Preview text:

1 TABLE OF CONTENTS

TABLE OF CONTENTS............................................................................1

PLEDGE.................................................................................................2

ACKNOWLEDGEMENT...........................................................................3

TEAM MEMBER......................................................................................4

TASK ASSIGNMENT...............................................................................5

I. CASES (TÌNH HUỐNG) (20 MARKS)....................................................6

Case 1................................................................................................6

Case 2................................................................................................7

II. ANALYZE THE TRANSACTIONE (20 MARKS)......................................8

III. ACCOUNTING CYCLES (50 MARKS)................................................15 2 PLEDGE

We pledge that the entire content of this essay has been completed

by our group and has not been copied or reproduced from any other

sources. All sources of information, references, and data have been

properly acknowledged and cited. We understand that plagiarism is a

serious academic offense, and we have ensured that this work fully

complies with the ethical guidelines of the institution. 3 ACKNOWLEDGEMENT

First of all, We would like to send to the lectures of Hoa Sen University

our sincerest and deepest thanks.

In particular, We would also like to give our warmest thanks to the

lecture, Mrs. Le Thi Bich Thao. You have wholeheartedly guided us

in the learning process as well as in completing the thesis. We could

not have completed this essay without you.

We have tried to complete this essay, but errors may not be avoided.

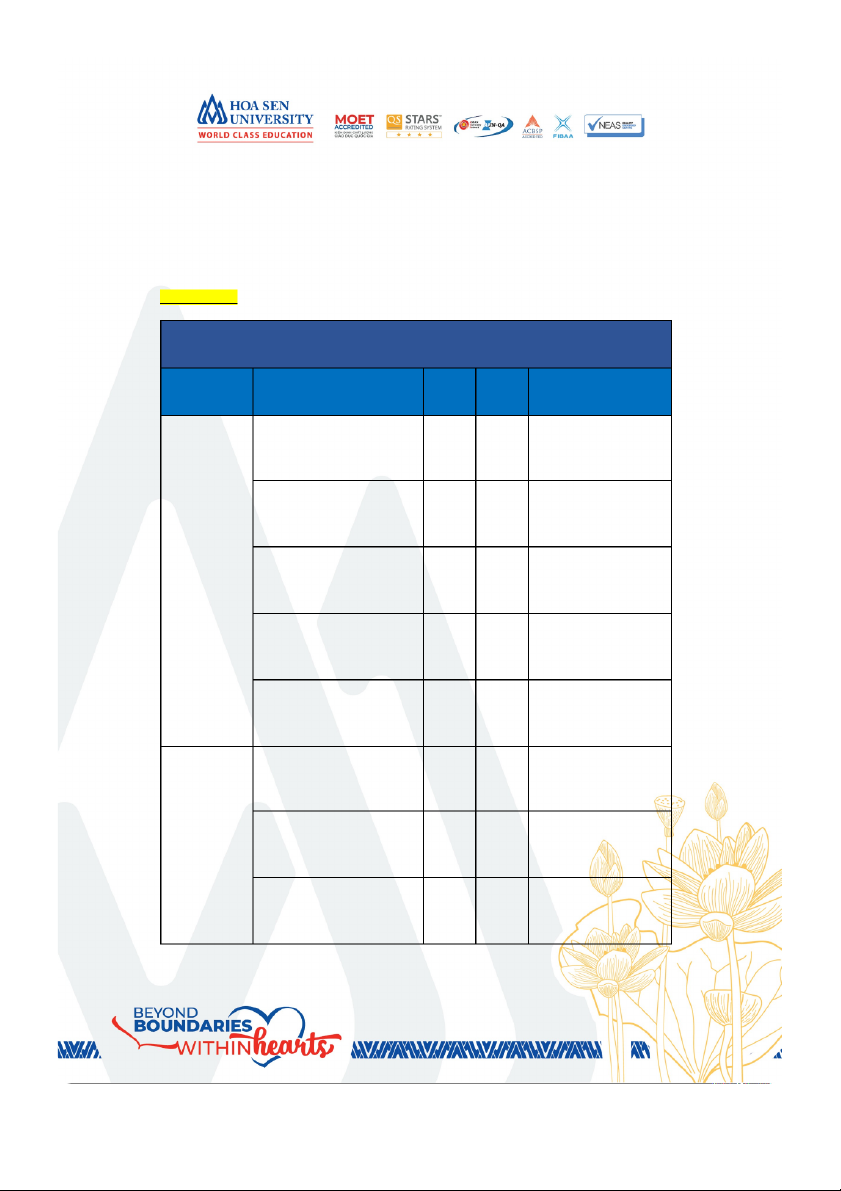

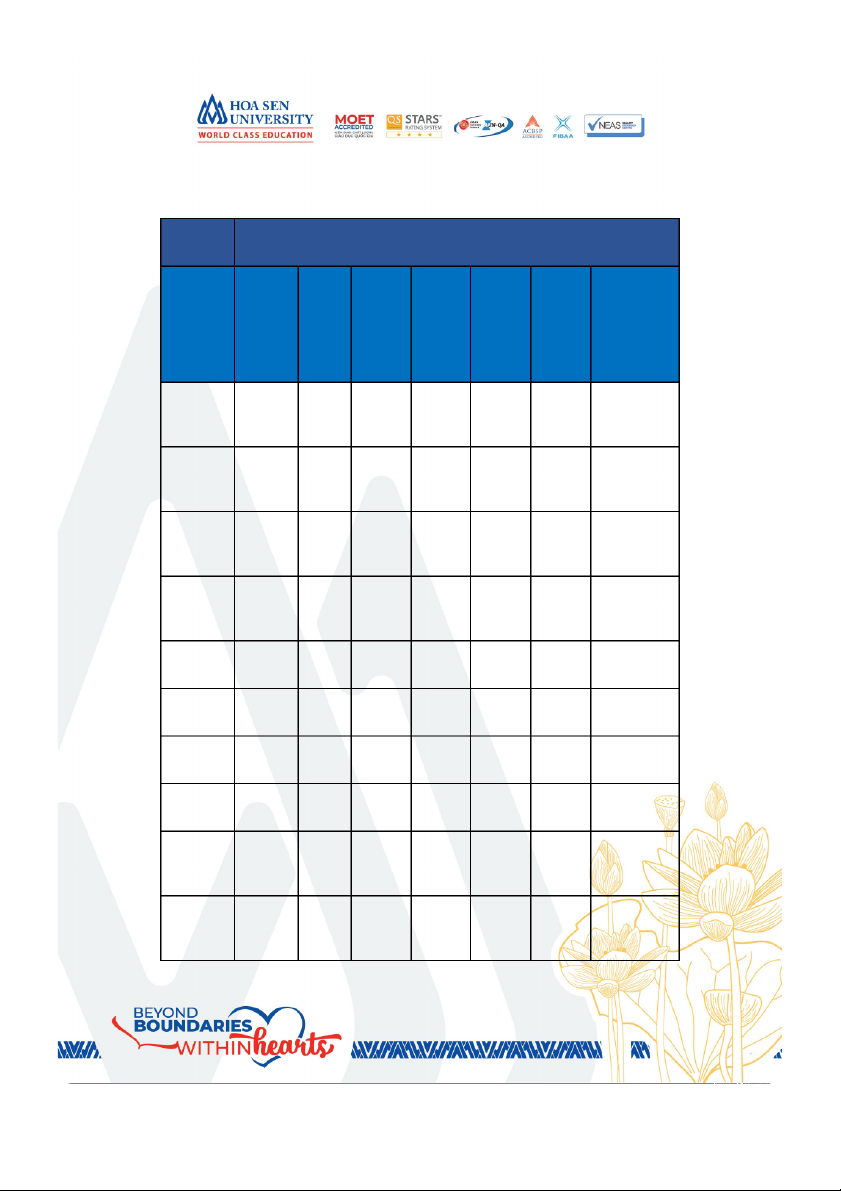

We respectfully hope to receive advices from lectures to improve the article. 4 TEAM MEMBER N Student ID Name Note o. number 1. 22206966 Đàng Thục Huệ Team leader 2. 22207436 Nguyễn Thị Hường 3. 22205062 Võ Ngọc Bảo Ngân 4. 22205884 Nguyễn Hoàng Nhật 5. 22201402 Nguyễn Hà An Thuyên 5 TASK ASSIGNMENT N Student Name Assigned Evalua Note o. ID tasks te number 1. 2220696 Đàng Thục Huệ Part III: a, b, 100% Team 6 c, d, e leader Report prepare 2. 2220743 Nguyễn Thị Part I 100% 6 Hường 3. 2220506 Võ Ngọc Bảo Part III: a, b, 100% 2 Ngân c, e 4. 2220588 Nguyễn Hoàng Part II 100% 4 Nhật 5. 2220140 Nguyễn Hà An Part IV, III: c 100% 2 Thuyên Đàng Thục Huệ Nguyễn Thị Hường Nguyễn Hoàng Nhật 6 Nguyễn Hà An Thuyên Võ Ngọc Bảo Ngân 7

I. CASES (TÌNH HUỐNG) (20 MARKS) Case 1 – 10 Marks

ABC Consulting Firm provides specialized consulting services to clients. On

March 1, 2024, ABC Consulting entered into a contract with XYZ Corporation

to provide a comprehensive market analysis report. The terms of the

contract stipulate that ABC Consulting will receive $12,000 upon the

completion of the report, which is due on May 31, 2024.

In addition, the firm received an advance payment of $4,000 from XYZ

Corporation on March 1, 2024, as a deposit against the total contract price.

Question. According to the Revenue Recognition Principle, how should

ABC Consulting record the $4,000 advance payment and the revenue from

the market analysis report in its financial statements?. SOLUTION

On March 1, 2024, ABC Consulting received an advance payment of $4,000

from XYZ Corporation. According to the Revenue Recognition Principle,

revenue should only be recognized when the service has been completed.

Therefore, this advance payment should not be immediately recognized as

revenue. Instead, the amount should be recorded as a liability in the

financial statements, as ABC Consulting has not yet completed the service

and still has the obligation to provide the market analysis report.

On May 31, 2024, ABC Consulting completed the market analysis report. At

this point, the service has been completed, and revenue can be recognized

according to the Revenue Recognition Principle. Therefore, the total revenue

from the contract, amounting to $12,000, should be recognized.

Once the service has been completed, the previously received advance

payment of $4,000 will be transferred from Unearned Revenue to Revenue,

since the service has been performed.

The remaining revenue of $8,000 (total contract revenue of $12,000 minus

the $4,000 advance payment) should be recognized as revenue. If the

$8,000 has not yet been received from XYZ Corporation at this time, it

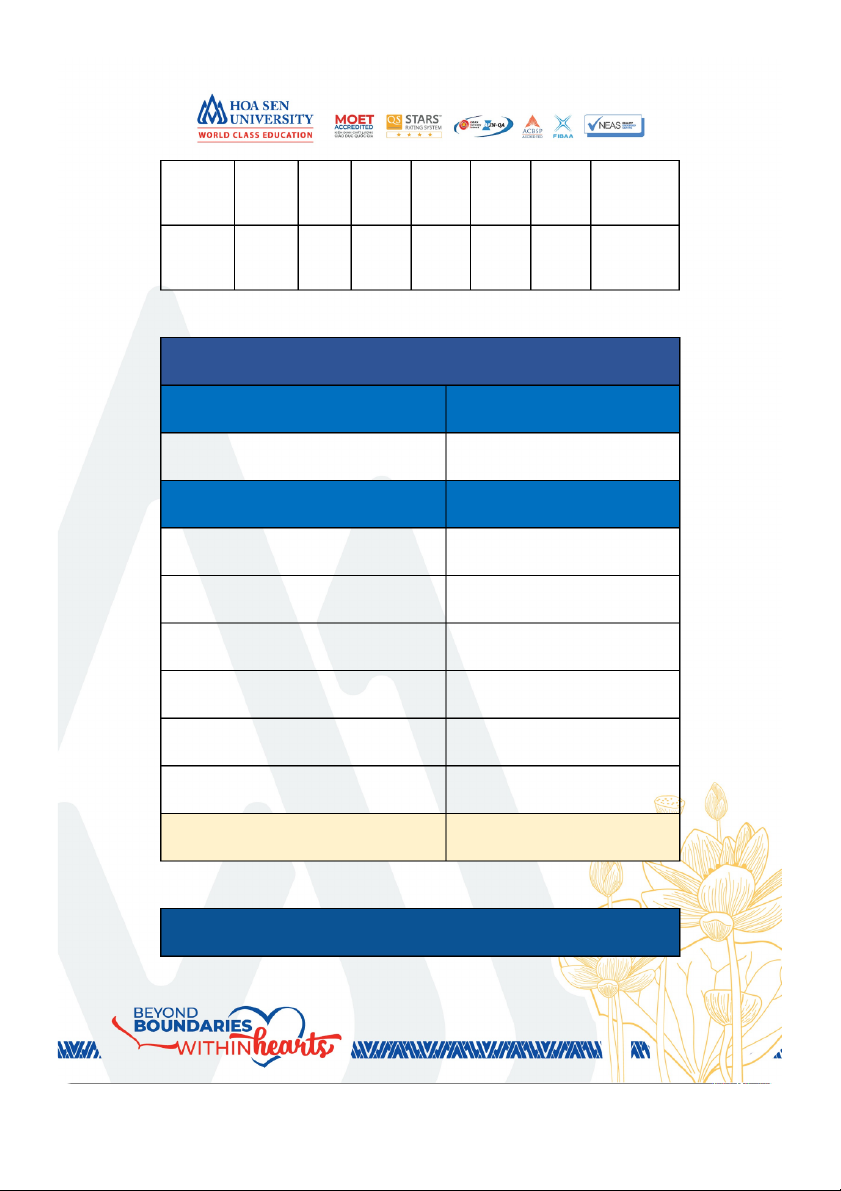

should be recorded as Accounts Receivable. Date Account Debit Credit March 1, 2024 Cash $4,000 $4,000 May 31, 2024 Unearned Revenue $4,000 8 Accounts Receivable $8,000 Revenue $12,000 Case 2 - 10 Marks

Fresh Produce Inc. is a company that deals in fresh fruits and vegetables. At

the end of the fiscal year on December 31, 2024, Fresh Produce Inc. is

evaluating its inventory of apples to determine the proper valuation for financial reporting. Inventory Details:

Total Quantity of Apples in Inventory: 1,000 units Cost per Unit $3. Total Cost of Inventory: 1,000 units × $3 = $3,000. Market Information:

Option 1. Estimated Selling Price per Unit: $4, Estimated Costs to Sell per Unit: $1.

Option 2. Estimated Selling Price per Unit: $3.5, Estimated Costs to Sell per Unit: $1.

Required. Given the details provided for Fresh Produce Inc., let’s evaluate

the inventory valuation using the Net Realizable Value (NRV) method

and compare it with the cost to determine the proper valuation for financial reporting. SOLUTION

Net Realizable Value (NRV) is the value that a company expects to receive

from the sale of inventory after subtracting the costs required to complete

the sale. NRV is calculated as follows:

NRV = Estimated Selling Price - Estimated Selling Costs Option 1

NRV per unit: NRV = $4 - $1 = $3]

Total NRV for inventory: 1,000 units x $3 = $3,000 Option 2 9

NRV per unit: NRV=$3.5−$1=$2.5

Total NRV for inventory: 1,000 units × $2.5 = $2,500

Comparison with Cost Price to Determine the Fair Value for Financial Reporting: Option 1

NRV ($3,000) = Cost Price ($3,000). Therefore, the inventory value is recorded as $3,000 Option 2

NRV ($2,500) < Cost Price ($3,000). Therefore, the inventory value is recorded as $2,500

II. ANALYZE THE TRANSACTIONE (20 MARKS)

Alpha Manufacturing Inc. is a company that produces electronic

components. During the fiscal year ending December 31, 2024, the

company recorded several significant transactions. You will analyze

these transactions to determine their impact on the financial

statements (Income Statement and Balance Sheet).

March 1, 2024, Sold 500 units of electronic components to Beta

Electronics for $200 per unit. Cost of Goods Sold (COGS): $120 per

unit. Customer paid 30% of cash.

March 10, 2024, Purchase office equipment costing $12,000. The

company paid $2,000 in cash and financed the remaining $10,000.

March 31, 2024, Paid salaries totaling $8,000 for the month of

March. The payment was made in cash.

April 2, 2024, Received $20,000 in cash from customers for sales made in March 1, 2024.

April 30, 2024, Accrued interest expense of $600 on a loan taken out

last year. The interest rate is 6% per annum.

May 10, 2024, Purchased 1,000 units of raw materials at $50 per unit

from Gamma Suppliers. Payment Terms: Net 60 days.

June 1, 2024, Paid monthly rent of $5,000 for the production facility.

October 15, 2024, Took a short-term loan of $50,000 from the bank

at an annual interest rate of 6%. Payment Terms: Due in 6 months. 10

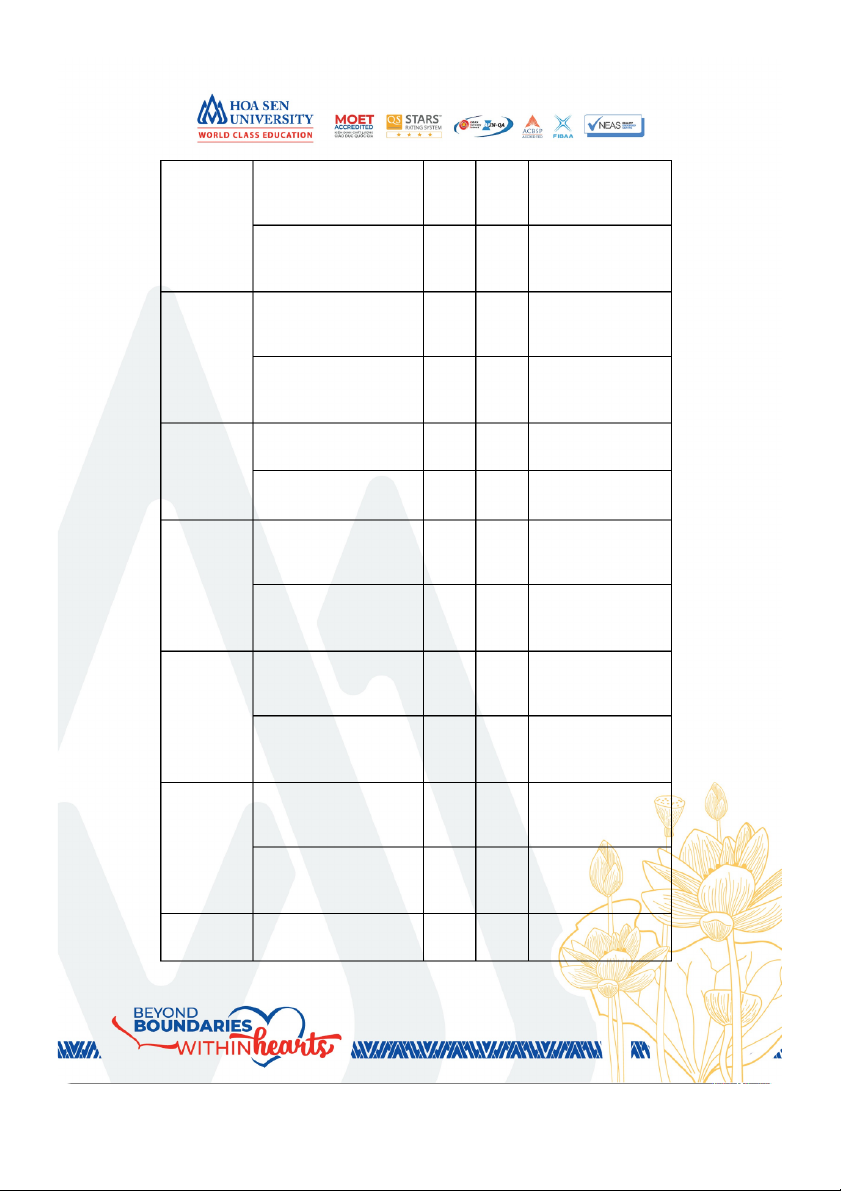

November 20, 2024, Paid $2,000 for utilities for the month of December.

December 31, 2024, recorded depreciation expense for machinery

amounting to $15,000 for the year. SOLUTION TRANSCATIONS ANALYSIS Date Account titile DR CR NOTE March 1 Cash 30.0 ] =500*200*30% 00 Account receivable 70.0 ] =500*200*70% 00 Revenue ] 10.0 =500*200 00 Cost of goods sold 60.0 ] =500*120 00 Inventory ] 60.0 ] 00 March 10 Equipment 12.0 ] ] 00 Cash ] 2.00 ] 0 Long term liabilities ] 10.0 ] 00 11 March 31 Salary expense 8.00 ] ] 0 Cash ] 8.00 ] 0 April 2 Cash 20.0 ] ] 00 Account Receivable ] 20.0 ] 00 April 30 Interest expense 600 ] ] Interest payable ] 600 ] May 10 Raw material 50.0 ] =50*1.000 00 Account Payable ] 50.0 ] 00 June 1 Rent expense 5.00 ] ] 0 Cash ] 5.00 ] 0 October Cash 50.0 ] ] 15 00 Note payable short ] 50.0 ] term 00 November Utilities expense 2.00 ] ] 12 20 0 Cash ] 2.00 ] 0 December Depreciation 15.0 ] ] 31 expense 00 Accumulated ] 15.0 ] depreciation] 00

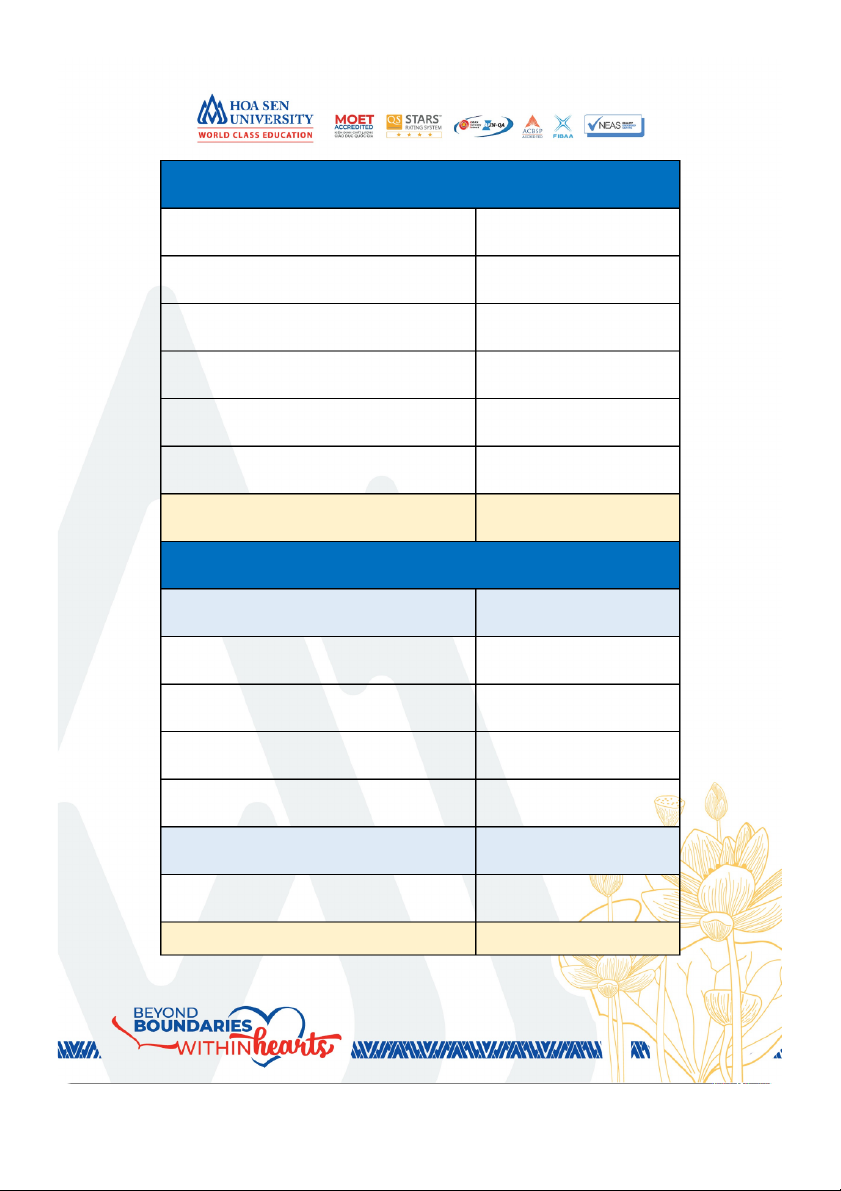

Analyzing the Impact of Transactions on the Income Statement and Balance Sheet Dat BALANCE SHEET e ] Ca Acco Inve Ra Equi Accu Acc Not Lon Inte sh unt ntor w pme mulat oun e g rest Recei y Mat nt ed t pay ter Pay vable eria depre Pay abl m abl l ciatio abl e liabi e n e sho litie rt s ter m Marc 30. 70.0 ] ] ] ] ] ] ] ] h 1 00 00 0 ] ] ] (60. ] ] ] ] ] ] ] 000) Marc (2. ] ] ] 12.0 ] ] ] 10.0 ] h 10 00 13 0) 00 00 Marc (8. ] ] ] ] ] ] ] ] ] h 31 00 0) April 20. (20.0 ] ] ] ] ] ] ] ] 2 00 00) 0 April ] ] ] ] ] ] ] ] ] 600 30 May ] ] ] 50. ] ] 50. ] ] ] 10 000 000 June (5. ] ] ] ] ] ] ] ] ] 1] 00 0) Octo 50. ] ] ] ] ] ] 50. ] ] ber 00 000 15 0 Nove (2. ] ] ] ] ] ] ] ] ] mbe 00 r 20 0) Dece ] ] ] ] ] (15.00 ] ] ] ] mbe 0) r 31 Total 83. 50.0 (60. 50. 12.0 (15.00 50. 50. 10.0 600 00 00 000) 000 00 0) 000 000 00 0 ] 14 ] Date INCOME STATEMENT ] Reven Cost Salary Rent Utilitie Intere Depreciati ue of expen expen s st on good se se expen expen expense s se se sold March 1 100.00 ] ] ] ] ] ] 0 ] ] 60.0 ] ] ] ] ] 00 March ] ] ] ] ] ] ] 10 March ] ] 8.000 ] ] ] ] 31 April 2 ] ] ] ] ] ] ] April 30 ] ] ] ] ] 600 ] May 10 ] ] ] ] ] ] ] June 1] ] ] ] 5.000 ] ] ] October ] ] ] ] ] ] ] 15 Novemb ] ] ] ] 2.000 ] ] er 20 15 Decemb ] ] ] ] ] ] 15.000 er 31 Total 100.00 60.0 8.000 5.000 2.000 600 15.000 0 00 IMCOME STATEMENT Total Revenue $100.000 Revenues $100.000 Total expense $90.600 ] Cost of goods sold $60.000 ] Salary expense $8.000 ] Interest expense $600 ] Utilities expense $2.000 ] Rent expense $5.000 ] Depreciation expense $15.000 Net income $9.400 BALANCE SHEET 16 ASSET Cash $83.000 Account Receivable $50.000 Inventory ($60.000) Raw material $50.000 Equipment $12.000 Accumulated depreciation ($15.000) TOTAL ASSET $120.000

LIABILITIES AND OWER EQUITY LIABILITIES D Account payable $50.000 Interest payable $600 Long term Liabilities] $10.000 Note payable – short term $50.000 OWNER EQUITY D Owner, capital $9.400

TOTAL LIABILITIES AND OWNER $120.000 17 EQUITY ] ] ]

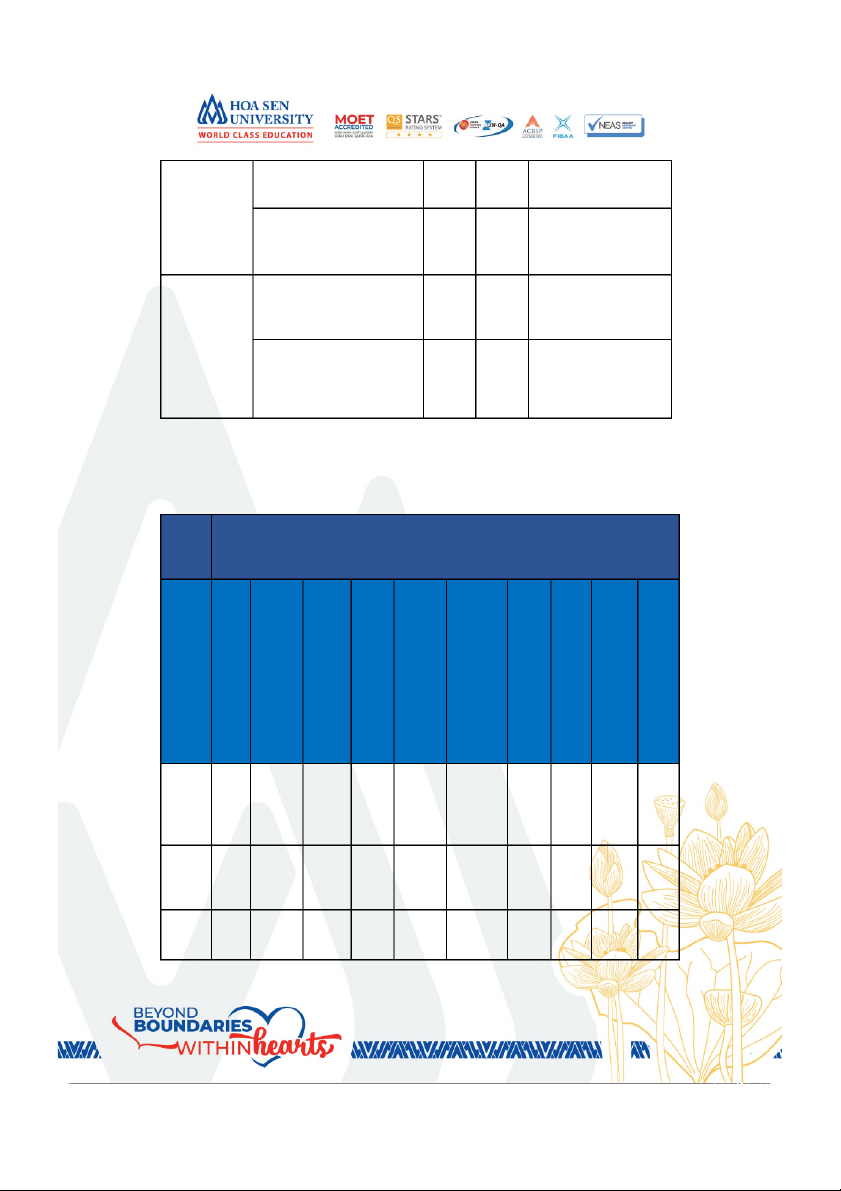

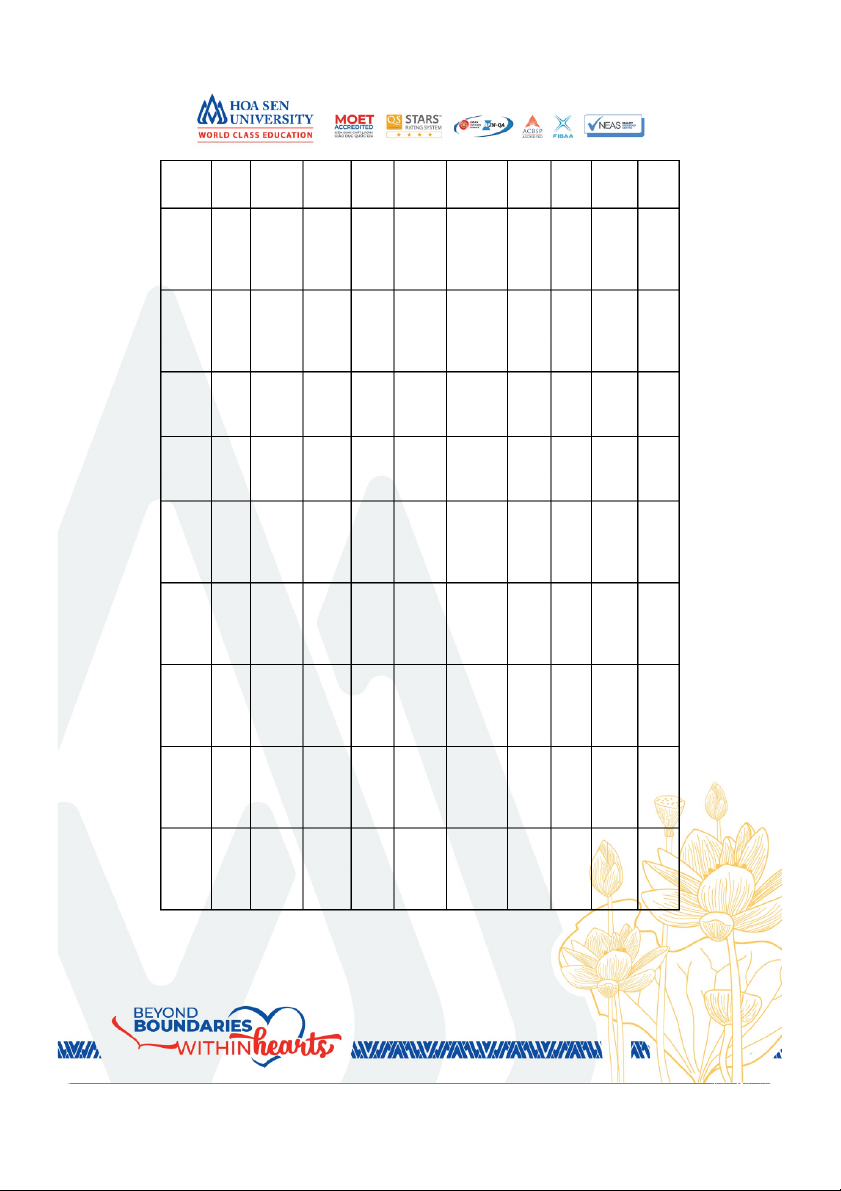

III. ACCOUNTING CYCLES (50 MARKS)

ABC Enterprises is a retail company that sells office furniture. The

company uses a perpetual inventory system, first-in-first-out

(FIFO), and straight-line depreciation.

Beginning balance of accounts in January 1, 2024 are listed as follow Accounts Amount(VND) Cash 1,000,000,000 Supplies 500,000,000 Notes payable 10,000,000,000 Accounts receivable 1,500,000,000 Accounts payable 2,000,000,000 Equipment 59,000,000,000

Merchandise inventories 5,000,000,000 Units: 2,500 units X; unit price Owner’s Capital 50,000,000,000 Accumulated 5,000,000,000 18 Depreciation

For the fiscal year ending December 31, 2024, the company recorded the following transactions.

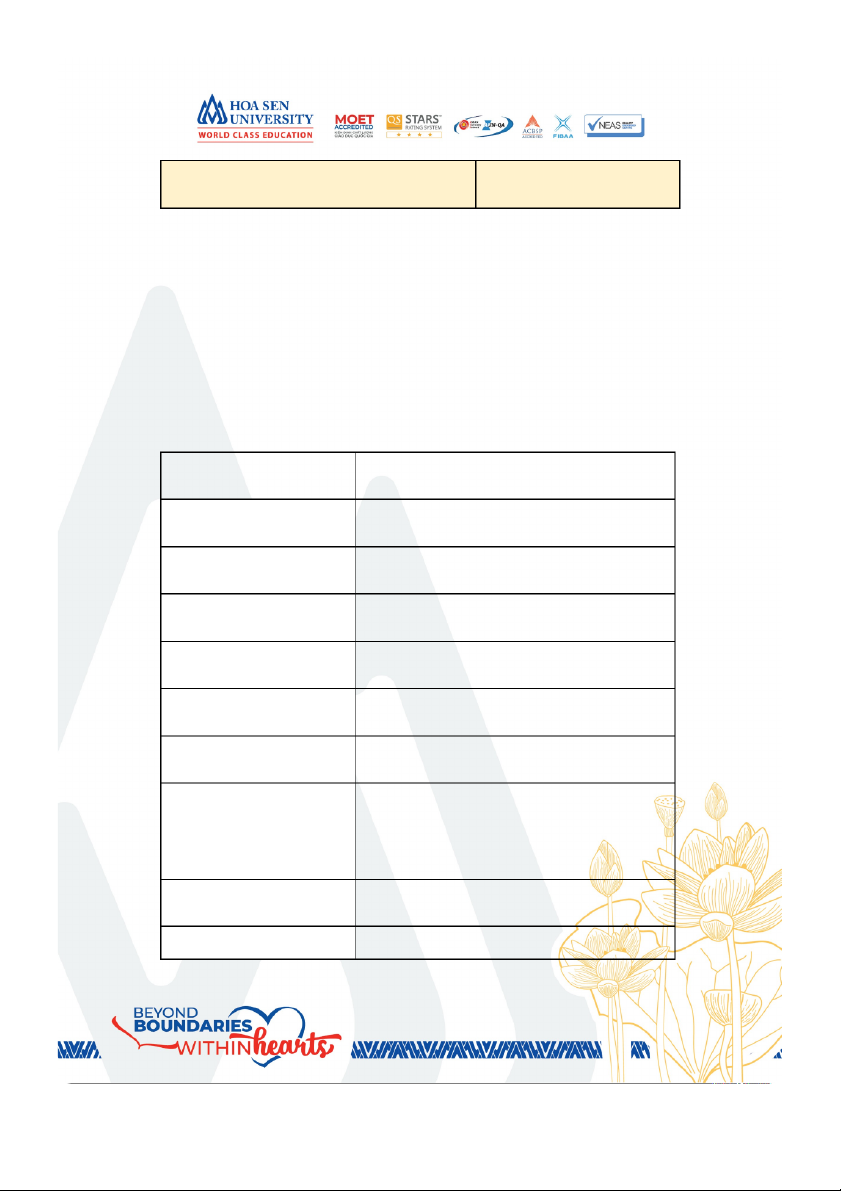

On December 1, company purchased equipment for 160,000,000VND.

The company paid , 60,000,000VND in cash and signed a note

payable for the remaining balance. The equipment is expected to

have a useful life of 5 years and a residual value of 10,000,000VND.

On December 10, purchased on account 5,000 units merchandise

inventory X of 2,100,000 VND per unit. On

December 12, collected cash from the customer for the beginning

Accounts receivable, 550,000,000 VND On

December 15, paid cash for rent expense to the supplier of 50,000,000 VND.

On December 16, sold 1,400 units merchandise inventory X of

3,500,000VND per unit. The customer paid 30% and remain on the balance.

On December 17, Paid 300,000,000VND to the supplier for the beginning account payable.

On December 18 purchased 5,500 units of 2,200,000VND per unit.

On December 19, the owner invested in the business] 2,000,000,000 VND cash.

On December 20 sold 6,000 units Merchandise Inventory X of 3,700,000 VND per unit. On

21, paid cash for utility expenses of 200,000,000 VND. December

On December 29 sold 3,500 units Merchandise Inventory X of 3,800,000 VND per unit On

31, paid salaries for all staffs of 200,000,000 December VND.

On December 31, calculate and record the accrued depreciation

expense for the fiscal year end. SOLUTION 19