25th of every month. Accompanied by a notice stating

"Yes" to the account "Deposit with no term". As for accounts with term

interest payments, the interest will be paid at the end of the period and

automatically entered into the capital.

Note that when using a margin account, you can only open 1 account for

each type of margin and make transactions on that account. One account cannot

be used for all types of bank deposits. b. Benifit only

When making a deposit, your business and organization will receive greater

benefits and benefits than not making a deposit:

● Build credibility with customers.

● Profitability from the balance in the account.

● Ensuring safety for the development of organizations and businesses.

● Organizations and businesses create prestige, assurance and bring peace of mind to business partners. 18

● Money deposited in the Bank can still generate interest in the bank account.

● For business psychology, escrow brings safety and comfort to

organizations, businesses as well as partners.

● Business activities develop smoothly, there is no high risk of default or

bad debt. Therefore, the company's finances are also guaranteed.

● Create higher trust and credibility for customers.

● Profitability for the balance in the account.

● Ensure the safe and sustainable development of organizations and businesses. 19

PART 2. ANSWER THE QUESTION Q uestion :

The reason why some commercial banks also require L/C applicants to

deposit a certain sum of money in their bank account even though these

companies have been provided a credit commiTment at these banks? Ans wer :

Commercial banks often require businesses to deposit an amount of money

even though the business already has a line of credit at the bank because:

In case the business signs a contract with a completely new partner, to

ensure the safety in the cooperation process, the partner company will require the

enterprise to have an intermediary bank to guarantee the contract performance of

the enterprise; if the enterprise complies with the contract, after the expiry of the

guarantee period, the bank will refund the deposit, but if the enterprise does not

comply with the terms signed with the partner in the contract, the the bank will

be the party to indemnify the amount originally guaranteed when performing the contract. Example:

For example, the importing party (Company A) wants to buy a shipment of

furniture with a price of 30 billion VND, which is processed by the exporter

(Company B). Besides, company A does not want to transfer money to company

B in advance to avoid being scammed, company B also does not want to give the

entire shipment to company A for the same reason. Therefore, company A will

ask the bank to make a L/C and commit to make payment to company B at the request of company B. 20