Preview text:

19:36 10/8/24 Final review

Final exam (proposal): 60’ -

10 True false: 2 points – 2.5 points (Multiple choice and glossary review) -

4 short answers: range from 1.5-2.5 points/each -

Cover chapter 9,10,11,12 Review:

Q1: On January 1, 2015, Evers Company purchased the following two machines for use in its production process.

Machine A: The recorded cost of this machine was $80,000. Evers estimates that the useful

life of the machine is 5 years with a $5,000 salvage value remaining at the end of that time period.

Machine B: The recorded cost of this machine was $180,000. Evers estimates that the useful

life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period. Instructions

(a) Calculate the amount of depreciation expense that Evers should record for Machine A

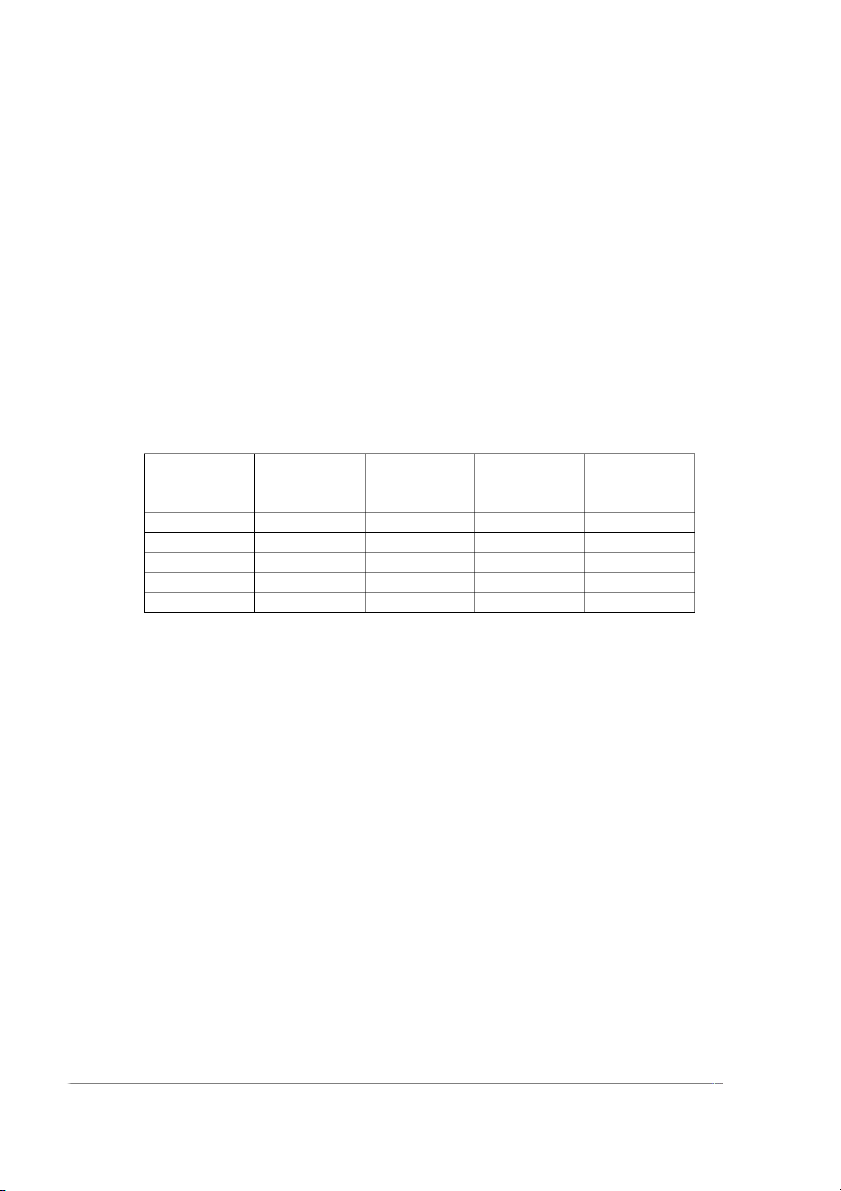

each year of its useful life under the declining-balance method. Year Book value Rate Depreciation Book value end expense annually 2015 80,000 40% 32,000 48,000 2016 48,000 40% 19,200 28,800 2017 28,800 40% 11,520 17,280 2018 17,280 40% 6,912 10,368 2019 10,368 X 5,368 5,000

(b) Calculate the amount of depreciation expense that Evers should record for Machine B

each year of its useful life under the units-of-activity method. The useful life of the

machine is 125,000 units. Actual usage is as follows: 2015, 45,000 units; 2016,

35,000 units; 2017, 25,000 units; 2018, 20,000 units.

Depreciation expense per unit = (180,000 – 10,000)/125,000 = 1.36 Year Actual usage Depreciation 2015 45,000 45,000 x 1.36 2016 35,000 2017 25,000 2018 20,000 2019

Q2: Shonrock Co. sold $100,000, 9%, 10-year bonds on January 1, 2019. The bonds were

dated January 1, and interest is paid on January 1 and July 1. The bonds were sold at 100.

1. Prepare the journal entry to record the issuance of the bonds on January 1, 2019. Dr cash 10,000 Cr Bond Payable 100,000

2. Prepare the journal entry to record bond interest on July 1, 2019 and Dec 31, 2019. about:blank 1/7 19:36 10/8/24 Final review July 1,2020 Dr Interest Expense 4,500 Dr Cash 4,500 Dec 31, 2020 Dr Interest expense 4,500 Cr Interest Payable 4,500

3. Assume that on Jan 1, 2020, Shonrock calls the bonds at 102. Record the redemption

of the bonds (assume that interest was not paid) Dr Interest Payable 4,500 Cr Cash 4,500 Dr Bond payable 100,000

Dr Loss on Bond redemption 2,000 Cr Cash 102,000

4. Shonrock Co. sold $10,000, 10%, 10-year bonds on January 1, 2020. Prepare the

journal entry to record the issuance of the bond if the bonds were sold at 105 and if the bonds were sold at 98. Dr Cash 10,500 Cr Bond payable 10,500 Dr Cash 9,800 Cr Bond payable 9,800

Q3: Hawthorne Corporation had the following stockholders’ equity accounts on January 1, 2019:

Ordinary Share ($1 par) $400,000,

Share Premium – Ordinary $500,000, Retained Earnings $100,000.

In 2019, the company had the following treasury stock transactions.

Mar. 1 Purchased 5,000 shares at $7 per share. Dr Treasury share 5,000 x $7 = 35,000 Cr Cash 35,000

June 1 Sold 1,000 shares at $10 per share. Dr Cash 1,000 x $10 = 10,000 Cr Treasury Share 7,000 Cr Share Premium – Treasury 3,000

Sept. 1 Sold 2,000 shares at $9 per share. Dr Cash 2,000 x $9 = 18,000 Cr Treasury Share 14,000

Cr Share premium – Treasury4,000

Dec. 1 Sold 1,000 shares at $5 per share. Dr Cash 1,000 x $5 = 5,000 about:blank 2/7 19:36 10/8/24 Final review Dr Share Premium – Treasury 2,000 Cr Treasury Share 7,000

Hawthorne Corporation uses the cost method of accounting for treasury stock. In 2019, the

company reported net income of $80,000. Dr Income summary/ Cr RE 80,000 Instructions

a. Journalize the treasury stock transactions.

b. Prepare the stockholders’ equity section for Hawthorne Corporation at December 31, 2019. Ordinary Share ($1 par) $400,000 400,000 share issued 390,000 share outstanding Share Premium – Ordinary $500,000 Share Premium – Treasury $5,000 RE $180,000 Less: Treasury Share $7,000 Total Equity

Q4: On January 1, 2019, Chen Corporation had the following stockholders’ equity accounts.

Ordinary Share ($5 par value, 200,000 shares issued and outstanding): $1,000,000

Share Premium—Ordinary: 200,000 Retained Earnings: 840,000

During the year, the following transactions occurred.

Jan 15, Declared a $1 cash dividend per share to stockholders of record on January 31, payable February 15. Dr Cash dividend 200,000 Cr Dividend payable 200,000

Jan 31, Paid the dividend declared in January. Dr Dividend payable 200,000 Cr Cash 200,000

Jun 1, Declared a 10% stock dividend to stockholders of record on Jun 30, payment on

July 15. On Jun 1, the market price of the stock was $15 per share. Dr Share dividend 10%x200,000x$15 = 300,000

Cr Ordinary share dividend distributable 100,000 Cr Share Premium – Ord 200,000

Jul 15, Issued the shares for the stock dividend.

Dr Ordinary shar dividend distributable 100,000 Cr Share Capital – Ord 100,000 Close dividend to RE: Dr RE 500,000 Cr Cash dividend 200,000 Cr Share dividend 300,000 Instructions

a. Journalize the transactions. about:blank 3/7 19:36 10/8/24 Final review

b. Prepare the stockholders’ equity section at December 31, 2019.

Ordinary shares ($5 par value, 220,000 shares issued and outstanding): $1,100,000 Share Premium ordinary

Q5: Talkington Electronics issues a $400,000, 8%, 10-year mortgage note on December

31, 2019. The terms of the note provide for annual installment payments of $59,612.

Payments are due on December 31.

a. Prepare an installment payments schedule for the first 4 years. Cash payment Interest Reduction on Principal expense principal unpaid balance Issue date Dec 31,2019 2020 $59,612 32,000 27,612 372,388 2021 $59,612 29,791 29,821 342,567 2022 $59,612 2023 $59,612 b. Prepare the entries for The loan: Dr Cash 400,000 Cr Mortgage note payable 400,000 The first installment payment: Dr Interest expense 32,000 Dr Mortgage payable 27,612 Cr Cash 59,612

c. Show how the total mortgage liability should be reported on the statement of financial

position at December 31, 2020.

Statement of financial position (partial) about:blank 4/7 19:36 10/8/24 Final review Dec 31,2020

Non – current liabilities Mortgage note payable 342,567 Current Liabilities

Current maturity portion of mortgage note payable 29,821

Q6: Streep Factory provides a 2-year warranty with one of its products which was first

sold in 2020. Streep sold $1,000,000 of products subject to the warranty. Streep expects

$125,000 of warranty costs over the next 2 years. In 2020, Streep spent $70,000 servicing

warranty claims. Prepare Streep’s journal entries in 2020 to record the sales of its products,

the costs incurred in honoring the warranties (assume expenditures are for repair costs), and

the estimated liability for warranties at December 31, 2020.

Prepare Streep’s journal entries in 2020 to record the sales of its products; Dr Cash 1,000,000 Cr Sales revenue 1,000,000

The costs incurred in honoring the warranties (assume expenditure are for repair costs), and (Chap 10) Dr Warranty

Q7: The payroll of Kee Ltd. for September 2020 is as follows (amounts in thousands):

total payroll was ¥340,000; income taxes in the amount of ¥80,000 were withheld, as was

¥9,000 in union dues; and the current Social Security tax is 8% of an employee’s wages. The

employer must also remit 8% for employees’ wages for Social Security taxes.

Prepare the journal entries to record

(a) salaries and wages payable, Dr SW expense 340,000 Cr Income tax payable 80,000 Cr Union due Payable 9,000 Cr Social security tax payable 8%x340,000 = 27,200 Cr SW payable ?

(b) salaries and wages paid, and about:blank 5/7 19:36 10/8/24 Final review Dr SW payable ? Cr Cash ? (c) employer payroll taxes. Dr payroll expense 8%x340,000 = 27,200 Cr Social security tax payable 27,200

Q8: Francis Manufacturing owns equipment that cost €50,000 when purchased on

January 1, 2017. It has been depreciated using the straight-line method based on an

estimated residual value of €8,000 and an estimated useful life of 5 years. The fiscal year-end is Dec 31.

Prepare Francis’s journal entries to record the sale of the equipment in these four independent situations. a.

Sold for €28,000 on January 1, 2020.

Depreciation expense for 3 years = (50,000 – 8,000)/5 *3 = 25,200 Dr Cash 28,000

Dr Accumulated depreciation 25,000 Cr Equipment 50,000

Cr Gain on disposal of equipment 3,200

b. Sold for €28,000 on May 1, 2020.

Depreciation expense for 3 years = (50,000 -8,000)/5*3 = 25,200

Depreciation expense for 4 months = (50,000 – 8,000) x 4/12 = Dr Depreciation expense 2,800

Cr Accumulated depreciation 2,800 Dr Cash 28,00 Cr Equipment 50,000 Cr Gain on disposal 6,000

c. Sold for €11,000 on January 1, 2020. Dr Cash 11,000 Dr Accumulated depreciation about:blank 6/7 19:36 10/8/24 Final review

d. Sold for €11,000 on October 1, 2020.

Record for depreciation expense for 9 months Dr Depreciation expense 6,300 Cr Accumulated depreciation 6,300 Dr Cash 11,000 Dr Accumulated depreciation 31,500

Dr Loss on disposal of equipment 7,500 Cr Equipment 50,000 about:blank 7/7