Preview text:

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0-----

HOMEWORK FINANCIAL ACCOUNTING Group 5_Thursday Morning:

Đinh Thị Quỳnh Hoa - BABAIU20054

Nguyễn Quỳnh Hoa - BABAWE20165

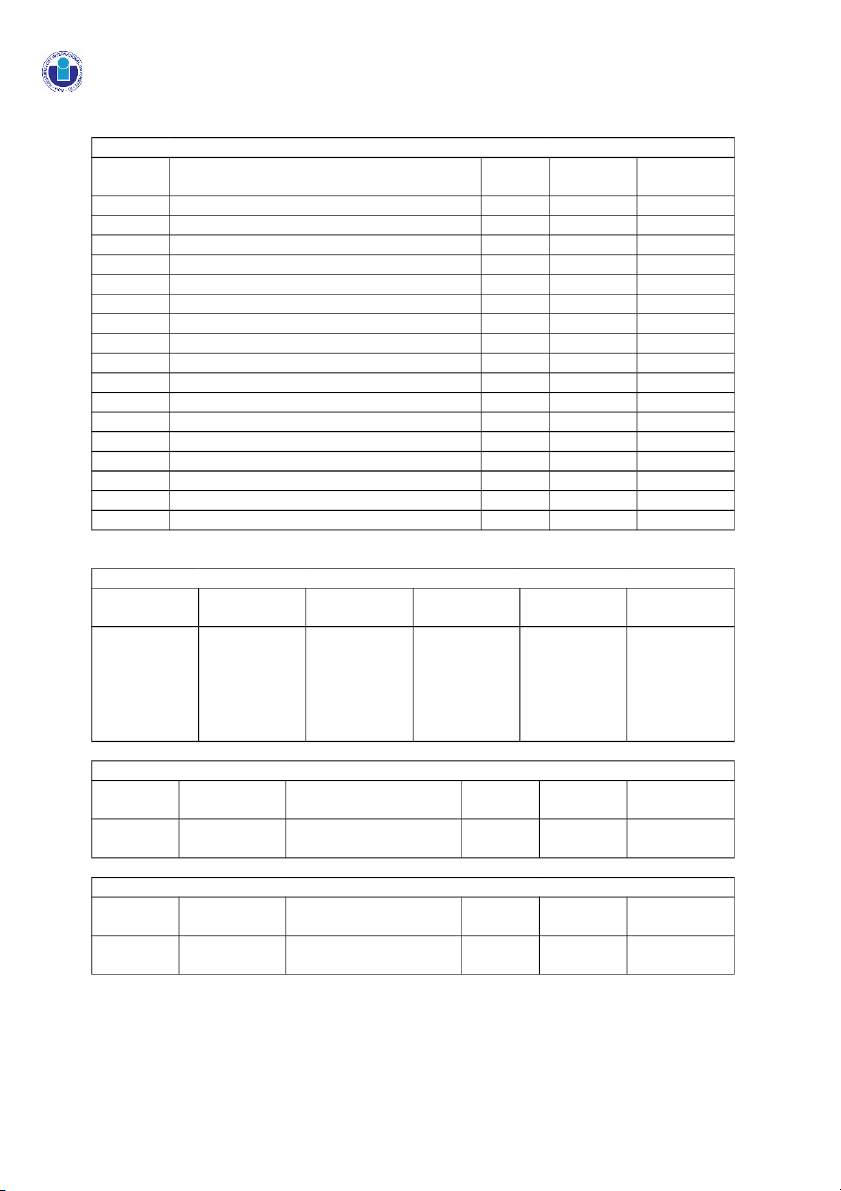

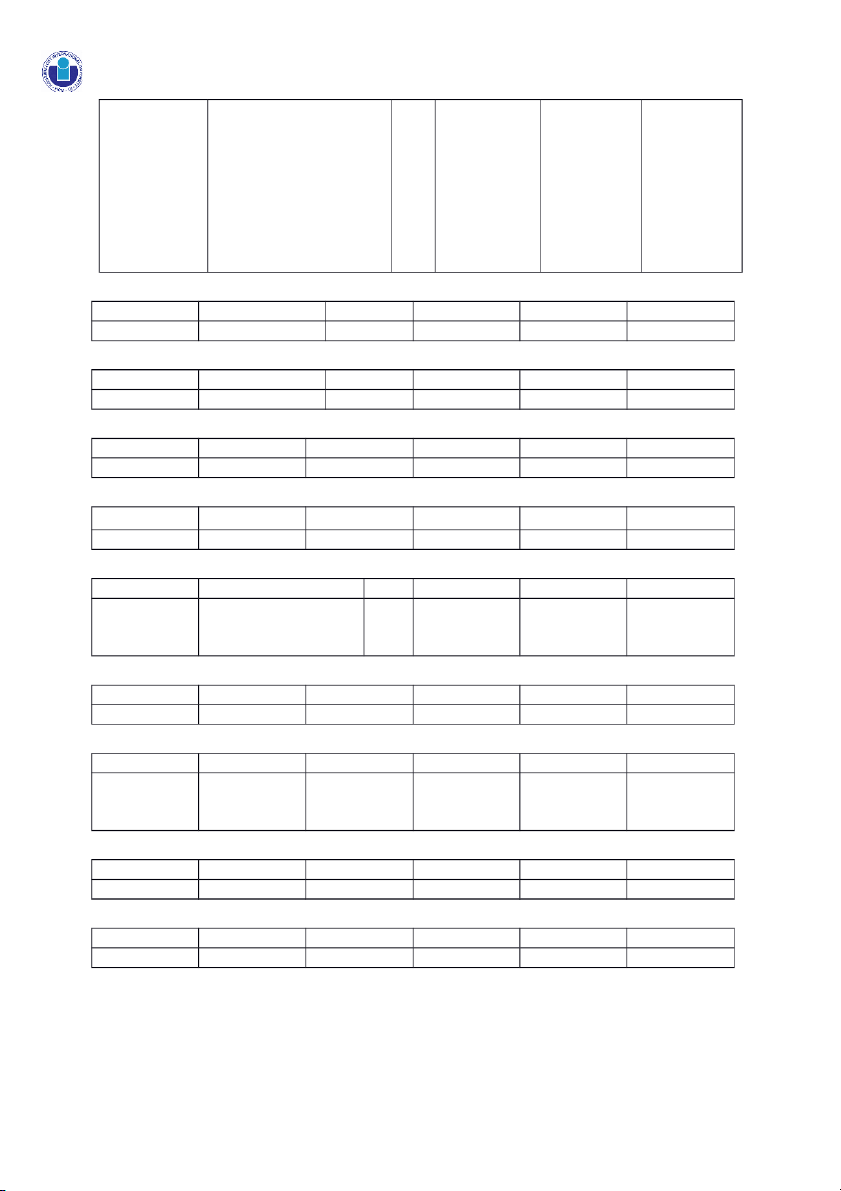

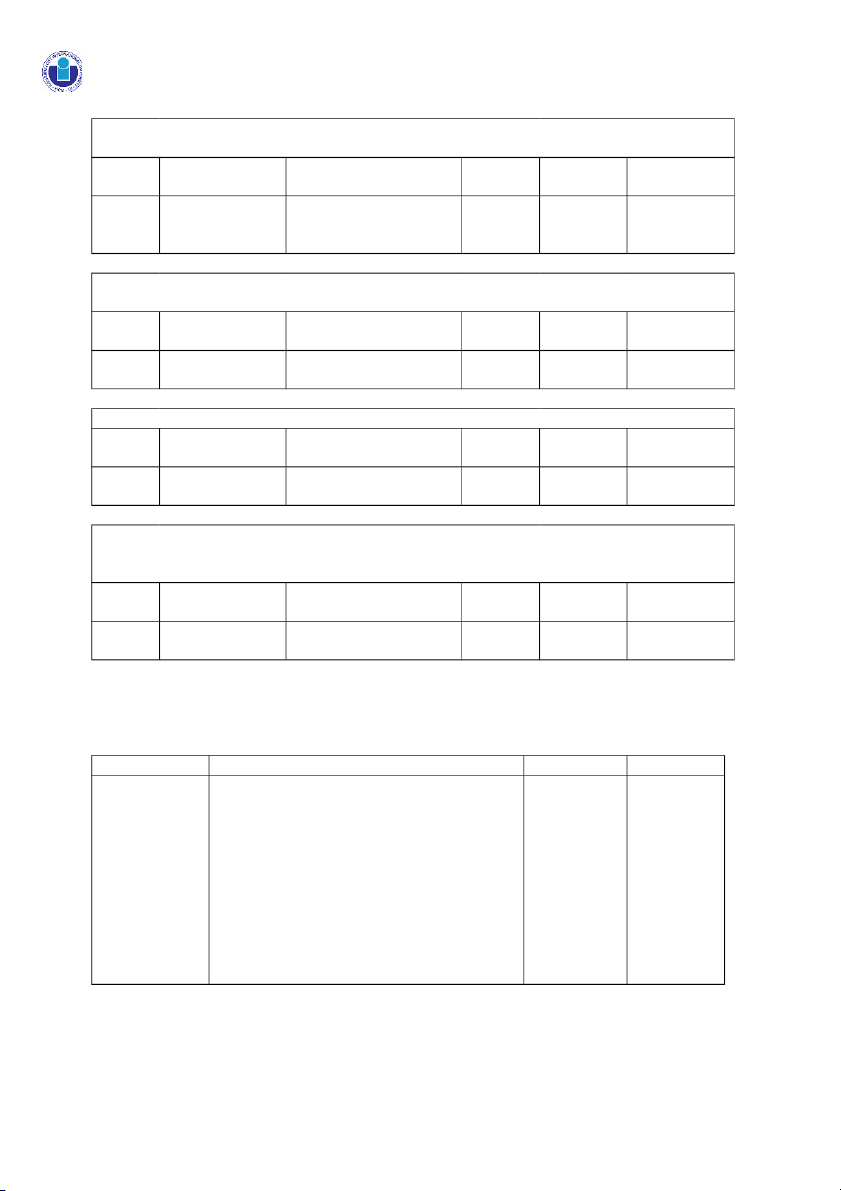

Dương Tuấn Khải - BAFNIU20304 CHAPTER 2 Question 1. Date

Account Titles and Explanations Ref. Debit Credit Mar. 1 Owner’s Capital $20,000 (Invested in the business) Cash $20,000 3

Purchased land, shed, equipment $12,000 $2,000 $1,000 Cash $15,000 5 Advertising Expenses $900 Cash $900 6 Prepaid Insurance $600 (A one-year insurance policy) Cash $600 10

Purchased equipment from Stevenson. $1,050 Company payable $1,050 Accounts Payable 18 Service Revenue $1,100 (Received cash for Golf fees) Cash $1,100 19 Unearned Service Rvenue $1,500

(Sold Coupon in cash 150x$10=$1,500) Cash $1,500 25 Owner’s Drawing $800

(Withdraw cash for personal use) Cash $800 30 Salaries Expense $250 Cash $250 30 Accounts payable $1050 (Paid creditors on accounts) Cash $1050 31 Service Revenue $2,700 (Received golf fees) Cash $2,700

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

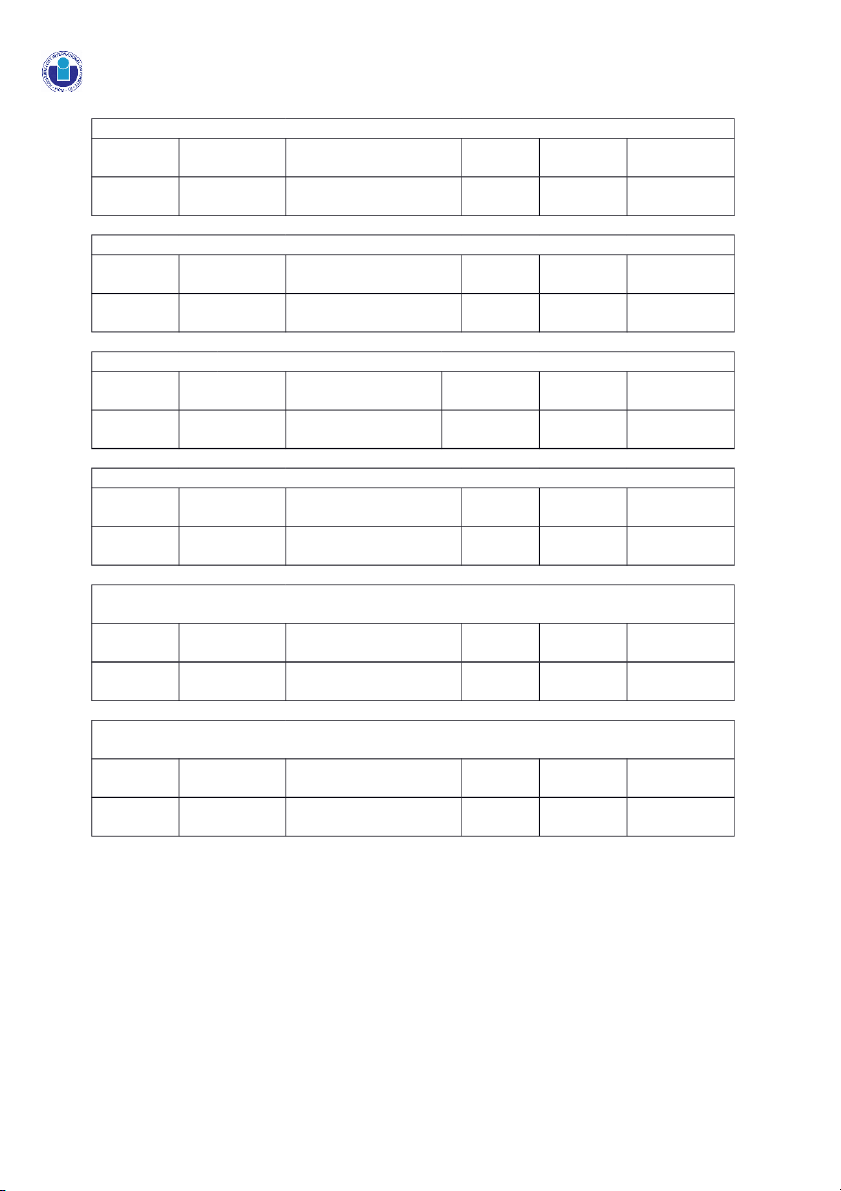

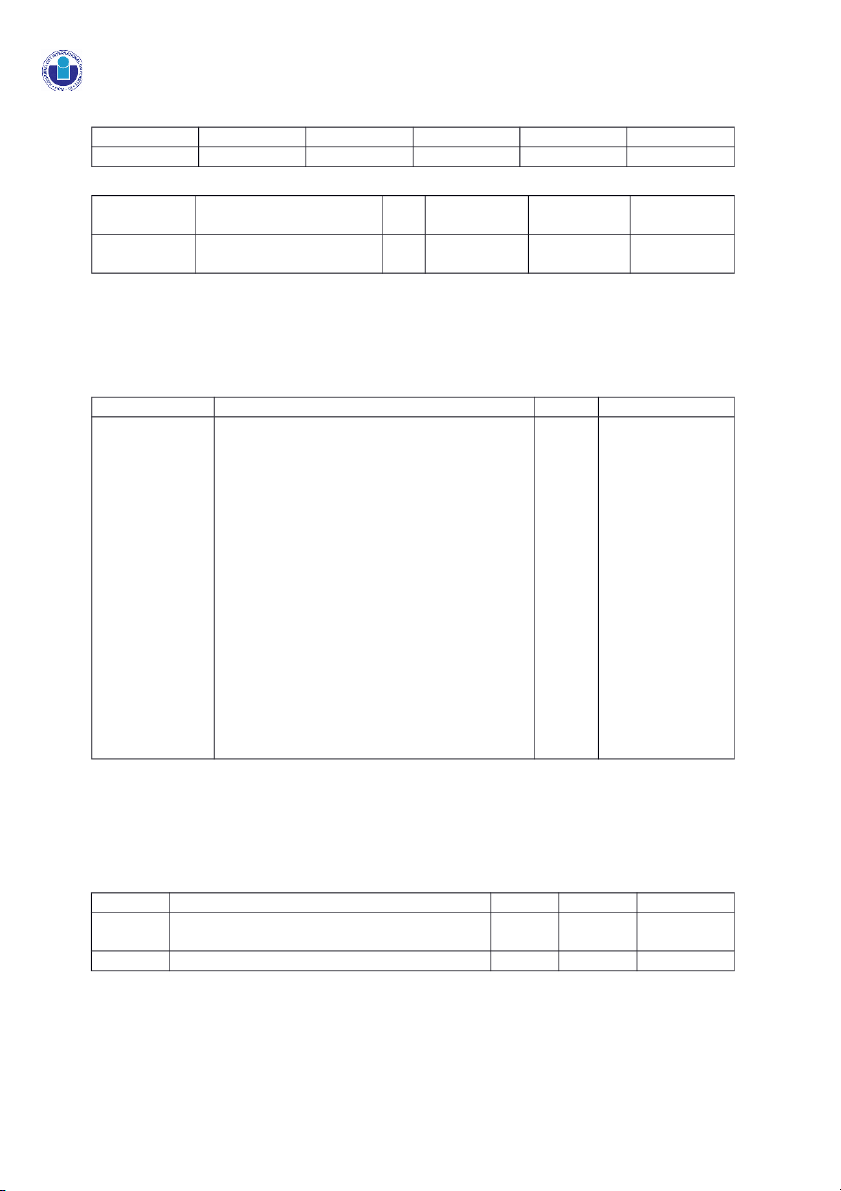

School of Business -----0----- Question 2. a) GENERAL JOURNAL Date

Account Titles and Explanations Ref. Debit Credit April 1 Cash 101 $20,000 Owner’s Capital 301 $20,000 1 No entry 2 Rent Expense 729 $1,100 Cash 101 $1,100 3 Supplies 126 $4,000 Accounts Payable 201 $4,000 10 Accounts Receivable 112 $5,100 Service Revenue 400 $5,100 11 Cash 101 $1,000 Unearned Service Revenue 209 $1,000 20 Cash 101 $2,100 Service Revenue 400 $2,100 30 Salaries and Wages Expense 726 $2,800 Cash 101 $2,800 30 Accounts Payable 112 $2,400 Cash $2,400 b) CASH No.101 Date Explanation Ref Debit Credit Balance April 1 J1 $20,000 $20,000 2 J1 $1,100 $18,900 11 J1 $1,000 $19,900 20 J1 $2,100 $22,000 30 J1 $2,800 $19,200 30 J1 $2,400 $16,800 OWNER’S CAPITAL No.301 Date Explanation Ref Debit Credit Balance April 1 J1 $20,000 $20,000 RENT EXPENSE No.729 Date Explanation Ref Debit Credit Balance April 2 J1 $1,100 $1,100

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- SUPPLIES No.126 Date Explanation Ref Debit Credit Balance April 3 J1 $4,000 $4,000 ACCOUNT PAYABLE No.201 Date Explanation Ref Debit Credit Balance April 3 J1 $4,000 $4,000 30 $2,400 $1,600 ACCOUNT RECEIVABLE No.112 Date Explanation Ref Debit Credit Balance April 10 J1 $5,100 $5,100 SERVICE REVENUE No.400 Date Explanation Ref Debit Credit Balance April 10 J1 $5,100 $5,100 20 $2,100 $7,200 UNEARNED No.209 SERVICE REVENUE Date Explanation Ref Debit Credit Balance April 11 J1 $1,000 $1,000 SALARY AND WAGE No.726 EXPENSE Date Explanation Ref Debit Credit Balance April 30 J1 $2,800 $2,800

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- c) Emily Valley Trial Balance April 30, 2017 Debit Credit Cash $ 16,800 Owner’s Capital 20,000 Rent Expense 1,100 Supplies 4,000 Account Payable 1,600 Account Receivable 5,100 Service Revenue 7,200 Unearned Service Revenue 1,000 Salary and Wage Expense 2,800 $29,800 $29,800 Question 3. a) CASH No.101 Date Explanation Ref. Dr. Cr. Balance March-1 3000 3000 LAND No.140 Date Explanation Ref. Dr. Cr. Balance March-1 24000 24000 BUILDINGS No.145 Date Explanation Ref. Dr. Cr. Balance March-1 10000 10000 EQUIPMENT No.157 Date Explanation Ref. Dr. Cr. Balance March-1 10000 10000 ACCOUNT PAYABLE No.201 Date Explanation Ref. Dr. Cr. Balance March-1 7000 7000

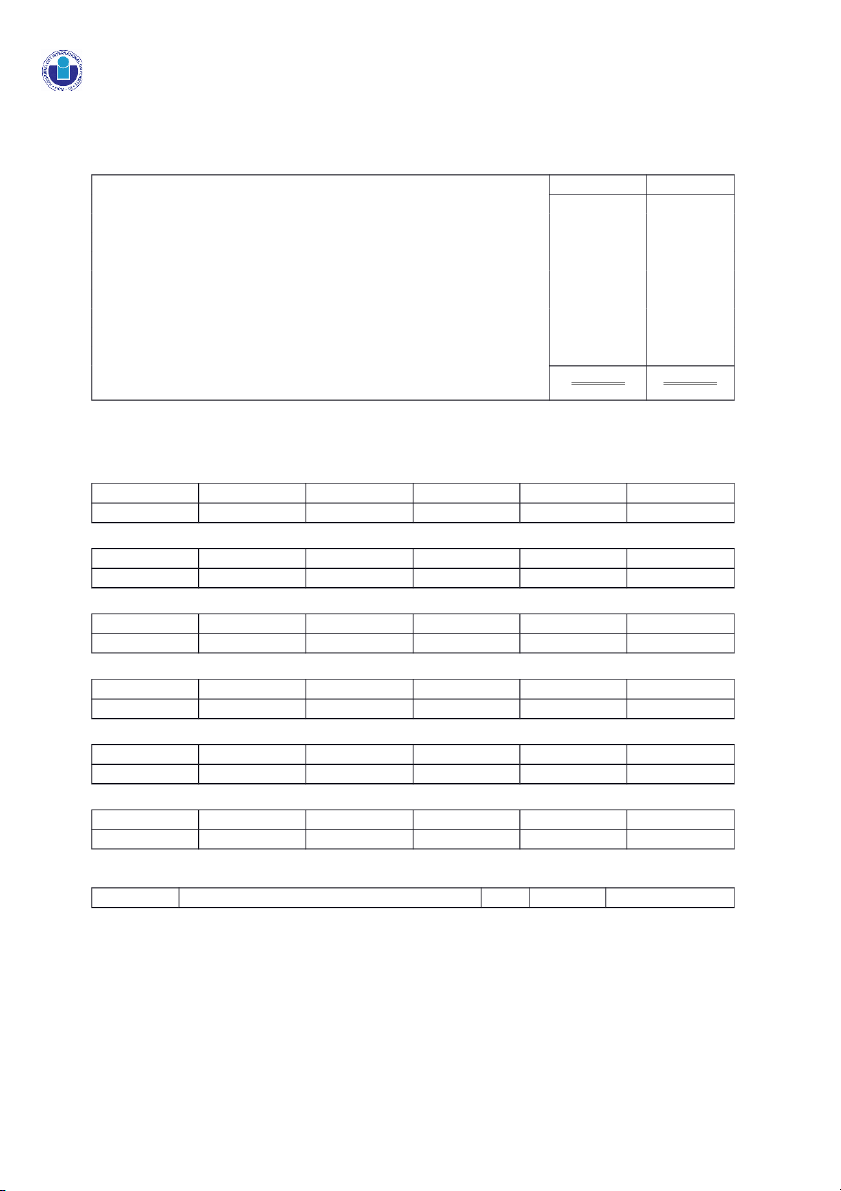

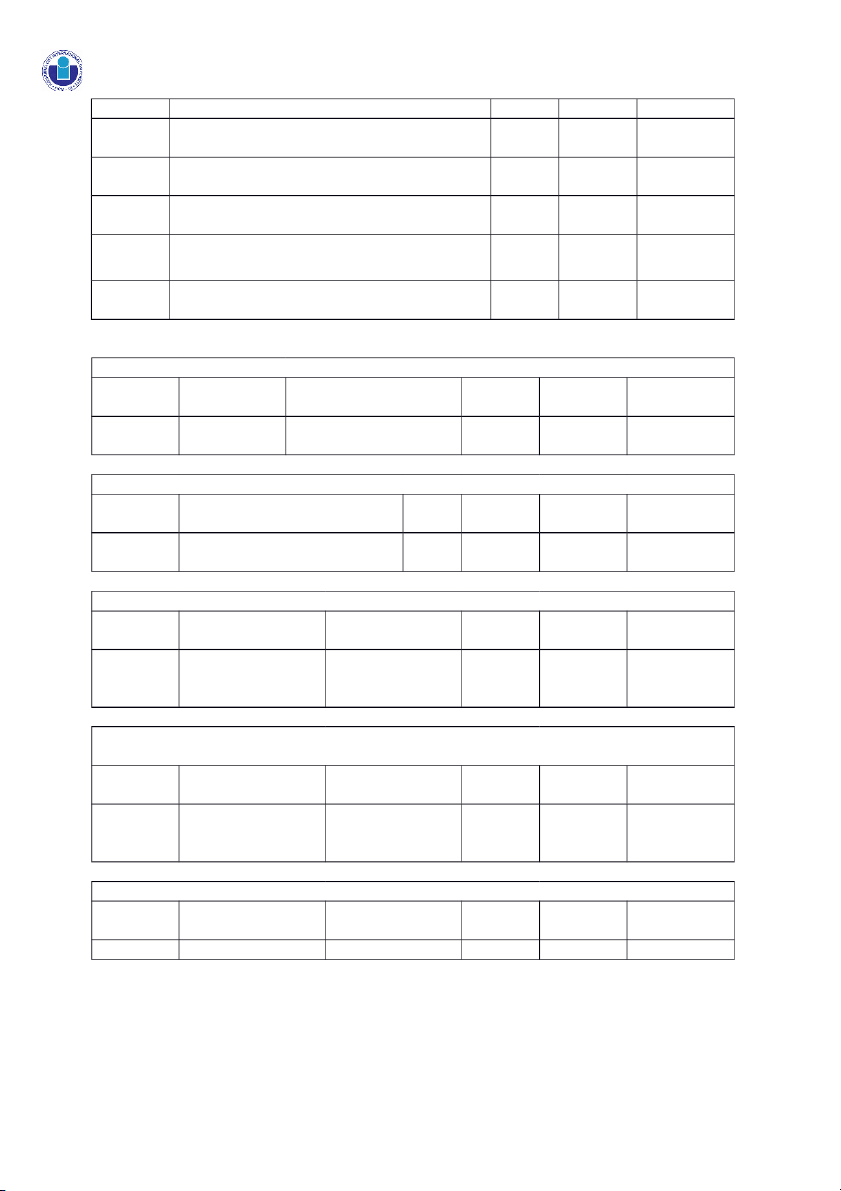

OWNER’S CAPITAL No.301 Date Explanation Ref. Dr. Cr. Balance March-1 40000 40000 b) Date

Account titles & explanations Ref. Debit Credit

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- March-2 Rental Expense $3500 Cash $1500 Accounts Payable $2000 (Paid cash for Film Rent) March-3 No Entry -

(Hide, order , contact , promise -

agrument etc are not financial transactions) March-9 Cash $4300 Admission Revenue $4300 (Received cash from admissions) March-10 Accounts Payable $4100 Cash $4100 (Paid creditors on accounts. ($2000 + $2100)=$4100 ) March-11 No entry -

(Hire , order , contact ,promise -

argument etc are not financial transactions) March-12 Advertising expense $900

Cash (paid cash for Advertising expense) $900 March-20 Cash $5000 Admission Revenue $5000

(Received cash from customer for Admission) March-20 Rent Expense $2000 Cash(Paid cash for Rental fee) $2000 March-31 Salaries Expense Cash(Paid cash for salaries) March-31 Cash(1/2 x $900= $450) $450

Account Receivable(1/2 x $900=$450) $450 Rent Revenue($6000x15%=$900) $900

(Received cash for concession of

the Adams to Operate which stands as Rent Revenue) March-31 Cash $9000 Admission Revenue $9000 (Received cash for Admission) c) Cash No.101 Date Explaination Ref Dr. Cr. Balance March-1 $3000 $3000 March-2 Rental Expense J1 $1500 $1500

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- March-9 Admission Revenue J1 $4300 $5800 March-10 Accounts Payable J1 $4100 $1700 March-12 Advertising Expense J1 $900 $800 March-20 Admission Revenue J1 $5000 $5800 March-20 Film Rental Expense J1 $2000 $3800 March-31 Salaries Expense J1 $3100 $700 March-31 Rent Revenue J1 $450 $1150 March-31 Admission Revenue J1 $9000 $10150 Account Receivable Date Explanation Ref. Dr. Cr. Balance March-31 Rent Revenue J1 $450 $450 Land Date Explanation Ref. Dr. Cr. Balance March-1 $24000 $24000 Buildings Date Explanation Ref. Dr. Cr. Balance March-1 $10000 $10000 Equipment Date Explanation Ref. Dr. Cr. Balance March-1 $10000 $10000 Account Payable Date Explanation Ref. Dr. Cr. Balance March-1 $7000 $7000 March-2 Film Rental Expense $2000 $9000 March-9 Cash $4100 $4900 Owner’s Capital Date Explanation Ref. Dr. Cr. Balance March-1 $40000 $40000 Admission Revenue Date Explanation Ref. Dr. Cr. Balance March-9 Cash J1 $4300 $4300 March-20 Cash J1 $5000 $9300 March-31 Cash J1 $9000 $18300 Rent Revenue Date Explanation Ref. Dr. Cr. Balance March-31 Cash J1 $900 $900 Salaries Expense Date Explanation Ref. Dr. Cr. Balance March-12 Cash J1 $3100 $3100

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- Advertising Expense Date Explanation Ref. Dr. Cr. Balance March-12 Cash J1 $800 $800 Rent Expense Date Explanation Ref Dr. Cr. Balance . March-2 Cash + Accounts Payable J1 $3500 $3500 March-20 Cash J1 $2000 $5500 d) The Starr Theater Trial Balance March 31 ,2018 Sl.No. Accounts title Dr. Cr. 101 Cash $1015 112 Accounts Receivable 0 140 Land $450 145 Buildings $2400 157 Equipments 0 201 Accounts Payable $1000 $4900 205 Owner’s Capital 0 $40000 405 Admission Revenue $1000 $18300 429 Rent Revenue 0 $900 610 Advertising Expense 726 Salaries Expense 729 Rent Expense Totals $64100 $900 $3100 $5500 $6410 0 CHAPTER 3 Question 1 a) KRAUSE CONSULTING

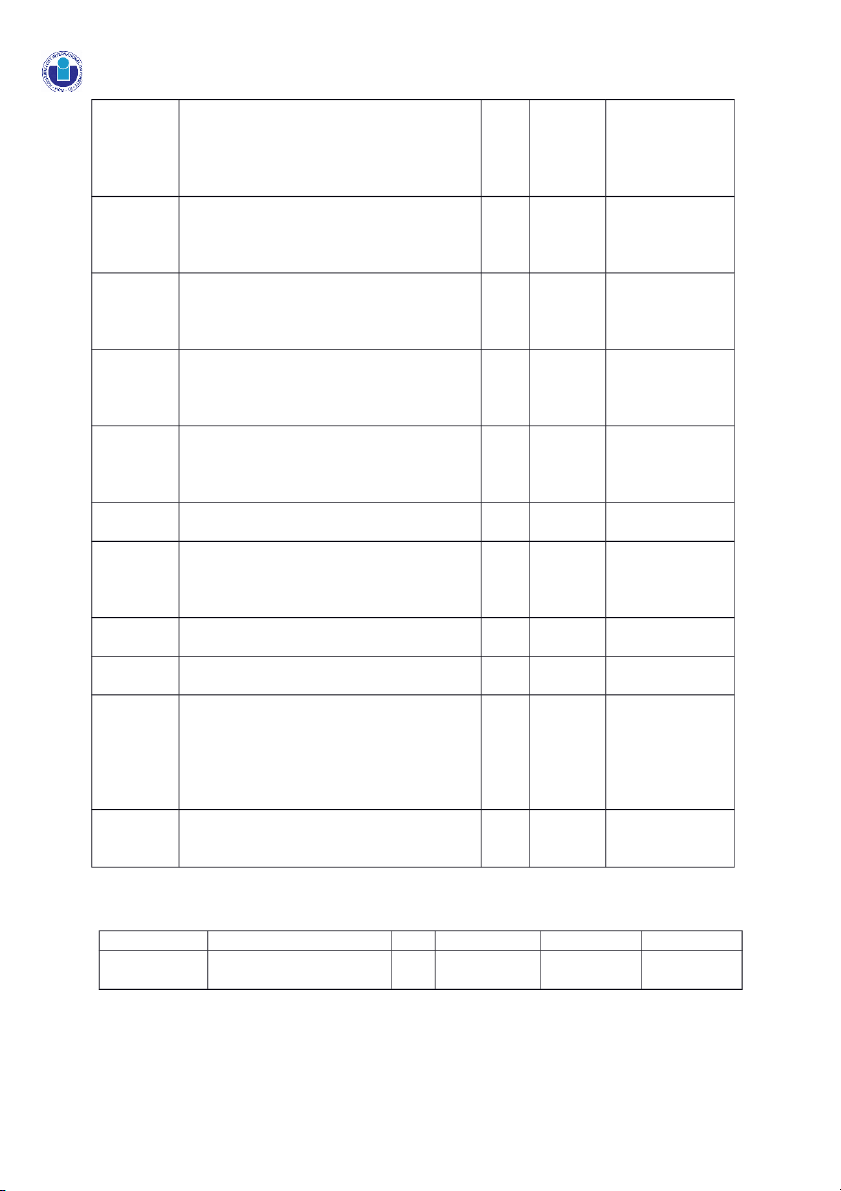

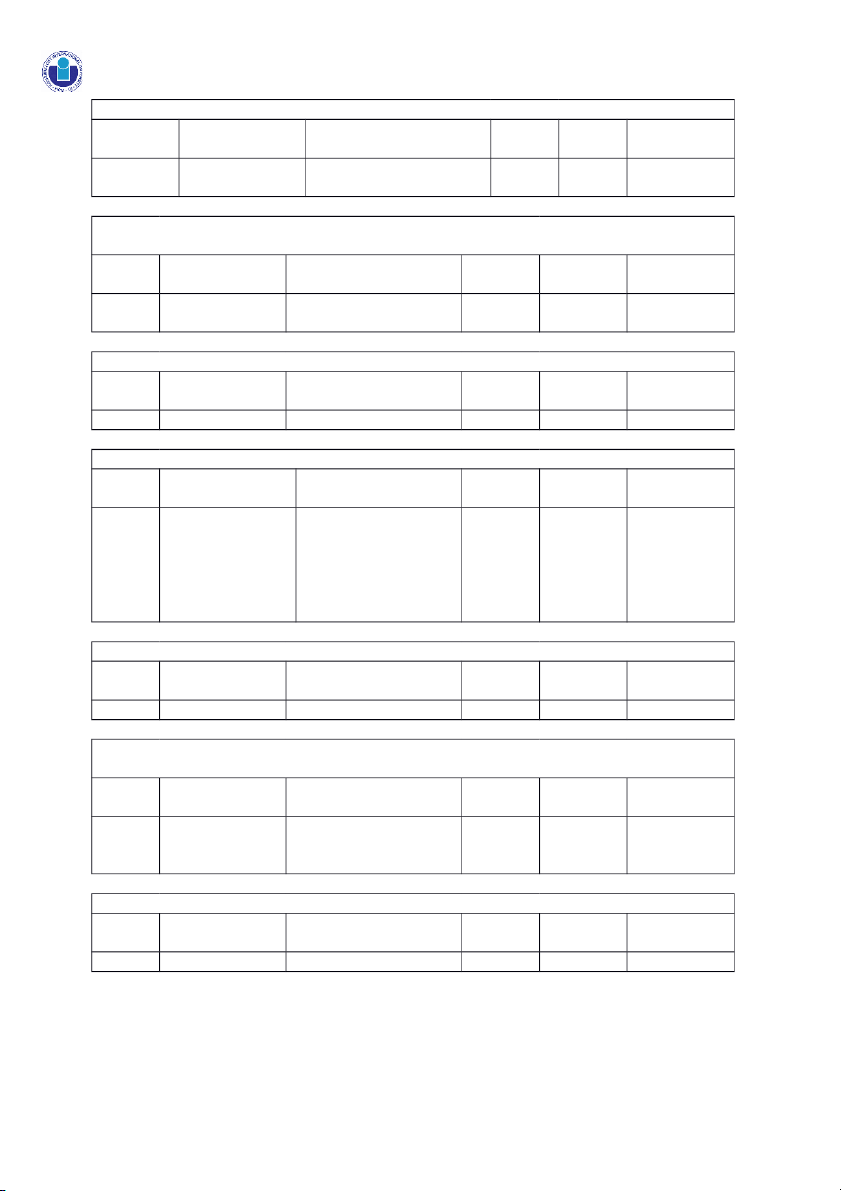

ADJUSTING JOURNAL ENTRIES Date

Account Titles and Explanations Ref. Debit Credit May- 31 Supplies Expenses 631 $900 Supplies 126 $900 May- 31 Utilities expense 732 $250

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- Account Payable 201 $250 May- 31 Insurance Expense 722 $150 Prepaid Insurance 130 $150 May- 31 Unearned service revenue 209 $1,600 Service revenue 400 $1,600 May- 31 Salaries and Wages Expense 726 $1,104 Salaries and Wages Payable 212 $1,104 May- 31 Depreciation Expense 717 $190

Accumulated Depreciation—Equipment 150 $190 May- 31 Accounts Receivable 112 $1,700 Service Revenue 400 $1,700 b) CASH No.101 Date Explanation Ref Debit Credit Balance May- 31 Balance $4,500 $4,500 ACCOUNT RECEIVEABLE No.112 Date Explanation Ref Debit Credit Balance May- 31 Balance $6,000 $6,000 Service Revenue J4 $1,700 $7,700 SUPPLIES No.126 Date Explanation Ref Debit Credit Balance May- 31 Balance $1,900 $1,900 Supplies Expenses J4 $900 $1,000 PREPAID No.130 INSURANCE Date Explanation Ref Debit Credit Balance May- 31 Balance $3,600 $3,600 Insurance Expenses J4 $150 $3,450 EQUIPMENT No.149 Date Explanation Ref Debit Credit Balance May- 31 Balance $11,400 $11,400

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- ACCOUNTS PAYABLE No.201 Date Explanation Ref Debit Credit Balance May- 31 Balance $4,500 $4,500 Utilities expense J4 $250 $4,750 UNEARNED No.209 SERVICE REVENUE Date Explanation Ref Debit Credit Balance May-31 Balance $2,000 $2,000 Service revenue J4 $1,600 $400 OWNER’S CAPITAL No.301 Date Explanation Ref Debit Credit Balance May-31 Balance $18,700 $18,700 SERVICE REVENUE No.405 Date Explanation Ref Debit Credit Balance May-31 Balance $9,500 $9,500 Unearned service revenue J4 $1,600 $11,100 Accounts Receivable J4 $1,700 $12,800 SUPPLIES EXPENSE No.631 Date Explanation Ref Debit Credit Balance May-31 Supplies J4 $900 $900 SALARIES AND No.726 WAGES EXPENSE Date Explanation Ref Debit Credit Balance May-31 Balance $6,400 $6,400 Salaries and J4 $1,104 $7,504 Wages Payable RENT EXPENSE No.729 Date Explanation Ref Debit Credit Balance May-31 Balance $900 $900

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

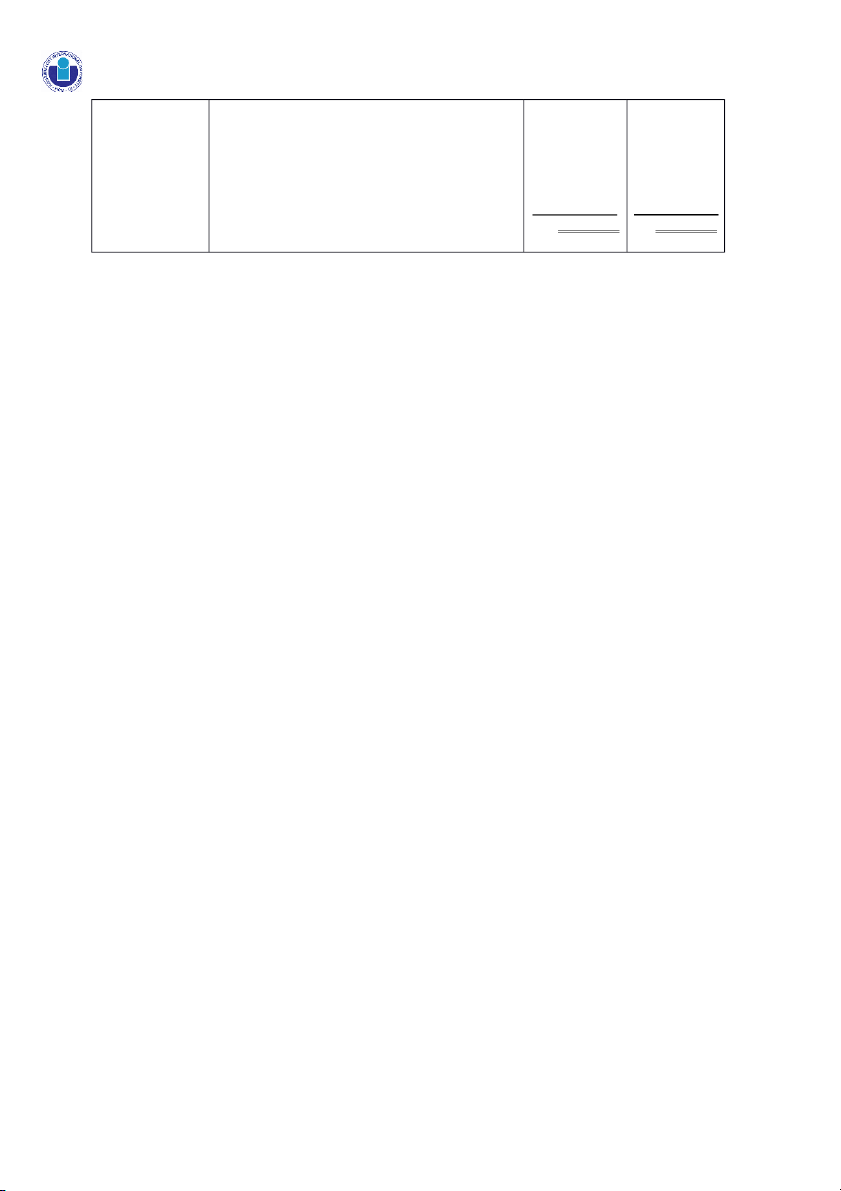

School of Business -----0----- DEPRECIATION No.717 EXPENSE Date Explanation Ref Debit Credit Balance May-31 Accumulated J4 $190 $190 Depreciation— Equipment INSURANCE No.722 EXPENSE Date Explanation Ref Debit Credit Balance May-31 Prepaid J4 $150 $150 Insurance UTILITIES EXPENSE No.732 Date Explanation Ref Debit Credit Balance May-31 Account J4 $250 $250 Payable ACCUMULATED No.150 DEPRECIATION— EQUIPMENT Date Explanation Ref Debit Credit Balance May-31 Depreciation J4 $190 $190 Expense c) KRAUSE CONSULTING ADJUSTED TRIAL BALANCE MAY 31, 2019 No. Accounts title Dr. Cr. 101 Cash $4,500 112 Accounts Receivable $7,700 126 Supplies $1,000 130 Prepaid Insurance $3,450 149 Equipments $11,400 150

Accumulated Depreciation—Equipment $190 201 Accounts Payable $4,750 209 Unearnd Service Revenue $400 212 Salaries and Wages Payable $1,104 301 Owner’s Capital $18,700 400 Service Revenue $12,800

INTERNATIONAL UNIVERSITY (IU) Course: Financial Accounting (BA005IU)

School of Business -----0----- 631 Supplies Expense $900 726 Salaries and Wages Expense $7,504 729 Rent Expense $900 717 Depreciation Expense $190 722 Insurance Expense $150 732 Utilities Expense $250 Totals $ 37,9440 $ 37,9440