Preview text:

LESSON 2: PURCHASES, SALES AND EXPENSES

After carefully studying this lesson, you should be able to:

1. recognise the various meanings attributed to the term ‘purchases’

2. record in double-entry form (i) the purchase, and (ii) the sale of goods

for cash and on credit; & (iii) the return of goods

3. appreciate the nature of and types of ‘expenses’

4. record the withdrawal of profit by ‘drawings’ INTRODUCTION

You will learn about the appropriate accounts in which to record the

increases and decreases in stock and how to record purchases and sales

on credit, in contrast to purchases and sales for cash. In addtion, you will

learn how to enter double entry transactions for expenses and revenues.

You will also learn about the effects that profit, loss and drawings have on capital. I. PURCHASES

In the balance sheet of Lesson 1 so far the item ‘goods’ has been included.

This refers to goods in which the firm trades and not to items such as the

motor vehicle or office furniture which are shown separately and will be kept for use in the business.

If every purchase or sale of goods were entered under the one heading

‘goods’, you would have a confused picture of what was happening. You need

to know for a given period (e.g. week, year) the total amount of purchases (of

goods for re-sale) as distinct from the total amount of sales. Therefore, we

have Purchases account and Sales account.

Let it be absolutely clear about what is meant by the term ‘purchases’. It means goods (i)

bought with the intention of reselling them as part of the firm’s trading

activities: goods in which the firm ‘deals’. or (ii)

bought in order to use them in the manufacture of other goods (e.g. raw

materials or in some way to change their form, e.g. the re-packaging of

goods carried out by some wholesalers. The intention is the same as in (i) but it is less direct.

Methods of payment can be made either (i)

purchases for cash (purchases of goods with immediate payment in cash or by cheque) or (ii)

purchases on credit (purchases of goods with payment to be made at later date)

You will now see the book entries for purchases.

I.1. Purchases of goods on credit

Refer to example (iii) in Lesson 1:

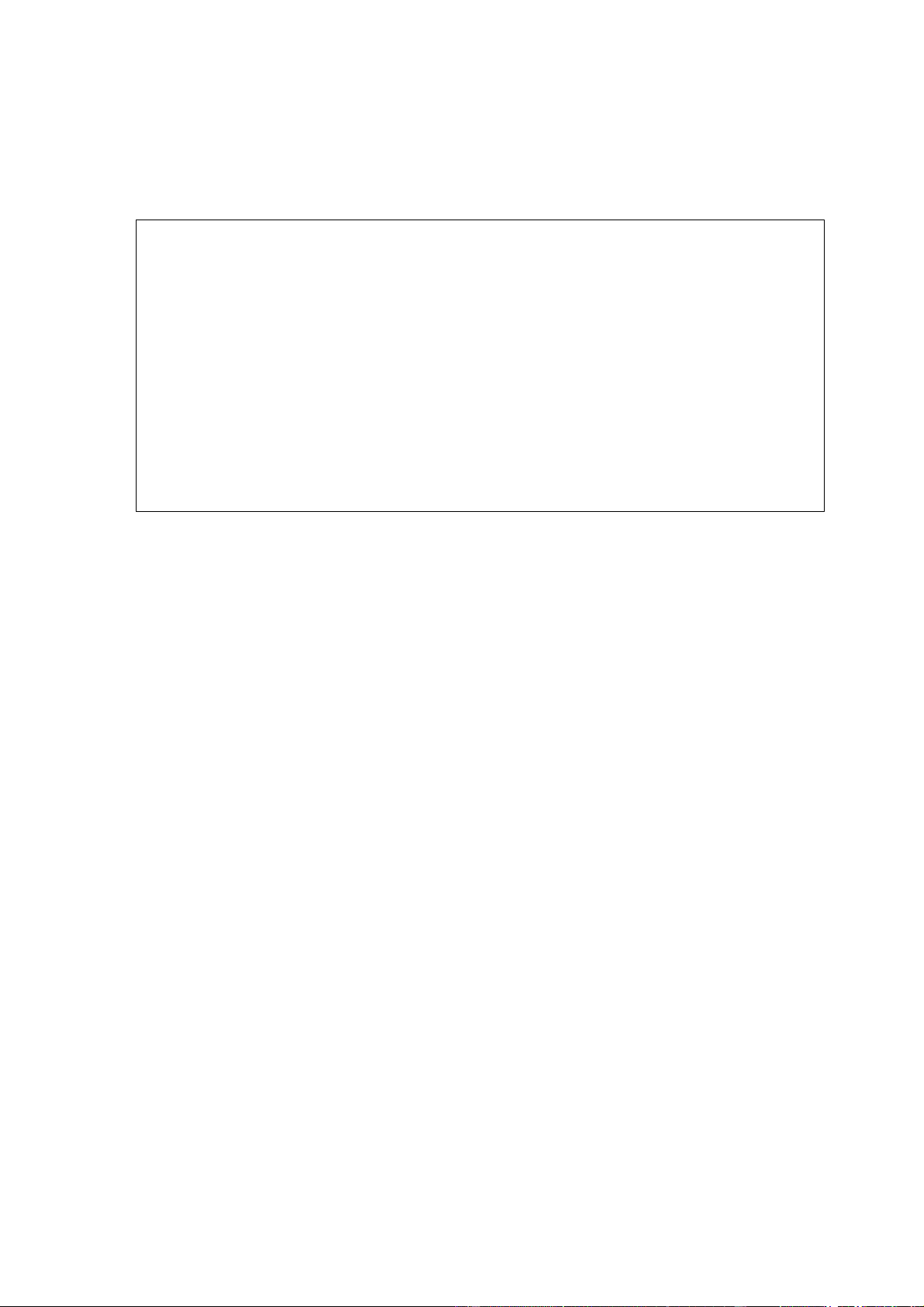

On 9 May Year 3, James Meredith bought goods on credit £180 from Rendell Supplies. As in Lesson 1 From this lesson Goods Purchases Year 3 £ Year 3 £ May 9Rendell May 9Rendell Supplies 180 Supplies 180 Rendell Supplies Rendell Supplies Year 3 £ Year 3 £ May 9 Goods May 9 Purchases 180 180

The goods account used in Lesson 1 is now replaced with a purchases account.

However, the same rules will apply: where you debited goods account for an

increase in asset amount, likewise you will debit purchases account.

I.2. Purchases of goods for cash

E.g. On 15 May Year 3, bought goods for £210, payment being made immediately by cheque.

In this transaction, there is an increase in asset account: Purchases. As there is

an increase in asset value, this will be debited.

The payment was made by cheque, so the money in bank account (asset

account) decreased. According to the rules for double-entry, if asset account

decreases, it will be credited. Purchases Year 3 £ May 15 Bank 210 Bank Year 3 £ May 15 Purchases 210

To summarise the book-keeping entries overall relating to Purchases: • Credit Purchase

- debit purchases account

- credit supplier’s (creditor’s) account • Cash Purchase

- debit purchases account

- credit Cash/ Bank account

In due course, payment will be made to the creditor, so

• Payment to creditor

- debit creditor’s account

- credit bank account or cash account II. SALES

The sale of goods means the decrease of an asset. Up to the present this has

been recorded to the credit of a goods account. Now, however, in order to

provide more information and to facilitate control, it is necessary to record all

sales of goods in a sales account, to include: (i)

sales ‘for cash’( goods sold with immediate payment, in cash or by cheque) (ii)

sales on credit (goods sold with payment to be received by an agreed future date)

II.1. Sales for cash

Refer to example (v) in Lesson 1:

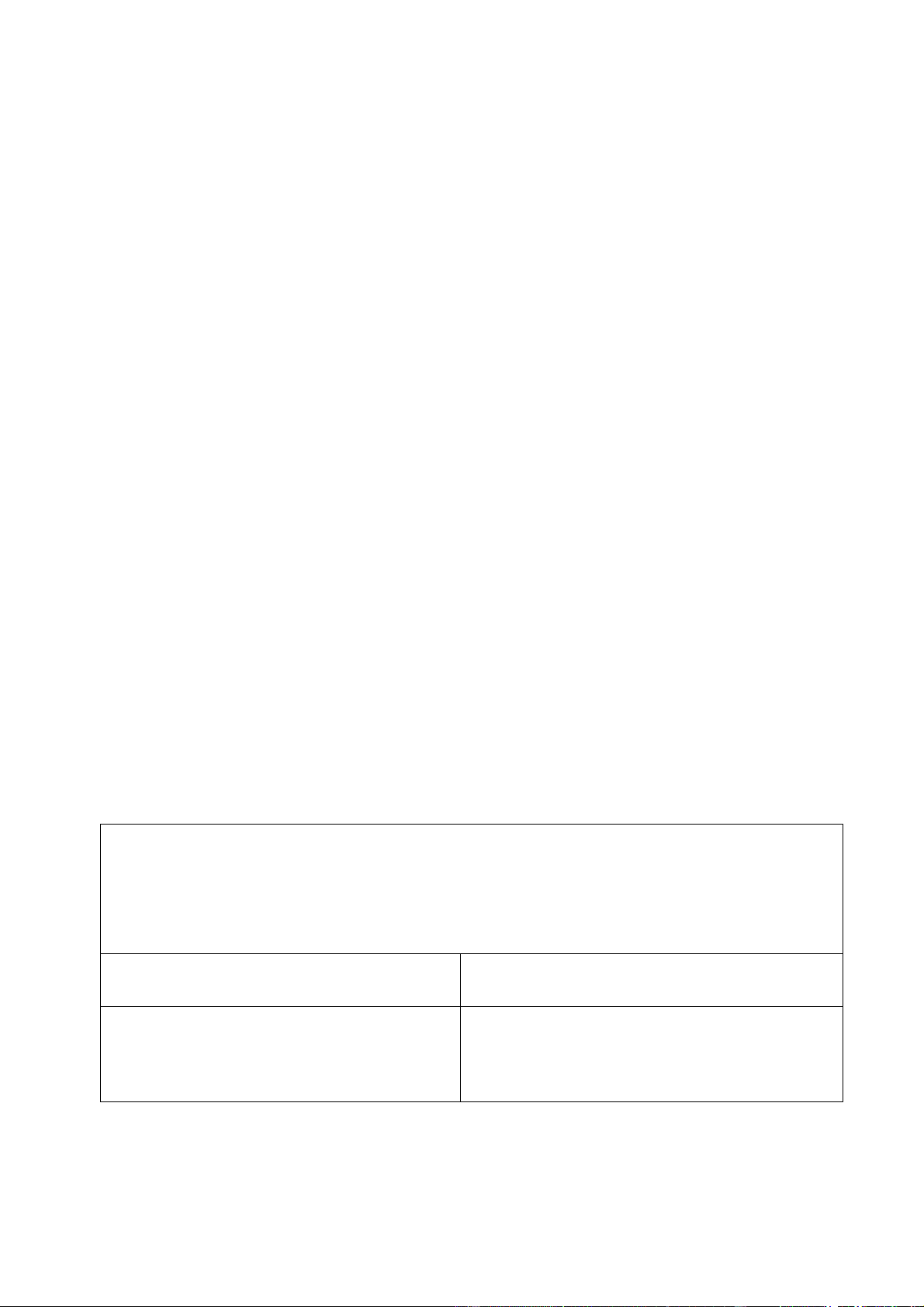

16 May Year 3, sold goods for cash £270. As in Lesson 1 From this lesson Goods Sales Year 3 £ Year 3 May 16 Cash £ 270 May 16 Cash 270 Cash Cash Year 3 £ Year 3 £ May 16 Goods 270 May 16 Sales 270

The term ‘for cash’ will include sales for actual cash as well as where payment is

received immediately into the firm’s bank account (e.g. payment by cheque).

II.2. Sales on credit

E.g. 23 May Year 3, sold goods on credit for £65 to N Tibbs.

Sales account similarly will be credited, representing the asset decrease. N Tibbs

is a debtor (debtors belong to asset accounts) and now owes the business £65.

Hence N Tibbs’ account must be debited to show the increase in asset value. Sales Year 3 £ May 23 N Tibbs 65 N Tibbs Year 3 £ May 23 Sales 65

To summarise the book-keeping entries overall relating to sales: • Cash Sale

- debit Cash/ Bank account - credit Sales account • Credit sale

- debit customer’s (debtor’s) account - credit sales account

• When payment is received from the debtor

- debit bank account or cash account

- credit debtor’s account III. RETURNS

III.1. Returns Outwards

Sometimes goods already purchased will be returned to the supplier, who will

agree to make an allowance. This will be recorded in a returns outwards

account (or purchases returns account). A corresponding entry will be made

in the relevant creditor’s account.

E.g. 24 May Year 3, Goods are returned to Rendell Supplies (a creditor) and an allowance of £50 is agreed. Returns Outwards Year 3 £ May 24 Rendell Supplies 50 Rendell Supplies Year 3 £ May 24 Returns Outwards 50

The £50 credit on Returns Outwards account effectively decreases the debit

amount on the purchases account.

If we bring together the two transactions relating to Rendell Supplies, his account now appears: Rendell Supplies Year 3 £ Year 3 £ May 23 Bank 80 May 9 Purchases 180 May 24 Returns Outwards 50

The difference between the two sides is a credit excess of £50. The business

owes Rendell Supplies that amount.

III.2. Returns Inwards

Sometimes, Goods previously sold may be returned to the seller, for which there

will be an agreed allowance. This will be recorded in a returns inwards account

(alternatively, sales returns account) as well as in the account of the customer.

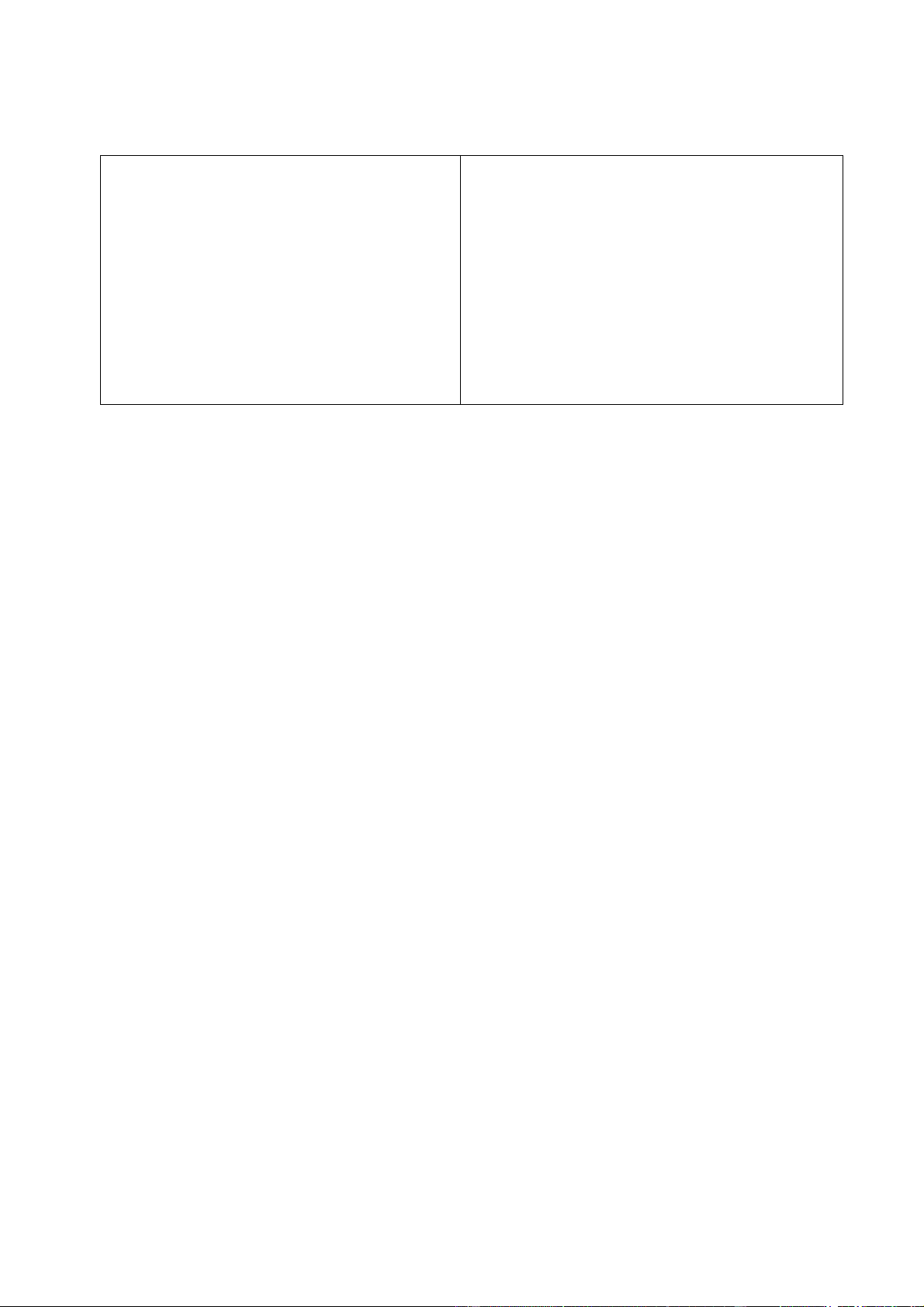

E.g. 26 May Year 3, N Tibbs returns the goods which he purchased on 23 May Year 3 Returns Inwards Year 3 £ May 26 N Tibbs 65 N Tibbs Year 3 £ May 26 Returns Inwards 65

The entry in the returns inwards account offsets the previous credit entry in the

Sales account. The credit entry on N Ttibb’s account cancels out the previous debit entry. N Tibbs Year 3 £ Year 3 £ May 23 Sales 65 May 26 Returns Inwards 65

This shows that N Tibbs now owes nothing.

To summarise the book-keeping entries overall relating to Returns:

• Returns outwards (or Purchases Returns)

- debit creditor’s account

- credit Returns Outwards account

• Returns Inwards (or Sales Returns)

- debit Returns Inwards account

- credit debtor’s account IV. EXPENSES

You now need to see how expenses are dealt with in the accounts.

If money is spent on buying an asset, such as office equipment, it is debited to

the asset account. Money has been spent on owing a resource. If expenditure is

on rent of premises, wages, telephone, etc. it is to obtain the use of a resource,

but paying for it ‘as you go’ rather than long in advance. It is therefore consistent

to debit the expenditure account, as one would the straightforward asset account.

Moreover, any expenditure will reduce profit and thus reduce capital. Any

reduction in capital needs to be debited: this further justifies the debit entry for expenses.

The owner of a business needs to know how much is being spent on each area

of expenditure. So, instead of having one ‘expense account’, it is usual to have

several, each one covering a category of expenditure. These may include items

such as: wages, salaries, rent, insurance and motor expenses, etc. Examples (i)

14 May Year 3, wages of £40 are paid in cash

Cash is reduced; therefore cash account should be credited. Expenditure on

wages (= for labour services) increases, so wages account should be debited with £80. Cash Year 3 £ May 14 Wages 40 Wages Year 3 £ May 14 Cash 40 (ii)

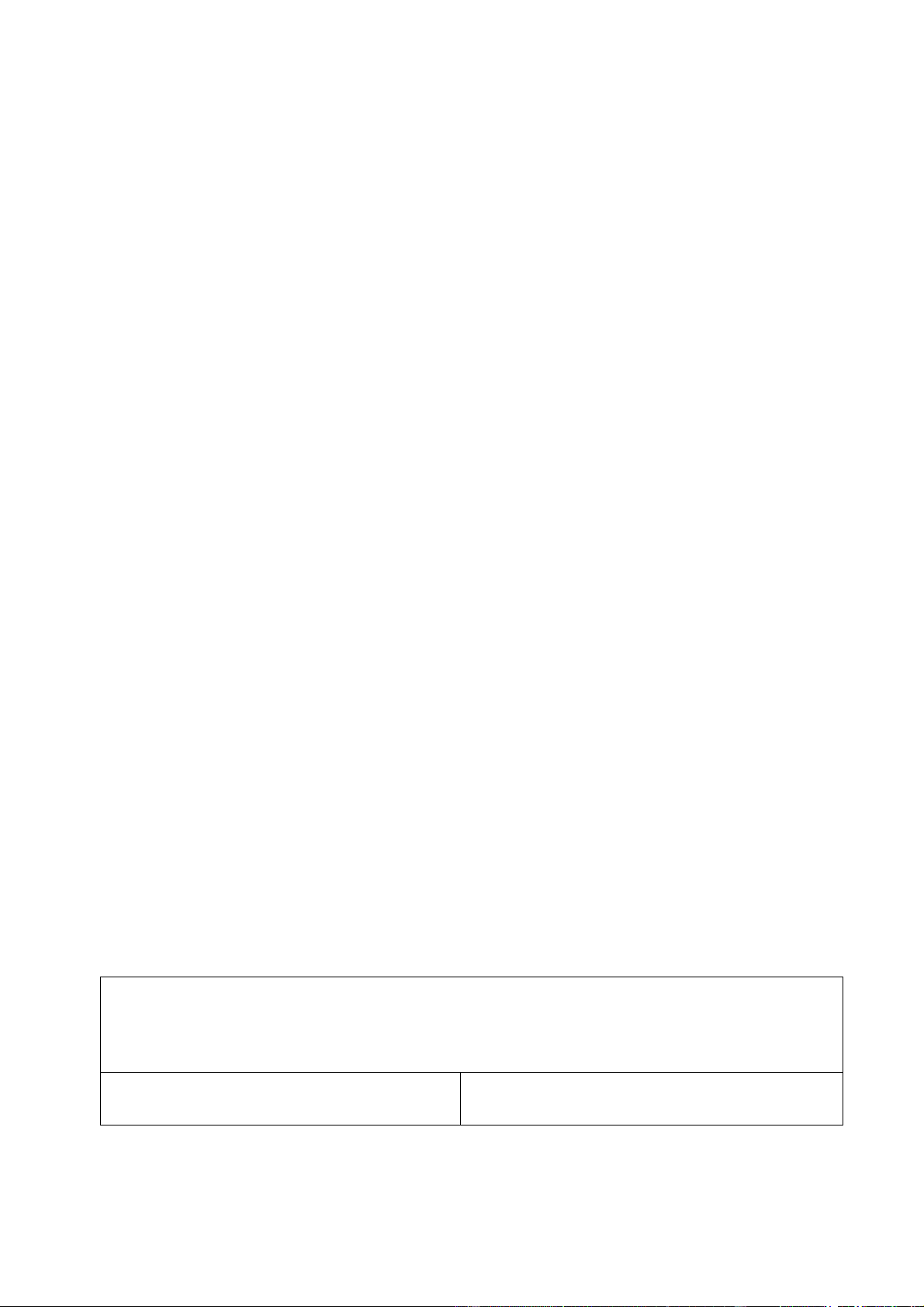

20 May Year 3, Insurance (against the risks of loss from fire and theft) is paid by cheque £55.

Payment by cheque results in a reduction in the balance of bank. Hence, bank account should be credited.

A period of insurance ‘cover’ is acquired. As this is effectively a resource of the

business, debit insurance account with £55. Bank Year 3 £ May 20 Insurance 55 Insurance Year 3 £ May 14 Bank 55 V. DRAWINGS

From time to time the owner will take money out of the business in the form of

cash (or withdrawal by cheque from the firm’s bank account) for his personal use,

not the business use. Occasionally the withdrawal may be in the form of goods or

services taken for the owner’s personal use. Therefore, the account related to the

withdrawals here is named “Drawings”.

The prudent owner will ensure that the amount he takes out on a weekly/ monthly

basis does not exceed the profit made by the business at that stage. Failure to

do so will result in a reduction in the capital account as might be expected.

Applying the double-entry rules, Drawings will make capital decrease, so

‘Drawings’ account must be debited. Money taken out of the business will reduce

money (reduce asset), hence Cash/ Bank account will be credited.

E.g. May 28 Year 3, James Meredith, the owner, withdrew for private use £130 cash. Cash Year 3 £ May 28 Drawings 130 Drawings Year 3 £ May 28 Cash 130

When the net profit has been determined and entered in the capital account, the

drawings account is closed by transferring the amount to the capital account.

This enables the drawings total to be set off against the net profit figure (and by

balancing the account, shows the amount owed to the owner at the end of the trading period).

Care must be taken not to confuse ‘drawings’ with expenses. To do so can give a

false picture of how the business is performing: total expenses might appear

much greater than they really are. SUMMARY

1. The purchases account is used to record the purchases of stock while the

returns inwards account is used to record goods returned by the business’s customers.

2. The sales account is used to record the sales of stock, while the returns

outwards account is used to record goods returned to supplers by the business.

3. Only goods bought with the intention of reselling them as a part of trading

activities are considered as purchases. The purchases of other assets is not considered as purchases.

4. Sales refered to the sale of those goods in which the business trades; the

sale of goods that were bought with the intention to resell.

5. The purchase or sale of goods for cash may involve payment or receipt being

made by cash or by cheque (bank).

6. Entries in an expense account will be on the debit side

7. Drawings are money or goods taken out of the business by the owner,

drawings are not an expense of the business

I hope you will be successful! GLOSSARY cash transaction (n) Giao d ch thanh toán ngay cheque (n) Séc commission (n) Tiền hoa hồng credit transaction (n) Giao d ch ghi nợ drawings (n) Rút vốn expense (n) Chi phí purchase (n) Việc mua hàng raw material (n) Nguyên liệu thô rent payable (n) Chi phí thuê trụ sở rent receivable (n) Tiền cho thuê trụ sở returns inwards (n) Hàng bán b trả lại returns outwards

Hàng mua trả lại cho nhà cung cấp sale (n) Việc bán hàng withdraw (v) Rút ra