Preview text:

lOMoAR cPSD| 59114765 MIC WEEK 8 CHAPTER 10: EXTERNALITIES Introduction

Market failures fall under a category called externalities.

An externality arises when a person engages in an activity that

influences the well-being of a bystander- a person whose are not

participants in the market at all; but neither of them pay nor

receives any compensation for that effect.

Negative externalities: ( ex: pollution from automobile exhaust

create smog that other pple have to breath => government

attempts to solve the problem by setting emission standard of cars

, also taxing gasoline to reduce the amount pple drive . Pollution

from noise negatively effect pple’s aural health. => Government

solves problem by: setting the rules for businesses with noise have

to locate far away from the residence area, karaoke bars must

have sound-proof walls & doors )

Positive externalities: (ex: restore historic building pple can

enjoy beauty & sense of history that these building provides => Government regulating the

destruction of historic building & providing tax breaks

to owners who restore them . Research into new technologies

create knowledge that pple can use => Government make up

patent system giving inventors exclusive use of their invention for a limited times.

Welfare Economics: a recap -

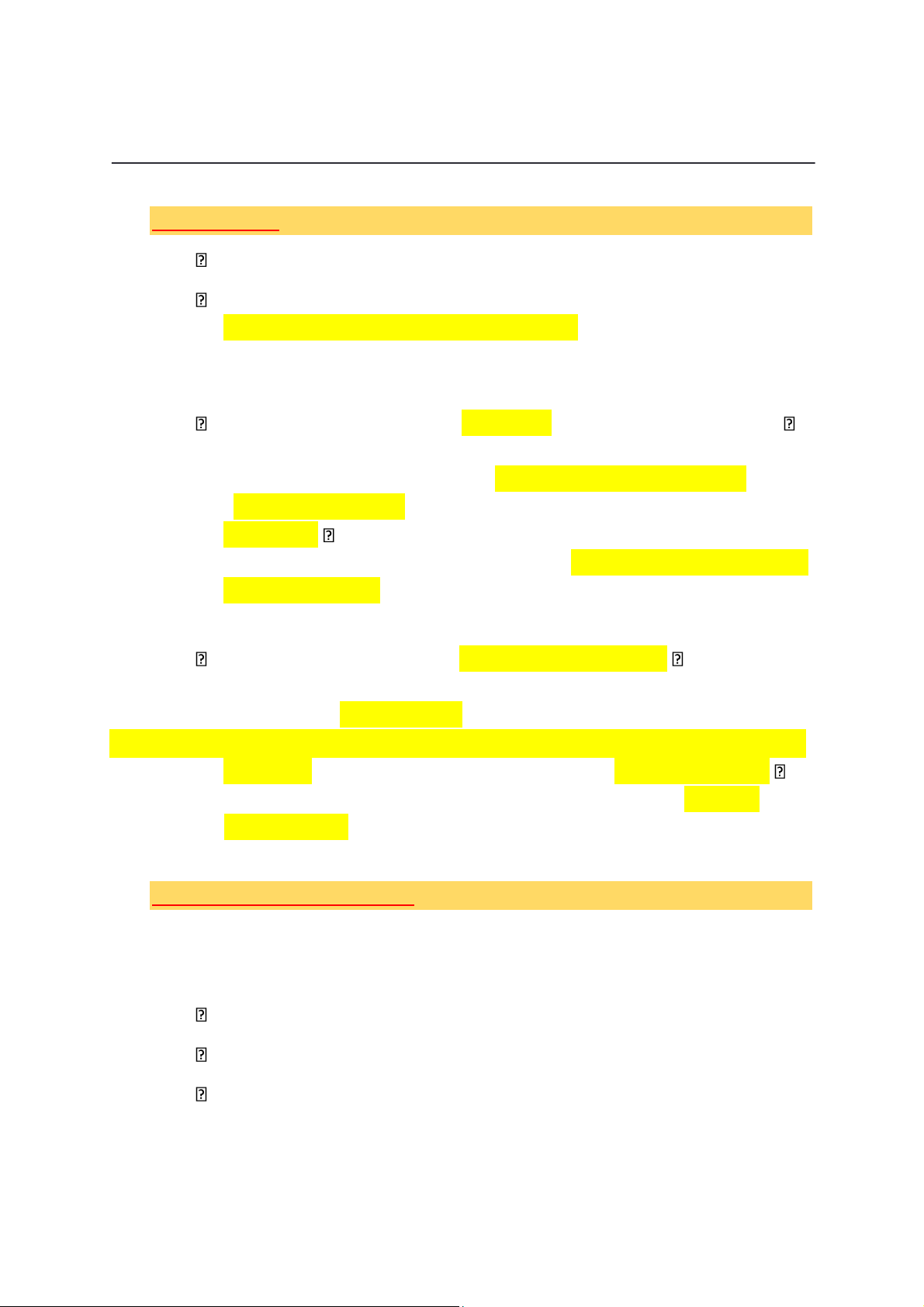

Consider a specific market – market for Aluminum - Recalled from chap 7

Total surplus = Value to buyers – Cost to sellers Demand curve : reflect value

When a market is in equilibrium: when buyers who value the good

more than the price (ae) choose to buy the good / buyers who

value it less than the price (eb) do not buy lOMoAR cPSD| 59114765

At any quantity below Equilibrium level (Q1), value to buyer > cost

to seller increasing quantity raises total surplus, until quantity reaches E level

The demand curve reflects the value to buyers, and the supply curve reflects

the costs of sellers. The equilibrium quantity, QMARKET, maximizes the total

value to buyers minus the total costs of sellers. In the absence of externalities,

therefore, the market equilibrium is efficient.

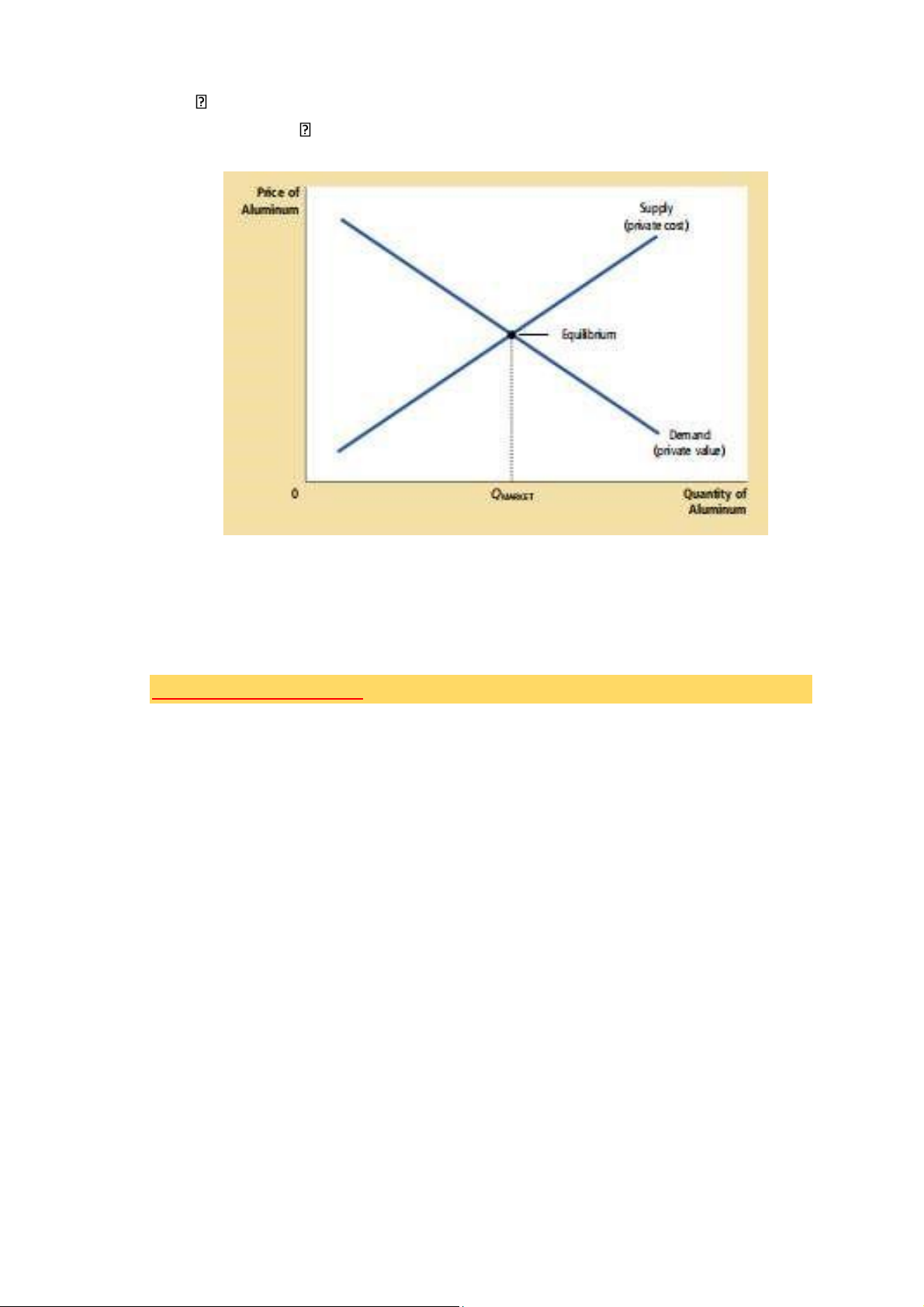

Negative externalities

- This intersection determines the optimal amount of aluminum from

the standpoint of society as a whole

- QMARKET, is larger than the socially optimal quantity, QOPTIMUM.

This inefficiency occurs because the market equilibrium reflects only

the private costs of production. In the market equilibrium, the

marginal consumer values aluminum at less than the social cost of

producing it. That is, at QMARKET, the demand curve lies below the

social-cost curve. Thus, reducing aluminum production and

consumption below the market equilibrium level raises total economic wellbeing lOMoAR cPSD| 59114765

Bcs of the externality, cost to society of producing AI is larger than the cost to the AI producer

- How can the social planner achieve the optimal outcome?

+ tax aluminum producers for each ton of aluminum sold. The tax

would shift the supply curve for aluminum upward by the size of the

tax. If the tax accurately reflected the external cost of pollutants

released into the atmosphere, the new supply curve would coincide

with the social-cost curve. In the new market equilibrium, aluminum

producers would produce the socially optimal quantity of aluminum.

Aluminum producers would take this cost of releasing pollutants to the air

- Market price would be with tax ( on producers )

This policy is based on the principle : pple respond to incentives.

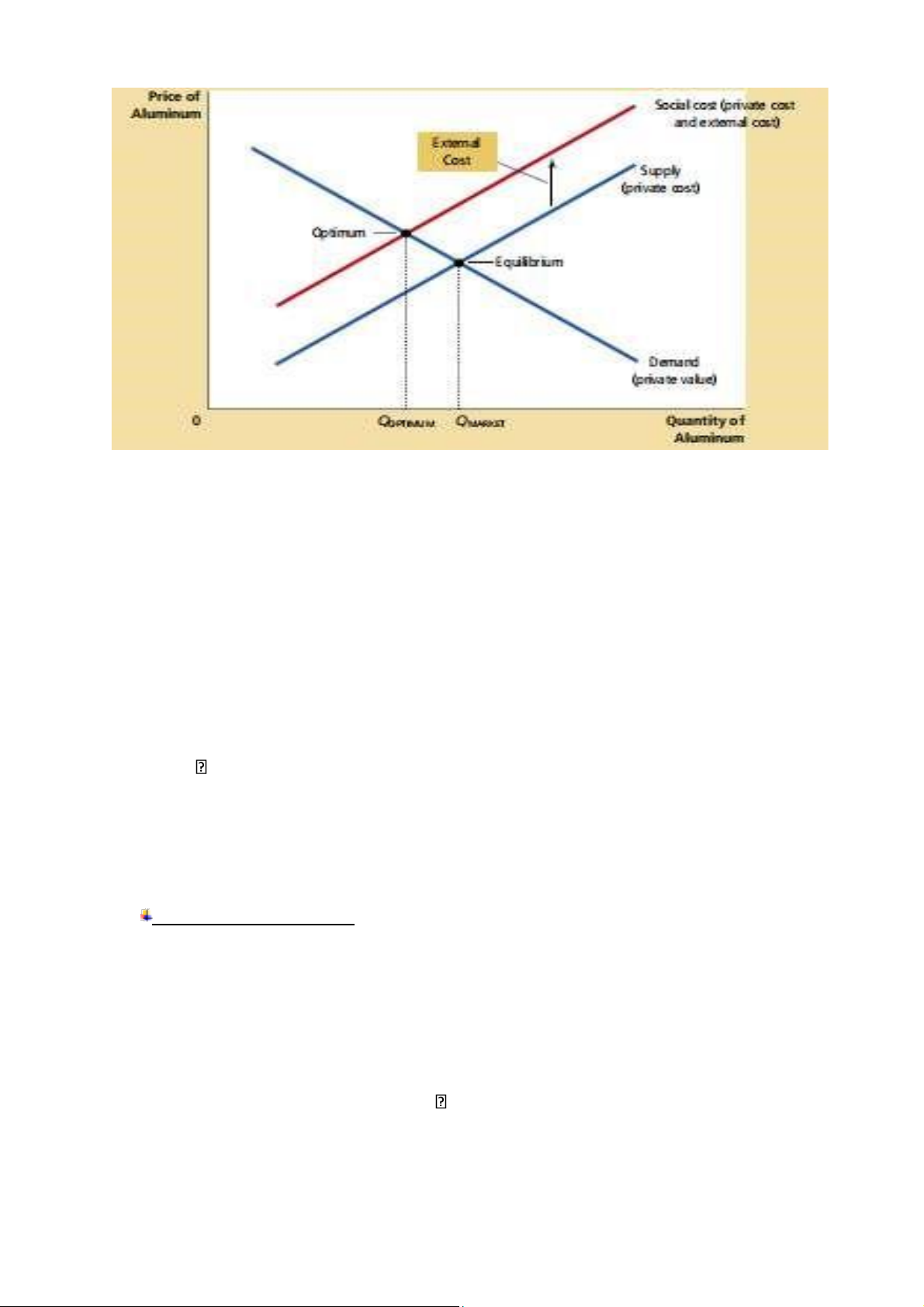

Positive Externalities

- Some activities impose cost on third parties, others yield benefits ( ex: education)

- To a large extent, the benefit of education is private:

- Beyond private benefit, education also yields positive externalities

- More educated population leads to more informed voters, tends to

mean lower crime rates, lead to higher productivity n higher wages for everyone,. lOMoAR cPSD| 59114765

- Government can correct the market failure by inducing market

participants to internalize externality

- Negative externalities lead markets to produce a larger quantity than socially desirable

- Positive externalities lead market to produce a smaller quantity than socially desire.

Public policies toward Externalities -

Government can respond to externalities in 1 of 2 ways

+ Command- and- control policies + Market-based policies -

Government can remedy an externalities by making certain

behaviors either required or forbidden (ex: it’s a crime to dump poisonous..)

Command-and Control Policies: regulation -

It’s impossible to prohibit all polluting activities ( ex: all form of

transportation produce some undesirable polluting by product. For

cars n motorbikes under operation, polluted gas discharge into the air ) -

Environmental regulations can make many forms:

+ Maybe tax level of pollution that a factory may emit or

+ Firm adopt a particular technology to reduce emissions lOMoAR cPSD| 59114765 -

Problem: regulator must know all of the details of an industry n

alternative technology in order to create efficient rules. Market-based Policies - Correct taxes and subsidies -

An ideal corrective tax: equal the external cost - 2 solutions are considered

+ Regulation : tell each factory to reduce it pollution to

300 tons if glop/year . Dictate level of pollution

+ Corrective tax: levy a tax on each factory , $50,000/ton of glop it

emits give factory owners an economic incentive to reduce pollution

Corrective tax can reduce negative externalities at a lower cost than

regulation bcs the tax essentially places a price on negative externalities ( ex:pollution)

Economists also argue that corrective tax a better for the environment -

Unlike other taxes, corrective taxes enhance efficiency rather reduce - Tradable pollution permits

+ Allows the holder of the permit to pollute a certain amount : if the

factory produces more pollution it has to buy permits of other firm, if less buy permits -

Firms that have a high cost of reducing their pollution will be willing

or pay a high price for the permits -

Those firms that can reduce pollution at a low cost will sell -

Tradable pollution permits set the quantity for pollution permitted

>< a corrective tax set the price of pollution ( set the tax ) -

Either method can reach efficient solution in the market -

Tradable pollution permits may be superior

Private Solutions to Externalies

Types of private solutions - Moral codes n social sanction lOMoAR cPSD| 59114765 -

Private markets can often solve the problem of externalities by

relying on self-interest of relevant parties n cause efficient mergers. -

Theses externalities could be internalized if keepers merges with the apple orchard. -

Another way: for the interested parties to enter in a contract

+ Ex: contract between apple grower n beekeeper can solve the

problem of too few trees n too few bees

? How effective is the private market in

dealing with externalities? -

According to Coase, the proposition that if private parties can

bargain without cost over the allocation of resources, they can solve

the problem of externalities on their own -

A social planner would compare the benefit that Dick gets from the

dog too the cost that his neighbor bears from the barking -

According to Coase theorem, private market will reach the efficient

outcome form its own The Coase theorem says that private

economics actors can potentially solve the problem of externalities

among themselves. - Conclusion:

+ Markets maximize total surplus to buyers n sellers in a market n this is usually efficient

+ If transaction cost are high, government policy may be needed to improve efficiency

+ Corrective taxes n pollution permits are preferred to command-n-

control policies bcs they reduce the pollution at a lower cost, and

therefore, increase the quantity demanded of a clean environment.