Preview text:

CHAPTER 1: OVERVIEW ABOUT MACROECONOMICS

A. Economics: way, scarce sources – allocate – alternative uses- human needs Human needs: unlimited Resources: Limited >>TRADE- OFF B.

How people make decision? 1. Compare MB and MC

MB: Marginal Benefit: The amount of utility/ benefit increases when you take one more action

MC: Marginal Cost: The amount of cost increases when you take one more action MB>MC of one action: Do

MC2. Opportunity cost: The value of the best alternative for one action OC is high>> Don’t OC is low>> Do C.

Division: 2 (Roles and Subfields) 1.

Roles: Positive vs Normative Positive Normative Scientists Policy advisors

What is happening? What Happened What SHOULD/NEED to be done? Facts Advisory

2. Subfields: Macroeconomics vs Microeconomics Macro Micro Overview More detailed

The whole economy of a country, a region,

Focus on behaviors of 3 “actors” of Economy: the world households, firms, governments

A basket of goods, The Price Index

Can: separated goods, price of each good

Unemployment rate, Economic growth

rate, interest rate, Inflation rate D. 3 questions and 3 types

3 Questions: Produce: What, How, To Whom 3 Types

Command: Governments ANSWER/ DECIDE ALL 3 questions

Market: NO government intervention: Only Households answer: To Whom, Firms answer: What+ How

Invisible hand: Adam Smith, >> PRICE IS the factor that drives the behaviors of firms and households

Mixed: Governments, Households, Firms answer 3 questions TOGETHER. Firms and

households interact first, if market failures emerge>> Governments intervene to stabilize

Command+ Mixed: Models have GOVERNMENT: Visible hand: Kenyes E. 3 Economics Models 1. Supply and Demand:

Exogenous: outside, cannot see in the model>> Shift (increase: Right, decrease: Left)

Edogenous: inside, can see in the model>> Move along a curve

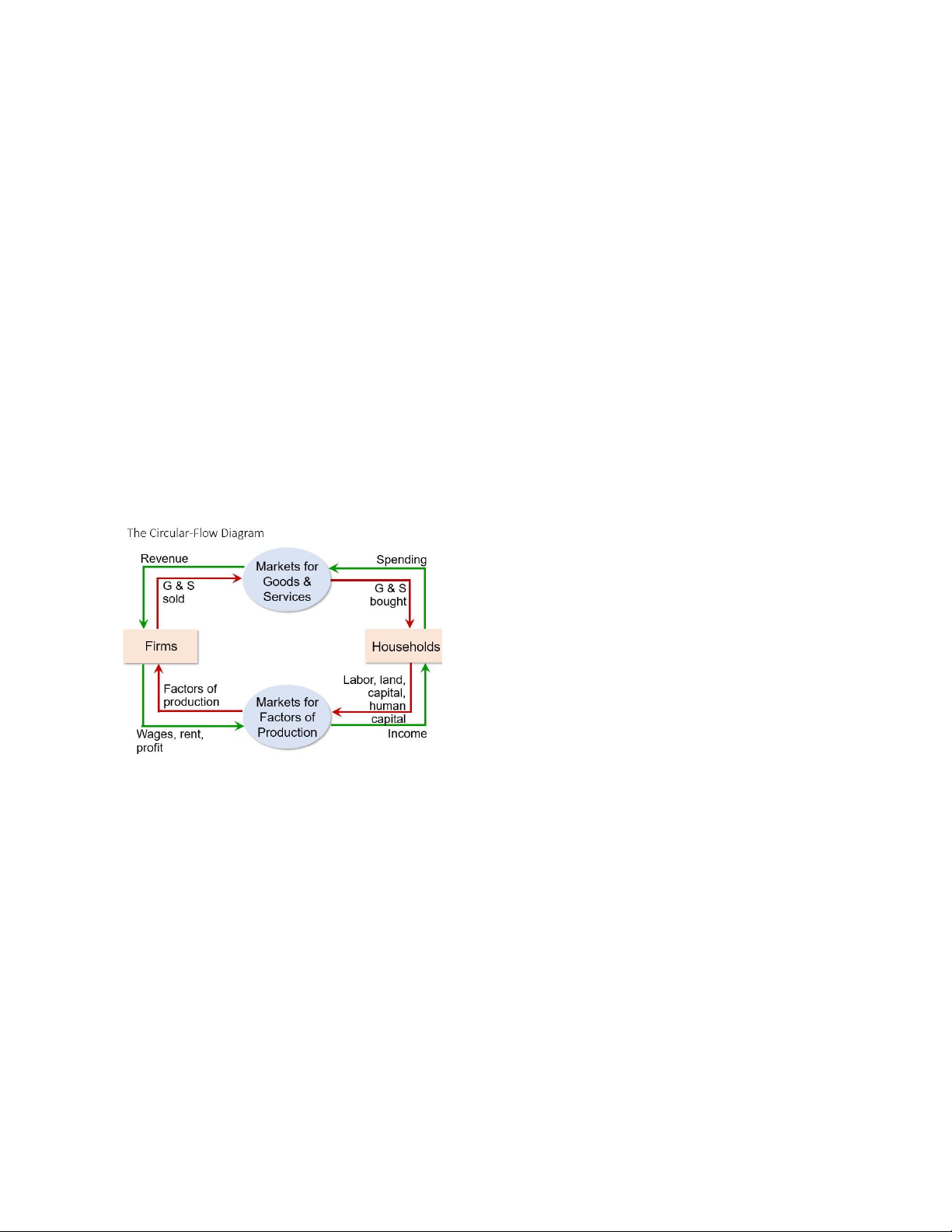

2. Circular Flow Diagram: 2 actors: Firms+ Households, 2 markets: Goods, Services and

Factors of Production, 2 REVERSED FLOWS: Money and tangible+ intangible goods

>> Income=Expenditure : from Households aspect

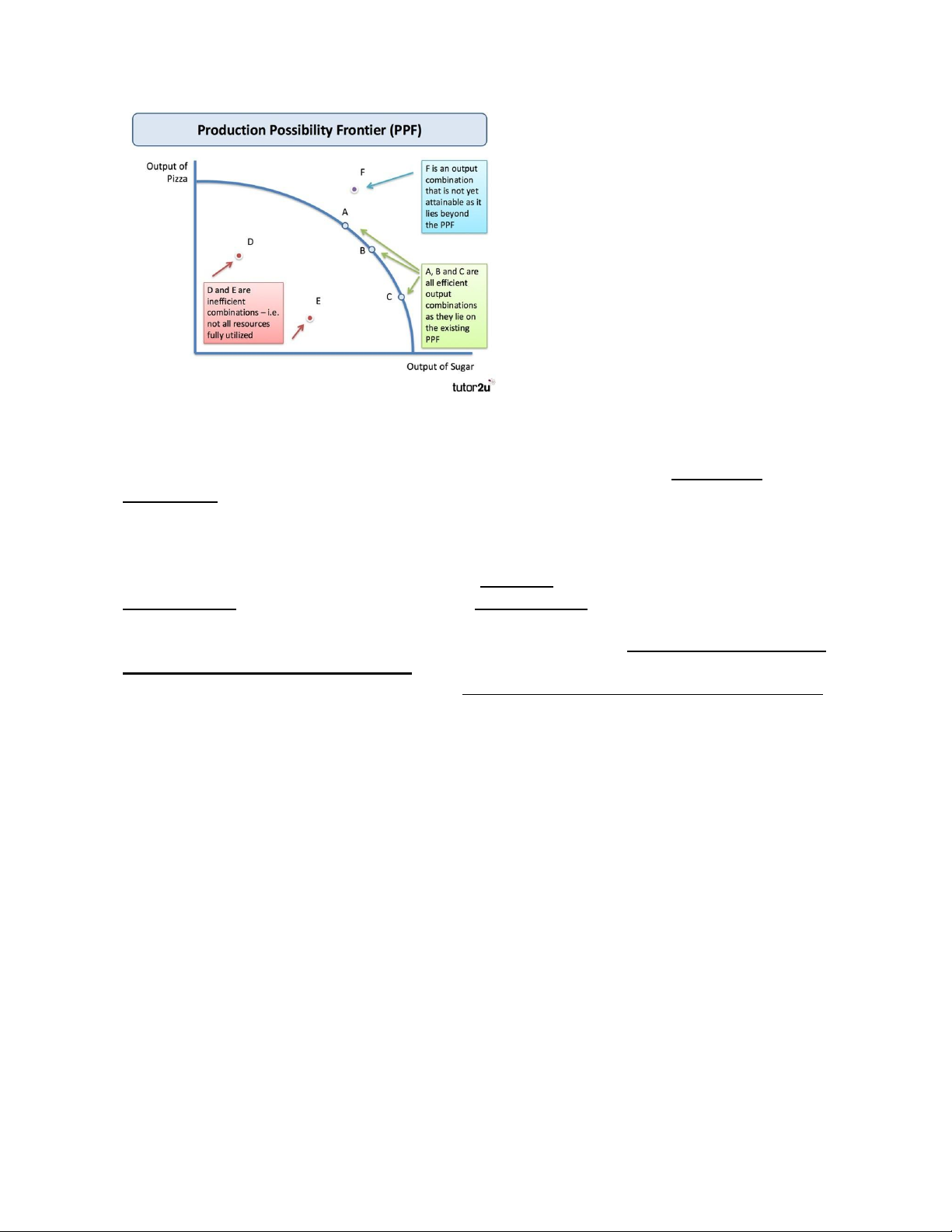

3. PPF: Production Possibility Frontier

2 goods, 1 economy produces, given resources and technology Meaning of PPF:

Trade off: OC when producing one more unit of X or Y>> PPF slopes down (increase X then decrease Y and vice visa)

Efficiency: On PPF: Possible+ Efficient: all resources are utilized, below (on the left handed

side): Possible+ Inefficient, Above (on right handed side): impossible (lack of resources)

Unemployment rate: Below> ON PPF (natural unemployment rate) > Above

CHAPTER 2: GDP, GNP, CPI A. GDP 1.

DEFINITION: ALL, MARKET VALUE, FINISHED GOODS, WITHIN A

COUNTRY, GIVEN PERIOD OF TIME •

All: không tính(exclude) self-supply (tự cung, tự cấp) and illegal -> VD: hoạt động ở nhà trông con •

Market value: không tính value on UNDERGROUND market •

Final: exclude INTERMEDIATE goods (EXCEPT: INTERMEDIATE goods FOR

EXPORTING and INTERMEDIATE FOR EXPORTING IN INVENTORY (còn trong tồn kho)) •

Within a country: GDP on country –only count for products produced in the territory

of that country (không tính: import) •

Produced + Given in a period of time: produce in which year>>count for that year only

(không tính: RESALES (mua đi+bán lại, thanh lý)

3 APPROACHES: Expenditure (production), Income, Value added

1. Expenditure: GDP = C +I +G+NX (product approach)

C: Consumption (của household)

HOUSEHOLDS: daily consumption for living, Note:

Include: renters: rental payments: included in C, home owners who use house for renting:

imputed value of the house (furniture, decoration, repair of goods in the house: included in C)

Exclude Households buy NEW HOUSE

I: Investment (total) = net investment + depreciation (khấu hao) •

Business: Inventory (PRODUCED but not SOLD YET) and NEW plants and

equipment (2 cách invest) •

Households: BUY NEW HOUSES

Investment of Macro vs General Investment •

Investment in the formula of GDP: TOTAL INVESTMENT = NET INVESTMENT+ DEPRECIATION •

Investment of Macro HAS to create Goods and services for market •

>> Stocks(cổ phiếu), bonds(trái phiếu) are not considered as an investment in marco but only SAVINGS STOCKS VS BONDS •

Stocks: ownership (equity), often depends on profit, khi nào cty có lợi nhuận, người giữ cố phiếu có lợi tức •

Bonds: debt , not depend on profit: chủ nợ của người phát hành trái phiếu, khi đến hạn,

có lợi nhuận hay k cx cần trả lợi nhuận cho người mua trái phiếu ➔ Stocks : risker > bonds ➔ Companies: risker > gov

HIGH RISK, HIGH RETURN(interest)

>> The yield (interest rate of stocks or bonds) depends on the risk that it has

G: Government spending (expenditure) •

Governments spend for goods and services •

Exclude TRANSFER PAYMENT : unemployment doll (trợ cấp thất nghiệp), pension

(lương hưu) , interest payment for bonds

NX: Net Export= Export – Import

2. Income : GDP =w+i+r+Pr+Ti+De • W: wage • I: Interest rate • R: rental payment • Pr: Profit = TR-TC • Ti: Indirect tax (VAT) •

De: Depreciation value (total I = 300, net I = 200 -> De = 300-200)

3. Value added: Sum of VA of all businesses in an economy

VA= value of production – value of intermediate goods bought from others

Trồng lúa mì, sau đó bán lúa mì cho người làm bột mì: 10

Người làm bột mì, mua lúa mì rồi sx bột bán đc giá: 20

Người làm bánh mì lại mua bột mì rồi bán được bm với giá: 30

VA on bán lúa mì = 10-0, VA on làm bột mì = 20-10, VA on bán bm = 30-20 GDP = 10+10+10 GDP nominal vs GDP real

GDP nominal: current price>> show difference in both Price and Ouput

GDP real: base year price>> Difference in GDPr>> Difference in output of economy GDP Deflator:

Dgdp: Price index = GDPn/GDPr x 100 (no unit) B. GNP 1.

DEFINITION: ALL, Market value, finished goods, people of one country, given a period of time GDP vs GNP

GNP= GDP + value of G&S produced by people of one country in other country – value of

G&S produced by people of other country in one country

=GDP+NFA(thu nhập dòng từ nhân tố nước ngoài) GNP GDP Geographical limit No Yes Personality limit Yes No Other formula: • NNP=GNP-De • NI=NNP-Ti • Yd= Y- Tax+ subsidies C.

CPI: Consumer Price Index

Definition: basket – typical consumer -> Cost of living How to calculate •

Fix the basket (find the goods + services in the basket) •

Find the prices of the goods and services in the basket •

Calculate the Cost of the basket in current year and the cost of basket in Base year •

Calculate CPI: CPI = Cost of the basket in current year/ cost of basket in Base year x 100 (no unit) •

Inflation rate = CPIt –CPI(t-1)/CPI (t-1) x 100 (%)

True/false: there are 2 indexs to calculate inflation rate

Why CPI is often overstated? •

Substitution: some goods have prices increased with quicker speed than others ->

consumers adjust their behaviors, but the basket is fixed (chicken for pork, beef for pork)

(không ghi nhân số lượng chính xác đc mua) •

Introduction of new goods: increase variety and choices>> real value of money

increases, but the basket doesn’t count this (Netflix) (không nghi nhận hàng hóa mua) •

Unmeasured Quality change of the goods and services in the basket: quality of goods

changes>> the real value of money changes >> but the basket doesn’t count (the upgraded

software with the same price)(VD: 10k 100ml -> KM: 10k 250ml) CPI Dgdp

Hàng hóa xa xỉ(luxurious item) X

Hàng hóa tư bản (phục vụ cho sx) X (capital goods)

Hàng hóa nhập khẩu (vì do 1 người tiêu X dung mua)

Giỏ hàng hóa(basket ) Cố định trong 1 Thay đổi vì sx ra khoảng thời gian gì thì tính cái đó CHAPTER 6: AD, AS A. AD: aggregate demand AD=C+I+G+NX 1.

AD: slopes down : P increases ->AD decreases and vice visa

➔ Mqh giữa P và AD tỉ lệ nghịch

P: mức giá chung (cpi, Dgdp)

Why AD slopes down : 3 theories: the wealth effect, the interest-rate effect, and the exchange rate effect. •

Pigou's wealth effect: When the price level fal s, cùng 1 income như cũ, mua đc nhiều

hàng hòa hơn -> consumers feel that they are wealthier, a condition which induces more

consumer spending>>a drop in the price level induces consumers to spend more, thereby

increasing the aggregate demand. •

Keynes's interest-rate effect: Price decreases>> Consumers need less money to buy a

certain number of goods and services>> They can have more money to save >> supply for

loanable funds market increases (supply for money) + ít nhu cầu vay -> cầu vay giảm >> Real

interest rate falls >> Investment of businesses increases >> AD increases (other factors keep unchanged) •

Mundell-Fleming's exchange-rate effect: Price decreases>> more savings>> interest

rate falls>> the people don’t want to invest domestically, instead they invest aboard (gửi tieefn

sang nước ngoài) >> the demand for foreign currency increases, demand for domestic currency

decreases, the value of domestic currency decreases>> Export increases, Import decreases>>

NX increases>> AD increases

2. Factors that make AD shift

Shift : khi là yếu tố ngoại sinh (yt không có trong hình)

Movement: khi là yếu tố nội sinh (yt có trong hình)

Nếu AD/AS tăng -> shift right

Nếu AD/AS giảm -> shift left Policies:

csach tiền tệ hay cs tài khóa chỉ tác động đến đường AD

cứ là chính sách mở rộng (tặng slg, kích cầu) -> AD tăng

csach thắt chặt -> AD giảm •

Fiscal policy: Government: Tax, Government spending (or subsidies) •

Monetary policy: Central Bank: 3 tools (in chapter Money and Monetary Tools) •

Fiscal or Monetary Policies ONLY AFFECT AD CURVE •

Policies to increases AD >> AD shifts right and vice visa

Demand shocks( include but not limited) • Shocks on Stock market •

Economic downturn>> decreases in Consumption, Investment •

Covid 19>> disruption in Global supply chain •

Có lợi: khởi sắc của thị trường Chkhoan, sự phục hồi nền kte-> shift right •

Bất lợi: covid 19 -> shift left B. AS 1.

Long term AS: LRAS, does NOT depend on Price

LRAS: depends on Technology, Human Resources ( Labour(population)), Natural

Resources, Labour, Capital (ngoại sinh) •

Tăng -> LRAS shift right •

Bất lợi -> LRAS shift left

LRAS cắt trục hoành tại Y*(mức sản lượng tiềm năng của nền kinh tế: mức sản lượng

khi nền kinh tế đã sử dụng tối đa nguồn lực – chỉ đạt đc trong dài hạn)

TRONG DÀI HẠN, NỀN KINH TẾ LUÔN Ở MỨC SẢN LƯỢNG TIỀM NĂNG

These factors change>> LRAS shifts to the right if potential yield increases and vice visa

2. Short term AS: SRAS: Slopes up due to 3 theories

Sticky wage: Price increases, but nominal wage stated in the contract (tiền lương kí hợp đồng)

doesn’t change immediately >> TR=PxQ of business increases, TC decreases relatively tương

đối so với cũ >> Profit increases>> Motive to produce more>> AS increases

Sticky price: Price increases, but the price on the menus or catalogues has not been

changed>> Consumers take chance to buy more in present (so that they can buy at cheaper

price in comparison with that in the future)>> TR=PxQ increases, other factors keep

unchanged, then profit increases, more motives to produce>> supply increases

Misconception: Price increases, the businesses think that the increase in prices may be due

to the increase in demand, so they produce more to meet the demands

3. What factors make SRAS shift? (include but not limited) Bất lợi -> trái Có lợi -> phải •

Prices of input for productions: tăng -> TC tăng -> profit giảm -> đluc sx giảm -> SRAS left •

Tax levied on production or businesses •

Future price (expected price): tăng -> sx trong tg lai có lợi hơn -> trái •

Recession(suy thOÁI) -> trái •

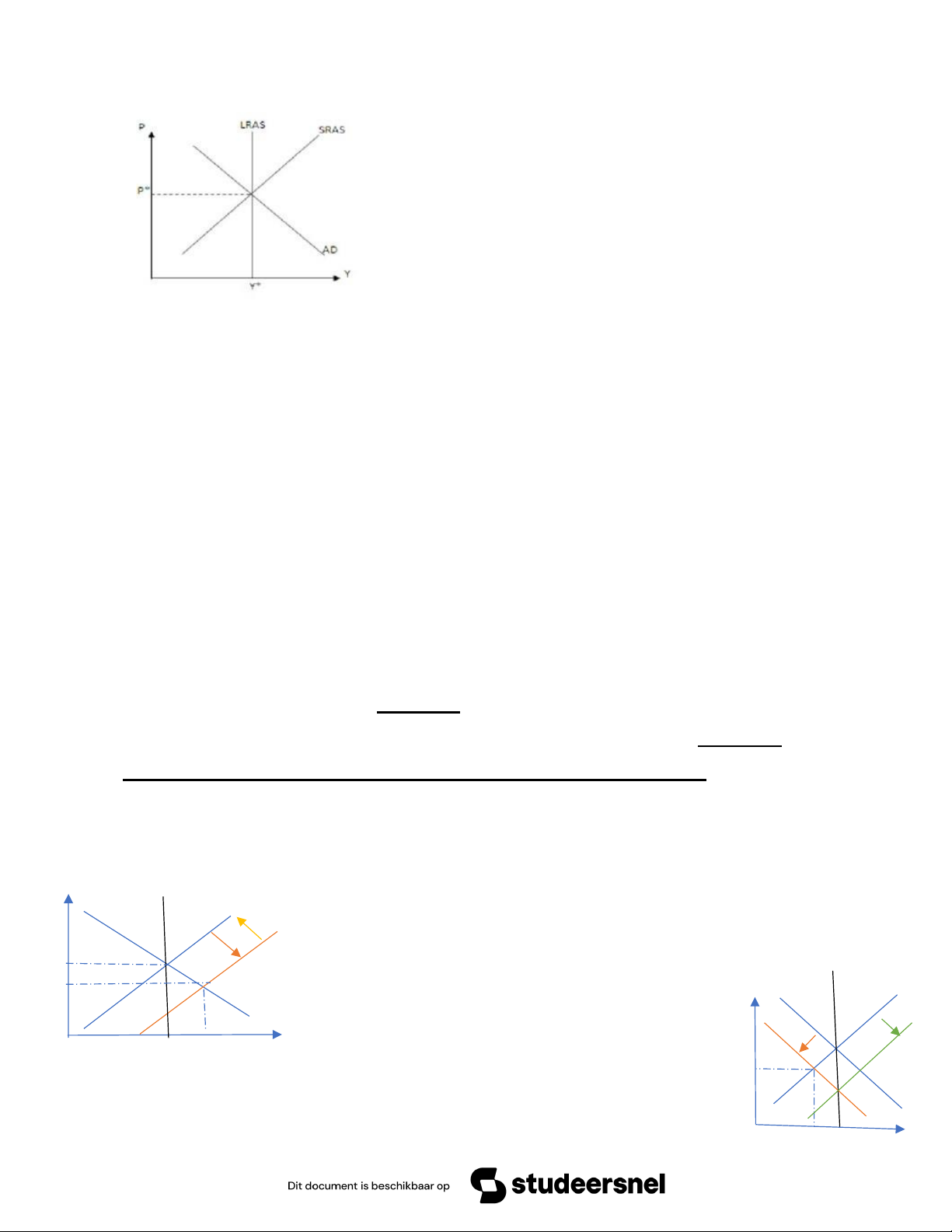

Disruption in GSC (global supply chain) C. AD-AS MODEL P: mức giá chung

VD giá dầu thô tăng -> ngoại sinh -> shift

Equilibrium in short term: SRAS and AD meet

Equilibrium in long term: point where LRAS, SRAS, AD meet. We have Y*: potential yield YY=Y*: balance Y>Y*: “hot” economy

In long run, the yield of economy always = Y* D.

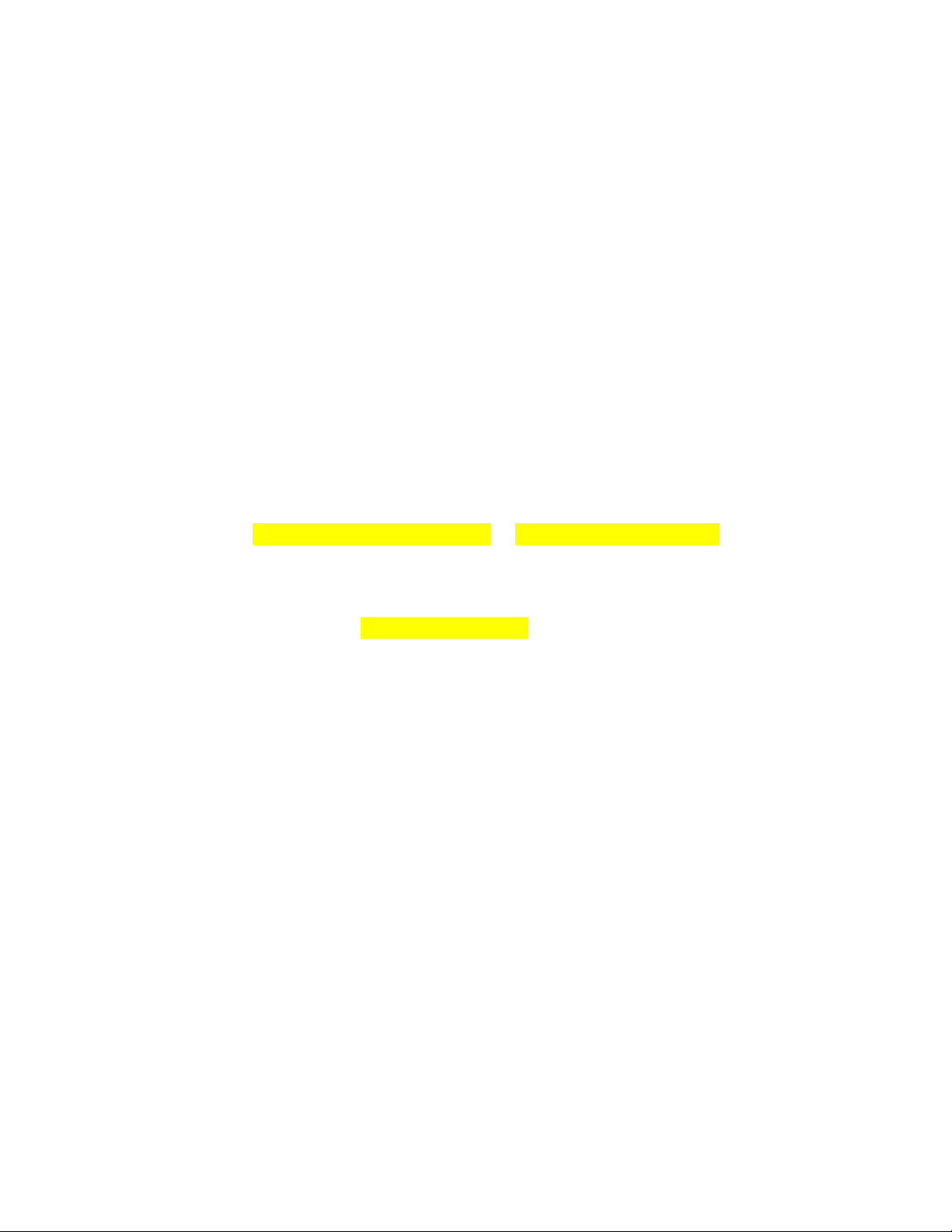

STEPS to create the model

Step 1: Analyse to know the situation will affect AD, or SRAS

Step 2: let AD or SRAS shift

Step 3: Find new equilibrium in short term

Step 4: Conclude about the temporary Price and Yield at new equilibrium in short term

Note: CẢ 2 ĐƯỜNG CÙNG DỊCH, CHỈ XÁC ĐC 1 YẾU TỐ Y HOẶC P

DỰA VÀO THỰC TẾ (TỈ LỆ LẠM PHÁT, THẤT NGHIỆP) -> ĐỂ ĐƯA RA GIẢ

ĐỊNH, VẼ ĐC CẢ 2 ĐƯỜNG DỊCH CHUYỂN ===Analyze in long term===

Step 5. 1: SRAS dịch phải -> Y at new equilibrium in short term > Y* (hot economy) , then to

increase Y, have to increase the wage paid for employees >> cost of

businesses increases, other factors keep unchanged>> Profit decreases>>

motives to produce decrease>> SRAS shifts to the left, economy returns to balanced point Y*

Step 5.2: AD dịch trái -> Y at new equilibrium in short term see that the resources of economy has not been used up yet (or we have

redundancy in resources, especially the labours)-> umemployment rate có xu Y Y*

hướng cao hơn -> to hire employees, businesses might pay less>> Their cost

decreases, Profit increases>> motives to produce increases>> SRAS shifts to the

right, economy returns to balanced point

➔ Quay về Y* với P < P* (Policies)

Hỏi về chính sách -> đưa ra chính sách + vẽ hình, mô tả tác động của chính sách

(AD dịch chuyển thế nào? Khiến sl giá thay đổi ra sao?)

CHAPTER 3: APE AND FISCAL POLICY A.

APE ( tông chi tiêu dự kiến = aggregate expected expenditure) 1.

Assumptions to create APE model

Price and wage is sticky in short-term

Aggregate supply can meet the aggregate demand

Do not consider the effect of Monetary market to Goods & Services Market

>> To indicate that in short term, Aggregate demand depends on aggregate expenditure of the economy

Income of economy is equal to The Yield of economy = Y 2.

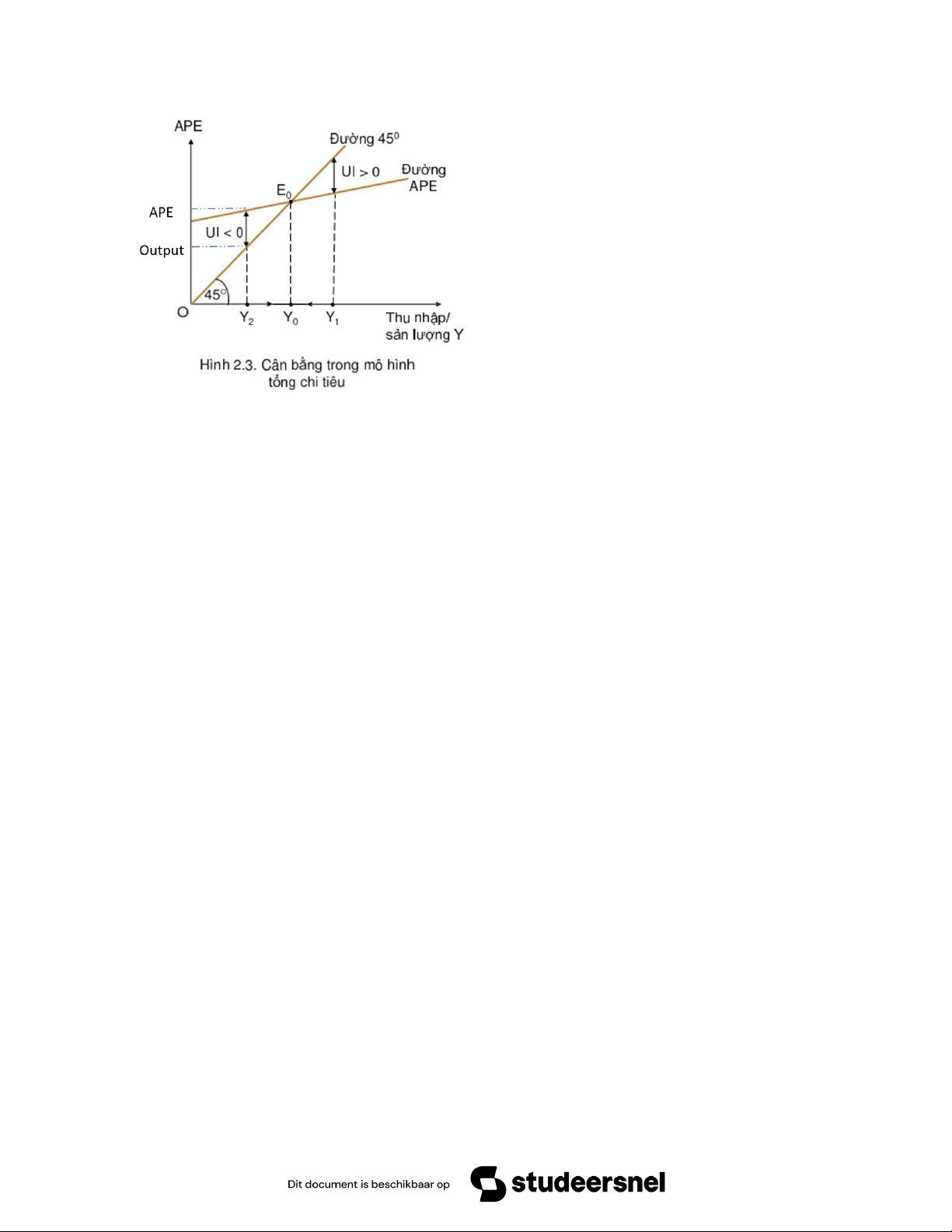

APE model of Kenyes (aggregate expenditure model): 2 lines

45 line: includes points in which: TOTAL AGGREGATE EXPENDITURE = TOTAL INCOME

APE line has 3 characteristics: •

Slopes up: the more income, the more expenditure • 0< hệ số góc <1 •

Angel coefficient <1: When income increases by 1, total aggregate expenditure increases

by an amount <1 ( khi thu nhap tang len 1 don vi, thì chi tiêu dự kiến tăng lên ít hơn 1 đv) •

Constant coefficient > 0( tông chi tiêu dự kiến tự đinh - tổng chi tiêu KHÔNG PHỤ

THUÔC VÀO THU NHÂP, LÀ MƯC CHI TIÊU THẤP NHẤT CUA NÊN KINH TÊ): Even

when the total income of economy(Y)=0, then there is still expenditure (for necessary

goods&services: foods, clothings,…). The level of aggregate expenditure o

Is the lowest level of aggregate expenditure o Does not depend on Income

45 line meets APE line at E0 where APE= Income (Y=APE), unexpected inventory=0

Real expenditure=expected expenditure E0(Y0,APE0)

If Y1 APE inventory increases (unexpected inventory (UI) >0) ➔ Kì tiếp, sx ít đi

If Y1>Y0 -> APE>Y -> inventory decreases (unexpected inventory <0)

➔ Kì tiếp, sx nhiều lên 3.

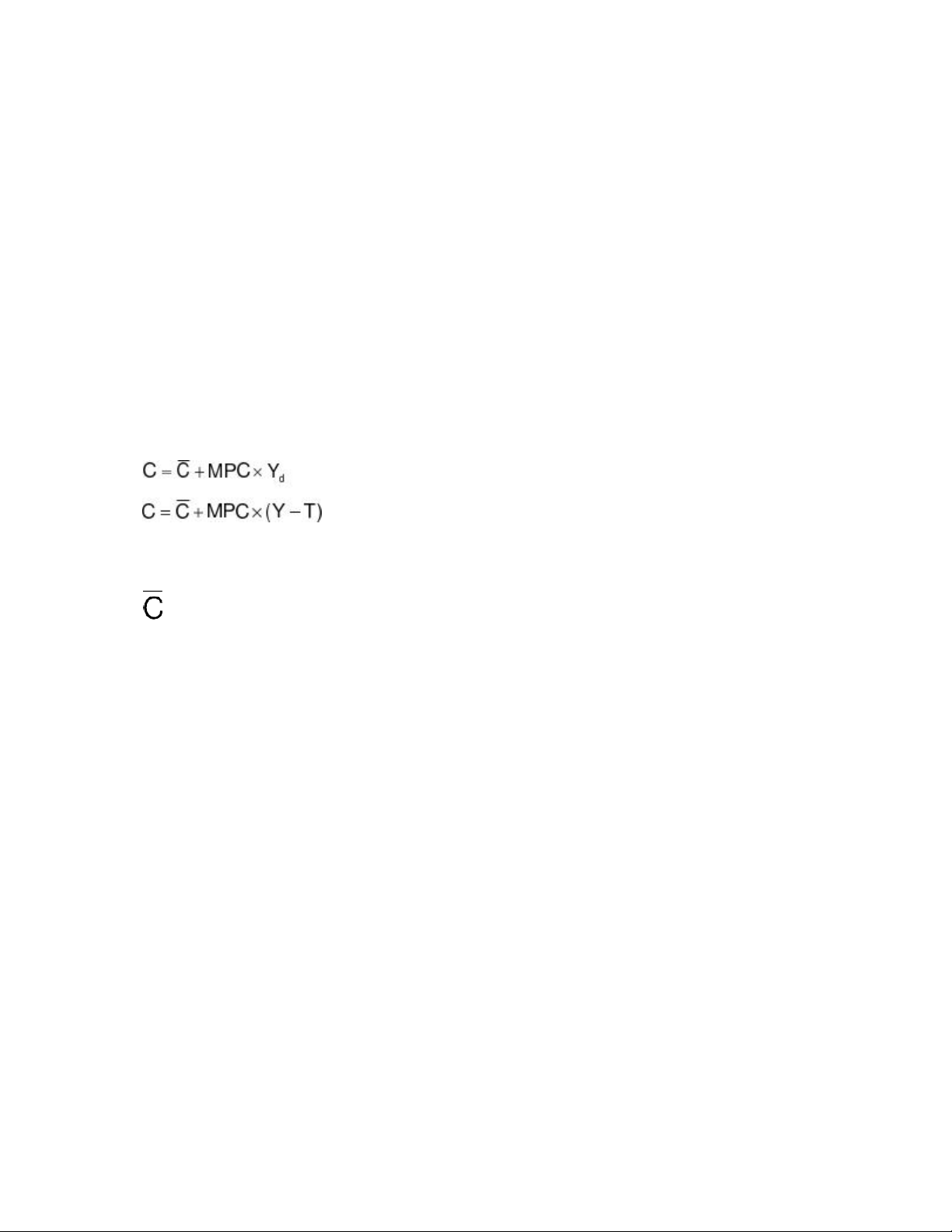

Formula of APE (APE= C+I+G+NX) 3.1. Consumption (C)

C NGANG: CHI TIÊU TỰ ĐỊNH CUA HÔ GIA ĐINH (CHI TIÊU CUA HGĐ KHÔNG

PHU THUÔC VÀO income, CHI TIÊU THẤP NHẤT CUA HGĐ)

MPC: XU HƯƠNG TIEU DÙNG CB: CHI TIÊU THAY ĐÔI LÊN BN KHI THU NHÂP

KHẢ DUNG THAY ĐÔI 1 ĐV (marginal propensity of consumption)

0Yd= thu nhập khả dụng = Y(thu nhập ) trư đi tất cả khoản thuế phải nộp và cộng vs trợ cấp nếu có

TH1: nền ktế đóng, ko có chính phủ

C= C ngang + MPC.Yd=C ngang + MPC (Y-0+0)= C ngang +MPC.Y Y=C+S

>> S=Y-C=Y – C NGANG-MPC.Y= - C NGANG + (1-MPC).Y

1-MPC=MPS = CHO BIÊT TK CO XU HƯƠNG THAY ĐÔI BN KHI thu nhập khả dung thay đổi 1 đv

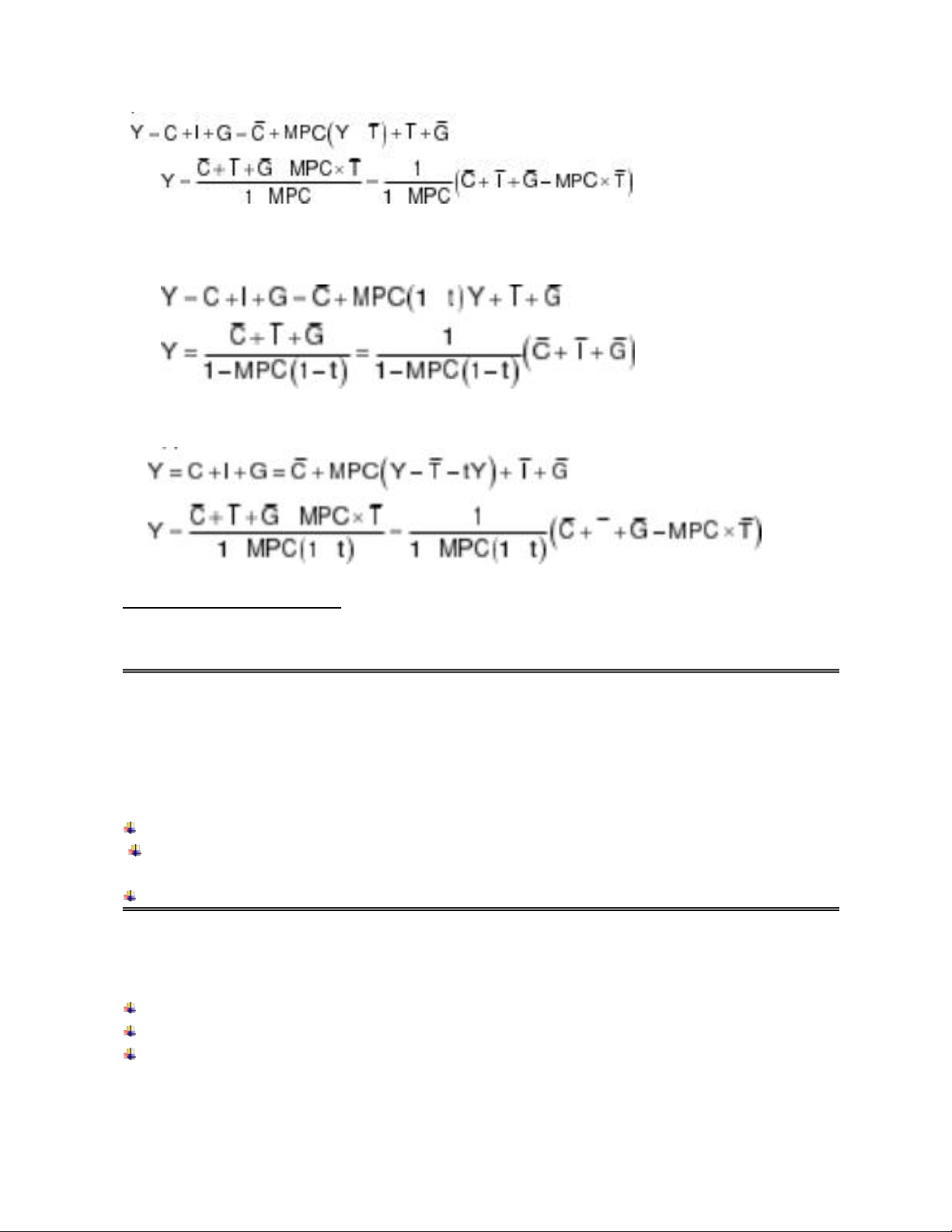

TH2: Nền ktế đóng, có chính phủ, chính phủ đánh thuế tư đinh

C= C ngang +MPC.Yd= C ngang + MPC (Y-T ngang )

TH3: Nền ktế đóng, có chính phủ,đánh thuế theo thu nhập >>tổng lượng thuế phải nộp = t.Y

C= C NGANG+ MPC.Yd= C ngang + MPC ( Y – tY)

TH4: Nền ktế đóng, có chính phủ,đánh thuế theo thu nhập(t.Y) và thuế tư đinh( T ngang)

C= C NGANG+ MPC.Yd= C ngang + MPC ( Y – tY- T ngang)

TH5: Nền ktế đóng, có chính phủ,đánh thuế theo thu nhập và thuế tự định và cho 1 khoản trợ cấp (TR)

C= C NGANG+ MPC.Yd = C ngang + MPC ( Y – tY- T ngang +TR) o C: Consumption of HOUSEHOLDS o

T ngang: Autonomous consumption (Tiêu dùng tự định) o

T: net tax = total Tax - subsidies o

Yd: dispensable income (income after tax and subsidies (if any) o

Yd= Y – autonomous tax – income tax + subsidies (if any) o

MPC: marginal propensity to consume: the amount of consumption increase when

dispensable income increases by 1 unit. MPC= dentaC/dentaYd o

MPS: Marginal propensity to save: the amount of saving increase when dispensable

income increases by 1 unit. MPS= dentaC/dentaYd

Investment : I = autonomous investment (does not depend on income, interest rate) = I ngang

Government spending: G = autonomous government spending = G ngang

Net export = NX = autonomous Export – autonomous Import – MPM. Y o Autonomous Export = EX/X ngang o Autonomous Import = IM/I ngang o

autonomous Export – autonomous Import = autonomous net export = NX ngang o

MPM: marginal propensity of import: the amount of import increases when INCOME

increases by 1 unit (=dentaIM/dentaY)

>> ĐỂ TIM SLG CB (Y) THI SẼ CHO APE=Y 4.

APE in simple +closed economy (without government and international trade) APE= C+I

The equilibrium of the economy (Y=Yd due to no tax and subsidies)

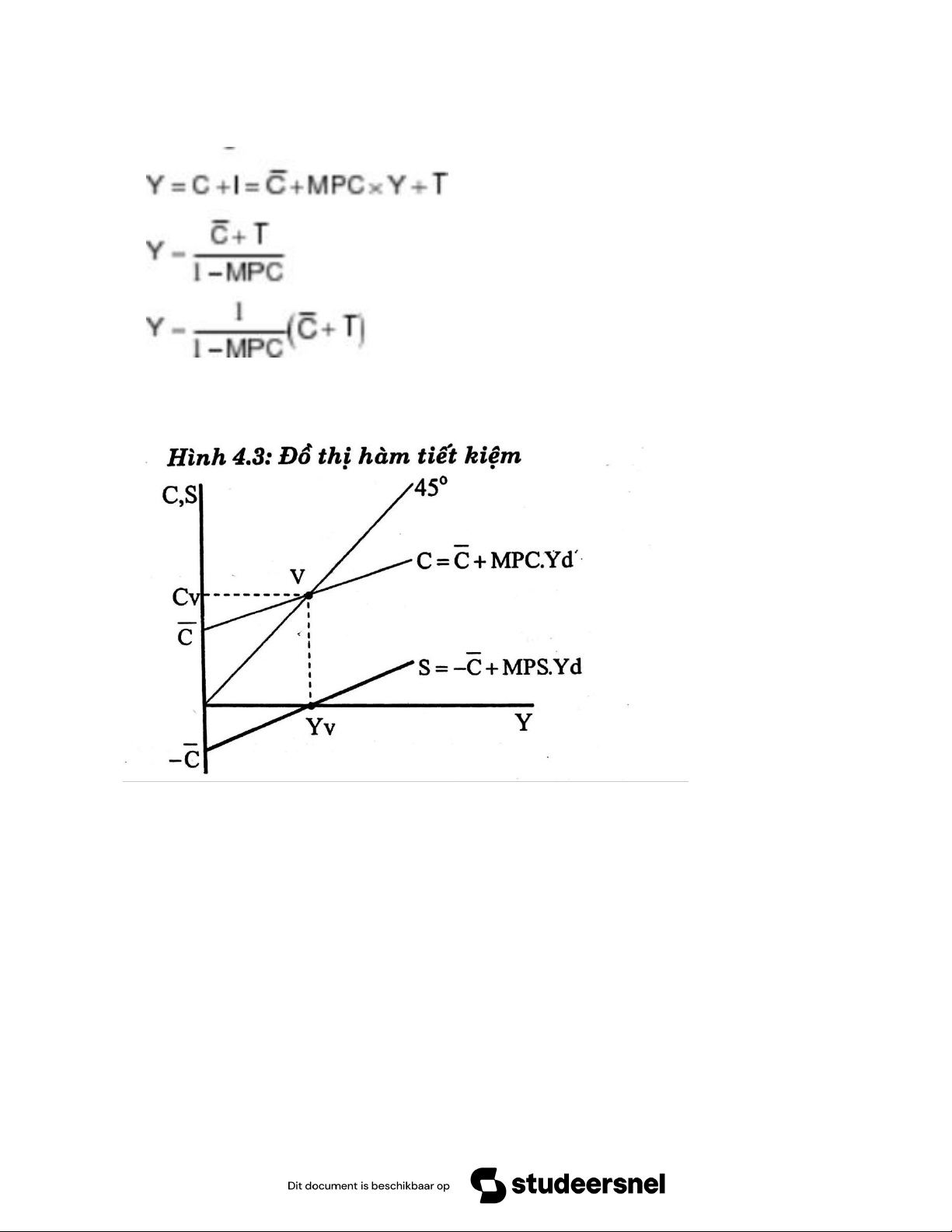

Saving function in simple economy No gov, no tax, Yd= Y C= CNGANG +MPC .Y

S=Y-C=Y-Cngang-MPC.Y= -Cngang + (1-MPC)Y 1-MPC=MPS 5.

APE in a closed economy (without international trade) APE = C+I+G 5.1. Autonomous tax 5.2. Tax depends on income 5.3. Both

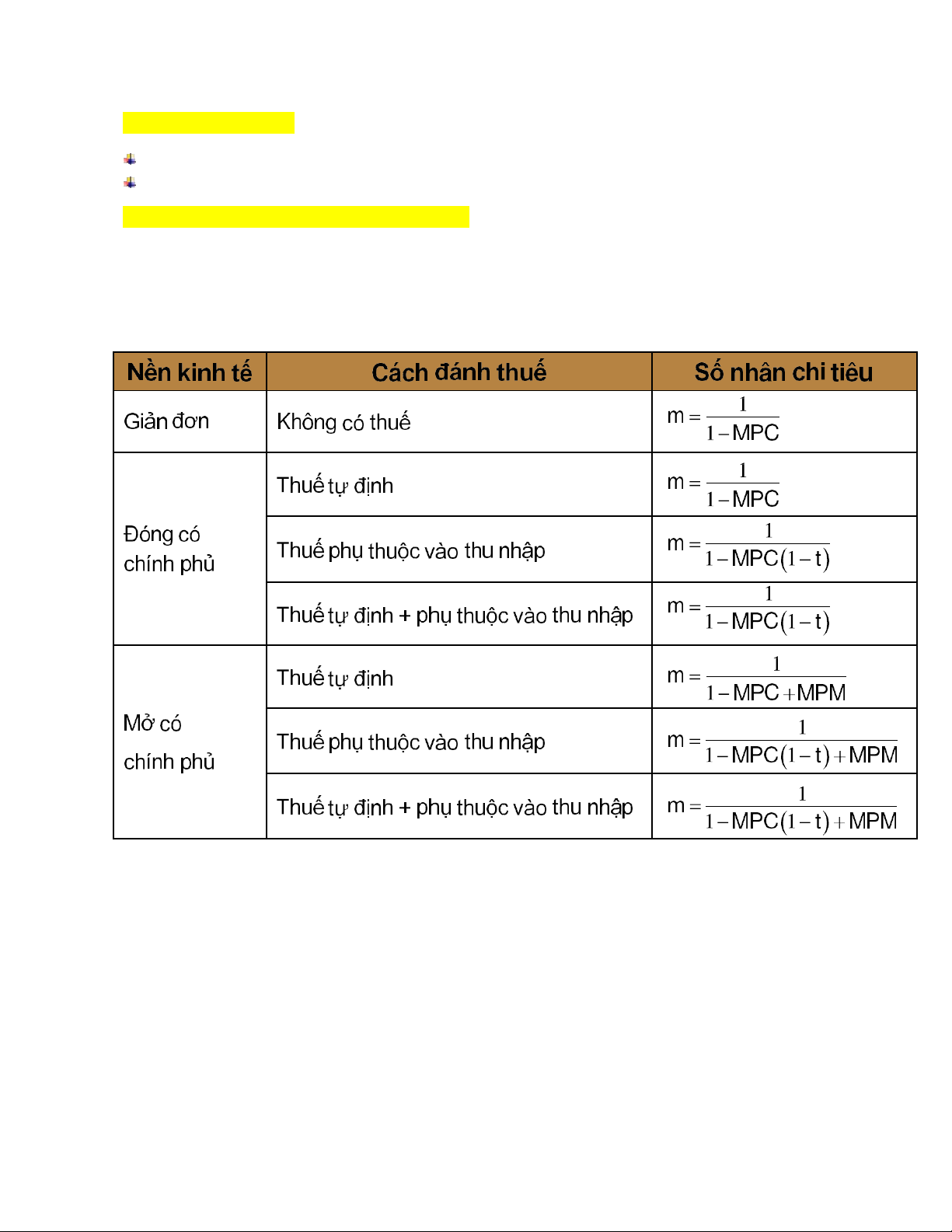

Số nhân chi tiêu chính phủ: cho biết sản lượng CÂN BĂNG (Y) thay đôi bao nhiêu khi chi

tiêu chính phủ thay đôi 1 đơn vị>> mg=DentaY/DentaG

C2: đê tính sluong thay đôi:

Mg= 1/(1-MPC+MPC.t)= dentaY/dentaG

>>dentaY=mg x DentaG= 1/1-mpc+mpc.t x 200= 1/1-0,8+0,8.0,25 x200 =500 >> Ycân băng

mới =Y+ dentaY= 2000+500=2500

Trường hợp đóng, đánh thuế suất >> mg=1/(1-MPC+MPC.t)

Kinh tế đóng, không đánh thuế suất: mg=DentaY/dentaG= (dentaG/1-MPC ): DentaG= 1/(1- MPC)

Trường hợp đánh thuế suất+ KT mở=> mg=1/1-MPC+MPC.t+MPM

Các trạng thái của cán cân ngân sách : 3 trạng thái Cb: ccns=0 Thâm hụt: ccns <0 Thặng du : CCNS>0 6.

APE in an opened economy APE=C+I+G+NX 6.1. Autonomous Tax 6.2. Tax on income 6.3. Both 7. Expenditure Multiplier

Expenditure multiplier: amount of equilibrium yield in the economy INCREASE when expenditure increase by 1 unit

>> expenditure multiplier= 1/1-b >1

C1: Số nhân chi tiêu :

Viết phương trình APE =APE tự định + Hệ số góc.Y

Số nhân chi tiêu = 1/1-hệ số góc

C2: Số nhân chi tiêu =1/1-mpc+mpc.t+mpm

Ko có thuế suất -> t =0 Đóng -> mpm =0 8.

Tax and government spending multiplier

Tax multiplier: the amount of equilibrium yield in economy increases when tax increases by 1 unit (autonomous tax)

Government spending: the amount of equilibrium yield in economy increases when

government spending increases by 1 unit

Số nhân chi tiêu chính phủ: cho biết sản lượng CÂN BĂNG (Y) tăng lên bao nhiêu khi chi

tiêu chính phủ thay đổi 1 đơn vị>> mg=DentaY/DentaG

Trong nền kinh tế ĐONG, KHÔNG ĐÁNH THUÊ SUẤT Ban đầu ta có

Y cb khi Y=APE= Cngang+MPC (Y-T ngang)+Ingang+Gngang

>>Y = Cngang-MPC.T ngang+Ingang+Gngang/(1-MPC)(1)

APE=C+I+G=Cngang+MPC (Y-T ngang)+Ingang+Gngang+dentaGngang Tim Y cb1

Y1=APE= C+I+G=Cngang+MPC (Y1-T ngang)+Ingang+Gngang+dentaGngang

>>Y1-MPC.Y1= (Cngang -MPC. T ngang+Ingang+Gngang)+dentaGngang

>>Y1=(Cngang -MPC. T ngang+Ingang+Gngang)/1-MPC +dentaGngang/1-MPC >>Y1=(1)+dentaG/1-MPC

>>dentaY=Y1-Y=dentaG/1-MPC

>>mg=DentaY/dentaG=1/1-MPC

Trường hợp đánh thuế suất >> mg=1/1-MPC+MPC.t

Trường hợp đánh thuế suất+ KT mở=> mg=1/1-MPC+MPC.t+MPM

Số nhân thuế: cho biết sản lượng CÂN BĂNG (Y) thay đổi bao nhiêu khi THUÊ TỰ ĐINH

thay đổi 1 đơn vị>>mT= DentaY/DentaT

CMTT>> mt trong nền kinh tế giản đơn KHONG DÁNH THUÊ SUẤT: mt=-MPC/1-

MPC Trườnghợpđánhthuếsuất>>mt=-MPC/1-MPC+MPC.t

Trường hợp đánh thuế suất+ KT mở=> mt=-MPC/1-MPC+MPC.t+MPM

Cho cả thuế và chi tiêu chính phủ tăng lương là Denta K thì Sản lượng cb thay đôi tn (hay vao)

Gợi y:Nền kinh tế, là nền kinh tế đóng, khống đánh thuế suất

Khi chi tiêu chính phủ thay đổi 1 lượng là dentaK thì sản lượng can băng thay đổi 1 lượng là : Mg=1/1-MPC

dentaY1= dentaK.mg=dentaK.1/1-MPC

Khi thuế tự định thay đổi 1 lượng là dentaK thì slg cân băng thay đổi 1 lượng là

dentaY2= dentaK. Mt= dentaK . (-MPC)/1-MPC

>> Tông sự thay đôi của slg cb là:

dentaY1+dentaY2= dentaK.1/1-MPC+ dentaK . (-MPC)/1-MPC= dentaK 9. Fiscal policy

Expansionary fiscal policy: làm tăng AD

decreases Tax>> Yd tăng >> C tăng

increases government spending>>G tăng

>>AD tăng>>AD dịch phải>> slg tăng và giá tăng ( cơ chế của CSTK mơ rộng) o

Mechanism: makes Yd (C) of houses holds and G increase>> APE increases, shift to

higher position, equilibrium yield of economy increases>> AD shifts to the right, price and yield increase o

Used: recession, high unemployment rate, deflation (equilibrium Y is low) o

Note: the period of time used (because the consequences are high budget deficit and inflation)

Contractionary fiscal policy:

increases Tax>> Yd giảm>>C giảm

decreases government spending>> G giảm

>>AD giảm ( AD dịch trái >> SLg giảm, giá giảm) o

Mechanism: makes Yd (C) of houses holds and G decrease>> APE decreases, shift to

lower position, equilibrium yield of economy increases>> AD shifts to the left, price and yield decrease o

Used: high inflation, heated growth, property bubbles (equilibrium Y is too high) o

Note: targets, time, (consequences: high unemployment rate, recession)

Limit of fiscal policy: CROWDING EFFECT: governments increase spending, making the

budget deficit, governments has to borrow more and lend less, Supply on loanable funds

decreases, demand increases>> Interest rate increases>> Investment decreases

T-G giam, thưc hiên qua liêu>> thâm hut ngân sach >> chinh phu đi vay nhiêu hơn, savings

cua chinh phu se bi giam đi >> Savings giam, demand cua vôn thi lai tăng >>Lai suât tăng>>

đâu tư giam >> AD không tăng đươc nhiều như dư kiến ban đầu.

10. 3 types of government budget:

CSTK: Gov: 2 công cu chính: T và G (fiscal)

CSTT: Central bank: 3 công cu (monetary) FINAL CHAPTER A. BALANCE OF PAYMENT

Definition: a statement of all transactions made between entities in one country and the rest

of the world over a defined period (BOP)

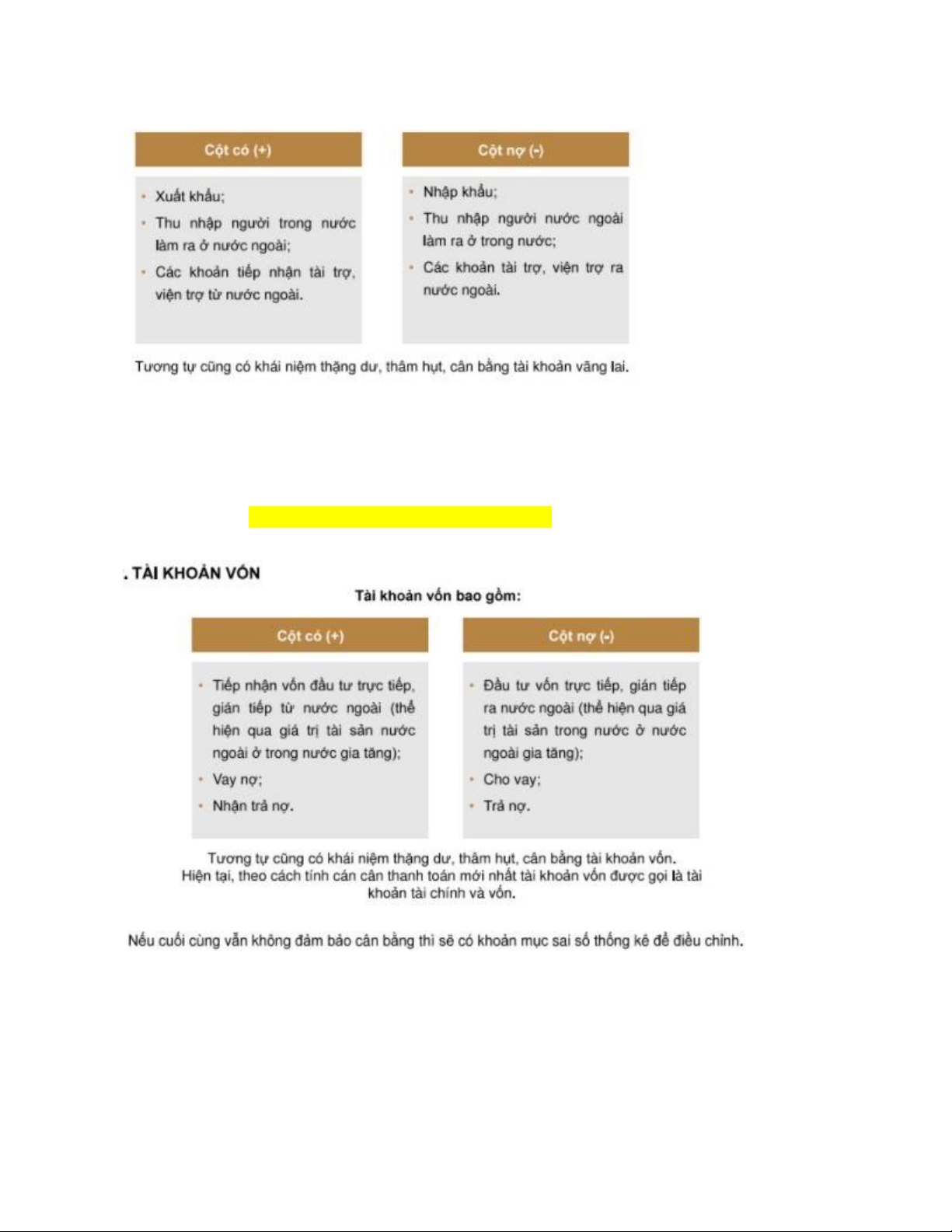

BOP = Current account + capital/financial account + errors=0

Current account=+5, capital account+=-7>> errors: 2

Current account: Transactions in goods&services (NX), investment income (thu nhập tư

đầu tư), financial instrument income, Interest payment from other countries, current transfer

NẾu dong tiền nào đô vào: cột có : xuất khẩu thu được ngoại tệ về >>cột có, người VN ở

nươc ngoài chuyên tiền về ng nhà: cột có Đô ra: cột nợ

Giả sử em đi đầu tư FDI ra nươc ngoài : số tiền đầu tư FDI ra nươc ngoài : Vào cán cân vốn (capital acc)

Số tiền thu đuOc tư việc đầu tư >> cc vãng lai (current acc)

Capital account: transactions in financial instruments B.

EXCHANGE RATE (tỉ giá hối đoái) •

Nominal: Money for money •

Real: Goods/services for goods/services ➢

Direct: 1 foreign = ? Domestic ➢

Indirect: 1 domestic = ? Foreign