Preview text:

OMoARcPSD|44862240

Name: Nguyễn Ngọc Quỳnh Như

ID: 1805025111

Class: k57BF-A

Homework 2 – Adjusting and Preparing Financial Statements

1. For each of the following separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31, 2011. (Assume that prepaid expenses are initially recorded in asset a ccounts and that fees collected in advance of work are initially recorded as liabilities.)

- One-third of the work related to $30,000 cash received in advance is performed this period.

- Wages of $9,000 are earned by workers but not paid as of December 31, 2011.

- Depreciation on the company’s equipment for 2011 is $19,127.

- The Office Supplies account had a $480 debit balance on December 31, 2010. During 2011, $5,349 of office supplies are purchased. A physical count of supplies at December 31, 2011, shows $587 of supplies available.

- The Prepaid Insurance account had a $5,000 balance on December 31, 2010. An analysis of insurance policies shows that $2,200 of unexpired insurance benefits remain at December 31, 2011.

- The company has earned (but not recorded) $750 of interest from investments in CDs for the year ended December 31, 2011. The interest revenue will be received on January 10, 2012.

- The company has a bank loan and has incurred (but not recorded) interest expense of $3,500 for the year ended December 31, 2011. The company must pay the interest on January 2, 2012.

2. Quake Co. had the following transactions in the last two months of its fiscal year ended May

31.

Apr. 1 | Paid $3,450 cash to an accounting firm for future consulting services. |

Apr 1 | Paid $2,700 cash for 12 months of insurance through March 31 of the next year. |

Apr 30 | Received $7,500 cash for future services to be provided to a customer. |

May 1 | Paid $3,450 cash for future newspaper advertising. |

May 23 | Received $9,450 cash for future services to be provided to a customer. |

May 31 | Of the consulting services paid for on April 1, $1,500 worth has been received. |

May 31 | A portion of the insurance paid for on April 1 has expired. No adjustment was made in |

April to Prepaid Insurance.

May 31 Services worth $3,600 are not yet provided to the customer who paid on April 30.

May 31 Of the advertising paid for on May 1, $1,050 worth is not yet used.

May 31 The company has performed $4,500 of services that the customer paid for on May 23.

Prepare entries for these transactions. Also prepare adjusting entries at the end of the year.

Answer

1. For each of the following separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31, 2011. (Assume that prepaid expenses are initially recorded in asset a ccounts and that fees collected in advance of work are initially recorded as liabilities.)

- One-third of the work related to $30,000 cash received in advance is performed this period.

- Wages of $9,000 are earned by workers but not paid as of December 31, 2011.

- Depreciation on the company’s equipment for 2011 is $19,127.

- The Office Supplies account had a $480 debit balance on December 31, 2010. During 2011, $5,349 of office supplies are purchased. A physical count of supplies at December 31, 2011, shows $587 of supplies available.

- The Prepaid Insurance account had a $5,000 balance on December 31, 2010. An analysis of insurance policies shows that $2,200 of unexpired insurance benefits remain at December 31, 2011.

- The company has earned (but not recorded) $750 of interest from investments in CDs for the year ended December 31, 2011. The interest revenue will be received on January 10, 2012.

- The company has a bank loan and has incurred (but not recorded) interest expense of $3,500 for the year ended December 31, 2011. The company must pay the interest on January 2, 2012.

Account Titles Debit Credit

- Unearned Revenue $10,000 Revenue $10,000

- Wages Expense $9,000

Wage Payable $9,000 C Depreciation Expense $19,127

(Equipment)

Accumulated Expense $19,127

(Equipment)

D Office Supplies Expense $5,242

Office Supplies $5,242

Account Titles

Debit

Credit

E

Insurance Expense

$2,800

Prepaid Expense

$2,800

Accounts Receivable

F

(

Interest

)

$750

Interest Revenue

$750

Interest Expense

G

$3,500

Accounts Payable

(Interest)

$3,500

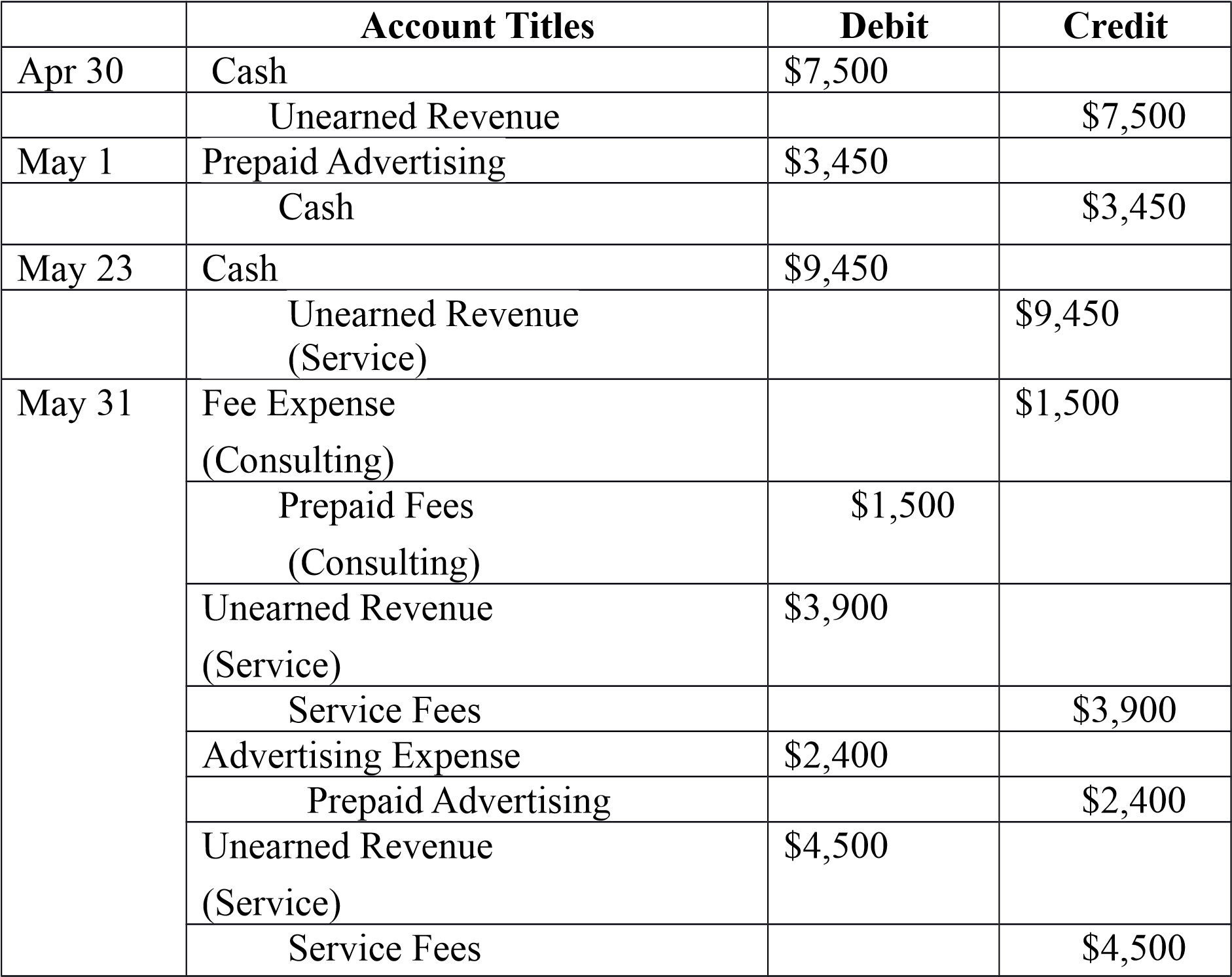

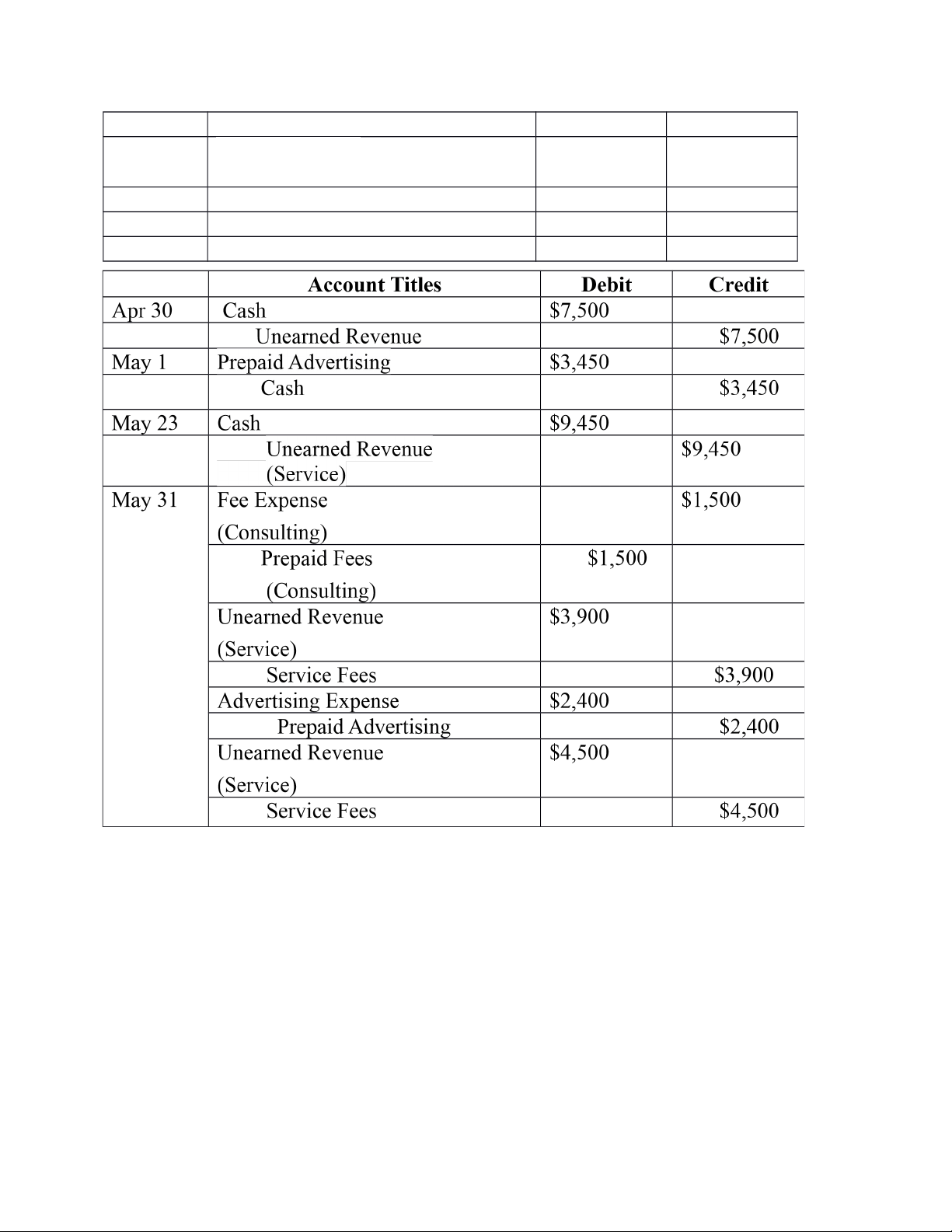

2. Quake Co. had the following transactions in the last two months of its fiscal year ended May 31.

Apr. 1 | Paid $3,450 cash to an accounting firm for future consulting services. |

Apr 1 | Paid $2,700 cash for 12 months of insurance through March 31 of the next year. |

Apr 30 | Received $7,500 cash for future services to be provided to a customer. |

May 1 | Paid $3,450 cash for future newspaper advertising. |

May 23 | Received $9,450 cash for future services to be provided to a customer. |

May 31 | Of the consulting services paid for on April 1, $1,500 worth has been received. |

May 31 | A portion of the insurance paid for on April 1 has expired. No adjustment was made in |

April to Prepaid Insurance.

May 31 Services worth $3,600 are not yet provided to the customer who paid on April 30.

May 31 Of the advertising paid for on May 1, $1,050 worth is not yet used.

May 31 The company has performed $4,500 of services that the customer paid for on May 23.

Prepare entries for these transactions. Also prepare adjusting entries at the end of the year.

Account Titles

Debit

Credit

Apr 1

Prepaid Expense

(

Consulting)

$3,450

Cash

$3,450

Prepaid Insurance

Apr 1

$2,700

Cash

$2,700