Preview text:

BỘ GIÁO DỤC VÀ ĐÀO TẠO

TRƯỜNG ĐẠI HỌC HOA SEN

KHOA KINH TẾ & QUẢN TRỊ --- * --- END OF TERM REPORT

TOPIC: THE REASON WHY EXPORTERS REQUIRE LETTER OF

CREDITS ISSUED BY SOME VIETNAMESE COMERCIAL BANK.

SOLUTIONS IMPROVE VIETNAMESE COMMERCIAL BANK’S

CREDITWORTHINESS IN L/C PAYMENT ACTIVITIES. Subject : International Payment Class No. : 1483 (Semester 2034) Student’s Group No. : Group 2 Instructor

: Lâm Thanh Phi Quỳnh

TP. Hồ Chí Minh, August 2021 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

BỘ GIÁO DỤC VÀ ĐÀO TẠO

TRƯỜNG ĐẠI HỌC HOA SEN

KHOA KINH TẾ & QUẢN TRỊ END OF TERM REPORT TOPIC:

THE REASON WHY EXPORTERS REQUIRE LETTER OF CREDITS

ISSUED BY SOME VIETNAMESE COMERCIAL BANK. SOLUTIONS

IMPROVE VIETNAMESE COMMERCIAL BANK’S

CREDITWORTHINESS IN L/C PAYMENT ACTIVITIES. Completation time

: From 22/08/2021 to 26/08/2020 Instructor

: Lâm Thanh Phi Quỳnh Student’s Group No. : Group 2 TP. HCM, August 2021 THANK YOU

First of all, our team would like to express our sincere and deep thanks to the instructor

Lam Thanh Phi Quynh for enthusiastically guiding, caring, as well as helping the group in ii ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

the past time so that our group can have a successfully complete this report. Our team

would also like to thank the author for providing useful documents and information for the group.

Finally, our team would like to thank Hoa Sen University for giving our students the

opportunity to experience useful subjects so that we can accumulate more knowledge for

the future. After completing the final report, our team also recognized the shortcomings

that each individual had. In the process of making the report, it is difficult to avoid

mistakes, the theoretical level is still limited, the team hopes that you will ignore it and

give suggestions to the group so that it can be more and more perfect. iii ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ LECTURER’S COMMENTS

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

................................................................................................................................................

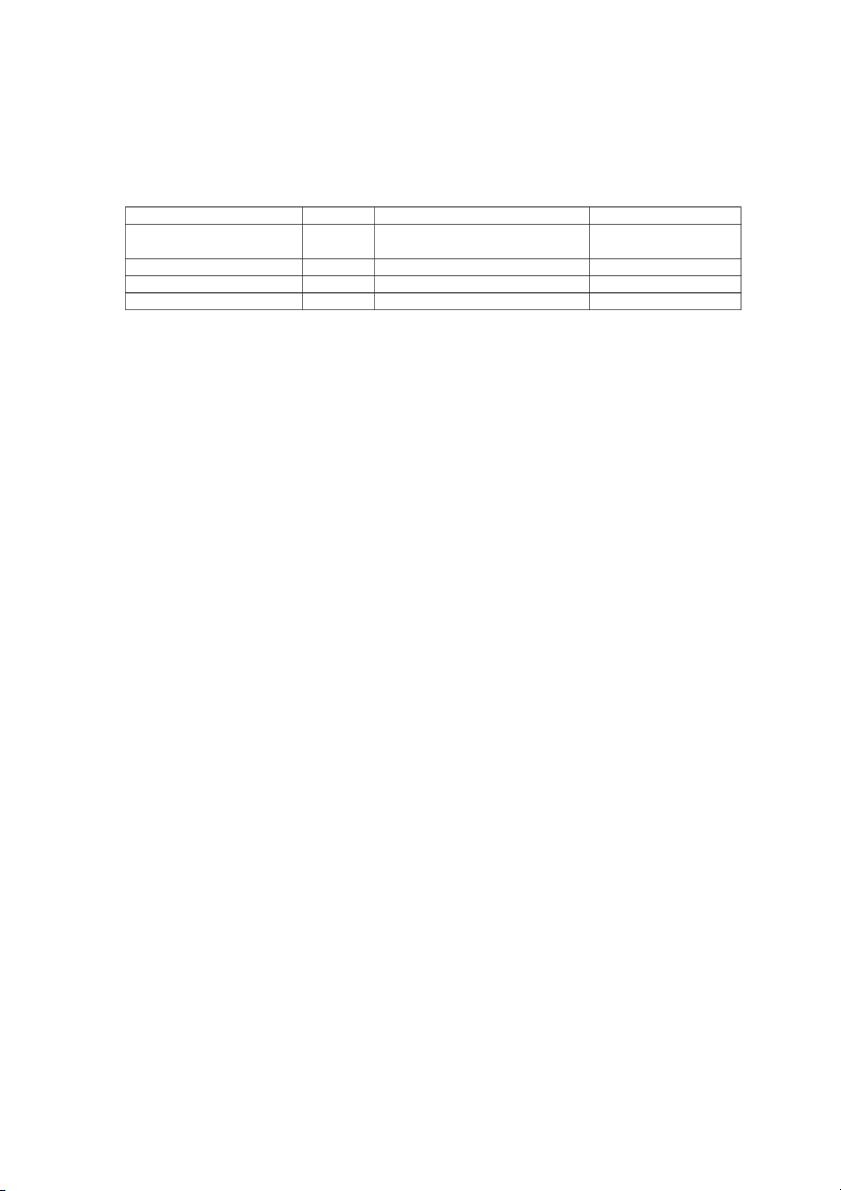

................................................................................................................................................ Tp.HCM, …/…/2021 (sign and full name) iv ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ JOB DISTRIBUTION TABLE ĐIỂM 7 MEMBER’S NAME ID DUTY COMPLETED Mai Thảo Nhi 2197193 1. Overall 100% 2. Word summary Phan Võ Hoàng Thông 2172651 1. Reasons 100% Đặng Phạm Mỹ Hiền 2181486 1. Reasons 90% Nguyễn Quốc Hùng 2182522 1. Solutions 100% 5 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ TABLE OF CONTENTS

THANK YOU...................................................................................................................iii

LECTURER’S COMMENTS.........................................................................................iv

JOB DISTRIBUTION TABLE........................................................................................5 I.

Overall of Letter of Credit and Creditworthiness.........................................................8

1. Definition of Letter of Credit....................................................................................8

2. Definition of Creditworthiness..................................................................................8 II.

Reasons why some exporters require letter of credits issued by some Vietnamese

commercial banks to be confirmed.....................................................................................9

1. Risks for the seller (exporter)....................................................................................9

2. Risks to the issuing bank of the LC.........................................................................11 III.

Solutions improve Vietnamese commercial bank’s creditworthiness in letter of

credit payment activities...................................................................................................12

1. Risk prevention.........................................................................................................12

2. Improve the bank’s system........................................................................................13

REFERENCES...............................................................................................................15 6 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ I.

Overall of Letter of Credit and Creditworthiness 1.

Definition of Letter of Credit

A letter of credit, or "credit letter" is a letter from a bank guaranteeing that a buyer's

payment to a seller will be received on time and for the correct amount. In the event that the

buyer is unable to make a payment on the purchase, the bank will be required to cover the

full or remaining amount of the purchase.

A letter of credit is issued against a pledge of securities or cash. And it ensures that the

seller is paid for presenting the documents totally complying with all terms and conditions in the L/C. Procedure of L/C

The entire process under LC consists of four primary steps: Step 1 - Issuance of LC

After the parties to the trade agree on the contract and the use of LC, the importer

applies to the issuing bank to issue an LC in favor of the exporter. The LC is sent by the

issuing bank to the advising bank. The latter is generally based in the exporter’s country

and may even be the exporter’s bank. The advising bank (confirming bank) verifies the

authenticity of the LC and forwards it to the exporter. Step 2 - Shipping of goods

After receipt of the LC, the exporter is expected to verify the same to their satisfaction

and initiate the goods shipping process.

Step 3 - Providing Documents to the confirming bank

After the goods are shipped, the exporter (either on their own or through the freight

forwarder) presents the documents to the advising/confirming bank.

Step 4 - Settlement of payment from importer and possession of goods

The bank, in turn, sends them to the issuing bank and the amount is paid, accepted, or

negotiated, as the case may be. The issuing bank verifies the documents and obtains

payment from the importer. It sends the documents to the importer, who uses them to get

possession of the shipped goods. 2.

Definition of Creditworthiness

Creditworthiness is a lender's willingness to trust you to pay your debts. A borrower

deemed creditworthy is one a lender considers willing, able and responsible enough to

make loan payments as agreed until a loan is repaid. How it works: 7 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

Lenders evaluate your creditworthiness—or how worthy you are to receive new credit—

when you apply for a debt obligation, such as a personal loan, credit card or line of credit.

Typically, lenders only extend credit to those they deem as creditworthy borrowers. A

creditworthy borrower is one who is able and responsible enough to repay their debts in a

timely manner. If a lender believes you are a risky borrower, it’s unlikely that you will qualify for new credit.

For example, Mary has a 700 credit score and has high creditworthiness. Mary gets

approval for a credit card with an 11% interest rate and a $5,000 credit limit. Doug has a

600 credit score and has low creditworthiness. Doug gets approval for a credit card with a

23.9% interest rate and a $1,000 credit limit.

How to check and improve your creditworthiness

Lenders pay the credit reporting agencies to access credit data on potential or existing

customers in addition to using their own credit scoring systems to grant approval for credit.

Every consumer should keep track of their credit score because it is the factor financial

institutions use to decide if an applicant is eligible for credit, preferred interest rates, and specific credit limits.

To improve your creditworthiness, there are several ways you can improve your credit

score to establish creditworthiness. The most obvious way is to pay your bills on time.

Make sure you get current on any late payments or set up payment plans to pay off past due

debt. Pay more than the minimum monthly payment to pay down debt faster and reduce the assessment of late fees. II.

Reasons why some exporters require letter of credits issued by some Vietnamese

commercial banks to be confirmed 1.

Risks for the seller (exporter)

Firstly, in the contract of sale, the agreement of the parties is based on good faith and

equality between the seller and the buyer to include in the terms of the contract. However,

despite coming from equality, the seller is still often the weaker party than the buyer in a

contract from which to accept unfavorable agreements on his side. That is shown through

the fact that the seller accepts extremely complicated documents and documents that the

buyer requires, even the seller accepts the documents.

It is because of this complicated composition that when the goods arrive, it is not

possible to do the paperwork. Accordingly, the Bank will not accept payment to the seller

due to the lack of documents and the goods must continue to be left at the port and cannot

be retrieved, causing a lot of damage to the seller. It can be seen that this is a case where the

buyer has installed some unfeasible terms to catch errors in the documents, thereby serving 8 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

as a basis to refuse to receive the goods or force the seller to reduce the price of the goods if

they do not want to bear additional costs.

Secondly, the L/C payment method is a safe and reputable payment method through the

bank, but it is for this reason that many people believe in the role of L/C without

understanding. that the L/C payment method is a conditional payment method. This

resulted in the seller failing to thoroughly check the terms and conditions of the L/C which

resulted in a failure to carefully examine the difficult requirements of the L/C. Therefore,

the seller will have to bear the costs.

In addition, even though the L/C payment method has been made, the payment is still

based on the goodwill of the buyer in the performance of the contract. As mentioned, the

form of payment by L/C is based on the transaction of written documents and the bank

must carefully check the accuracy of the documents little by little and even from the

payment. smallest errors. Therefore, although the goods have been delivered in full, in the

correct quantity and quality, but because of minor errors in the documents, the seller has not

The third is breach of “strict compliance”. The importer applies the letter of credit from

an issuing bank without strict compliance with the contract. The terms and conditions of

credit should be in compliance with the contract. In many cases, however, the importer do

not open/issue the credit based on the sales contract because kinds of reasons. This

behavior makes difficult for the performance of contract difficult, or leads the added loss on

exporters. The most frequent situations are: importers do not open the credit on time or do

not apply the credit from banks at all. For example, in the case of concerning market

change, strict restriction for the foreign currency, the importer will alter the time or delay

the time to open the letter of credit. The importer adds some accessional clauses in the

credit, for example, the importer may upgrade the kind of insurance; increase the amount of

insurance; change the port of destination; change the packing, in order to get the purpose of

changing the contract. Or the importer may make many restrictions on the credit, which is

considered as the “flexible clauses”.

The fouth is setting barriers in malice. By using the crucial principle of letters of

credit---“strict compliance” of documents and credit, the importer adds some conditions

that are hard to achieve, or sets some business trap on purpose. Such as unconfirmed

clauses; credit with words mistakes and conflicted clauses on content. It is not only a piece

of cake that there are some words mistakes on letters of credit. Those mistakes can be the

typing mistakes of the beneficiary’s name, address, shipment, the expiry time, and so on.

The mistakes may affect directly the documents that must submit, and sometimes it will be

the excuse for rejection of payment by the issuing bank.

The fifth is bogus letter of credit. If importers use the bogus letter of credit, or steal the

letter of credit with vacant form from a bank, or get the credit from a clerk who worked in a 9 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

bank that has been or is going to be bankruptcy, the exporters may face the calamity of losing both goods and money.

The sixth is requests of especial documents. The importer asks for the documents that

are hard to achieve. Some importers regulate the requests that cannot be fulfilled or

controlled by the exporters. Such requests may be: under the terms of FOB42 & CFR43,

the exporter can ask the payment only within the return receipt of insurance; or the

documents with some specific signature.

The seventh is conflict between clauses of credit and related law. The clauses of credit

are not accordant with the law of related country. In the real practice of international trade,

some clauses in the credit are advantage to the exporter on the appearance. The noticeable

point is that if the clauses are allowed according to the law of importer’s country. The

exporter should know the law in related country, and negotiated the clauses that cannot be

implemented in the importer’s country. Otherwise, the exporter will not only loss the

advantage in contract, but also involves in the restriction of another national law. For

example, the accrual and final discount fee is responsible by the importer according to the

letter of credit. The reasons are: citizens should turn in the income tax of the interest based on the national or state law.

The final is fraud by altering letter of credit. Importers alter the overdue letters of credit

purposely. The exporter may be cheated for their goods by this altered credit. Importers

change the amount, the date of shipment, and beneficiary’s name of the overdue credit.

With the purpose of finance the money by a credit from the bank, importers may prevail the

exporters on issuing the credit.

The group have not told about the creditworthiness of the issuing banks this is the main

reason why L/C issued by Vietnamese commercial banks are needed to be confirmed. 2.

Risks to the issuing bank of the LC

The first is credit risk. That is, the bank can advance an amount of money, but it is

unlikely that it will be recovered. For example, the issuing bank of the LC upon receipt of a

complete set of valid documents is obliged to pay the exporters to the beneficiaries.

However, in this case, if the importer is no longer able to pay, or goes bankrupt, then the

issuing bank will have a loss associated with the credit risk.

Next is the risk related to document errors. For example, for an issuing bank, there are

several types of errors as follows: First, the set of documents is incomplete, but the issuing

bank does not detect it and still makes payments to the exporter.

The second case is that the LC payment documents are complete, but the issuing bank

thinks that there is an error, so failing to pay the exporter will bear the risk of being sued by the exporter. 10 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

Therefore, when conducting LC payment procedures, there are many banks that

carefully check the documents of the importer and exporter (the beneficiary), and at the

same time, the risk acceptance conditions of each bank are also very important. different.

Therefore, not all LC applications of enterprises are accepted by the bank.

In conclusion, issuing bank is the entity, which gives the main conditional payment

guarantee to the beneficiary. As a result, issuing bank is more vulnerable to the risks in

letters of credit transactions than any other parties involved. Insolvency

Risk of the Applicant : Issuing bank may not be able to recover the credit

amount that has already paid to the beneficiary, if applicant becomes insolvent after

issuance of the letter of credit. Fraud

Risks : Beneficiary and applicant may act together to scam issuing banks under letter of credit transactions. Political

Risks : Issuing bank may not be able to honor its payment obligation due to

various political risks. Most recent examples are sanction clauses inserted into letters of credit. III.

Solutions improve Vietnamese commercial bank’s creditworthiness in letter of credit payment activities 1. Risk prevention

With the development of a multi-component commodity economy, the money market is

increasingly vibrant and intertwined with the commodity market. One of the tasks for bank

management is to have an effective risk management structure that sets out specific

monitoring measures and business processes to prevent and limit risks. In the market

economy, risk prevention for bank credit activities is indispensable, credit business contains

great risks. It can be said that risks are always happening at all times, everywhere, in all

aspects, the causes are both objective and subjective. Thus, research on risk in credit

business is the first step in risk prevention and limitation. From there, propose measures to

improve the quality of commercial activities of commercial banks.

Commercial banks need a change in the strategic orientation of credit risk management,

focusing on credit portfolio risk management. However, when it comes to credit portfolio

risk management, commercial banks now face difficulties in calculating the customer's

default probability (PD) and building the customer's maturity matrix. to determine the

default loss (LGD). To overcome difficulties when implementing credit portfolio

management, Vietnamese commercial banks need to take steps to prepare: 1.

Develop a reasonable capital mobilization policy. 2.

Diversify customers and forms of credit. 3. Diversify investment fields. 11 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ 4.

Improve the quality of customer assessment and credit appraisal. 5.

strengthen debt management, settle overdue debts and monitor credit. 6. Advanced banking technology. 7.

The database is large and long enough, updated regularly, and the management of

credit information must be professional. 8.

Modernize and standardize the core banking system to ensure the inconsistency

and accuracy of information and statistical data when reporting and using analytics. 9.

Improve the quality of the staff. 10. Enhance marketing activities .

Credit activities of commercial banks in the current market economic conditions in our

country still face many difficulties and risks. This situation is caused by a combination of many different causes.

Credit activity is the basic operation of a bank, credit risk is a potential problem. Find a

method to fulfill those obligations that can eliminate the risk completely and can guarantee

a certain amount in advance. Certain financial results are not possible. We can only offer

the lowest “risk reduction and prevention measures”.

2. Improve the bank’s system

The group of solutions to improve the reputation of the State Bank analyzed, one of the

reasons why people do not want to deposit money in the Bank is because they do not fully

trust the Vietnamese banking system, that means the bank's reputation is not high.

Therefore, in order to regain the trust of the people, the Bank needs to persistently analyze

to find the causes and step by step propose appropriate solutions.

Improve utilities for customers. This means, the Bank must always improve innovation

in Technology and business processes or services to ensure benefits and convenience for

customers . Keeping credibility with customers: The bank must ensure the ability to pay

in all conditions, not beg or delay with customers due to lack of money, but also have to

do the payment and use quickly. computers , cash counters ... and modern forms of

payment such as automatic teller machines ATM , international credit card payment,

VISA card, master card, travel check. Participate in interbank clearing by networking

with the clearinghouse. If the Bank can do this, customers will increasingly trust the

Bank and of course they will deposit more money. Publicly report the Bank's business

activities, when customers choose the Bank to deposit. they all have to find out if the

bank is profitable or not?, is the bank's business operations stable, safe or not? 12 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

Does the Bank's business area contain many risk factors? Therefore, the Bank needs to

publicly disclose its operating results through financial statements, which can be

considered as a solution not only to improve the efficiency of capital mobilization but

also to enhance the Bank's reputation. However, due to competitive factors and security

in business activities, there are very few banks that implement this solution, usually

through audits, but this is the basis for depositors to believe in the Bank's business

performance. Improve material and technical facilities: In the current operating

conditions, having physical facilities is one of the strong foundations to create trust for

depositors. The Bank needs to build a working office. with a large scale, convenient

location, spacious and modern, quick and timely service time, meeting and satisfying the

needs of depositors, showing trust to depositors, increasing the capacity competition ,

increasing the efficiency of capital mobilization of the Bank . Innovating the Bank's

service style: In the current operating environment, when the diversification in the form

of capital mobilization or the application of banking technology takes place every day,

the service style is the most important. The factor that creates the characteristics of the

Bank's operations, attracting customers to the Bank The service style and attitude of the

Bank's staff is the mirror of the Bank's image.

Why are customers entering the bank confused and embarrassed? it is due to

psychological factors, so to change that, it must be thanks to the service attitude of the

bank's staff, with a gentle communication attitude, dedicated and enthusiastic to answer

questions. Of customers, the result is not only attracting capital from customers but also

creating a reputation for the Bank to expand and improve service quality to satisfy all

customers' needs in the best way, to attract them to participate in deposit transactions. At

the same time, they also enjoy benefits for themselves and their families. For example:

Service Bank, Home Banking, Receiving Deposits, Home Loans, Working Overtime.

Improving staff qualifications and innovating management in the Bank Any task must be

performed on the basis of its process and capital mobilization is also a business of the

Bank, in fact at the Bank. there are many professional staff with management capacity

and management is increasingly focused. However, in order for the capital mobilization

to be highly effective, the Bank needs to pay more attention to the Bank's staff and the

management in the Bank, specifically on improving the professional qualifications of the

staff, especially is an officer in charge of capital mobilization.

Must continue training and re-training, in order to fully equip with professional

knowledge and technology to perform well assigned tasks.

In addition, the Bank should have a policy to encourage its staff to improve their

qualifications by self-study or self-study in order to create a team of dedicated and 13 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

good professionals. management, in addition to improving and investing more in

equipment for capital mobilization, the Bank should improve model organizational

apparatus, reasonable arrangement. The bank needs to select and train competent

and qualified staff to delegate management authority. This will improve the

efficiency of capital mobilization. In short, the human factor is always the most

important factor, solving all the success or failure of all economic activities.

Therefore, in order to serve the long-term development and improve the efficiency. REFERENCES

1. Trung tâm Xuất nhập khẩu Lê Ánh (15/08/2021) "RỦI RO CỦA THANH TOÁN LC VÀ

CÁCH GIẢM THIỂU RỦI RO". xuatnhapkhauleanh.edu.vn. Truy cập ngày 24/08/2021 từ trang:

https://xuatnhapkhauleanh.edu.vn/rui-ro-cua-thanh-toan-lc-va-cach-giam-thieu-rui- ro.html

2. Phạm Yen (18/04/2013) NHÓM GIẢI PHÁP NÂNG CAO UY TÍN NGÂN HÀNG.

https://toc.123docz.net. Truy cập từ ngày 26/08/2021 từ trang:

https://toc.123docz.net/document/2333478-nhom-giai-phap-nang-cao-uy-tin-cua-ngan- hang.htm

3. ĐỀ ÁN GIẢI PHÁP NÂNG CAO CHẤT LƯỢNG TÍN DỤNG CÁC NGÂN HÀNG.

Truy cập từ ngày 26/08/2021 từ trang:

http://sotuphap.backan.gov.vn/DocumentLibrary/3f80c37076209760/01.%20Đề%20án

%20giải%20pháp%20nâng%20cao%20chất%20lượng%20t%C3%ADn%20dụng%20các

%20ngân%20hàng%20thuơng%20mại%20ở%20việt%20nam.doc

4. Nguyễn Thị Thuý Quỳnh, Vũ Thế Anh, Nguyễn Thị Thu Huyền, Trường Đại học Kinh tế

& Quản trị kinh doanh Thái Nguyên (03/04/2021) GIẢI PHÁP PHÁT TRIỂN TÍN

DỤNG DOANH NGHIỆP ĐỐI VỚI CÁC NGÂN HÀNG THƯƠNG MẠI.

https://tapchitaichinh.vn. Truy cập từ ngày 26/08/2021 từ trang:

https://tapchitaichinh.vn/ngan-hang/giai-phap-phat-trien-tin-dung-doanh-nghiep-doi-voi-

cac-ngan-hang-thuong-mai-332973.html

5. Yan Hao (08/2013) RISK ANALYSIS OF LETTER OF CREDIT. https://ijbssnet.com/.

Truy cập từ ngày 25/08/2021 từ trang

https://ijbssnet.com/journals/Vol_4_No_9_August_2013/20.pdf 14 ĐẠI HỌC HOA SEN KHOA KINH TẾ - QUẢN TRỊ

6. Ozgur Eker (17/01/2018) RISKS IN LETTERS OF CREDIT.

https://www.letterofcredit.biz/. Truy cập từ ngày 25/08/2021 từ trang

https://www.letterofcredit.biz/index.php/2018/01/17/risks-in-letters-of-credit/

7. Sanjay Bulaki Borad (22/03/2021) ADVANTAGES AND DISADVANTAGES OF

LETTER OF CREDIT. https://efinancemanagement.com/. Truy cập từ ngày 25/08/2021 từ trang

https://efinancemanagement.com/sources-of-finance/advantages-disadvantages-letter- credit

8. NAB (22/03/2021). WHAT IS CREDITWORTHINESS AND WHY DOES IT

MATTER?. https://www.nab.com.au/ . Truy cập từ ngày 25/08/2021:

https://www.nab.com.au/personal/life-moments/manage-money/money- basics/creditworthin

9. Investopedia (22/03/2021). CREDITWORTHINESS. https://www.investopedia.com/ .

Truy cập từ ngày 25/08/2021:

https://www.investopedia.com/terms/c/credit-worthiness.asp 10.

Drip/c (17/01/2018). LETTER OF CREDIT EXPLAINED WITH PROCESS &

EXAMPLE https://www.dripcapital.com/ . Truy cập từ ngày 25/08/2021:

https://www.dripcapital.com/resources/blog/letter-of-credit-lc 15