Preview text:

Financial Accounting 2 CHAPTER 12 FORMING A PARTNERSHIP

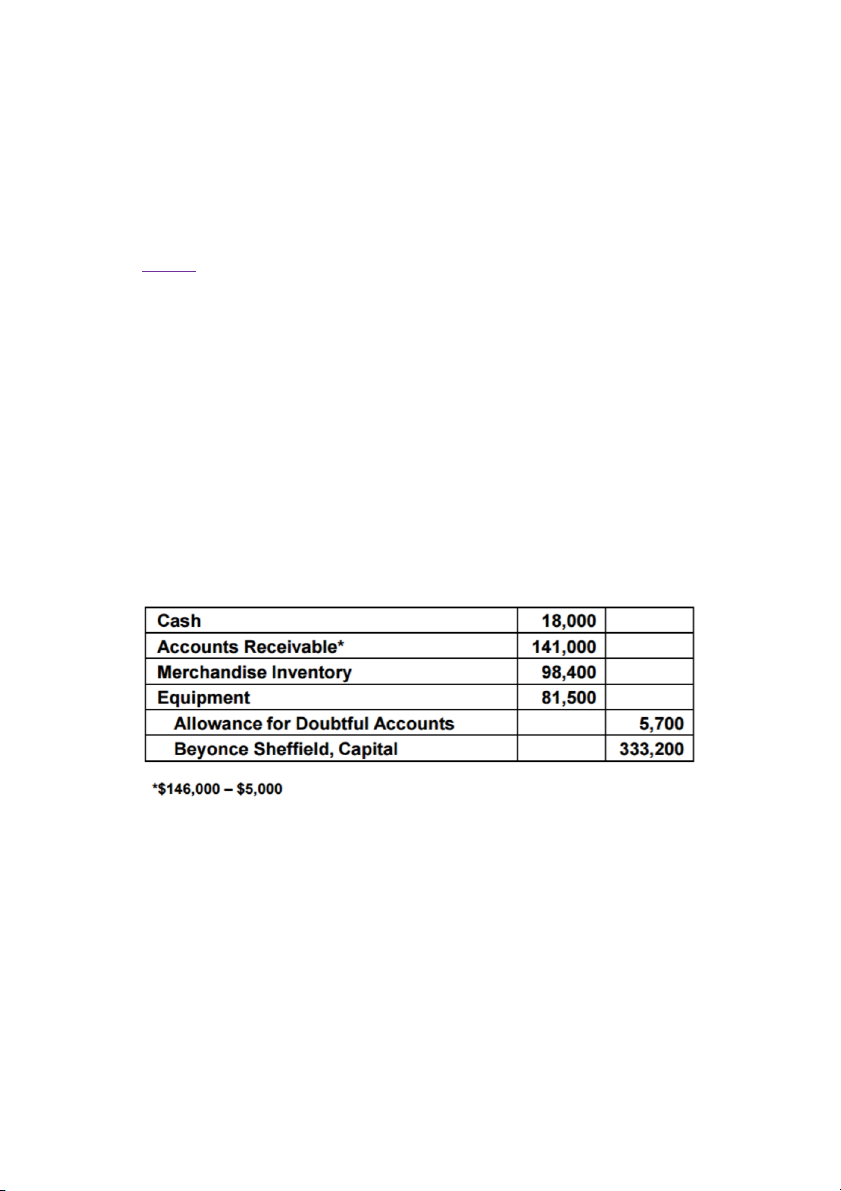

EX 12-1: Recording partner’s original investment

Beyonce Sheffield and Brittany Field decide to form a partnership by combining the

assets of their separate businesses. Sheffield contributes the following assets to the

partnership: cash, $18,000; accounts receivable with a face amount of $146,000 and an

allowance for doubtful accounts of $4,200; merchandise inventory with a cost of $92,000;

and equipment with a cost of $136,000 and accumulated depreciation of $45,000.

The partners agree that $5,000 of the accounts receivable are completely worthless and

are not to be accepted by the partnership, that $5,700 is a reasonable allowance for the

uncollectibility of the remaining accounts, that the merchandise inventory is to be recorded

at the current market price of $98,400, and that the equipment is to be valued at $81,500.

Journalize the partnership’s entry to record Sheffield’s investment.

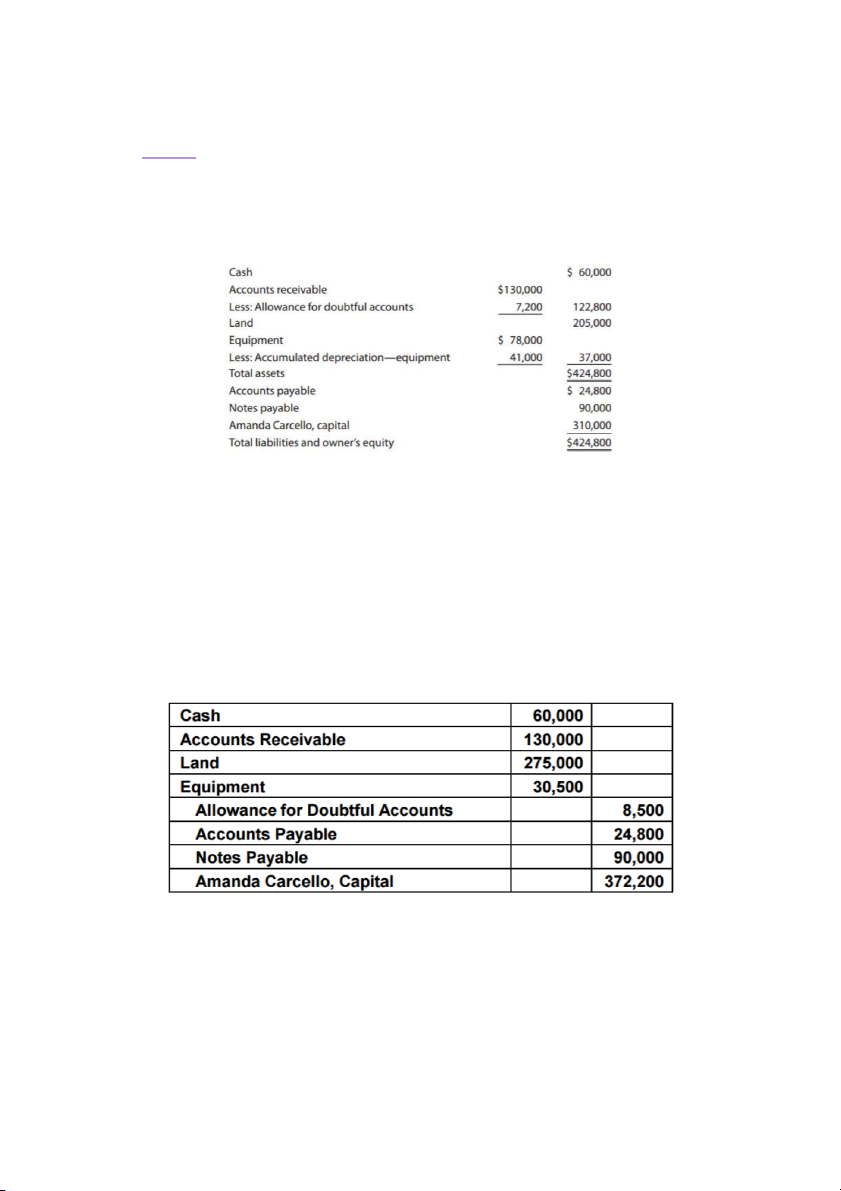

EX 12-2: Recording partner’s original investment

Amanda Carcello and Miguel Gaspar form a partnership by combining assets of their

former businesses. The following balance sheet information is provided by Carcello, sole proprietorship:

Carcello obtained appraised values for the land and equipment as follows: Land $275,000 Equipment 30,500

An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $8,500.

Journalize the partnership’s entry for Carcello’s investment.

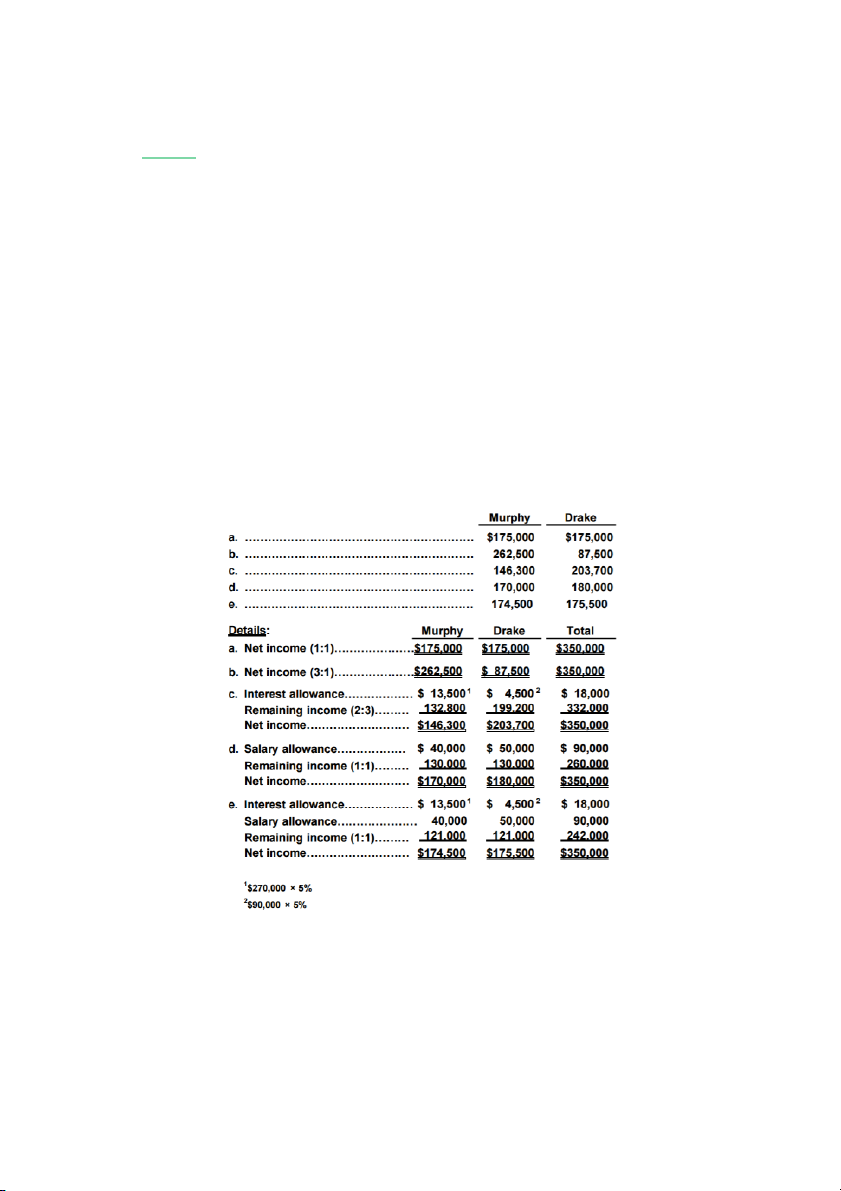

EX 12-3: Dividing partnership income

Nicole Murphy and Ashley Drake formed a partnership, investing $270,000 and $90,000,

respectively. Determine their participation in the year’s net income of $350,000 under each

of the following independent assumptions:

(a) no agreement concerning division of net income;

(b) divided in the ratio of original capital investment;

(c) interest at the rate of 5% allowed on original investments and the remainder divided in the ratio of 2:3;

(d) salary allowances of $40,000 and $50,000, respectively, and the balance divided equally;

(e) allowance of interest at the rate of 5% on original investments, salary allowances of

$40,000 and $50,000, respectively, and the remainder divided equally.

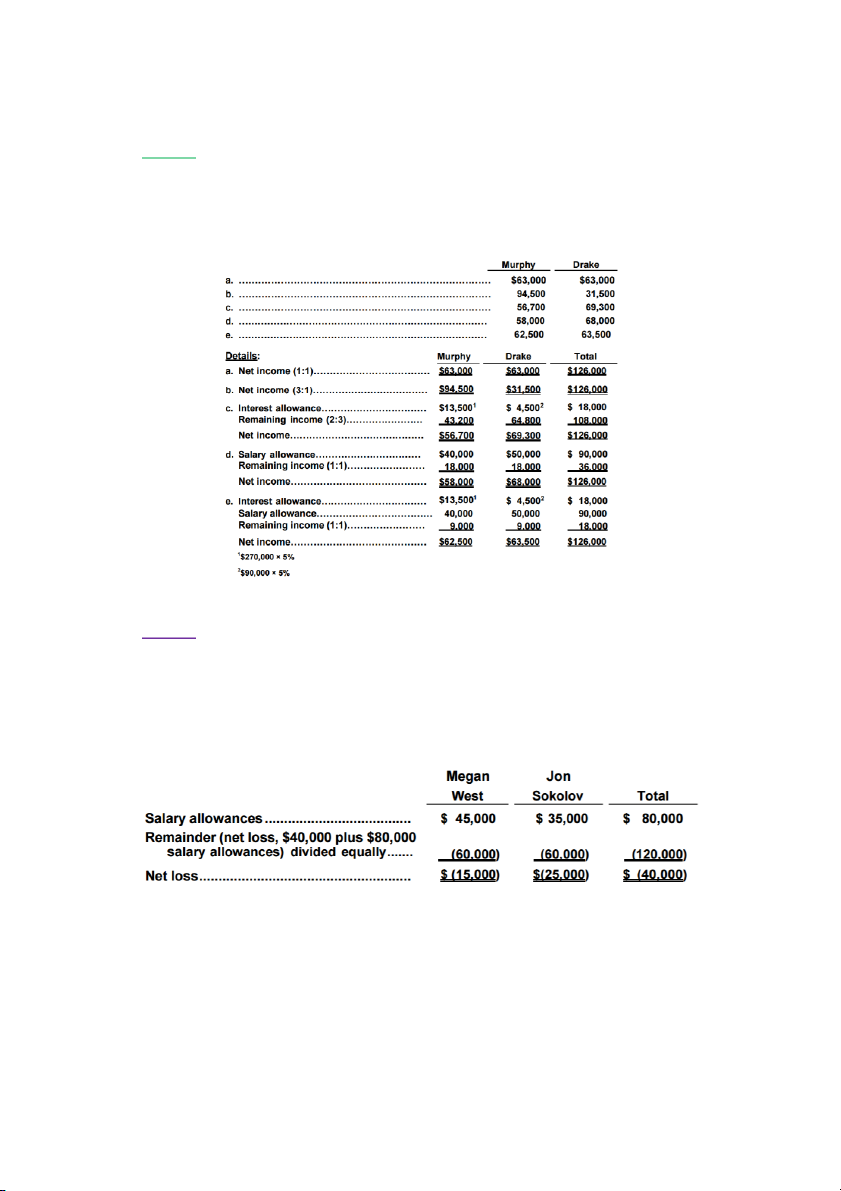

EX 12-4: Dividing partnership income

Determine the income participation of Murphy and Drake, according to each of the five

assumptions as to income division listed in Exercise 12-3, if the year’s net income is $126,000.

EX 12-5: Dividing partnership net loss

Megan West and Jon Sokolov formed a partnership in which the partnership agreement

provided for salary allowances of $45,000 and $35,000, respectively. Determine the

division of a $40,000 net loss for the current year, assuming remaining income or losses are

shared equally by the two partners. WITHDRAWAL OF A PARTNER

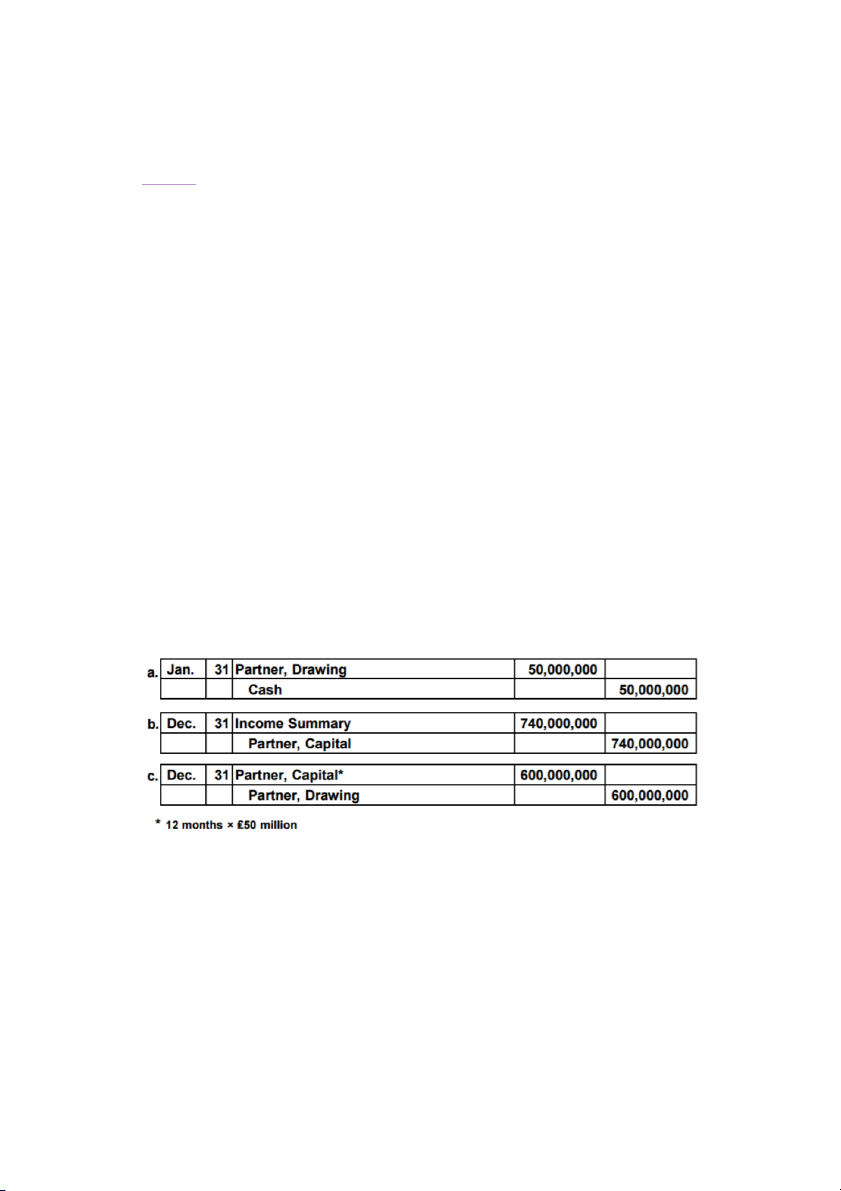

EX 12-9: Partner income and withdrawal journal entries

The notes to the annual report for KPMG LLP (U.K.) indicated the following policies

regarding the partners’ capital:

The allocation of profits to those who were partners during the financial year occurs

following the finalization of the annual financial statements. During the year, partners

receive monthly drawings and, from time to time, additional profit distributions. Both

the monthly drawings and profit distributions represent payments on account of current-

year profits and are reclaimable from partners until profits have been allocated.

Assume that the partners draw £50 million per month for 2014 and the net income for the year

is £740 million. Journalize the partner capital and partner drawing control accounts in the following requirements:

a. Provide the journal entry for the monthly partner drawing for January.

b. Provide the journal entry to close the income summary account at the end of the year.

c. Provide the journal entry to close the drawing account at the end of the year.

d. Why would partner drawings be considered “reclaimable” until profits have been allocated?

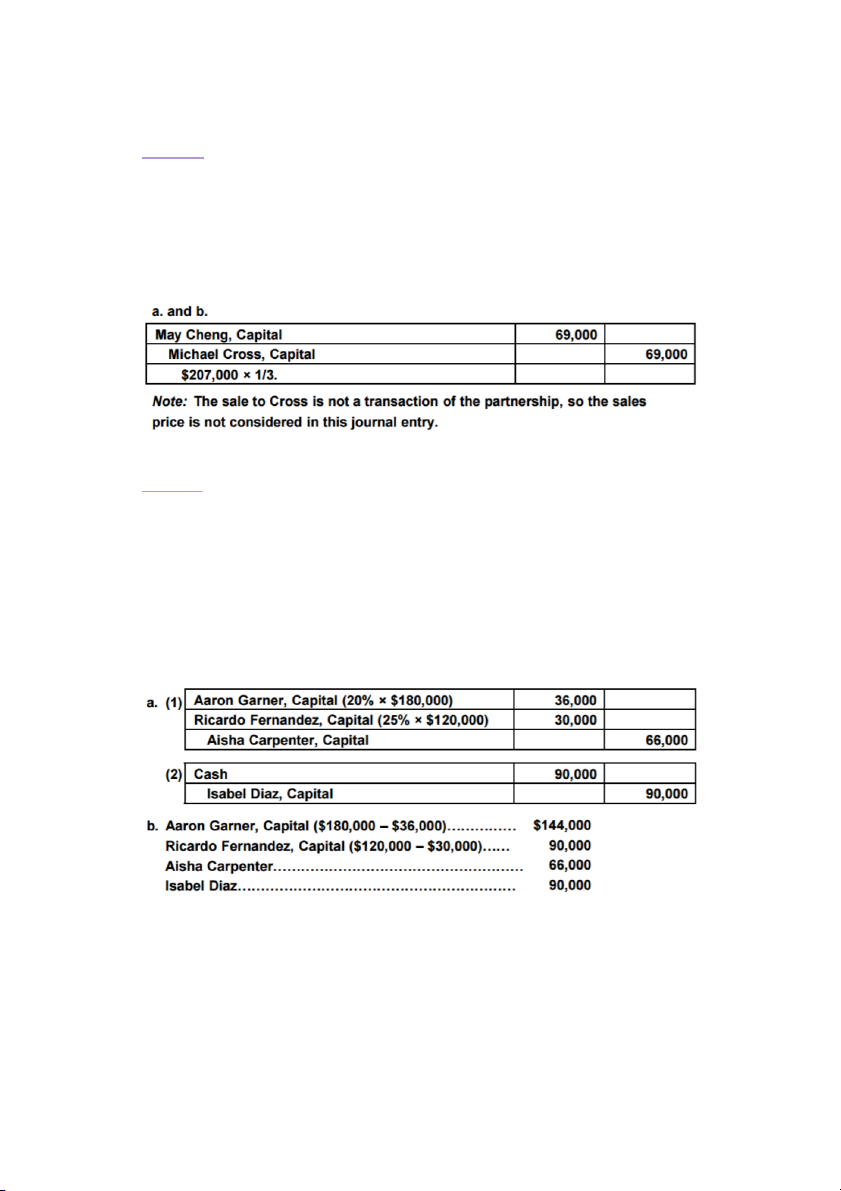

EX 12-10: Admitting new partners

May Cheng and Hannah Webster are partners who share in the income equally and have

capital balances of $207,000 and $62,500, respectively. Cheng, with the consent of

Webster, sells one-third of her interest to Michael Cross. What entry is required by the

partnership if the sales price is (a) $60,000? (b) $80,000?

EX 12-11: Admitting new partners who buy an interest and contribute assets

The capital accounts of Aaron Garner and Ricardo Fernandez have balances of $180,000

and $120,000, respectively. Aisha Carpenter and Isabel Diaz are to be admitted to the

partnership. Carpenter buys one-fifth of Garner’s interest for $50,000 and one-fourth of

Fernandez’s interest for $32,000. Diaz contributes $90,000 cash to the partnership, for

which she is to receive an ownership equity of $90,000.

a. Journalize the entries to record the admission of (1) Carpenter and (2) Diaz.

b. What are the capital balances of each partner after the admission of the new partners?

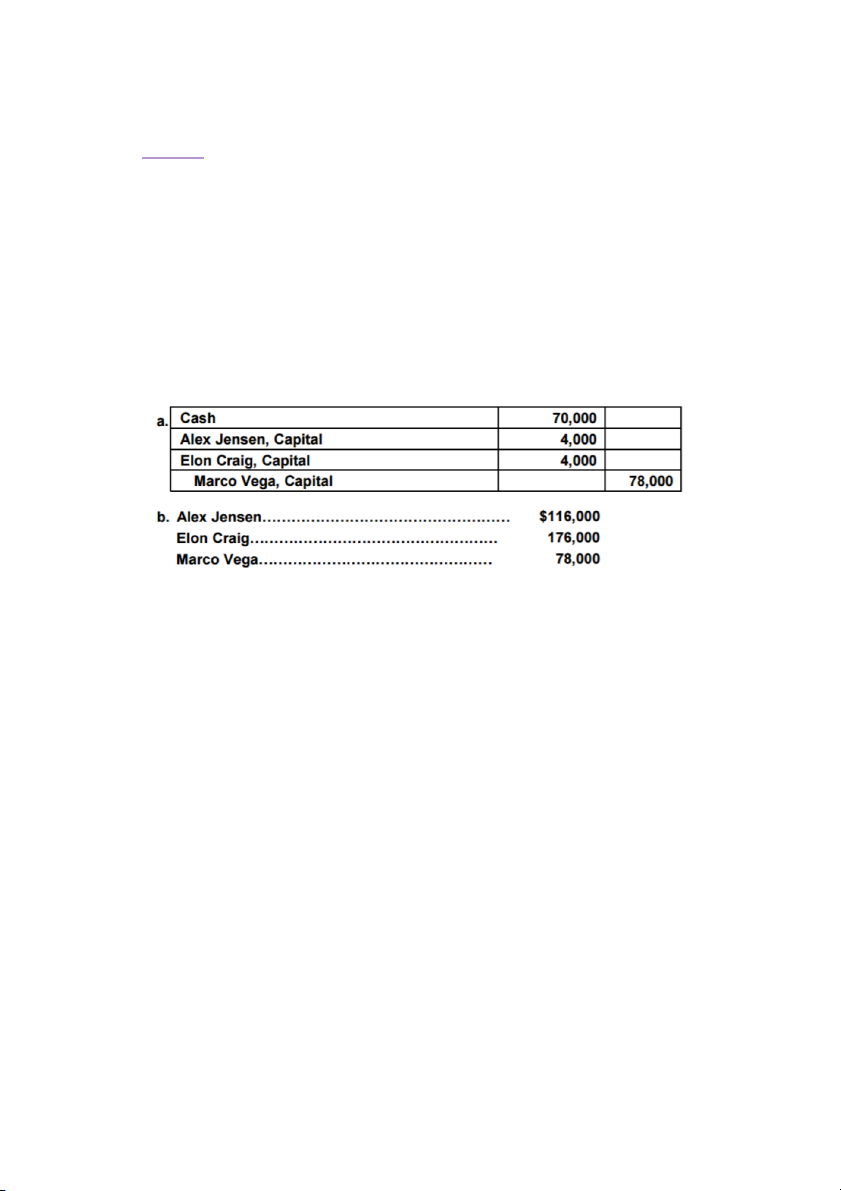

EX 12-12: Admitting new partner who contributes assets

After the tangible assets have been adjusted to current market prices, the capital accounts of

Alex Jensen and Elon Craig have balances of $120,000 and $180,000, respectively. Marco

Vega is to be admitted to the partnership, contributing $70,000 cash to the partnership, for

which he is to receive an ownership equity of $78,000. All partners share equally in income.

a. Journalize the entry to record the admission of Vega, who is to receive a bonus of $8,000.

b. What are the capital balances of each partner after the admission of the new partner?

c. Why are tangible assets adjusted to current market prices, prior to admitting a new partner?

c. Tangible assets should be adjusted to current market prices so that the new partner does

not share in any gains or losses from changes in market prices prior to being admitted. For

example, if the market price of land doubled prior to admitting a new partner, the existing

partners should realize the increase in the value of the land in their capital accounts prior to

the new partner’s admission. Otherwise, the new partner would share in the increase in the market value of the land.

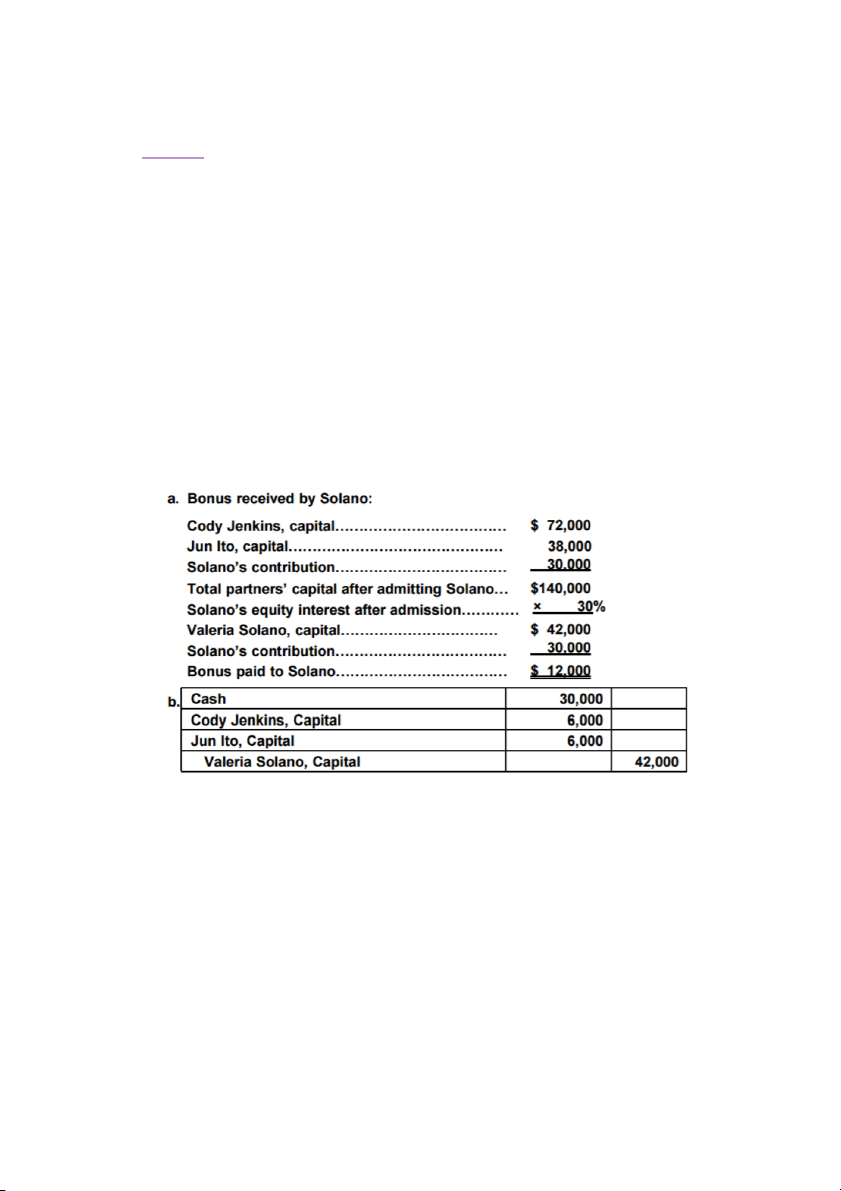

EX 12-13: Admitting new partner with bonus

Cody Jenkins and Jun Ito formed a partnership to provide landscaping services. Jenkins and

Ito shared profits and losses equally. After all the tangible assets have been adjusted to

current market prices, the capital accounts of Cody Jenkins and Jun Ito have balances of

$72,000 and $38,000, respectively. Valeria Solano has expertise with using the computer to

prepare landscape designs, cost estimates, and renderings. Jenkins and Ito deem these skills

useful; thus, Solano is admitted to the partnership at a 30% interest for a purchase price of $30,000.

a. Determine the recipient and amount of the partner bonus.

b. Provide the journal entry to admit Solano into the partnership.

c. Why would a bonus be paid in this situation?

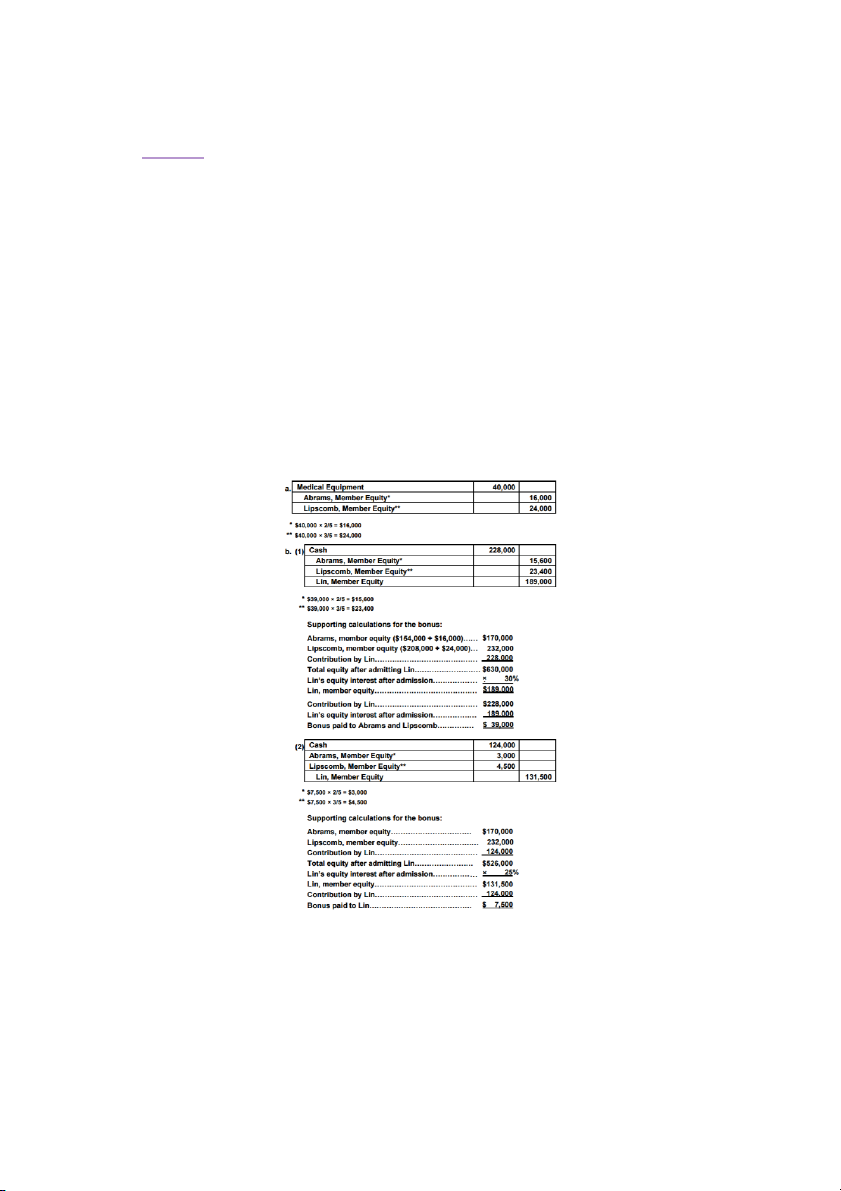

EX 12-14: Admitting a new LLC member with bonus

Alert Medical, LLC, consists of two doctors, Abrams and Lipscomb, who share in all

income and losses according to a 2:3 income-sharing ratio. Dr. Lin has been asked to join

the LLC. Prior to admitting Lin, the assets of Alert Medical were revalued to reflect their

current market values. The revaluation resulted in medical equipment being increased by

$40,000. Prior to the revaluation, the equity balances for Abrams and Lipscomb were

$154,000 and $208,000, respectively.

a. Provide the journal entry for the asset revaluation.

b. Provide the journal entry for the bonus under the following independent situations:

1. Lin purchased a 30% interest in Alert Medical, LLC, for $228,000.

2. Lin purchased a 25% interest in Alert Medical, LLC, for $124,000.

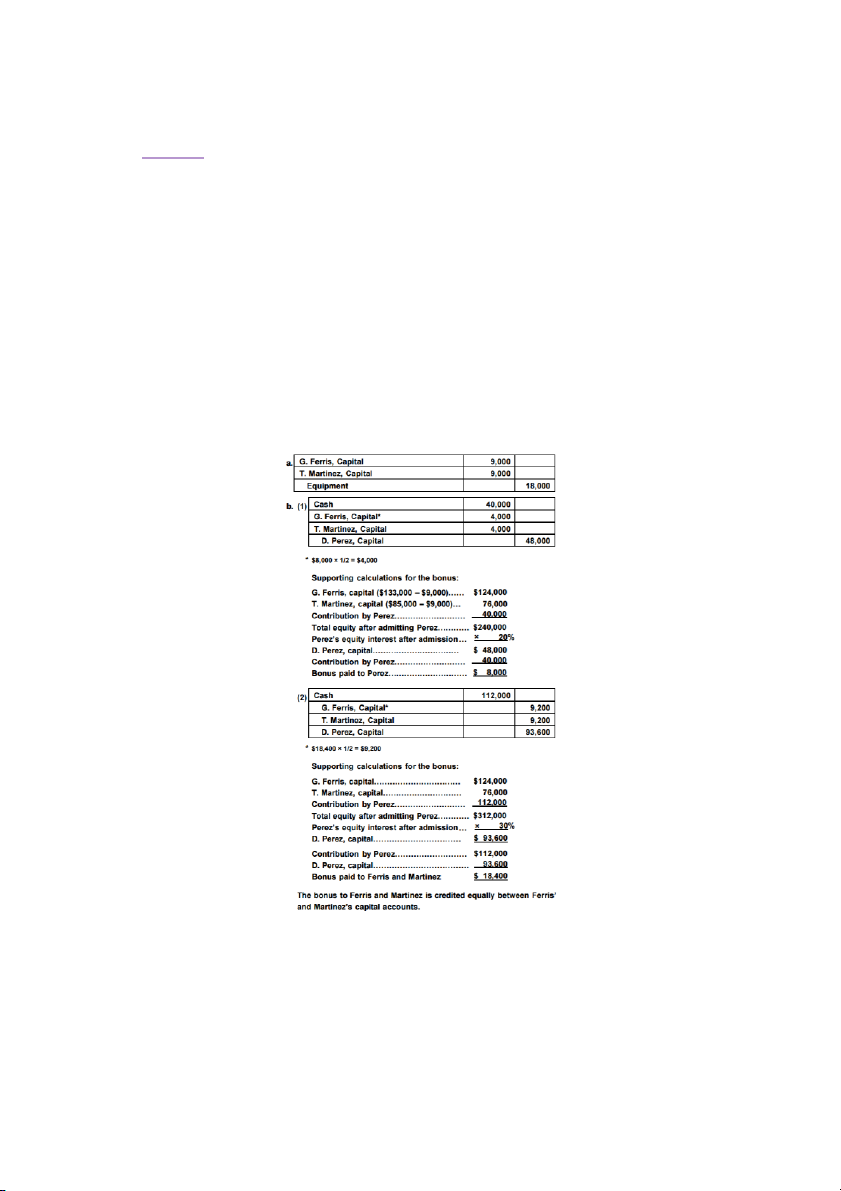

EX 12-15: Admitting new partner with bonus

G. Ferris and T. Martinez are partners in Elegant Event Consultants. Ferris and Martinez

share income equally. D. Perez will be admitted to the partnership. Prior to the admission,

equipment was revalued downward by $18,000. The capital balances of each partner are

$133,000 and $85,000, respectively, prior to the revaluation.

a. Provide the journal entry for the asset revaluation.

b. Provide the journal entry for Perez’s admission under the following independent situations:

1. Perez purchased a 20% interest for $40,000.

2. Perez purchased a 30% interest for $112,000.

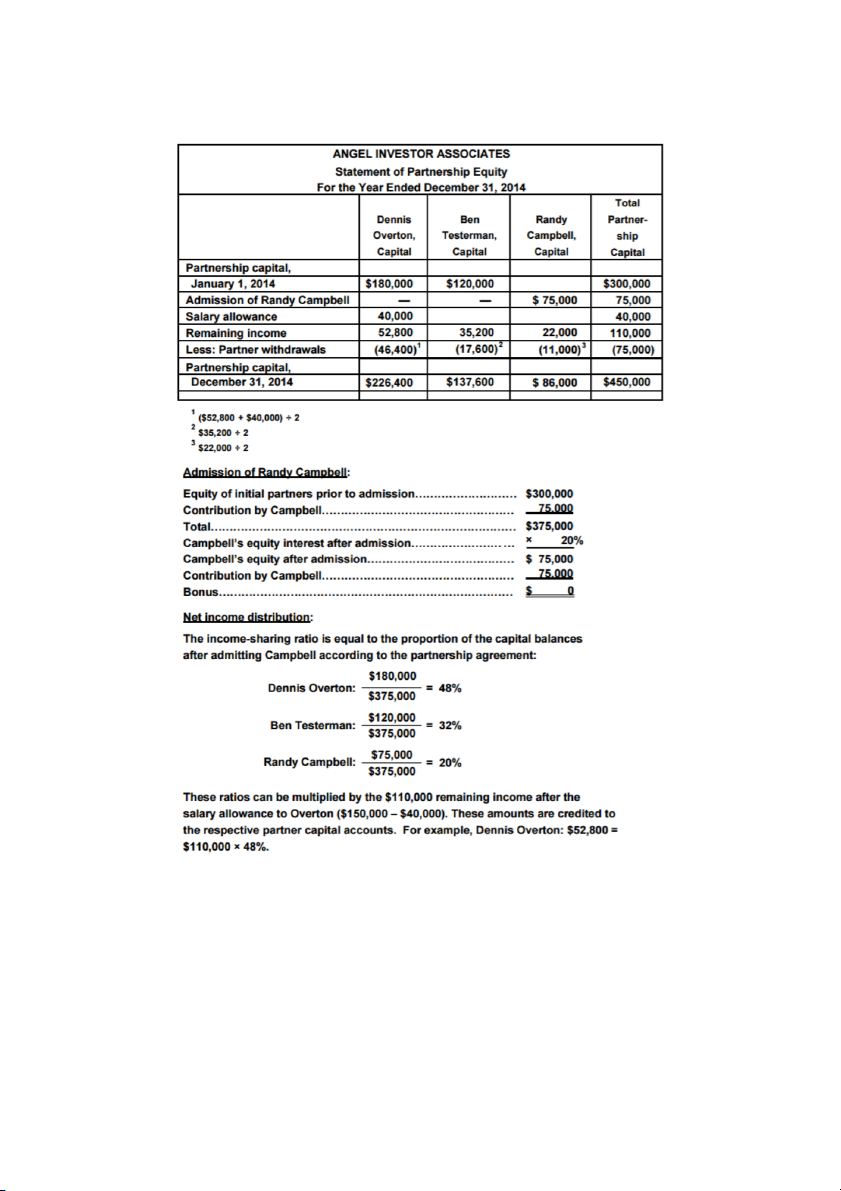

EX 12-16: Partner bonuses, statement of partners’ equity

The partnership of Angel Investor Associates began operations on January 1, 2014, with

contributions from two partners as follows: Dennis Overton $180,000 Ben Testerman 120,000

The following additional partner transactions took place during the year:

1. In early January, Randy Campbell is admitted to the partnership by contributing

$75,000 cash for a 20% interest.

2. Net income of $150,000 was earned in 2014. In addition, Dennis Overton received

a salary allowance of $40,000 for the year. The three partners agree to an income-sharing

ratio equal to their capital balances after admitting Campbell.

3. The partners’ withdrawals are equal to half of the increase in their capital balances

from salary allowance and income.

Prepare a statement of partnership equity for the year ended December 31, 2014.

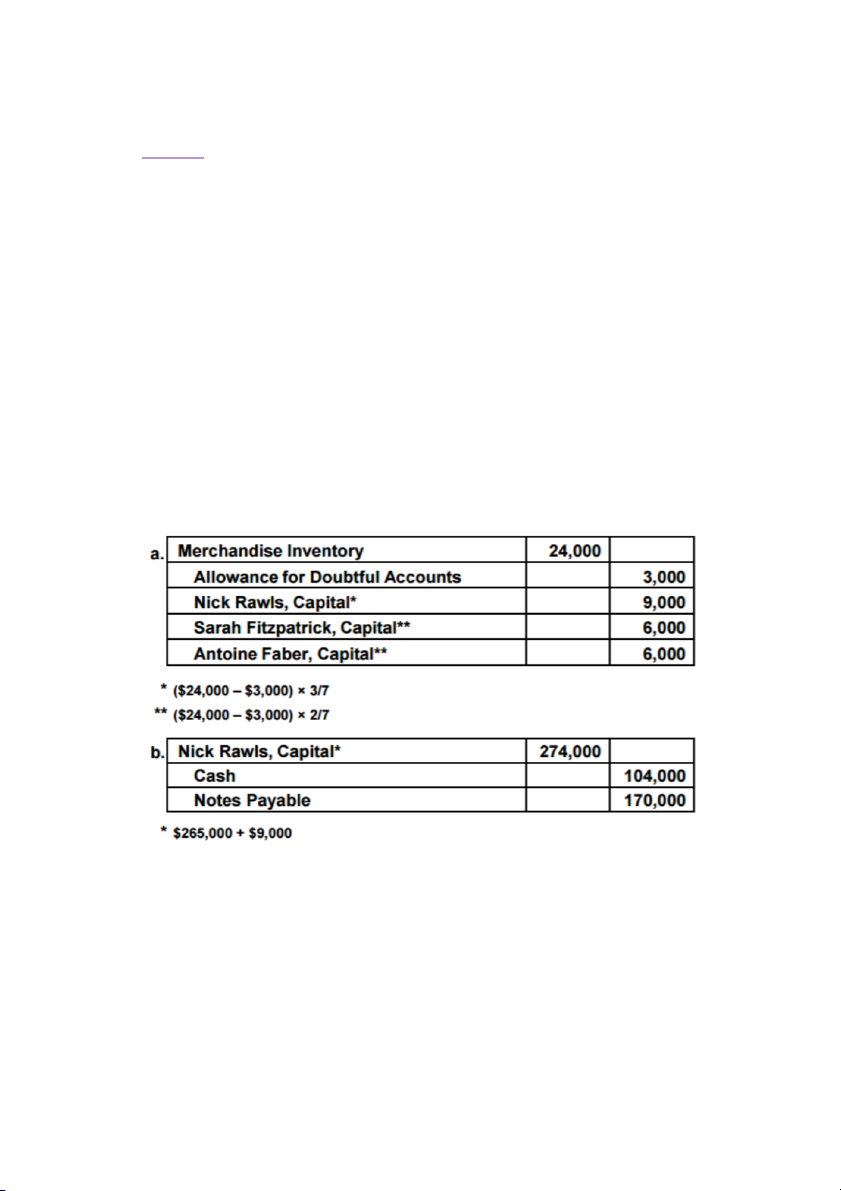

EX 12-17: Withdrawal of partner

Nick Rawls is to retire from the partnership of Rawls and Associates as of March 31, the

end of the current fiscal year. After closing the accounts, the capital balances of the

partners are as follows: Nick Rawls, $265,000; Sarah Fitzpatrick, $130,000; and Antoine

Faber, $165,000. They have shared net income and net losses in the ratio of 3:2:2. The

partners agree that the merchandise inventory should be increased by $24,000, and the

allowance for doubtful accounts should be increased by $3,000. Rawls agrees to accept a

note for $170,000 in partial settlement of his ownership equity. The remainder of his

claim is to be paid in cash. Fitzpatrick and Faber are to share equally in the net income or

net loss of the new partnership.

Journalize the entries to record (a) the adjustment of the assets to bring them into

agreement with current market prices and (b) the withdrawal of Rawls from the partnership.

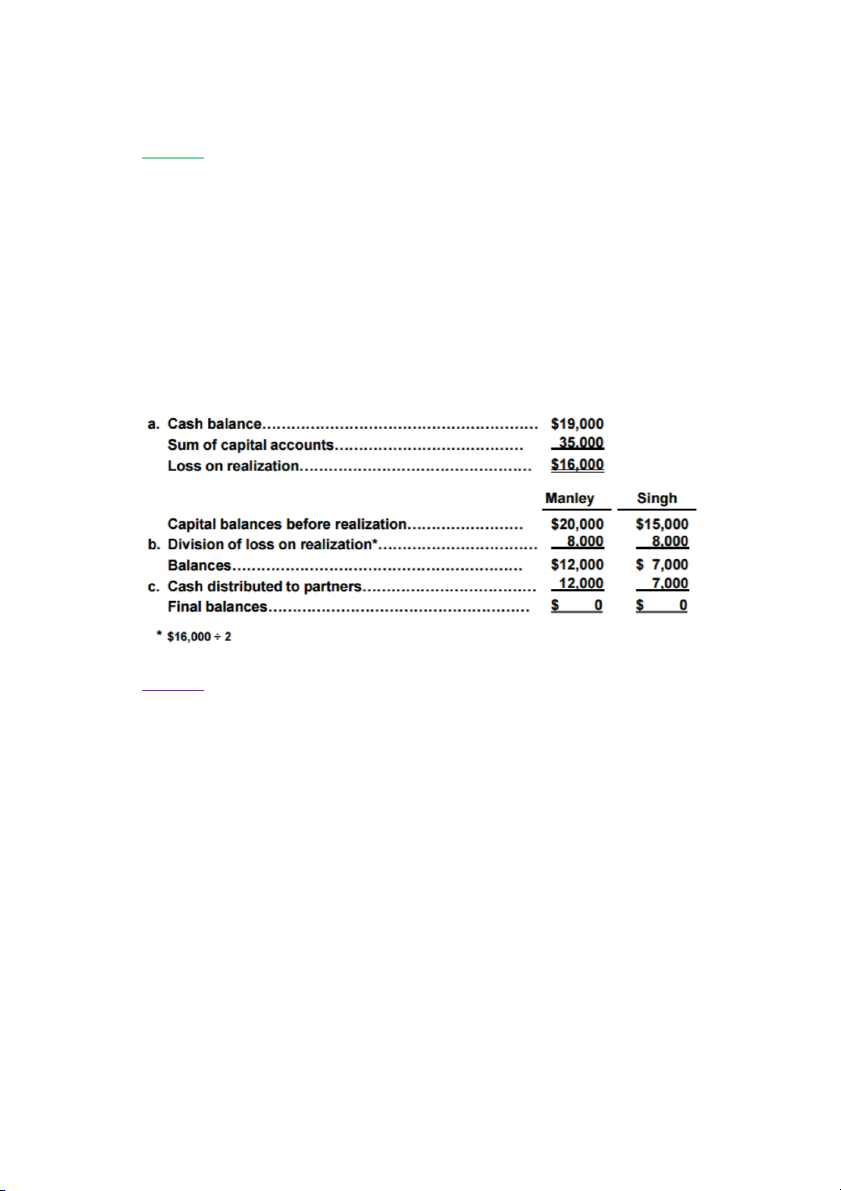

EX 12-19: Distribution of cash upon liquidation

Manley and Singh are partners, sharing gains and losses equally. They decide to terminate

their partnership. Prior to realization, their capital balances are $20,000 and $15,000,

respectively. After all noncash assets are sold and all liabilities are paid, there is a cash balance of $19,000.

a. What is the amount of a gain or loss on realization?

b. How should the gain or loss be divided between Manley and Singh?

c. How should the cash be divided between Manley and Singh?

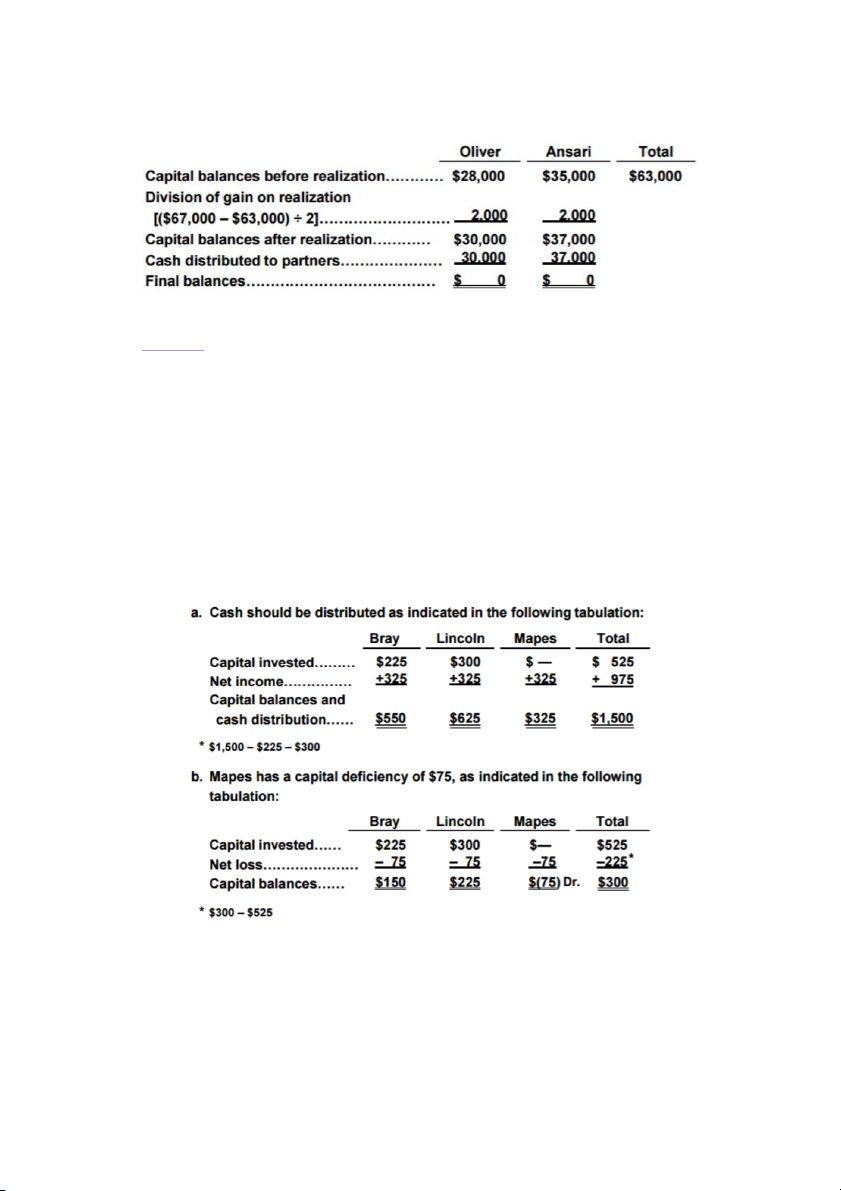

EX 12-20: Distribution of cash upon liquidation

David Oliver and Umar Ansari, with capital balances of $28,000 and $35,000,

respectively, decide to liquidate their partnership. After selling the noncash assets and

paying the liabilities, there is $67,000 of cash remaining. If the partners share income and

losses equally, how should the cash be distributed?

EX 12-22: Distribution of cash upon liquidation

Bray, Lincoln, and Mapes arranged to import and sell orchid corsages for a university

dance. They agreed to share equally the net income or net loss of the venture. Bray and

Lincoln advanced $225 and $300 of their own respective funds to pay for advertising and

other expenses. After collecting for all sales and paying creditors, the partnership has $1,500 in cash.

a. How should the money be distributed?

b. Assuming that the partnership has only $300 instead of $1,500, do any of the three

partners have a capital deficiency? If so, how much? LOSS ON REALIZATION

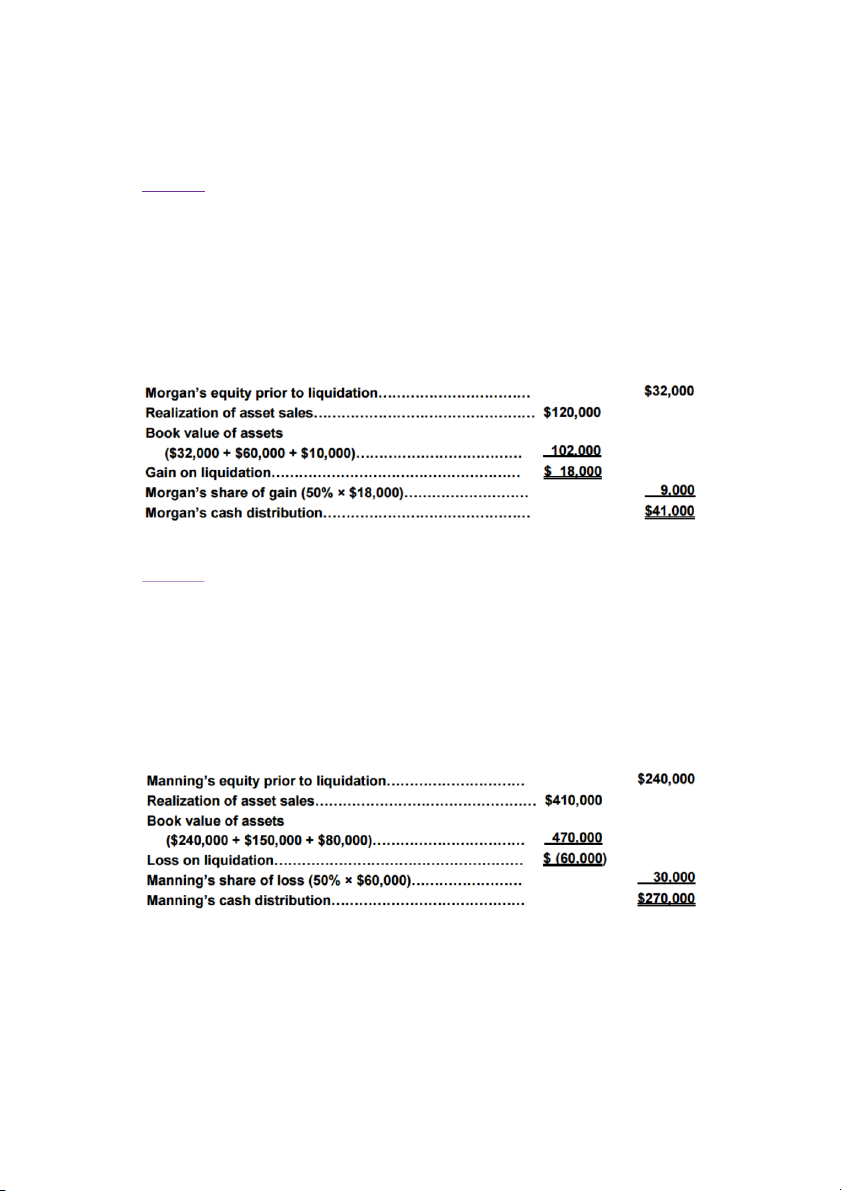

PE 12-5A: Liquidating partnerships

Prior to liquidating their partnership, Morgan and Chow had capital accounts of 532,000

and $60,000, respectively. Prior to liquidation, the partnership had no cash assets other

than what was realized from the sale of assets. These partnership assets were sold for

$120,000. The partnership had $10,000 of tabilities. Morgan and Chow share income and

losses equally. Determine the amount received by Morgan as a final distribution from

liquidation of the partnership.

PE 12-5B: Liquidating partnerships

Prior to liquidating their partnership, Manning and Adamo had capital accounts of

$240,000 and $150,000, respectively. Prior to liquidation, the partnership had no cash

assets other than what was realized from the sale of assets. These partnership assets were

sold for $410,000. The partnership had $80,000 of liabilities. Manning and Adamo share

income and losses equally. Determine the amount received by Manning as a final dis

tribution from liquidation of the partnership.

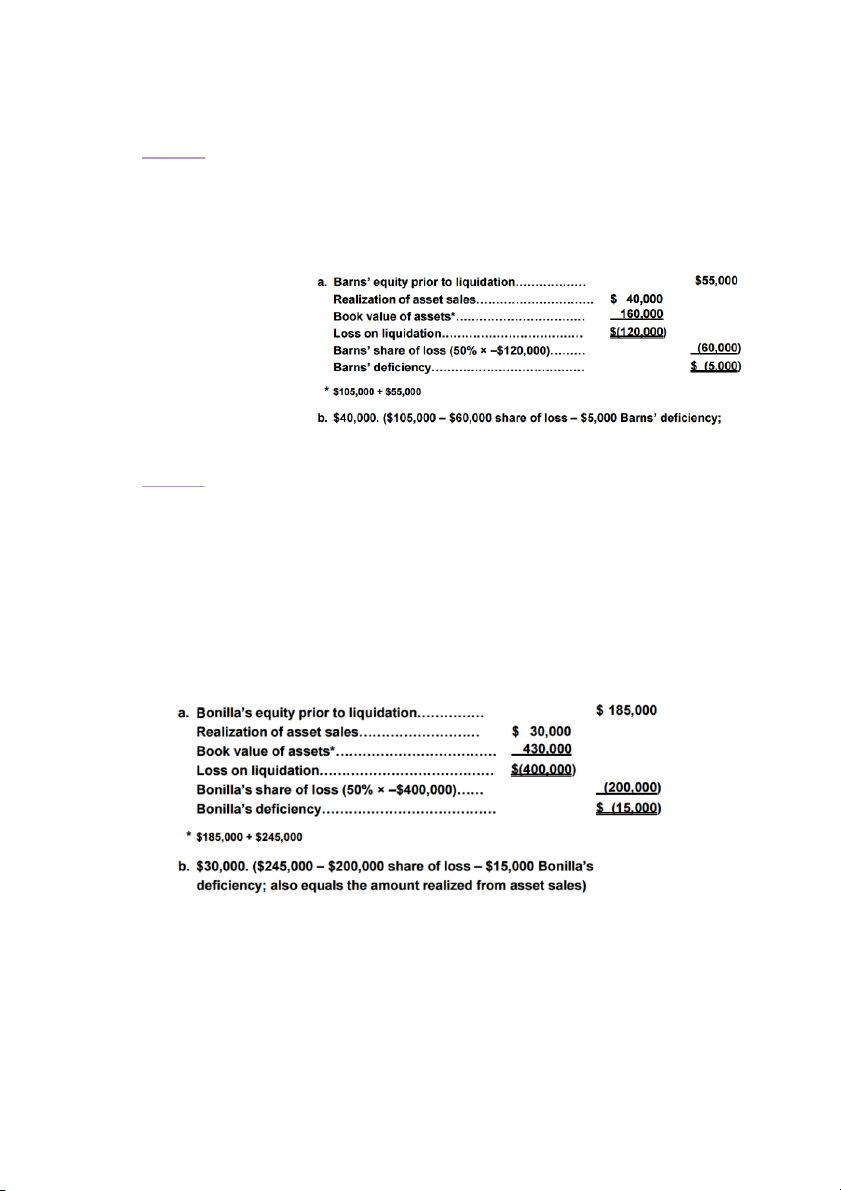

PE 12-6A: Liquidating partnerships—deficiency

Prior to liquidating their partnership, Wakefield and Barns had capital accounts of

$105,000 and $55,000, respectively. The partnership assets were sold for $40,000. The

partnership had no liabilities. Wakefield and Barns share income and losses equally. a. Determine the amount of Barns’ deficiency. b. Determine the amount distributed to Wakefield, assuming Barns is unable to satisfy the deficiency.

PE 12-6B: Liquidating partnerships—deficiency

Prior to liquidating their partnership, Bonilla and Han had capital accounts of $185,000

and $245,000, respectively. The partnership assets were sold for $30,000. The partnership

had no liabilities. Bonilla and Han share income and losses equally.

a. Determine the amount of Bonilla’s deficiency.

b. Determine the amount distributed to Han, assuming Bonilla is unable to satisfy the deficiency.

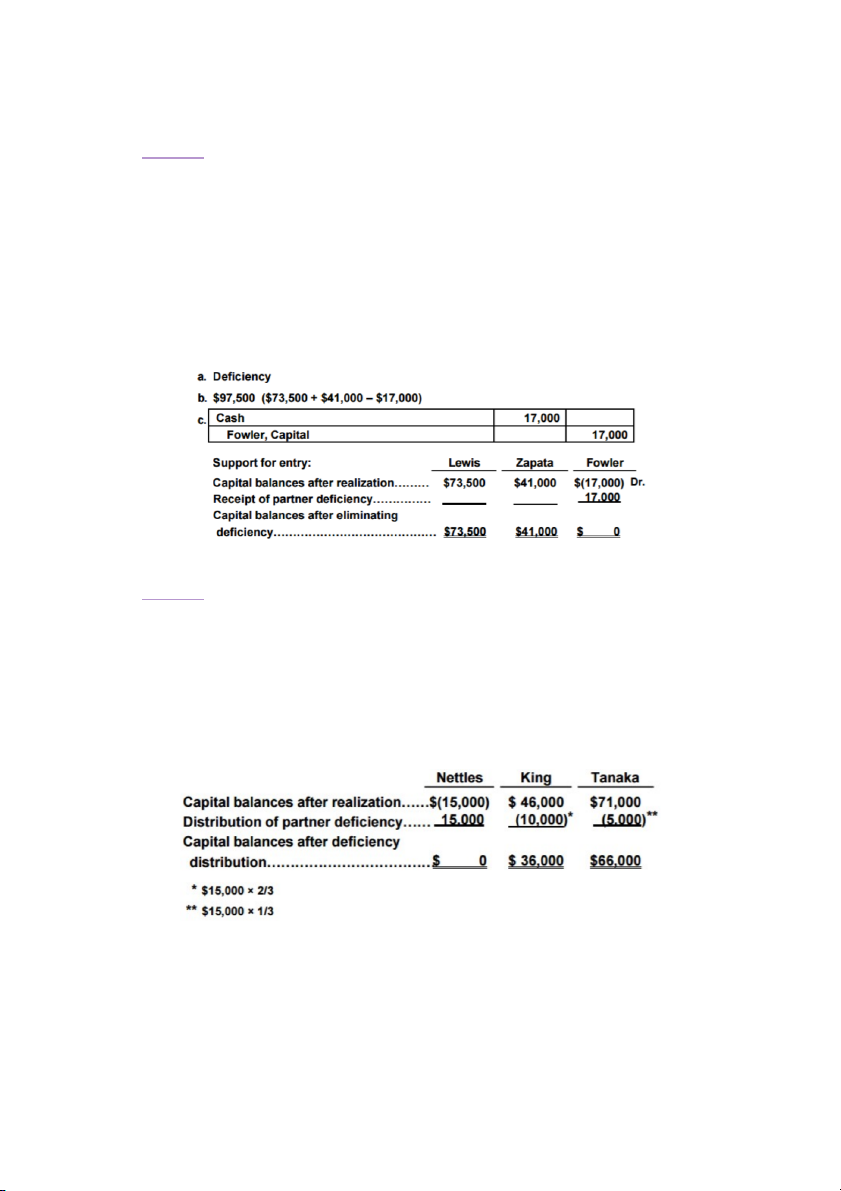

EX 12-21: Liquidating partnerships—capital deficiency

Lewis, Zapata, and Fowler share equally in net income and net losses. After the

partnership sells all assets for cash, divides the losses on realization, and pays the

liabilities, the balances in the capital accounts are as follows: Lewis, $73,500 Cr.; Zapata,

$41,000 Cr.; Fowler, $17,000 Dr.

a. What term is applied to the debit balance in Fowler’s capital account?

b. What is the amount of cash on hand?

c. Journalize the transaction that must take place for Lewis and Zapata to receive cash in

the liquidation process equal to their capital account balances.

EX 12-23: Liquidating partnerships—capital deficiency

Nettles, King, and Tanaka are partners sharing income 3:2:1. After the firm’s loss from

liquidation is distributed, the capital account balances were: Nettles, $15,000 Dr.; King,

$46,000 Cr.; and Tanaka, $71,000 Cr. If Nettles is personally bankrupt and unable to pay

any of the $15,000, what will be the amount of cash received by King and Tanaka upon liquidation?

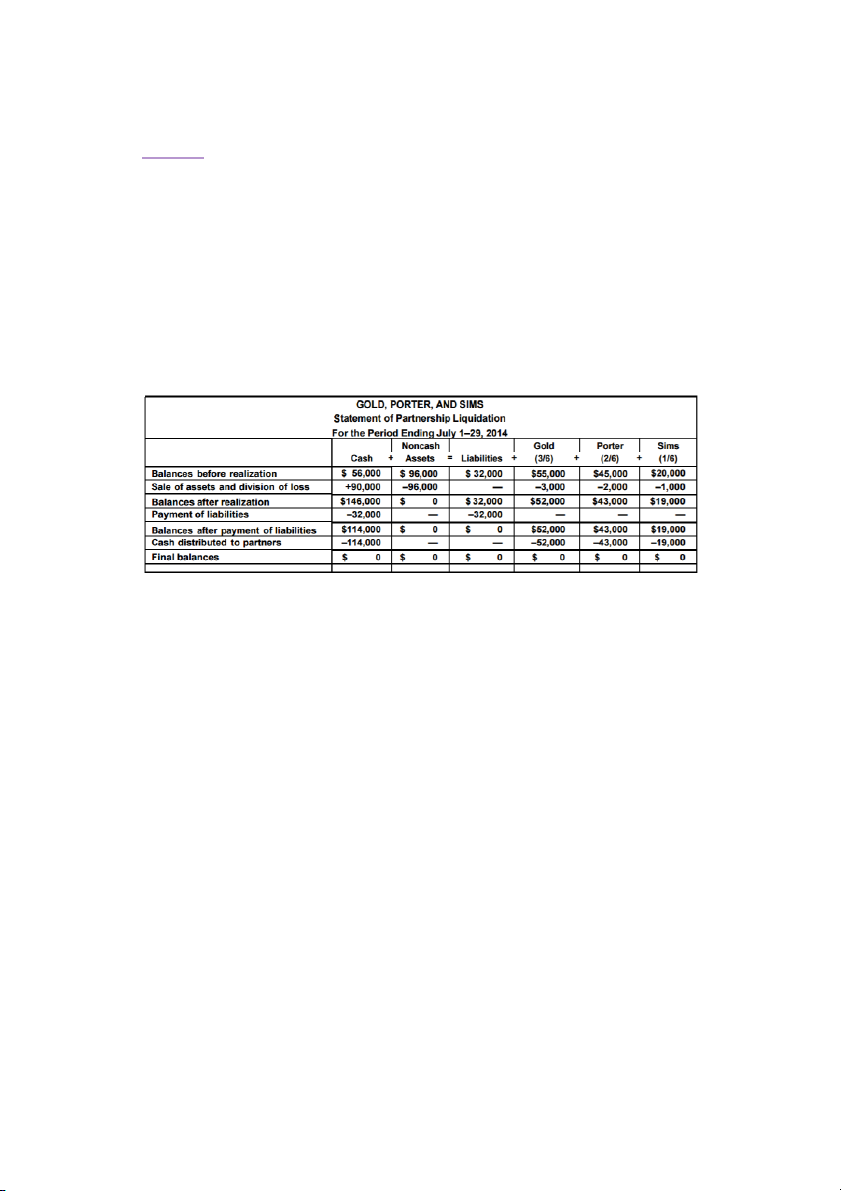

EX 12-24: Statement of partnership liquidation

After closing the accounts on July 1, prior to liquidating the partnership, the capital

account balances of Gold, Porter, and Sims are $55,000, $45,000, and $20,000,

respectively. Cash, noncash assets, and liabilities total $56,000, $96,000, and $32,000,

respectively. Between July 1 and July 29, the noncash assets are sold for $90,000, the

liabilities are paid, and the remaining cash is distributed to the partners. The partners

share net income and loss in the ratio of 3:2:1. Prepare a statement of partnership

liquidation for the period July 1–29, 2014. CHAPTER 13

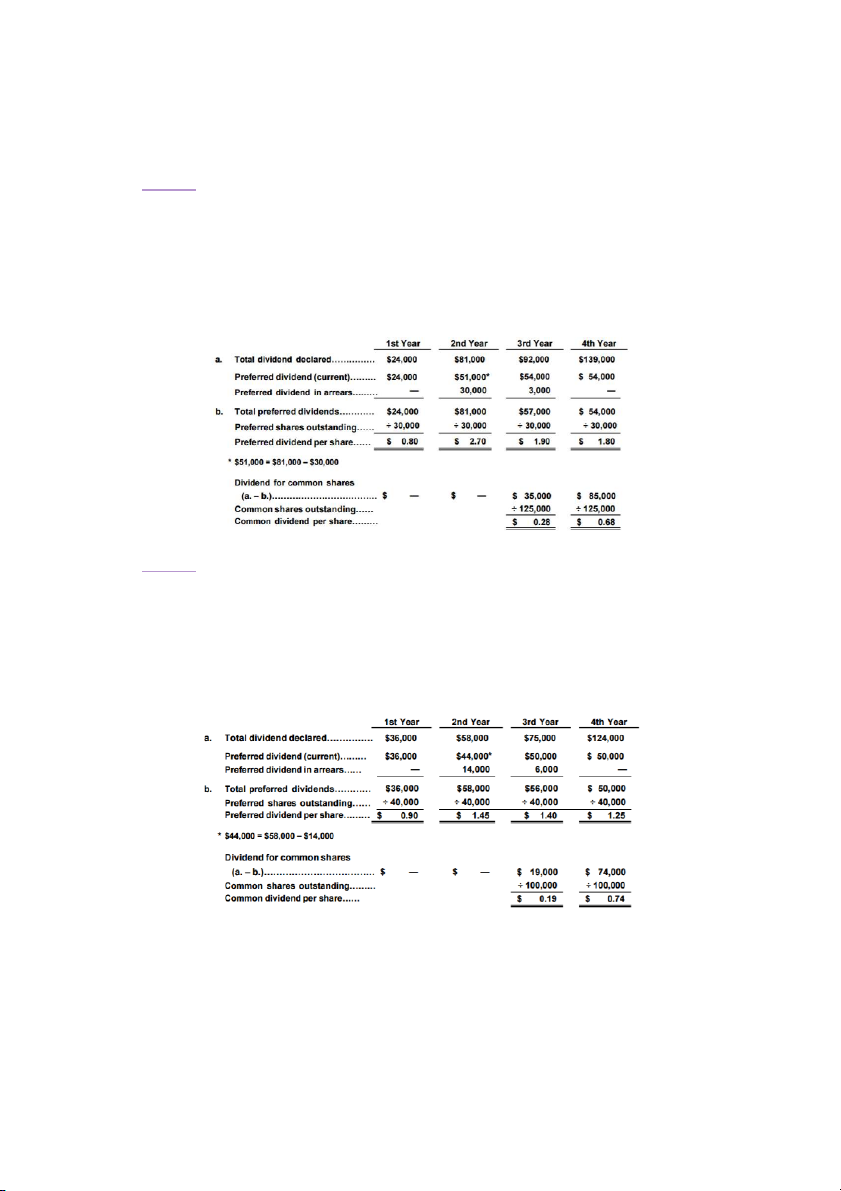

EX 13-1: Dividends per share

Wallace Inc., a developer of radiology equipment, has stock outstanding as follows: 30,000

shares of cumulative preferred 2% stock, $90 par and 125,000 shares of $10 par common.

During its first four years of operations, the following amounts were distributed as

dividends:first year, $24,000; second year, $81,000; third year, $92,000; fourth year,

$139,000. Calculate the dividends per share on each class of stock for each of the four years.

EX 13-2: Dividends per share

Lightfoot Inc., a software development firm, has stock outstanding as follows: 40,000 shares

of cumulative preferred 1% stock, $125 par, and 100,000 shares of $150 par common.

During its first four years of operations, the following amounts were distributed as dividends:

first year, $36,000; second year, $58,000; third year, $75,000; fourth year, $124,000.

Calculate the dividends per share on each class of stock for each of the four years.