Preview text:

lOMoAR cPSD| 59114765

CHAPTER 14: FIRM IN COMPETITIVE MARKET MIC WEEK 10 I. INTRODUCTION

- Your local dairy company raised ít price for milk products by 20%.

- A market is compettive if each buyer & seller is small compared to the

size of market , n therefore has little ability ro influence market prices

- If a firm can influence the market price of good it sells, it is said to have market power. II.

WHAT IS A COMPETITIVE MARKET?

1. The meaning of competition

- A competitive market, also called perfectly competitive market, has 2 characteristics:

+ There are many buyers n many sellers in that market.

+ The goods offered by the various sellers are largely the same

Actions of any single buyer or seller in that market have a negligible impact on the market price

Buyer n seller must accept price market determined They are price takers (ex: market for milk)

+ Firm can freely enter or exit the market .

- A firm in a competitive market, like most other firms in the economy ,

tries to maximize profit ( i.e: tries to maximum total revenue..)

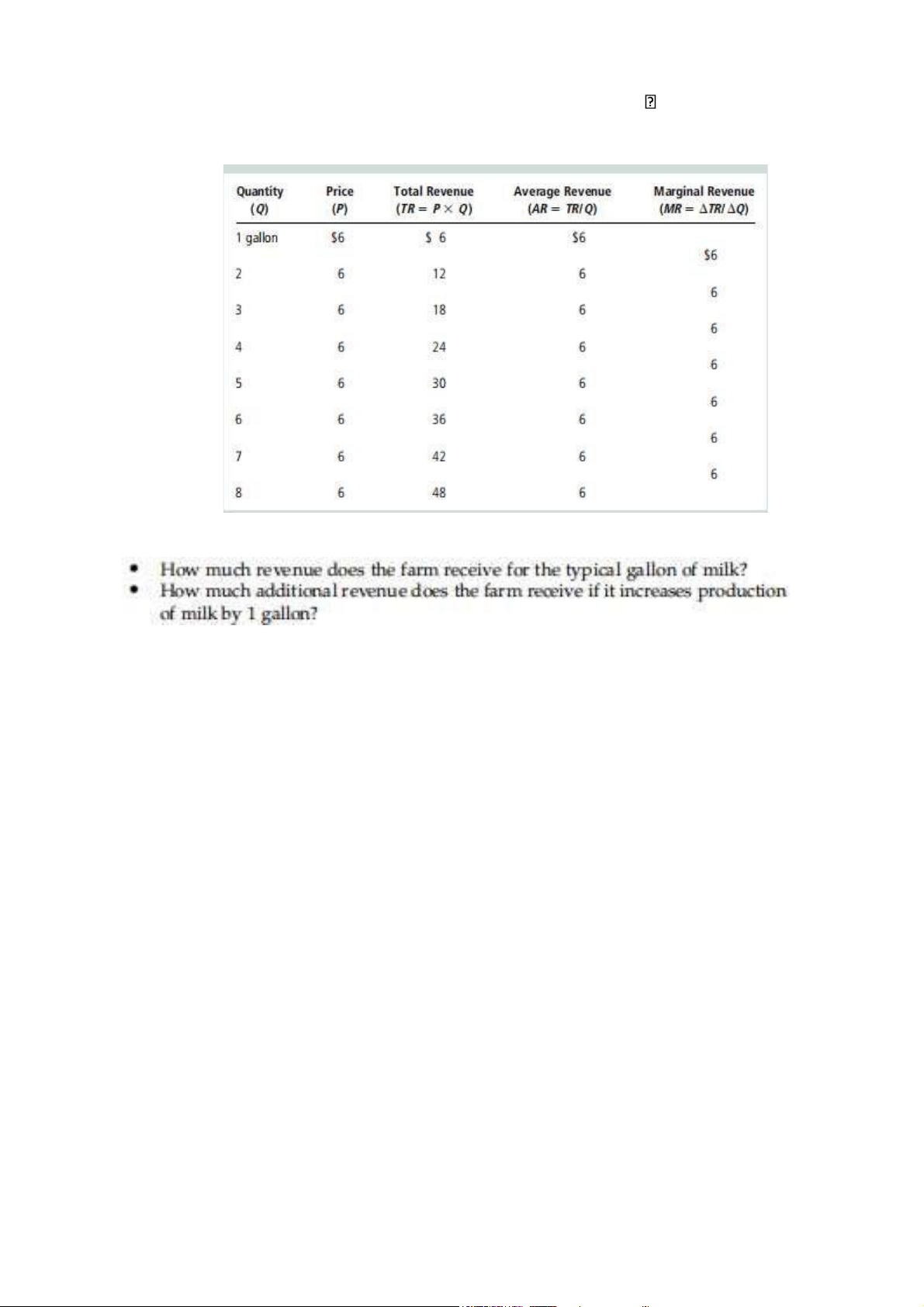

2. The revenue of a Competitive Firm

- To see how firm does it, we consider revenue of a competitive firm -

Case: Vaca Family dairy farm

+ Produce n sell 1,000 gallons + Price: $6/ gallon

+ Bcs Vaca Farm is small compared to the world market for milk

Vaca price take the price as given by market condition. lOMoAR cPSD| 59114765

+ If Vaca produces 2,00 gallons, price remain same

Total revenue : 2,000 x 6 =12,000

- 2 questions are considered:

- Answer in the last 2 columns

+ Average Revenue = Total revenue / quantity sold

+ Marginal revenue: the change in total revenue from an additional unit sold.

- Result in table - MR equals $6, the price of a gallon of mailk –

illustrates a lesson that applues only to competitive firms

- For competitive firms , marginal revenue equals the price of a goods.

III. PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S

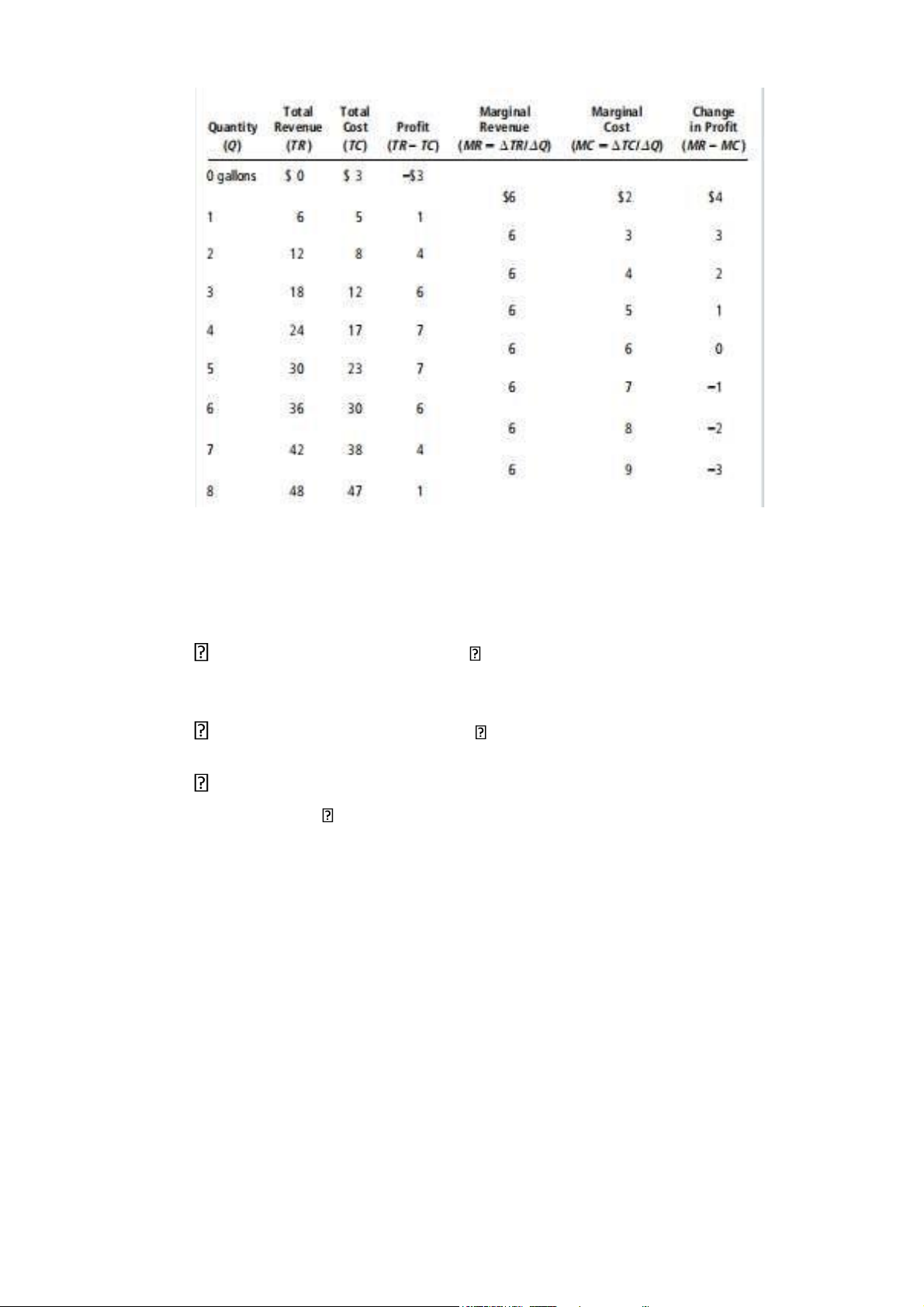

SUPPLY CURVE 1. A simple example of profit Maximization

- The goal of a competitive firm is to maximize profit lOMoAR cPSD| 59114765

- Another way to look at Vaca Farm’s decision:

- Recall: “Rational People think at the margin”. Principle applied in Vaca Farm case

If MR>MC ( at 1,2,3 gallon) Vaca should increase the production of milk

If MR< MC ( at 6,7,8 gallon) Vaca should decrease production

If Vaca think at the margin n make small adjustment to the level of

production they are naturally led to produce the profit- maximizing quantity.

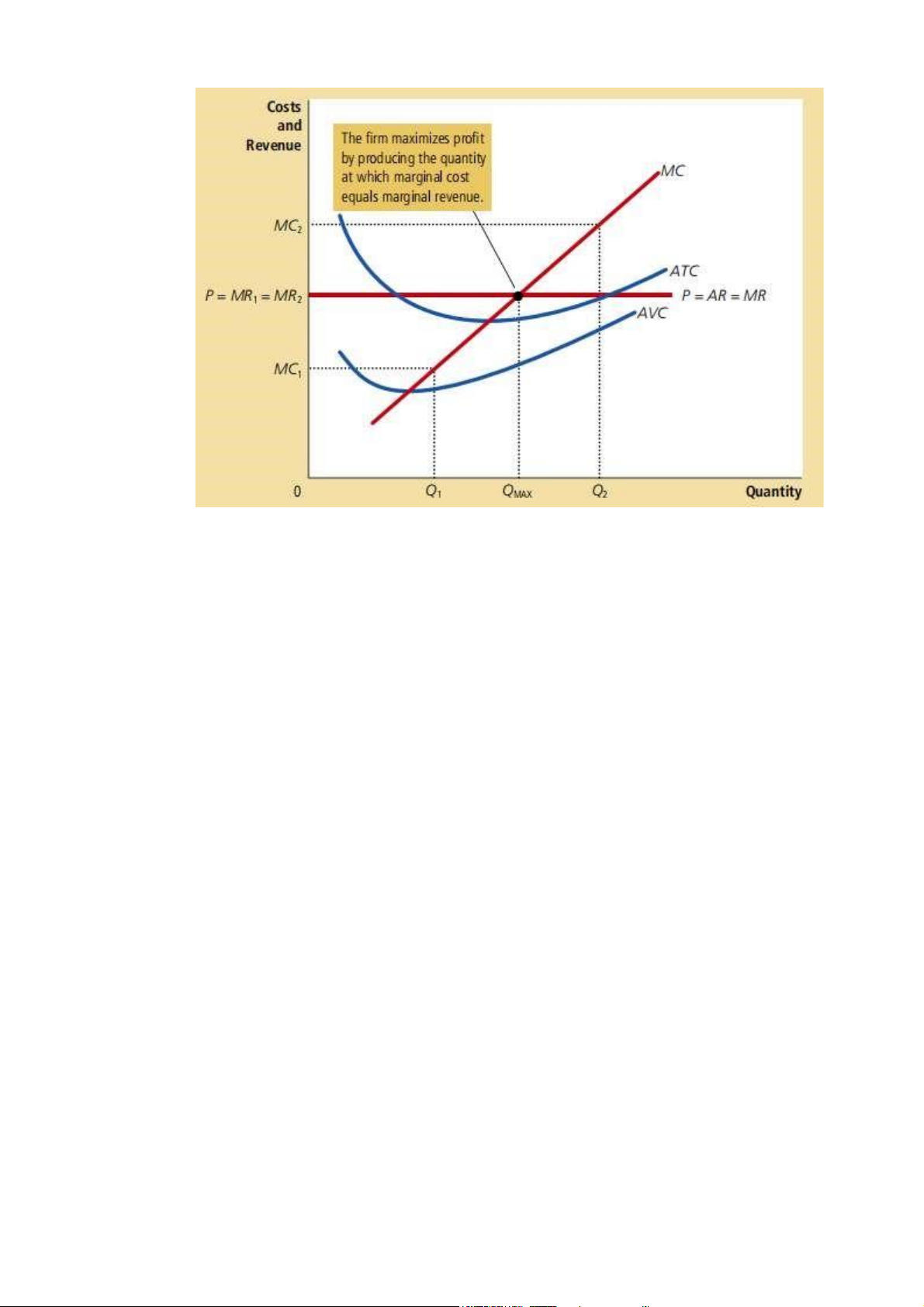

2. The Marginal Cost Curve n The Firm’s Supply Decision

- MC curve crosses ATC at the minmum of ATC - Price line is

horizontal bcs firm is a price taker.

- Price is the same regardless of the quantity that firm decide to produce lOMoAR cPSD| 59114765

- 3 general rules for profit maximization

+ If MR> MC , the firm should increase its ouput

+ If MC> MR, the firm should decrease its output

+ At the profit-maximizing level of output, marginal revenue n

marginal cost ate exactly equal

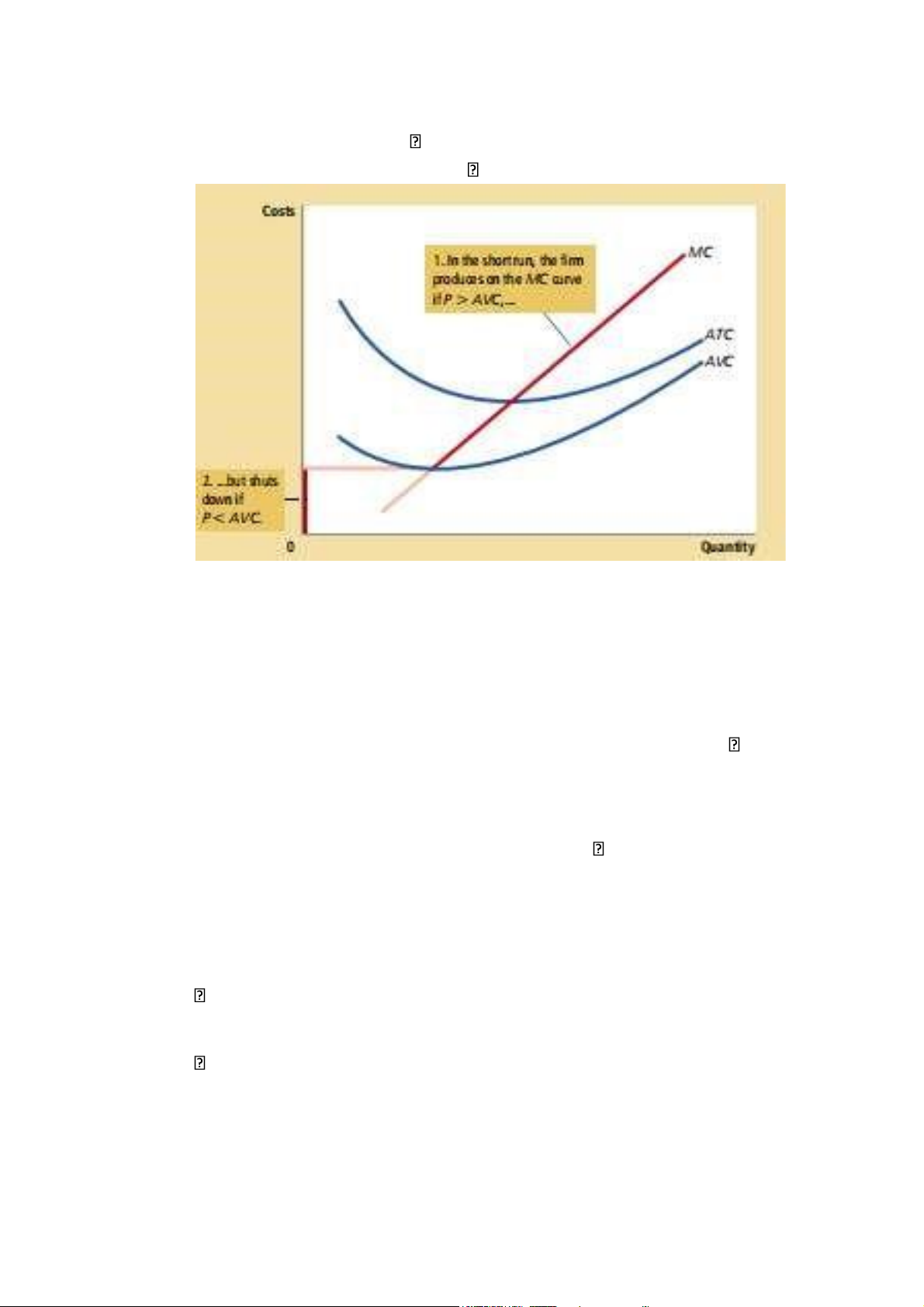

3. The firm ‘s Short run decision to shut down

- In certainn circumstannces, the firm will decide to shut down n notproduce anything at all

- Distinguish between a tenporarily shut down of a firm n the permanent ext form a market

+ A shutdown refers to a shjort run decision ot to produce anything

during a specific period of time bcs of current market conditions +

Exit refers to a long-run decision to leave the market.

- Short-run n long-run decision differ bcs

+ Most firm cannot avoid their fixed costs in the short run but can avoid it in the long-run

+ A firm that shut down temporarily still has to pay it fixed cost ><

firm that exits the market does not have to pay

- Sunk cost: a cost that has been committed n cannot be recovered -

What determines a firm’s shutdown decision? lOMoAR cPSD| 59114765

- The firms’s decision can be writeen in math:

+ Shut down if TR< VC means, firms shut down if TR/Q ( price) <

VCfirm shut down if P< AVC.

4. Spilt Milk n Other Sunk Cost -

Rational decision making:” don’t cry over spilt milk” or “let

bygones be bygones” - Sunk cost:

+ EX: you place $15 value on seeing a newly released movie

+ You buy a ticket $10 but lose it before entering the theater

Should buy another ticker or go home? -

Buy another ticket: The benefit of seeing a movie $15 still

exceeds the opportunity cost ( $10 for 2nd ticket) $10 paid for the

lost ticket is a sunk cost. - If firm exiits

+ it will again lose all revenue from the sales of product

+ But it will save both variable costs & foxed cost

Firm exits the market if the revenue it would get from producing its less than its Total cost.

Firm’s exit decision in math:

+ Exit if TR< TC , means exit if TR/Q < TC/Q, Exit of P < ATC

+ Firm woulf enter market if such an actiojn would be profitable. lOMoAR cPSD| 59114765

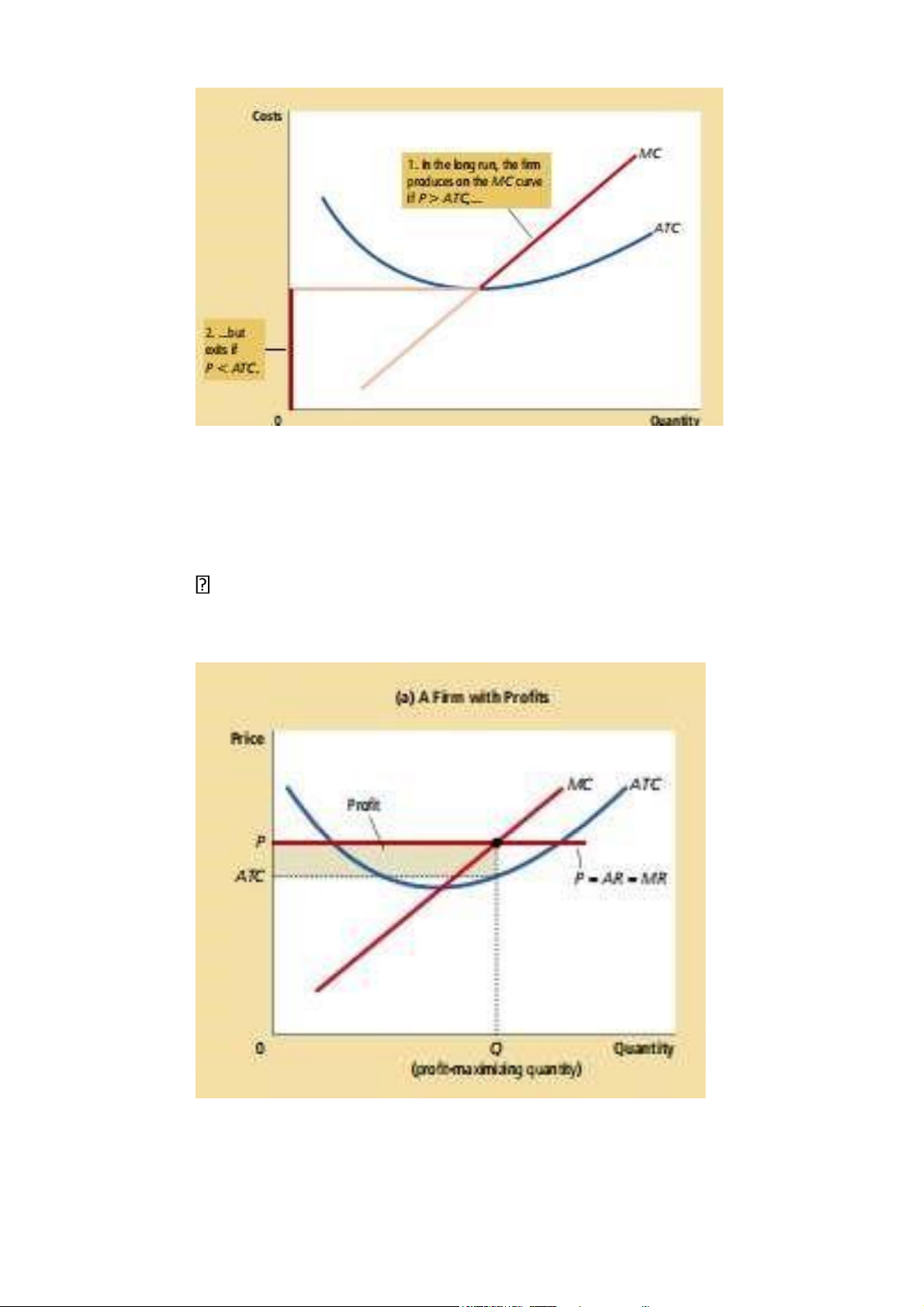

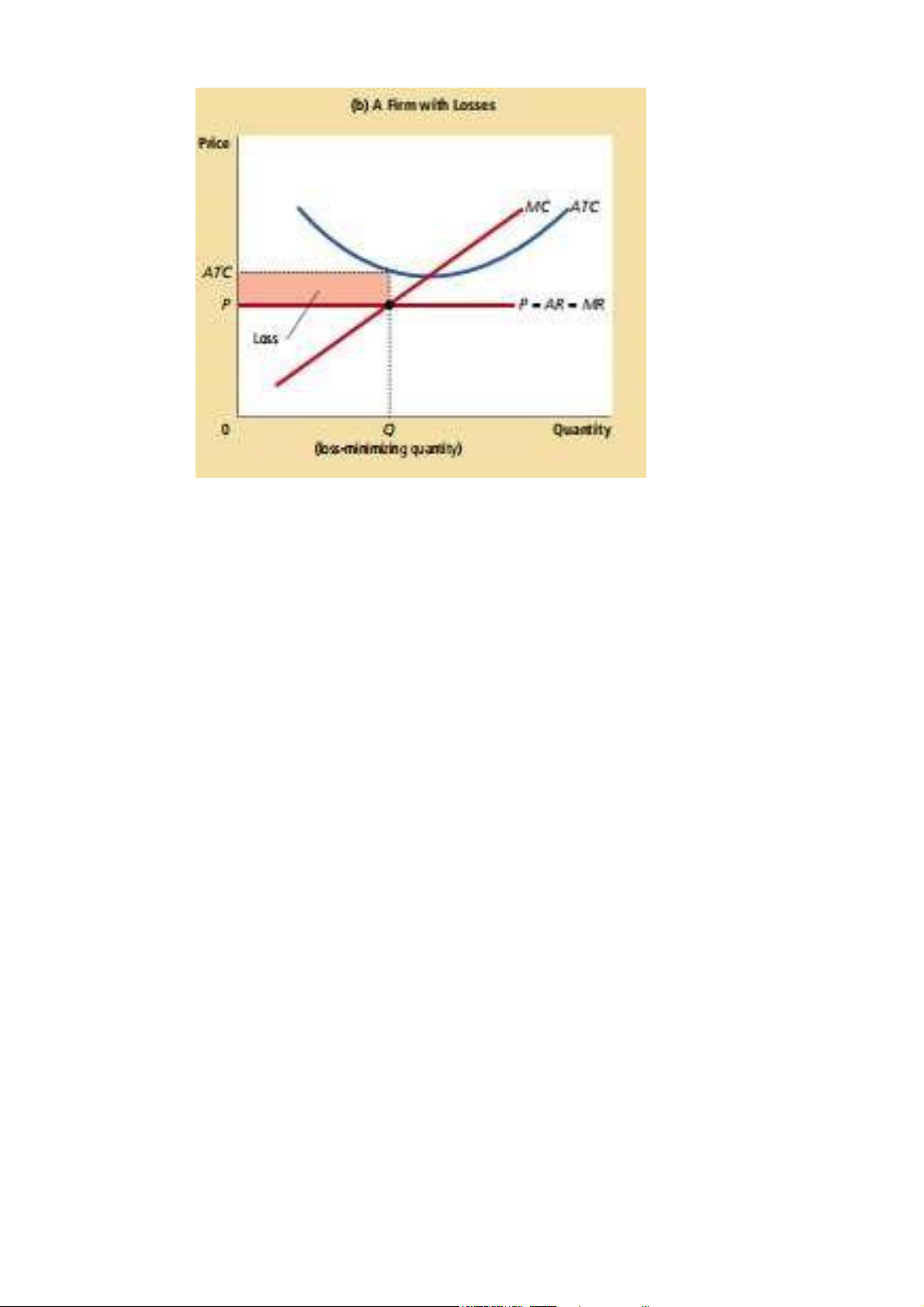

5. Measuring Profit in our graph for the competitive firm -

Profit = TR -TC = ( TR/Q – TC/Q) x Q

Profit = ( P – ATC ) x Q

IV. THE SUPPLY SURVE IN A COMPETITIVE MARKET 1. The firm

long-run decision to exit or enter a market lOMoAR cPSD| 59114765