Preview text:

Objects of Desire

Australian Special Edition h Luxury rc a e s /re m o .c k n Investment Index tfrahignk 2019

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9

THE KNIGHT FRANK LUXURY INVESTMENT INDEX

KFLII tracks the capital value of a theoretical

basket of selected collectable asset classes

using existing third-party indices provided by

leading independent experts (see below). Each 4

asset class is weighted to reflect its relative RESEARCH:

importance and value within the basket. The THE KNIGHT FRANK LUXURY

index does not take into account dealing, INVESTMENT INDEX

storage or other associated ownership costs.

Data provided by: Art Market Research (art, jewellery,

watches, stamps, coins and furniture), Fancy Color

Research Foundation (coloured diamonds), HAGI

(classic cars), Wine Owners and Rare Whisky 101.

Please contact andrew.shirley@knightfrank.com 6 for more information. SPECIAL REPORT: INVESTMENTS OF PASSION

Editor – Andrew Shirley IN AUSTRALIA andrew.shirley@knightfrank.com

Media enquiries – Philippa Giles

philippa.giles@au.knightfrank.com Design – Quiddity ro quidditymedia.com P Fr

Front cover: 7.5ct oval diamond ring by 10 Ob Fairfax & Roberts report provid INTERVIEW: SARAH the performa ORFANOS VANT,

© Knight Frank LLP 2019 many of whic FAIRFAX & ROBERTS

This report is published for general information only and as investmen

not to be relied upon in any way. Although high standards

have been used in the preparation of the information, research, how

analysis, views and projections presented in this report,

no responsibility or liability whatsoever can be accepted comes to thes

by Knight Frank LLP for any loss or damage resultant

from any use of, reliance on or reference to the contents of passion, it

of this document. As a general report, this material does that be the sp

not necessarily represent the view of Knight Frank LLP in

relation to particular properties or projects. Reproduction engine of a cl

of this report in whole or in part is not allowed without

prior written approval of Knight Frank LLP to the form generated by

and content within which it appears. Knight Frank LLP is art – that is s

a limited liability partnership registered in England with 12

registered number OC305934. Our registered office is collectors. Au

55 Baker Street, London, W1U 8AN, where you may look DEVELOPMENT FOCUS: at a list of members’ names. over the follo CROWN RESIDENCES, ONE BARANGAROO best the coun

OT H E R M A R K E T- L E A D I N G K N I G H T fine wine, da

F R A N K P U B L I C AT I O N S furniture or s Of course, largest indep

The global perspect ive on prime pro perty and i nvestment business, we argue that pr investment o residential pr and other par past decade b The Wealth Report 2019 International View 2019 development P A G E 2

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9 W H I S K Y G A L O R E Hatlapa. A Ni fetched US$6 Art boom By contras growth with t World Index, results, growi Lukasova-Du

Andrew Shirley, Head of Luxury Research at Knight Frank, shares the latest the market he

findings from our Luxury Investment Index (KFLII) “The 2019 cracking start by Elisabeth- for US$7.2 mi Masters. The of Muhamma Ambassador t not just for th Old Masters. “Last year Portrait of an

hisky surged straight to the top Supercars

However, the most desirable cars are living artist w

of KFLII when we introduced it W

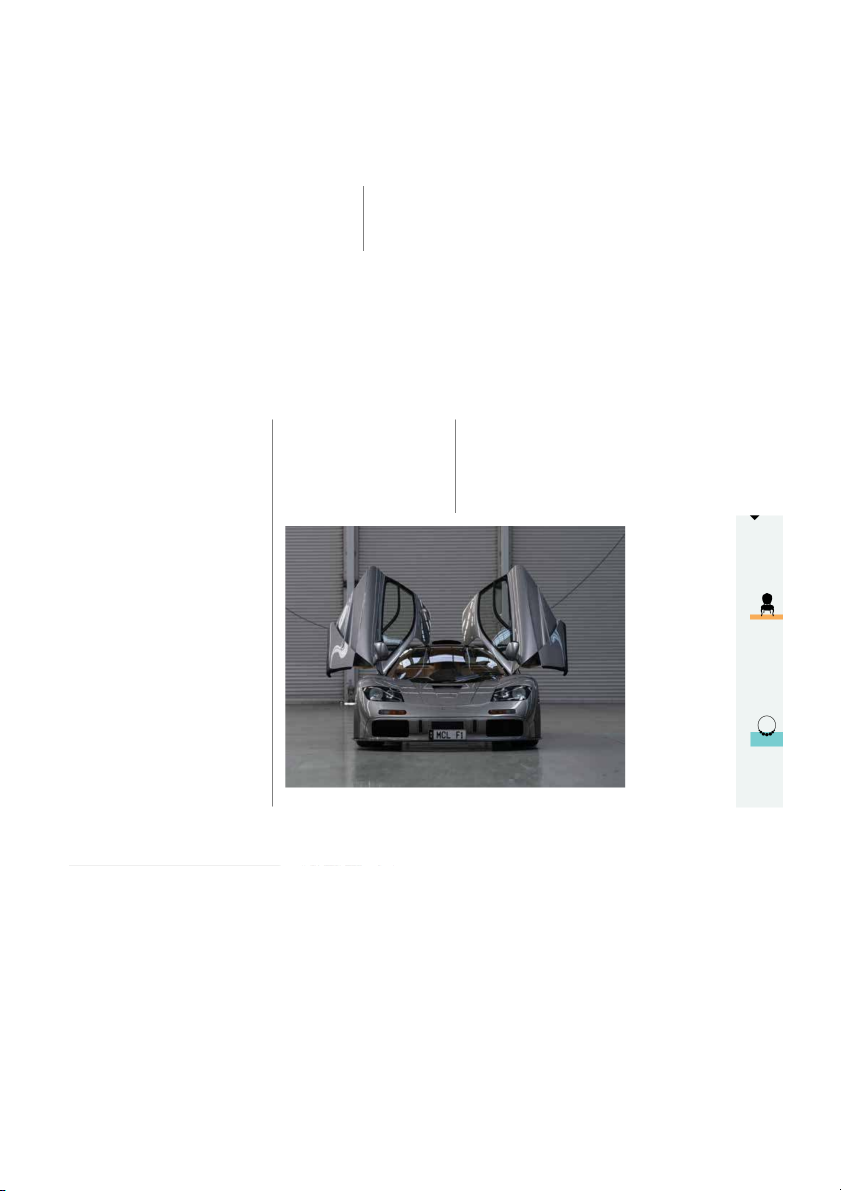

still fetching big money. A McLaren F1

Dietrich Hatlapa of HAGI, which provides at Christie’s in

to the index at the end of 2018

“LM” spec supercar was the top seller at

our classic car data, says the dip is down to didn’t last lon

to reflect the growing interest from UHNWI

the recent benchmark Monterey sales in

speculative investors leaving the market collector paid

collectors, particularly in China and the

California fetching almost US$20 million –

to genuine enthusiasts who are more gleaming stai wider Asia-Pacific region.

a marque record. The market for Formula

circumspect about paying over the odds Postwar and C

Since then, market growth – as

1 cars is also hot right now, points out Mr for vehicles.

measured by the Knight Frank Rare Whisky

100 Index, compiled for us by the experts at The Knig

Rare Whisky 101 – has moderated slightly,

but prices still rose by 23% during the 12

months to the end of June, far ahead of any 10 YEAR

of the other asset classes in the index.

Andy Simpson of Rare Whisky 101 says a

steep downturn in prices for The Macallan

– a mainstay of the investment market Furniture

by both volume and value – coupled with -30%

plenty of supply, was one of the main

reasons the index stuttered, but he

predicts values will rise again during the rest of 2019.

“Things have since picked up 12 MONT

significantly, so we’re expecting a wholly

better set of results at the year end.”

Elsewhere in the KFLII, we have seen

a mixed picture among some of the more Jewellery -7%

mainstream asset classes. Growth in the

classic car market, for example, has slipped Source: Comp

into reverse gear, but investment-grade HAGI (cars), R

A 1994 McLaren F1 “LM spec” sold at the Monterey auctions by RM Sotheby’s for US$19.8m.

wine and art have both performed strongly. IMAGE COURTESY RM SOTHEBY’S P A G E 4

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9 P A S S I O N P L A Y

Andrew Shirley curates a special focus looking at the latest trends shaping the

luxury investment landscape in Australia hen it comes to investments

over AU$1 million by Sotheby’s Australia

much more mixed picture,” explains AMR’s of passion in Australia, art W

in April, more than doubling the artist’s

Sebastian Duthy. “Average values are is the most collected asset previous record.

now half their peak in 2012 after changes

class, according to our research. It is also

“Over the past several years, it has

in Australian government regulations,

currently setting the pace in terms of price

been immensely pleasing to see the artists

including artist resale rights and pension

growth if recent auction sales are anything

we champion receive the recognition

fund rules, had a negative impact on prices. to go by.

they deserve, with commercial results

“But as this year’s auction results

At its Important Australian Art sale in

increasingly reflecting the depth of artistic

suggest prices are showing recovery at the

August, Sotheby’s Australia hammered

merit Australia has to offer,” says Geoffrey

top end of the market. The average value

works worth in total over AU$12 million,

Smith, Chairman of Sotheby’s Australia.

of the index is up 95% from 2015, which

a record sum. Records were achieved for

“Indeed, we are seeing stronger

was the lowest point since 2007,” points

three artists: William Dobell, Peter Booth

engagement from our clients than ever out Mr Duthy. and Cressida Campbell.

and our results are reflecting this demand

Interest in Australian art, however,

The top seller was Mountain Creek,

– with record prices being achieved

is not restricted to works being snapped

Mount Kosciusko by Fred Williams.

regularly for both long established and

up by private collectors, explains Owen

Estimated to make between AU$800,000

contemporary artists,” he adds.

Craven, Senior Curator at UAP – a global

and AU$1.2 million, the oil on canvas work

However, while prices have risen public art and design firm.

eventually sold for AU$1.7 million.

strongly, a detailed analysis by Art Market

“Australian art is so exciting right now.

Earlier in the year, Seafood Paella also

Research (AMR) shows the market is still

With the advent of the art fair over the past

set a record for John Olsen, often referred some way from its peak.

decade, our galleries and artists have been

to as Australia’s greatest living artist.

“An index of 14 of the best performing

afforded exposure to the global market and

The six-metre oil panel was sold for just

Australian 20th Century artists reveals a

this has pushed artists’ boundaries into the global context.

“It’s hard to pinpoint any one artist but

Lindy Lee is an artist whose practice is

Most collected luxury assets by Australian UHNWIs

gaining global recognition. We are proud

to be delivering public commissions with 1. 2. 3. 4. 5.

her in cities around the globe including Shanghai and New York.” Raise a glass

While it is whisky collectors based in Art Wine Classic cars Watches Jewellery

Singapore, China and Hong Kong who are

Source: The Knight Frank Wealth Report Attitudes Survey 2019

really setting the pace when it comes to

the very top of the market in the Asia- P A G E 6

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9

“The Glenlivet released The Winchester

Collection, which is comprised of three

P A I N T I N G B Y N U M B E R S

single malts that have been resting in our

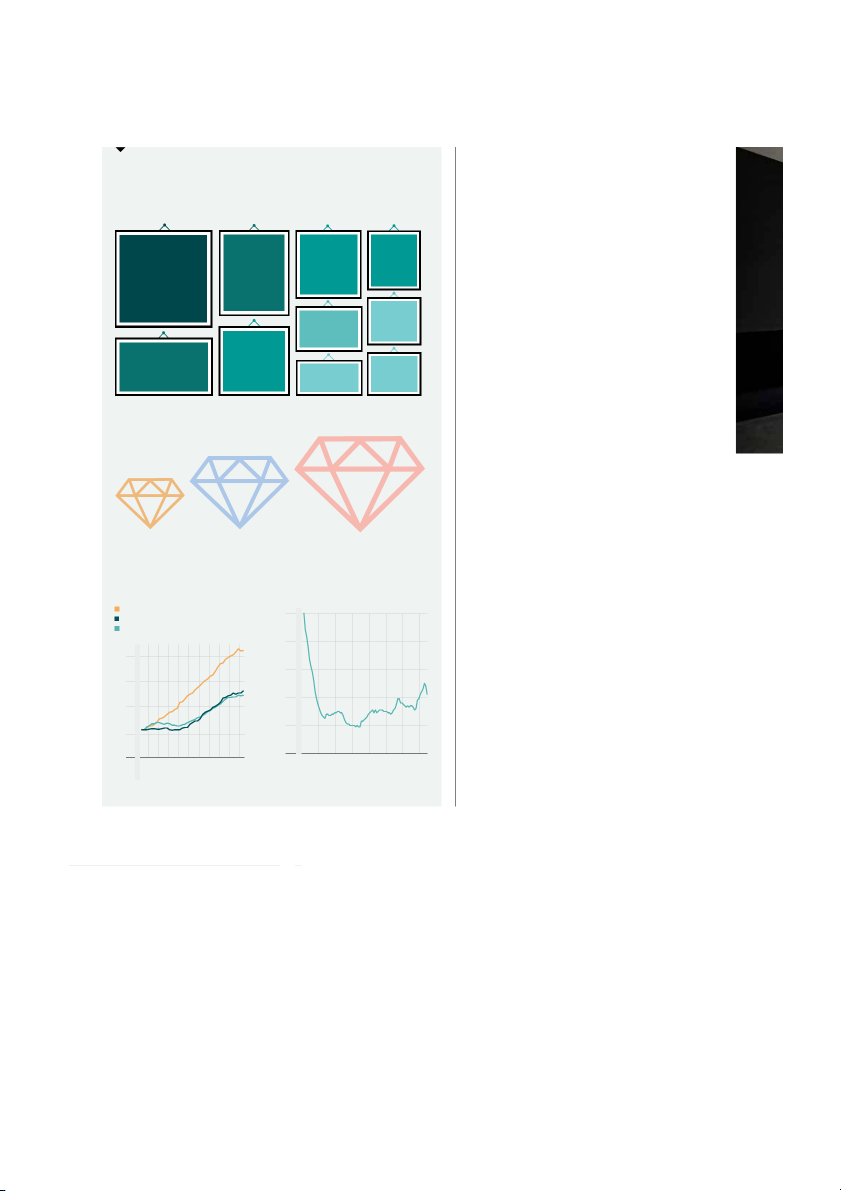

L U X U R Y D A T A I N S I G H T

cellars for fifty years. The 1964 edition

was laid down by Captain William Smith

Most valuable Australian artists by highest priced individual work

Grant, the last distilling descendant of

The Glenlivet’s founder. It is an extremely SIR ARTHUR

limited release, with only one hundred ERNEST FRED WILLIAMS STREETON You Yangs

bottles available and it provides an JOHN CECIL Sydney Harbour, Landscape 1, 1963 1907 BRACK AU$2,287,500

incredible tangible link to the distillery’s SIDNEY NOLAN The Old Time, 1969 AU$2,074,000 Sold Jun-13

First-Class Marksman, 1946 AU$3,360,000 Sold Aug-16 AU$5,400,000 Sold May-07 rich history.” Sold Mar-10

Rarity could also boost the demand for ARTHUR MERRIC BLOOMFIELD

a “home-grown” Australian investment BOYD EMILY KAME Drowned KNGWARREYE

of passion. The imminent closure of Bridegroom (1959)

Earth’s Creation I, 1994 AU$1,952,000 AU$2,100,000 Aug-2018

the Argyle mine in Western Australia, Sold Nov-17 CLIFFORD POSSUM

which produces many of the world’s TJAPALTJARRI Warlugulong, 1977 SIR WILLIAM BRETT WHITELEY

pink diamonds, may help support price My Armchair, 1976 AU$2,400,000 DOBELL CHARLES BLACKMAN AU$3,927,272 Sold Jul-07 The Dead Landlord,

Mad Hatter’s Tea Party,

growth. Pink diamonds already outperform Sold Oct-13 1936 1956 AU$1,220,000 AU$1,891,000 Sold Aug-19 Sold Nov-17

blue and yellow stones, according to the

Fancy Color Research Foundation, which

Source: Art Market Research *By most expensive work, sale price includes buyer’s premium

provides data for the Knight Frank Luxury Investment Index. 10-year price change of coloured diamonds Fine Wine

While Australian craft malt whisky 320%

production has cranked up in response to 205%

the surge in demand – in 2014 there were Basket Press S 144%

nine distilleries on Tasmania, now there Henschke Hil

are 32 – and is winning awards around and 707 and G

the world, the country’s most famous Series Chardo Y E L LO W B L U E P I N K

home-produced alcoholic beverage is still One man w

Source: Fancy Color Research Foundation

wine. And values for the best bottles are than most ab powering ahead. Crawford, wh

Performance of luxury investments

Average price at auction* for strategy for C versus prime property

Australian 20th Century artists almost 425,00 uu

Knight Frank Luxury Investment Index 100 the wine indu My philosophy is great Sydney prime residential “Australia Melbourne prime residential

things should be opened sensational w 80 and enjoyed a lot of Austra 250 drink a lot of 60 uu can afford it – 200 19 0 for wine prod 2 2 40 Q 150

“Penfolds Grange Bin 95 has entered things that I’d = 0 10

the Knight Frank Fine Wine Icons leader never even ha x e d 20 In

board with growth of 25% over the last 12 “For instan 100

months,” says Nick Martin of Wine Owners, Tasmania. Jim 0 50

which compiles the index for us. at McWilliam 12 13 14 15 16 17 18 19 9 11 12 13 15 17 18 19 0 0 0 0 0 0 0 0 10 14 16 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2

“The Wine Owners Australian 70 index now, but Cha 0 0 0 0 2 2 2 2 2 2 2 2 2 2 2

is a star performer up 21% over the last 12 hectare block Source: Art Market Research Source: Knight Frank Research

*Calculated in AU$, central 80% of sales

months and by almost 13% since the start does pinot. T

of 2019. Top performers include Rockwood expensive – o P A G E 8

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9 surrounded b

A S P A R K L I N G S U C C E S S of the time. The turn o it many chan became a nat newfound pa jewellery to a showcased th

Sarah Orfanos Vant, Director of Brand and Partnerships at jeweller fauna were o

Fairfax & Roberts, explains how jewellery trends continue to reflect Australia’s everything fr development as a nation and crocodile pieces that w As the sou War I faded, i and bubble o

Fairfax & Roberts is Australia’s

mosaic. Gentleman’s jewellery consisted begun on the

oldest jewellery house. How did

of ornate breast pins, studs and gold watch had a bold sty it all begin?

chains, which signified status and style enthusiasm i within a conservative period.

Richard Lamb, who had emigrated from jewellery wor

The discovery of gold in the 1850s

London to Sydney in 1836 and established inter-war yea

brought a gold rush to New South Wales

himself as a jeweller and optician was With fashion

and Victoria, and with it Australia’s

joined by Alfred Fairfax – of the Fairfax linear, jewell

prosperity and population grew. Along

publishing family – to create Sydney’s first streamlined,

with a new wave of immigration came

emporium for fine silver and watchmaking triangles and

new styles of jewellery. Australia’s gold

at 394 George St – already the bustling increasingly

rush attracted fortune seekers from

artery of the growing city. When Fairfax

around the world, a number of whom were

& Roberts first opened its doors in 1858, a Tastes and

jewellers. At a time when photography

journey of luxury bespoke jewellery began. fluid, but a

did not yet exist, souvenir jewellery that

One of our early achievements in 1873 you are see

literally depicted life, and success, on the

was the design and production of the iconic there some

goldfields was very popular. Brooches

tower time piece that still marks Sydney’s out of fash

often featured mining equipment

Central Station. Over our 160-year history, Definitely co

we have crafted treasured possessions in engagemen

and heirlooms for princes, governors and recent high p

many of Australia’s finest families, and we weddings. On

are proud to say that many of our earliest out of fashion

pieces are still in use today. handmade pi that one pers

Your history has run pretty much down throug

in tandem with the creation

of modern Australia. Have the Australia h

country’s milestones been cultural m

reflected in your jewellery? the huge ri the Asia-Pa

While the jewellery of the time was much internation

influenced by European styles, Australian that affect

jewellers such as Lamb and Fairfax made of jeweller

their own mark on the craft by producing

pieces that strongly reflected Australia’s I have to say t

identity as a colony. Women’s brooches As a bespoke

often featured native flora and fauna, set make is uniqu

with European silver, around a cameo or The Starlet pendant by the individ P A G E 1 0

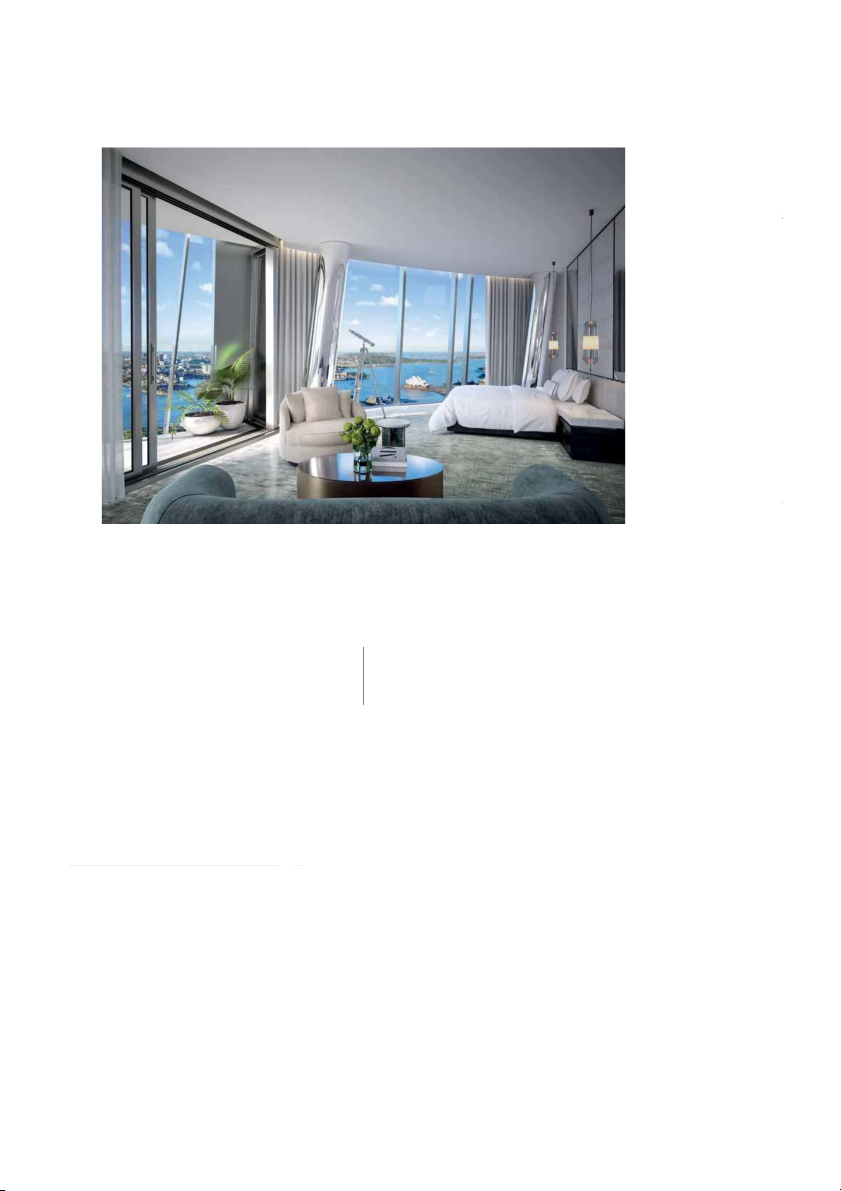

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9 o y flo D yo latest oversea fresh linens la at the end of a a bottle of rar your special g entertaining? can be reques in a Crown Re in Sydney. Sydney is lifestyle, bout exceptional r harbour that a certain je ne cosmopolitan and return to living though and country e then spots lik nestled by the Sydney is cafes and rest Sydney-sider superb wine b spectacular su from its abun Located on th

Something to sing about – a view from the penthouse Barangaroo is become the d Waterfron This year Syd “Most Liveab V I E W T O A T H R I L L Economist In Australia is cu most preferre residential pr the global fin residential ca 5% of the mar total 71% to Ju

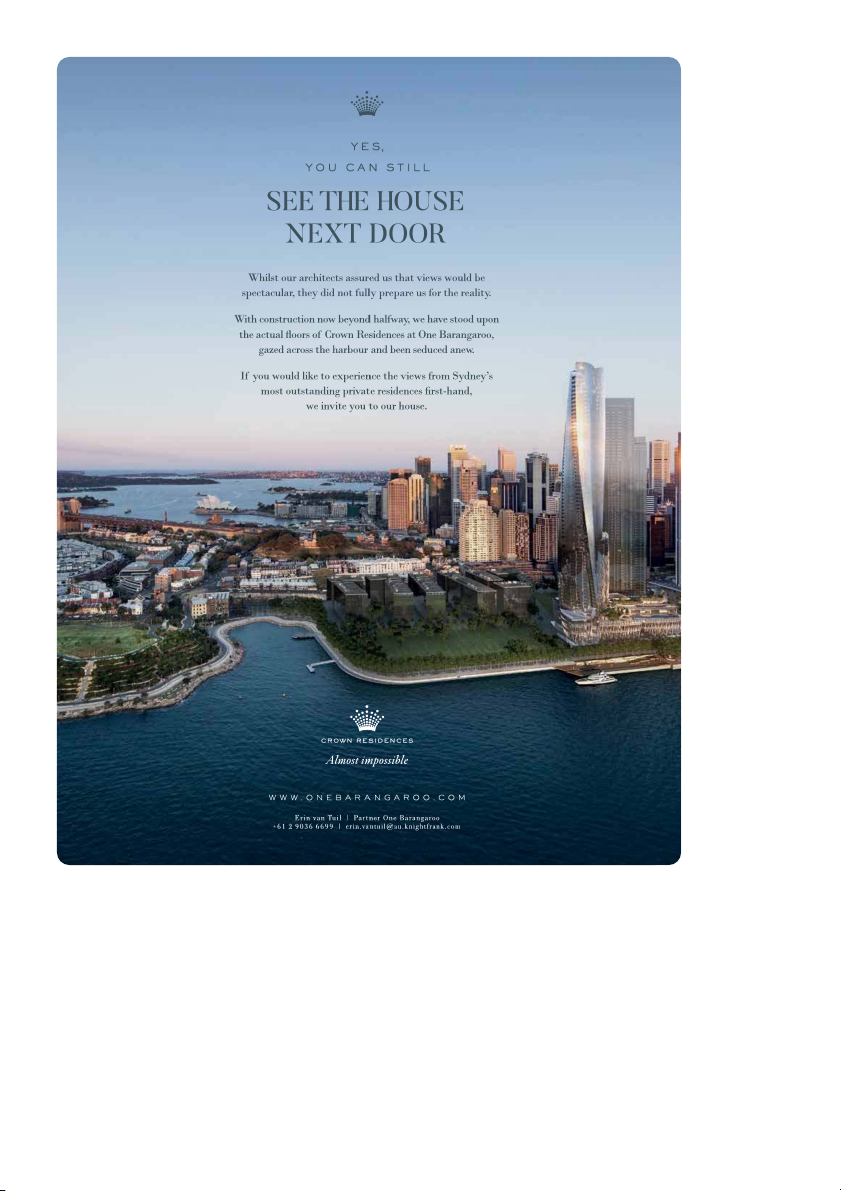

Crown Residences at One Barangaroo will set new standards Global and

for Sydney harbour-front living when they open in 2021. attracted to th

Knight Frank’s Erin van Tuil explains why in 2018, these average prem with similar p inland withou Homeowners P A G E 1 2

L U X U R Y I N V E S T M E N T I N D E X 2 0 1 9

metres high, giving multi-aspect views

With location, views, design and

your Residence, overlooking the majestic Investmen

of the Harbour Bridge, iconic Opera

certainty being everything, what is left?

harbour or pamper yourself in the Blainey The starting p

House and beyond from the moment they Service of course.

North-designed spa after a dip in one of the AU$9.5 millio

wake up, to breakfast on the open-air

As Australia’s leading hospitality

resort’s two infinity-edge pools. such conveni

balcony or a private moment soaking in a

provider, it seems the most natural fit that

The list of first-class amenities one Enviable posi

windows-edge, free-standing bathtub.

Crown Resorts would step in to provide its

can expect include: 24-hour residents’ amenities, aw award-winning service.

concierge, valet parking, doorman, security, Style and service international

“We are confident that our residents will

in-home dining and housekeeping with best the world

The captivating architectural façade,

appreciate the unique offering of this iconic

complete access to the resort-style facilities investment fo

designed by the genius WilkinsonEyre,

building, brought to the market by Crown

(tennis court, gym, residents’ pool, spa) value – and b

is only a taste of the lifestyle behind its

Resorts, which has a 20-year track record of

and then some you wouldn’t normally residence like

walls. Step into interiors designed by

delivering luxury hospitality in Australia,”

expect like grocery stocking, dog walking, fetch a 25-33%

New York-based Meyer Davis Studios and

says the company’s Todd Nisbet. sommelier or a private chef. Asian cities, a

immediately you are swept off your feet.

Life at Crown Residences will be about

To be a resident of Crown Residences 2019 Branded

The interior design emanates warmth

ease and convenience, with modern

is to be treated as a permanent VIP of our “Many of o

and entertaining is front of mind; focal

amenities such as in-residence dining,

hotel where the real indulgence is knowing Crown Reside

living spaces destined to bring people

where meals are prepared by the integrated

that there is always someone looking out for choice enabli

together, thanks to design elements such

six-star hotel or, if you feel so inclined,

you. Take comfort in knowing that managing a la

as European oak floors, ripple textured

you can venture to one of the in-house,

your everyday needs will be expertly and the assoc

bronze glass, polished stainless steel and

handpicked restaurants situated downstairs. executed here. recognise tha

stunning veined marble slabs from the

People may spend the year between Fine dining unique, and t best quarries in the world.

several homes around the world or travel investment w

A fortunate few will have a choice of

Book your table at your favourite restaurant

extensively for business or pleasure. The asset for the w

two, three or four-bedroom Residences

or bar when friends come over simply by

joy of Crown Residences is that you can Mr Nisbet.

with a single, six-bedroom duplex

calling your dedicated concierge. Banish

call the concierge ahead of your arrival “Crown Re

penthouse also available. All oversized

all guilt by working out in the state-of-

and your linens are pressed and your a city pad; the of course.

the-art gym that enjoys the same views as fridge is stocked. children, gran gather to enjo Sydney’s C Barangaroo a discerning of just a home, t returns the ul And the pr harbour is ab Crown Reside halfway mark ahead of sche To be a Reside as a P L E A S E C O N E R I N . V A N

The whisky bar offers a place to relax and enjoy fine spirits P A G E 1 4