Preview text:

Vietnam National University – HCMC International University

SCHOOL OF BUSINESS ADMINISTRATION COURSE SYLLABUS* BA186IU Investment Banking

Note: The outline with specific venue and time, and updated learning

materials for the current semester will be provided to the enrolled students by the lecturer 1. COURSE STAFF

Lecturer: Trinh Thu Nga, Ph.D. Room: O1.304 E-mail: ttnga@hcmiu.edu.vn

Consultation Hours: Thursday 9:30 a.m. – 11 a.m. BA186IU

VNU – International University Investment Banking School of Business Saturday 2 p.m. – 3 p.m.

Teaching Assistant: N/A Room: Telephone: E-mail: Consultation Hours:

Should the students wish to meet the staff outside the consultation hours, they are advised

to make an appointment in advance. 2. COURSE INFORMATION

2.1 Teaching time and Location Lecture:

Saturday 10:35 a.m. – 1:05 p.m. Venue: A2.507

Link for online class (if any) will be announced. 2.2 Units of Credit

This course is worth 3 credits.

2.3 Parallel teaching in the course

There is no parallel teaching involved in this course.

2.4 Relationship of this course to others

BA186IU–Investment Banking introduces students to financial institutions from the

perspective of both the consumer and the financial institution manager. It extends basic

understanding of finance taught in BA016IU–Fundamental of Financial Management and

BA134IU–Financial Institutions and Markets. Students could also take BA185IU–

Commercial Banking and BA189IU–Banking Risk Management to grasp more knowledge of banking analysis.

2.5 Approach to learning and teaching 2 BA186IU

VNU – International University Investment Banking School of Business

Employing the interactive learning and problem-based teaching approach, this course

emphasizes the interaction between lecturers and students. The lecture materials will be

uploaded on Blackboard to help students to preview the materials and to concentrate on

listening and critical thinking during the lecture. Through a combination of lectures,

student-led presentations, in-class discussions and problem-solving sessions (teams and

individuals), students will be exposed to the above outcomes in Financial Services and

Investment Banking. An active learning environment will be encouraged. Accordingly,

student inquiry and involvement will be highly encouraged.

3. COURSE AIMS AND OUTCOMES 3.1 Course Aims

This course is designed to help students understand and prepare for a position as a financial

analyst in an investment bank or a related field such as private equity, equity research, asset

management, private wealth management or leveraged finance. Students will become

familiar with the financial services offered to the public and with the financial, operational,

and organizational aspects of the institution.

3.2 Course Learning Outcomes (CLO)

After successfully completing the course, students should be able to:

1. describe the history of banking, identify key financial products, the major

operations within investment banks, investment banking functions and traditional commercial banking functions;

2. know how to value a company;

3. communicate the relevance of regulation to banking and financial institutions;

4. explain the Merger & Acquisition process (M&A);

5. calculate the synergies (financial) from mergers & acquisitions;

6. explain the Leveraged Buyout (LBO);

7. understand the process of equity offerings; and

8. apply critical thinking and problem solving skills to solve problems in finance.

In generic terms, students completing this course are likely to achieve the following attributes:

• In-depth knowledge of the field of the study: A comprehensive and well-founded

knowledge of the field of the study. All of the course objectives lead to

comprehensive fundamentals and advances to the field of finance.

• Effective communication: The ability to collect, analyze, and organize information

and to convey information clearly and fluently, in both written and spoken forms. 3 BA186IU

VNU – International University Investment Banking School of Business

• Critical argument and judgment: The ability to identify and debate critical issues /

problems, as well as to evaluate financial information, make decisions, and reflect

critically on the justification of decisions.

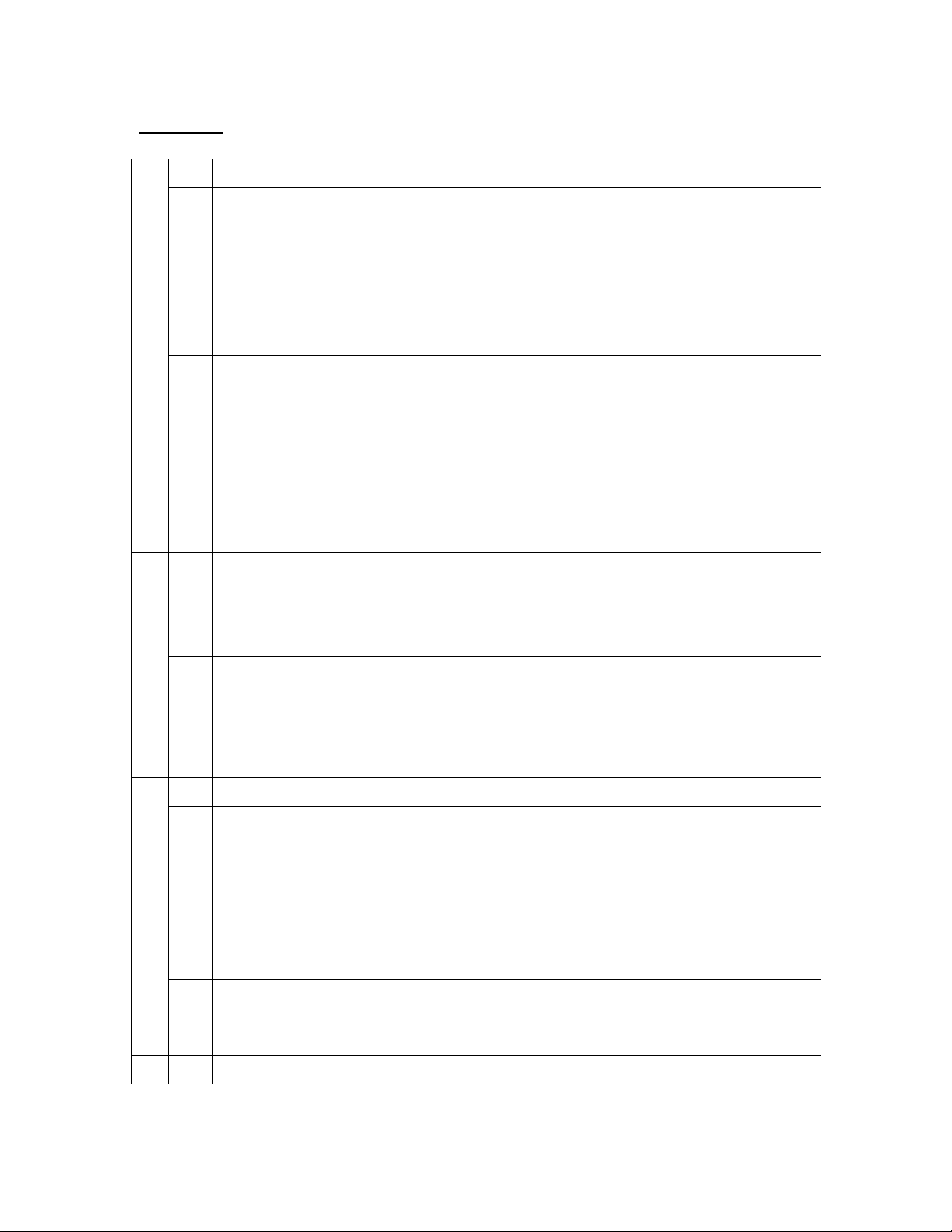

Mapping of Course Learning Outcomes to Program Learning Outcomes

Course Learning Outcome (CLO)

Program Learning Outcome (PLO) 1 1-3 2 1-6 3 1-5 4 1-5 5 1-6 6 1-5 7 1-5 8 4-7

Program Learning Outcomes (PLO): See Appendix

3.3 Teaching Strategies

The learning system in this course consists of lectures and scheduled

presentations/discussions. Lectures elaborate the appropriate theoretical content in the

textbook and readings. Classes provide a more detailed and refined analysis of both

concepts and applied materials. Classes are strongly oriented towards interactive discussion

of the text and cases. In order to gain the most from the lectures and class activities, the

assigned text/reading should be read before the lecture to participate in the discussions.

By the end of the second week, students need to form groups (4-5 students/group) to do the

group project. Discussing with group members about the common strategy for sourcing,

documenting, analyzing and presenting the projects - for which a basic minimum

interaction will be necessary. For the audience of group presentations, it is important that

they contribute to the project by getting additional information carefully beforehand so that

they are well-prepared to participate in the discussions.

4. STUDENT RESPONSIBILITIES AND CONDUCT 4.1 Workload

It is expected that students spend at least six hours per week studying this course. This time

should be made up of reading, research, working on exercises and problems, and attending

classes. In periods where they need to complete assignments or prepare for examinations, the workload may be greater. 4 BA186IU

VNU – International University Investment Banking School of Business

Over-commitment has been a cause of failure for many students. They should take the

required workload into account when planning on how to balance study with part-time jobs and other activities. 4.2 Attendance

Regular and punctual attendance at lectures is expected in this course. University

regulations indicate that if students attend less than eighty per cent of scheduled classes

they may be refused final assessment. Exemptions may only be made on medical grounds.

4.3 General Conduct and Behaviour

Students are expected to conduct themselves with consideration and respect for the needs

of the fellow students and teaching staff. Conduct which unduly disrupts or interferes with

a class, such as ringing or talking on mobile phones, is not acceptable and students will be

asked to leave the class. More information on student conduct is available on the university webpage. 4.4 Keeping informed

Students should take note of all announcements made in class or on the course’s Blackboard.

From time to time, the university will send important announcements to students’ university

e-mail addresses without providing a paper copy. Students will be deemed to have received this information. 5. LEARNING ASSESSMENT 5.1 Formal Requirements

In order to pass this course, students must:

• achieve a composite mark of at least 50; and

• make a satisfactory attempt at all assessment tasks (see below). 5.2 Assessment Details

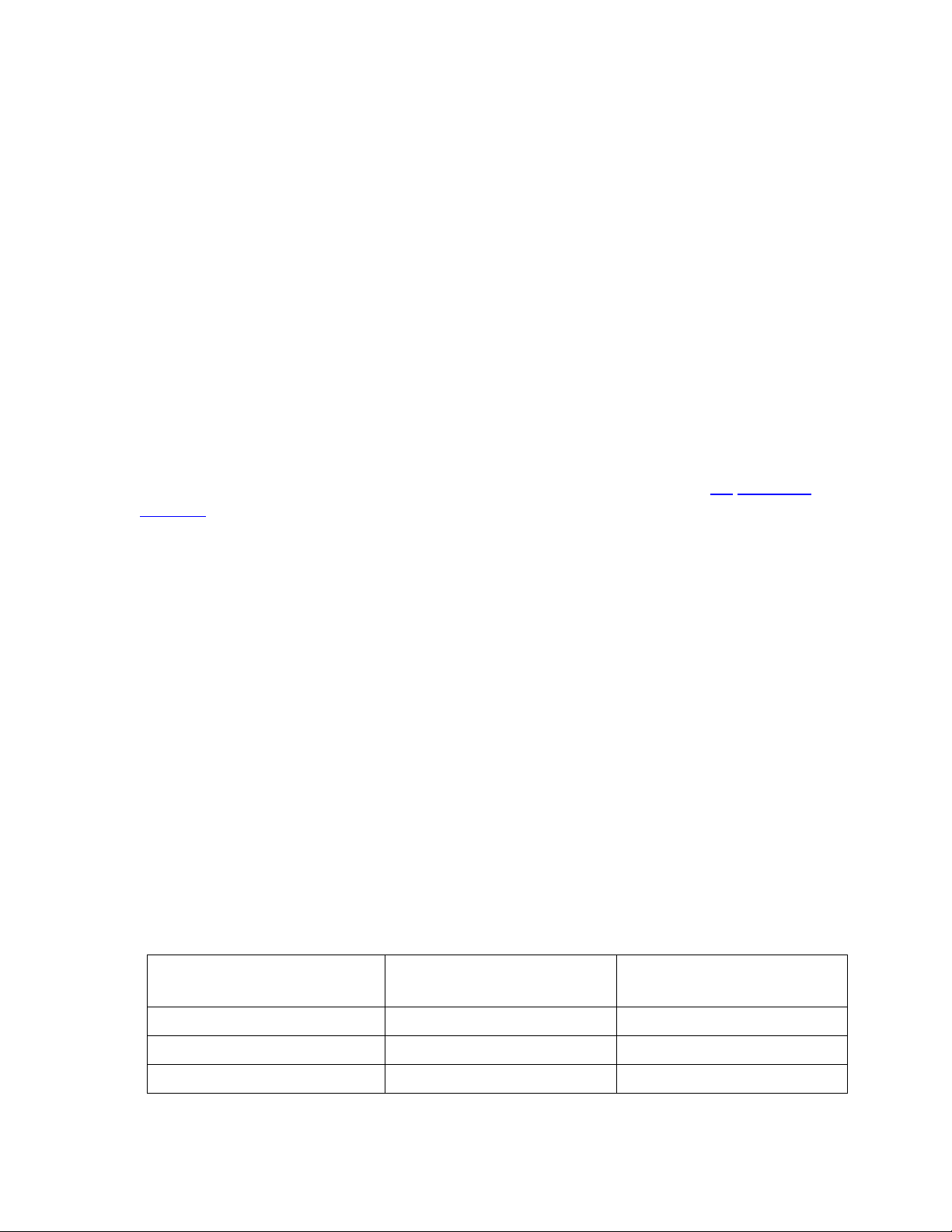

Assessment will be made as follows: Grading and Assessment Percentage of Course

Course Learning Outcome Tool Grade Assessed Attendance and participation 10% 1-8 Group project 20% 1, 2, 4, 5, 8 Mid-term exam 30% 1-4, 8 5 BA186IU

VNU – International University Investment Banking School of Business Final exam 40% 4-8 5.3 Assessment Format Exams

All exams are open book, open note. Remember to bring your calculators. Exams consist

of application problems and short-answer/discussion questions.

You may not use your cell phone, computer, or similar devices during an exam.

Group project

In groups of 4-5 students, students will analyze an M&A transaction and value the target

company using two out of the three approaches covered in this course. Each group needs

to write a report and make a presentation. Details will be provided later on.

The project will be assessed for analytical content and presentation. The same mark will be

awarded to all students in the same group. All work must be original and must not have

been submitted for any other subject or course here or elsewhere. Copying or plagiarizing

work of other authors, including your fellow students, or cutting and pasting from the

internet and other sources is an offence and will be seriously penalized.

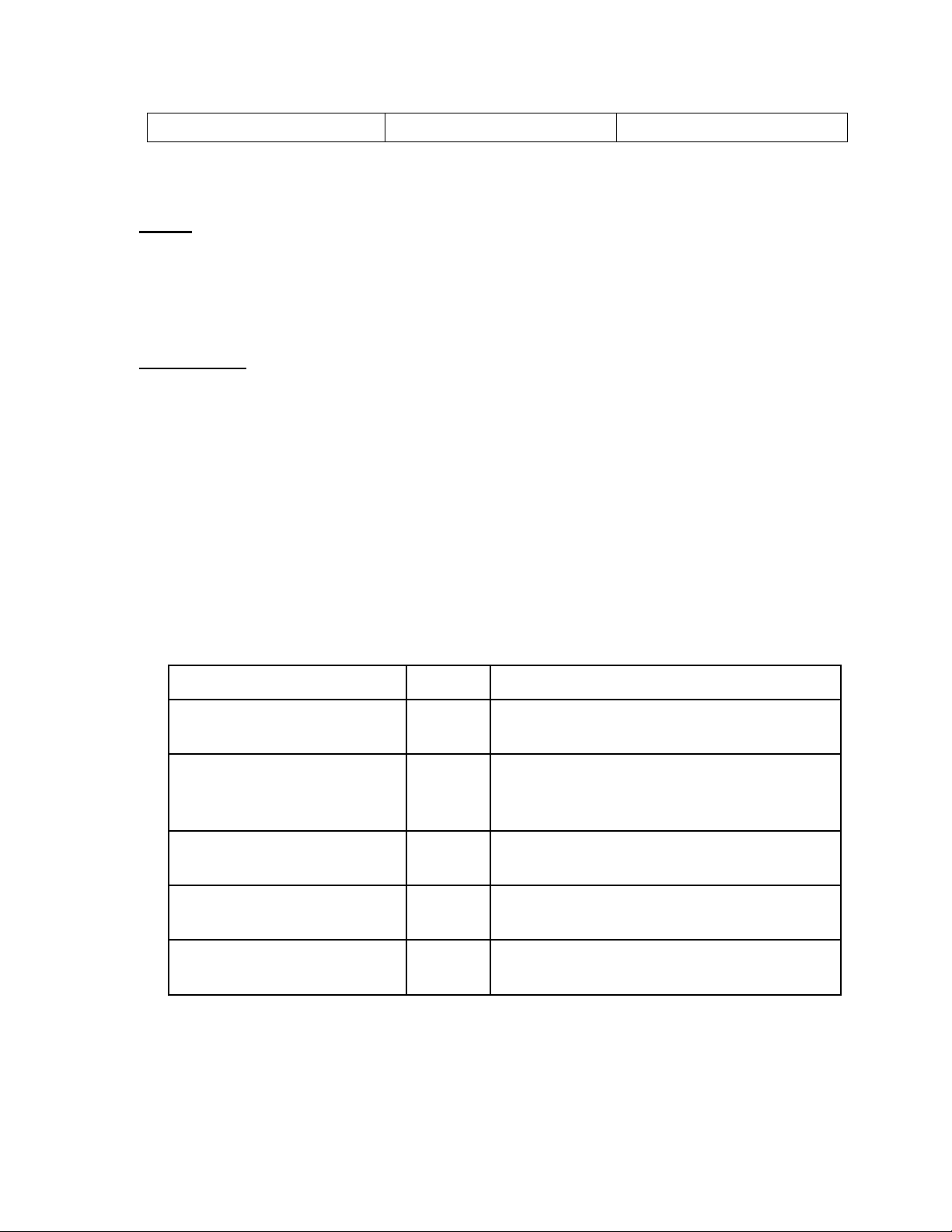

5.4 Marking criteria (project report) Marking Criteria

Marks Learning outcomes/attributes Quality of arguments: 20

Ability to give compelling arguments and relevance, logic and cohesion reasoning to support analysis Use of frameworks to 20

Ability to structure problems in accordance support analysis

with theoretical frameworks and resolve them Use of case evidence to 20

Ability to conduct applied research to gather support analysis

data/information pertaining to the case Originality and usefulness of 20

Ability to engage in creative problem- the analysis solving skills Organization, clarity of 20 Clarity of vision expression, editing etc.

5.5 Class participation 6 BA186IU

VNU – International University Investment Banking School of Business

Students are expected to attend class regularly and participate in class discussions. Students

are responsible for materials covered during their absence.

5.6 Special Consideration

Request for special consideration (for final examination only) must be made to the Office

of Academic Affairs within one week after the examination. General policy and

information on special consideration can be found at the Office of Academic Affairs.

6. ACADEMIC HONESTY AND PLAGIARISM

Plagiarism is the presentation of the thoughts or work of another as one’s own (definition

proposed by the University of Newcastle). Students are also reminded that careful time

management is an important part of study and one of the identified causes of plagiarism is

poor time management. Students should allow sufficient time for research, drafting, and

the proper referencing of sources in preparing all assessment items. The university regards

plagiarism as a form of academic misconduct, and has very strict rules regarding plagiarism.1 7. STUDENT RESOURCES 7.1 Course Resources

Please note that it is very important to gain familiarity with the subject matter in the

readings and cases prior to attending classes. Textbook:

Rosenbaum, Joshua and Pearl, Joshua (2013) Investment banking: Valuation, leveraged

buyouts, and mergers & acquisitions. 2nd ed. John Wiley & Sons, Inc. Fleuriet, Michel

(2008) Investment banking explained: An insider’s guide to the industry. McGraw-Hill. Reference books:

Pignataro, Paul (2015) Mergers, Acquisitions, Divestitures, and Other Restructurings. John Wiley & Sons, Inc.

Stowell, David P. (2013) Investment banks, Hedge funds, and Private equity. 2nd ed. Academic Press.

Additional materials provided on Blackboard

The lecturer will attempt to make lecture notes and additional reading available on

Blackboard. However, this is not an automatic entitlement for students doing this subject.

Note that this is not a distance learning course, and you are expected to attend classes and

take notes. This way, you will get additional benefits of class interaction and demonstration.

1 This is adapted with kind permission from the University of New South Wales. 7 BA186IU

VNU – International University Investment Banking School of Business

7.2 Other Resources, Support and Information

Additional learning assistance is available for students in this course and will be made

available on Blackboard. Academic journal articles are available through connections via

the VNU - Central Library. Recommended articles will be duly informed to the students.

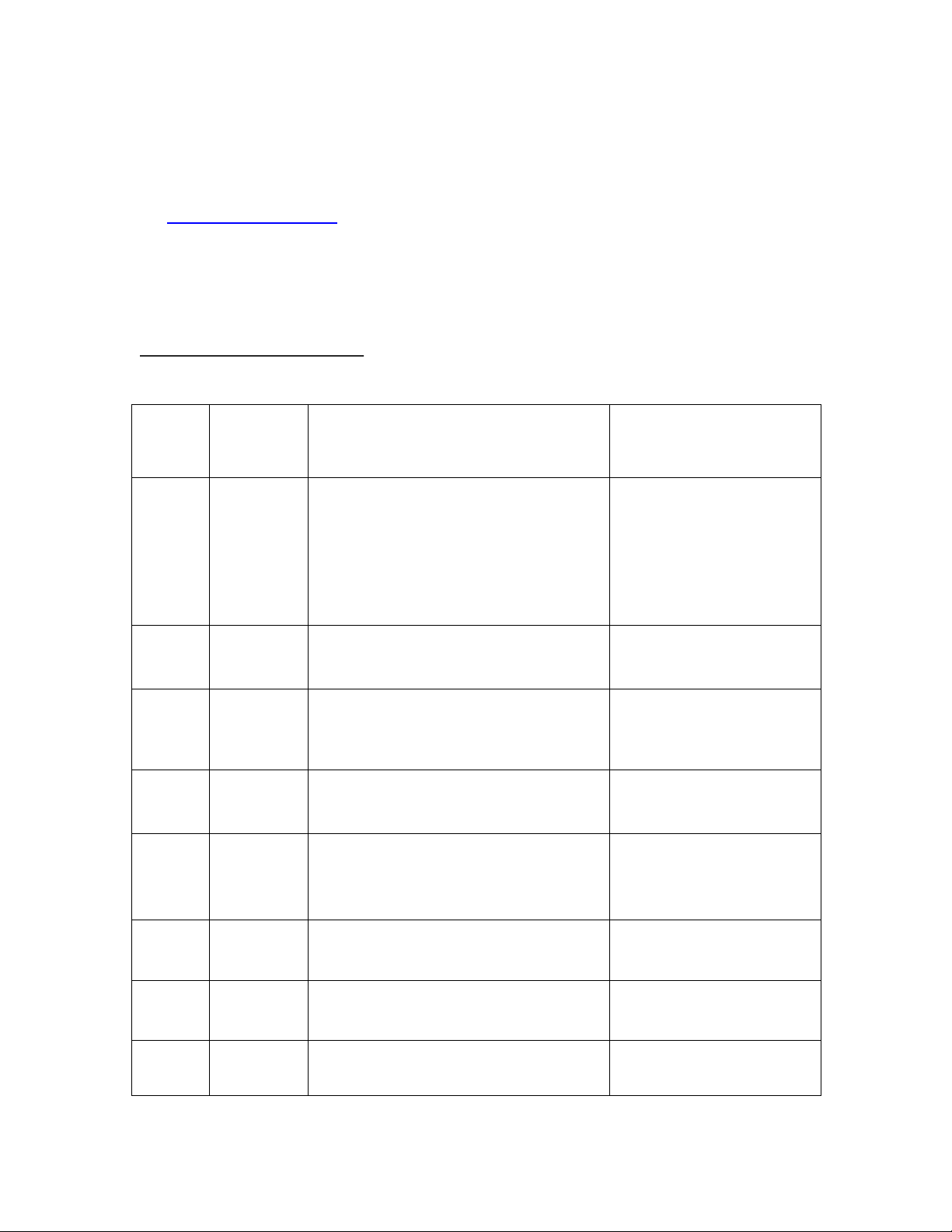

8. COURSE SCHEDULE (TENTATIVE) Week Date Topic Required readings and activities 1 12/2/2022 Course Syllabus Syllabus

Lecture 1: Introduction to Investment Chapters 3&4, Fleuriet banking

Form groups and start

thinking of an M&A transaction for the project 2

19/2/2022 Lecture 2: Introduction to M&A Chapters 14&15, Fleuriet Finalize groups 3

26/2/2022 Lecture 3: Valuation: Comparable Chapter 16, Fleuriet Companies Analysis Chapter 1, Rosenbaum and Pearl 4

5/3/2022 Lecture 4: Valuation: Precedent Chapter 2, Rosenbaum Transactions Analysis and Pearl 5

12/3/2022 Case study for Comparable Excel file Companies Analysis and

Precedent Transactions Analysis 6

19/3/2022 Lecture 5: Valuation: Discounted Cash Chapter 3, Rosenbaum Flow Analysis and Pearl 7

26/3/2022 Case study for Discounted Excel file Cash Flow Analysis 8 2/4/2022 Review 8 BA186IU

VNU – International University Investment Banking School of Business 9&10 Mid-term Exam 11 23/4/2022 Lecture notes

Lecture 6: Synergy and Summary of Valuation methods 12

No class on Lecture 7: Sell-side M&A Chapter 6, Rosenbaum Apr. 30. and Pearl Make-up class will be scheduled 13 7/5/2022 Lecture 8: Buy-side M&A Chapter 7, Rosenbaum and Pearl 14

14/5/2022 Lecture 9: Leveraged Buyouts Chapter 4, Rosenbaum and Pearl 15

21/5/2022 Lecture 10: The Business of Equity Chapters 10&11, Fleuriet Offerings and IPOs

Project report due 16

28/5/2022 Project Presentations 17 4/6/2022 Review 9 BA186IU

VNU – International University Investment Banking School of Business

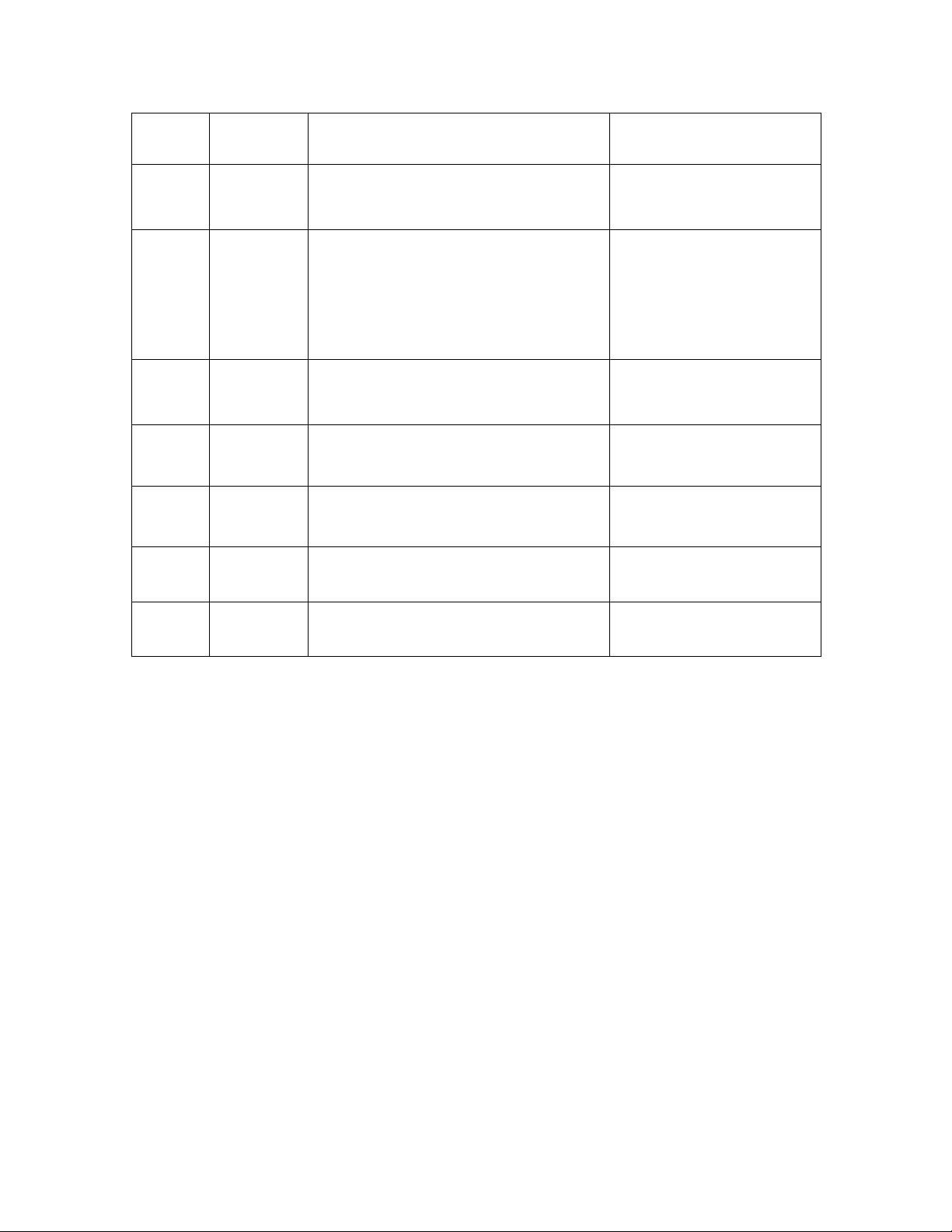

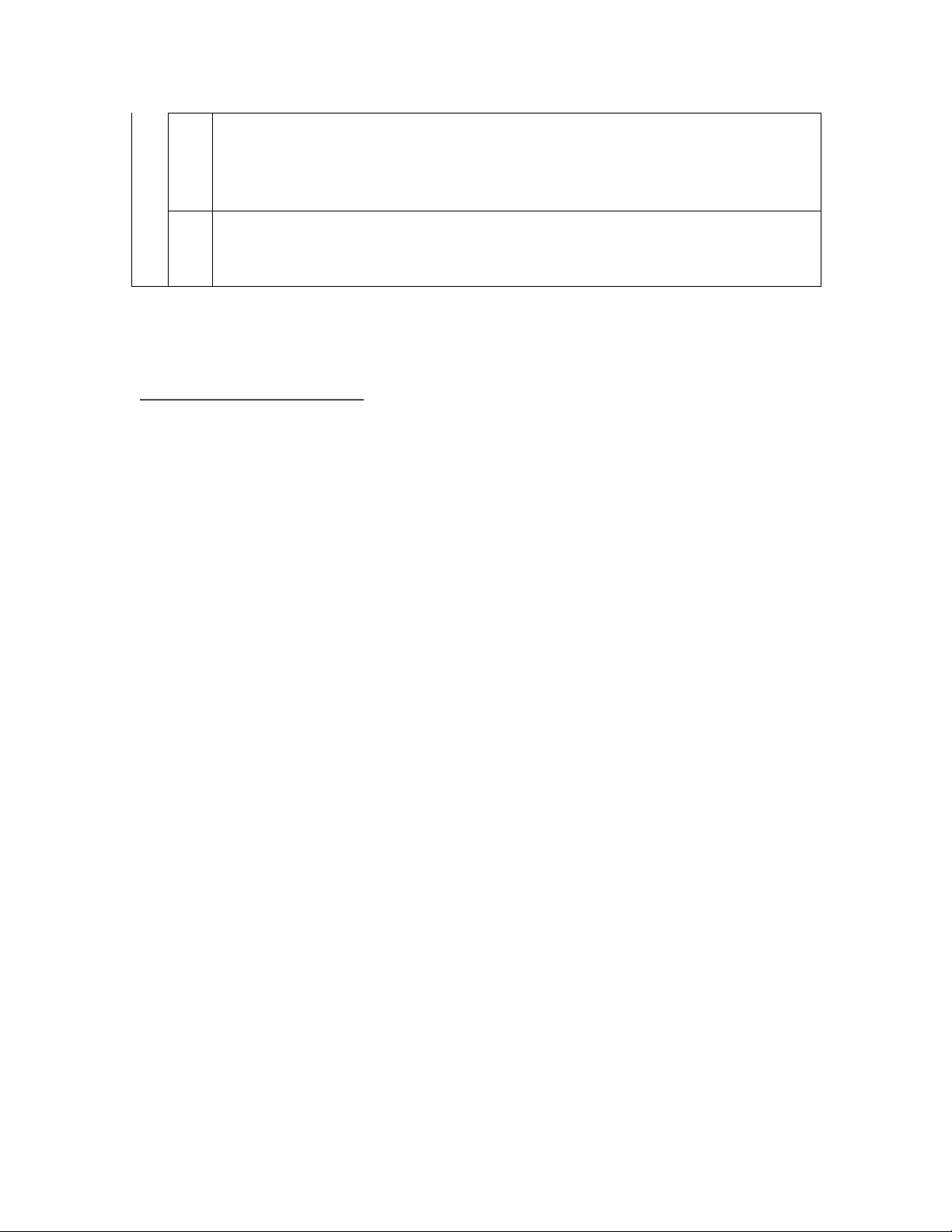

Appendix: Program Learning Outcomes (PLO)

No. Business Knowledge

a1. Students possess extended, updated knowledge about business

management which is based on the platform of the knowledge that has been

taught at the undergraduate level: knowledge of marketing management.

1. statistics in business, business finance, accounting, strategic management,

international business management, human resource management, supply

chain management, management information system, production and operation a.

management, economics and organizational behavior.

a2. Students gain knowledge of scientific research methods to become capable

2. researchers in Business Administration field. With the acquired knowledge,

they can continue to learn Doctoral program in Business Administration.

a3. Students have deep knowledge about current economic issues in Vietnam as

well as in the world economy. They understand micro and macro

3. environmental factors that can affect company business performance and

success. They know about various models used to analyze strength, weakness,

threats and opportunities for strategic planning and forecasting purpose. Skills

b1. Students master up-to-date scientific research methods and tools in the

4. field of economics and management. They can recognize practical business

problems, do researches and propose measures to solve the problems.

b. b2. Students acquire skills of critical thinking, analyzing, researching,

evaluating, comparing, synthesizing, which they can use to find out and solve

5. business problems and make relevant business decisions. The students master

communication skills and social skills, which help them work successfully in

an international multicultural environment. Abilities

c1. Students are able to take management positions of all levels at domestic

and foreign companies in various sectors of an economy. They can perform

c. 6. well management functions of planning, organizing, coordinating, motivating,

leading, and controlling. They are able to make appropriate decisions in fast

changing market conditions. They are able to design and develop strategic

plans and policies for companies. Virtue d.

d1. Students possess professional ethics, moral, and proper understanding of

7. integrity, responsibility, accountability. Students are aware of unethical and

illegal behavior and actions. They stand against bribery and corruption.

Language and computer skills 10 BA186IU

VNU – International University Investment Banking School of Business

e1. Students master English skills that they use effectively in an international

8. working environment. They can work well with foreign partners and e.

colleagues. They can use English well in negotiation and networking, communication and reporting.

e2. Students have good computer skills they can use for their management

9. purpose. They can use some computer software to do research, process data

and perform statistical analysis.

* The syllabus is prepared following the format provided by the School of Organization and Management,

University of New South Wales, with kind permission. 11